0000063276false00000632762024-09-112024-09-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

FORM 8-K

______________________________________________

Current Report

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

September 11, 2024

______________________________________________

MATTEL, INC.

(Exact name of registrant as specified in its charter)

______________________________________________

| | | | |

| | | | |

(State or other jurisdiction of incorporation) | | | | (I.R.S. Employer Identification No.) |

333 Continental Boulevard

El Segundo, California 90245-5012

(Address of principal executive offices including Zip Code)

Registrant's telephone number, including area code

(310) 252-2000

N/A

(Former name or former address, if changed since last report)

______________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the

registrant under any of the following provisions:

| |

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

| | | | Name of each exchange on which registered |

Common Stock, $1.00 per share | | | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Section 5 – Corporate Governance and Management

Item 5.02.Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

On September 11, 2024, the Compensation Committee (the “Committee”) of the Board of Directors of Mattel, Inc. (the

“Company”), in order to incentivize retention and drive significant Company stock price performance and market

outperformance, approved a one-time retention award of performance-based restricted stock units (the “Retention Performance

Grant”) to Ynon Kreiz, the Company’s Chief Executive Officer (“CEO”), under the Company’s Amended and Restated 2010

Equity and Long-Term Compensation Plan (the “Plan”), to be granted on September 30, 2024.

The Retention Performance Grant is intended to incentivize Mr. Kreiz’s continued leadership of the Company and execution of

key growth initiatives and further align his incentive opportunity to the execution of our strategy and stockholder value creation

by conditioning any vesting on the achievement of rigorous performance metrics tied to significant Company stock price

performance and the Company’s relative total stockholder return (“relative TSR”) as compared to the companies comprising the

S&P 500 as of the date of grant.

In designing the Retention Performance Grant, the Committee considered Mr. Kreiz’s track record of strong performance as the

Company’s CEO and the importance of his continued leadership at the Company. The Committee believes that Mr. Kreiz’s

leadership is a key factor for the Company’s ongoing success and growth potential and that Mr. Kreiz has been and continues to

be the driving force behind the Company’s transformation to become an IP-driven toy business with an expanding

entertainment offering. Highlights of Mr. Kreiz’s tenure include:

•Strong improvement in financial results across key metrics, including revenue, gross margin, and earnings per share

•Significantly increased market share in the major categories Dolls and Vehicles, and for Mattel’s leading power

brands, Barbie and Hot Wheels

•In 2023, Mattel was the #1 toy company in the U.S. for the 30th consecutive year, achieving its largest annual share

gain in the U.S. on record, per Circana

•Successfully executed cost savings programs, achieving over $1.3 billion of savings

•Achieved an investment grade credit rating and significantly strengthened financial position and flexibility

•Resumed share repurchases, including approving a $1 billion dollar share repurchase program in early 2024

•Initiated and continues to lead strategy to capture the full value of Mattel’s IP, including the launch of Mattel Films

and Mattel Television Studios; Mattel Films has announced 16 motion pictures in active development with major

studio partners, including the Company’s first movie, Barbie, which became a cultural phenomenon, achieving the

largest global box office in 2023 and becoming the industry’s 15th-highest grossing movie of all time, and Mattel

Television Studios is distributing content in more than 190 countries and more than 30 languages, with 13 series and

specials in 2024

•Successfully relaunched several owned franchises, including Masters of the Universe and Monster High, and won

major entertainment licenses, including Disney Princess and Disney Frozen

The Retention Performance Grant has a target value of $15 million, with the target number of units granted to be determined

based on the closing price of the Company’s common stock on the date of grant. The Retention Performance Grant is 100%

performance-based, with no portion of the Retention Performance Grant earned unless the Company achieves rigorous

performance goals, as described below. In addition, the Retention Performance Grant will only be earned if Mr. Kreiz remains

employed through the settlement date following the completion of a five-year vesting period from September 30, 2024 to

September 30, 2029 (such five-year vesting period referred to as the “performance measurement period”), subject to potential

acceleration on certain qualifying terminations of employment as described below.

The Retention Performance Grant was designed by the Committee, in coordination with the Company’s independent

compensation consultant, and is eligible to vest subject to Mr. Kreiz’s continuous service through the settlement date following

the completion of the five-year performance measurement period, with 50% of the Retention Performance Grant subject to

vesting based on the achievement of the stock price hurdles during the final three years of the five-year performance

measurement period, and the remaining 50% of the Retention Performance Grant subject to vesting based on the Company’s

relative TSR over the five-year performance measurement period, as set forth in the following tables:

| |

| Percentage of Target Performance Units Earned |

| |

| |

| |

A stock price hurdle will be deemed achieved if the average closing price of a share of the Company’s common stock for any

consecutive thirty trading-day period during the final three years of the five-year performance measurement period equals or

exceeds the applicable stock price hurdle set forth above. No portion of the Retention Performance Grant that is based on

achievement of the stock price hurdles will vest unless the average closing price of a share of the Company’s common stock for

any consecutive thirty trading-day period during the final three years of the five-year performance measurement period exceeds

$27.00 per share, which represents a 48% increase in the trading price of the Company’s common stock as compared to the

closing price on the date of approval of the Retention Award.

| |

| Percentage of Target Performance Units Earned |

| |

| |

| |

Relative TSR will be measured over the five-year performance measurement period based on the Company’s performance as

compared to the companies comprising the S&P 500 as of the date of grant. Importantly, no portion of the Retention

Performance Grant that is based on achievement of relative TSR will vest unless the Company’s total stockholder return over

the five-year performance measurement period equals or exceeds the 55th percentile when compared to the companies

comprising the S&P 500 as of the date of grant.

Linear interpolation will be used for achievement between the thresholds in the tables above. For the avoidance of doubt, the

maximum number of performance-based restricted stock units that may be earned under the Retention Performance Grant is

200% of the target number of performance-based restricted stock units subject to the grant.

Under the terms of the Retention Performance Grant, there is no acceleration or continued vesting of the Retention Performance

Grant in the event of a termination of employment for any reason other than death or disability or due to a termination without

“cause” or for “good reason” (each as defined in the Company’s Amended and Restated Executive Severance Plan B (the

“Severance Plan”) (any such termination, a “qualifying termination”), provided that acceleration upon a qualifying termination

absent a Change in Control (as defined in the Plan) will only occur if such qualifying termination occurs during the last three

years of the five-year performance measurement period). Additionally, there is no “single trigger” Change in Control

acceleration and any vesting acceleration following a Change in Control requires the occurrence of a qualifying termination.

