Momentus Announces $2.75 Million Private Placement

16 September 2024 - 10:00PM

Business Wire

Momentus Inc. (NASDAQ: MNTS) (“Momentus” or the “Company”), a

U.S. commercial space company that offers satellite buses,

transportation, and other in-space infrastructure services, today

announced that it has entered into a securities purchase agreement

with a single U.S. institutional investor for the purchase and sale

of 5,000,000 shares of common stock (or common stock equivalents in

lieu thereof) at a purchase price of $0.55 per share pursuant to a

private placement offering, resulting in total gross proceeds of

approximately $2.75 million, before deducting placement agent

commissions and other estimated offering expenses. The Company

further agreed to issue to the investor Class A Common Warrants to

purchase up to an aggregate of 10,000,000 shares of common stock

and Class B Common Warrants to purchase up to an aggregate of

5,000,000 shares of common stock, together the Common Warrants. The

Class A Common Warrants will have an exercise price of $0.575, will

be exercisable at any time on or after the date that is six months

after the original issuance date and will expire on the five year

and six-month anniversary of the original issuance date. The Class

B Common Warrants will have an exercise price of $0.575, will be

exercisable at any time on or after the date that is six months

after the original issuance date and will expire on the 18-month

anniversary of the original issuance date.

The closing of the offering is expected to occur on or about

September 17, 2024, subject to the satisfaction of customary

closing conditions.

The gross proceeds from the offering are expected to be

approximately $2.75 million. The Company intends to use the net

proceeds from the offering for general corporate purposes, which

may include payment to the Company’s independent accounting firm,

Frank, Rimerman + Co. LLP, payment to its tax advisors, repayment

of principal on the Company’s indebtedness, capital expenditures,

and funding its working capital needs, but shall not use such

proceeds: (a) for the redemption of any Common Stock or Common

Stock Equivalents, or (b) in violation of FCPA or OFAC

regulations.

A.G.P./Alliance Global Partners is acting as the sole placement

agent for the offering.

The offer and sale of the foregoing securities is being made in

a transaction not involving a public offering, and the securities

have not been and will not initially be registered under the

Securities Act of 1933, as amended (the “Securities Act”), or

applicable state securities laws. Accordingly, the securities may

not be offered or sold in the United States except pursuant to an

effective registration statement or an applicable exemption from

the registration requirements of the Securities Act and such

applicable state securities laws. Pursuant to a registration rights

agreement entered into with the investor, the Company agreed to

file a registration statement with the U.S. Securities and Exchange

Commission (the “SEC”) covering the resale of the securities to be

issued to the institutional investor no later than 28 calendar days

after the date of the registration rights agreement and to use

commercially reasonable efforts to have the registration statement

declared effective as promptly as practicable thereafter, and in

any event no later than 45 days after the date of the registration

rights agreement (or within 60 calendar days following the date of

the registration rights agreement in the event of a “limited

review” by the SEC of the registration statement or within 90

calendar days following the date of the registration rights

agreement in the event of a “full review” by the SEC of the

registration statement).

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or other jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to the registration or qualification under the securities laws of

any such state or other jurisdiction.

About Momentus

Momentus is a U.S. commercial space company that offers

commercial satellite buses and in-space infrastructure services

including in-space transportation, hosted payloads, and other

in-orbit services.

Forward-Looking Statements

This press release contains certain statements that may

constitute “forward-looking statements” for purposes of the federal

securities laws. Forward-looking statements include, but are not

limited to, statements regarding the expected closing of the

offering, the intended use of proceeds and fulfillment of customary

closing conditions. Momentus or its management team’s expectations,

hopes, beliefs, intentions or strategies regarding the future,

projections, forecasts or other characterizations of future events

or circumstances, including any underlying assumptions, and are not

guarantees of future performance. Because forward-looking

statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict and many of which are outside of Momentus’

control. Many factors could cause actual future events to differ

materially from the forward-looking statements in this press

release, including but not limited to risks and uncertainties

included under the heading “Risk Factors” in the Annual Report on

Form 10-K filed by the Company on June 6, 2024, as such factors may

be updated from time to time in our other filings with the

Securities and Exchange Commission (the “SEC”), accessible on the

SEC’s website at www.sec.gov and the Investor Relations section of

our website at https://momentus.space. Forward-looking statements

speak only as of the date they are made. Readers are cautioned not

to put undue reliance on forward-looking statements, and, except as

required by law, the Company assumes no obligation and does not

intend to update or revise these forward-looking statements,

whether as a result of new information, future events, or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240916895580/en/

Momentus Contacts Investors:

investors@momentus.space

Media: press@momentus.space

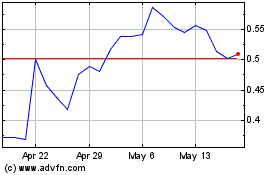

Momentus (NASDAQ:MNTS)

Historical Stock Chart

From Nov 2024 to Dec 2024

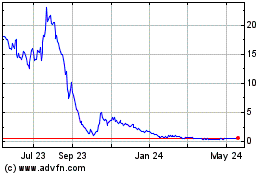

Momentus (NASDAQ:MNTS)

Historical Stock Chart

From Dec 2023 to Dec 2024