Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

27 October 2022 - 11:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2022

Commission File Number: 001-36515

Materialise NV

Technologielaan 15

3001

Leuven

Belgium

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

This Form 6-K is incorporated by

reference into the registrant’s Registration Statement on Form F-3 (File No. 333-213649).

Third Quarter 2022 Financial Results

Except as otherwise required by the context, references to “Materialise,” “Company,” “we,” “us” and “our” are

to Materialise NV and its subsidiaries.

Third Quarter 2022 Results

Total revenue for the third quarter of 2022 increased 11.7% to 58,288 kEUR from 52,195 kEUR for the third quarter of 2021.

Revenue from our Materialise Software segment increased 3.8% to 10,863 kEUR for the third quarter of 2022 from 10,468 kEUR for the same quarter last year.

Revenue from our Materialise Medical segment increased 13.1% to 21,391 kEUR for the third quarter of 2022 compared to 18,910 kEUR for the same period in

2021.

Revenue from our Materialise Manufacturing segment increased 14.1% to 26,033 kEUR for the third quarter of 2022 from 22,817 kEUR for the third

quarter of 2021.

Gross profit was 32,042 kEUR compared to 31,076 kEUR for the same period last year, while gross profit as a percentage of revenue

decreased to 55.0% compared to 59.5% for the third quarter of 2021.

Research and development (“R&D”), sales and marketing

(“S&M”) and general and administrative (“G&A”) expenses increased, in the aggregate, 24.5% to 33,491 kEUR for the third quarter of 2022 from 26,900 kEUR for the third quarter of 2021.

Net other operating income increased to 1,166 kEUR from 355 kEUR for the third quarter of 2021.

Operating result amounted to (282) kEUR compared to 4,529 kEUR for the third quarter of 2021.

Net financial result was 2,173 kEUR compared to 4,203 kEUR for the third quarter of 2021.

The third quarter of 2022 contained income tax expenses of (478) kEUR, compared to (75) kEUR in the third quarter of 2021.

As a result of the above, net profit for the third quarter of 2022 was 1,413 kEUR, compared to 8,657 kEUR for the same period in 2021. Total comprehensive

income for the third quarter of 2022, which includes exchange differences on translation of foreign operations, was 1,638 kEUR compared to 8,272 kEUR for the 2021 period.

At September 30, 2022, we had cash and cash equivalents of 150,621 kEUR compared to 196,028 kEUR at December 31, 2021. Gross debt amounted to 83,925

kEUR, compared to 99,107 kEUR at December 31, 2021. As a result, our net cash position (cash and cash equivalents less gross debt) was 66,696 kEUR, a decrease of 30,225 kEUR, and included the effect of our call option exercise to acquire 100%

of the shares of Link3D, and of our acquisition of Identify3D.

Cash flow from operating activities for the third quarter of the year 2022 was 3,840 kEUR compared to 4,388

kEUR for the same period in 2021. Total capital expenditures for the third quarter of 2022 amounted to 9,441 kEUR.

Net shareholders’ equity at

September 30, 2022 was 236,559 kEUR compared to 232,577 kEUR at December 31, 2021.

Adjusted EBITDA amounted to 5,072 kEUR for the third quarter

of 2022 compared to 9,739 kEUR for the 2021 period. The Adjusted EBITDA margin (Adjusted EBITDA divided by total revenue) for the third quarter of 2022 was 8.7%, compared to 18.7% for the third quarter of 2021.

Adjusted EBITDA from our Materialise Software segment decreased, including the effect of ongoing investments in Link3D and Identify3D, to 202 kEUR from 3,708

kEUR while the segment EBITDA margin (segment EBITDA divided by segment revenue) was 1.9% compared to 35.4% for the prior-year period.

Adjusted EBITDA

from our Materialise Medical segment amounted to 4,765 kEUR for the third quarter of 2022 compared to 5,251 kEUR while the segment EBITDA margin was 22.3% compared to 27.8% for the third quarter of 2021.

Adjusted EBITDA from our Materialise Manufacturing segment amounted to 2,530 kEUR compared to 3,546 kEUR for the same period last year, while the segment

EBITDA margin was 9.7% compared to 15.5% for the third quarter of 2021.