Other than in connection with (i) his death or disability, (ii) a qualifying termination of employment that occurs during the final

three years of the five-year performance measurement period, or (iii) a qualifying termination following a Change in Control,

Mr. Kriez will need to remain employed by the Company through the settlement date following the end of the five-year

performance measurement period to receive any benefit under the Retention Performance Grant. The terms of the Severance

Plan applicable to Mr. Kreiz shall not apply to the Retention Performance Grant, except in the case of a qualifying termination

that occurs following a Change in Control, as described in more detail below.

If Mr. Kreiz’s employment terminates during the five-year performance measurement period and prior to the occurrence of a

Change in Control due to his death or disability, (i) the achievement of the stock price hurdles will be measured on the date of

termination and to the extent any stock price hurdle has been achieved, a pro-rated number of shares subject to the Retention

Performance Grant, determined based on the length of service completed during the five-year performance measurement period,

shall vest in connection with such termination of employment, and (ii) following the end of the full five-year performance

measurement period, the Committee will determine the relative TSR achievement for the full five-year performance

measurement period and to the extent any relative TSR goal has been achieved, a pro-rated number of shares subject to the

Retention Performance Grant, determined based on the length of service completed during the five-year vesting period, shall

vest in connection with such termination of employment. If Mr. Kreiz’s employment terminates due to death or disability

following the completion of the five-year performance measurement period but prior to the occurrence of a Change in Control

and prior to the settlement date, the number of shares subject to the Retention Performance Grant that are earned will be

determined based on achievement of the performance goals through the end of the full five-year performance measurement

period and shall vest in connection with such termination of employment without the need to remain employed through the

settlement date. If Mr. Kreiz experiences a qualifying termination in the final three years of the five-year performance

measurement period and prior to the occurrence of a Change in Control, (i) the achievement of the stock price hurdles will be

measured on the date of termination and to the extent any stock price hurdle has been achieved, the corresponding number of

shares subject to the Retention Performance Grant shall vest in connection with such termination of employment and (ii)

following the end of the full five-year performance measurement period, the Committee will determine the relative TSR

achievement for the full five-year performance measurement period and to the extent any relative TSR goal has been achieved,

the corresponding number of shares subject to the Retention Performance Grant shall vest at such time.

If a Change in Control occurs during the five-year performance measurement period and Mr. Kreiz remains employed until at

least immediately prior to the occurrence of such Change in Control, the Retention Performance Grant will be eligible to

convert into time-based restricted stock units based on achievement of the stock price hurdles and relative TSR based on the

price paid per share of common stock in the Change in Control (or, with respect to achievement of the stock price hurdles, the

actual achievement level during the last three years of the five-year performance measurement period, if higher), and such time-

based restricted stock units, if any, will vest at the end of the five-year performance measurement period subject to continued

employment through such date. In the event that performance through the date of the Change in Control results in fewer than

the maximum number of units becoming time-based restricted stock units, the remaining shares subject to the Retention

Performance Grant will be forfeited; provided, however, that if the Company’s common stock (or the common stock of the

acquiring or surviving entity in such Change in Control) continues to be publicly traded on a national stock exchange following

such Change in Control, and Mr. Kreiz remains continuously employed following such Change in Control until the settlement

date, the remaining shares subject to the Retention Performance Grant will remain outstanding and eligible to vest (the

“Continuing Performance Units”) based on the achievement of the stock price hurdles and relative TSR during the five-year

performance measurement period (with such goals equitably adjusted as necessary to reflect the Change in Control).

Notwithstanding the foregoing, if, following the occurrence of a Change in Control and prior to the end of the five-year

performance measurement period, Mr. Kreiz experiences a termination of employment due to death or disability, any such time-

based restricted stock units will vest in full as of the date of such termination and any Continuing Performance Units will be

treated as described above with respect to a termination due to death or disability. Further, in the event of Mr. Kreiz’s

qualifying termination that occurs following a Change in Control and prior to the end of the five-year performance

measurement period, any such time-based restricted stock units will vest in full at the time of such termination and any

Continuing Performance Units will vest based on achievement of the stock price hurdles and relative TSR as of the date of such

termination.

The foregoing description of the Retention Performance Grant does not purport to be complete and is qualified in its entirety by

reference to the full text of the Form of Grant Agreement, a copy of which is attached as Exhibit 10.1 to this Current Report on

Form 8-K and incorporated by reference herein.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

| | |

| | |

| | |

| | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

| | | | |

| |

| |

| | |

| | | | |

| | | | Executive Vice President, Chief Legal Officer, and Secretary |

Date: September 13, 2024

FORM OF GRANT AGREEMENT FOR

PERFORMANCE-BASED RESTRICTED STOCK UNITS

FOR YNON KREIZ UNDER THE

MATTEL, INC. AMENDED AND RESTATED

2010 EQUITY AND LONG-TERM COMPENSATION PLAN

This is a Grant Agreement (this “Grant Agreement”) between Mattel, Inc. (“Mattel”) and the individual (the “Holder”) named in the Notice of Grant – Performance-Based Restricted Stock Units (the “Notice”). The Notice accompanying this Grant Agreement is deemed a part of this Grant Agreement.

Recitals

Mattel has adopted the Amended and Restated 2010 Equity and Long-Term Compensation Plan, as may be amended from time to time (the “Plan”), for the granting to selected employees of awards based upon shares of Common Stock of Mattel. In accordance with the terms of the Plan, the Compensation Committee of the Board of Directors (the “Committee”) has approved the execution of this Grant Agreement between Mattel and the Holder. Capitalized terms used herein without definition shall have the meanings assigned to such terms in the Plan. This Grant Agreement incorporates certain provisions of the Mattel, Inc. Amended and Restated Executive Severance Plan B, as may be amended from time to time (the “Severance Plan”).

