UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month

of October 2023

Commission

File Number: 001-38766

MMTEC, INC.

(Translation of registrant’s name into

English)

Room 2302, 23rd Floor

FWD Financial Center

308 Des Voeux Road Central

Sheung Wan, Hong Kong

Tel: +852 36908356

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

Other Information

Attached hereto as Exhibit

99.1 is a Notice of Annual Meeting of Shareholders and Proxy Statement of MMtec, Inc. (the “Company”).

Where to Find Additional Information

The Company is a foreign private

issuer. As such, the proxy statement is not subject to review and comment by the Securities and Exchange Commission (the “SEC”).

Shareholders are urged to carefully read the proxy statement because it contains important information about the Company and the Meeting

of Shareholders. Copies of the proxy statement and other documents filed by the Company will be available at the website maintained by

the SEC at www.sec.gov. Copies of such filings can also be obtained, without charge, by directing a request to Room 2302, 23rd Floor,

FWD Financial Center, 308 Des Voeux Road Central, Sheung Wan, Hong Kong.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

MMTEC, INC. |

| |

|

|

| |

By: |

/s/ Min Kong |

| |

|

Min Kong, Chief Financial Officer |

Date: October 13, 2023

2

Exhibit 99.1

MMTEC, INC.

Room 2302, 23rd Floor

FWD Financial Center

308 Des Voeux Road Central

Sheung Wan, Hong Kong

Notice of Annual Meeting of Shareholders

To be held on November 10, 2023

To the Shareholders of MMtec, Inc.:

Notice is hereby given

that the Annual Meeting of the Shareholders of MMtec, Inc. (the “Company”) will be held on November 10, 2023 at 9:00

a.m. local China time (or November 9, 2023 at 8:00 p.m. Eastern Standard Time), at the Company’s principal executive offices

in Hong Kong, China. The meeting is called for the following purposes:

1. To elect Class C director

to serve until the next Annual Meeting of Shareholders at which Class C directors are elected and until his successor is duly appointed.

2. To elect Class A directors,

each to serve until the next Annual Meeting of Shareholders at which Class A directors are elected and until each successor is duly

appointed.

3. To transact any other business that is

properly brought before the Annual Meeting or any adjournment or postponement thereof.

The close of business on October

10, 2023, has been fixed as the record date for the purpose of determining the shareholders entitled to notice of, and to vote at, the

meeting. The register of members of the Company will not be closed. The date on which this Proxy Statement and the accompanying form of

proxy card will first be mailed or given to the Company’s shareholders is on or about October 13, 2023.

All shareholders are cordially

invited to attend the meeting. Whether or not you expect to attend, you are respectfully requested by the Board of Directors to sign,

date and return the enclosed proxy card promptly. Shareholders who appoint proxies retain the right to revoke them at any time prior to

the voting thereof. A return envelope which requires no postage if mailed in the United States is enclosed for your convenience.

This Proxy Statement, a form

of proxy card and our most recent Annual Report are available online at the following internet address: https://ir.haisc.com/corporate/meeting.

| |

By Order of the Board of Directors, |

| |

|

| |

/s/ Xiangdong Wen |

| |

Xiangdong Wen, Chairman of the Board |

| |

|

| |

Dated: October 13, 2023 |

MMTEC, INC.

TABLE OF CONTENTS

MMTEC, INC.

Room 2302, 23rd Floor

FWD Financial Center

308 Des Voeux Road Central

Sheung Wan, Hong Kong

Proxy Statement

Annual Meeting of Shareholders

This Proxy Statement is furnished

in connection with the solicitation of proxies by the Board of Directors (the “Board”) of MMtec, Inc. (the “Company,”

“MMTEC”, “we,” “us,” or “our”) for the Annual Meeting of Shareholders to be held on November

10, 2023 at the Company’s principal executive offices at Room 2302, 23rd Floor, FWD Financial Center, 308 Des Voeux Road Central,

Sheung Wan, Hong Kong, at 9:00 a.m. local China time (or 8:00 p.m. Eastern Standard Time) and for any adjournment or adjournments thereof,

for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. The Company will bear the costs of this solicitation.

