Mereo BioPharma Group plc (NASDAQ: MREO) (“Mereo” or the

“Company”), a clinical-stage biopharmaceutical company focused on

rare diseases, today announced its financial results for the first

quarter ended March 31, 2024, and provided an update on recent

corporate highlights. The Company reported cash and cash

equivalents of $48.7 million as of March 31, 2024 and continues to

expect this to fund its operations into 2026.

“2024 is off to an exciting start following the

completion of enrollment by our partner Ultragenyx in both the

Orbit and Cosmic studies of setrusumab in Osteogenesis Imperfecta

(OI) along with the continued advancement of the pre-launch

activities in Mereo’s European territories. These include further

identification of patients who could potentially benefit from

setrusumab treatment, the ongoing dialogues with the HTA’s and

Payors in Europe to support both rapid adoption and efficient

reimbursement following a potential European approval, and SATURN,”

said Dr. Denise Scots-Knight, Chief Executive Officer of Mereo.

“Further, in parallel with the ongoing partnering discussions for

alvelestat, we have completed the initial validation work for the

St. George’s Respiratory Questionnaire (SGRQ) instrument in the

Alpha-1 Antitrypsin Deficiency-associated Lung Disease (AATD-LD)

population.”

First Quarter 2024 Highlights, Recent

Developments and Anticipated Milestones

Setrusumab (UX143)

- Enrollment completed in the Phase 3

Orbit and Cosmic studies of setrusumab in OI, conducted by our

partner Ultragenyx.

- The Phase 3 portion of the Orbit

Phase 2/3 trial completed enrollment with 158 patients aged 5 to 25

years old. Patients were randomized 2:1 to receive setrusumab or

placebo, and the study has a primary efficacy endpoint of

annualized clinical fracture rate. Additional longer-term safety

and efficacy data from the Phase 2 portion of the Orbit study are

expected in the second half of 2024.

- The Cosmic study was initiated in

the second half of 2023 and completed enrollment with 69 patients.

Cosmic is a Phase 3 open-label, randomized study in patients aged 2

to <7 years evaluating setrusumab compared to bisphosphonates on

reduction in total annualized clinical fracture rate.

- The initial results from the IMPACT

Survey, a joint initiative between the Osteogenesis Imperfecta

Foundation, Osteogenesis Imperfecta Federation Europe and its

members, and Mereo, were recently made available. IMPACT is the

largest ever burden of disease survey on the impact of OI on

patients, physicians and caregivers. Additional information is

available at www.impactsurveyoi.com.

- The Company continues to invest in

pre-launch activities and other studies to generate further

evidence that will inform coverage, pricing and reimbursement

decisions in Mereo’s European territory. These include SATURN

(Systematic Accumulation of Treatment practices and Utilization,

Real world evidence, and Natural history data for OI) which is

expected to provide a coordinated data set across multiple

treatment centers for OI across European countries, to support

pricing and reimbursement decisions. The Company’s patient

identification activities are continuing, with a focus on adult

patients in the key five European countries where these activities

were previously initiated, and adult and pediatric patients in

additional European countries.

Alvelestat (MPH-966)

- Mereo remains on-track to submit

the completed initial validation work supporting the use of the

SGRQ-Total Score as the primary efficacy endpoint to the FDA,

alongside the detailed Phase 3 study protocol in the first half of

2024.

- The content validation of the SGRQ

using semi-structured interviews with patients with AATD-LD from

several sites in the United States has been completed. The analysis

concluded that the current SGRQ instrument is fit for purpose with

valid content measures for patients with AATD-LD and is suitable

for use as a key Clinical Outcomes Assessment endpoint.

- The global Phase 3 study, which is

supported by positive data from the ASTRAEUS and ATALANTa studies,

is expected to enroll approximately 220 early- and late-stage

patients with the severe Pi*ZZ genotype and confirmed emphysema,

with a treatment period of 18 months. If the Phase 3 trial is

successful, it is expected to support full approvals of alvelestat

in the U.S. and Europe.

- Mereo continues to actively engage

with multiple potential partners for the development and

commercialization of alvelestat and aims to initiate the Phase 3

study with a partner around the end of 2024.

