Liquidity Services (NASDAQ:LQDT; www.liquidityservices.com), a

leading global commerce company powering the circular economy,

today announced its financial results for the quarter ended

September 30, 2024, as compared to the corresponding prior year

quarter:

- Gross Merchandise Volume (GMV) of $361.0 million, up 14%, and

Revenue of $106.9 million, up 34%

- GAAP Net Income of $6.4 million, up $0.1 million, and GAAP

Diluted Earnings Per Share (EPS) of $0.20

- Non-GAAP Adjusted EBITDA of $14.5 million, up 13%, and Non-GAAP

Adjusted EPS of $0.32, up 23%

- Cash balances of $155.5 million1 with zero financial debt

"Our strong fourth quarter results capped a

successful year of market share expansion and consistent growth in

Fiscal Year 2024 backed by investments in innovation, service and

execution for our customers. We achieved double-digit consolidated

GMV growth in each quarter throughout the year and each of our

segments achieved double-digit annual GMV growth, culminating in

record annual GMV of $1.4 billion. Overall, we are seeing enhanced

network effects in our two-sided marketplace platform as we grew

our auction participants and completed transactions by 22% and 12%,

respectively, during the quarter. We converted this growth to over

$22 million in operating cash flow in the fourth quarter,

highlighting the strength of our asset light business model.

“In the fourth quarter, our RSCG segment set new

quarterly records in GMV, revenue and segment direct profit, as we

drove expanded relationships with our seller clients by leveraging

our decades of industry leading expertise and multi-channel buyer

liquidity. Our GovDeals segment delivered robust double-digit

growth through ongoing seller acquisition and service expansion.

Additionally, our Machinio segment achieved another quarterly

revenue record, further solidifying its position as a leading

platform for connecting buyers and sellers of used equipment

worldwide.

“We are also thrilled to celebrate a significant

milestone - our 25th anniversary. Over the past quarter-century,

Liquidity Services has grown from a scrappy start-up into a leading

global e-commerce company, powering the circular economy and

delivering unmatched value worldwide. Our journey has been marked

by remarkable growth, innovation, and a steadfast commitment to

sustainability. From developing cutting-edge technologies to

expanding our services across various industries, we have

continuously evolved to meet the needs of our clients and

communities. This milestone allows us to reflect on our

achievements and express our deepest gratitude to our dedicated

team, loyal clients, and supportive stakeholders who have been

instrumental in our success.

“As we look to the future, we remain committed

to driving excellence and innovation in all that we do. Overall,

our scalable marketplace technology, broad range of services,

diversified client base, organic growth initiatives and pipeline of

acquisition opportunities will propel us in continuing our track

record of growth. Together, we will continue to lead the industry,

create value, and build a better future for surplus,” said Bill

Angrick, Chairman & CEO.

Recent Business Highlights

- RSCG relocated and expanded its Indianapolis operations to

accommodate expanded supply from seller clients, enhance the

customer experience for liquidation resellers and consumers, and

reaffirm our commitment to sustainability by extending the life

cycle of the products we handle.

- GovDeals successfully conducted its largest auction to date,

helping the State of Missouri to complete the sale of the historic

Wainwright State Office Building in downtown St. Louis for $8.3

million.

- CAG demonstrated the depth of its global capabilities,

successfully executing sales ranging from a bankruptcy auction of

oil-and-gas machinery and equipment held at multiple sites in the

U.S. to a surplus sale of dairy processing equipment in

Indonesia.

Fourth Quarter Financial

Highlights

GMV for the fiscal fourth quarter of 2024 was

$361.0 million, a 14% increase from $315.6 million in the fourth

fiscal quarter of 2023.

- GMV in our RSCG segment increased 28%, setting a new quarterly

record of $95.5 million, driven by an expansion in our purchase

programs and sell-in place consignment solutions.

- GMV in our GovDeals segment increased 14%, driven by new seller

acquisition, service expansion and strong results in its vehicle

and heavy equipment categories.

- GMV in our CAG segment decreased 2%, as increased consignment

sales in our industrial and heavy equipment categories were more

than offset by lower availability of large spot purchase

transactions with international clients.

- Consignment sales represented 82% of consolidated GMV for the

fourth quarter of 2024.

Revenue for the fiscal fourth quarter of 2024

was $106.9 million, a 34% increase from $80.0 million in the fourth

fiscal quarter of 2023.

- Revenue in our RSCG segment increased 49%, setting a new

quarterly record of $73.7 million, reflecting that the increase in

overall GMV was driven by broader expansions in our purchase

programs relative to consignment programs. While this mix shift

tends to lower RSCG’s segment direct profit as a percentage of

revenue, these increased purchase volumes were mainly sourced from

lower-touch programs.

- Revenue in our GovDeals segment increased 26%, reflecting the

increase in overall GMV, paired with a higher blended revenue

take-rate due to an expansion of service offerings to new,

high-volume sellers.

- Revenue in our Machinio segment increased 13% due to increased

subscriptions and pricing for its Advertising and System

subscription services.

- Revenue in our CAG segment decreased 17%, reflecting the lower

GMV from large spot purchase transactions.

