Lulu’s Fashion Lounge Holdings, Inc. (“Lulus” or the

“Company”) (Nasdaq: LVLU) today reported financial results for the

first quarter ended March 31, 2024 and announced that its Board of

Directors has authorized a share repurchase program for the

repurchase of up to $2.5 million of the Company’s common stock.

Crystal Landsem, CEO of Lulus, said:

"As we continue to make strides in evolving our

product assortment, our net revenue comp for the first quarter

improved modestly on a sequential quarterly basis by 250 basis

points. Strong customer demand for our new and novelty products

bolsters our confidence in our reorder pipeline, contributing to

positive sales comparisons and favorable margin performance in

several of our high-volume categories. In addition, we saw

improvement in gross margin in the first quarter and our inventory

levels declined by 20% from Q1 2023, exceeding our net revenue

decline on a year-over-year basis and reinforcing the agility of

our data driven buying model. Our strong balance sheet and ability

to generate cash flow supported a $2 million reduction in our

revolver balance in Q1 2024. We advanced our strategic initiatives

around brand awareness and customer engagement, which we believe

will bear fruit in the coming quarters. We are optimistic about our

opportunities to return to growth as we continue to build upon

our operational efficiency, innovation, and product offering."

First Quarter 2024 Highlights:

- Net revenue of $77.3 million, a

decrease of 15% compared to $91.0 million in the same period last

year, driven by a 17% decrease in Total Orders Placed with higher

return rates, offset by higher Average Order Value (“AOV”).

Markdown sales were down 18% compared to the same period last year,

contributing to the overall net revenue decline and Gross Margin

improvement.

- Active Customers of 2.8 million, a decrease of 13% compared to

3.2 million in the same period last year.

- AOV of $143, an increase of 11% compared to $129 in the same

period last year.

- Gross profit decreased 14% and Gross Margin increased 60 basis

points to 42.3%, in each case compared to the same period last

year.

- Net loss of $5.7 million, a decrease of 2% compared to $5.6

million in the same period last year.

- Adjusted EBITDA* of ($2.7) million, compared to $16.0 thousand

in the same period last year.

- Net cash provided by operating activities of $6.9 million, an

increase of 88% compared to $3.7 million in the same period last

year.

- Free Cash Flow* of $6.0 million, an increase of 127% compared

to $2.6 million in the same period last year.

- Total debt, comprised of the revolving line of credit, of $6.0

million, a decrease of 70% compared to $20.0 million at the end of

the same period last year.

- Net Debt* of $0.5 million, a decrease of 96% compared to $12.2

million at the end of the same period last year.

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

| |

|

March 31, 2024 |

|

|

April 2, 2023 |

|

|

YoY Change |

|

| |

|

(In thousands, except percentages) |

|

Net revenue |

|

$ |

77,259 |

|

|

|

$ |

90,976 |

|

|

|

(15 |

) |

% |

| Gross profit |

|

$ |

32,646 |

|

|

|

$ |

37,961 |

|

|

|

(14 |

) |

% |

| Gross Margin* |

|

|

42.3 |

|

% |

|

|

41.7 |

|

% |

|

60 |

|

bps |

| Net loss |

|

$ |

(5,736 |

) |

|

|

$ |

(5,618 |

) |

|

|

2 |

|

% |

| Adjusted EBITDA* |

|

$ |

(2,659 |

) |

|

|

$ |

16 |

|

|

|

NM |

|

|

| Diluted loss per share |

|

$ |

(0.15 |

) |

|

|

$ |

(0.14 |

) |

|

|

5 |

|

% |

| Active Customers* |

|

|

2,770 |

|

|

|

|

3,173 |

|

|

|

(13 |

) |

% |

| Net cash provided by operating

activities |

|

$ |

6,947 |

|

|

|

$ |

3,705 |

|

|

|

88 |

|

% |

| Free Cash Flow* |

|

$ |

5,988 |

|

|

|

$ |

2,636 |

|

|

|

127 |

|

% |

| Total debt |

|

$ |

(6,000 |

) |

|

|

$ |

(20,000 |

) |

|

|

(70 |

) |

% |

| Net Debt* |

|

$ |

(511 |

) |

|

|

$ |

(12,171 |

) |

|

|

(96 |

) |

% |

NM – not meaningful* Note: This is a non-GAAP financial measure.

See “Use of Non-GAAP Financial Measures and Other Operating

Metrics” section below for definitions of these metrics.