If the enclosed proxy is properly

executed and returned, the shares represented thereby will be voted in accordance with the directions thereon and otherwise in accordance

with the judgment of the persons designated as proxies. Any proxy card on which no instruction is specified will be voted in favor of

the actions described in this Proxy Statement and for the election of the nominees set forth under the caption “Election of Directors.”

Any shareholder appointing such a proxy has the power to revoke it at any time before it is voted. If you are a holder of record, written

notice of such revocation should be forwarded to VStock Transfer, LLC, 18 Lafayette Place, Woodmere, NY 11598, Attn: Proxy Services. If

you hold your shares in street name, you should contact your broker about revoking your proxy.

Your vote is important. Accordingly,

you are urged to sign and return the accompanying proxy card whether or not you plan to attend the meeting. If you do attend the meeting

and are a record holder, you may vote by ballot at the meeting and your proxy will be deemed to be revoked. If you hold your shares in

street name and wish to vote your shares at the meeting, you should contact your broker about getting a proxy appointing you to vote your

shares.

VOTING SECURITIES

Only holders of our common

shares (the “Shares”) at the close of business on October 10, 2023 (the “Record Date”) are entitled to vote at

the meeting. On the record date, the Company had 199,145,041 common shares outstanding and entitled to vote at the Annual Meeting. For

purposes of voting at the Annual Meeting, each Share is entitled to one vote upon all matters to be acted upon at the meeting.

No less than one-third (1/3)

of the outstanding Shares entitled to vote at the Annual Meeting represented in person or by proxy will constitute a quorum throughout

the meeting. Each of the proposals relating to the election of directors, and the approval of the appointment of independent certified

public accountants are to be approved by the affirmative vote of a simple majority of the votes cast in person or by proxy at the Annual

Meeting and entitled to vote at the meeting.

Only Shares that are voted

are taken into account in determining the proportion of votes cast for the election of directors. Any Shares not voted (whether by abstention,

broker non-vote or otherwise) will therefore only impact the election of directors to the extent that the failure to vote for any individual

may result in another individual’s receiving a larger proportion of votes cast. Similarly, any Shares not voted (whether by abstention,

broker non-vote or otherwise) will only impact the percentage of votes cast for or against the other matters. Except for determining the

presence or absence of a quorum for the transaction of business, broker non-votes are not counted for any purpose in determining whether

a matter has been approved.

VOTING

If you are a shareholder of

record, you may vote in person at the annual meeting. We will give you a ballot sheet when you arrive. If you do not wish to vote in person

or you will not be attending the annual meeting, you may vote by proxy. If you have received a printed copy of these proxy materials by

mail, you may vote by proxy using the enclosed proxy card. To vote by proxy using the enclosed proxy card (only if you have received a

printed copy of these proxy materials by mail), complete, sign and date your proxy card and return it promptly in the envelope provided.

If you intend to vote by proxy, your vote must be received by 11:59 p.m., Eastern Standard Time on November 8, 2023 to be counted. Following

instructions on your proxy card, you may also vote by online (www.vstocktransfer.com/proxy), via facsimile (646-536-3179), and email (vote@vstocktransfer.com).

If you are not a shareholder

of record, please follow the directions provided to you by your bank or broker. If you wish to vote in person at the meeting, please contact

your bank or broker for the procedures necessary to allow you to vote your Shares in person.

ELECTION OF CLASS C DIRECTOR

(PROPOSAL NO. 1)

The Board has nominated Xiangdong

Wen for re-election as Class C directors to serve until the next Annual Meeting of Shareholders at which Class C directors are elected

(which is expected to be the 2025 Annual Meeting of stockholders), and until his or her successor are elected and become qualified. It

is intended that the proxy appointed by the accompanying proxy card will vote for the election, as director, of the person named below,

unless the proxy card contains contrary instructions. The Company has no reason to believe that the nominees will not be a candidate or

will be unable to serve as a director. However, in the event that the nominees should become unable or unwilling to serve as a director,

the persons named in the proxy have advised that they will vote for the election of such person or persons as shall be designated by the

directors, unless the proxy card contains contrary instructions. The following sets forth the nominee’s name, age, principal occupations

and brief employment history of the nominee, including the names of other publicly-held companies of which he serves or has served as

a director during the past five years.

