Mesa Laboratories, Inc. (NASDAQ:MLAB), a global leader in the

design and manufacturing of life science tools and critical quality

control solutions, today announced results for its second fiscal

quarter (“2Q24”) ended September 30, 2023.

Second quarter FY 2024 compared to second quarter FY 2023:

- Revenues decreased 9.5% but

increased 5.0% vs 1Q24

- Non-GAAP core organic revenues3

decreased 10.1% but increased 2.7% vs. 1Q24

- Operating income decreased

101.5%

- Non-GAAP adjusted operating income1 excluding unusual items

decreased 29.1% but increased 17.2% vs 1Q24

Executive Commentary (amounts in thousands)

“Second quarter performance was lower than the previous year, as

expected, due to sluggish capital equipment orders in the

biopharmaceutical vertical and the previously announced customer

loss of Sema4 in our Clinical Genomics division early in 3Q23 but

was better than the first quarter for both revenues and AOI

excluding unusual items. Total revenues for the second quarter were

$53,165, which resulted in an organic revenue (“organic”) decline

of 9.6% versus the same quarter in the prior year (“2Q23”), or a

5.0% sequential increase when compared to the first quarter of the

current fiscal year. Specifically, decreases in hardware and

software revenues in our Biopharmaceutical Development division and

the lost Sema4 revenue accounted for the substantial majority of

the company wide decline seen in the current quarter. Core organic

revenues (“core organic”), which excludes the impact of currency

and COVID related revenues, declined 10.1% in the quarter as the

USD/EUR exchange rate peaked in our second quarter last fiscal

year” said Gary Owens, Chief Executive Officer of Mesa Labs.

Mr. Owens continued, “profitability for 2Q24, as measured by our

primary metric of adjusted operating income (“AOI”) excluding

unusual items was $11,163, a decrease of 29.1% quarter over quarter

primarily due to the decreased revenues. This number however did

increase by 17.2% sequentially from 1Q24 primarily due to increases

in revenues. Additionally, during 2Q24 we implemented cost control

actions taken in response to the unclear macroeconomic environment

and the specific slow-down in the biopharmaceutical vertical which

are expected to generate annual savings of approximately $2,000

starting in 3Q24.”

“We are pleased to see that 2Q24 Biopharmaceutical Development

division consumables revenues grew by 4.7% versus the same quarter

in the prior year and by 13.2% year to date versus the prior year.

We believe that strong utilization of our equipment is the best

indicator of the long-term health of the division. Additionally, we

are beginning to see increasing quote activity in the

Biopharmaceutical Development division although end of calendar

year capital budgets for our customers remain opaque. While our

business in China has held up through 2Q24, we are seeing requests

for proposal activity in our Clinical Genomics business in the

region begin to slow and it is likely that we will not be immune to

the ongoing macroeconomic headwinds in China over the second half

of fiscal year 2024” added Mr. Owens.

“In early October we continued to add to Mesa’s capability in

the Sterilization & Disinfection Control division through the

acquisition of GKE, which is based in Waldems, Germany. GKE brings

a highly competitive portfolio of chemical indicators and

healthcare focused channels that are very complementary to our SDC

division’s strength in biological indicators and life sciences

channels. Over the first 12 months of complete ownership, we expect

GKE to add €19-€20 million of revenues and, excluding the impact of

purchase accounting and integration expenses, we expect gross

profit as a percentage of revenues to be in line with our existing

SDC business and AOI as a percentage of revenues to approach

37%-40%. Additionally, we expect GKE to deliver mid-single digit

organic revenues growth over the next several years and enable

other synergies benefiting the division’s life sciences and

healthcare customers alike” concluded Mr. Owens.

Financial Results (amounts in thousands, except

per share data)

Total revenues were $53,165, a decrease of 9.5% compared to the

second quarter of fiscal year 2023 (“2Q23”). Operating (loss)

income decreased 101.5% to $(60). Net (loss) income was $(1,230), a

decrease of 194% or $(0.23) per diluted share of common

stock. As detailed in the Unusual Items table below,

operating income for 2Q24 and 2Q23 was impacted by unusual items

totaling $855 and $267, respectively.

On a non-GAAP basis, core organic decline was 10.1% and AOI

decreased 33.4% to $10,308 or $1.91 per diluted share of common

stock compared to 2Q23. As detailed in the Unusual Items table

below, AOI for 2Q24 and 2Q23 was impacted by unusual items totaling

$855 and $267, respectively. Excluding the unusual items for 2Q24

and 2Q23, AOI decreased 29.1% to $11,163. A

reconciliation of non-GAAP measures is provided in the tables

below.

