false000123546800012354682025-02-062025-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 06, 2025 |

Liquidity Services, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

0-51813 |

52-2209244 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

6931 Arlington Road Suite 460 |

|

Bethesda, Maryland |

|

20814 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 202 4676868 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value |

|

LQDT |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Matters.

Attached hereto as Exhibit 99.1 is the transcript for the earnings conference call of the Company held on February 6, 2025.

The information in this Current Report on Form 8-K, including the exhibits attached hereto, shall be considered "furnished" pursuant to Item 8.01 of Form 8-K and shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended, nor shall it be deemed incorporated by reference into any of the Company's reports or filings with Securities and Exchange Commission, whether made before or after the date thereof, except as expressly set forth by specific reference in such report or filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

99.1 Transcript for Earnings Call February 6, 2025

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

LIQUIDITY SERVICES, INC. |

|

(Registrant) |

|

|

Date: February 7, 2025 |

By: |

/s/ Mark A. Shaffer |

|

Name: |

Mark A. Shaffer |

|

Title: |

Chief Legal Officer and

Corporate Secretary |

Exhibit 99.1

Liquidity Services, Inc. (NASDAQ: LQDT) Q4 2024 Earnings Call Transcript February 6, 2025 10:30 AM ET

Company Participants

Michael Patrick - Senior Vice President and Controller

Bill Angrick - Chairman and Chief Executive Officer

Jorge Celaya - Executive Vice President and Chief Financial Officer

Conference Call Participants

George Sutton - Craig-Hallum

Gary Prestopino - Barrington

Operator

Welcome to the Liquidity Services Inc. First Quarter of Fiscal Year 2025 Financial Results Conference Call. My name is Tonya, and I'll be your operator for today's call. Please note that this conference call is being recorded. [Operator Instructions]

I will now turn the call over to Michael Patrick, Liquidity Services Vice President and Controller. Please go ahead.

Michael Patrick

Good morning. On the call today are Bill Angrick, our Chairman and Chief Executive Officer; and Jorge Celaya, our Executive Vice President and Chief Financial Officer. They will be available for questions after their prepared remarks.

The following discussion and responses to your questions reflect management's views as of today, February 6, 2025, and will include forward-looking statements. Actual results may differ materially. Additional information about factors that could potentially impact our financial results is included in today's press release and in filings with the SEC, including our most recent annual report on Form 10-K. As you listen to today's call, please have our press release in front of you, which includes our financial results as well as metrics and commentary on the quarter.

During this call, management will discuss certain non-GAAP financial measures. In our press release and filings with the SEC, each of which is posted on our website, you will find additional disclosures regarding these non-GAAP measures, including the reconciliations of these measures with their most comparable GAAP measures as available. Management also uses certain supplemental operating data as a measure of certain components of operating performance, which we also believe is useful for management and investors. This supplemental operating data includes gross merchandise volume and should not be considered a substitute for or superior to GAAP results.

At this time, I will turn the presentation over to our Chairman and CEO, Bill Angrick.

Bill Angrick

Good morning, and welcome to our Q1 earnings call.

I'll review our Q1 performance and the progress of our business segments. And next, Jorge Celaya will provide more details on the quarter. Our strong start to fiscal year 2025 was fueled by the continuing adoption of our services by customers and continued momentum across our businesses, resulting in record quarterly GMV and double-digit GMV growth in each of our segments. The strength of our performance across all of our segments is powered by our relentless drive to exceed the expectations of our sellers and buyers by continually enhancing our services and leveraging advanced technologies.

We are attracting more sellers and buyers to our platform and enhancing our overall marketplace experiences. We continue to see growing network effects in our marketplace platform as we have now eclipsed a $1.5 billion annual GMV run rate and grew our auction participants by 13% year-over-year during the quarter, reflecting consistent strong demand for the value of priced goods offered in our marketplace against a backdrop of persistent inflation.

Strong buyer participation drove record quarterly GMV, revenue and direct profit in our Retail Supply Chain Group segment for the second quarter in a row. Our rapid growth reflects our position as the most reliable and trusted solution

provider in the retail supply chain. We expect to continue our momentum by continuing to grow our buyer base and value-added services.

Notably, we continue to expand our presence with consumer buyers for high-value goods using our online auction marketplace capabilities and our distribution center network to facilitate low-cost customer pickup of single items. Our GovDeals segment grew its GMV and revenues by 11% and 29% year-over-year, respectively, driven by growth in both high-value capital goods and non-vehicle asset categories over a growing seller base.

Notable new sellers for GovDeals during Q1 included New York City; Tulsa, Oklahoma; Humboldt County, California; and Naval Air Station, Jacksonville, Florida. We also set a new record for GovDeal sellers with over $1 million of GMV transacted in a quarter, reflecting our ability to continue to penetrate our existing sellers through continuous improvement in our service and results. Our CAG segment grew its GMV 31% organically year-over-year, driven by strength in its energy and heavy equipment verticals as we continue to scale our recurring seller base.