Xiangdong

Wen, age 38, has served as the Chairman of the Board of MMTEC, Inc. since January 2018 and has served as the Chief Executive Officer

of MMTEC, Inc. since June 2020. Mr. Wen founded Gujia in 2015 and was Gujia’s Chief Executive Officer between June 2015 and January

2016. Mr. Wen has also served as Gujia’s executive director since June 2015. Between May 2012 and May 2015, Mr. Wen served as Chief

Executive Officer of Jiazi Investment Co., Ltd, an investment management company. Between February 2015 and June 2015, Mr. Wen served

as Chief Operating Officer of Beijing Dongfangjuhe Technology Co., Ltd, providing technology solutions to the broker/dealer industry.

Mr. Wen holds a Bachelor’s degree in business management from Communication University of China.

Vote Required and Board Recommendation

The affirmative vote of a

simple majority of the votes cast in person or by proxy at the Annual Meeting and entitled to vote at the meeting is required for approval

of this Proposal. The Board recommends a vote “FOR” the election of the above nominee.

ELECTION OF CLASS A DIRECTORS

(PROPOSAL NO. 2)

The Board has nominated Min

Kong and Dan Fu for re-election as Class A directors to serve until the next Annual meeting of Shareholders at which Class A directors

are elected (which is expected to be the 2026 Annual Meeting of stockholders), and until his or her successor are elected and become qualified.

It is intended that the proxy appointed by the accompanying proxy card will vote for the election, as directors, of the persons named

below, unless the proxy card contains contrary instructions. The Company has no reason to believe that any of the nominees will not be

a candidate or will be unable to serve as a director. However, in the event that any of the nominees should become unable or unwilling

to serve as a director, the persons named in the proxy have advised that they will vote for the election of such person or persons as

shall be designated by the directors, unless the proxy card contains contrary instructions. The following set forth the names, ages, principal

occupations and brief employment history of each of the nominees, including the names of other publicly-held companies of which each serves

or has served as a director during the past five years.

Min Kong,

age 34, has served as the Chief Financial Officer of MMTEC since January 2018. Between June 2015 and January 2018, Mr. Kong served as

the Institutional business Director of Gujia (Beijing) Technology Co., Ltd. Between February 2014 and February 2015, Mr. Kong served as

a Data Analyst Manager of American Dental Solutions, LLC. Between April 2012 and January 2013, Mr. Kong served as Marketing manager of

Yiwu Yi Jue Trading Company. Mr. Kong received his MBA degree from Missouri State University.

Dan Fu,

age 36, has served as the Marketing Department Manager at Beijing Yingding Education Technology Co., Ltd. from July 2015 to July 2016.

Ms. Fu then served as Brand Department Manager at Baoding Huazhong Group from August 2016 to March 2021. York at Stony Brook (1989), and

a Master of Business Administration degree from Baruch College (CUNY, 1992).

To the best of our knowledge,

there have been no events under any bankruptcy act, criminal proceedings, judgments, injunctions, orders or decrees material to the evaluation

of the ability and integrity of any director, executive officer, promoter or control person of the Company during the past ten years and

there have been no material proceedings to which any director or executive officer is a party adverse to the Company or any of its subsidiaries

or has any material interest averse to the Company or any of its subsidiaries.

THE BOARD AND BOARD COMMITTEES

During the year ended December

31, 2022, the Board met four times and acted by unanimous written consents on four occasions. All of the directors attended 75% or more

of the aggregate of meetings of the Board and meetings of any committee which such director is a member. Each director is expected to

participate, either in person or via teleconference, in meetings of our Board and meetings of committees of our Board in which each director

is a member, and to spend the time necessary to properly discharge such director’s respective duties and responsibilities. We do

not have a written policy with regard to directors’ attendance at annual meetings of shareholders; however, all directors are encouraged

to attend the annual meeting. The Board has determined that Qingshun Meng, Shufang Lai and Dan Fu are “independent” within

the meaning of the NASDAQ rules.

The Board standing committee memberships are as

follows:

| |

● |

Audit Committee: |

Shufang Lai (Chair and the Audit Committee financial expert), Qingshun Meng and Dan Fu. |

| |

|

|

|

| |

● |

Compensation Committee: |

Dan Fu (Chair), Shufang Lai and Qingshun Meng. |

| |

|

|

|

| |

● |

Nominating Committee: |

Qingshun Meng (Chair), Dan Fu and Shufang Lai. |

Written charters for each

of our standing committees are available on our corporate website at http://ir.haisc.com/corporate/governance.