Restricted Stock Units

1. Grant. Mattel grants to the Holder the number of restricted stock units based on shares of Common Stock set forth in the Notice (the “Performance Units”), subject to adjustment, forfeiture, and the other terms and conditions set forth below, as of the effective date of the grant (the “Grant Date”) specified in the Notice. The number of Performance Units specified in the Notice reflects the target number of Performance Units that may become vested. The Company and the Holder acknowledge that the Performance Units (a) are being granted hereunder in exchange for the Holder’s agreement to provide services to the Company after the Grant Date, and which the Company deems to have a value at least equal to the aggregate par value of the shares of Common Stock, if any, that the Holder may become entitled to receive under this Grant Agreement, and (b) will, except as provided in Sections 4 and 5 hereof, be forfeited by the Holder if the Holder’s termination of employment occurs before the Settlement Date (as defined in Section 7, below), and, to the extent permitted under applicable law, are further subject to cancellation (and any shares of Common Stock or cash delivered in settlement of the Performance Units are subject to recapture) if the Holder engages in certain conduct detrimental to the Company, in each case as more fully set forth in this Grant Agreement and the Plan.

2. Performance Criteria. Subject to the Holder’s continuous employment through the Settlement Date, but subject to Sections 4-6 below, the Holder will vest in a number of Performance Units on the Settlement Date determined based on (i) the achievement of the Stock Price Hurdles set forth in the table below over the Performance Measurement Period (as defined

below) and (ii) the relative total stockholder return (“Relative TSR”) over the Award Term. A Stock Price Hurdle will be deemed achieved if the average closing price of a share of Common Stock for any consecutive thirty (30) trading-day period during the last three (3) years of the Award Term (the “Performance Measurement Period”) equals or exceeds a price set forth in the chart below (each, a “Stock Price Hurdle”). To the extent that the highest thirty (30) trading-day average closing price during the Performance Measurement Period falls between a Stock Price Hurdle, the number of Performance Units earned with respect to the Stock Price Hurdles will be calculated using linear interpolation.

| | | | | |

Stock Price Hurdle | Percentage of Target Performance Units Earned |

$27.00 | 0% |

$33.50 | 50% |

$40.00 | 100% |

In addition to the Performance Units that may be earned based on the achievement of the Stock Price Hurdles, the Holder will be eligible to earn an additional number of Performance Units as set forth in the table below based upon Mattel’s Relative TSR over the Award Term. To the extent Mattel’s Relative TSR over the Award Term falls between the 55th and 85th percentiles, the number of Performance Units earned with respect to Relative TSR will be calculated using linear interpolation.

| | | | | |

Relative TSR | Percentage of Target Performance Units Earned |

<55th Percentile | 0% |

55th Percentile | 50% |

85th Percentile | 100% |

Relative TSR performance shall be determined by the Committee in the manner consistent with Mattel’s currently outstanding performance units awards, utilizing the peer group set forth on Exhibit A hereto. For example, if the $40 Stock Price Hurdle were achieved and Mattel’s Relative TSR were at the 55th percentile, then the number of earned Performance Units would be 150% of the target number of Performance Units (i.e., 100% for Stock Price Hurdle achievement and 50% for Relative TSR achievement). For the avoidance of doubt, the maximum number of Performance Units that may be earned hereunder is 200% of the target number of Performance Units.

3. Dividend Equivalent Rights. The Performance Units are granted with Dividend Equivalent rights, as set forth in this Section 3. As of each payment date for any cash dividend or distribution with respect to the Common Stock with a record date on or after the commencement date and on or before all of the Performance Units are settled or forfeited as set forth below, the Holder shall be credited (without interest) with an additional number of Performance Units, in whole or in fractions thereof, in an amount determined by dividing (i) the aggregate cash dividends that would have been paid on such dividend payment date in respect of the number of shares of Common Stock underlying the Performance Units actually earned by the

Holder in accordance with this Grant Agreement, by (ii) the Common Stock closing price on the ex-dividend date (two trading days prior to the record date). All such additional Performance Units shall be subject to the same terms and conditions (including vesting conditions and Dividend Equivalent rights) applicable to the Performance Units in respect of which they were credited and shall be settled at the time of settlement of the Performance Units to which they are related, in accordance with Section 7. Dividend Equivalent rights and any amounts that may become distributable in respect thereof, to the extent subject to Section 409A of the Code, shall be treated separately from the Performance Units and the rights arising in connection therewith for purposes of the designation of time and form of payments required by Section 409A of the Code.

4. Consequences of Termination of Employment. The terms of the Severance Plan applicable to the Holder shall only apply to the Performance Units in the event of a Change of Control Covered Termination (as defined in the Severance Plan, provided that for purposes of this Grant Agreement such term shall be modified so that it applies until the Settlement Date regardless of whether the applicable 2-year period set forth in the Severance Plan has expired). For avoidance of doubt, if the Holder experiences a termination of employment for any other reason, the Severance Plan shall not be applicable to the Performance Units and only the terms and conditions set forth herein shall apply to the Performance Units. The consequences of the Holder’s termination of employment prior to the Settlement Date and before a Change in Control shall be as follows:

i. In the case of a termination of the Holder’s employment with the Company (a “Termination of Employment”) as a result of the Holder’s death or Disability prior to the end of the Award Term, the number of Performance Units earned shall be determined as follows:

With respect to the Performance Units that vest based upon the achievement of the Stock Price Hurdles: first, the Committee shall determine the number of Performance Units earned based on achievement of the Stock Price Hurdles through the date of the Holder’s Termination of Employment; and second, the number of Performance Units so obtained, if any, shall be multiplied by a fraction (no greater than one), the numerator of which is the total number of full months elapsed from the first day of the Award Term to the date of the Holder’s Termination of Employment as a result of the Holder’s death or Disability and the denominator of which is sixty (60) months (i.e., the total number of months in the Award Term). Such number of Performance Units shall then be settled on or within sixty (60) days after the Holder’s Termination of Employment in accordance with Section 7. If the Holder experiences a Termination of Employment due to death or Disability following the end of the Award Term and prior to the Settlement Date, there shall not be any pro-ration and the number of Performance Units earned shall be determined based on achievement of the Stock Price Hurdles through the end of the Award Term and shall vest and be settled on or within sixty (60) days after the Holder’s Termination of Employment in accordance with Section 7 without the need for the Holder to remain employed through the Settlement Date.