Our CAG auction participants more than doubled year-over-year, reflecting the increased vibrancy of our CAG marketplace for sellers of industrial and heavy equipment. We have a strong pipeline heading into Q2, and are well positioned to continue this momentum. Finally, our Machinio segment recorded double-digit organic growth in revenue and direct profit during Q1 and now has over 4,000 subscribers from over 100 countries on the platform.

Machinio has continued to expand its coverage into the Asia Pacific region, which represents a significant growth opportunity for our classifieds marketplace for used machinery. We expect continued steady growth in fiscal '25 for Machinio, driven by continuous improvement to our marketplace traffic, enhanced features and increased value to our subscriber base.

As we look to the future, we continue to invest in growing our seller base, buyer channels and value-added services, both organically and via acquisitions. Investors should expect acquisitions that are accretive and which expand our market share and capabilities. In that context, we're excited to announce the acquisition of Auction Software and Simple Auction Site, a private label auction marketplace and SaaS solutions provider. This acquisition will enhance our software development capabilities and extend our market reach.

Our leadership team continues to make progress towards our midterm goal of achieving $2 billion of annual GMV. To achieve this objective, we will focus on increasing the sales volume transacted on our marketplace, expanding our buyer base and sales channels to enhance recovery on the assets we sell, modernizing our platform with new technologies to increase our operational efficiencies and improve the customer experience, and finally, executing complementary bolt-on acquisitions.

With our market-leading solutions, our strong financial foundation and strategic focus, we are well positioned to capitalize on numerous emerging opportunities in the $100 billion circular economy and drive long-term growth and shareholder value.

I'll now turn it over to Jorge for more details on the quarter.

Jorge Celaya

Good morning.

We are pleased to report a strong start to our 2025 fiscal year. Our fiscal first quarter results finished slightly above our first quarter guidance range. We set a new quarterly consolidated GMV record as we have seen continued expanding market share with double-digit GMV growth across each of our segments. Our growth, diversification and mix of business has led to four quarters of sequential operating leverage to adjusted EBITDA from our scalable solutions and resilient operational capabilities.

Our consolidated results for the fiscal first quarter of 2025 included GMV of $386.1 million, up 26% from $305.9 million in the same quarter last year. Revenue was $122.3 million, up 72% from $71.3 million last year. Consistent with our previous fourth quarter of fiscal year 2024, revenue has continued to grow faster than GMV mainly due to the expansion of lower-touch purchase programs in our Retail segment. Our GAAP earnings per share was $0.18, while $0.28 on a non-GAAP adjusted basis. Our GAAP net income was $5.8 million, up 205% and our non-GAAP adjusted EBITDA was $13.1 million, up 81% versus last year.

We ended the fiscal first quarter with $139.1 million in cash, cash equivalents and short-term investments. We continue to have zero debt and we have $17.5 million of available borrowing capacity under our credit facility. We also are not expecting any significant changes in the near term to our capital expenditures relative to our recent historical averages.

Specifically comparing segment results from this fiscal first quarter of 2025 for the same quarter last year. Our Retail segment was up 65% on GMV, doubled its revenue growing 101% and was up 31% on segment direct profit, setting new quarterly records for each of these metrics for the second consecutive quarter.

Our Capital Assets Group segment was up 31% on GMV, 26% on revenue and up 27% on segment direct profit led by continued addition of recurring sellers of low-touch heavy equipment sales.

As a reminder, last year, the fiscal first quarter of 2024 for the CAG segment experienced delays in selected international sales events, many which subsequently took place during the fiscal second quarter last year. Our GovDeals segment's GMV was up 11%, revenue up 29% and direct profit up 25%, driven by strong performance in vehicles, continued growth in new sellers and the service initiatives from Sierra Auction expansion. Machinio's revenue and Segment direct profit were each up 10%. Our outlook for the fiscal second quarter of 2025 anticipates continuing our solid start to the fiscal year as a whole.

Guidance anticipates a strong first half of fiscal year 2025 for growth and operating leverage. Consistent with our fiscal first quarter results last year, the expanded purchase programs in our retail segment are expected to continue to grow revenue at a higher rate than GMV and therefore, impacting the percent direct profit to revenue ratio.

While our CAG-heavy equipment and energy categories are expected to continue solid growth, the prior year comparable period for CAG reflected the completion of several international sales events that had previously been delayed from last year's fiscal first quarter. Our GovDeals and Machinio segments are expected to continue expansion of new clients, grow with existing clients and grow expanded service offerings. On a consolidated basis, Consignment GMV is expected to continue to be approximately 80% of total GMV.

