false

0001042729

0001042729

2024-07-11

2024-07-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): July 11, 2024

Mercantile Bank Corporation

(Exact name of registrant as specified in its charter)

| Michigan |

000-26719 |

38-3360865 |

| (State or other jurisdiction |

(Commission File |

(IRS Employer |

| of incorporation) |

Number) |

Identification Number) |

| |

|

|

| 310 Leonard Street NW, Grand Rapids, Michigan |

49504 |

| (Address of principal executive offices) |

(Zip Code) |

| |

|

| Registrant's telephone number, including area code |

616-406-3000 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

MBWM

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Adoption of Bonus Plan

On July 11, 2024, the Boards of Directors of Mercantile Bank Corporation (“Mercantile”), and of Mercantile’s wholly-owned subsidiary, Mercantile Bank (the “Bank”), adopted an executive officer bonus plan for 2024 (the “Executive Officer Plan”).

The Executive Officer Plan provides for cash bonuses for Raymond E. Reitsma, President and Chief Executive Officer of the Bank and Mercantile; Charles E. Christmas, the Executive Vice President, Chief Financial Officer, and Treasurer of Mercantile, and the Executive Vice President and Chief Financial Officer of the Bank; Scott Setlock, the Executive Vice President, Chief Operating Officer and Secretary of the Bank and Mercantile; Brett E. Hoover, the Senior Vice President and Chief Human Resource Officer of the Bank and Mercantile; Robert B. Kaminski, Jr., the retired President and Chief Executive Officer of Mercantile and the Chief Executive Officer of the Bank (for partial-year service); and two other members of Mercantile’s executive management team.

Payment from the bonus pool under the Executive Officer Plan is based on the achievement of targets under the following 2024 bonus metrics. The specific targets for each metric will be established by the Compensation Committee of Mercantile’s Board of Directors. The Compensation Committee will establish a target level of performance for each metric (the “Target Level”) and a maximum level of performance for each metric (the “Maximum Level”). If Mercantile’s performance on a metric is at the Target Level, the percentage associated with that metric which will be credited toward the calculation of the bonus pool will be at the Target Percentage shown in the chart below. If Mercantile’s performance on a metric is at or above the Maximum Level, the percentage associated with that metric which will be credited toward calculation of the bonus pool will be at the Maximum Percentage shown in the chart below. A linear interpolation would be used to determine the percentage assigned to that metric in the event that Mercantile’s performance falls between the Target Level and the Maximum Level.

| Metric |

Target Level |

Maximum Level |

| Earnings per share |

25.0% |

37.50% |

| Return on assets |

12.5% |

18.75% |

| Net interest margin |

12.5% |

18.75% |

| Efficiency ratio |

12.5% |

18.75% |

| Non-performing assets |

12.5% |

18.75% |

| Loans-to-deposits |

25.0% |

37.50% |

The amount that will be allocated to the bonus pool under the Executive Officer Plan will depend on Mercantile’s performance on each of the 2024 bonus metrics. If performance on each bonus metric is at the Target Level, the amount allocated to the bonus pool will be $1,137,897 (the “Target Bonus Pool”). The amount allocated to the bonus pool will be increased if performance on one or more bonus metrics exceeds the Target Level, but will not be greater than 150% of the Target Bonus Pool or $1,706,845 (the “Maximum Bonus Pool”). A linear interpolation would be used to determine the amount allocated to the bonus pool in the event that performance on one or more metrics falls between the Target Level and the Maximum Level.

The maximum amount will be appropriately adjusted if (a) a newly hired employee becomes a named executive officer (as defined in Item 402(a)(3) of SEC Regulations S-K) or a designated member of the executive management team and becomes eligible to participate in the Executive Officer Plan, (b) an executive officer's base salary is adjusted during the year, or (c) an executive officer becomes ineligible before December 31, 2024. The bonus pool has been adjusted to take into account Mr. Kaminski’s base salary through his retirement date.