Division Performance

| |

Revenues |

|

Organic Revenues Growth2 |

|

Core Organic Revenues

Growth3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in thousands) |

Three Months Ended September 30, 2023 |

|

Six Months Ended September 30, 2023 |

|

Three Months Ended September 30, 2023 |

|

Six Months Ended September 30, 2023 |

|

Three Months Ended September 30, 2023 |

|

Six Months Ended September 30, 2023 |

|

| Sterilization and Disinfection

Control |

$ |

17,080 |

|

$ |

33,007 |

|

0.7 |

% |

4.0 |

% |

(1.5 |

)% |

2.5 |

% |

| Clinical Genomics |

|

15,549 |

|

|

28,918 |

|

(15.7 |

)% |

(12.2 |

)% |

(14.9 |

)% |

(10.3 |

)% |

| Biopharmaceutical

Development |

|

9,207 |

|

|

19,096 |

|

(24.4 |

)% |

(17.8 |

)% |

(25.4 |

)% |

(16.5 |

)% |

| Calibration Solutions |

|

11,329 |

|

|

22,789 |

|

1.1 |

% |

6.4 |

% |

1.1 |

% |

6.6 |

% |

| Total reportable segments |

$ |

53,165 |

|

$ |

103,810 |

|

(9.6 |

)% |

(5.0 |

)% |

(10.1 |

)% |

(4.6 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sterilization and Disinfection Control (32% of

revenues in 2Q24) revenues were $17,080 for the quarter which

resulted in organic growth of 0.7% and a core organic decline of

1.5%. Gross profit percentage expanded 110 bps versus the same

quarter in the prior year to 73.0%, well within our target range at

this level of quarterly revenues.

Clinical Genomics (29% of revenues in 2Q24)

revenues were $15,549 for the quarter which resulted in an organic

decline of 15.7% and a core organic decline of 14.9%. The quarter

was strongly impacted by the previously announced closure of

Sema4’s expanded carrier screening, an approximate $8,200 annual

headwind that began fully impacting the business in 3Q23. Excluding

the 2Q23 Sema4 loss, the core organic decline for this division

would have been approximately 2.0% for the quarter. Gross profit

percentage was 49.7% for the quarter, a decline of 800 bps as

compared to the same quarter prior year and well below our

long-term target of high 50’s to low 60’s primarily as a result of

lower revenues on a partially fixed cost base and unfavorable

product mix.

Biopharmaceutical Development (17% of revenues

in 2Q24) revenues were $9,207 which yielded an organic decline of

24.4% and core organic decline of 25.4%, both results well below

our long-term growth expectations. As mentioned previously,

headwinds are concentrated in hardware placements into the

biopharmaceutical vertical and while funnel sizes are increasing,

the capital budgeting process in this market remains opaque and it

is unclear if revenues will increase substantially next quarter.

Despite the decline in revenues, gross profit percentage held up

reasonably well at 59.8% due mostly to an increase in consumables

revenues and a favorable product mix which partially mitigated the

impact of decreased hardware revenues.

Calibration Solutions (22% of revenues in 2Q24)

revenues were $11,329 which resulted in both organic and core

organic growth of 1.1% as compared to the same quarter prior year.

Gross profit percentage was 56.6% for the quarter, an increase of

290 bps as compared to the same quarter prior year primarily due to

favorable product mix and increased revenues on a partially fixed

cost base.

Use of Non-GAAP Financial Measures

Adjusted operating income, organic revenues growth and core

organic revenues growth are non-GAAP measures that exclude or

adjust for certain items, as detailed after the tables that

accompany this press release under the heading “Supplemental

Information Regarding Non-GAAP Financial Measures.” Reconciliations

of GAAP to non-GAAP financial measures are provided in the tables

that accompany this press release.

1 The non-GAAP measures of adjusted operating income and

adjusted operating income per diluted share are defined to exclude

the non-cash impact of amortization of intangible assets acquired

in a business combination, stock-based compensation and impairment

of goodwill and long-lived assets. A reconciliation between these

non-GAAP measures and their GAAP counterparts is set forth below,

along with additional information regarding their use.

2 Organic revenues growth, a non-GAAP measure, is reported

revenues growth excluding the impact of acquisitions.

3 Core organic revenues growth, a non-GAAP measure, is reported

revenues growth excluding the impact of acquisitions, currency

translation and COVID related revenues.