Audit Committee.

Our Audit Committee, which was established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), held one meeting and acted by written consent on one occasion in 2022. The audit committee oversees the Company’s

financial reporting process on behalf of the Board. The committee’s responsibilities include the following functions:

| ● | appointing, compensating, retaining, evaluating, terminating, and overseeing our independent registered

public accounting firm, |

| ● | discussing with our independent registered public accounting firm the independence of its members from

its management, |

| ● | reviewing with our independent registered public accounting firm the scope and results of their audit, |

| ● | approving all audit and permissible non-audit services to be performed by our independent registered public

accounting firm, |

| ● | overseeing the financial reporting process and discussing with management and our independent registered

public accounting firm the interim and annual financial statements that we file with the SEC, |

| ● | reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls,

and compliance with legal and regulatory requirements, |

| ● | coordinating the oversight by our Board of Directors of our code of business conduct and our disclosure

controls and procedures, |

| ● | establishing procedures for the confidential and or anonymous submission of concerns regarding accounting,

internal controls or auditing matters, and |

| ● | reviewing and approving related-party transactions |

Compensation Committee.

Our Compensation Committee held no meetings in 2022. Our Compensation Committee is responsible for, among other matters:

| |

● |

reviewing and approving, or recommending to the Board of Directors to approve the compensation of our CEO and other executive officers and directors, |

| |

● |

reviewing key employee compensation goals, policies, plans and programs, |

| |

● |

administering incentive and equity-based compensation, |

| |

● |

reviewing and approving employment agreements and other similar arrangements between us and our executive officers, and |

| |

● |

appointing and overseeing any compensation consultants or advisors. |

Nominating Committee.

Our Nominating Committee is responsible for identifying potential candidates to serve on our board and its committees. The Nominating

Committee held no meetings in 2022. The Committee’s responsibilities include the following functions:

| ● | selecting or recommending for selection candidates for directorships, |

| ● | evaluating the independence of directors and director nominees, |

| ● | reviewing and making recommendations regarding the structure and composition of our Board of Directors

and the Board of Directors committees, |

| ● | developing and recommending to the Board of Directors corporate governance principles and practices; |

| ● | reviewing and monitoring our company’s Code of Business Conduct and Ethics, and |

| ● | overseeing the evaluation of our company’s management |

The Committee submits candidates

who have personal and professional integrity, who have demonstrated ability and judgment and who shall be effective, in conjunction with

the other nominees to the board, in collectively serving the long-term interests of the shareholders. In evaluating nominees, the Committee

takes into consideration the following attributes: independence, professional reputation, financial acumen, business experience, professional

network, industry and Company knowledge, high ethical standards, and diversity. Depending upon the current needs of the Board, certain

factors may be weighed more or less heavily. In considering candidates for the Board, the directors evaluate the entirety of each candidate’s

credentials and do not have any specific minimum qualifications that must be met. The Committee will consider candidates from any reasonable

source, including current Board members, shareholders, professional search firms or other persons.

Board Leadership Structure

and Role in Risk Oversight. Xiangdong Wen serves as our Chief Executive Officer and the Chairman of the Board. The Board of Directors

believes that Mr. Wen is best situated to serve as Chairman of the Board because he will be the director most capable of effectively identifying

strategic priorities and leading the discussion and execution of strategy. The Board has not designated a lead director. Given the small

number of directors comprising the board, the independent directors call and plan their executive sessions collaboratively and, between

Board meetings, communicate with management and one another directly. Given the circumstances, the directors believe that formalizing

in a lead director functions in which they all participate might detract from rather than enhance performance of their responsibilities

as directors. The Board is responsible for the overall supervision of the Company’s risk oversight efforts as they relate to the

key business risks facing the organization. Management identifies, assesses, and manages the risks most critical to the Company’s

operations on a day-to-day basis. The Board’s role in risk oversight of the Company is consistent with the Company’s leadership

structure, with senior management having responsibility for assessing and managing the Company’s risk exposure, and the Board and

its Committees providing oversight as necessary in connection with those efforts.