The changes in our profitability metrics reflect

our increased top-line performance, and increases in sales,

marketing, technology, and operations expenses to drive market

share expansions, resulting in:

- GAAP Net Income of $6.4 million for the fiscal fourth quarter

of 2024, an increase from $6.3 million for the same quarter last

year. Both periods resulted in $0.20 GAAP Net Income per share. The

fiscal fourth quarter of 2024 included a $1.9 million increase in

stock compensation expense driven by variable performance-based

stock awards.

- Non-GAAP Adjusted Net Income for the fiscal fourth quarter of

2024 of $10.2 million, or $0.32 per share, an increase from $8.4

million, or $0.26 per share, for the same quarter last year.

- Non-GAAP Adjusted EBITDA for the fiscal fourth quarter of 2024

of $14.5 million, a $1.7 million increase from $12.8 million in the

same quarter last year.

On December 9, 2024, the Company's Board of

Directors authorized the repurchase of up to $10.0 million of

the Company's outstanding shares of common stock through December

31, 2026. This authorization is in addition to the

$7.6 million remaining under the September 8, 2023

authorization to repurchase up to $15.2 million in shares

through December 31, 2025. The timing and actual number of shares

repurchased will depend on a variety of factors, including price,

general business and market conditions, and the existence of

alternative investment opportunities. The repurchase program will

be executed consistent with the Company's capital allocation

strategy of prioritizing investment to grow the business over the

long term.

1 Includes $153.2 million of Cash and cash equivalents and $2.3

million of Short-term investments.

Fourth Quarter Segment Financial

Results

We present operating results for our four

reportable segments: GovDeals, RSCG, CAG and Machinio. For further

information on our reportable segments, including Corporate and

elimination adjustments, see Note 17, Segment Information, to our

Annual Report on Form 10-K for the period ended September 30, 2024.

Segment direct profit is calculated as total revenue less cost of

goods sold (excluding depreciation and amortization).

Our Q4-FY24 segment results are as follows (unaudited, dollars

in thousands):

|

|

|

|

|

Three Months Ended September 30, |

Twelve Months Ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

GovDeals: |

|

|

|

|

|

|

|

|

|

|

|

|

|

GMV |

|

$ |

210,002 |

|

|

$ |

184,100 |

|

|

$ |

836,288 |

|

|

$ |

726,124 |

|

|

Total revenue |

|

$ |

20,173 |

|

|

$ |

16,054 |

|

|

$ |

76,557 |

|

|

$ |

62,010 |

|

|

Segment direct profit |

|

$ |

18,745 |

|

|

$ |

15,238 |

|

|

$ |

71,727 |

|

|

$ |

58,810 |

|

|

Segment direct profit as a percentage of total revenue |

|

|

92.9 |

% |

|

|

94.9 |

% |

|

|

93.7 |

% |

|

|

94.8 |

% |

| RSCG: |

|

|

|

|

|

|

|

|

|

|

|

|

|

GMV |

|

$ |

95,538 |

|

|

$ |

74,661 |

|

|

$ |

320,683 |

|

|

$ |

285,574 |

|

|

Total revenue |

|

$ |

73,704 |

|

|

$ |

49,561 |

|

|

$ |

233,003 |

|

|

$ |

200,218 |

|

|

Segment direct profit |

|

$ |

18,395 |

|

|

$ |

17,505 |

|

|

$ |

66,873 |

|

|

$ |

68,068 |

|

|

Segment direct profit as a percentage of total revenue |

|

|

25.0 |

% |

|

|

35.3 |

% |

|

|

28.7 |

% |

|

|

34.0 |

% |

| CAG: |

|

|

|

|

|

|

|

|

|

|

|

|

|

GMV |

|

$ |

55,417 |

|

|

$ |

56,814 |

|

|

$ |

209,661 |

|

|

$ |

191,333 |

|

|

Total revenue |

|

$ |

8,904 |

|

|

$ |

10,681 |

|

|

$ |

37,668 |

|

|

$ |

38,476 |

|

|

Segment direct profit |

|

$ |

7,657 |

|

|

$ |

8,749 |

|

|

$ |

31,268 |

|

|

$ |

32,215 |

|

|

Segment direct profit as a percentage of total revenue |

|

|

86.0 |

% |

|

|

81.9 |

% |

|

|

83.0 |

% |

|

|

83.7 |

% |

|

Machinio: |

|

|

|

|

|

|

|

|

|

|

|

|

|

GMV |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Total revenue |

|

$ |

4,163 |

|

|

$ |

3,678 |

|

|

$ |

16,157 |

|

|

$ |

13,821 |

|

|

Segment direct profit |

|

$ |

3,955 |

|

|

$ |

3,499 |

|

|

$ |

15,364 |

|

|

$ |

13,110 |

|

|

Segment direct profit as a percentage of total revenue |

|

|

95.0 |

% |

|

|

95.2 |

% |

|

|

95.1 |

% |

|

|

94.9 |

% |

|

Consolidated: |

|

|

|

|

|

|

|

|

|

|

|

|

|

GMV |

|

$ |

360,957 |

|

|

$ |

315,575 |

|

|

$ |

1,366,632 |

|

|

$ |

1,203,031 |

|

|

Total revenue |

|

$ |

106,927 |

|

|

$ |

79,957 |

|

|

$ |

363,318 |

|

|

$ |

314,462 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter Operational Metrics

- Registered Buyers — At the end of Q4-FY24, registered buyers,

defined as the aggregate number of persons or entities who have

registered on one of our marketplaces, totaled approximately 5.5

million, representing a 7% increase over the approximately 5.1

million registered buyers at the end of Q4-FY23.

