UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 5, 2024

NOCTURNE ACQUISITION CORPORATION

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-40259 |

|

N/A |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS. Employer

Identification No.) |

P.O. Box 25739

Santa Ana, CA 91799

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (650) 953-0312

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one Ordinary Share, par value $0.0001, and one right |

|

MBTCU |

|

The Nasdaq Stock Market LLC |

| Ordinary Shares included as part of the Units |

|

MBTC |

|

The Nasdaq Stock Market LLC |

| Rights included as part of the Units |

|

MBTCR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On February 5, 2024, Nocturne

Acquisition Corporation (the “Company”) issued a press release announcing that the extraordinary general meeting of its shareholders

to vote on the proposed business combination with Cognos Therapeutics, Inc. (“Cognos,” such merger, the “Merger,”

and such meeting, the “Extraordinary General Meeting”) originally scheduled for Tuesday, January 30, 2024, and postponed to

Tuesday, February 6, 2024 is being further postponed to Tuesday, February 27, 2024 at 9:00 a.m. Eastern Time and will be held virtually

(the “Postponed Meeting”). The Company plans to continue to solicit proxies from shareholders during the period prior to the

Postponed Meeting.

A copy of the press release

is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Cautionary Note Regarding Forward-Looking Statements

Statements contained in this

Current Report on Form 8-K that are not historical facts may be forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate

to future events or the Company’s future financial or operating performance. In some cases, you can identify forward-looking statements

because they contain words such as “may,” “will,” “should,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,”

“believes,” “estimates,” “predicts,” “potential” or “continue” or the negative

of these words or other similar terms or expressions that concern the Company’s expectations, strategy, plans or intentions. . Such

forward-looking statements do not constitute guarantees of future performance and are subject to a variety of risks and uncertainties.

The Company does not undertake any obligation to update forward-looking statements as a result of new information, future events or developments

or otherwise.

Additional Information and Where to Find It

A full description of the

terms of that certain Agreement and Plan of Merger and Reorganization, dated December 30, 2022, by and among Nocturne, Cognos, and Nocturne

Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Nocturne, in connection with the proposed Merger is provided

in the definitive Registration Statement which includes a prospectus with respect to the combined company’s securities to be issued

in connection with the Merger and a proxy statement with respect to the Extraordinary General Meeting to vote on the Merger. The

definitive proxy statement/prospectus included in the Registration Statement has been mailed to stockholders of Nocturne as of the record

date of December 29, 2023. Stockholders are also able to obtain a copy of the Registration Statement, including the proxy statement/prospectus,

and other documents filed with the SEC without charge, by directing a request to Nocturne Acquisition Corporation, P.O Box 25739, Santa

Ana, CA 92799, Attention Thomas Ao. The preliminary and definitive proxy statement/prospectus included in the Registration Statement can

also be obtained, without charge, at the SEC’s website (www.sec.gov).

Participants in Solicitation

Nocturne, Cognos and their

respective directors and officers may be deemed to be participants in the solicitation of proxies from Nocturne’s stockholders in

connection with the proposed business combination. Information about Nocturne’s directors and executive officers and their ownership

of Nocturne’s securities is set forth in Nocturne’s filings with the SEC. Additional information regarding the interests of

those persons and other persons who may be deemed participants in the proposed business combination may be obtained by reading the Registration

Statement when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

Safe Harbor Statement

This Current Report on Form

8-K is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the

potential transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of Nocturne, the combined

company or Cognos, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation,

or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. |

|

Description |

| 99.1 |

|

Press Release |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

NOCTURNE ACQUISITION CORP. |

| |

|

| |

By: |

/s/ Henry Monzon |

| |

|

Name: |

Henry Monzon |

| |

|

Title: |

Chief Executive Officer and Director |

| |

|

|

|

| Date: February 5, 2024 |

|

|

3

Exhibit 99.1

NOCTURNE ACQUISITION CORPORATION ANNOUNCES POSTPONEMENT

OF EXTRAORDINARY

GENERAL MEETING

SANTA ANA, CA – February 5, 2024 --

Nocturne Acquisition Corp. (NASDAQ: MBTCU) (the “Company”), announced today that the Board of Directors has voted in favor

of a second postponement of the meeting date for the Extraordinary General Meeting that was to be held on January 30, 2024 for shareholders

to vote on the proposed business combination with Cognos Therapeutics, Inc. The Extraordinary General Meeting that was postponed until