Each individual target must be met at the Target Level in order for the percentage associated with that metric to be credited toward payment from the bonus pool. The accumulated percentage for each individual target attained will be applied to the bonus pool to determine the total amount of the bonus pool to be awarded (the “Award Amount”). For example, if the first four factors are attained at the Target Level and the next two factors are not attained, the Award Amount under this Plan would be $1,137,897 x 62.5% = $711,185.63. As another example, if the first three factors are attained at the Maximum Level and the next three factors are attained at the Target Level, the Award Amount under this Plan would be $1,137,897 x 125% = $1,422,371.25.

The Award Amount will be paid to each executive officer pro rata based on a uniform percentage of the executive officer's 2024 salary (and the pro-rated 2024 salary of the retired Chief Executive Officer), not to exceed:

| |

Target Percentage |

Maximum Percentage |

| Retired Chief Executive Officer |

55.0% |

82.5% |

| Chief Executive Officer |

60.0% |

90.0% |

| Chief Financial Officer |

40.0% |

60.0% |

| Chief Operating Officer |

35.0% |

52.5% |

| Chief Human Resources Officer |

30.0% |

45.0% |

The “target percentage” of salary in the chart above will be adjusted downward if Mercantile does not satisfy each bonus metric at the Target Level. A linear interpolation will be used to determine the percentage of salary to be paid if Company performance on one or more metrics falls between the Target Level and the Maximum Level.

Any bonus awards that are earned under the plan will be paid to the executive officers on or before March 15, 2025.

Payments under the plan are subject to specified conditions, qualifications, and clawback provisions. The plan, to the extent provided for in the plan, may be amended by the Compensation Committee of Mercantile's Board of Directors.

A copy of the Executive Officer Plan is attached as Exhibit 10.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit Number Description

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Mercantile Bank Corporation

|

|

|

|

|

|

|

|

|

By:

|

/s/ Charles Christmas

|

|

|

|

|

Charles Christmas

|

|

|

|

|

Executive Vice President, Chief

Financial Officer and Treasurer

|

|

Date: July 11, 2024

Exhibit Index

Exhibit Number Description

| |

10.1

|

2024 Mercantile Executive Officer Bonus Plan

|

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Exhibit 10.1

MERCANTILE BANK CORPORATION/MERCANTILE BANK

2024 MERCANTILE EXECUTIVE OFFICER BONUS PLAN

This 2024 Mercantile Executive Officer Bonus Plan (this “Plan”) is designed to reflect that the directors of Mercantile Bank Corporation (the “Company”) and Mercantile Bank (the “Bank”) believe that the Company’s shareholders are willing to share financially in operating results that meet or exceed certain specific financial metrics.

The purpose of this Plan is to:

| |

•

|

Promote the growth, profitability and expense control necessary to accomplish corporate strategic long-term plans;

|

| |

•

|

Encourage superior results by providing a meaningful incentive;

|

| |

•

|

Provide an enhanced payout if the Company's performance exceeds the financial metrics; and |

| |

•

|

Support teamwork among employees.

|

Robert B. Kaminski, Jr., Raymond E. Reitsma, Charles E. Christmas, Scott Setlock, Brett E. Hoover, [the Chief Commercial Banking Officer] and [the Chief Experience Officer] (the “Executive Officers,” and each an “Executive Officer”) are included in this Plan. The following provisions (a) – (d) set forth circumstances where an Executive Officer will, or will not, be eligible for a bonus payout, or where an unpaid bonus award will be cancelled:

(a) Except as provided below, an Executive Officer must be an active employee as of December 31, 2024 to be eligible to receive a bonus payout.

(b) An Executive Officer that is out on medical leave as of December 31, 2024 will be eligible to receive a bonus award.

(c) An Executive Officer that is suspended with or without pay or is on final written warning as of December 31, 2024 will not be eligible to receive a bonus award.

(d) Except as provided below, if an Executive Officer terminates his or her employment with the Bank during 2024, any unpaid bonus award for the Executive Officer is cancelled.