Updating Financial Outlook for Fiscal Year

2024:

We remain confident in the long-term growth

trajectory of our business and are as committed as ever to growing

our brand. In light of softer than expected net revenue in the

first quarter of 2024, we are adjusting our net revenue outlook for

the full year 2024. Due to actions being taken to improve our Gross

Margin, as well as ongoing discipline in managing our costs, we are

increasing the low end of our Adjusted EBITDA outlook for the

year.

- We expect net revenue to be between

$350 million and $360 million, which represents between a -1.5%

decrease and a 1.4% increase compared to 2023. With markdown sales

anticipated to remain below prior year levels, we expect our Gross

Margin to be approximately 180 and 200 basis points higher compared

to 2023.

- We expect Adjusted EBITDA to be

between $6 million and $8 million, which represents an increase of

between 86% and 148% compared to 2023.

- We continue to expect capital

expenditures to be between $5 million and $6 million, which

represents an increase of between 28% and 54% compared to

2023.

Forecasting future results or trends is

inherently difficult for any business, and actual results or trends

may differ materially from those forecasted. Lulus’ outlook is

based on current indications for its business. Lulus’ outlook

factors in our current best estimates for anticipated headwinds,

including those related to the level of demand, spending and

returns by our customers, macroeconomic uncertainties, inflation,

supply chain pressures, and shipping costs. Given the volatile

nature of current consumer demand and potential for further impacts

to consumer behavior due to macroeconomic factors, including

continued inflation, higher interest rates, the resumption of

student loan interest and payments, as well as world events, wars,

and domestic and international conflicts that affect overall

consumer confidence and the predictability of consumer purchasing

behavior, Lulus’ financial outlook is subject to change.

| |

|

LULU’S FASHION LOUNGE

HOLDINGS, INC.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS ANDCOMPREHENSIVE

LOSS(Unaudited)(In thousands,

except share and per share data) |

| |

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

| |

|

March 31, |

|

April 2, |

| |

|

2024 |

|

2023 |

|

Net revenue |

|

$ |

77,259 |

|

|

$ |

90,976 |

|

|

Cost of revenue |

|

|

44,613 |

|

|

|

53,015 |

|

|

Gross profit |

|

|

32,646 |

|

|

|

37,961 |

|

| Selling and marketing

expenses |

|

|

17,693 |

|

|

|

19,489 |

|

| General and administrative

expenses |

|

|

21,111 |

|

|

|

24,348 |

|

| Loss from operations |

|

|

(6,158 |

) |

|

|

(5,876 |

) |

|

Interest expense |

|

|

(383 |

) |

|

|

(523 |

) |

|

Other income, net |

|

|

226 |

|

|

|

73 |

|

| Loss before benefit for income

taxes |

|

|

(6,315 |

) |

|

|

(6,326 |

) |

| Income tax benefit |

|

|

579 |

|

|

|

708 |

|

| Net loss and comprehensive

loss |

|

$ |

(5,736 |

) |

|

$ |

(5,618 |

) |

| |

|

|

|

|

|

|

| Basic loss per share |

|

$ |

(0.15 |

) |

|

$ |

(0.14 |

) |

| Diluted loss per share |

|

$ |

(0.15 |

) |

|

$ |

(0.14 |

) |

| Basic weighted-average shares

outstanding |

|

|

39,450,502 |

|

|

|

39,233,953 |

|

| Diluted weighted-average

shares outstanding |

|

|

39,450,502 |

|

|

|

39,233,953 |

|

| |

|

|

|

|

|

|

|

|

| |

|

LULU’S FASHION LOUNGE

HOLDINGS, INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(Unaudited)(In thousands,

