UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 29, 2023

NOCTURNE ACQUISITION CORPORATION

(Exact name of Registrant as Specified in Its

Charter)

| Cayman Islands |

|

001-40259 |

|

N/A |

| (State or Other Jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification No.) |

| P.O. Box 25739 |

|

|

| Santa Ana, CA |

|

92799 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including

Area Code: (858) 375-8026

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one ordinary share, $0.0002 par value and one right |

|

MBTCU |

|

The Nasdaq Stock Market LLC |

| Ordinary shares included as part of Units |

|

MBTC |

|

The Nasdaq Stock Market LLC |

| Rights included as part of the Units |

|

MBTCR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 1.01 - Entry into a Material Definitive Agreement.

Merger Agreement Amendment

As previously announced,

on December 30, 2022, Nocturne Acquisition Corporation, a special purpose acquisition company incorporated as a Cayman Islands exempted

company (“Nocturne”), entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”)

with Nocturne Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Nocturne (“Merger Sub”), and Cognos

Therapeutics, Inc., a Delaware corporation (“Cognos”), with respect to a proposed initial business combination which would

involve a domestication of Nocturne as a Delaware corporation, in connection with which Nocturne would also change its name to “Cognos

Therapeutics Holdings, Inc.”, followed by a merger of Merger Sub with and into Cognos (the “Merger”), with Cognos continuing

as the surviving entity and a wholly owned subsidiary of Nocturne. The Merger Agreement is filed as Exhibit 2.1 to Nocturne’s Current

Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on January 4, 2023 (the “January

Form 8-K”). The material terms of the Merger Agreement are described in Item 1.01 of the January Form 8-K and are incorporated by

reference herein.

On September 29, 2023, Nocturne,

Cognos and Merger Sub entered into the First Amendment to the Merger Agreement (the “Amendment”). The Amendment amends Section

7.1(c) of the Merger Agreement to change the date after which either Nocturne or Cognos may terminate the Merger Agreement if the closing

of the transactions contemplated thereby has not occurred from September 30, 2023 to March 31, 2024.

The foregoing description of the Amendment does not purport to

describe all of the terms thereof and is qualified by reference to the Amendment, which is attached as Exhibit 2.1 hereto and incorporated

herein by reference.

Forward-Looking Statements

This Current Report on Form

8-K contains certain “forward-looking statements” within the meaning of the Securities Act and the Exchange Act. Statements

that are not historical facts, including statements about the Merger between Nocturne and Cognos, the Merger Agreement, the transactions

contemplated thereby and the parties’ perspectives and expectations, are forward-looking statements. The words “expect,”

“believe,” “estimate,” “intend,” “plan” and similar expressions indicate forward-looking

statements. These forward-looking statements are not guarantees of future performance and are subject to various risks, uncertainties

and assumptions (including assumptions about general economic, market, industry and operational factors), known or unknown, which could

cause the actual results to vary materially from those indicated or anticipated.

These forward-looking statements

are subject to a number of risks and uncertainties, including the risk that Cognos and Nocturne may be unable to successfully or timely

consummate the Merger, including as a result of any regulatory approvals that are not obtained, are delayed or are subject to unanticipated

conditions that could adversely affect the combined company or the expected benefits of the Merger, that approval by the stockholders

of Cognos or Nocturne may not be obtained, that the Merger may not result in the benefits anticipated by Nocturne and Cognos, as well

as the risks discussed in Nocturne’s final prospectus dated March 30, 2021 under the heading “Risk Factors,” and in

other documents Nocturne has filed, or will file, with the SEC, including the registration statement, as amended, on Form S-4/A, filed

by Nocturne on October 4, 2023, in connection with the proposed initial business combination (the “Registration Statement”),

which includes a proxy statement/prospectus. If any of these risks materialize or underlying assumptions prove incorrect, actual results

could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Nocturne

nor Cognos presently know, or that Cognos or Nocturne currently believe are immaterial, that could also cause actual results to differ

from those contained in the forward-looking statements. In addition, forward-looking statements reflect Nocturne’s and Cognos’

expectations, plans, or forecasts of future events and views as of the date of this Current Report on Form 8-K. Nocturne and Cognos anticipate

that subsequent events and developments will cause Nocturne’s and Cognos’ assessments to change. Accordingly, you are cautioned

not to place undue reliance on these forward-looking statements. Forward-looking statements relate only to the date they were made, and

Nocturne, Cognos and their affiliates undertake no obligation to update forward-looking statements to reflect events or circumstances

after the date they were made except as required by law or applicable regulation.

Additional Information and Where to Find It

A full description of the

terms of the Merger Agreement is provided in the preliminary Registration Statement, as amended, filed by Nocturne on October 4, 2023,

with the SEC, which includes a prospectus with respect to the combined company’s securities to be issued in connection with the

Merger and a proxy statement with respect to the stockholder meeting of Nocturne to vote on the Merger. The Registration Statement

filed by Nocturne on October 4, 2023 with the SEC is a preliminary Registration Statement and is subject to change. Nocturne urges its

investors, stockholders and other interested persons to read the final Registration Statement, when available, as well as other documents

filed with the SEC because these documents will contain important information about Nocturne, Cognos and the Merger. After the Registration

Statement is declared effective, the definitive proxy statement/prospectus included in the Registration Statement will be mailed to stockholders

of Nocturne as of a record date to be established for voting on the proposed Merger. Stockholders are also able to obtain a copy of the

Registration Statement, including the proxy statement/prospectus, and other documents filed with the SEC without charge, by directing

a request to Nocturne Acquisition Corporation, P.O Box 25739, Santa Ana, CA 92799, Attention Thomas Ao. The preliminary and definitive

proxy statement/prospectus included in the Registration Statement can also be obtained, without charge, at the SEC’s website (www.sec.gov).

