0001837344

false

00-0000000

0001837344

2023-09-06

2023-09-06

0001837344

MBTC:UnitsEachConsistingOfOneOrdinaryShare0.0001ParValueAndOneRightMember

2023-09-06

2023-09-06

0001837344

MBTC:OrdinarySharesIncludedAsPartOfUnitsMember

2023-09-06

2023-09-06

0001837344

MBTC:RightsIncludedAsPartOfUnitsMember

2023-09-06

2023-09-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

September 6, 2023

NOCTURNE ACQUISITION CORPORATION

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-40259 |

|

N/A |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

P.O. Box 25739, Santa Ana, CA 92799

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (650) 935-0312

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one ordinary share, $0.0001 par value and one right |

|

MBTCU |

|

The Nasdaq Stock Market LLC |

| Ordinary shares included as part of Units |

|

MBTC |

|

The Nasdaq Stock Market LLC |

| Rights included as part of the Units |

|

MBTCR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

ITEM 7.01 REGULATION FD

Attached hereto as Exhibit

99.1 and incorporated into this Item 7.01 by reference is a copy of an investor presentation which contains certain information about

Nocturne Acquisition Corporation (“Nocturne” or the “Company”) and Cognos Therapeutics, Inc. (“Cognos”),

the proposed target in Nocturne’s initial business combination, which will be used beginning September 7, 2023, in whole or in part,

from time to time by executives of Nocturne and/or Cognos, in one or more potential meetings with investors and analysts.

The information presented

in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section

18 of the Exchange Act, or otherwise subject to the liabilities of that section, unless we specifically state that the information is

to be considered “filed” under the Exchange Act or specifically incorporate it by reference in any filing under the Securities

Act or the Exchange Act.

All information in Exhibit

99.1 is presented as of the particular date or dates referenced therein, and neither the Company nor Cognos undertakes any obligation

to, and disclaims any duty to, update any of the information provided. This Current Report on Form 8-K will not be deemed an admission

as to the materiality of any information of the information in this Item 7.01, including Exhibit 99.1.

Forward-Looking Statements

This Current Report on Form

8-K contains certain “forward-looking statements” within the meaning of the Securities Act and the Exchange Act. Statements

that are not historical facts, including statements about the previously announced, pending merger (the “Merger”) between

Nocturne and Cognos, the transactions contemplated thereby and the parties’ perspectives and expectations, are forward-looking statements.

The words “expect,” “believe,” “estimate,” “intend,” “plan” and similar expressions

indicate forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to various

risks, uncertainties and assumptions (including assumptions about general economic, market, industry and operational factors), known or

unknown, which could cause the actual results to vary materially from those indicated or anticipated.

These forward-looking statements

are subject to a number of risks and uncertainties, including the risk that Cognos and Nocturne may be unable to successfully or timely

consummate the Merger, including as a result of any regulatory approvals that are not obtained, are delayed or are subject to unanticipated

conditions that could adversely affect the combined company or the expected benefits of the Merger, that approval by the stockholders

of Cognos or Nocturne may not be obtained, that the Merger may not result in the benefits anticipated by Nocturne and Cognos, as well

as the risks discussed in Nocturne’s final prospectus dated March 30, 2021 under the heading “Risk Factors,” and in

other documents Nocturne has filed, or will file, with the SEC, including the registration statement on Form S-4, filed by Nocturne on

August 14, 2023, in connection with the proposed initial business combination (the “Registration Statement”), which

includes a proxy statement/prospectus. If any of these risks materialize or underlying assumptions prove incorrect, actual results could

differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Nocturne nor

Cognos presently know, or that Cognos or Nocturne currently believe are immaterial, that could also cause actual results to differ from

those contained in the forward-looking statements. In addition, forward-looking statements reflect Nocturne’s and Cognos’

expectations, plans, or forecasts of future events and views as of the date of this Current Report on Form 8-K. Nocturne and Cognos anticipate

that subsequent events and developments will cause Nocturne’s and Cognos’ assessments to change. Accordingly, you are cautioned

not to place undue reliance on these forward-looking statements. Forward-looking statements relate only to the date they were made, and

Nocturne, Cognos and their affiliates undertake no obligation to update forward-looking statements to reflect events or circumstances

after the date they were made except as required by law or applicable regulation.

Additional Information and Where to Find It

A full description of the

terms of that certain Agreement and Plan of Merger and Reorganization, dated December 30, 2022, by and among Nocturne, Cognos, and Nocturne

Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Nocturne, in connection with the proposed Merger is provided

in the preliminary Registration Statement filed by Nocturne on August 14, 2023, with the SEC, which includes a prospectus with respect

to the combined company’s securities to be issued in connection with the Merger and a proxy statement with respect to the stockholder

meeting of Nocturne to vote on the Merger. The Registration Statement filed by Nocturne on August 14, 2023 with the SEC is a preliminary

Registration Statement and is subject to change. Nocturne urges its investors, stockholders and other interested persons to read the final

Registration Statement, when available, as well as other documents filed with the SEC because these documents will contain important information

about Nocturne, Cognos and the Merger. After the Registration Statement is declared effective, the definitive proxy statement/prospectus

included in the Registration Statement will be mailed to stockholders of Nocturne as of a record date to be established for voting on

the proposed Merger. Stockholders are also able to obtain a copy of the Registration Statement, including the proxy statement/prospectus,

and other documents filed with the SEC without charge, by directing a request to Nocturne Acquisition Corporation, P.O Box 25739, Santa

Ana, CA 92799, Attention Thomas Ao. The preliminary and definitive proxy statement/prospectus included in the Registration Statement can

also be obtained, without charge, at the SEC’s website (www.sec.gov).