except share and per share data) |

| |

|

|

|

|

|

|

| |

|

March 31, |

|

December

31, |

| |

|

2024 |

|

2023 |

| Assets |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,489 |

|

|

$ |

2,506 |

|

|

Accounts receivable |

|

|

5,212 |

|

|

|

3,542 |

|

|

Inventory, net |

|

|

41,271 |

|

|

|

35,472 |

|

|

Assets for recovery |

|

|

5,062 |

|

|

|

3,111 |

|

|

Income tax refund receivable |

|

|

2,889 |

|

|

|

2,510 |

|

|

Prepaids and other current assets |

|

|

5,297 |

|

|

|

5,379 |

|

|

Total current assets |

|

|

65,220 |

|

|

|

52,520 |

|

|

Property and equipment, net |

|

|

4,694 |

|

|

|

4,712 |

|

|

Goodwill |

|

|

35,430 |

|

|

|

35,430 |

|

|

Tradename |

|

|

18,509 |

|

|

|

18,509 |

|

|

Intangible assets, net |

|

|

3,147 |

|

|

|

3,263 |

|

|

Lease right-of-use assets |

|

|

28,182 |

|

|

|

29,516 |

|

|

Other noncurrent assets |

|

|

5,451 |

|

|

|

5,495 |

|

| Total assets |

|

$ |

160,633 |

|

|

$ |

149,445 |

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

8,312 |

|

|

$ |

8,900 |

|

|

Accrued expenses and other current liabilities |

|

|

30,077 |

|

|

|

18,343 |

|

|

Returns reserve |

|

|

15,858 |

|

|

|

7,854 |

|

|

Stored-value card liability |

|

|

13,209 |

|

|

|

13,142 |

|

|

Revolving line of credit |

|

|

6,000 |

|

|

|

8,000 |

|

|

Lease liabilities, current |

|

|

5,530 |

|

|

|

5,648 |

|

|

Total current liabilities |

|

|

78,986 |

|

|

|

61,887 |

|

|

Lease liabilities, noncurrent |

|

|

23,863 |

|

|

|

25,427 |

|

|

Other noncurrent liabilities |

|

|

38 |

|

|

|

1,179 |

|

|

Total liabilities |

|

|

102,887 |

|

|

|

88,493 |

|

| |

|

|

|

|

|

|

| Stockholders'

equity: |

|

|

|

|

|

|

|

Preferred stock: $0.001 par value, 10,000,000 shares authorized,

and no shares issued or outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock: $0.001 par value, 250,000,000 shares authorized; and

41,255,966 and 40,618,206 shares issued and outstanding as of March

31, 2024 and December 31, 2023, respectively |

|

|

41 |

|

|

|

41 |

|

|

Additional paid-in capital |

|

|

256,646 |

|

|

|

254,116 |

|

|

Accumulated deficit |

|

|

(198,941 |

) |

|

|

(193,205 |

) |

|

Total stockholders' equity |

|

|

57,746 |

|

|

|

60,952 |

|

|

Total liabilities and stockholders' equity |

|

$ |

160,633 |

|

|

$ |

149,445 |

|

|

|

|

|

|

|

|

|

|

|

| |

|

LULU’S FASHION LOUNGE

HOLDINGS, INC.CONDENSED CONSOLIDATED

STATEMENTS OF CASH

FLOWS(Unaudited)(In

thousands) |

| |

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

| |

|

March 31, |

|

April 2, |

| |

|

2024 |

|

2023 |

| Cash Flows from

Operating Activities |

|

|

|

|

|

|

|

Net loss |

|

$ |

(5,736 |

) |

|

$ |

(5,618 |

) |

| Adjustments to reconcile net

loss to net cash provided by operating activities: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,339 |