Consolidated revenue as a percent of GMV is expected to remain in the low 30s percentage range. And the total of our segment direct profits as a percent of consolidated revenue is expected to be in the low 40s percentage range. These ratios can vary based on our overall business mix of segments and within each segment, including asset categories in any given period. Management's guidance for the second quarter of fiscal year 2025 is as follows. We expect GMV to range from $360 million to $390 million.

GAAP net income is expected in the range of $5.5 million to $8 million with the corresponding GAAP net earnings per share ranging from $0.17 to $0.25 per share. Non-GAAP adjusted diluted earnings per share is estimated in the range of $0.27 to $0.35 per share.

We estimate non-GAAP adjusted EBITDA to range from $12 million to $14.5 million. The GAAP and non-GAAP earnings per share guidance assumes our effective tax rate applied to our fiscal second quarter results will follow our historical trends and be in the low to mid-20s. Our annual effective tax rate is still expected to be in the high 20s or low 30s.

We also expect that we will have approximately 32 million to 32.5 million fully diluted weighted average shares outstanding. The acquisition of Auction Software is not expected to materially impact our consolidated results for the quarter.

Thank you. We will now take your questions.

Question-and-Answer Session

Operator

[Operator Instructions] Our first question will be coming from George Sutton of Craig-Hallum. Your line is open.

George Sutton

Thank you. Wonderful results. Congratulations. So I wondered if we could address something you had in your prepared comments, you mentioned expanding market share, which is fairly obvious given the growth. I'm just curious if you could talk about how much is expanding market share versus just a better market condition as you see it?

Bill Angrick

I think the market share comment relates to customers providing access to more goods, more categories, more geographic regions, and that's across each of our segments. Market conditions have been fairly choppy depending upon where you sit. Different categories have different cross currents. I did note the persistent inflation, which tends to bring

buyers to a platform offering value priced goods, George. But I think this is about just blocking and tackling, bringing the brand to more corporate and government organizations.

George Sutton

So you mentioned inflation. And just as on that, we have a potential new tariff set of situations. I'm curious, historically, what have you seen when tariffs are put in place relative to your business?

Bill Angrick

Well, the scarcity value of product in various categories already being in the U.S. and available tends to be a positive. Used equipment can be quite useful if you can import it. And I think that's something that on balance is probably neutral positive for us.

George Sutton

One last thing. I wondered if you could just walk through the Simple Auction acquisition in -- it looks like a relatively small but fast-growing business. It's fairly narrow as it's set up on the memorabilia side. I'm wondering how broad could that offering ultimately become?

Bill Angrick

Sure. I think this is a great example for us of bringing our ecosystem to include the transactional marketplaces we serve. And then the Software, we can provide resellers on our platform. We are largely a B2B platform, our buyer base consists of many small entrepreneurial and midsized businesses who often resell what they acquire. They are all looking to be on the digital platform to support their own individual small businesses in both Simple Auction Site and Auction Software, which is the other part of this company we acquired.

It provide the tools, the auction platform, the resale platform and capabilities to further serve our buyers who then are looking to grow the resale business. So this has a few aspects. One, it's an acqui-hire, a lot of great talent developing modern scalable software. And two, a business that's operated in a Software-as-a-Service business model for many years successfully, an area that we think has a potential to grow. I think, three, puts us in a position to add value in some new categories.

You mentioned a few. I think there's a great opportunity and just generally in retail goods. I think there's a very loyal group of auctioneers, resellers and nostalgia categories, including collectibles and even estate sales and antiques that leverage this online auction community. And I think we can monetize our buyer base. I think we can extend the reach to more categories and do so in a very asset-light software-enabled way. So it's a great fit for us.

George Sutton

Super. Lastly, the -- your DOGE press release was, frankly, one of the better thought out press releases I've seen in a long time. Congratulations on that.

Bill Angrick

Well, thank you. We founded our business originally in Washington, D.C. We have a lot of experience working within the federal government. A lot of these principles we've been talking about for 25 years. And when you have some open-mindedness to rethink how government functions, I think it's a great entry point for companies like Liquidity Services.

We, right now, could unlock efficiency for federal agencies, and we look forward to having future interaction and conversation with decision makers as they arrive at new policy.

George Sutton

Super. Thank you.

Operator

One moment for our next question. Our next question will be coming from Gary Prestopino of Barrington. Your line is open.

Gary Prestopino

Hi. Good morning, all. Bill, a question on GovDeals. Are you starting to see more of an increased flow of vehicles coming through to auction that was kind of constricted over the last couple of years due to what happened with the pandemic. So how is that looking now? And what's your take on what's happening in the future there?