Participants in Solicitation

Nocturne, Cognos and their

respective directors and officers may be deemed to be participants in the solicitation of proxies from Nocturne’s stockholders in

connection with the proposed business combination. Information about Nocturne’s directors and executive officers and their ownership

of Nocturne’s securities is set forth in Nocturne’s filings with the SEC. Additional information regarding the interests of

those persons and other persons who may be deemed participants in the proposed business combination may be obtained by reading the Registration

Statement when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

Safe Harbor Statement

This Current Report on Form

8-K is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the

potential transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of Nocturne, the combined

company or Cognos, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation,

or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits. The following exhibits are filed with this Form 8-K:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

NOCTURNE ACQUISITION CORPORATION |

| |

|

| |

By: |

/s/ Henry Monzon |

| |

|

Name: |

Henry Monzon |

| |

|

Title: |

Chairman and Chief Executive Officer |

Dated: September 6, 2023

3

Exhibit 99.1

SEPtember 2023 Investor Presentation Cognos therapeutics, inc. Nocturne acquisition corp.

FORWARD LOOKING STATEMENTS This presentation (“ Presentation ”) is for informational purposes only to assist interested parties in making their own evaluation with respect to the propose d o ffering (the “ Offering ”) of Cognos Therapeutics, Inc., a Delaware corporation (“ Cognos ”), of common stock. The offering is being made in connection with, but is not subject to or conditioned upon, the consummati on of a proposed business combination (the “ Business Combination ”) between Nocturne Acquisition Corporation (“ Nocturne ”) and the Company (the “ Purpose ”). By accepting this Presentation, the recipient acknowledges and agrees that all of the information contained herein is confidential, that the recipient will distribute, disclose, and use such information only for such Purpose and that th e recipient shall not distribute, disclose or use such information in anyway detrimental to Cognos or Nocturne. The information contained herein does not purport to be all - inclusive and none of Nocturne, Cognos, and Maxi m Group nor any of their respective affiliates nor any of its or their controlling persons, officers, directors, employees or representatives makes any representation or warranty, express or implied, as to th e a ccuracy, completeness or reliability of the information contained in this Presentation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters des cri bed herein, and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision. Any securities to be offered in any transaction contemplated hereby have not been registered under the Securities Act of 1933 , a s amended (the “ Securities Act ”), or any applicable state or foreign securities law. Any securities to be offered in any transaction contemplated hereby have not been approved or disapproved by the Securities and E xch ange Commission (the “ SEC ”), any state securities commission or other United States or foreign regulatory authority and will be offered and sold solely in reliance on the exemption from the registration re quirements provided by the Securities Act and rules and regulations promulgated thereunder (including Regulation D or Regulation S under the Securities Act). Neither the SEC or any U.S. state securities co mmi ssion has approved or disapproved the Offering, passed upon the merits or fairness of the Offering, or passed any comment upon the adequacy, accuracy or completeness of any disclosure in relation to the Offering. An y r epresentation to the contrary is a criminal offence in the United States. This Presentation does not constitute, or form a part of, an offer to sell or the solicitation of an offer to buy in any state or oth er jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such state or jurisdiction. The financial information contained in this presentation is preliminary and unaudited. As such the Company’s independent audi tor s have not audited, studied, reviewed or performed any procedures with respect to such preliminary information, and accordingly, have not expressed an opinion or provided any other form of as sur ances thereto for the Purposes of this presentation. There can be no assurance that such preliminary results are indicative of the future performance of the Company and actual results may materi all y differ. Certain statements in this Presentation may be considered forward - looking statements. Forward - looking statements generally relat e to future events or Cognos’ or Nocturne’s future financial or operating performance. For example, statements concerning the following include forward - looking statements: Cognos’ ability to identify, develop and co mmercialize product candidates; the initiation, cost, timing, progress and results of research and development activities, preclinical or clinical trials with respect to Cognos’ drug candidates; future revenue, exp enses, capital requirements and needs for additional financing; and the potential effects of the Business Combination on Nocturne and Cognos and related capital raising activities. In some cases, you can identify forwa rd - looking statements by terminology such as “may”, “should”, “expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “plan”, “potential” or “continue”, or the negatives of these terms or variati ons of them or similar terminology. Such forward - looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by suc h f orward - looking statements. These forward - looking statements are based upon estimates and assumptions that, while considered reasonable by Nocturne and its management, and Cognos and its management, as the case may be, are inherently uncertain. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Factors that may cause actual results to differ mat erially from current expectations include, but are not limited to, various factors beyond management’s control including general economic conditions (such as rising interest rates or bank failures) and other risks, unc ertainties and factors set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in Nocturne’s final prospectus relating to its initial public offering, dated February 22, 2021, and other filings with the SEC, as well as factors associated with companies, such as Cognos, that are engaged in preclinical studies and other research and development activities in the biopharma industry, i ncl uding uncertainty in the timing or results of preclinical studies and clinical trials, product acceptance and/or receipt of regulatory approvals for product candidates, including any delays and other impacts from the Cov id - 19 pandemic. Additionally, important factors that could cause actual results to differ materially from those presented or implied in the forward - looking statements include, among others: without limitation, (i) the ability of the Company to complete the development of its products in a timely manner, (ii) the demand for and timing of demand for such products, (iii) competition from other products and companies, (iv) the res ult s of the Company’s safety and efficacy studies, (v) delay and challenges the results of the regulatory approval process, (vi) the Company’s sales and marketing capabilities, (vii) the Company’s ability to sell its pro duc ts profitably, (viii) the ability of the Company’s third party suppliers to provide products and services in timely and a reliable manner; (ix) availability of adequate debt and equity financing on favorable terms and (x) gen eral business and economic conditions. There can be no assurance that the Company will be able to anticipate, respond to, or adapt to changes in any factors affecting the Company’s business and financial results. 2