About Mesa Laboratories, Inc.

Mesa is a global leader in the design and manufacturing of life

science tools and critical quality control solutions for regulated

applications in the pharmaceutical, healthcare and medical device

industries. Mesa offers products and services to help our customers

ensure product integrity, increase patient and worker safety, and

improve the quality of life throughout the world.

For more information about Mesa, please visit its website at

www.mesalabs.com.

Forward Looking Statements

This press release contains forward-looking statements regarding

our future business expectations. Forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially from our historical experience

and present expectations or projections. Any statements contained

herein that are not statements of historical fact may be

forward-looking statements, including statements relating to: our

ability to successfully grow our business, including as a result of

acquisitions; the results on operations of acquisitions; our

ability to consummate acquisitions at our historical rate and at

appropriate prices; our ability to effective integrate acquired

businesses and achieve desired results; the market acceptance of

our products; reduced demand for our products that adversely

impacts our future revenues, cash flows, results of operations and

financial condition; conditions in the global economy and the

particular markets we serve; significant developments or

uncertainties stemming from the U.S. government, including changes

in U.S. trade policies and medical device regulations; the timely

development and commercialization, and customer acceptance, of

enhanced and new products and services; projections of revenues,

growth, operating results, profit margins, expenses, earnings,

margins, tax rates, tax provisions, cash flows, liquidity, demand,

and competition; the effects of additional actions taken to become

more efficient or lower costs; restructuring activities; laws

regulating fraud and abuse in the health care industry and the

privacy and security of health and personal information;

outstanding claims, legal proceedings, tax audits and assessments

and other contingent liabilities; foreign currency exchange rates

and fluctuations in those rates; general economic, industry, and

capital markets conditions; the timing of any of the foregoing;

assumptions underlying any of the foregoing; and any other

statements that address events or developments that Mesa intends or

believes will or may occur in the future. Without limiting the

foregoing, the words “expect,” “plan,” “seek,” “anticipate,”

“intend,” “believe,” “could,” “should,” “estimate,” “may,”

“target,” “project,” and similar expressions identify

forward-looking statements. However, the absence of these words or

similar expressions does not mean that a statement is not

forward-looking. These forward-looking statements are made based on

expectations and beliefs concerning future events affecting us and

are subject to risks and uncertainties relating to our operations

and business environments, all of which are difficult to predict

and many of which are beyond our control, that could cause our

actual results to differ materially from those matters expressed or

implied by these forward-looking statements. These risks and

uncertainties also include, but are not limited to, those described

in our filings with the Securities and Exchange Commission

including our Annual Report on Form 10-K for the year ended March

31, 2023 and our subsequent Quarterly Reports on Form 10-Q. We

assume no obligation to update the information in this press

release.

Mesa Laboratories Contacts: Gary Owens; President and CEO, John

Sakys; CFO1-303-987-8000investors@mesalabs.com

Financial Summary (Unaudited except for the

information as of March 31, 2023)

Condensed Consolidated Statements of

Operations

| (Amounts in thousands, except per

share data) |

Three Months EndedSeptember

30, |

Six Months EndedSeptember 30, |

|

|

|

2023 |

|

|

2022 |

|

2023 |

|

|

2022 |

|

| Revenues |

$ |

53,165 |

|

$ |

58,749 |

$ |

103,810 |

|

$ |

109,202 |

|

| Cost of revenues |

|

21,056 |

|

|

22,363 |

|

40,518 |

|

|

41,475 |

|

| Gross profit |

|

32,109 |

|

|

36,386 |

|

63,292 |

|

|

67,727 |

|

| Operating expenses |

|

32,169 |

|

|

32,391 |

|

64,016 |

|

|

68,326 |

|

| Operating (loss) income |

|

(60 |

) |

|

3,995 |

|

(724 |

) |

|

(599 |

) |

| Nonoperating expense

(income) |

|

1,265 |

|

|

611 |

|

1,538 |

|

|

1,429 |

|

| (Loss) earnings before income

taxes |

|

(1,325 |

) |

|

3,384 |

|

(2,262 |

) |

|

(2,028 |

) |

| Income tax (benefit)