Non-IFRS Measures

Materialise uses EBITDA and Adjusted EBITDA as supplemental financial measures of its financial performance. EBITDA is calculated as net profit plus income

taxes, financial expenses (less financial income), shares of profit or loss in a joint venture and depreciation and amortization. Adjusted EBITDA is determined by adding share-based compensation expenses, acquisition-related expenses of business

combinations, impairments and revaluation of fair value due to business combinations to EBITDA. Management believes these non-IFRS measures to be important measures as they exclude the effects of items which

primarily reflect the impact of long-term investment and financing decisions, rather than the performance of the company’s day-to-day operations. As compared to net

profit, these measures are limited in that they do not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenues in the company’s business, or the charges associated with impairments.

Management evaluates such items through other financial measures such as capital expenditures and cash flow provided by operating activities. The company believes that these measurements are useful to measure a company’s ability to grow or as a

valuation measurement. The company’s calculation of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies. EBITDA and Adjusted EBITDA should not be considered as alternatives to net profit or

any other performance measure derived in accordance with IFRS. The company’s presentation of EBITDA and Adjusted EBITDA should not be construed to imply that its future results will be unaffected by unusual or

non-recurring items.

Exchange Rate

This document contains translations of certain euro amounts into U.S. dollars at specified rates solely for the convenience of readers. Unless otherwise noted,

all translations from euros to U.S. dollars in this document were made at a rate of EUR 1.00 to USD 0.9748, the reference rate of the European Central Bank on September 30, 2022.

About Materialise

Materialise incorporates 30 years of 3D printing experience into a range of software solutions and 3D printing services, which form the backbone of the 3D

printing industry. Materialise’s open and flexible solutions enable players in a wide variety of industries, including healthcare, automotive, aerospace, art and design, and consumer goods, to build innovative 3D printing applications that aim

to make the world a better and healthier place. Headquartered in Belgium, with branches worldwide, Materialise combines one of the largest groups of software developers in the industry with one of the largest 3D printing facilities in the world.

Consolidated income statements (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

for the three months ended

September 30, |

|

|

for the nine months ended

September 30, |

|

| In ‘000 |

|

2022 |

|

|

2022 |

|

|

2021(*) |

|

|

2022 |

|

|

2021(*) |

|

| |

|

U.S.$ |

|

|

€ |

|

|

€ |

|

|

€ |

|

|

€ |

|

| Revenue |

|

|

56,819 |

|

|

|

58,288 |

|

|

|

52,195 |

|

|

|

169,319 |

|

|

|

148,461 |

|

| Cost of Sales |

|

|

(25,584 |

) |

|

|

(26,245 |

) |

|

|

(21,119 |

) |

|

|

(76,236 |

) |

|

|

(64,378 |

) |

| Gross Profit |

|

|

31,235 |

|

|

|

32,042 |

|

|

|

31,076 |

|

|

|

93,083 |

|

|

|

84,084 |

|

| Gross profit as % of revenue |

|

|

55.0 |

% |

|

|

55.0 |

% |

|

|

59.5 |

% |

|

|

55.0 |

% |

|

|

56.6 |

% |

| Research and development expenses |

|

|

(9,078 |

) |

|

|

(9,313 |

) |

|

|

(6,602 |

) |

|

|

(26,074 |

) |

|

|

(19,982 |

) |

| Sales and marketing expenses |

|

|

(14,815 |

) |

|

|

(15,198 |

) |

|

|

(12,413 |

) |

|

|

(44,841 |

) |

|

|

(35,730 |

) |

| General and administrative expenses |

|

|

(8,754 |

) |

|

|

(8,980 |

) |

|

|

(7,885 |

) |

|

|

(26,089 |

) |

|

|

(23,449 |

) |

| Net other operating income (expenses) |

|

|

1,137 |

|

|

|

1,166 |

|

|

|

355 |

|

|

|

2,603 |

|

|

|

2,318 |

|

| Operating (loss) profit |

|

|

(275 |

) |

|

|

(282 |

) |

|

|

4,529 |

|

|

|

(1,318 |

) |

|

|

7,239 |

|

| Financial expenses |

|

|

(2,057 |

) |

|

|

(2,110 |

) |

|

|

2,334 |

|

|

|

(4,671 |

) |

|

|

(3,182 |

) |

| Financial income |

|

|

4,175 |

|

|

|

4,283 |

|

|

|

1,869 |

|

|

|

9,800 |

|

|

|

4,426 |

|

| Share in loss of joint venture |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| (Loss) profit before taxes |