FORWARD LOOKING STATEMENTS With the exception of the historical information contained in this presentation, the matters described herein contain forward - lo oking statements that involve risk and uncertainties that individually or jointly impact the matters herein described, including but not limited to financial projections, product demand and market acceptance, the effec t o f economic conditions, the impact of competitive products and pricing, governmental regulations, technological difficulties and/or other factors outside the control of the Company. These important factors and cer tain other factors that might affect the Company’s financial and business results are discussed in this presentation . Nothing in this Presentation should be regarded as a representation by any person that the forward - looking statements set forth herein will be achieved or that any of the contemplated results of such forward - looking statements will be achieved. You should not place any reliance on forward - looking statements in this Presentation, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein. Neither Nocturne nor Cognos undertakes any duty to update th ese forward - looking statements. Certain information contained in this Presentation relates to or is based on studies, publications, surveys and Cognos’ own i nte rnal estimates and research. In addition, all of the market data included in this Presentation involve a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while Cognos believes its internal research is reliable, such research has not been verified by any independent source. Nocturne has retained Chardan Capital Markets LLC as placement agent (together with its affiliates, partners, directors, agents, employees, representatives , and controlling persons, the “ Placement Agent ”) with respect to capital raising activities in connection with the Business Combination. The Placement Agent is acting solely as pl ace ment agent (and, for the avoidance of doubt, not as underwriter, initial purchaser, dealer or any other principal capacity) for Cognos in connection with a potential transaction. The Placement Agent has not independe ntl y verified any of the information contained herein or any other information that has been or will be provided to you. Nothing contained herein or in any other oral or written information provided to you is, nor sh all be relied upon as, a promise or representation of any kind by the Placement Agent, Nocturne or Cognos, whether as to the past or the future. Without limitation of the foregoing, none of the Placement Agents, Noc turne or Cognos shall be liable to you or any prospective investor or any other person for any information contained herein or that otherwise has been or will be provided to you, or any action heretofore or herea fte r taken or omitted to be taken, in connection with this potential transaction. This Presentation is being distributed solely for the consideration of sophisticated prospective purchasers who are accredited inv est ors, including institutional investors who are accredited investors, with sufficient knowledge and experience in investment, financial and business matters and the capability to conduct their own due diligence inv estigation and evaluation in connection with the Purpose. This Presentation does not purport to summarize all of the conditions, risks and other attributes of an investment in Nocturne or Cognos. Information co nta ined herein will be superseded by, and is qualified in its entirety by reference to, any other information that is made available to you in connection with the Purpose, including your investigation of Nocturne and Cog nos. Additional Information . In connection with the proposed Business Combination, Nocturne has filed with the SEC a registration statement on Form S - 4 con taining a preliminary proxy statement/prospectus of Nocturne, and after the registration statement is declared effective, Nocturne will mail a definitive proxy statement/prospec tus relating to the proposed Business Combination to its shareholders. This Presentation does not contain all the information that should be considered concerning the proposed Business Combination and is not intend ed to form the basis of any investment decision or any other decision in respect of the Business Combination. Nocturne’s shareholders and other interested persons are advised to read, when available, the prelimina ry proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and other documents filed in connection with the proposed Business Combination, as these materials will con tain important information about Cognos, Nocturne and the Business Combination. When available, the definitive proxy statement/prospectus and other relevant materials for the proposed Business Combination wil l be mailed to shareholders of Nocturne as of a record date to be established for voting on the proposed Business Combination. Nocturne shareholders will also be able to obtain copies of the preliminary prox y s tatement/prospectus, the definitive proxy statement/prospectus and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov. Participants in the Solicitation. Nocturne and its directors and executive officers may be deemed participants in the solicitation of proxies from Nocturne’s s har eholders with respect to the proposed Business Combination. A description of the interests of Nocturne’s directors and executive officers in Nocturne is contained in Nocturne’s final prospectus relating to it s initial public offering, February 22, 2021, which was filed with the SEC and is available free of charge at the SEC’s website at www.sec.gov. Additional information regarding the intere sts of such participants will be contained in the proxy statement/prospectus for the proposed Business Combination when available. 3

4 Henry Monzon Chairman & CEO Nocturne’s team has extensive experience in disruptive technologies, business operations and investing. Seasoned Executive, Entrepreneur and Investor with 25+ years of experience in Fortune 500 companies and deep - tech Technology start - ups across multiple domains such as semiconductors (chips), artificial intelligence (AI), wireless and blockchain. Various C - suite and Founder roles. Ka Seng (Thomas) Ao Chief Financial Officer Direct access to strategic and financial capital pool in and out of Silicon Valley Ability to offer operator level expertise to targets Proven track record in tech operating, investing and deal - making Proprietary in - house t arget i dentification c apability Extensive experience with M&A transactions and financial leasing. Current and former roles include: ▪ Chief Executive Officer of MCL Financial Leasing ▪ Managing partner of Mindfulness Capital ▪ Previously the Vice President of HF Venture Overview of Nocturne Acquisition Corporation s0