|

|

|

1,121 |

|

|

Noncash lease expense |

|

|

970 |

|

|

|

864 |

|

|

Amortization of debt discount and debt issuance costs |

|

|

39 |

|

|

|

40 |

|

|

Equity-based compensation expense |

|

|

1,934 |

|

|

|

4,698 |

|

|

Deferred income taxes |

|

|

— |

|

|

|

(2,105 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

|

(1,670 |

) |

|

|

(3,326 |

) |

|

Inventories |

|

|

(5,799 |

) |

|

|

(8,644 |

) |

|

Assets for recovery |

|

|

(1,951 |

) |

|

|

(2,862 |

) |

|

Income taxes (receivable) payable |

|

|

(379 |

) |

|

|

1,388 |

|

|

Prepaid and other current assets |

|

|

82 |

|

|

|

(295 |

) |

|

Accounts payable |

|

|

(549 |

) |

|

|

1,719 |

|

|

Accrued expenses and other current liabilities |

|

|

20,053 |

|

|

|

17,572 |

|

|

Operating lease liabilities |

|

|

(939 |

) |

|

|

(803 |

) |

|

Other noncurrent liabilities |

|

|

(447 |

) |

|

|

(44 |

) |

|

Net cash provided by operating activities |

|

|

6,947 |

|

|

|

3,705 |

|

| Cash Flows from

Investing Activities |

|

|

|

|

|

|

|

Capitalized software development costs |

|

|

(397 |

) |

|

|

(551 |

) |

|

Purchases of property and equipment |

|

|

(562 |

) |

|

|

(518 |

) |

|

Net cash used in investing activities |

|

|

(959 |

) |

|

|

(1,069 |

) |

| Cash Flows from

Financing Activities |

|

|

|

|

|

|

|

Proceeds from borrowings on revolving line of credit |

|

|

10,000 |

|

|

|

2,000 |

|

|

Repayments on revolving line of credit |

|

|

(12,000 |

) |

|

|

(7,000 |

) |

|

Proceeds from issuance of common stock under employee stock

purchase plan (ESPP) |

|

|

167 |

|

|

|

269 |

|

|

Principal payments on finance lease obligations |

|

|

(743 |

) |

|

|

(245 |

) |

|

Withholding tax payments related to vesting of RSUs |

|

|

(429 |

) |

|

|

(43 |

) |

|

Other |

|

|

— |

|

|

|

(7 |

) |

|

Net cash used in financing activities |

|

|

(3,005 |

) |

|

|

(5,026 |

) |

| Net increase (decrease) in

cash, cash equivalents and restricted cash |

|

|

2,983 |

|

|

|

(2,390 |

) |

| Cash, cash equivalents and

restricted cash at beginning of period |

|

|

2,506 |

|

|

|

10,219 |

|

| Cash, cash equivalents and

restricted cash at end of period |

|

$ |

5,489 |

|

|

$ |

7,829 |

|

| |

|

|

|

|

|

|

Webcast & Conference Call

Information

The Company will host a conference call and live

webcast with the investment community at 5:00 p.m. Eastern Time

today, Wednesday, May 8, 2024, to discuss its first quarter 2024

financial results. The live webcast will be accessible through the

Investor Relations section of the Company’s website at

https://investors.lulus.com/. To access the call through a

conference line, dial 1-877-407-0792 (in the U.S.) or

1-201-689-8263 (international callers). A replay of the conference

call will be posted shortly after the call and will be available

for seven days following the call. To access the replay, dial

1-844-512-2921 (in the U.S.) or 1-412-317-6671 (international

callers). The access code for the replay is 13745696.

About Lulus

Headquartered in California and serving millions

of customers worldwide, Lulus is an attainable luxury fashion brand

for women, offering modern, unapologetically feminine designs at

accessible prices for all of life’s fashionable moments. Our aim is

to make every woman feel beautiful, celebrated and as if she’s the

most special version of herself for every occasion – from work desk

to dream date or cozied up on the couch to the spotlight of her

wedding day. Founded in 1996, Lulus delivers fresh styles to

consumers daily, using direct consumer feedback and insights to

refine product offerings and elevate the customer experience.

Lulus’ world class personal stylists, bridal concierge, and

customer care team share an unwavering commitment to elevating

style and quality and bring exceptional customer service and

personalized shopping to customers around the world. Follow @lulus

on Instagram and @lulus on TikTok. Lulus is a registered

trademark of Lulu’s Fashion Lounge, LLC. All rights reserved.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the Private Securities Litigation Reform Act of

1995. All statements other than statements of historical or current

fact included in this press release are forward-looking statements,

including but not limited to statements regarding our opportunities

for growth in the coming quarters, the long-term growth trajectory

of our business and our updated financial outlook for the

fiscal year ending December 29, 2024. These statements are

neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause

Lulus’ actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements, including,

but not limited to, the risk factors discussed in Part I, Item 1A,

“Risk Factors” in Lulus’ Annual Report on Form 10-K for the fiscal

year ended December 31, 2023 and our other filings with the

Securities and Exchange Commission which could cause actual results

to differ materially from those indicated by the forward-looking

statements made in this press release. Any such forward-looking

statements represent management’s estimates as of the date of this

press release. While Lulus may elect to update such forward-looking

statements at some point in the future, it disclaims any obligation

to do so, except as required by law, even if subsequent events

cause its views to change.