Etigilimab (MPH-313)

- Etigilimab in combination with

nivolumab, is being studied in an ongoing investigator-led

single-arm, two-stage, open-label Phase 1b/2 trial in a subtype of

platinum-resistant recurrent ovarian cancer (clear cell ovarian

cancer) at the MD Anderson Cancer Center, financed by the Cancer

Focus Fund. Based on the results to-date, the study has been

expanded from the initial 10 patients to 20 patients and an update

may be provided by the investigator in the second half of 2024 or

early 2025.

First Quarter 2024 Financial

Results

Total research and development (R&D)

expenses decreased by $1.3 million, or 25%, from $5.3 million in

the first quarter of 2023 to $4.0 million in the first quarter of

2024. The decrease was primarily due to a $1.8 million reduction in

R&D expenses for etigilimab, partially offset by increases of

$0.3 million of R&D expenses for both setrusumab and

alvelestat. The reduction in etigilimab expenses was primarily due

to the winding down and completion during 2023 of the open label

Phase 1b/2 basket study in combination with an anti-PD-1 in a range

of tumor types. Program expenses for setrusumab are in relation to

increases in ongoing activities in Europe, and input into

development, regulatory and manufacturing plans with our partner,

Ultragenyx, as the global development program is funded by

Ultragenyx pursuant to our license and collaboration agreement.

Program expenses for alvelestat primarily include the preparatory

work for the Phase 3 study, including manufacturing and drug

formulation activities, SGRQ validation activities and regulatory

interactions.

General and administrative expenses decreased by

$0.5 million, or 8%, from $6.4 million in the first quarter of 2023

to $5.9 million in the first quarter of 2024. The decrease is

primarily related to recognition of a $1.7 million reduction in

expenses in the first quarter of 2024 for amounts from our

depository to reimburse certain expenses incurred by us in respect

of our ADR program, partially offset by an increase in

employee-related expenses and professional fees. No similar

reimbursements from our depository were recognized in the first

quarter of 2023.

Net loss for the first quarter of 2024 was $9.0

million, compared to $12.1 million during the first quarter of

2023, primarily reflecting an operating loss of $9.9 million.

As of March 31, 2024, the Company had cash and

cash equivalents of $48.7 million, compared to $57.4 million as of

December 31, 2023. The Company’s guidance remains unchanged and it

continues to expect, based on current operational plans, that its

existing cash and cash equivalents balance will enable it to fund

its currently committed clinical trials, operating expenses, and

capital expenditure requirements into 2026. This guidance does not

include any potential upfront payments associated with a

partnership for alvelestat or business development activity around

any of the Company’s non-core programs.

Total ordinary shares issued as of March

31, 2024 were 701,349,434. Total ADS equivalents as of March

31, 2024 were 140,269,886, with each ADS representing five ordinary

shares of the Company.

About Mereo BioPharma

Mereo BioPharma is a biopharmaceutical company

focused on the development of innovative therapeutics for rare

diseases. The Company has two rare disease product candidates,

setrusumab for the treatment of osteogenesis imperfecta (OI) and

alvelestat primarily for the treatment of severe alpha-1

antitrypsin deficiency-associated lung disease (AATD-LD). The

Company’s partner, Ultragenyx Pharmaceutical, Inc., has completed

enrollment in the Phase 3 portion of a pivotal Phase 2/3 pediatric

study in young adults (5 to 25 years old) for setrusumab in OI and

in the Phase 3 study in pediatric patients (2 to <7 years old)

in the first half of 2024. The partnership with Ultragenyx includes

potential additional milestone payments of up to $245 million and

royalties to Mereo on commercial sales in Ultragenyx territories.

Mereo has retained EU and UK commercial rights and will pay

Ultragenyx royalties on commercial sales in those territories.

Setrusumab has received orphan designation for osteogenesis

imperfecta from the EMA and FDA, PRIME designation from the EMA and

has pediatric disease designation from the FDA. Alvelestat has

received U.S. Orphan Drug Designation for the treatment of AATD and

Fast Track designation from the FDA. Following results from

ASTRAEUS and ATALANTa in AATD-lung disease, the Company has aligned

with the FDA and the EMA on the primary endpoints for a Phase 3

pivotal study which if successful could enable full approval in

both the U.S. and Europe. In addition to the rare disease programs,

Mereo has two oncology product candidates in clinical development.