AT A GLANCE FOUNDATION HISTORY STRATEGIC COLLABORATORS Our mission is to develop and commercialize medical products that combine diagnostic, therapeutic, and sensing technologies with state - of - the - art drug delivery to advance healthcare through improved patient outcomes CAPITAL RAISED $22.8 Million* 5 *Includes $1.6 million in convertible bridge note and $2.5 million from a revenue share agreement with Tako Ventures, LLC, a Larry Ellison controlled venture capital fund, that will convert into a 25% ownership interest in COGNOS immediately prior to closing of the proposed business combination with Nocturne. 2006 2015 FOUNDED DELAWARE CORP AS PHARMACO - KINESIS COMPANY SPINOFF AS COGNOS THERAPEUTICS Cognos Therapeutics, Inc. 2015 to Present Pre - Spin Off - Pharmaco - Kinesis Corp. 2006 to 2015 INTELLECTUAL PROPERTY ( US & International) Issued Patents 30+ Non - Provisional Pa tent Applications Pending 57 Signed NDA and in discussion to do joint study for use of SINNAIS Œ to deliver drug to brain Conducted a small study to demonstrate local delivery of a combination of Avastin ® and Campto ® improves survival rate in mice YEARS OF R&D EXPERTISE COGNOS THERAPEUTICS (“ COGNOS ”) is a medical technology company focused on creating advanced implantable pump devices for neurological and oncological indications intended to adjust the course of therapeutics for the treatment and mitigation of disease models where current technology does not provide an effective solution . Our flagship product, the SINNAIS TM Implantable Smart Pump (ISP), is a fully implantable pump that is designed to metronomically administer therapeutics directly to the central nervous system (CNS), bypassing the blood - brain barrier (BBB) with potential to enable stable, continuous drug delivery for improved outcomes for brain cancers and other CNS diseases . COGNOS is also working on developing a Smart Drug Optical Sensor (SOS) which can collect important data from the disease target site and transmit that data to the cloud (big data, IA, and IoT) for further data analysis to customize drug dose (personalized medicine) and patient disease progression monitoring, which is intended to be part of the second generation SINNAIS TM pump – to bring virtual physician concept to reality . Developing propriety bonding technique Developing propriety piezoelectric micropump Center where Cognos conducted animal survival study in sheep

CORPORATE HIGHLIGHTS 6 • Disruptive smart pump technology designed to offer metronomic drug delivery • A next - generation piezoelectric micropump technology for precise, metronomic dosing • The only pump under development to deliver drug intraventricularly, thereby bypassing the blood - brain barrier (BBB) • Development of biosensor capability for a second - generation pump to provide cloud - enabled physician monitoring and precision dosing • Technology may enable broad applicability across multiple indications and therapeutics • Potential for use with small molecule therapeutics and biologics (i.e.. large molecule, cell therapies, etc.) • Technology validated through multiple small and large animal model studies • Addressing large market opportunities in multiple neurological and other disease indications including cancer • D elivery of approved drugs which offers a regulatory pathway that can lower risk and therefore gain engagement of drug companies • Multiple potential milestones within ~24 months of the business combination, including: • PMA submission to FDA for SINNAIS TM as a Class III pump indicated for infusion of Infumorph , potentially using FDA’s 6 - Year Rule which would allow PMA approval without conducting new human clinical trials • Investigational New Drug (IND) application submission for the initiation of Phase II human clinical trial of SINNAIS TM as a combination product for metronomic delivery of methotrexate (MTX) for the treatment of Leptomeningeal Carcinomatosis (LC) • CE - Mark submission in EU for SINNAIS TM as device alone based upon data with the first drug: methotrexate • Strong intellectual property portfolio covering the pump design, smart pump delivery, and method of use • Experienced management, board, and clinical advisors

FIRST - TIER MARKETS – $15.8B $8B $6B $1.8B LEPTOMENINGEAL CARCINOMATOSIS (LC) • Complication in which primary tumor metastasizes to leptomeninges (tissue covering the brain and spinal cord). • Approximately 5% to 10% of solid tumors progress into LC, although many are underdiagnosed. • Majority of cases arise in patients with breast cancer, lung cancer, or melanoma. • Average survival rate from diagnosis is 3 - 4 months. PANCREATIC CANCER • Accounts for ~3% of all diagnosed cancers. • Accounts for 7% of all cancer deaths. • Global incidence doubled between 1990 and 2017. • Majority of cases are detected once resection is no longer feasible, resulting in a 5 - year relative survival rate of 10.8%. • While the rate of new cases in the US is increasing, the death rate remains flat due in part to the emergence of better diagnostic methods. GLIOBLASTOMA MULTIFORME (GBM) • Most common malignant brain/CNS tumor, representing 16% of all such neoplasms. • Increased incidence in recent years, possibly due to more sophisticated neuroimaging. • Prognosis is poor with a median five - year survival rate of less than 5%. • Survival rates have not improved during the last three decades. 7 Source: MCRA (a Leading CRO Consulting Company) - Cognos Market Opportunity Assessment Key Findings Report Date: 11/2021

Lead Indication – LEPTOMENINGEAL CARCINOMATOSIS (LC) Estimated per - patient annual expenditure for top cancers leading to LC (MIDDLE CIRCLE) PRIMARY DIAGNOSIS (OUTER CIRCLE) Treatment of all LC cases in the US grosses approximately $6 billion USD annually with most of the revenue generated treating breast and lung cancer patients $ 4.2B Est. total annual expenditure on LC treatment for all other primary indications $1.7B 8 Source: MCRA (a Leading CRO Consulting Company) - Cognos Market Opportunity Assessment Key Findings Report Date: 11/2021