Use of Non-GAAP Financial Measures and Other Operating

Metrics

To supplement our condensed consolidated

financial statements, which are prepared and presented in

accordance with accounting principles generally accepted in the

United States of America (“GAAP”), we reference in this press

release and the accompanying tables the following non-GAAP

financial measures: Adjusted EBITDA, Adjusted EBITDA Margin, Net

Debt and Free Cash Flow. The presentation of this non-GAAP

financial information is not intended to be considered in isolation

or as a substitute for, or superior to, the financial information

prepared and presented in accordance with GAAP, and our non-GAAP

measures may be different from non-GAAP measures used by other

companies. We use these non-GAAP financial measures to evaluate our

operating performance, generate future operating plans and make

strategic decisions regarding the allocation of capital. Our

management believes that these non-GAAP financial measures provide

meaningful supplemental information regarding our performance and

liquidity by excluding certain expenses that may not be indicative

of our ongoing core operating performance. We believe that both

management and investors benefit from referring to these non-GAAP

financial measures in assessing our performance and when analyzing

historical performance and liquidity and when planning,

forecasting, and analyzing future periods. For a reconciliation of

these non-GAAP financial measures to GAAP measures, please see the

tables captioned “Reconciliation of Non-GAAP Financial Measures”

included at the end of this release. Definitions of our non-GAAP

financial measures and other operating metrics are presented below.

A reconciliation of Adjusted EBITDA guidance to net loss on a

forward-looking basis cannot be provided without unreasonable

efforts, as we are unable to provide reconciling information with

respect to equity-based compensation expense and income tax, all of

which are adjustments to Adjusted EBITDA. We also use certain key

operating metrics, including Gross Margin, Active Customers,

Average Order Value, and Total Orders Placed.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure

that we calculate as net loss before interest expense, income

taxes, depreciation and amortization, adjusted to exclude the

effects of equity-based compensation. Adjusted EBITDA is a key

measure used by management to evaluate our operating performance,

generate future operating plans and make strategic decisions

regarding the allocation of capital. In particular, the exclusion

of certain expenses in calculating Adjusted EBITDA facilitates

operating performance comparisons on a period-to-period basis and,

in the case of exclusion of the impact of equity-based

compensation, excludes items that we do not consider to be

indicative of our core operating performance.

Adjusted EBITDA Margin

Adjusted EBITDA Margin is

a non-GAAP financial measure that we calculate as

Adjusted EBITDA (as defined above) as a percentage of our net

revenue.

Active Customers

We define Active Customers as the number of

customers who have made at least one purchase across our platform

in the prior 12-month period. We consider the number of Active

Customers to be a key performance metric on the basis that it is

directly related to consumer awareness of our brand, our ability to

attract visitors to our digital platform, and our ability to

convert visitors to paying customers. Active Customer counts are

based on de-duplication logic using customer account and guest

checkout name, address, and email information.

Average Order Value

We define Average Order Value (“AOV”) as the sum

of the total gross sales before returns across our platform in a

given period, plus shipping revenue, less discounts and markdowns,

divided by the Total Orders Placed (as defined below) in that

period. AOV reflects average basket size of our customers. AOV may

fluctuate as we continue investing in the development and

introduction of new Lulus merchandise and as a result of our

promotional discount activity.

Free Cash Flow

Free Cash Flow is a non-GAAP financial measure

that we calculate as net cash provided by operating activities less

cash used for capitalized software development costs and purchases

of property and equipment. We view Free Cash Flow as an

important indicator of our liquidity because it measures the amount

of cash we generate.

Gross Margin

We define Gross Margin as gross profit as

a percentage of our net revenue. Gross profit is equal to our

net revenue less cost of revenue. Certain of our competitors and

other retailers report cost of revenue differently than we do. As a

result, the reporting of our gross profit and Gross Margin may not

be comparable to other companies.

Net Debt

Net Debt is defined as total debt, which

currently consists of the revolving line of credit, less cash and

cash equivalents. We consider Net Debt to be an important

supplemental measure of our financial position, which allows us to

analyze our leverage.

Total Orders Placed

We define Total Orders Placed as the number of

customer orders placed across our platform during a particular

period. An order is counted on the day the customer places the

order. We do not adjust the number of Total Orders Placed for any

cancellation or return that may have occurred subsequent to a

customer placing an order. We consider Total Orders Placed as a key

performance metric on the basis that it is directly related to our

ability to attract and retain customers as well as drive purchase

frequency. Total Orders Placed, together with AOV, is an indicator

of the net revenue we expect to generate in a particular

period.