With respect to the Performance Units that vest based upon Relative TSR: first, the Committee shall determine the number of Performance Units earned based on actual achievement of Relative TSR following the end of the Award Term; and second, the number of Performance Units so obtained shall be multiplied by a fraction (no greater than one), the numerator of which is the total number of full months elapsed from the first day of the Award Term to the date of the Holder’s Termination of Employment as a result of the Holder’s death or Disability and the denominator of which is sixty (60) months (i.e., the total number of months in the Award Term). Such number of Performance Units shall then be settled in accordance with Section 7 as if the Holder remained employed through the end of the Award Term without the need for the Holder to remain employed through the Settlement Date.

ii. In the event Holder’s Termination of Employment is by the Company without Cause or by Holder with Good Reason (as defined in the Severance Plan) after the commencement of the Performance Measurement Period and before the end of the Award Term, then (i) the Committee shall determine the number of Performance Units earned based on achievement of the Stock Price Hurdles through the date of the Holder’s Termination of Employment, and the number of Performance Units so obtained shall vest without proration and such number of Performance Units shall then be settled on or within sixty (60) days after the Holder’s Termination of Employment in accordance with Section 7 and (ii) following the end of the Award Term, the Committee shall determine the number of Performance Units earned based on achievement of Relative TSR through the entire Award Term, and the number of Performance Units so obtained shall vest without proration and such number of Performance Units shall then be settled on or within sixty (60) days after the completion of the Award Term in accordance with Section 7.

iii. In all other cases (for avoidance of doubt, other than in the case of a Change in Control, which is addressed in Section 5), the Performance Units shall be forfeited as of the date of the Termination of Employment.

5. Change in Control. If a Change in Control occurs at any time during the Award Term and the Holder has remained continuously employed by the Company until at least immediately prior to such Change in Control, the Performance Units shall not vest in accordance with the terms of Section 18 of the Plan and instead shall be treated as follows:

i. The Performance Units shall, immediately prior to, and subject to the consummation of, such Change in Control, convert into time-based restricted stock units (the “RSUs") and references in this Grant Agreement to Performance Units shall refer to any such RSUs as the context may require. The number of RSUs, if any, will be calculated based upon the tables set forth above in Section 2 but will use (i) the Relative TSR achieved in connection with the Change in Control (and for avoidance of doubt taking into account the stock price paid per share of Common Stock in the Change in Control), and (ii) the higher of (A) achievement of the Stock Price Hurdles during the Performance Measurement

Period and (B) achievement of the Stock Price Hurdle based upon the stock price paid per share of Common Stock in the Change in Control to determine achievement of the Stock Price Hurdles and Relative TSR. For avoidance of doubt, if a Change in Control occurs prior to the commencement of the Performance Measurement Period, then calculation of the achievement of the Stock Price Hurdle shall be solely based upon the stock price paid per share of Common Stock in the Change in Control. Subject to the Holder’s continued employment with the Company, the RSUs will vest on the last day of the Award Term.

ii. In the event that fewer than the maximum number of Performance Units become RSUs in connection with such a Change in Control, the remaining Performance Units will be forfeited and of no further force or effect at the time of such Change in Control; provided, however, that in the event the Company’s Common Stock (or the common stock of the acquiring or surviving entity in such Change in Control) continues to be publicly traded on a national stock exchange following such Change in Control and the Holder remains continuously employed following such Change in Control until the Settlement Date, then such unearned Performance Units shall remain outstanding and eligible to vest based on the achievement of the Stock Price Hurdles and Relative TSR during the Performance Measurement Period and Award Term, respectively, calculated as described in Section 2, with the Stock Price Hurdles and Relative TSR equitably adjusted to reflect the Change in Control (the “Continuing Performance Units”).

iii. If, following the occurrence of a Change in Control and prior to the last day of the Award Term, the Holder experiences a Termination of Employment as a result of the Holder’s death or Disability, (i) the RSUs shall vest in full as of the date of such Termination of Employment and (ii) the Continuing Performance Units shall be treated as described in Section 4.i.

iv. If the Holder experiences a Change of Control Covered Termination prior to the last day of the Award Term, then as of immediately prior to the Holder’s Change of Control Covered Termination, (i) all outstanding RSUs shall fully vest as of the date of such Change of Control Covered Termination and (ii) the Continuing Performance Units shall be treated as described in Section 5.ii, but achievement of the Stock Price Hurdles and Relative TSR shall be determined as of the date of the Change of Control Covered Termination and any earned Continuing Performance Units shall be settled on or within sixty (60) days after the date of the Change of Control Covered Termination in accordance with Section 7.

v. Any RSUs or Continuing Performance Units which vest pursuant to this Section 5 shall be settled on or within 60 days after the applicable vesting date, in accordance with Section 7.

If a Change in Control occurs following the end of the Award Term and prior to the Settlement Date, the number of Performance Units earned shall be determined based on the higher of (i) achievement of the Stock Price Hurdles and Relative TSR through the end of the Award Term

and (ii) achievement of the Stock Price Hurdles and Relative TSR based upon the stock price paid per share of Common Stock in the Change in Control in lieu of any thirty (30) trading-day average closing price during the Performance Measurement Period, and shall be paid on the Settlement Date; provided, however, that in such case, the Holder need only remain employed until immediately prior to the Change in Control rather than through the Settlement Date to vest in any earned Performance Units.

6. Termination, Rescission and Recapture. The Holder specifically acknowledges that the Performance Units or RSUs, as applicable, and any shares of Common Stock or cash delivered in settlement thereof are subject to the provisions of Section 19 of the Plan, entitled “Termination, Rescission and Recapture,” which can cause the forfeiture of the Performance Units or RSUs and/or the recapture of any shares of Common Stock and/or cash delivered in settlement thereof and/or the proceeds of the sale of any such shares of Common Stock. Except as provided in the final sentence in this Section 6, as a condition of the settlement of the Performance Units or RSUs, as the case may be, the Holder will be required, if requested by the Company, to certify that the Holder is in compliance with the terms and conditions of the Plan (including the conditions set forth in Section 19 of the Plan) and, if a Termination of Employment has occurred, to state the name and address of the Holder’s then-current employer or any entity for which the Holder performs business services and the Holder’s title, and shall identify any organization or business in which the Holder owns a greater-than-five-percent equity interest. If the Company conditions the settlement of the Performance Units or RSUs on such a certification from the Holder, and the period during which the Holder may provide such certification spans two taxable years, then such settlement shall occur in the second taxable year but in no event later than March 15 of such second taxable year. Section 19 of the Plan is inapplicable, and accordingly such certification shall not be required, after a Change of Control Covered Termination.