Board Member Attendance

at Annual Meetings. Our Board nominees are generally expected to attend our Annual Meetings unless personal circumstances make

the Board member or director nominee attendance impracticable or inappropriate.

Shareholder Communications

with Directors. We have no formal written policy regarding communication with the Board. Persons wishing to write to the Board

or to a specified director or committee of the Board should send correspondence to the Secretary at our main office. Electronic submissions

of shareholder correspondence will not be accepted. The Secretary will forward to the directors all communications that, in his judgment,

are appropriate for consideration by the directors. Any correspondence received that is addressed generically to the Board will be forwarded

to the Chairman of the Board, with a copy will be sent to the Chairman of the Audit Committee.

Interested Transactions.

A director may vote, attend a board meeting or sign a document on our behalf with respect to any contract or transaction in which he or

she is interested. A director must promptly disclose the interest to all other directors after becoming aware of the fact that he or she

is interested in a transaction we have entered into or are to enter into. A general notice or disclosure to the board or otherwise contained

in the minutes of a meeting or a written resolution of the board or any committee of the board that a director is a shareholder, director,

officer or trustee of any specified firm or company and is to be regarded as interested in any transaction with such firm or company will

be sufficient disclosure, and, after such general notice, it will not be necessary to give special notice relating to any particular transaction.

Qualification.

A director is not required to hold shares as a qualification to office.

DIRECTOR COMPENSATION

All directors hold office

until the next annual meeting of shareholders at which their respective class of directors is re-elected and until their successors have

been duly elected and qualified. There are no family relationships among our directors or executive officers. Officers are elected by

and serve at the discretion of the Board of Directors. Employee directors do not receive any compensation for their services. Non-employee

directors are entitled to receive $10,000 per year for serving as directors and may receive option grants from our company. In addition,

non-employee directors are entitled to receive compensation for their actual travel expenses for each Board of Directors meeting attended.

We have entered into independent director agreements with our directors which agreements set forth the terms and provisions of their engagement.

None of our officers currently serves, or has served during the last completed fiscal year, on the compensation committee or board of

directors of any other entity that has one or more officers serving as a member of our board of directors.

EXECUTIVE OFFICERS

The following sets forth the

names and ages of our current executive officers, their respective positions and offices, and their respective principal occupations or

brief employment history.

|

Name |

|

Age |

|

Office |

| Xiangdong Wen |

|

38 |

|

Chief Executive Officer and Chairman of the Board |

| Min Kong |

|

34 |

|

Chief Financial Officer |

Xiangdong Wen has

served as the Chairman of the Board of MMTEC since January 2018 and has served as the Chief Executive Officer of MMTEC since June 2020.

Mr. Wen founded Gujia in 2015 and was Gujia’s Chief Executive Officer between June 2015 and January 2016. Mr. Wen has also served

as Gujia’s executive director since June 2015. Between May 2012 and May 2015, Mr. Wen served as Chief Executive Officer of

Jiazi Investment Co., Ltd, an investment management company. Between February 2015 and June 2015, Mr. Wen served as Chief Operating Officer

of Beijing Dongfangjuhe Technology Co., Ltd, providing technology solutions to the broker/dealer industry. Mr. Wen holds a Bachelor’s

degree in business management from Communication University of China. Mr. Wen was nominated as a director because of his experience serving

in executive positions at companies operating in the financial industry and his extensive knowledge, experience and relationships in China’s

financial industry.

Min Kong has

served as the Chief Financial Officer of MMTEC since January 2018. Between June 2015 and January 2018, Mr. Kong served as the Institutional

Business Director of Gujia (Beijing) Technology Co., Ltd. Between February 2014 and February 2015, Mr. Kong served as Data Analyst Manager

of American Dental Solutions, LLC. Between April 2012 and January 2013, Mr. Kong served as Marketing Manager of Yiwu Yi Jue Trading Company.

Mr. Kong received his MBA degree from Missouri State University.