Notwithstanding any of the provisions (a), (b), (c) or (d) above, no such provision shall adversely affect an Executive Officer’s eligibility for, or right to receive, any bonus award, if during 2024, or during the first four months of 2025 pursuant to a notice given in 2024, the employment of Messrs. Kaminski, Reitsma, Christmas, Setlock or Hoover terminates under one or more circumstances set forth in Section 8.5 or 9 of (i) the Employment Agreement dated as of November 29, 2018, and effective as of December 31, 2018, between each of Messrs. Kaminski and Christmas, the Company and the Bank, (ii) the Employment Agreement dated as of November 29, 2018, and effective as of December 31, 2018, as amended by an amendment dated as of May 31, 2024, between Mr. Reitsma, the Company and the Bank, (iii) the Employment Agreement dated as of November 30, 2023 and effective as January 1, 2024, as amended by an amendment dated as of May 31, 2024, between Mr. Setlock, the Company and the Bank, and (iv) the Employment Agreement dated as of November 17, 2022 and effective as of January 1, 2023, between Mr. Hoover, the Company and the Bank, or the employment of the Chief Commercial Banking Officer or the Chief Experience Officer terminates under one or more circumstance set forth in Section 10.5 of (v) the Employment Agreement dated as of November 17, 2016, as amended by an amendment dated as of November 30, 2022, between the Chief Commercial Banking Officer and the Bank, and (vi) the Employment Agreement dated as of November 19, 2020, as amended by an amendment dated as of November 29, 2022, between the Chief Experience Officer and the Bank, in which case, such Executive Officer is eligible for 100% of his or her bonus payout (a “Special Termination”). Further, Mr. Kaminski will be eligible for a bonus payout notwithstanding his retirement on June 1, 2024 if he is serving as a member of the Board of Directors of the Company or the Bank on December 31, 2024.

|

3.

|

Bonus Pool, Performance Metrics and Bonus Awards

|

Payment from the bonus pool under this plan is based on the achievement of targets under the following 2024 Bonus Metrics. The specific targets for each metric will be established by the Compensation Committee of the Company. The Compensation Committee will establish a target level of performance for each metric (the “Target Level”) and a maximum level of performance for each metric (the “Maximum Level”). If the Company’s performance on a metric is at the Target Level, the percentage associated with that metric which will be credited toward the calculation of the bonus pool will be at the Target Percentage shown in the chart below. If the Company’s performance on a metric is at or above the Maximum Level, the percentage associated with that metric which will be credited toward calculation of the bonus pool will be at the Maximum Percentage shown in the chart below. A linear interpolation would be used to determine the percentage assigned to that metric in the event that Company performance falls between the Target Level and the Maximum Level.

| Metric |

Target Level |

Maximum Level |

| Earnings per share |

25.0% |

37.50% |

| Return on assets |

12.5% |

18.75% |

| Net interest margin |

12.5% |

18.75% |

| Efficiency ratio |

12.5% |

18.75% |

| Non-performing assets |

12.5% |

18.75% |

| Loans-to-deposits |

25.0% |

37.50% |

The amount that will be allocated to the bonus pool under this Plan (the “Executive Officer Bonus Pool”) will depend on the Company’s performance on each of the 2024 Bonus Metrics. If the Company’s performance on each Bonus Metric is at the Target Level, the amount allocated to the Executive Officer Bonus Pool will be $1,137,897 (the “Target Bonus Pool”). The amount allocated to the Executive Officer Bonus Pool will be increased if the Company’s performance on one or more Bonus Metrics exceeds the Target Level, but will not be greater than 150% of the Target Bonus Pool or $1,706,845 (the “Maximum Bonus Pool”). A linear interpolation would be used to determine the amount allocated to the Executive Officer Bonus Pool in the event that Company performance on one or more metrics falls between the Target Level and the Maximum Level.

The maximum amount will be appropriately adjusted if (a) a newly hired employee becomes a named executive officer (as defined in Item 402(a)(3) of SEC Regulations S-K) or a designated member of the executive management team and becomes eligible to participate in this Plan, (b) an Executive Officer's base salary is adjusted during the year, or (c) an Executive Officer becomes ineligible before December 31, 2024. The bonus pool has been adjusted to take into account Mr. Kaminski’s base salary through his retirement date.