Etigilimab (anti-TIGIT) has completed a Phase 1b/2 basket study

evaluating its safety and efficacy in combination with an anti-PD-1

in a range of tumor types including three rare tumors and three

gynecological carcinomas – cervical, ovarian, and endometrial and

is an ongoing Phase 1b/2 investigator led study at the MD Anderson

Cancer Center in clear cell ovarian cancer; Navicixizumab, for the

treatment of late line ovarian cancer, has completed a Phase 1

study and has been partnered with Feng Biosciences Inc. in a global

licensing agreement that includes milestone payments and royalties.

Mereo has entered into an exclusive global license agreement with

ReproNovo SA for the development and commercialization of

leflutrozole, a non-steroidal aromatase inhibitor. Under the terms

of the agreement, ReproNovo, a reproductive medicine company, is

responsible for all future development and commercialization of

leflutrozole.

Forward-Looking Statements

This press release contains “forward-looking

statements” that involve substantial risks and uncertainties. All

statements other than statements of historical fact contained

herein are forward-looking statements within the meaning of Section

27A of the United States Securities Act of 1933, as amended, and

Section 21E of the United States Securities Exchange Act of 1934,

as amended. Forward-looking statements usually relate to future

events and anticipated revenues, earnings, cash flows or other

aspects of our operations or operating results. Forward-looking

statements are often identified by the words “believe,” “expect,”

“anticipate,” “plan,” “intend,” “foresee,” “should,” “would,”

“could,” “may,” “estimate,” “outlook” and similar expressions,

including the negative thereof. The absence of these words,

however, does not mean that the statements are not forward-looking.

These forward-looking statements are based on the Company’s current

expectations, beliefs and assumptions concerning future

developments and business conditions and their potential effect on

the Company. While management believes that these forward-looking

statements are reasonable as and when made, there can be no

assurance that future developments affecting the Company will be

those that it anticipates.

All of the Company’s forward-looking statements

involve known and unknown risks and uncertainties some of which are

significant or beyond its control and assumptions that could cause

actual results to differ materially from the Company’s historical

experience and its present expectations or projections. Such risks

and uncertainties include, among others, the uncertainties inherent

in the clinical development process; the Company’s reliance on

third parties to conduct and provide funding for its clinical

trials; the Company’s dependence on enrollment of patients in its

clinical trials; and the Company’s dependence on its key

executives. You should carefully consider the foregoing factors and

the other risks and uncertainties that affect the Company’s

business, including those described in the “Risk Factors” section

of its Annual Report on Form 10-K, as well as discussions of

potential risks, uncertainties, and other important factors in the

Company’s subsequent filings with the Securities and Exchange

Commission. The Company wishes to caution you not to place undue

reliance on any forward-looking statements, which speak only as of

the date hereof. The Company undertakes no obligation to publicly

update or revise any of our forward-looking statements after the

date they are made, whether as a result of new information, future

events or otherwise, except to the extent required by law.