Participants in Solicitation

Nocturne, Cognos and their

respective directors and officers may be deemed to be participants in the solicitation of proxies from Nocturne’s stockholders in

connection with the proposed business combination. Information about Nocturne’s directors and executive officers and their ownership

of Nocturne’s securities is set forth in Nocturne’s filings with the SEC. Additional information regarding the interests of

those persons and other persons who may be deemed participants in the proposed business combination may be obtained by reading the Registration

Statement when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

Safe Harbor Statement

This Current Report on Form

8-K is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the

potential transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of Nocturne, the combined

company or Cognos, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation,

or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended.

Item 9.01 - Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NOCTURNE ACQUISITION CORPORATION |

| |

|

| |

/s/ Henry Monzon |

| |

Henry Monzon |

| Date: October 5, 2023 |

Chairman and Chief Executive Officer |

3

Exhibit 2.1

Execution Version

FIRST AMENDMENT TO

AGREEMENT AND PLAN OF MERGER AND REORGANIZATION

This First Amendment to Agreement

and Plan of Merger and Reorganization (this “Amendment”) is made and entered into as of September 29, 2023, by and

among (i) Nocturne Acquisition Corporation, a Cayman Islands exempted company (“Nocturne”), (ii) Cognos Therapeutics,

Inc., a Delaware corporation (the “Company”), and (iii) Nocturne Merger Sub, Inc., a Delaware corporation and a wholly

owned subsidiary of Nocturne (“Merger Sub”). Each of Nocturne, the Company, and Merger Sub is also referred to herein

as a “Party” and, collectively, as the “Parties.” Capitalized terms used but not otherwise defined

herein shall have the respective meanings assigned to such terms in the Original Agreement (as defined below).

WHEREAS, the Parties are parties

to that certain Agreement and Plan of Merger and Reorganization made and entered into as of December 30, 2022 (the “Original

Agreement”); and

WHEREAS, the Parties desire

to amend the Original Agreement (as amended from time to time, including by this Amendment, the “Merger Agreement”)

on the terms and conditions set forth herein;

NOW, THEREFORE, in consideration

of the foregoing and the covenants and agreements set forth in this Amendment, and subject to the terms and conditions set forth in this

Amendment, the Parties, intending to be legally bound, hereby agree as follows:

1. Amendment

to the Merger Agreement. Section 7.1(c) of the Original Agreement is hereby amended by deleting the words “September 30, 2023”

and substituting therefor the words “March 31, 2024”.

2. Miscellaneous.

Except as expressly provided in this Amendment, all of the terms and provisions in the Original Agreement are and shall remain unchanged

and in full force and effect, on the terms and subject to the conditions set forth therein. This Amendment does not constitute, directly

or by implication, an amendment or waiver of any provision of the Original Agreement, or any other right, remedy, power or privilege of

any party, except as expressly set forth herein. Any reference to the Merger Agreement in the Merger Agreement or any other agreement,

document, instrument or certificate entered into or issued in connection therewith shall hereafter mean the Original Agreement as amended

by this Amendment (or as the Merger Agreement may be further amended or modified after the date hereof in accordance with the terms thereof).

The Original Agreement, as amended by this Amendment, together with the documents or instruments attached hereto or thereto or referenced

herein or therein, constitutes the entire agreement between the parties with respect to the subject matter of the Merger Agreement, and

supersedes all prior agreements and understandings, both oral and written, between the Parties with respect to its subject matter. If

any provision of the Original Agreement is materially different from or inconsistent with any provision of this Amendment, the provision

of this Amendment shall control, and the provision of the Original Agreement shall, to the extent of such difference or inconsistency,

be disregarded. This Amendment shall be interpreted, construed, governed and enforced in a manner consistent with the Original Agreement,

and, without limiting the foregoing, Sections 8.3 through 8.12, inclusive, of the Original Agreement are hereby incorporated herein by

reference as if fully set forth herein, and such provisions apply to this Amendment as if all references to the “Agreement”

contained therein were instead references to this Amendment.

[Signature Pages Follow]

IN WITNESS WHEREOF, each of

the undersigned has caused this First Amendment to Agreement and Plan of Merger and Reorganization to be duly executed as of the date

first above written.

| |

NOCTURNE ACQUISITION CORPORATION |

| |

|

|

|

| |

By: |

/s/ Henry Monzon |

| |

|

Name: |

Henry Monzon |

| |

|

Title: |

Chief Executive Officer |

| |

NOCTURNE MERGER SUB, INC. |

| |

|

|

|

| |

By: |

/s/ Henry Monzon |

| |

|

Name: |

Henry Monzon |

| |

|

Title: |

Authorized Representative |

| |

COGNOS THERAPEUTICS,

INC. |

| |

|

|

|

| |

By: |

/s/ Frank Adell |

| |

|

Name: |

Frank Adell |

| |

|

Title: |

Chief Executive Officer |

Nocturne Acquisition (NASDAQ:MBTCU)

Historical Stock Chart

From Apr 2024 to May 2024

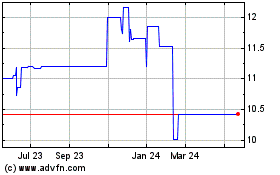

Nocturne Acquisition (NASDAQ:MBTCU)

Historical Stock Chart

From May 2023 to May 2024