|

|

1,843 |

|

|

|

1,891 |

|

|

|

8,732 |

|

|

|

3,812 |

|

|

|

8,483 |

|

| Income Taxes (*) |

|

|

(466 |

) |

|

|

(478 |

) |

|

|

(75 |

) |

|

|

(1,377 |

) |

|

|

(101 |

) |

| Net (loss) profit for the period (*) |

|

|

1,377 |

|

|

|

1,413 |

|

|

|

8,657 |

|

|

|

2,435 |

|

|

|

8,382 |

|

| Net (loss) profit attributable to: |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| The owners of the parent |

|

|

1,385 |

|

|

|

1,421 |

|

|

|

8,660 |

|

|

|

2,457 |

|

|

|

8,386 |

|

| Non-controlling interest |

|

|

(8 |

) |

|

|

(8 |

) |

|

|

(3 |

) |

|

|

(21 |

) |

|

|

(4 |

) |

| Earning per share attributable to owners of the parent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic (*) |

|

|

0.02 |

|

|

|

0.02 |

|

|

|

0.15 |

|

|

|

0.04 |

|

|

|

0.15 |

|

| Diluted (*) |

|

|

0.02 |

|

|

|

0.02 |

|

|

|

0.15 |

|

|

|

0.04 |

|

|

|

0.15 |

|

| Weighted average basic shares outstanding |

|

|

59,064 |

|

|

|

59,064 |

|

|

|

58,731 |

|

|

|

59,064 |

|

|

|

55,935 |

|

| Weighted average diluted shares outstanding |

|

|

59,089 |

|

|

|

59,089 |

|

|

|

58,944 |

|

|

|

59,099 |

|

|

|

56,206 |

|

| (*) |

The year 2021 has been restated to reflect the final accounting of the business combination with RS Print.

Impact on the nine months ended September 30 income taxes and net profit is (46)k€. |

The year 2021 has been

restated to reflect the final accounting of the business combination with RS Print. Impact on the three months ended September 30 income taxes and net profit is 5 k€.

Consolidated statements of comprehensive income (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

for the three months ended

September 30, |

|

|

for the nine months ended

September 30, |

|

| In 000€ |

|

2022 |

|

|

2022 |

|

|

2021(*) |

|

|

2022 |

|

|

2021(*) |

|

| |

|

U.S.$ |

|

|

€ |

|

|

€ |

|

|

€ |

|

|

€ |

|

| Net profit (loss) for the period (*) |

|

|

1,377 |

|

|

|

1,413 |

|

|

|

8,657 |

|

|

|

2,435 |

|

|

|

8,382 |

|

| Other comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Recycling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exchange difference on translation of foreign operations |

|

|

219 |

|

|

|

225 |

|

|

|

(385 |

) |

|

|

1,291 |

|

|

|

1,590 |

|

| Non-recycling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fair value adjustments through OCI - Equity instruments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0 |

) |

|

|

48 |

|

| Other comprehensive income (loss), net of taxes |

|

|

219 |

|

|

|

225 |

|

|

|

(385 |

) |

|

|

1,291 |

|

|

|

1,638 |

|

| Total comprehensive income (loss) for the year, net of taxes |

|

|

1,596 |

|

|

|

1,638 |

|

|

|

8,272 |

|

|

|

3,726 |

|

|

|

10,020 |

|

| Total comprehensive income (loss) attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| The owners of the parent |

|

|

1,604 |

|

|

|

1,646 |

|

|

|

8,275 |

|

|

|

3,748 |

|

|

|

10,023 |

|

| Non-controlling interests |

|

|

(8 |

) |

|

|

(8 |

) |

|

|

(3 |

) |

|

|

(21 |

) |

|

|

(3 |

) |

| (*) |

The year 2021 has been restated to reflect the final accounting of the business combination with RS Print.

Impact on the nine months ended September 30 income taxes and net profit is (46)k€. |

The year 2021 has been

restated to reflect the final accounting of the business combination with RS Print. Impact on the three months ended September 30 income taxes and net profit is 5 k€.

