false

0001412100

0001412100

2025-02-17

2025-02-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 18, 2025 (February 17, 2025)

Maiden Holdings, Ltd.

(Exact name of registrant as specified in its charter)

| Bermuda |

001-34042 |

98-0570192 |

|

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

| |

48 Par-La-Ville Road, Suite 1141 Hamilton HM 11, Bermuda |

|

| |

(Address of principal executive offices) (Zip Code) |

|

Registrant’s telephone number, including

area code: (441) 298-4900

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| x |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of

each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which

registered |

| Common Shares, par value $0.01 per share |

|

MHLD |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive

Agreement

As previously announced, on December 29,

2024, Maiden Holdings, Ltd., a Bermuda exempted company limited by shares (“Maiden”), entered into a Combination

Agreement (the “Combination Agreement”) with Kestrel Group, LLC, a Delaware limited liability company (“Kestrel”),

the equityholders of Kestrel (the “Kestrel Equityholders”), Ranger U.S. Newco LLC, a Delaware limited liability company

(“US NewCo”), Ranger Bermuda Merger Sub Ltd, a Bermuda exempted company limited by shares and a direct wholly owned

subsidiary of US NewCo (“Merger Sub 1”), Ranger Bermuda Topco Ltd, a Bermuda exempted company limited by shares (“Bermuda

NewCo”), and Ranger Merger Sub 2 LLC, a Delaware limited liability company and a direct wholly owned subsidiary of Bermuda NewCo

(“Merger Sub 2”).

The Combination Agreement provides that, upon

the terms and subject to the conditions set forth therein, Maiden and Kestrel will effect a transaction to combine their respective businesses

through: (a) the contribution of all of the Class A units and Class B units of Kestrel owned by each Kestrel Equityholder

to US NewCo, (b) the merger of Merger Sub 1 with and into Maiden (the “First Merger”), with Maiden surviving the

First Merger as a direct wholly owned subsidiary of US NewCo and (c) the merger of Merger Sub 2 with and into US NewCo (the “Second

Merger” and, together with the First Merger, the “Mergers”) with US NewCo surviving the Second Merger as

a wholly owned subsidiary of Bermuda NewCo. Upon the consummation of the Mergers, Maiden and Kestrel will be wholly owned subsidiaries

of Bermuda NewCo, which will be rebranded as Kestrel Group following the closing of the transactions contemplated by the Combination Agreement

(the “Transactions”).

On February 17, 2025, Maiden, Kestrel, the

Kestrel Equityholders, US NewCo, Merger Sub 1, Bermuda NewCo and Merger Sub 2 entered into an amendment to the Combination Agreement (the

“Amendment”). The Amendment amended the Combination Agreement to (i) extend the deadline for the performance of

Maiden’s obligations to prepare and cause Bermuda NewCo to file a registration statement on Form S-4 with the Securities and

Exchange Commission (the “SEC”) in connection with the Transactions to March 7, 2025 and (ii) correspondingly

extend the Outside Date (as defined in Section 9.01(b)(i) of the Combination Agreement) to August 20, 2025.

The foregoing description of the Amendment does

not purport to be complete and is subject to and qualified in its entirety by reference to the Amendment, a copy of which is included

as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

* * *

Additional Information Regarding the Transactions and Where to Find

It

In connection with the Transactions, Bermuda NewCo

will file a registration statement on Form S-4 with the SEC that will include a prospectus with respect to Bermuda NewCo’s

securities to be issued in connection with the Transactions and a proxy statement with respect to the Maiden shareholder meeting to approve

the Transactions and related matters (the “proxy statement/prospectus”). Maiden and Bermuda NewCo may also file or

furnish other documents with the SEC regarding the Transactions. This Current Report on Form 8-K is not a substitute for the registration

statement, the proxy statement/prospectus or any other document that Maiden or Bermuda NewCo may file or furnish or cause to be filed

or furnished with the SEC. INVESTORS IN AND SECURITY HOLDERS OF MAIDEN ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER

RELEVANT DOCUMENTS THAT ARE FILED OR FURNISHED OR WILL BE FILED OR WILL BE FURNISHED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS

TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS

AND RELATED MATTERS.

Investors and security holders may obtain free

copies of the registration statement, the proxy statement/prospectus (when available) and other documents filed with or furnished to the

SEC by Maiden or Bermuda NewCo through the web site maintained by the SEC at www.sec.gov or by contacting the investor relations department

of Maiden:

Maiden Holdings, Ltd.