- Auction Participants — Auction participants, defined as

registered buyers who have bid in an auction during the period (a

registered buyer who bids in more than one auction is counted as an

auction participant in each auction in which he or she bids), was

approximately 1,016,000 in Q4-FY24, a 22% increase from the

approximately 836,000 auction participants in Q4-FY23.

- Completed Transactions — Completed transactions, defined as the

number of auctions in a given period, were approximately 279,000 in

Q4-FY24, a 12% increase from the approximately 250,000 completed

transactions in Q4-FY23.

First Quarter Business Outlook

Our fiscal first quarter 2025 guidance ranges

for all metrics are substantially improved from our results of the

same fiscal quarter of 2024, led by recently expanded purchase

programs in our RSCG segment and an improved project pipeline in

our CAG segment compared to last year across our heavy equipment,

industrial and energy verticals. These drivers are expected to

increase their respective segments' GMV and revenues, with revenues

growing at higher rate than GMV. The expanded purchase programs in

our RSCG segment should increase its overall mix of lower-touch

product flows and are expected to improve RSCG’s results in the

coming quarter compared to the same quarter last year.

We anticipate our GovDeals segment to continue

to deliver year-over-year GMV growth, with revenue growing at a

faster year-over-year rate than GMV due to expanded consignment

service offerings as reflected in our acquisition of Sierra Auction

in January 2024. Our Machinio subscription-based business is also

anticipated to continue to grow revenue by double digits

year-over-year.

Given the expected mix in segment volumes,

including the expansion of lower-touch purchase programs in the

RSCG segment, RSCG’s segment direct profit as a percent of revenue

is expected to decline year-over-year and sequentially resulting in

our overall consolidated consignment GMV to be at approximately

eighty percent of total GMV, our consolidated revenue as a percent

of GMV be up in the low thirty percentage range, and the total of

our segment direct profits as a percent of total revenue to be down

to the low forty percent range. These ratios can vary based on our

mix, including asset categories in any given period.

Consistent with prior year trends, to drive

growth and market share gains throughout the coming fiscal year,

our operating expenses, including sales, operations and technology,

are expected to increase in the fiscal first quarter with operating

leverage expected to improve during the second half of the fiscal

year.

Our Q1-FY25 guidance is as follows:

| |

|

$ in millions, except per share data |

Q1-FY25 Guidance |

| GMV |

$350 to $385 |

| GAAP Net

Income |

$2.5 to $5.0 |

| Non-GAAP Adjusted

EBITDA |

$9.5 to $12.5 |

| GAAP Diluted

EPS |

$0.08 to $0.16 |

| Non-GAAP Adjusted

Diluted EPS |

$0.18 to $0.26 |

| |

|

Our Business Outlook includes forward-looking

statements which reflect the following trends and assumptions for

Q1-FY25 as compared to the prior year's period, as well as other

the risks and uncertainties set forth in the Company’s Annual

Report on Form 10-K for the year ended September 30, 2024:

Potential Impacts to GMV, Revenue, Segment

Direct Profits, and ratios calculated using these metrics

- fluctuations in the mix of purchase and consignment

transactions. Generally, when the mix of purchase transactions

increases, revenue as a percent of GMV increases, while segment

direct profit as a percentage of revenue decreases. When the mix of

consignment transactions increases, revenue as a percent of GMV

decreases, while segment direct profit as a percentage of revenue

increases;

- variability in the inventory product mix handled by our RSCG

segment, which can cause a change in revenues and/or segment direct

profit as a percentage of revenue;

- real estate transactions in our GovDeals segment can be subject

to significant variability due to changes that include

postponements or cancellations of scheduled or expected auction

events and the value of properties to be included in the auction

event;

- continued variability in project size and timing within our CAG

segment;

- continued growth and expansion resulting from the continuing

acceleration of broader market adoption of the digital economy,

particularly in our GovDeals and RSCG seller accounts and programs,

including the execution by RSCG on its business plans for

AllSurplus Deals and its expanded direct-to-consumer

marketplace;

- changes in economic or political conditions could impact our

current or prospective buyers' and sellers' priorities and cause

variability in our operating results;

Potential Impacts to Operating Expenses

- continued R&D spending to support omni-channel behavioral

marketing, analytics, and buyer/seller payment optimization;

- spending in business development activities to capture market

opportunities, targeting efficient payback periods;

- variability in the volumes and sourcing locations of products

handled by our RSCG segment, which can cause the capacity and

related operating expense requirements of our warehouse locations

to fluctuate;

- changes in our financial performance could cause fluctuations

in the amount of stock compensation expense recognized for

performance-based awards;

Potential Impacts to GAAP Net Income and EPS and

Non-GAAP Adjusted Net Income and Adjusted EPS

- our FY25 annual effective tax rate (ETR) is expected to range

from approximately 28% to 34%. This range excludes any potential

impacts from legislative changes to corporate tax rates that may be

enacted in the U.S. or internationally; and excludes potential

impacts that have limited visibility and can be highly variable,

including effects of stock compensation due to participant exercise

activity and changes in our stock price. We expect that cash paid

for income taxes will increase in FY25 as our remaining US federal

net operating loss carryforward position is expected to be fully

utilized in the first half of the year; and

- our diluted weighted average number of shares outstanding is

expected to be approximately 31.5 to 32.0 million. As of September

30, 2024, we had $7.6 million in remaining authorization to

repurchase shares of our common stock and on December 9, 2024, our

Board of Directors authorized an additional $10.0 million to

repurchase shares.