7. Payout of Performance Units. Within fifteen (15) business days following the expiration of the Award Term and the Committee’s approval of the achievement of the Stock Price Hurdles and Relative TSR, but in no event later than March 15, 2030, or such other date as may be required in accordance with Sections 4-6 above (the “Settlement Date”), subject to Section 9 below, the Company shall settle each earned Performance Unit by delivering to the Holder one share of Common Stock or a cash payment equal to the Fair Market Value of a share of Common Stock, as the Company may in its sole discretion determine (and the Company may settle some Performance Units in shares of Common Stock and some in cash). In the case of Performance Units settled by delivery of shares of Common Stock, the Company shall (a) issue or cause to be delivered to the Holder (or the Holder’s Heir, as defined below, if applicable) one or more unlegended stock certificates representing such shares, or (b) cause a book entry for such shares to be made in the name of the Holder (or the Holder’s Heir, if applicable). In the case of the Holder’s death, the cash and/or shares of Common Stock to be delivered in settlement of Performance Units as described above shall be delivered to the Holder’s beneficiary or beneficiaries (as designated in the manner determined by the Committee), or if no beneficiary is so designated or if no beneficiary survives the Holder, then the Holder’s administrator, executor, personal representative, or other person to whom the Performance Units are transferred by means of the Holder’s will or the laws of descent and distribution (such beneficiary, beneficiaries, or other person(s), the “Holder’s Heir”).

8. Code Section 409A. The Performance Units are not intended to constitute “deferred compensation” within the meaning of Section 409A of the Code. If Mattel determines after the Grant Date that an amendment to this Grant Agreement is necessary or advisable to ensure that the Performance Units will not be subject to Section 409A of the Code, or alternatively to ensure that they comply with Section 409A of the Code, it may make such amendment, effective as of the Grant Date or at any later date, without the consent of the Holder.

Notwithstanding anything in this Grant Agreement to the contrary, to the extent that any payment or benefit constitutes non-exempt “nonqualified deferred compensation” for purposes of Section 409A of the Code, and such payment or benefit would otherwise be payable or distributable hereunder by reason of the Holder’s Termination of Employment, all references to the Holder’s Termination of Employment shall be construed to mean a “separation from service,” as defined in Treasury Regulation Section 1.409A-1(h) (a “Separation from Service”), and the Holder shall not be considered to have a Termination of Employment unless such termination constitutes a Separation from Service with respect to the Holder.

9. Tax Withholding. The Company shall withhold from the cash and/or shares of Common Stock deliverable in settlement of the Performance Units an amount necessary to satisfy the income taxes, social taxes, payroll taxes, and other taxes required to be withheld in connection with such settlement. If such payment is in the form of shares of Common Stock deliverable on the Settlement Date, the Fair Market Value of such shares on the Settlement Date shall not exceed the sums necessary to pay the tax withholding based on the minimum statutory withholding rates for federal and state tax purposes, including payroll taxes, that are applicable to such supplemental taxable income, rounded up to the nearest whole number of shares (unless higher withholding is permissible without adverse accounting consequences to the Company). If any such taxes are required to be withheld at a date earlier than the Settlement Date, then notwithstanding any other provision of this Grant Agreement, the Company may (i) satisfy such obligation by causing the forfeiture of a number of Performance Units having a Fair Market Value, on such earlier date, equal to the amount necessary to satisfy the minimum required amount of such withholding (unless higher withholding is permissible without adverse accounting consequences to the Company), or (ii) make such other arrangements with the Holder for such withholding as may be satisfactory to the Company in its sole discretion. The Company may, in its discretion, withhold any amount necessary to pay the applicable taxes from the Holder’s regular salary/wages or any other amounts payable to the Holder, with no withholding of shares of Common Stock, or may require the Holder to submit payment equivalent to the minimum taxes required to be withheld (unless higher withholding is permissible without adverse accounting consequences to the Company) by means of certified check, cashier’s check, or wire transfer.

Further, if the Holder becomes subject to taxation in more than one country between the Grant Date and the date of any relevant taxable or tax withholding event, as applicable, the Holder acknowledges that the Company may be required to withhold or account for taxes in more than one country. In the event the withholding requirements for the applicable taxes are not satisfied, no shares of Common Stock will be issued to the Holder (or the Holder’s estate) upon settlement of the Performance Units unless and until satisfactory arrangements (as determined by the Company in its sole discretion) have been made by the Holder with respect to

the payment of any such applicable taxes. By accepting the Performance Units, the Holder expressly consents to the methods of withholding as provided hereunder. All other taxes related to the Performance Units and any shares of Common Stock delivered in settlement thereof shall be the sole responsibility of the Holder.

10. Compliance with Law.

i. No shares of Common Stock shall be issued and delivered pursuant to a vested Performance Unit unless and until all applicable registration requirements of the Securities Act of 1933, as amended, all applicable listing requirements of any national securities exchange on which the shares of Common Stock are then listed, and all other requirements of law or of any regulatory bodies having jurisdiction over such issuance and delivery, shall have been complied with and are in full force. In particular, the Committee may require certain investment (or other) representations and undertakings in connection with the issuance of securities in connection with the Plan in order to comply with applicable law.

ii. If any provision of this Grant Agreement is determined to be unenforceable or invalid under any applicable law, such provision will be applied to the maximum extent permitted by applicable law, and shall automatically be deemed amended in a manner consistent with its objectives to the extent necessary to conform to any limitations required under applicable law. Furthermore, if any provision of this Grant Agreement is determined to be illegal under any applicable law, such provision shall be null and void to the extent necessary to comply with applicable law, but the other provisions of this Grant Agreement shall remain in full force and effect.