Consolidated statement of financial position

(Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

As of

September 30, |

|

|

As of

December 31, |

|

| In 000€ |

|

2022 |

|

|

2021 |

|

| Assets |

|

|

|

|

|

|

|

|

| Non-current assets |

|

|

|

|

|

|

|

|

| Goodwill |

|

|

50,190 |

|

|

|

18,726 |

|

| Intangible assets |

|

|

38,710 |

|

|

|

31,668 |

|

| Property, plant & equipment |

|

|

92,335 |

|

|

|

84,451 |

|

| Right-of-Use

assets |

|

|

8,520 |

|

|

|

9,054 |

|

| Investments in joint ventures |

|

|

— |

|

|

|

— |

|

| Deferred tax assets |

|

|

217 |

|

|

|

227 |

|

| Investments in convertible loans |

|

|

3,431 |

|

|

|

3,560 |

|

| Investments in non-listed equity instruments |

|

|

399 |

|

|

|

399 |

|

| Other non-current assets |

|

|

4,948 |

|

|

|

7,520 |

|

| Total non-current assets |

|

|

198,750 |

|

|

|

155,605 |

|

| Current assets |

|

|

|

|

|

|

|

|

| Inventories |

|

|

15,532 |

|

|

|

11,295 |

|

| Trade receivables |

|

|

42,329 |

|

|

|

41,541 |

|

| Other current assets |

|

|

8,374 |

|

|

|

8,940 |

|

| Cash and cash equivalents |

|

|

150,621 |

|

|

|

196,028 |

|

| Total current assets |

|

|

216,856 |

|

|

|

257,803 |

|

| Total assets |

|

|

415,606 |

|

|

|

413,408 |

|

|

|

|

|

|

|

|

|

|

| |

|

As of

September 30, |

|

|

As of

December 31, |

|

| In 000€ |

|

2022 |

|

|

2021 |

|

| Equity and liabilities |

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

|

| Share capital |

|

|

4,487 |

|

|

|

4,489 |

|

| Share premium |

|

|

233,869 |

|

|

|

233,872 |

|

| Retained earnings and other reserves |

|

|

(1,797 |

) |

|

|

(5,784 |

) |

| Equity attributable to the owners of the parent |

|

|

236,559 |

|

|

|

232,577 |

|

| Non-controlling interest |

|

|

(21 |

) |

|

|

1 |

|

| Total equity |

|

|

236,538 |

|

|

|

232,578 |

|

| Non-current liabilities |

|

|

|

|

|

|

|

|

| Loans & borrowings |

|

|

58,126 |

|

|

|

72,637 |

|

| Lease liabilities |

|

|

5,004 |

|

|

|

5,268 |

|

| Deferred tax liabilities |

|

|

4,239 |

|

|

|

4,371 |

|

| Deferred income |

|

|

6,932 |

|

|

|

4,952 |

|

| Other non-current liabilities |

|

|

1,027 |

|

|

|

2,168 |

|

| Total non-current liabilities |

|

|

75,328 |

|

|

|

89,396 |

|

| Current liabilities |

|

|

|

|

|

|

|

|

| Loans & borrowings |

|

|

17,593 |

|

|

|

17,849 |

|

| Lease liabilities |

|

|

3,202 |

|

|

|

3,353 |

|

| Trade payables |

|

|

25,038 |

|

|

|

20,171 |

|

| Tax payables |

|

|

1,128 |

|

|

|

783 |

|

| Deferred income |

|

|

36,112 |

|

|

|

33,306 |

|

| Other current liabilities |

|

|

20,667 |

|

|

|

15,972 |

|

| Total current liabilities |

|

|

103,740 |

|

|

|

91,434 |

|

| Total equity and liabilities |

|

|

415,606 |

|

|

|

413,408 |

|

Consolidated statement of cash flows (Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