9 Challenges of CURRENT PUMP TECHNOLOGY All of the current commercially available pumps are based on technology and architecture that is more than three decades old and pose the following problems : • No intraventricular delivery – Drug cannot bypass blood - brain barrier (BBB). • Not customizable to each patient. • Do not automatically respond to situational changes in the patient’s condition. • Have a limited ability to receive delivery commands. • Are unable to deliver precise and accurate dosing. • Can not provide a metronomic delivery of drugs, which provides programmable scheduled dosing within a therapeutic range vs bolus injection. • Are not able to provide real - time biofeedback and communication. • Have limited disease model application. • Do not integrate with other systems. • Are not MRI - compatible. • Cannot meet many of the new safety regulatory requirements set by the FDA to deliver therapeutics to the brain. • Due to crude dose size (1ml +) and not being able to provide information about level toxicity after drug administered in brain, are not suitable to deliver drug to brain. Source: MCRA (a Leading CRO Consulting Company) A Market Opportunity Assessment Key Findings, a report dated: 11/21/2022

THE SOLUTION BENEFITS TO STAKEHOLDERS The SINNAIS TM Implantable pump is expected to provide many key benefits across the healthcare spectrum to patients, healthcare providers and drug manufacturing companies FOR PATIENTS • Improved quality of life and mobility • Lower side effects • Shorter hospital stays • Lower health insurance premium • Lower hospitalization cost • Increases postoperative longevity FOR HEALTHCARE PROVIDERS • Reduced costs • Access to the patient’s “Big Data” using AI to apply triage and better diagnostics FOR PHARMACEUTICAL COMPANIES • Converts a generic drug into a proprietary BRANDED drug • Reduces cost of development for improved drug efficacy • Increases the life of a drug’s intellectual property • Ability to adapt the system to various disease models and drugs 10 • SINNAIS TM is believed to be the world’s first implantable pump with SMART that delivers drugs locally and metronomically under development • Intended to provide direct delivery of therapeutics into the brain ventricle, bypassing the blood - brain barrier • Potential to deliver neuroleptics locally to treat brain cancers, neurodegenerative diseases, and mental illnesses such as Alzheimer’s, Parkinson’s, and MS • Biocompatible and fully MRI compatible • Precise programmable schedules • Micro - dose adjustment control based on a patient’s reaction and tolerance • Enables delivery of multiple drugs* • Secure high - level encrypted wireless communication through the cloud from anywhere in the world • Refilling Next Generation SINNAIS TM Additional Features Under Development: • B iofeedback capability in real - time • Customizes and optimizes dosage to patients’ specific pharmacokinetic and pharmacodynamic needs – Personalized Medicine • SMART shunt and smart optical sensor (SOS) can monitor drug toxicity and concentration in real - time using a wireless connection to the cloud • Can be refilled and recharged transcutaneously INTRODUCING SINNAIS TM Metronomic drug delivery directly into the brain, bypassing the Blood - Brain - Barrier (BBB). Some key features/attributes include: * SINNAIS TM piezoelectric micropump is made of titanium and silicon therefore the chemistry of material in pump does not interact with drugs regardless of drug biological and chemistry composition. ML0

THE DIFFERENCE: novel design to address multiple challenges DRUG RESERVOIR PROPELLENT CHAMBER ELECTRONICS CHAMBER 22 GAUGE NEEDLE 25 GAUGE NEEDLE SKULL - MOUNTED OPTICAL SENSOR* SINNAIS TM IMPLANTABLE PUMP DOUBLE LUMEN CATHETER METRONOMIC DRUG DELIVERY TO TUMOR SITE BIOSENSOR FEEDBACK TO SINNAIS TM DRUG DELIVERY PORTS ACTIVE BIOSENSOR SINNAIS TM Implantable Pump Basic Flow Diagram 11 Inlet Safety Valve Prevents access drug pass - through from pump to patient body Reservoir Pressure Sensor Reads the level of drug Piezoelectric Micropump Metronomic delivery Catheter Access Port Drug refill and unclogs catheter tip Unique Features of SINNAIS Œ • Inlet Safety Valve – Prevents over pressurizing reservoir during refill • Reservoir Pressure Sensor – Reads the level of the drug • Piezoelectric Micropump – Metronomic delivery • Catheter Access Port – Drug refill and unclogs catheter tip *Skull - Mounted Optical Sensor is in development as part of the SINNAIS TM second - generation configuration. The current version of SINNAIS TM does not include this sensor

THE DIFFERENCE: metronomic delivery Metronomic delivery has been shown to minimize peak toxicity levels associated with current systemic delivery models . In addition to keeping therapeutic drug levels within acceptable ranges, metronomic delivery has also been shown to provide longer efficacy of the therapeutic in the beneficial therapeutic range . The chart below shows that metronomic delivery allowed a therapeutic to stay within acceptable toxicity ranges while also maintaining the targeted therapeutic range set by the physician. This study was based on delivering the standard dosage amount of methotrexate (MTX) for treating GBM. 1 The Bolus injection below represents the current gold standard of delivery with implantable pumps 0 1 2 3 4 5 6 7 TIME (days) 60 50 40 30 20 10 0 CONCENTRATION ( ug /ml) Bolus Injection 12.5mg/5cc/3.5 days .298mg/.416cc/2hr = 12.5mg/5cc/3.5 days 1.49mg/.416cc/2hr = 62.5mg/5cc/3.5 days 1. 2011 Metlab Simulation Model Study performed by Pharmaco - Kinesis Corp. (Cognos pre - spin - off) TARGETED THERAPEUTIC RANGES 12