48 Par-La-Ville Road, Suite 1141

Hamilton HM 11

Bermuda

Attn: Corporate Secretary

* * *

Item 9.01. Financial Statements and Exhibits.

| Exhibit No. |

Description |

| |

|

| 2.1 |

Letter Agreement, amending the Combination Agreement, dated February 17, 2025, by and among Maiden Holdings, Ltd., Kestrel Group, LLC, all of the equityholders of Kestrel Group, LLC, Ranger U.S. Newco LLC, Ranger Bermuda Merger Sub Ltd, Ranger Bermuda Topco Ltd and Ranger Merger Sub 2 LLC |

Participants in the Solicitation

Each

of Maiden, Bermuda NewCo and their respective directors, executive officers, members of management and employees, and Luke Ledbetter,

President and Chief Executive Officer of Kestrel, and Terry Ledbetter, Executive Chairman of Kestrel, may, under the rules of

the SEC, be deemed to be participants in the solicitation of proxies from Maiden’s shareholders in connection with the Transactions.

Information regarding Maiden’s directors and executive officers, including a description of their direct interests, by security

holdings or otherwise, is contained in Maiden’s annual proxy statement filed with the SEC on March 27, 2024, its annual report

on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on March 12, 2024, and in subsequent

documents filed with the SEC, each of which can be obtained free of charge from the sources indicated above. A summary biography for each

of Luke Ledbetter and Terry Ledbetter is set forth below:

Luke Ledbetter serves as President and Chief Executive

Officer of Kestrel. Mr. Ledbetter previously served as Chief Underwriting Officer and Head of Business Development with State National

Companies. During Mr. Ledbetter‘s tenure at State National, gross written premium grew to more than $2.5 billion annually.

Mr. Ledbetter holds law degrees from Cambridge University and the University of Texas School of Law in addition to a B.A. from the

University of Texas at Austin.

Terry Ledbetter serves as Executive Chairman of

Kestrel. Mr. Ledbetter co-founded State National Companies in 1973 and served as Chairman, President and Chief Executive Officer

until his retirement at the end of 2019. Mr. Ledbetter pioneered the dedicated fronting business model in the property &

casualty industry and guided State National through its initial public offering in 2014 and sale to Markel Corporation in 2017. He received

his B.B.A. from Southern Methodist University.

Neither of Luke Ledbetter or Terry Ledbetter own

directly any securities of Maiden at this time.

Additional information regarding the identity

of all potential participants in the solicitation of proxies to Maiden shareholders in connection with the Transactions and other matters

to be voted upon at the Maiden shareholders meeting to approve the Transactions, and their direct and indirect interests, by security

holdings or otherwise, will be included in the definitive proxy statement/prospectus, when it becomes available.

No Offer or Solicitation

This Current Report on Form 8-K is for informational

purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe

for, buy or sell or an invitation to subscribe for, buy or sell any securities or the solicitation of any vote or approval in any jurisdiction

pursuant to or in connection with the proposed Transactions or otherwise, nor shall there be any sale, issuance or transfer of securities

in any jurisdiction in contravention of applicable law.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

MAIDEN HOLDINGS, LTD. |

| |

|

| Date: February

18, 2025 |

By: |

/s/

Patrick J. Haveron |

| |

|

Name: |

Patrick J. Haveron |

| |

|

Title: |

Chief Executive Officer and Chief Financial Officer |

Exhibit 2.1

EXECUTION VERSION

February 17, 2025

Maiden Holdings, Ltd.

Clarendon House, 2 Church Street,

Hamilton HM 11 Bermuda

| Attention: |

Patrick Haveron |

| |

Lawrence Metz |

| Email: |

phaveron@maiden.bm |

| |

lmetz@maiden.bm |

Paul, Weiss, Rifkind, Wharton &

Garrison LLP

1285 Avenue of the Americas

New York, NY 10019

| Attention: |

Adam Givertz |

| |

Stan Richards |

| Email: |

agivertz@paulweiss.com |

| |

srichards@paulweiss.com |

| RE: | Extension

of Deadline to File Registration Statement and Outside Date |

Ladies and Gentlemen

We

refer to that certain Combination Agreement (the “Combination Agreement”), dated as of December 29,