Each individual target must be met at the Target Level in order for the percentage associated with that metric to be credited toward payment from the Executive Officer Bonus Pool. The accumulated percentage for each individual target attained will be applied to the Executive Officer Bonus Pool to determine the total amount of the Bonus Pool to be awarded (the “Award Amount”). For example, if the first four factors are attained at the Target Level and the next two factors are not attained, the Award Amount under this Plan would be $1,137,897 x 62.5% = $711,185.63. As another example, if the first three factors are attained at the Maximum Level and the next three factors are attained at the Target Level, the Award Amount under this Plan would be $1,137,897 x 125% = $1,422,371.25.

The Award Amount will be paid to each Executive Officer pro rata based on a uniform percentage of the Executive Officer's 2024 salary (and the pro-rated 2024 salary of the retired Chief Executive Officer), not to exceed:

| |

Target Percentage |

Maximum Percentage |

| Retired Chief Executive Officer |

55.0% |

82.5% |

| Chief Executive Officer |

60.0% |

90.0% |

| Chief Financial Officer |

40.0% |

60.0% |

| Chief Operating Officer |

35.0% |

52.5% |

| Chief Human Resources Officer |

30.0% |

45.0% |

| Chief Commercial Banking Officer |

35.0% |

52.5% |

| Chief Experience Officer |

30.0% |

45.0% |

The “Target Percentage” of salary in the chart above will be adjusted downward if the Company does not satisfy each Bonus Metric at the Target Level. A linear interpolation will be used to determine the percentage of salary to be paid if Company performance on one or more metrics falls between the Target Level and the Maximum Level.

Payouts made under this Plan are subject to recovery or clawback, and an Executive Officer receiving a payout will be required to promptly return the monies (or any portion of the monies requested by the Company) in each of the following circumstances:

| |

●

|

if it is determined that the Executive Officer was engaging in an activity during 2024 that would have resulted in the employee being suspended without pay, placed on final written warning or terminated on or before December 31, 2024, and no Special Termination of the Executive Officer is involved.

|

| |

●

|

If the payout is based on materially inaccurate financial statements (which includes, but is not limited to statements of earnings, revenues, or gains) or any other materially inaccurate performance metric criteria, including net income.

|

| |

●

|

If the payout is required to the Clawback Policy adopted by the Company effective October 2, 2023 in order to comply with the Dodd-Frank Wall Street Reform and Consumer Protection Act, Rule 10D-1 of the Securities Exchange Act of 1934, as amended, and Nasdaq Listing Rule 5608.

|

In the event that the Company or Bank demands recovery or clawback of any payout (or portion of any payout), and the Executive Officer who received the payout does not promptly return the payout (or demanded portion of the payout) to the Company or the Bank, the Executive Officer shall be required to pay to the Company or the Bank, immediately upon demand, all expenses, including reasonable attorneys’ fees, incurred to recover the payout (or demanded portion of the payout), unless the Executive Officer establishes in an appropriate legal proceeding that he or she had no obligation under this Section of this Plan to return the payout (or demanded portion of the payout). Executive Officers, as a condition to receiving a payout under this Plan, may be required to agree in writing to the terms of this Section.

|

5.

|

Timing of Bonus Payouts

|

Bonus awards that are earned under this Plan will be paid to eligible Executive Officers on or before March 15, 2025.

The Board of Directors of the Company and its Compensation Committee, or if the Board of Directors of the Company so designates, another committee of the Board of Directors of the Company or the Bank (each, an "Administrator"), will each have the authority to administer and interpret this Plan, and approve or determine the amounts to be distributed under this Plan as bonus awards, in its sole discretion. Any interpretation or construction of this Plan or approval or determination of bonus awards by an Administrator will be final and binding on the Company, the Bank and their respective subsidiaries, all employees and past employees of any of them, their heirs, successors and assigns. No member of the Board of Directors of the Bank or the Company, or any of their affiliates, or any committee of the Board of Directors of the Bank, the Company, or any affiliate, will be liable for any action or determination made in good faith regarding this Plan or any bonus award.

|

7.

|

No Right to Employment

|

This Plan does not give any Executive Officer any right to continued employment, or limit in any way the right of the Bank or any affiliated company to terminate his employment at any time.