expense |

|

(95 |

) |

|

2,078 |

|

(483 |

) |

|

(1,896 |

) |

| Net (loss) income |

$ |

(1,230 |

) |

$ |

1,306 |

$ |

(1,779 |

) |

$ |

(132 |

) |

| |

|

|

|

|

| (Loss) earnings per share

(basic) |

$ |

(0.23 |

) |

$ |

0.25 |

$ |

(0.33 |

) |

$ |

(0.02 |

) |

| (Loss) earnings per share

(diluted) |

|

(0.23 |

) |

|

0.24 |

|

(0.33 |

) |

|

(0.02 |

) |

| |

|

|

|

|

| Weighted average common shares

outstanding: |

|

|

|

|

| Basic |

|

5,387 |

|

|

5,323 |

|

5,379 |

|

|

5,298 |

|

| Diluted |

|

5,387 |

|

|

5,364 |

|

5,379 |

|

|

5,298 |

|

|

Consolidated Condensed Balance Sheets |

| (Amounts in thousands) |

September 30, 2023 |

March 31, 2023 |

| Cash and cash equivalents |

$35,617 |

$32,910 |

|

Other current assets |

|

82,045 |

|

86,065 |

|

Total current assets |

|

117,662 |

|

118,975 |

| Property, plant and equipment,

net |

|

28,574 |

|

28,149 |

| Other assets |

|

490,952 |

|

514,708 |

|

Total assets |

$637,188 |

$661,832 |

| |

|

|

| Liabilities |

$249,429 |

$268,352 |

| Stockholders’ equity |

|

387,759 |

|

393,480 |

|

Total liabilities and stockholders’ equity |

$637,188 |

$661,832 |

|

Reconciliation of Non-GAAP Measures |

|

(Unaudited) |

| (Amounts in thousands, except per

share data) |

Three Months EndedSeptember

30, |

Six Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

2023 |

|

|

2022 |

|

| Operating (loss) income

(GAAP) |

$(60) |

|

$3,995 |

$(724) |

|

$(599) |

|

| Amortization of intangible

assets |

|

7,185 |

|

|

7,106 |

|

14,405 |

|

|

14,426 |

|

| Stock-based compensation

expense |

|

3,183 |

|

|

4,371 |

|

6,151 |

|

|

7,803 |

|

| Adjusted operating income

(non-GAAP) |

$10,308 |

|

$15,472 |

$19,832 |

|

$21,630 |

|

| |

|

|

|

|

| Adjusted operating income per

share (basic) |

$1.91 |

|

$2.91 |

$3.68 |

|

$4.08 |

|

| Adjusted operating income per

share (diluted) |

$1.91 |

|

$2.88 |

$3.68 |

|

$4.08 |

|

| |

|

|

|

|

| Weighted average common shares

outstanding: |

|

|

|

|

| Basic |

|

5,387 |

|

|

5,323 |

|

5,379 |

|

|

5,298 |

|

| Diluted |

|

5,387 |

|

|

5,364 |

|

5,379 |

|

|

5,298 |

|

Organic and Core Organic Revenues

Growth (Unaudited)

| |

Three Months Ended September 30, 2023 |

Six Months Ended September 30, 2023 |

|

Total revenues growth |

(9.5 |

)% |

(4.9 |

)% |

| Impact of acquisitions |

(0.1 |

)% |

(0.1 |

)% |

| Organic revenues

growth |

(9.6 |

)% |

(5.0 |

)% |

| Currency translation |

(0.8 |

)% |

0.1 |

% |

| COVID related revenues |

0.3 |

% |

0.3 |

% |

| Core organic revenues

growth |

(10.1 |

)% |

(4.6 |

)% |

Detail of Unusual Items (Unaudited)

As discussed above, operating income and adjusted operating

income were impacted by various unusual items during the three and

six months ended September 30, 2023 and 2022. The following table

provides detail of such items and reconciles the impact on

operating income as reported under GAAP and non-GAAP adjusted

operating income. (Amounts in thousands.)