2024, by and among Kestrel Group LLC, a Delaware limited liability company (the “Company”), all of the equityholders

of the Company (the “Company Equityholders”), Maiden Holdings, Ltd., a Bermuda exempted company limited by shares

(“Parent”), Ranger U.S. Newco LLC, a Delaware limited liability company and a direct wholly owned Subsidiary of Parent

(“US NewCo”), Ranger Bermuda Merger Sub Ltd, a Bermuda exempted company limited by shares and a direct wholly owned

Subsidiary of US NewCo (“Merger Sub Ltd.”), Ranger Bermuda Topco Ltd, a Bermuda exempted company limited by shares

and a direct wholly owned Subsidiary of Parent (“Bermuda NewCo”), and Ranger Merger Sub 2 LLC, a Delaware limited

liability company and a direct wholly owned Subsidiary of Bermuda NewCo (“Merger Sub LLC”). The Company, the Company

Equityholders, Parent, US NewCo, Merger Sub Ltd., Bermuda NewCo and Merger Sub LLC are collectively referred to herein as the “parties.”

The

parties have agreed to enter into this Letter Agreement (this “Letter Agreement”) to set forth their agreement with

respect to certain matters regarding the Combination Agreement as described below.

1. Capitalized

Terms. Capitalized terms used and not defined in this Letter Agreement shall have the meanings ascribed to such terms in the Combination

Agreement.

2. Agreement

to Extend Deadline to File Registration Statement. Pursuant to Section 10.03 of the Combination Agreement, each of the parties

hereby agrees to extend the time for the performance of Parent’s obligations to prepare and cause Bermuda NewCo to file the Registration

Statement with the SEC as set forth in the first sentence of Section 7.04(a) of the Combination Agreement until March 7,

2025.

3. Extension

of Outside Date. Each of the parties hereby acknowledges and agrees that the Outside Date (as defined in Section 9.01(b)(i) of

the Combination Agreement) be extended to August 20, 2025. Each of the parties further acknowledges and agrees that if on such date

the condition precedent to the consummation of the Second Merger set forth in Section 8.01(a) of the Combination Agreement

shall not have been satisfied but all other conditions precedent to the consummation of the Second Merger have been satisfied (or, in

the case of conditions that by their terms are to be satisfied at the Closing, are capable of being satisfied on that date), then the

Outside Date shall be automatically be extended to October 20, 2025, and references to the “Outside Date” shall instead

refer to such extended date.

4. No

Other Waiver. Except as expressly waived and/or superseded by this Letter Agreement, the Combination Agreement remains and shall

remain in full force and effect. This Letter Agreement shall not constitute an amendment or waiver of any provision of the Combination

Agreement not expressly amended or waived herein and shall not be construed as an amendment, waiver or consent to any action that would

require an amendment, waiver or consent, except as expressly set forth herein. Upon the execution and delivery hereof, the Combination

Agreement shall thereupon be deemed to be supplemented as hereinabove set forth as fully and with the same effect as if the waivers,

acknowledgments and agreements made hereby were originally set forth in the Combination Agreement. This Letter Agreement and the Combination

Agreement shall each henceforth be read, taken and construed as one and the same instrument, but such waivers, acknowledgments and agreements

shall not operate so as to render invalid or improper any action heretofore taken under the Combination Agreement. If and to the extent

there are any inconsistencies between the Combination Agreement and this Letter Agreement with respect to the matters set forth herein,

the terms of this Letter Agreement shall control. References in the Combination Agreement to the Combination Agreement shall be deemed

to mean the Combination Agreement as modified and supplemented by this Letter Agreement. On and after the date of this Letter Agreement,

each reference to the Combination Agreement, “this Agreement”, “hereof”, “hereunder”, “herein”

or words of like import referring to the Combination Agreement shall mean and be a reference to the Combination Agreement as modified

hereby, provided that references in the Combination Agreement to “the date hereof” or “the date of this Agreement”

or words of like import shall continue to refer to the date of December 29, 2024.

5. Counterparts.

This Letter Agreement may be executed in one or more counterparts (including by electronic mail),

each of which shall be deemed to be an original but all of which taken together shall constitute one and the same agreement, and shall

become effective when one or more counterparts have been signed by each of the parties and delivered to the other parties.

