Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

23 January 2025 - 10:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of January 2025

Commission File Number 001-34837

MAKEMYTRIP LIMITED

(Exact name of registrant as specified in its charter)

19th Floor, Building No. 5

DLF Cyber City

Gurugram, India, 122002

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Other Events

Unaudited Business and Financial Highlights for the Quarter ended December 31, 2024

On January 23, 2025, MakeMyTrip Limited (“MakeMyTrip”) issued a press release announcing its unaudited business and financial highlights for the third quarter of fiscal 2025 (i.e. quarter ended December 31, 2024). A copy of the press release dated January 23, 2025 is attached hereto as Exhibit 99.1.

Exhibit

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 23, 2025

|

|

|

MAKEMYTRIP LIMITED |

|

|

By: |

|

/s/ Rajesh Magow |

Name: |

|

Rajesh Magow |

Title: |

|

Group Chief Executive Officer |

Exhibit 99.1

EARNINGS PRESS RELEASE

MakeMyTrip achieves all-time high Quarterly Revenue and AOP1 as Indian Travel demand continues to rise

National, January 23, 2025 (NASDAQ: MMYT) — MakeMyTrip Limited, India’s leading travel service provider, today announced its unaudited financial and operating results for its fiscal third quarter ended December 31, 2024 as attached herewith and available at www.sec.gov/ and on our website at http://investors.makemytrip.com.

Business & Financial Highlights | Q3 FY25

|

|

|

|

|

Q3 FY25 ($ Million) |

Q3 FY24 ($ Million) |

YoY Change (Constant Currency)2 |

Gross Bookings |

2,612.4 |

2,088.3 |

26.8% |

Revenue as per IFRS |

267.4 |

214.2 |

26.2% |

Adjusted Margin1 |

|

|

|

Air Ticketing |

93.8 |

79.2 |

20.0% |

Hotels and Packages |

121.9 |

98.8 |

24.9% |

Bus Ticketing |

35.0 |

26.9 |

31.3% |

Others |

19.8 |

13.0 |

53.9% |

Results from Operating Activities |

34.7 |

22.6 |

|

Adjusted Operating Profit1 (also referred to as Adjusted EBIT)3 |

46.0 |

33.4 |

|

Profit for the period |

27.1 |

24.2 |

|

•Revenue as per IFRS grew by 26.2% YoY in constant currency2 to $267.4 million in Q3 FY25 from $214.2 million in Q3 FY24.

•Adjusted Operating Profit1 registered growth of 37.6% YoY and reached $46.0 million in Q3 FY25 compared to $33.4 million in Q3 FY24.

•Profit for Q3 FY25 was $27.1 million, compared to $24.2 million in Q3 FY24.

Commenting on the results, Rajesh Magow, Group Chief Executive Officer, MakeMyTrip, said,

“The Indian travel and tourism sector is witnessing robust growth, reflecting a strong desire among travelers to explore new horizons. While Indian destinations continue to shine, many countries have made significant efforts to attract Indian travelers. Our strong performance this quarter reflects these macro trends, along with our focused execution and commitment to customer centricity.”

Commenting on the results, Mohit Kabra, Group Chief Financial Officer, MakeMyTrip, said,

“Our robust financial performance this quarter across all lines of business underscores our strong execution of strategic priorities and the resilience of the travel sector. Our disciplined approach to cost management, combined with targeted investments in technology and customer experience, has enabled us to capitalize on growing travel demand and drive profitable growth.”

Notes:

(1)This is a non-IFRS measure. Reconciliations of IFRS measures to non-IFRS financial measures, and operating results are included at the end of our earnings release. For more information, see “About Key Performance Indicators and Non-IFRS Measures” in our earnings release.

(2)Constant currency refers to our financial results assuming constant foreign exchange rates for the current fiscal period based on the rates in effect during the comparable period in the prior fiscal year. This is a non-IFRS measure. Reconciliations of IFRS measures to non-IFRS financial measures and operating results are included at the end of our earnings release. For more information, see “About Key Performance Indicators and Non-IFRS Measures” in our earnings release.

(3)Adjusted Operating Profit (AOP) is commonly referred to among investors and analysts in India as Adjusted EBIT.

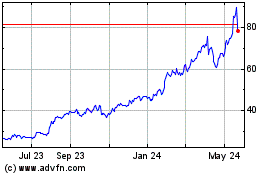

MakeMyTrip (NASDAQ:MMYT)

Historical Stock Chart

From Feb 2025 to Mar 2025

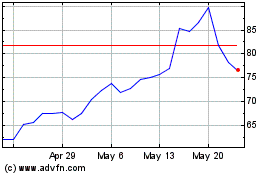

MakeMyTrip (NASDAQ:MMYT)

Historical Stock Chart

From Mar 2024 to Mar 2025