| |

|

LULU’S FASHION LOUNGE

HOLDINGS, INC.KEY OPERATING AND FINANCIAL

METRICS(Unaudited) |

| |

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

| |

|

March 31, 2024 |

|

|

April 2, 2023 |

|

| |

|

(In thousands, except Average Order Value

and percentages) |

|

Gross Margin |

|

|

42.3 |

|

% |

|

|

41.7 |

|

% |

| Net loss |

|

$ |

(5,736 |

) |

|

|

$ |

(5,618 |

) |

|

| Adjusted EBITDA |

|

$ |

(2,659 |

) |

|

|

$ |

16 |

|

|

| Adjusted EBITDA Margin |

|

|

(3.4 |

) |

% |

|

|

— |

|

% |

| Average Order Value |

|

$ |

143 |

|

|

|

$ |

129 |

|

|

| Active Customers |

|

|

2,770 |

|

|

|

|

3,173 |

|

|

Note: Refer to “Use of Non-GAAP Financial Measures and Other

Operating Metrics” section above for definitions of these

metrics.

| |

|

LULU’S FASHION LOUNGE

HOLDINGS, INC.RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES(Unaudited) |

| |

A reconciliation to non-GAAP Net Debt from total

debt as of March 31, 2024, and December 31, 2023, respectively, is

as follows:

| |

|

|

|

|

|

|

|

| |

|

As of |

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

| |

|

(In thousands) |

|

Total debt (1) |

|

$ |

(6,000 |

) |

|

$ |

(8,000 |

) |

|

| Cash and cash equivalents |

|

|

5,489 |

|

|

|

2,506 |

|

|

| Net Debt |

|

$ |

(511 |

) |

|

$ |

(5,494 |

) |

|

(1) Consists of the revolving

line of credit

A reconciliation to non-GAAP Adjusted EBITDA

from net loss for the thirteen weeks ended March 31, 2024 and April

2, 2023 is as follows:

| |

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

| |

|

March 31, 2024 |

|

|

April 2, 2023 |

|

| |

|

(In thousands, except percentages) |

|

|

Net loss |

|

$ |

(5,736 |

) |

|

|

$ |

(5,618 |

) |

|

| Excluding: |

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

1,339 |

|

|

|

|

1,121 |

|

|

| Interest expense |

|

|

383 |

|

|

|

|

523 |

|

|

| Income tax benefit |

|

|

(579 |

) |

|

|

|

(708 |

) |

|

| Equity-based compensation

expense (1) |

|

|

1,934 |

|

|

|

|

4,698 |

|

|

| Adjusted EBITDA |

|

$ |

(2,659 |

) |

|

|

$ |

16 |

|

|

| Net loss margin |

|

|

(7.4 |

) |

% |

|

|

(6.2 |

) |

% |

| Adjusted EBITDA margin |

|

|

(3.4 |

) |

% |

|

|

— |

|

% |

(1) The thirteen weeks ended

March 31, 2024 include equity-based compensation expense for

restricted stock unit (“RSU”) and performance stock unit (“PSU”)

awards granted during the period, as well as equity-based awards

granted in prior periods. The thirteen weeks ended April 2, 2023

include equity-based compensation expense for RSU and PSU awards

granted during the period, accelerated expense associated with the

voluntary forfeiture of stock options, and equity-based awards

granted in prior periods.

A reconciliation to non-GAAP Free Cash Flow from

net cash provided by operating activities for the thirteen weeks

ended March 31, 2024 and April 2, 2023 is as follows:

| |

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

| |

|

March 31, 2024 |

|

April 2, 2023 |

|

|

Net cash provided by operating activities |

|

$ |

6,947 |

|

|

$ |

3,705 |

|

|

| Capitalized software

development costs |

|

|

(397 |

) |

|

|

(551 |

) |

|

| Purchases of property and

equipment |

|

|

(562 |

) |

|

|

(518 |

) |

|

| Free Cash Flow |

|

$ |

5,988 |

|

|

$ |

2,636 |

|

|

| |

|

|

|

|

|

|

|

|

|

Contact

Abbygail ReyesVice President,

Communicationsinvestors@lulus.com

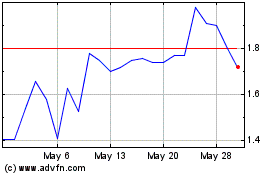

Lulus Fashion Lounge (NASDAQ:LVLU)

Historical Stock Chart

From Oct 2024 to Nov 2024

Lulus Fashion Lounge (NASDAQ:LVLU)

Historical Stock Chart

From Nov 2023 to Nov 2024