The Bank and any affiliated company will have the right to deduct from any payment to be made pursuant to this Plan any Federal, state or local taxes required by law to be withheld. It is contemplated that substantially all payments that are made under this Plan will be made by the Bank or one of its subsidiaries, and not by the Company.

|

9.

|

Amendment of this Plan

|

This Plan may be amended from time to time by the Compensation Committee of the Company, without the consent of any Executive Officer or past Executive Officer, (a) to the extent required to comply with applicable law; (b) to make reasonable adjustments for any acquisition or sale of a business or branch, merger, reorganization, or restructuring, change in accounting principles or their application, or special charges or extraordinary items, that materially affect the Company or any of its consolidated subsidiaries; (c) to make any changes that do not materially and adversely affect the bonus award payable to any eligible employee; (d) to expand the Executive Officers or other employees who are eligible to receive a bonus from the amounts available for bonuses under this Plan; or (e) to make any other changes that the Compensation Committee of the Company, in its sole discretion, deems appropriate, even if such changes materially and adversely affect, or eliminate, the bonus award payable to any Executive Officer or past Executive Officer; provided that, after a Special Termination or notice that will result in a Special Termination, no amendment made under provision (d) or (e) of this paragraph above shall adversely affect an Executive Officer’s rights under this Plan.

The validity, construction and interpretation of this Plan will be determined in accordance with the laws of the State of Michigan.

This Plan was approved by the Boards of Directors of the Company and the Bank on July 11, 2024, and is effective as of January 1, 2024.

Schedule 1

2024 Executive Bonus Pool Metrics

Payment from the Executive Bonus Pool, if any, is based on the achievement of the following 2024 Executive Bonus Metrics, which are measured pre-bonus accrual and excluding unbudgeted and one-time/non-core income and expenses.

TARGET LEVEL

|

Percentage of Total

|

Metric

|

Target Level

|

| |

|

|

|

25.0%

|

Earnings per share

|

|

|

12.5%

|

Return on assets

|

|

|

12.5%

|

Net interest margin

|

|

|

12.5%

|

Efficiency ratio

|

|

|

12.5%

|

Non-performing assets

|

|

|

25.0%

|

Loans-to-deposits

|

|

MAXIMUM LEVEL

|

Percentage of Total

|

Metric

|

Maximum Level

|

| |

|

|

|

37.50%

|

Earnings per share

|

|

|

18.75%

|

Return on assets

|

|

|

18.75%

|

Net interest margin

|

|

|

18.75%

|

Efficiency ratio

|

|

|

18.75%

|

Non-performing assets

|

|

|

37.50%

|

Loans-to-deposits

|

|

A linear interpolation will be used to determine the percentage assigned to a metric in the event that Company performance on one or more metrics falls between the Target Level and the Maximum Level.

v3.24.2

Document And Entity Information

|

Jul. 11, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Mercantile Bank Corporation

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jul. 11, 2024

|

| Entity, Incorporation, State or Country Code |

MI

|

| Entity, File Number |

000-26719

|

| Entity, Tax Identification Number |

38-3360865

|

| Entity, Address, Address Line One |

310 Leonard Street NW

|

| Entity, Address, City or Town |

Grand Rapids

|

| Entity, Address, State or Province |

MI

|

| Entity, Address, Postal Zip Code |

49504

|

| City Area Code |

616

|

| Local Phone Number |

406-3000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

MBWM

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001042729

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

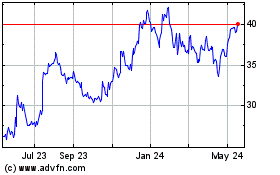

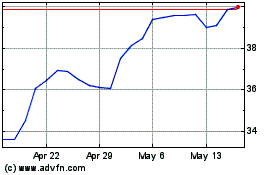

Mercantile Bank (NASDAQ:MBWM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mercantile Bank (NASDAQ:MBWM)

Historical Stock Chart

From Jul 2023 to Jul 2024