EXECUTIVE COMPENSATION

The following table shows

the annual compensation paid by us for the years ended December 31, 2022, 2021 and 2020:

| | |

| | |

| | |

Equity | | |

All Other | | |

Total | |

| Name/principal position | |

Year | | |

Salary | | |

Compensation | | |

Compensation | | |

Paid | |

| Xiangdong Wen, CEO | |

| 2020 | | |

$ | 32,860 | | |

$ | - | | |

$ | 4,025 | | |

$ | 36,885 | |

| | |

| 2021 | | |

$ | 170,724 | | |

$ | - | | |

$ | 2,564 | | |

$ | 173,288 | |

| | |

| 2022 | | |

$ | 305,101 | | |

$ | - | | |

$ | 8,974 | | |

$ | 314,075 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Min Kong, CFO | |

| 2020 | | |

$ | 40,486 | | |

$ | - | | |

$ | 5,184 | | |

$ | 45,670 | |

| | |

| 2021 | | |

$ | 99,206 | | |

$ | 313,250 | | |

$ | 5,503 | | |

$ | 417,959 | |

| | |

| 2022 | | |

$ | 108,342 | | |

$ | - | | |

$ | 8,981 | | |

$ | 117,323 | |

Employment Agreements

Xiangdong Wen

On June 18, 2020, we entered

into an employment agreement with Xiangdong Wen pursuant to which he agreed to serve as our Chief Executive Officer. The agreement provides

for an annual base salary of RMB210,000 (or approximately USD$32,000) payable in accordance with our company’s ordinary payroll

practices. Under the terms of this “at-will” employment agreement, the executive is entitled to receive an annual cash bonus

the extent and timing of which are to be determined by the Compensation Committee. If the executive’s employment with our company

is terminated for any reason, he will be only entitled to the accrued but unpaid base salary compensation.

Min Kong

On January 11, 2018, we entered

into an employment agreement with Min Kong pursuant to which he agreed to serve as our Chief Financial Officer. The agreement provides

for an annual base salary of RMB180,000 (or approximately USD$27,000) payable in accordance with our company’s ordinary payroll

practices. Under the terms of this “at-will” employment agreement, the executive is entitled to receive an annual cash bonus

the extent and timing of which are to be determined by the Compensation Committee. If the executive’s employment with our company

is terminated for any reason, he will be only entitled to the accrued but unpaid base salary compensation.

Termination of Employment

Agreements under Chinese Law

Under Chinese law, we may

only terminate employment agreements without cause and without penalty by providing notice of non-renewal one month prior to the date

on which the employment agreement is scheduled to expire. If we fail to provide this notice or if we wish to terminate an employment agreement

in the absence of cause, then we are obligated to pay the employee one month’s salary for each year we have employed the employee.

We are, however, permitted to terminate an employee for cause without penalty to our company, where the employee has committed a crime

or the employee’s actions or inactions have resulted in a material adverse effect to us.

SECURITIES OWNERSHIP

The following table sets forth,

as of October 1, 2023, certain information regarding beneficial ownership of our shares by each person who is known by us to beneficially

own more than 5% of our shares. The table also identifies the share ownership of each of our directors, each of our named executive officers,

and all directors and officers as a group. Except as otherwise indicated, the shareholders listed in the table have sole voting and investment

powers with respect to the shares indicated. Our major shareholders do not have different voting rights than any other holder of our shares.

Shares which an individual or group has a right to acquire within 60 days of October 1, 2023, pursuant to the exercise or conversion

of options, warrants or other similar convertible or derivative securities are deemed to be outstanding for the purpose of computing the

percentage ownership of such individual or group, but are not deemed to be outstanding for the purpose of computing the percentage ownership

of any other person shown in the table. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange

Commission and generally includes voting and investment power. Except as otherwise indicated below, each beneficial owner holds voting

and investment power directly. The percentage of ownership is based on 99,145,041 shares

issued and outstanding as of October 1, 2023. Unless otherwise indicated, the address of each beneficial owner listed in the table below

is Room 2302, 23rd Floor, FWD Financial Center, 308 Des Voeux Road Central, Sheung Wan, Hong Kong.