6. Sections

of the Combination Agreement. Section 10.04 (Assignment), Section 10.06 (Entire Agreement; No Third-Party Beneficiaries),

Section 10.07 (Governing Law; Jurisdiction), Section 10.09 (Waiver of Jury Trial), and Section 10.11 (Severability)

of the Combination Agreement are each hereby incorporated by reference mutatis mutandis.

[The remainder

of this page is intentionally blank.]

| |

Respectfully, |

| |

|

| |

KESTREL GROUP LLC |

| |

|

| |

By: |

/s/

Bradford Luke Ledbetter |

| |

|

Name: |

Bradford Luke Ledbetter |

| |

|

Title: |

President and Chief Executive

Officer |

| |

|

| |

KESTREL INTERMEDIATE

LEDBETTER HOLDINGS LLC |

| |

|

| |

By |

/s/

Bradford Luke Ledbetter |

| |

|

Name: |

Bradford Luke Ledbetter |

| |

|

Title: |

Authorized Signatory |

[Signature

Page to Letter Agreement]

| |

AMTRUST FINANCIAL

SERVICES, INC. |

| |

|

| |

By: |

/s/

Adam Karkowsky |

| |

|

Name: |

Adam Karkowsky |

| |

|

Title: |

President |

[Signature Page to

Letter Agreement]

| |

/s/

Dan Dijak |

| |

Name: |

Dan Dijak |

[Signature

Page to Letter Agreement]

| |

/s/

Duncan McColl |

| |

Name: |

Duncan McColl |

[Signature

Page to Letter Agreement]

| |

/s/

Elise Clarke |

| |

Name: |

Elise Clarke |

[Signature

Page to Letter Agreement]

| |

/s/

Rod Newcomer |

| |

Name: |

Rod Newcomer |

[Signature

Page to Letter Agreement]

| |

/s/

Barb Lane |

| |

Name: |

Barb Lane |

[Signature Page to

Letter Agreement]

Acknowledged and agreed:

| MAIDEN HOLDINGS, LTD. |

|

| |

|

|

| By: |

/s/

Patrick Haveron |

|

| Name: |

Patrick Haveron |

|

| Title: |

Chief Executive Officer and |

|

| |

Chief Financial Officer |

|

| |

|

|

| RANGER U.S. NEWCO

LLC |

|

| |

|

|

| By: |

/s/

Patrick Haveron |

|

| Name: |

Patrick Haveron |

|

| Title: |

Chief Executive Officer and |

|

| |

Chief Financial Officer |

|

| |

|

|

| RANGER BERMUDA MERGER

SUB LTD |

|

| |

|

|

| By: |

/s/

Patrick Haveron |

|

| Name: |

Patrick Haveron |

|

| Title: |

Chief Executive Officer and |

|

| |

Chief Financial Officer |

|

| |

|

|

| RANGER BERMUDA TOPCO

LTD |

|

| |

|

|

| By: |

/s/

Patrick Haveron |

|

| Name: |

Patrick Haveron |

|

| Title: |

Chief Executive Officer and |

|

| |

Chief Financial Officer |

|

| |

|

|

| RANGER MERGER SUB

2 LLC |

|

| |

|

|

| By: |

/s/

Patrick Haveron |

|

| Name: |

Patrick Haveron |

|

| Title: |

Chief Executive Officer and |

|

| |

Chief Financial Officer |

|

[Signature Page to

Letter Agreement]

v3.25.0.1

Cover

|

Feb. 17, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 17, 2025

|

| Entity File Number |

001-34042

|

| Entity Registrant Name |

Maiden Holdings, Ltd.

|

| Entity Central Index Key |

0001412100

|

| Entity Tax Identification Number |

98-0570192

|

| Entity Incorporation, State or Country Code |

D0

|

| Entity Address, Address Line One |

48 Par-La-Ville Road

|

| Entity Address, Address Line Two |

Suite 1141

|

| Entity Address, City or Town |

Hamilton

|

| Entity Address, Country |

BM

|

| Entity Address, Postal Zip Code |

HM 11

|

| City Area Code |

441

|

| Local Phone Number |

298-4900

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares, par value $0.01 per share

|

| Trading Symbol |

MHLD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

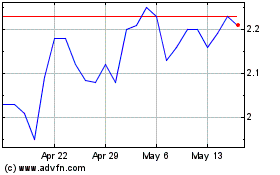

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Feb 2024 to Feb 2025