POWER SOURCE ROUTE OF DELIVERY MECHANISM OF OPERATION MRI COMPATIBILITY COMPATIBLE DRUGS UNCLOGGING CATHETER TIP DOSE RATE METRONOMIC/ BIOFEEDBACK DEVICE Battery Power Intraventricular Piezoelectric Plus MRI Safe Small Molecule and Biologics YES 1ul YES SINNAIS Œ Implantable Smart Pump* Battery Power Intrathecal Peristaltic Action MRI Conditional Infumorph ®, Prialt ®, Lioresal ® chemo (pipeline) NO 0.048 - 24 mL/day NO SynchroMed TM II Gravity Power Intratumor Gravity Drip MRI Safe Chemotherapy, Antimicrobials, Antineoplastic, Analgesic, etc. NO 2 mL volume NO Integra Œ Reservoir Battery Power Intrathecal Valve - gate Action MRI Conditional Morphine, Baclofen Valproate NO 0 - 28.8 mL/day NO Reprogrammable Prometra *** Electrolysis Power Intratumor Diaphragm Action MRI Safe Paclitaxel NO ~1.5 mg/day NO PTM - 101* Diaphragm Intrathecal Diaphragm Action MRI Conditional I - dopa, Prozac, chemo (pipeline) NO N/A ** NO MiNDS Pump* THE COMPARISION *Product is not yet on the market and subject to FDA approval **Dose rate for the MiNDs pump was not available on the MIT website *** Algorithm Sciences acquired Flowonix in June 2023 Source: MCRA (www.mcra.com) “Findings and Recommendations for Cognos Therapeutics, Inc SINNAIS TM ISP , dated: 12/2021 Technical Specification and data are shown in this table for SynchroMed II, Integra, MIT, MiNDS , and Flowonix pumps have been compiled from each company’s website and the product brochures respectively 13 SINNAIS TM offers one of the most advanced micro - pump technology in the industry today. Its unique design is a significant departure and advancement for controlled therapeutic drug delivery to the brain and central nervous system.

DEVELOPMENT History COGNOS pursued a strategic path of in vivo research in animal studies utilizing supporting clinical data that were generated from Dr. Shinoura’s clinical work that was conducted in 2008 demonstrating that local delivery improves the incidences of cure in patients with Glioblastoma Multiform (GBM). HUMAN (20 subjects) SMALL ANIMAL 1 (30 mice) SMALL ANIMAL 2 (30 mice) LARGE ANIMAL 1 (5 pigs) LARGE ANIMAL 2 (9 sheep) 2008 Dr. Nobusada Shinoura Prove viability of convection enhanced delivery (CED) to the brain for treating LC 20 patient study using an extremal pump and a catheter to deliver Methotrexate directly into the brain The study showed that patients who received local delivery survived significantly longer than those who did not 2010 * COGNOS Prove viability of local delivery of Velcade for the treatment of glioma An Alzet mini - osmotic pump was implanted in a group of mice with gliomas for local delivery of Velcade with a second group receiving same - dose systemic delivery and a third control group with no treatment The study showed that the mice who received local delivery had longer survival rates then those receiving systemic delivery 2009 * COGNOS Prove viability of local delivery of Genentech’s Avastin for the treatment of LC An Alzet mini - osmotic pump was implanted in a group of mice with LC for local delivery of Avastin with a second group receiving same - dose systemic delivery and third control group with no treatment The study showed that the mice who received local delivery had survival rates 20% longer than those receiving systemic delivery 2011 * COGNOS Prove the viability of the MBP to deliver MTX to the brain and to provide a relevant sampling of c erebrospinal fluid (CSF) Test pigs had the SINNAIS TM and catheter implanted over a course of four studies where both contrast dye and MTX were metronomically delivered and CSF sampling was performed The studies showed that the pump delivered therapeutics that were well tolerated, and wireless communication through animal skin was successful confirming the antenna in SINNAIS TM receiving signals successfully 2020 COGNOS Prove viability of SINNAIS TM to deliver MTX to the brain in micro - dose levels that could be controlled and monitored remotely 9 sheep (Group 1 (3), Group 2 (6)) were implanted with the SINNAIS TM pump and an Ommaya reservoir where MTX was then delivered at various micro - dose levels and intervals over both an 8 - week term for group one and 12 - week term for group two The study showed that the test animals tolerated the pump and therapeutic; and that control and monitoring of the pump could be done remotely TYPE DATE BY PURPOSE METHOD RESULT 14 * Study conducted by Pharmaco - Kinesis Corp. (Cognos pre - spin - off)

OBJECTIVES • Validate the pump’s ability to deliver metronomic dosing of a therapeutic to the brain in a large animal model • Test the ability of the pump’s wireless data and system control to allow for remote dose adjustment (metronomic delivery) and the flow delivery data to be received and monitored 1 st Pilot Study • Three animal non - GLP (Good Laboratory Practices) studies using sheep • Eight - week survival study • Studied verified: • Wireless communication • Pump delivery capabilities • Ability to safely refill the implanted pump 2 nd Pilot Study • Six animal non - GLP study using sheep • Twelve - week survival study • Study verified: • Metronomic pumping at micro - dose levels • Delivery of Methotrexate (MTX) to the brain • Durability and biocompatibility of the pump Dr. Wu checks communication protocols between the SINNAIS TM pump and several smartphones being used in the trial. SINNAIS TM pump is connected to catheter prior to implantation in a test animal. An Omamya reservoir connected to the SINNAIS TM pump is implanted in the test animal’s brain. The research team monitors the SINNAIS TM pump’s function after the implantation. 15 VALIDATION STUDIES – SHEEP MODEL RESULTS • Provided insight to continue to refine the pump’s accuracy and biocompatibility in providing adjustable, controlled micro - dose delivery of a therapeutic • Provided insight to develop the protocols for control of the system, CSF sampling, and data monitoring via wireless communication to a remote computer or an app - enabled smartphone