| | |

Beneficial Ownership | |

| Name of Beneficial Owner | |

Common Shares | | |

Percentage | |

| Xiangdong Wen * (1) | |

| 327,599 | | |

| 0.33 | % |

| Min Kong * | |

| 35,000 | | |

| 4 | % |

| Qingshun Meng * | |

| - | | |

| ** | |

| Shufang Lai * | |

| - | | |

| ** | |

| Dan Fu * | |

| - | | |

| ** | |

| All officers and directors as a group (6 persons) | |

| 362,599 | | |

| 0.37 | % |

| | |

| | | |

| | |

| 5% or greater beneficial owners | |

| | | |

| | |

| - | |

| - | | |

| ** | % |

| 5% or greater beneficial owners as a group | |

| - | | |

| ** | % |

| * | Officer and/or director of our

company |

| (1) | Represent (i) 309,600 shares owned

by Mr. Wen and (ii) 54,001 shares owned by MMBD Information Technology Limited, of which Mr. Wen holds 33.33%. This takes into account

the 1-for-10 reverse stock split on the Company’s common stock that was effectuated on July 13, 2022. MMBD Information Technology

Limited, a Hong Kong corporation with the mailing address of Rm 18D 27/F Ho King Comm. Ctr., 2-16 Fayuen St. Mongkok, Hong Kong 999077

China. |

As

of October 10, 2023, there were 61 registered holders of record of our common shares, based upon information received from our stock transfer

agent. However, this number does not include beneficial owners whose shares were held of record by nominees or broker dealers. The number

of individual holders of record is based exclusively upon our share register and does not address whether a share or shares may be held

by the holder of record on behalf of more than one person or institution who may be deemed to be the beneficial owner of a share or shares

in our company. To our knowledge, no other shareholder beneficially owns more than 5% of our shares. Our company is not owned or controlled

directly or indirectly by any government or by any corporation or by any other natural or legal person severally or jointly. Our major

shareholders do not have any special voting rights.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Due to Related Parties

As

of December 31, 2022 and 2021, balances of due to related parties were $0.

Shareholders’ Contribution

During

the years ended December 31, 2022, 2021 and 2020, there were no shareholder contributions to the Company for working capital needs.

OTHER MATTERS

Management does not know of

any matters other than those stated in this Proxy Statement that are to be presented for action at the meeting. If any other matters should

properly come before the meeting, it is intended that proxies in the accompanying form will be voted on any such other matters in accordance

with the judgment of the persons voting such proxies. Discretionary authority to vote on such matters is conferred by such proxies upon

the persons voting them.

The Company will bear the

cost of preparing, printing, assembling and mailing the proxy card, Proxy Statement and other material which may be sent to shareholders

in connection with this solicitation. It is contemplated that brokerage houses will forward the proxy materials to beneficial owners at

our request. In addition to the solicitation of proxies by use of the mails, officers and regular employees of the Company may solicit

proxies without additional compensation, by telephone or telegraph. We may reimburse brokers or other persons holding Shares in their

names or the names of their nominees for the expenses of forwarding soliciting material to their principals and obtaining their proxies.

WHERE YOU CAN FIND MORE INFORMATION

The Company files annual and

current reports and other documents with the SEC under the Exchange Act. The Company’s SEC filings made electronically through the

SEC’s EDGAR system are available to the public at the SEC’s website at http://www.sec.gov. You may also read and copy any

document we file with the SEC at the SEC’s public reference room located at 100 F Street, NE, Room 1580, Washington, DC 20549. Please

call the SEC at (800) SEC-0330 for further information on the operation of the public reference room.

| October 13, 2023 |

By Order of the Board of Directors |

| |

|

| |

/s/ Xiangdong Wen |

| |

Xiangdong Wen, Chairman |

ANNUAL MEETING OF SHAREHOLDERS OF MMTEC, INC.

November 10, 2023

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIAL:

The Notice of Meeting, Proxy Statement and Proxy

Card are available at:

https://ir.haisc.com/corporate/meeting

Please sign, date and mail your proxy card in

the envelope provided promptly.

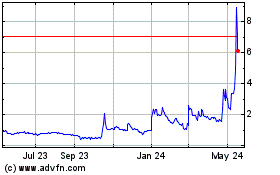

MMTec (NASDAQ:MTC)

Historical Stock Chart

From Jan 2025 to Feb 2025

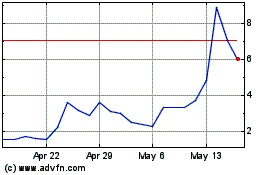

MMTec (NASDAQ:MTC)

Historical Stock Chart

From Feb 2024 to Feb 2025