iii. If the Holder is a resident of or employed in a country other than the United States, the Holder agrees, as a condition to the grant of the Performance Units, to repatriate all payments attributable to the shares of Common Stock and/or cash acquired under the Plan (including, but not limited to, dividends and any proceeds derived from the sale of the shares of Common Stock acquired pursuant to this Performance Units) in accordance with local foreign exchange rules and regulations in the Holder’s country of residence (and country of employment, if different). In addition, the Holder agrees to take any and all actions, and consents to any and all actions taken by the Company, as may be required to allow the Company to comply with local laws, rules, and regulations in the Holder’s country of residence (and country of employment, if different). Finally, the Holder agrees to take any and all actions that may be required to comply with the Holder’s personal legal and tax obligations under local laws, rules, and regulations in the Holder’s country of residence (and country of employment, if different).

iv. If the Holder is a resident of or employed in a country that is a member of the European Union, the grant of the Performance Units and this Grant Agreement are intended to comply with the age discrimination provisions of the EU Equal Treatment Framework Directive, as implemented into local law (the “Age

Discrimination Rules”). To the extent that a court or tribunal of competent jurisdiction determines that any provision of the Performance Units is invalid or unenforceable, in whole or in part, under the Age Discrimination Rules, Mattel, in its sole discretion, shall have the power and authority to revise or strike such provision to the minimum extent necessary to render it valid and enforceable to the full extent permitted under local law.

v. Upon the issuance of shares of Common Stock in settlement of earned Performance Units, Mattel may require the Holder to sell such shares at any time to the extent the Holder’s continued holding of such shares is prohibited under applicable law or is administratively burdensome (in which case, this Grant Agreement shall provide Mattel with the authority to issue sales instructions in relation to such shares of Common Stock on the Holder’s behalf).

11. Assignability. The Performance Units shall not be transferable by the Holder, other than upon the death of the Holder in accordance with such beneficiary designation procedures or other procedures as Mattel may prescribe from time to time.

12. Certain Corporate Transactions. In the event of certain corporate transactions, the Performance Units shall be subject to adjustment as provided in Section 17 of the Plan. In the event of a Change in Control, these Performance Units shall be subject to the provisions of Section 18 of the Plan, except as provided in Section 5 of this Grant Agreement.

13. No Additional Rights.

i. Neither the granting of the Performance Units nor their vesting or settlement shall (i) affect or restrict in any way the power of the Company to take any and all actions otherwise permitted under applicable law, (ii) confer upon the Holder the right to continue in the employment of or performing services for the Company, or (iii) interfere in any way with the right of the Company to terminate the services of the Holder at any time, with or without Cause.

ii. The Holder acknowledges that (i) this is a one-time grant, (ii) the making of this grant does not mean that the Holder will receive any similar grant or grants in the future, or any future grants at all, (iii) the Plan and the benefits the Holder may derive from participation in the Plan are not part of the employment conditions and/or benefits provided by the Company, (iv) any modifications or amendments of the Plan by Mattel, or a termination of the Plan by Mattel, shall not constitute a change or impairment of the terms and conditions of the Holder’s employment with the Company, and (v) this grant does not in any way entitle the Holder to future grants under the Plan, if any, and Mattel retains sole and absolute discretion as to whether to make any additional grants to the Holder in the future and, if so, the quantity, terms, conditions, and provisions of any such grants.

iii. Without limiting the generality of subsections (i) and (ii) immediately above and subject to Sections 4 and 5 of this Grant Agreement, if there is a Termination of Employment of the Holder, the Holder shall not be entitled to any compensation

for any loss of any right or benefit or prospective right or benefit relating to the Performance Units or under the Plan which the Holder might otherwise have enjoyed, whether such compensation is claimed by way of damages for wrongful dismissal or other breach of contract or by way of compensation for loss of office or otherwise.

iv. The Holder’s participation in the Plan is voluntary. The value of the Performance Units and any other awards granted under the Plan is an extraordinary item of compensation outside the scope of the Holder’s employment (and the Holder’s employment contract, if any). Any grant under the Plan, including the grant of the Performance Units, is not part of the Holder’s normal or expected compensation for purposes of calculating any severance, resignation, redundancy, end of service payments, bonuses, long-service awards, holiday pay, pension or retirement benefits, or similar payments.

14. Rights as a Stockholder. Neither the Holder nor the Holder’s Heir shall have any rights as a stockholder with respect to any shares represented by the Performance Units unless and until shares of Common Stock have been issued in settlement thereof.

15. Data Privacy.

i. Holders employed outside of the European Union, the European Economic Area or the United Kingdom hereby explicitly and unambiguously consent to the collection, use and transfer, in electronic or other form, of Data (defined below), for the exclusive purposes of (i) granting the Performance Units, (ii) implementing, administering, and managing the Holder’s participation in the Plan, and (iii) generally administering employee compensation and related benefits for the Holder, pursuant to applicable personal data protection laws. The collection, use and transfer of the Holder’s Data is voluntary, but necessary for Mattel’s administration of the Plan and the Holder’s participation in the Plan, and the Holder’s denial and/or objection to the collection, use and transfer of Data may affect the Holder’s ability to participate in the Plan. As such, the Holder voluntarily acknowledges and consents (where required under applicable law) to the collection, use, and transfer of Data as described herein.

ii. The Company uses certain personal information about the Holder, including (but not limited to) the Holder’s name, home address and telephone number, email address, date of birth, social security, passport or other employee identification number, salary, nationality, job title, any shares of Common Stock or directorships held in Mattel, and details of all Performance Units or any other entitlement to shares of Common Stock awarded, canceled, purchased, vested, unvested or outstanding in the Holder’s favor (“Data”), for the purpose of managing and administering the Plan. The Data may be provided by the Holder or collected, where lawful, from third parties, and the Company will use the Data for the exclusive purpose of implementing, administering, and managing the Holder’s participation in the Plan, and generally administering employee compensation and related benefits for the Holder. The Company’s usage of Data

10

Form of Grant Agreement

will take place through electronic and non-electronic means according to logics and procedures strictly correlated to the purposes for which the Data is collected and with confidentiality and security provisions as set forth by applicable laws and regulations in the Holder’s country of residence. The Data will be accessible within the Company’s organization only by those persons requiring access for purposes of the implementation, administration, and operation of the Plan and for the Holder’s participation in the Plan.