Bill Angrick

Vehicle flow has been healthy. I wouldn't say it has been a massive catalyst to support our results but it is not anemic, which was an issue, as you point out, Gary, when inputs were -- chipsets weren't available. So I think the supply chain has more normalized flows, steady. That isn't the primary catalyst for GovDeals result. I think, as I mentioned, we've had good results in non-vehicle categories and another high-value capital item categories, which could include things like high-value fire trucks, helicopters, construction equipment to maintain roads and bridges. Those are all performing well for us.

We, as you know, also have a real estate category that, as we've seen through some of our results and even some of our press releases. We're now getting a lot of government and real estate on the platform which tends to bring larger chunks of GMV. And just is a wonderful category for us to expand and it makes no sense for those sales to occur in an offline manner. So broad-based growth, vehicles are a healthy contributor among many.

Gary Prestopino

Okay. Can -- I don't know if this question was asked or you did mention it, but in terms of the GMV increase. You also mentioned that you've got new high-volume sellers. I mean how much of that GMV increase came from new accounts recently signed over the last six to 12 months.

Bill Angrick

As you go through each of the categories, I think GovDeals and CAG benefited from continued growth in the -- in the seller community. So we've invested in expanding sales business development capacity. We're beginning to reap the benefits of that. I think retail is a combination of us penetrating existing relationships and adding new territories and new categories. So we know that there is a lot of room to grow sort of circular economy.

Commerce in the retail category, we're committed to that. So it's a good mix, Gary, of both new names and existing relationships driving that GMV growth.

Gary Prestopino

Okay. That's helpful. And then with the Auction Software business, you're saying it's a SaaS model. I mean, is the revenue streams there generated just from selling the SaaS software on a rental basis? Or does the platform allow you to take any percentage of the transaction as a fee as well.

Bill Angrick

It's a combination of both. And we see an opportunity to standardize and provide a very reasonably priced SaaS e-commerce platform and then unlock additional recovery for these, call it, subscribers by providing access to an aggregated buyer marketplace. And in terms of delivering value from those improved auction results and access to a larger buyer base, we would receive a percentage of that GMV. But again, that would be well within the affordability of small and midsized businesses. So it's a very asset-light marketplace business model that does unlock additional value for these subscribers and would reap some GMV-related pricing for Liquidity Services.

Gary Prestopino

So as I looked at this website, obviously, it's kind of niche-y at those collectibles. I saw wine auctions and things of that nature. But does this give you the ability now if you have a potential client that wants to run their own auctions, you would sell them the platform and they would be able to do that across all three of your segments? Or are you -- is that kind of how you see this being leveraged across your portfolio of businesses?

Bill Angrick

Yes, there are a couple of areas that have application. First, in the retail supply chain, there are a lot of individual resellers who know that digital presence is important, and these are large companies that specialize in particular categories and they're reselling to consumers, and they want to have a good experience.

And so we think we can bundle this auction platform with those use cases and help many people who buy from us, someone who's buying a truckload might be reselling to consumers. So we think it's a nice adjacency that we can serve within the retail marketplace. You also see that in the Machinio segment where you have something like $20 billion of used equipment, looking for a home on Machinio's classifieds marketplace.

Machinio is not a transactional platform and dealers often like to control their brand and their experience. And so a white label auction marketplace platform or sales platform would be a very good fit for those dealer customers. They get to control the brand, they get to control the pricing and what we help them do, Gary, is convert that traffic to their marketplace, to e-commerce sales and handle the payment, handle the invoicing and billing, something we do very well. So I think that's another area of application.

Gary Prestopino

Okay. Thank you

Operator

We have no further questions at this time. This concludes today's conference call. Thank you for participating. You may now disconnect.

v3.25.0.1

Document And Entity Information

|

Feb. 06, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 06, 2025

|

| Entity Registrant Name |

Liquidity Services, Inc.

|

| Entity Central Index Key |

0001235468

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

0-51813

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

52-2209244

|

| Entity Address, Address Line One |

6931 Arlington Road

|

| Entity Address, Address Line Two |

Suite 460

|

| Entity Address, City or Town |

Bethesda

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20814

|

| City Area Code |

202

|

| Local Phone Number |

4676868

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

LQDT

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

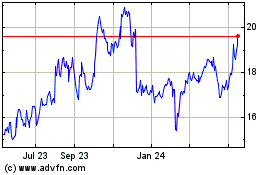

Liquidity Services (NASDAQ:LQDT)

Historical Stock Chart

From Jan 2025 to Feb 2025

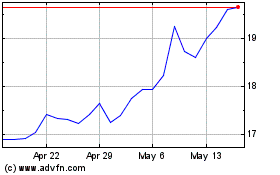

Liquidity Services (NASDAQ:LQDT)

Historical Stock Chart

From Feb 2024 to Feb 2025