|

Mereo BioPharma Contacts: |

|

|

Mereo |

+44 (0)333 023 7300 |

|

Denise Scots-Knight, Chief Executive Officer |

|

|

Christine Fox, Chief Financial Officer |

|

|

|

|

|

Burns McClellan (Investor Relations Adviser to

Mereo) |

+01 646 930 4406 |

|

Lee Roth |

|

|

Investors |

investors@mereobiopharma.com |

|

MEREO BIOPHARMA GROUP PLCCONDENSED CONSOLIDATED BALANCE SHEETS(In

thousands, except share and per share data)(Unaudited) |

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

48,660 |

|

|

$ |

57,421 |

|

|

Prepaid expenses and other current assets |

|

3,188 |

|

|

|

5,156 |

|

|

Research and development incentives receivables |

|

1,648 |

|

|

|

1,183 |

|

|

Total current assets |

|

53,496 |

|

|

|

63,760 |

|

|

Property and equipment, net |

|

360 |

|

|

|

405 |

|

|

Operating lease right-of-use assets |

|

1,109 |

|

|

|

1,245 |

|

|

Intangible assets |

|

972 |

|

|

|

1,089 |

|

|

Total assets |

$ |

55,937 |

|

|

$ |

66,499 |

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

2,455 |

|

|

$ |

2,346 |

|

|

Accrued expenses |

|

2,539 |

|

|

|

5,467 |

|

|

Convertible loan notes – current |

|

4,630 |

|

|

|

— |

|

|

Operating lease liabilities – current |

|

662 |

|

|

|

652 |

|

|

Other current liabilities |

|

718 |

|

|

|

1,021 |

|

|

Total current liabilities |

|

11,004 |

|

|

|

9,486 |

|

|

Convertible loan notes – non-current |

|

— |

|

|

|

4,394 |

|

|

Warrant liabilities – non-current |

|

855 |

|

|

|

412 |

|

|

Operating lease liabilities – non-current |

|

727 |

|

|

|

906 |

|

|

Other non-current liabilities |

|

513 |

|

|

|

764 |

|

|

Total liabilities |

|

13,099 |

|

|

|

15,962 |

|

|

Commitments and contingencies (Note 15) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ Equity |

|

|

|

|

|

|

Ordinary shares, par value £0.003 per share; 701,349,434 shares

issued at March 31, 2024 (December 31, 2023: 701,217,089). |

|

2,775 |

|

|

|

2,775 |

|

|

Treasury shares |

|

— |

|

|

|

(1,230 |

) |

|

Additional paid-in capital |

|

486,927 |

|

|

|

486,107 |

|

|

Accumulated deficit |

|

(428,581 |

) |

|

|

(419,630 |

) |

|

Accumulated other comprehensive loss |

|

(18,283 |

) |

|

|

(17,485 |

) |

|

Total shareholders’ equity |

|

42,838 |

|

|

|

50,537 |

|

|

Total liabilities and shareholders’ equity |

$ |

55,937 |

|

|

$ |

66,499 |

|

|

MEREO BIOPHARMA GROUP PLCCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS(In thousands, except share and

per share amounts)(Unaudited) |

|

|

Three Months Ended

March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

Revenue |

$ |

— |

|

|

$ |

— |

|

|

Operating expenses: |

|

|

|

|

|

|

Cost of revenue |

|

— |

|

|

|

347 |

|

|

Research and development |

|

(3,994 |

) |

|

|

(5,307 |

) |

|

General and administrative |

|

(5,906 |

) |

|

|

(6,450 |

) |

|

Loss from operations |

|

(9,900 |

) |

|

|

(11,410 |

) |

|

Other income/(expenses) |

|

|

|

|

|

|

Interest income |

|

617 |

|

|

|

306 |

|

|

Interest expense |

|

(310 |

) |

|

|

(800 |

) |

|

Changes in the fair value of financial instruments |

|

(448 |

) |

|

|

542 |

|

|

Foreign currency transaction gain/(loss), net |

|

613 |

|

|

|

(1,207 |

) |

|

Other expenses, net |

|

— |

|

|

|

(6 |

) |

|

Benefit from research and development tax credit |

|

477 |

|

|

|

499 |

|

|

Net loss before income tax |

|

(8,951 |

) |

|

|

(12,076 |

) |

|

Income tax benefit |

|

— |

|

|

|

— |

|

|

Net loss |

$ |

(8,951 |

) |

|

$ |

(12,076 |

) |

|

|

|

|

|

|

|

|

Loss per share – basic and diluted |

$ |

(0.01 |

) |

|

$ |

(0.02 |

) |

|

Weighted average shares outstanding – basic and diluted |

|

700,263,490 |

|

|

|

623,925,635 |

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(8,951 |

) |

|

$ |

(12,076 |

) |

|

Other comprehensive (loss)/income – Foreign currency transaction

adjustments, net of tax |

|

(798 |

) |

|

|

2,278 |

|

|

Total comprehensive loss |

$ |

(9,749 |

) |

|

$ |

(9,798 |

) |

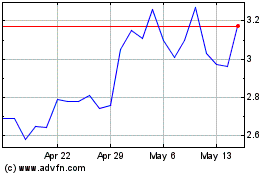

Mereo BioPharma (NASDAQ:MREO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Mereo BioPharma (NASDAQ:MREO)

Historical Stock Chart

From Feb 2024 to Feb 2025