iii. The Company will transfer Data as necessary for the purpose of implementation, administration and management of the Holder’s participation in the Plan, and the Company may further transfer Data to any third parties assisting the Company in the implementation, administration and management of the Plan. These recipients may be located in the United States or elsewhere throughout the world. The Holder hereby authorizes the recipients to receive, possess, use, retain and transfer the Data, in electronic or other form, for purposes of implementing, administering and managing the Holder’s participation in the Plan, including any requisite transfer of such Data as may be required for the administration of the Plan and/or the subsequent holding of shares of Common Stock on the Holder’s behalf to a broker or other third party with whom the Holder may elect to deposit any shares of Common Stock acquired pursuant to the Plan.

iv. The Holder understands that Data will be held only as long as is necessary to implement, administer and manage the Holder’s participation in the Plan. The Holder may, under certain circumstances, exercise the Holder’s rights provided under applicable personal data protection laws, which may include the right to (i) obtain confirmation as to the existence of the Data, (ii) verify the content, origin and accuracy of the Data, (iii) request the integration, update, amendment, deletion, or blockage (for breach of applicable laws) of the Data, and (iv) oppose the collection, processing or transfer of the Data which is not necessary or required for the implementation, administration and/or operation of the Plan or the Holder’s participation in the Plan. The Holder may seek to exercise these rights by contacting the Holder’s local HR manager.

v. The Holder understands that the Holder is providing the consents herein on a purely voluntary basis. If the Holder does not consent, or if the Holder later seeks to revoke the Holder’s consent, the Holder’s employment status or service with the Company will not be affected. The only consequence of refusing or withdrawing the Holder’s consent is that Mattel may be unable to grant Performance Units or other equity awards to the Holder or administer or maintain such awards. Therefore, the Holder understands that refusing or withdrawing the Holder’s consent may affect the Holder’s ability to participate in the Plan. For more information on the consequences of the Holder’s refusal to consent or withdrawal of consent, the Holder should contact the local HR manager.

16. Compliance with Plan. The Performance Units and this Grant Agreement are subject to, and Mattel and the Holder agree to be bound by, all of the terms and conditions of the

11

Form of Grant Agreement

Plan as it shall be amended from time to time, and the rules, regulations, and interpretations relating to the Plan as may be adopted by the Committee, all of which are incorporated herein by reference. No amendment to the Plan or this Grant Agreement shall adversely affect the Performance Units or this Grant Agreement without the consent of the Holder, except as permitted by Section 22 of the Plan. In the case of a conflict between the terms of the Plan and this Grant Agreement, the terms of the Plan shall govern and this Grant Agreement shall be deemed to be modified accordingly.

17. Effect of Grant Agreement on Individual Agreements. Notwithstanding the provisions of any Individual Agreement, (i) in the case of a conflict between the terms of the Holder’s Individual Agreement and this Grant Agreement, the terms of the Grant Agreement shall govern, and (ii) the vesting and settlement of Performance Units shall in all events occur in accordance with this Grant Agreement to the exclusion of any provisions contained in an Individual Agreement regarding the vesting or settlement of the Performance Units, and any such Individual Agreement provisions shall have no force or effect with respect to the Performance Units.

18. Governing Law. The interpretation, performance and enforcement of this Grant Agreement shall be governed by the laws of the State of Delaware without regard to principles of conflicts of laws. The Holder may only exercise the Holder’s rights in respect of the Plan, the Grant Agreement and these Performance Units to the extent that it would be lawful to do so, and Mattel would not, in connection with this Grant Agreement, be in breach of the laws of any jurisdiction to which the Holder may be subject. The Holder shall be solely responsible to seek advice as to the laws of any jurisdiction to which the Holder may be subject, and participation by the Holder in the Plan shall be on the basis of a warranty by the Holder that the Holder may lawfully so participate without Mattel being in breach of the laws of any such jurisdiction.

19. No Advice Regarding Grant. Mattel is not providing any tax, legal or financial advice, nor is Mattel making any recommendations, regarding the Holder’s participation in the Plan or the Holder’s acquisition or sale of the underlying shares of Common Stock. The Holder is hereby advised to consult with the Holder’s own personal tax, legal and financial advisors regarding the Holder’s participation in the Plan before taking any action related to the Plan.

20. Insider Trading/Market Abuse Laws. The Holder may be subject to insider trading and/or market abuse laws in applicable jurisdictions, including the United States, the Holder’s country of residence, and the Holder’s country of employment (if different) that may affect the Holder’s ability to acquire or sell shares of Common Stock under the Plan during such times the Holder is considered to have “inside information” (as defined in the laws of applicable jurisdictions). These laws may be the same or different from any insider trading policy of Mattel. The Holder acknowledges that it is the Holder’s responsibility to be informed of and compliant with such regulations.

21. English Language. The Holder acknowledges and agrees that it is the Holder’s express intent that the Grant Agreement, the Plan and all other documents, notices and legal proceedings entered into, given or instituted pursuant to the Performance Units, be drawn up in English. If the Holder has received the Grant Agreement, the Plan or any other documents related to the Performance Units translated into a language other than English, and if the

12

Form of Grant Agreement

meaning of the translated version is different than the English version, the English version will control.

22. Electronic Delivery. Mattel will deliver any documents related to the Performance Units and the Holder’s participation in the Plan, or future awards that may be granted under the Plan, by electronic means unless otherwise determined by Mattel in its sole discretion. The Holder hereby consents to receive such documents by electronic delivery and agrees to participate in the Plan through an on-line or electronic system established and maintained by Mattel or a third party designated by Mattel.

23. Value of the Performance Units. The Holder acknowledges and agrees that the value of the underlying shares of Common Stock is unknown and cannot be predicted with certainty and if the Holder earns Performance Units in accordance with the terms of this Grant Agreement and is issued shares of Common Stock, the value of those shares may increase or decrease. The Company shall not be liable for any foreign exchange rate fluctuation between the local currency of the Holder’s country of residence and the U.S. dollar that may affect the value of the Performance Units or of any amounts due to the Holder pursuant to the settlement of the Performance Units or the subsequent sale of any shares of Common Stock acquired upon settlement of the Performance Units.