Reconciliation of GAAP to Non-GAAP Measures

Non-GAAP EBITDA and Non-GAAP Adjusted EBITDA.

Non-GAAP EBITDA is a supplemental non-GAAP financial measure and is

equal to Net Income plus interest and other income, net; provision

for income taxes; and depreciation and amortization. Our definition

of Non-GAAP Adjusted EBITDA differs from Non-GAAP EBITDA because we

further adjust Non-GAAP EBITDA for stock compensation expense,

acquisition costs such as transaction expenses and changes in

earn-out estimates, business realignment expenses, litigation

settlement expenses that are not expected to reoccur, and goodwill,

long-lived and other non-current asset impairment. A reconciliation

of Net Income to Non-GAAP EBITDA and Non-GAAP Adjusted EBITDA is as

follows:

|

|

|

|

|

Three Months Ended September 30, |

Twelve Months Ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net income |

|

$ |

6,375 |

|

|

$ |

6,279 |

|

|

$ |

19,991 |

|

|

$ |

20,978 |

|

| Interest and other income,

net(1) |

|

|

(1,244 |

) |

|

|

(1,161 |

) |

|

|

(4,048 |

) |

|

|

(2,859 |

) |

| Provision for income

taxes |

|

|

2,198 |

|

|

|

2,774 |

|

|

|

7,269 |

|

|

|

8,039 |

|

| Depreciation and

amortization |

|

|

2,823 |

|

|

|

2,821 |

|

|

|

12,120 |

|

|

|

11,255 |

|

| Non-GAAP EBITDA |

|

$ |

10,152 |

|

|

$ |

10,713 |

|

|

$ |

35,332 |

|

|

$ |

37,412 |

|

| Stock compensation

expense |

|

|

3,879 |

|

|

|

1,975 |

|

|

|

11,087 |

|

|

|

8,191 |

|

| Acquisition-related costs and

litigation settlement expense(2) |

|

|

173 |

|

|

|

69 |

|

|

|

1,830 |

|

|

|

252 |

|

| Business realignment

expenses(3) |

|

|

251 |

|

|

|

— |

|

|

|

251 |

|

|

|

— |

|

| Non-GAAP Adjusted EBITDA |

|

$ |

14,455 |

|

|

$ |

12,757 |

|

|

$ |

48,500 |

|

|

$ |

45,855 |

|

| |

1 Interest and other income, net, per the

Consolidated Statements of Operations, excluding the non-service

components of net periodic pension cost (benefit).2

Acquisition-related costs are included in other operating expenses,

net on Consolidated Statement of Operations. Litigation settlement

expense reflects significant legal settlements not expected to

reoccur and are included in general and administrative expense on

the Consolidated Statement of Operations.3 Business realignment

expenses, included as a component of Other operating expenses, net

on the Consolidated Statements of Operations, includes the amounts

accounted for as exit costs under ASC 420, Exit or Disposal Cost

Obligations, and the related impacts of business realignment

actions subject to other accounting guidance.

Non-GAAP Adjusted Net Income and Non-GAAP

Adjusted Basic and Diluted Earnings Per Share. Non-GAAP Adjusted

Net Income is a supplemental non-GAAP financial measure and is

equal to Net Income plus stock compensation expense, amortization

of intangible assets, acquisition related costs such as transaction

expenses and changes in earn-out estimates, business realignment

expenses, litigation settlement expenses that are not expected to

reoccur, goodwill, long-lived and other non-current asset

impairments, and the estimated impact of income taxes on these

non-GAAP adjustments as well as non-recurring tax adjustments.

Non-GAAP Adjusted Basic and Diluted Income Per Share are determined

using Non-GAAP Adjusted Net Income. The tax rates used to estimate

the impact of income taxes on the non-GAAP adjustments were based

upon the GAAP effective tax rates for each period, which were 27%

for Q4-FY24 and 28% for Q4-FY23. A reconciliation of Net Income to

Non-GAAP Adjusted Net Income and Non-GAAP Adjusted Basic and

Diluted Income Per Share is as follows:

| |

| |

|

Three Months Ended September 30, |

|

|

Twelve Months Ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net income |

|

$ |

6,375 |

|

|

$ |

6,279 |

|

|

$ |

19,991 |

|

|

$ |

20,978 |

|

| Stock compensation

expense |

|

|

3,879 |

|

|

|

1,975 |

|

|

|

11,087 |

|

|

|

8,191 |

|

| Intangible asset

amortization |

|

|

954 |

|

|

|

846 |

|

|

|

3,967 |

|

|

|

3,791 |

|

| Acquisition-related costs and

litigation settlement expense(1) |

|

|

173 |

|

|

|

69 |

|

|

|

1,830 |

|

|

|

252 |

|

| Business realignment

expenses(2) |

|

|

251 |

|

|

|

— |

|

|

|

251 |

|

|

|

— |

|

| Income tax impact on the

adjustment items |

|

|

(1,404 |

) |

|

|

(801 |

) |

|

|

(4,575 |

) |

|

|

(3,389 |

) |

| Non-GAAP Adjusted net

income |

|

$ |

10,228 |

|

|

$ |

8,368 |

|

|

$ |

32,551 |

|

|

$ |

29,823 |

|

| Non-GAAP Adjusted basic

earnings per common share |

|

$ |

0.34 |

|

|

$ |

0.27 |

|

|

$ |

1.07 |

|

|

$ |

0.96 |

|

| Non-GAAP Adjusted diluted

earnings per common share |

|

$ |

0.32 |

|

|

$ |

0.26 |

|

|

$ |

1.03 |

|

|

$ |

0.93 |

|

| Basic weighted average shares

outstanding |

|

|

30,491,799 |

|

|

|

30,576,142 |

|

|

|

30,496,306 |

|

|

|

31,075,648 |

|

| Diluted weighted average

shares outstanding |

|

|

31,738,515 |

|

|

|

31,749,902 |

|

|

|

31,634,192 |

|

|

|

32,074,561 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Acquisition-related costs are included in

other operating expenses, net on Consolidated Statement of

Operations. Litigation settlement expense reflects significant

legal settlements not expected to reoccur and are included in

general and administrative expense on the Consolidated Statement of

Operations.2 Business realignment expenses, included as a component

of Other operating expenses, net on the Consolidated Statements of

Operations, includes the amounts accounted for as exit costs under

ASC 420, Exit or Disposal Cost Obligations, and the related impacts

of business realignment actions subject to other accounting

guidance.

Conference Call Details

The Company will host a conference call to discuss these results

at 10:30 a.m. Eastern Time today. Investors and other interested

parties may access the teleconference by registering here to

receive the dial-in number and unique conference pin. A live

listen-only webcast of the conference call will be provided on the

Company's investor relations website at

https://investors.liquidityservices.com. An archive of the web cast

will be available on the Company's website until December 12, 2025

at 11:59 p.m. Eastern Time. The replay will be available starting

at 1:30 p.m. Eastern Time on the day of the call.

Non-GAAP Measures

To supplement our consolidated financial

statements presented in accordance with generally accepted

accounting principles (GAAP), we use certain non-GAAP measures of

certain components of financial performance. These non-GAAP

measures include earnings before interest, taxes, depreciation and

amortization (EBITDA), Adjusted EBITDA, Adjusted Net Income (Loss)

and Adjusted Earnings (Loss) per Share. These non-GAAP measures are

provided to enhance investors’ overall understanding of our current

financial performance and prospects for the future. We use EBITDA

and Adjusted EBITDA: (a) as measurements of operating performance

because they assist us in comparing our operating performance on a

consistent basis as they do not reflect the impact of items not

directly resulting from our core operations; (b) for planning

purposes, including the preparation of our internal annual

operating budget; (c) to allocate resources to enhance the

financial performance of our business; (d) to evaluate the

effectiveness of our operational strategies; and (e) to evaluate

our capacity to fund capital expenditures and expand our business.

Adjusted Earnings (Loss) per Share is the result of our Adjusted

Net Income (Loss) and diluted shares outstanding.

We prepare Non-GAAP Adjusted EBITDA by

eliminating from Non-GAAP EBITDA the impact of items that we do not

consider indicative of our core operating performance. You are

encouraged to evaluate these adjustments and the reasons we

consider them appropriate for supplemental analysis. As an

analytical tool, Non-GAAP Adjusted EBITDA is subject to all of the

limitations applicable to Non-GAAP EBITDA. Our presentation of

Non-GAAP Adjusted EBITDA should not be construed as an implication

that our future results will be unaffected by unusual or

non-recurring items.

We believe these non-GAAP measures provide

useful information to both management and investors by excluding

certain expenses that may not be indicative of our core operating

measures. In addition, because we have historically reported

certain non-GAAP measures to investors, we believe the inclusion of

non-GAAP measures provides consistency in our financial reporting.

These measures should be considered in addition to financial

information prepared in accordance with GAAP, but should not be

considered a substitute for, or superior to, GAAP results. A

reconciliation of all historical non-GAAP measures included in this

press release, to the most directly comparable GAAP measures, may

be found in the financial tables included in this press

release.

We do not quantitatively reconcile our guidance

ranges for our non-GAAP measures to their most comparable GAAP

measures in the Business Outlook section of this press release. The

guidance ranges for our GAAP and non-GAAP financial measures

reflect our assessment of potential sources of variability in our

financial results and are informed by our evaluation of multiple

scenarios, many of which have interactive effects across several

financial statement line items. Providing guidance for individual

reconciling items between our non-GAAP financial measures and the

comparable GAAP measures would imply a degree of precision and

certainty in those reconciling items that is not a consistent

reflection of our scenario-based process to prepare our guidance

ranges. To the extent that a material change affecting the

individual reconciling items between the Company’s forward-looking

non-GAAP and comparable GAAP financial measures is anticipated, the

Company has provided qualitative commentary in the Business Outlook

section of this press release for your consideration. However, as

the impact of such factors cannot be predicted with a reasonable

degree of certainty or precision, a quantitative reconciliation is

not available without unreasonable effort.