The chart below shows a sample of the pressure and temperature readings taken from a test animal in the second phase of the large animal trial . As can be seen, using both the pressure and the temperature remain extremely stable which shows the pump’s ability to provide consistent metronomic delivery in a manner that has no adverse effect on the test subject . DATA COLLECTION DATE – OCT 2010 PRESSURE (PSI) and TEMPERATURE © PUMP INLET PRESSURE and TEMPERATURE READINGS FROM TEST ANIMAL 2 Pressure Temperature VALIDATION STUDIES – SHEEP MODEL 16

VALIDATION METRONOMIC DELIVERY – SHEEP MODEL 17 • Sheep 90 - 0 ( 38 D 2 ) produced a sufficient quantity of CSF . The chart shows that the MTX concentration level in CSF samples tracked well with the changes in the delivery rate . • Sheep 134 - R (FB 90 ) generally produced a sufficient quantity of CSF except on 04 / 08 / 21 and 04 / 15 / 21 . We received a smaller quantity of CSF on those two days . FB 90 was set to deliver about half the rate of 38 D 2 so we expected to find the MTX concentration level to be about half of 38 D 2 . • The data supports the metronomic pump’s successful delivery of MTX into the ventricle CSF at different rates and, following a lag, and taking into account dilution/ADME (absorption, distribution, metabolism, and excretion), the CSF MTX concentration is rate responsive . • The data shows the implanted SINNAIS TM pump is working in vivo and the delivered drug concentration is responsive to changes in pump rate. MTX Concentration in CSF Samples from Sheep 90 - 0 Compared with Delivery Rate 03/05/21 03/15/21 03/25/21 04/04/21 04/14/21 0 4/24/21 05/04/21 450 400 350 300 250 200 150 100 50 0 metronomic pump’s strokes/ hr given into sheep 90 - O’s ventricle. The pump rate was wirelessly changed over time to develop a MTX protocol to identify the maximum tolerated dose for a future GLP study micromolar (mM) concentration of MTX in the CSF at that specific time/day in sheep 90 - O

Combined Regulatory FDA and EU Approval Strategy U.S. Q4 2021 – Filed pre - submission with FDA for PMA submission for SINNAIS TM Q1 2022 – Received FDA’s written pre - sub feedback, which will inform application for SINNAIS TM ~24 Months* – Submit PMA application to FDA approval for for SINNAIS TM as a Class III pump indicated for infusion of Infumorph , potentially using FDA’s 6 - year Rule which would allow PMA approval without conducting new human clinical trials as a device alone (from Device Center (CDRH) and Drug Center (CDER) – Initiate Phase II human clinical trial of SINNAIS TM as a combination product for metronomic delivery of MTX for treatment of LC under IND from CDER E.U. ~24 Months* – CE - Mark submission for SINNAIS TM as device alone based upon data with the first drug: methotrexate. After SINNAIS TM receives CE - Mark in EU market, SINNAIS TM will be allowed to be used with any approved drug in the European market without requiring to go through additional regulatory approvals 18 *Expected development timeline from closing of the business combination – See slide 19 for further detail

19 SINNAIS Nj ~24 MONTHS development timeline * Expected timing of FDA decision for PMA and IND submissions, and CE - mark in E.U. ** BSI is a European medical device regulatory agency that issues CE - Marks for products in the EU. BSI performs a similar role t o the FDA in the U.S. *** Expected development timeline from closing of the business combination LC Development Timeline US FDA/PMA Path Pre - IND and Actual Data and Protocol PMA Submission *PMA Approval – Pump is approved for currently designed drugs * IND Submission and Approval Phase II Clinical Human Trials Initiation EU/CE Mark Acceptance by BSI** for ISO Certification and CE Certification review Telcom meeting with BSI to discuss key points for CE pathway (inc. clinical) ISO Certification Clinical Study in EU Submission Design Dossier to BSI *CE Certification and CE - Mark Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q 1

comprehensive IP PORTFOLIO COGNOS has always pursued an aggressive strategy of identifying and protecting its Intellectual Property assets through global patent protection COGNOS IP Portfolio by the Numbers: ISSUED – Over 30 Patents issued in the U.S. and Internationally PENDING – 57 Patent Applications pending in the U.S. and Internationally • Implantable pump for detection of spine issues • Implantable piezoelectric pump for delivery of therapeutics to the spine • A method for Cerebral Microdialysis to treat neurological disease • Implantable piezoelectric pump for delivery of b iological response modifiers • Artificial Tooth Medicating device for local delivery of therapeutics • An implantable magnetic breather pump for local delivery of bevacizumab into a brain tumor • A method for creation and manufacture of a hermetic seal for use in an implantable metronomic drug pump • Creation of a MRI compatible drug pump with overpressure protection • Method for the intratumoral delivery of Bortezomib • Development of a Magnetic Breather Pump for tumor treatment • An implantable pump for the local delivery of intrathecal chemotherapy for Leptomeningpal Carcinomatosis • Development of a Multipurpose Cerebrospinal Fluid Sensor • Development of a Skull - Mounted Drug And Pressure Sensor 20 IP Portfolio Covers