24. Clawback Policy. The Performance Units and any amounts acquired pursuant to the Performance Units (including any shares of Common Stock or cash amounts) shall be subject to (i) the Mattel, Inc. Rule 10D-1 Compensation Recovery Policy as in effect on the Grant Date and any successor policy and any related policies adopted by Mattel from time to time (the “Clawback Policy”) and (ii) any other compensation recovery policy adopted after the Performance Units are granted to facilitate compliance with applicable law and any applicable listing rules or other rules and regulations implementing the foregoing. For purposes of this Section 24, the Holder expressly and explicitly authorizes Mattel to issue instructions, on the Holder’s behalf, to any brokerage firm and/or third party administrator engaged by Mattel to hold any shares of Common Stock and other amounts acquired pursuant to the Performance Units or the Plan to re-convey, transfer or otherwise return such shares of Common Stock and/or other amounts to Mattel upon Mattel’s enforcement of the Clawback Policy or any other compensation recovery policy adopted by the Board or the Committee. For the avoidance of doubt, to the extent that the terms of this Grant Agreement and any Company clawback policy conflict, the terms of the clawback policy shall prevail.

25. Additional Requirements. Mattel reserves the right to impose other requirements on the Performance Units, any shares of Common Stock acquired pursuant to the Performance Units, and the Holder’s participation in the Plan, to the extent Mattel determines, in its sole discretion, that such other requirements are necessary or advisable in order to comply with local laws, rules, and regulations, or to facilitate the operation and administration of the Performance Units and the Plan. Such requirements may include (but are not limited to) requiring the Holder to sign any agreements or undertakings that may be necessary or advisable to accomplish the foregoing.

26. Section 280G. To the extent that any benefit provided hereunder would be subject to the excise tax imposed by Section 4999 of the Code, together with any interest or

13

Form of Grant Agreement

penalties imposed with respect to such excise tax (the “Excise Tax”), Mattel (or any successor entity) and the Holder agree to take such steps as reasonably requested by the Holder and permitted pursuant to applicable law to eliminate or mitigate the Excise Tax (but excluding, for avoidance of doubt, the payment of any gross-up with respect to any such Excise Tax).

Notwithstanding any provision of this Grant Agreement to the contrary, if the Holder does not accept the Performance Units (in accordance with the method specified by Mattel) by the six-month anniversary of the date of grant, the Performance Units will be deemed accepted, and the Holder shall be subject to the terms and conditions of the Plan, the rules, regulations, and interpretations relating to the Plan as may be adopted by the Committee, and this Grant Agreement.

*******************************************************

14

Form of Grant Agreement

RELATIVE TOTAL STOCKHOLDER RETURN – DEFINITIONS

The following definitions shall apply to the determination of the Relative TSR Percentage of Target Performance Units Earned as set forth in Section 2 of the Grant Agreement.

TSR CALCULATION DEFINITIONS:

•Relative TSR Percentage of Target Performance Units Earned – The earnout percent, between 0% - 100%, related to the Company’s Relative TSR ranking versus companies in the S&P 500 over the Award Term.

•TSR Calculation – TSR is calculated as the sum of (i) the Company’s Ending Average Share Price minus the Company’s Beginning Average Share Price, and (ii) Dividends Paid, the total of which is divided by the Company’s Beginning Average Share Price.

•Beginning Average Share Price – The average closing market price of the Company’s stock for the first 60 days of the Award Term.

•Ending Average Share Price – The average closing market price of the Company’s stock for the last 60 days of the Award Term.

•Award Term – The time period set forth on the Notice of Grant.

•Dividends Paid – The value of dividend equivalent shares, based on total shares assuming each dividend is reinvested in shares at the closing price, on the ex-dividend date. Dividends paid (including cash dividends, stock dividends, and any other cash distributions to shareholders) during the Award Term will be included. If there are any stock splits during the Award Term, the TSR Calculation is adjusted as of the ex-dividend date to reflect the dilution associated with the stock split.

•S&P 500 Companies – Consists of the 500 companies designated in the S&P 500 index as of the first day of the Award Term (as set forth below). During the Award Term, the S&P 500 Companies may be changed as follows:

o If an S&P 500 Company becomes delisted as a result of bankruptcy/insolvency, then it will continue to be included in the S&P 500 Companies based on the TSR calculated through the last available trade price and date. A company that is delisted, but is present at the beginning and end of the Award Term, will be included through the last available trade price and date as of the initial delisting date.

o If an S&P 500 Company is no longer publicly traded as a result of a “going private” transaction, then it will be excluded from the S&P 500 Companies.

o If an S&P 500 Company is acquired or merged with another company and ceases to be a separately traded entity, it will be excluded from the S&P 500 Companies.

o If an S&P 500 Company merges with another entity and the S&P 500 Company is the surviving entity, it will continue to be included in the S&P 500 Companies.

•Percentile of the S&P 500 – The Percentile of the S&P 500 is calculated by ranking the S&P 500 Companies’ TSR Calculations in descending order and numerically ranking them. The Company’s numerical ranking is divided by the total number of companies remaining in the designated S&P 500 Companies, rounded to the nearest whole percentile (Percentile = (Total number of companies – Mattel’s ranking) / (Total number of companies – 1)).

S&P 500 Companies:

[List of S&P 500 companies as of the first day of the Award Term]

v3.24.2.u1

Cover

|

Sep. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 11, 2024

|

| Entity Registrant Name |

MATTEL, INC.

|

| Entity Central Index Key |

0000063276

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-05647

|

| Entity Tax Identification Number |

95-1567322

|

| Entity Address, Address Line One |

333 Continental Boulevard

|

| Entity Address, City or Town |

El Segundo

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90245-5012

|

| City Area Code |

310

|

| Local Phone Number |

252-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $1.00 per share

|

| Trading Symbol |

MAT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Document Information [Line Items] |

|

| Document Period End Date |

Sep. 11, 2024

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

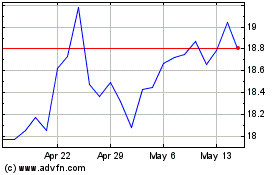

Mattel (NASDAQ:MAT)

Historical Stock Chart

From Dec 2024 to Dec 2024

Mattel (NASDAQ:MAT)

Historical Stock Chart

From Dec 2023 to Dec 2024