Supplemental Operating Data

To supplement our consolidated financial

statements presented in accordance with GAAP, we use certain

supplemental operating data as a measure of certain components of

operating performance. GMV is the total sales value of all

transactions for which we earned compensation upon their completion

through our marketplaces or other channels during a given period of

time. We review GMV because it provides a measure of the volume of

goods being sold in our marketplaces and thus the activity of those

marketplaces. GMV and our other supplemental operating data,

including registered buyers, auction participants and completed

transactions, also provide a means to evaluate the effectiveness of

investments that we have made and continue to make in the areas of

seller and buyer support, value-added services, product

development, sales and marketing and operations. Therefore, we

believe this supplemental operating data provides useful

information to both management and investors. In addition, because

we have historically reported certain supplemental operating data

to investors, we believe the inclusion of this supplemental

operating data provides consistency in our financial reporting.

This data should be considered in addition to financial information

prepared in accordance with GAAP, but should not be considered a

substitute for, or superior to, GAAP results.

Forward-Looking Statements

This document contains forward-looking

statements made pursuant to the Private Securities Litigation

Reform Act of 1995. These statements are only predictions. The

outcome of the events described in these forward-looking statements

is subject to known and unknown risks, uncertainties and other

factors that may cause our actual results, levels of activity,

performance or achievements to differ materially from any future

results, levels of activity, performance or achievements expressed

or implied by these forward-looking statements. These statements

include, but are not limited to, statements regarding the Company’s

business outlook; expected future results; expected future

effective tax rates; and trends and assumptions about future

periods. You can identify forward-looking statements by terminology

such as “may,” “will,” “should,” “could,” “would,” “expects,”

“intends,” “plans,” “anticipates,” “believes,” “estimates,”

“predicts,” “potential,” “continues” or the negative of these terms

or other comparable terminology. Our business is subject to a

number of risks and uncertainties, and our past performance is no

guarantee of our performance in future periods. Although we believe

that the expectations reflected in the forward-looking statements

are reasonable, we cannot guarantee future results, levels of

activity, performance or achievements.

There are several risks and uncertainties that

could cause our actual results to differ materially from the

forward-looking statements in this document. Important factors that

could cause our actual results to differ materially from those

expressed as forward-looking statements are set forth in our

filings with the SEC from time to time, and include, among others:

our ability to source sufficient assets from sellers to attract and

retain active professional buyers; our need to successfully react

to the increasing importance of mobile commerce and the increasing

environmental and social impact aspects of e-commerce in an

increasingly competitive environment for our business, including

not only risks of disintermediation of our e-commerce services by

our competitors but also by our buyers and sellers; our ability to

timely upgrade and develop our information technology systems,

infrastructure and digital marketing and customer service

capabilities at reasonable cost while complying with applicable

data privacy and security laws and maintaining site stability and

performance to allow our operations to grow in both size and scope;

our ability to attract, retain and develop the skilled employees

that we need to support our business; retail clients investing in

their warehouse operations capacity to handle higher volumes of

online returns, resulting in retailers sending the Company a

reduced volume of returns merchandise or sending us a product mix

lower in value due to the removal of high value returns; system

interruptions that could affect our websites or our transaction

systems and impair the services we provide to our sellers and

buyers; our ability to maintain the privacy and security of

personal and business information amidst multiplying threat

landscapes and in compliance with privacy and data protection

regulations globally; the numerous factors that influence the

supply of and demand for used merchandise, equipment and surplus

assets; political, business, economic and other conditions in

local, regional and global sectors; the operations of customers,

project size and timing of auctions, operating costs, and general

economic conditions; our ability to integrate acquired companies,

and execute on anticipated business plans such as the efforts

underway with local and state governments to advance legislation

that allows for online auctions for foreclosed and tax foreclosed

real estate; the continuing impacts of geopolitical events,

including armed conflicts in Ukraine, in and adjacent to Israel,

and elsewhere; and impacts from escalating interest rates and

inflation on the our operations; the numerous government

regulations of e-commerce and other services, competition, and

restrictive governmental actions, including any failure or

perceived failure by us, or third parties with which we do

business, to comply with applicable data privacy and security laws;

the supply of, demand for or market values of surplus assets, such

as shortages in supply of used vehicles; and other the risks and

uncertainties set forth in the Company’s Annual Report on Form 10-K

for the year ended September 30, 2024, which is available on the

SEC and Company websites. There may be other factors of which we

are currently unaware or which we deem immaterial that may cause

our actual results to differ materially from the forward-looking

statements.

All forward-looking statements attributable to

us or persons acting on our behalf apply only as of the date of

this document and are expressly qualified in their entirety by the

cautionary statements included in this document. Except as may be

required by law, we undertake no obligation to publicly update or

revise any forward-looking statement to reflect events or

circumstances occurring after the date of this document or to

reflect the occurrence of unanticipated events.

About Liquidity Services

Liquidity Services (NASDAQ:LQDT) operates the

world's largest B2B e-commerce marketplace platform for surplus

assets with over $10 billion in completed transactions to more than

five million qualified buyers and 15,000 corporate and government

sellers worldwide. The company supports its clients' sustainability

efforts by helping them extend the life of assets, prevent

unnecessary waste and carbon emissions, and reduce the number of

products headed to landfills.