February 6, 2024 has been postponed further and will now be held virtually on February 27, 2024 at 9:00 a.m. Eastern Time. The Company

plans to continue to solicit proxies from shareholders during the period prior to the Extraordinary General Meeting. The record date for

the Extraordinary General Meeting remains the close of business on December 29, 2023. No changes have been made in the proposals to be

voted on by the shareholders at the postponed meeting. Shareholders who have previously submitted their proxy or otherwise voted and who

do not want to change their vote need not take any action. Stockholders as of the record date may vote, even if they have subsequently

sold their shares. The deadline by which shareholders must exercise their redemption rights in connection with the Extraordinary General

Meeting has been extended to two business days prior to the second postponed meeting.

About Nocturne Acquisition Corp.

The Company

is a blank check company organized for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, recapitalization,

reorganization, or other similar business combination with one or more businesses or entities. While the Company may pursue an acquisition

opportunity in any industry or sector, the Company focuses its search for targets bringing to market disruptive technologies in the blockchain/crypto

and artificial intelligence technology sectors. Equity value of potential targets is expected to be in the $300 million to $1 billion

USD range.

Cautionary Note Regarding Forward-Looking Statements

Statements contained in this

press release that are not historical facts may be forward-looking statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to

future events or the Company’s future financial or operating performance. In some cases, you can identify forward-looking statements

because they contain words such as “may,” “will,” “should,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,”

“believes,” “estimates,” “predicts,” “potential” or “continue” or the negative

of these words or other similar terms or expressions that concern the Company’s expectations, strategy, plans or intentions. . Such

forward-looking statements do not constitute guarantees of future performance and are subject to a variety of risks and uncertainties.

The Company does not undertake any obligation to update forward-looking statements as a result of new information, future events or developments

or otherwise.

Additional Information and Where to Find It

A full description of the

terms of that certain Agreement and Plan of Merger and Reorganization, dated December 30, 2022, by and among Nocturne, Cognos, and Nocturne

Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Nocturne, in connection with the proposed Merger is provided

in the definitive Registration Statement which includes a prospectus with respect to the combined company’s securities to be issued

in connection with the Merger and a proxy statement with respect to the Extraordinary General Meeting to vote on the Merger. The

definitive proxy statement/prospectus included in the Registration Statement has been mailed to stockholders of Nocturne as of the record

date of December 29, 2023. Stockholders are also able to obtain a copy of the Registration Statement, including the proxy statement/prospectus,

and other documents filed with the SEC without charge, by directing a request to Nocturne Acquisition Corporation, P.O Box 25739, Santa

Ana, CA 92799, Attention Thomas Ao. The preliminary and definitive proxy statement/prospectus included in the Registration Statement can

also be obtained, without charge, at the SEC’s website (www.sec.gov).

Participants in Solicitation

Nocturne, Cognos and their respective directors

and officers may be deemed to be participants in the solicitation of proxies from Nocturne’s stockholders in connection with the

proposed business combination. Information about Nocturne’s directors and executive officers and their ownership of Nocturne’s

securities is set forth in Nocturne’s filings with the SEC. Additional information regarding the interests of those persons and

other persons who may be deemed participants in the proposed business combination may be obtained by reading the Registration Statement.

MBTC Company/Media Contact:

investors@nocturnecorp.com

media@nocturnecorp.com

MBTC Investor Relations Contact:

Chris Tyson/Doug Hobbs

SPAC Alpha IR+

(949) 491-8235

MBTC@mzgroup.us

Nocturne Acquisition (NASDAQ:MBTCU)

Historical Stock Chart

From Apr 2024 to May 2024

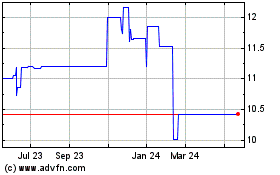

Nocturne Acquisition (NASDAQ:MBTCU)

Historical Stock Chart

From May 2023 to May 2024