Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

10 November 2022 - 10:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November 2022

Commission File Number 001-41418

Lytus Technologies

Holdings PTV. Ltd.

(Translation of registrant’s name into English)

601 Everest Grande, A

Wing

Mahakali Caves Road

Andheri (East)

Mumbai, India 400 093

(Address of principal

executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒

Form 40-F ☐

On November 9,

2022, Lytus Technologies Holdings PTV. Ltd. (the “Company”) entered into a Securities Purchase Agreement (the

“Purchase Agreement”) with a certain accredited investor as purchaser (the “Investor”). Pursuant to the

Securities Purchase Agreement, the Company sold, and the Investor purchased, $3,333,333.33 million in principal amount of unsecured

senior convertible notes (the “Notes”) and warrants (the “Warrants”).

The Notes were issued

with a conversion price at a 20% premium to the most recent closing price, an original issue discount of 10%, do not bear interest, and

mature twelve months from the date of issuance. The Notes are convertible into shares of the Company’s common shares, par value $0.01 per share (“Common Shares”),

at a conversion price per share of $1.044, subject to adjustment under certain circumstances described in the Notes.

The Warrants are

exercisable for five years to purchase an aggregate of up to 1,754,386 Common Shares at an exercise price of $0.957,

subject to adjustment under certain circumstances described in the Warrants.

The Common Shares issuable upon conversion of the Notes and exercise of the Warrants are not registered under the Securities Act of 1933, as

amended (the “Securities Act”). Accordingly, the Company and the Investor also entered into a Registration Rights

Agreement whereby the Company shall use its best efforts to file a registration statement registering the resale of the shares of

Common Shares issuable upon conversion of the Notes and upon exercise of the Warrants within 30 days following the closing of this

offering. The Company shall use is best efforts to have the registration statement declared “effective” within 90 days

following the initial filing deadline (as defined in the Registration Rights Agreement).

The Notes and Warrants

sold were not registered under the Securities Act or the securities laws of any state, and were offered and sold in reliance upon the

exemption from registration afforded by Section 4(a)(2) under the Securities Act and Regulation D promulgated thereunder and corresponding

provisions of state securities laws, which exempt transactions by an issuer not involving any public offering. The Investor is an “accredited

investor” as such term is defined in Regulation D promulgated under the Securities Act. This Report of Foreign Private Issuer of

Form 6-K shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall such securities be offered or sold in

the United States absent registration or an applicable exemption from the registration requirements and certificates evidencing such shares

contain a legend stating the same.

The foregoing description

of the Notes, the Warrants, the Purchase Agreement and the Registration Rights Agreement does not purport to be a complete description

of the rights and obligations of the parties thereunder and is qualified in its entirety by reference to the full text of such agreements,

copies of which are attached hereto as Exhibits 4.1, 4.2, 10.1 and 10.2, respectively.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: November 10, 2022

| |

Lytus Technologies Holdings PTV. Ltd. |

| |

|

| |

By: |

/s/ Dharmesh Pandya |

| |

|

Name: Dharmesh Pandya |

| |

|

Title: Chief Executive Officer |

2

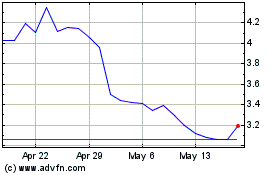

Lytus Technologies Holdi... (NASDAQ:LYT)

Historical Stock Chart

From May 2024 to Jun 2024

Lytus Technologies Holdi... (NASDAQ:LYT)

Historical Stock Chart

From Jun 2023 to Jun 2024