Contact:Investor

Relationsinvestorrelations@liquidityservicesinc.com

|

|

|

Liquidity Services and

SubsidiariesUnaudited Condensed Consolidated

Balance Sheets(Dollars in Thousands, Except Par

Value) |

| |

| |

|

September 30, |

|

| |

|

2024 |

|

|

2023 |

|

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

153,226 |

|

|

$ |

110,281 |

|

|

Short-term investments |

|

|

2,310 |

|

|

|

7,891 |

|

|

Accounts receivable, net of allowance for doubtful accounts of

$1,680 and $1,424 |

|

|

11,467 |

|

|

|

7,848 |

|

|

Inventory, net |

|

|

17,099 |

|

|

|

11,116 |

|

|

Prepaid taxes and tax refund receivable |

|

|

1,519 |

|

|

|

1,783 |

|

|

Prepaid expenses and other current assets |

|

|

13,614 |

|

|

|

7,349 |

|

|

Total current assets |

|

|

199,235 |

|

|

|

146,268 |

|

| Property and equipment,

net |

|

|

17,961 |

|

|

|

17,156 |

|

| Operating lease assets |

|

|

12,005 |

|

|

|

9,888 |

|

| Intangible assets, net |

|

|

13,912 |

|

|

|

12,457 |

|

| Goodwill |

|

|

97,792 |

|

|

|

89,388 |

|

| Deferred tax assets |

|

|

1,728 |

|

|

|

7,050 |

|

| Other assets |

|

|

4,255 |

|

|

|

6,762 |

|

| Total assets |

|

$ |

346,888 |

|

|

$ |

288,970 |

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

58,693 |

|

|

$ |

39,115 |

|

|

Accrued expenses and other current liabilities |

|

|

28,261 |

|

|

|

23,809 |

|

|

Current portion of operating lease liabilities |

|

|

5,185 |

|

|

|

4,101 |

|

|

Deferred revenue |

|

|

4,788 |

|

|

|

4,701 |

|

|

Payables to sellers |

|

|

58,226 |

|

|

|

48,992 |

|

|

Total current liabilities |

|

|

155,153 |

|

|

|

120,718 |

|

| Operating lease

liabilities |

|

|

9,060 |

|

|

|

6,581 |

|

| Other long-term

liabilities |

|

|

115 |

|

|

|

137 |

|

| Total liabilities |

|

|

164,328 |

|

|

|

127,436 |

|

| Commitments and contingencies

(Note 16) |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

| Common stock, $0.001 par

value; 120,000,000 shares authorized; 36,707,840 shares issued and

outstanding at September 30, 2024; 36,142,346 shares issued and

outstanding at September 30, 2023 |

|

|

37 |

|

|

|

36 |

|

|

Additional paid-in capital |

|

|

275,771 |

|

|

|

265,945 |

|

|

Treasury stock, at cost; 6,015,496 shares at September 30, 2024,

and 5,433,045 shares at September 30, 2023 |

|

|

(93,854 |

) |

|

|

(84,031 |

) |

|

Accumulated other comprehensive loss |

|

|

(9,427 |

) |

|

|

(10,457 |

) |

|

Retained earnings (accumulated deficit) |

|

|

10,033 |

|

|

|

(9,958 |

) |

|

Total stockholders’ equity |

|

|

182,560 |

|

|

|

161,533 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

346,888 |

|

|

$ |

288,970 |

|

|

|

|

Liquidity Services and

SubsidiariesUnaudited Condensed Consolidated

Statements of Operations (Dollars in Thousands,

Except Per Share Data) |

|

|

|

|

|

Three Months Ended September 30, |

|

|

Twelve Months Ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Purchase revenues |

|

$ |

67,074 |

|

|

$ |

43,373 |

|

|

$ |

209,800 |

|

|

$ |

172,089 |

|

| Consignment and other fee

revenues |

|

|

39,853 |

|

|

|

36,584 |

|

|

|

153,518 |

|

|

|

142,373 |

|

|

Total revenue |

|

|

106,927 |

|

|

|

79,957 |

|

|

|

363,318 |

|

|

|

314,462 |

|

| Costs and expenses from

operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold (excludes depreciation and amortization) |