Cognos Therapeutics Founders & Management TEAM JOSH SHACHAR * Co - Founder CHIEF INNOVATION OFFICER THOMAS CHEN, MD, PhD* Co - Founder CHIEF NEUROSURGEON & ONCOLOGY OFFICER THOMAS LOBL, PhD* CHIEF OPERATING OFFICER SUSAN ALPERT, MD, PhD* LEAD REGULATORY CONSULTANT WINSTON WU, PhD SR. VP. PRODUCT DEVELOPMENT AND CHIEF TECHNOLOGY OFFICER ELI GANG, MD, FACC, FACP* CHIEF MEDICAL OFFICER FRANK ADELL Co - Founder CHIEF EXECUTIVE OFFICER JAAP LAUFER, MD, PhD* LEAD REGULATORY FOR EU CE - MARK DARCI DIAGE* MANAGER, SPECIAL REGULATORY AND COMPLIANCE 21 * Consultant BRETT CLARK * CHIEF FINANCIAL OFFICER ROGER KORNBERG, PhD* STRATEGIC ADVISOR and CO - FOUNDER

Cognos Therapeutics ANTICIPATED BOARD OF DIRECTORS 22 JOSH SHACHAR DIRECTOR THOMAS CHEN, MD, PhD DIRECTOR FRANK ADELL CHAIRMAN Philippe Gadal , PhD DIRECTOR NOMINEE CHRISTOPHER SMITH DIRECTOR NOMINEE CRAIG BURSON DIRECTOR NOMINEE RICK PANICUCCI, PhD DIRECTOR NOMINEE

Summary transaction overview 23 • The combined company will be known as Cognos Therapeutics Holding Corp. • Will operate under the same management team as Cognos Therapeutics, Inc. • Anticipated closing in Q4 2023 Overview Ownership Financing Transaction Rationale Use of Proceeds • The transaction contemplates an enterprise value of $120 million for Cognos Therapeutics, Inc. • As part of the transaction, all shares owned by Cognos’ existing equity holders will be converted into Class A common stock • There is expected to be a minimum of $10 million in cash on the balance sheet at closing that may be sourced from a combination of the cash held in trust, net of redemptions, cash on the balance sheet, and through additional financing sources • Provides Cognos Therapeutics, Inc. with access to the capital markets, allowing it to accelerate the development and advancement of its technology and future applicability • Multiple near - term value inflection points • To advance the development of SINNAIS TM toward an Investigational New Drug (IND) for the initiation of Phase II human clinical trial of SINNAIS TM as a combination product for metronomic delivery of Methotrexate for the treatment of Leptomeningeal Carcinomatosis & obtaining a CE market in the E.U. • Working capital and general corporate purposes

detailed transaction overview 24 1. Assumes no further redemptions by Nocturne public shareholders. This amount will be reduced by the amount of cash used to sat isfy redemptions. Also assumes no cash from Cognos’ balance sheet 2. Estimated $10 million in gross proceeds from a PIPE to close concurrently with the business combination 3. Pro forma diluted basis at $10.30 per share, assumes no redemptions 4. Includes Nocturne’s assumption of current Cognos warrants, options and restricted stock units 5. Factors in the shares underlying certain Cognos convertible notes 6. Includes the Nocturne Founder’s shares and Private Placement shares Illustrative Sources & Uses Sources ($mm) $120.0 Stock Issuance to Cognos 4,5 $39.6 Nocturne Sponsor Shares 6 $20.1 Nocturne Cash in Trust 1,2 $10.0 Cash from PIPE 2 $189.8 Total Sources Uses ($mm) $120.0 Cognos Equity Rollover 4,5 $39.6 Nocturne Sponsor Shares 6 $19.6 Cash to Balance Sheet 1,2 $10.6 Estimated Transaction Fees & Expenses $189.8 Total Uses Pro Forma Valuation (in millions, except share price) 19.5 Pro Forma Shares Outstanding 1,2,3,4,5 $10.30 (x) Illustrative Share Price $200.9 Pro Forma Equity Value 1,2,3,4,5 $19.6 ( - ) Pro Forma Net Cash 1,2 $181.3 Pro Forma Enterprise Value 1,2,3,4,5 Pro Forma Share Ownership 1,2,3,4,5 59 % 15% 20% 6% Existing Cognos Shareholders Nocturne Public Shareholders Nocturne Sponsor Shares PIPE Investors 6 ST0

v3.23.2

Cover

|

Sep. 06, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 06, 2023

|

| Entity File Number |

001-40259

|

| Entity Registrant Name |

NOCTURNE ACQUISITION CORPORATION

|

| Entity Central Index Key |

0001837344

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

P.O. Box 25739

|

| Entity Address, City or Town |

Santa Ana

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92799

|

| City Area Code |

650

|

| Local Phone Number |

935-0312

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one ordinary share, $0.0001 par value and one right |

|

| Title of 12(b) Security |

Units, each consisting of one ordinary share, $0.0001 par value and one right

|

| Trading Symbol |

MBTCU

|

| Security Exchange Name |

NASDAQ

|

| Ordinary shares included as part of Units |

|

| Title of 12(b) Security |

Ordinary shares included as part of Units

|

| Trading Symbol |

MBTC

|

| Security Exchange Name |

NASDAQ

|

| Rights included as part of the Units |

|

| Title of 12(b) Security |

Rights included as part of the Units

|

| Trading Symbol |

MBTCR

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MBTC_UnitsEachConsistingOfOneOrdinaryShare0.0001ParValueAndOneRightMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MBTC_OrdinarySharesIncludedAsPartOfUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MBTC_RightsIncludedAsPartOfUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

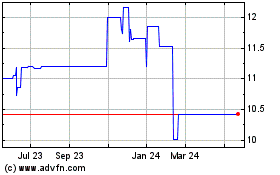

Nocturne Acquisition (NASDAQ:MBTCU)

Historical Stock Chart

From Apr 2024 to May 2024

Nocturne Acquisition (NASDAQ:MBTCU)

Historical Stock Chart

From May 2023 to May 2024