| Impact of unusual

items on operating income |

Three Months Ended September 30, |

Six Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

2023 |

|

|

2022 |

|

| Operating (loss) income

(GAAP) |

$ |

(60 |

) |

$ |

3,995 |

$ |

(724 |

) |

$ |

(599 |

) |

| |

|

|

|

|

| Unusual items – before

tax |

|

|

|

|

| Agena integration costs |

$ |

-- |

|

$ |

267 |

$ |

-- |

|

$ |

623 |

|

| GKE acquisition costs |

|

505 |

|

|

-- |

|

505 |

|

|

-- |

|

| Restructuring costs |

|

350 |

|

|

-- |

|

350 |

|

|

-- |

|

| Total Impact of unusual items

on operating income – before tax |

|

855 |

|

|

267 |

|

855 |

|

|

623 |

|

| |

|

|

|

|

| Operating income excluding

unusual items |

$ |

795 |

|

$ |

4,262 |

$ |

131 |

|

$ |

24 |

|

| |

|

|

|

|

| Impact of unusual

items on adjusted operating income |

Three Months Ended September 30, |

Six Months Ended September 30, |

| |

|

2023 |

|

|

2022 |

|

2023 |

|

|

2022 |

|

| Adjusted operating income

(non-GAAP) |

$ |

10,308 |

|

$ |

15,472 |

$ |

19,832 |

|

$ |

21,630 |

|

| |

|

|

|

|

| Unusual items – before

tax |

|

|

|

|

| Agena integration costs |

$ |

-- |

|

$ |

267 |

$ |

-- |

|

$ |

623 |

|

| GKE acquisition costs |

|

505 |

|

|

-- |

|

505 |

|

|

-- |

|

| Restructuring costs |

|

350 |

|

|

-- |

|

350 |

|

|

-- |

|

| Total impact of unusual items

on adjusted operating income – before tax |

|

855 |

|

|

267 |

|

855 |

|

|

623 |

|

| |

|

|

|

|

| Adjusted operating income

excluding unusual items |

$ |

11,163 |

|

$ |

15,739 |

$ |

20,687 |

|

$ |

22,253 |

|

Supplemental Information Regarding Non-GAAP Financial

Measures

In addition to the financial measures prepared in accordance

with generally accepted accounting principles (GAAP), we provide

non-GAAP adjusted operating income, non-GAAP adjusted operating

income per share amounts, non-GAAP adjusted operating income

excluding unusual items, organic revenues growth, and core organic

revenues growth in order to provide meaningful supplemental

information regarding our operational performance. We believe that

the use of these non-GAAP financial measures, in addition to GAAP

financial measures, helps investors to gain a better understanding

of our operating results, consistent with how management measures

and forecasts its operating performance, especially when comparing

such results to previous periods and to the performance of our

competitors. Such measures are also used by management in their

financial and operating decision-making and for compensation

purposes. This information facilitates management's internal

comparisons to our historical operating results as well as to the

operating results of our competitors. Since management finds this

measure to be useful, we believe that our investors can benefit by

evaluating both GAAP and non-GAAP results.

The non-GAAP measures of adjusted operating income and adjusted

operating income per share presented in the reconciliation above

are defined to exclude the non-cash impact of amortization of

intangible assets acquired in a business combination, stock-based

compensation and impairment of goodwill and long-lived assets. To

calculate adjusted operating income, we exclude, as applicable:

- Impairments of

long-lived assets as such charges are outside of our normal

operations and in most cases are difficult to accurately

forecast.

- Stock-based

compensation expense as it is a non-cash charge and costs

calculated for this expense vary in accordance with the stock price

on the date of grant.

- The expense

associated with the amortization of acquisition-related intangible

assets as a significant portion of the purchase price for

acquisitions may be allocated to intangible assets that have lives

of up to 20 years. Exclusion of the amortization expense allows

comparisons of operating results that are consistent over time for

both our newly acquired and long-held businesses and with both

acquisitive and non-acquisitive peer companies.

Our management recognizes that items such as amortization of

intangible assets, stock-based compensation expense and impairment

losses on goodwill and long-lived assets can have a material impact

on our operating and net income. To gain a complete picture of all

effects on our profit and loss from any and all events, management

does (and investors should) rely upon the GAAP consolidated

statements of income. The non-GAAP numbers focus instead upon our

core operating business.

Readers are reminded that non-GAAP measures are merely a

supplement to, and not a replacement for, or superior to financial

measures prepared according to GAAP. They should be evaluated in

conjunction with the GAAP financial measures. Our non-GAAP

information may be different from the non-GAAP information provided

by other companies.

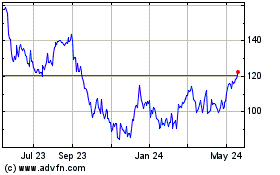

Mesa Laboratories (NASDAQ:MLAB)

Historical Stock Chart

From Feb 2025 to Mar 2025

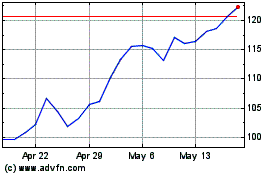

Mesa Laboratories (NASDAQ:MLAB)

Historical Stock Chart

From Mar 2024 to Mar 2025