|

|

58,192 |

|

|

|

34,982 |

|

|

|

178,152 |

|

|

|

142,322 |

|

|

Technology and operations |

|

|

16,241 |

|

|

|

13,655 |

|

|

|

61,377 |

|

|

|

57,078 |

|

|

Sales and marketing |

|

|

13,898 |

|

|

|

13,731 |

|

|

|

54,832 |

|

|

|

49,443 |

|

|

General and administrative |

|

|

8,116 |

|

|

|

6,832 |

|

|

|

31,962 |

|

|

|

28,074 |

|

|

Depreciation and amortization |

|

|

2,823 |

|

|

|

2,821 |

|

|

|

12,120 |

|

|

|

11,255 |

|

|

Other operating expenses, net |

|

|

391 |

|

|

|

58 |

|

|

|

1,471 |

|

|

|

186 |

|

|

Total costs and expenses |

|

|

99,661 |

|

|

|

72,079 |

|

|

|

339,914 |

|

|

|

288,358 |

|

| Income from operations |

|

|

7,266 |

|

|

|

7,878 |

|

|

|

23,404 |

|

|

|

26,105 |

|

| Interest and other income,

net |

|

|

(1,306 |

) |

|

|

(1,175 |

) |

|

|

(3,854 |

) |

|

|

(2,912 |

) |

| Income before provision for

income taxes |

|

|

8,572 |

|

|

|

9,053 |

|

|

|

27,260 |

|

|

|

29,016 |

|

| Provision for income

taxes |

|

|

2,198 |

|

|

|

2,774 |

|

|

|

7,269 |

|

|

|

8,039 |

|

| Net income |

|

$ |

6,374 |

|

|

$ |

6,279 |

|

|

$ |

19,991 |

|

|

$ |

20,978 |

|

| Basic income per common

share |

|

$ |

0.21 |

|

|

$ |

0.21 |

|

|

$ |

0.66 |

|

|

$ |

0.68 |

|

| Diluted income per common

share |

|

$ |

0.20 |

|

|

$ |

0.20 |

|

|

$ |

0.63 |

|

|

$ |

0.65 |

|

| Basic weighted average shares

outstanding |

|

|

30,491,799 |

|

|

|

30,576,142 |

|

|

|

30,496,306 |

|

|

|

31,075,648 |

|

| Diluted weighted average

shares outstanding |

|

|

31,738,515 |

|

|

|

31,749,902 |

|

|

|

31,634,192 |

|

|

|

32,074,561 |

|

|

|

|

Liquidity Services and

SubsidiariesUnaudited Condensed Consolidated

Statements of Cash Flows(Dollars in

Thousands) |

|

|

Year Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

| Operating

activities |

|

|

|

|

|

|

Net income |

$ |

19,991 |

|

|

$ |

20,978 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

12,120 |

|

|

|

11,255 |

|

|

Stock compensation expense |

|

11,087 |

|

|

|

8,191 |

|

|

Inventory adjustment to net realizable value |

|

163 |

|

|

|

1,048 |

|

|

Provision for doubtful accounts |

|

839 |

|

|

|

1,390 |

|

|

Deferred tax expense (benefit) |

|

5,323 |

|

|

|

6,578 |

|

|

(Gain) loss on disposal of property and equipment |

|

(14 |

) |

|

|

(36 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

(4,269 |

) |

|

|

2,725 |

|

|

Inventory |

|

4,949 |

|

|

|

(479 |

) |

|

Prepaid taxes and tax refund receivable |

|

264 |

|

|

|

(152 |

) |

|

Prepaid expenses and other assets |

|

(3,036 |

) |

|

|

(1,166 |

) |

|

Operating lease assets and liabilities |

|

1,447 |

|

|

|

(228 |

) |

|

Accounts payable |

|

8,374 |

|

|

|

(2,889 |

) |

|

Accrued expenses and other current liabilities |

|

4,212 |

|

|

|

277 |

|

|

Deferred revenue |

|

87 |

|

|

|

262 |

|

|

Payables to sellers |

|

8,684 |

|

|

|

(581 |

) |

|

Other liabilities |

|

— |

|

|

|

(157 |

) |

| Net cash provided by operating

activities |

|

70,221 |

|

|

|

47,016 |

|

| Investing

activities |

|

|

|

|

|

| Purchases of property and

equipment, including capitalized software |

|

(8,907 |

) |

|

|

(5,386 |

) |

| Purchase of short-term

investments |

|

(2,264 |

) |

|

|

(8,037 |

) |

| Maturities of short-term

investments |

|

8,161 |

|

|

|

1,923 |

|

| Cash paid for business

acquisition, net of cash acquired |

|

(13,157 |

) |

|

|

— |

|

| Other investing activities,

net |

|

54 |

|

|

|

68 |

|

| Net cash used in investing

activities |

|

(16,113 |

) |

|

|

(11,432 |

) |

| Financing

activities |

|

|

|

|

|

| Payments of the principal

portion of finance lease liabilities |

|

(89 |

) |

|

|

(101 |

) |

| Proceeds from exercise of

common stock options, net of tax |

|

598 |

|

|

|

496 |

|

| Taxes paid associated with net

settlement of stock compensation awards |

|

(2,254 |

) |

|

|

(1,262 |

) |

| Common stock repurchases |

|

(9,426 |

) |

|

|

(21,198 |

) |

| Net cash used in financing

activities |

|

(11,171 |

) |

|

|

(22,065 |

) |

| Effect of exchange rate

differences on cash and cash equivalents |

|

8 |

|

|

|

640 |

|

| Net increase (decrease) in

cash and cash equivalents |

|

42,945 |

|

|

|

14,159 |

|

| Cash and cash equivalents at

beginning of year |

|

110,281 |

|

|

|

96,122 |

|

| Cash and cash equivalents at

end of year |

|

153,226 |

|

|

|

110,281 |

|

| Supplemental

disclosure of cash flow information |

|

|

|

|

|

| Cash paid for income taxes,

net |

$ |

1,710 |

|

|

$ |

1,590 |

|

| Non-cash: Common stock

surrendered in the exercise of stock options |

$ |

397 |

|

|

$ |

200 |

|

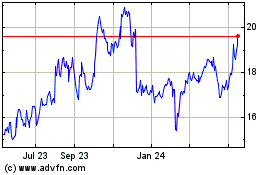

Liquidity Services (NASDAQ:LQDT)

Historical Stock Chart

From Nov 2024 to Dec 2024

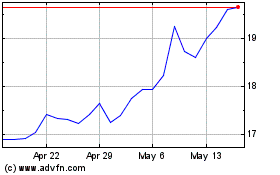

Liquidity Services (NASDAQ:LQDT)

Historical Stock Chart

From Dec 2023 to Dec 2024