for the nine months ended

September 30, |

|

| In 000€ |

|

2022 |

|

|

2021* |

|

| Operating activities |

|

|

|

|

|

|

|

|

| Net (loss) profit for the period (*) |

|

|

2,435 |

|

|

|

8,382 |

|

| Non-cash and operational adjustments |

|

|

|

|

|

|

|

|

| Depreciation of property plant & equipment |

|

|

11,335 |

|

|

|

11,460 |

|

| Amortization of intangible assets |

|

|

4,859 |

|

|

|

3,780 |

|

| Impairment of goodwill and intangible assets |

|

|

— |

|

|

|

— |

|

| Share-based payment expense |

|

|

(121 |

) |

|

|

(878 |

) |

| Loss (gain) on disposal of property, plant & equipment |

|

|

59 |

|

|

|

43 |

|

| Movement in provisions |

|

|

(506 |

) |

|

|

7 |

|

| Movement reserve for bad debt and slow moving inventory |

|

|

(42 |

) |

|

|

154 |

|

| Financial income |

|

|

(9,771 |

) |

|

|

(4,426 |

) |

| Financial expense |

|

|

5,009 |

|

|

|

3,182 |

|

| Impact of foreign currencies |

|

|

98 |

|

|

|

107 |

|

| Share in loss (gain) of a joint venture (equity method) |

|

|

— |

|

|

|

— |

|

| (Deferred) income taxes (*) |

|

|

1,384 |

|

|

|

101 |

|

| Other non-current liabilities |

|

|

— |

|

|

|

— |

|

| Working capital adjustments |

|

|

9,109 |

|

|

|

(4,531 |

) |

| Decrease (increase) in trade receivables and other receivables |

|

|

(184 |

) |

|

|

(7,553 |

) |

| Decrease (increase) in inventories and contracts in progress |

|

|

(4,356 |

) |

|

|

(1,770 |

) |

| Increase (decrease) in deferred revenue |

|

|

3,815 |

|

|

|

(56 |

) |

| Increase (decrease) in trade payables and other payables |

|

|

9,834 |

|

|

|

4,848 |

|

| Income tax paid & Interest received |

|

|

(262 |

) |

|

|

108 |

|

| Net cash flow from operating activities |

|

|

23,587 |

|

|

|

17,490 |

|

| (*) |

The year 2021 has been restated to reflect the final accounting of the business combination with RS Print.

Impact on Net profit for the period and on (Deferred) income taxes is (46) k€. |

|

|

|

|

|

|

|

|

|

| |

|

for the nine months ended

September 30, |

|

| In 000€ |

|

2022 |

|

|

2021 |

|

| Investing activities |

|

|

|

|

|

|

|

|

| Purchase of property, plant & equipment |

|

|

(16,066 |

) |

|

|

(4,827 |

) |

| Purchase of intangible assets |

|

|

(3,422 |

) |

|

|

(2,439 |

) |

| Proceeds from the sale of property, plant & equipment & intangible assets

(net) |

|

|

319 |

|

|

|

295 |

|

| Acquisition of subsidiary (net of cash) |

|

|

(29,355 |

) |

|

|

— |

|

| (Convertible) Loans granted |

|

|

— |

|

|

|

1,239 |

|

| Investment in subsidiary, net of cash acquired |

|

|

— |

|

|

|

(1,680 |

) |

| Net cash flow used in investing activities |

|

|

(48,523 |

) |

|

|

(7,412 |

) |

| Financing activities |

|

|

|

|

|

|

|

|

| Repayment of loans & borrowings |

|

|

(15,182 |

) |

|

|

(11,169 |

) |

| Repayment of leases |

|

|

(2,566 |

) |

|

|

(2,841 |

) |

| Capital increase |

|

|

— |

|

|

|

85,787 |

|

| Interest paid |

|

|

(1,665 |

) |

|

|

(1,652 |

) |

| Other financial income (expense) |

|

|

1,378 |

|

|

|

2,740 |

|

| Net cash flow from (used in) financing activities |

|

|

(18,035 |

) |

|

|

72,865 |

|

| Net increase/(decrease) of cash & cash equivalents |

|

|

(42,972 |

) |

|

|

82,943 |

|

| Cash & Cash equivalents at the beginning of the year |

|

|

196,028 |

|

|

|

111,538 |

|

| Exchange rate differences on cash & cash equivalents |

|

|

(2,433 |

) |

|

|

465 |

|

| Cash & cash equivalents at end of the period |

|

|

150,621 |

|

|

|

194,946 |

|

Reconciliation of Net Profit (Loss) to EBITDA and Adjusted EBITDA (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

for the three months ended

September 30, |

|

|

for the nine months ended

September 30, |

|

| In 000€ |

|

2022 |

|

|

2021 (*) |

|

|

2022 |

|

|

2021 (*) |

|

| Net profit (loss) for the period (*) |

|

|

1,413 |

|

|

|

8,657 |

|

|

|

2,435 |

|

|

|

8,382 |

|

| Income taxes (*) |

|

|

478 |

|

|

|

75 |

|

|

|

1,377 |

|

|

|

101 |

|

| Financial expenses |

|

|

2,110 |

|

|

|

(2,334 |

) |

|

|

4,671 |

|

|

|

3,182 |

|

| Financial income |

|

|

(4,283 |

) |

|

|

(1,869 |

) |

|

|

(9,800 |

) |

|

|

(4,426 |

) |

| Depreciation and amortization |

|

|

5,378 |

|

|

|

5,314 |

|

|

|

16,194 |

|

|

|

15,240 |

|

| Share in loss of joint venture |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| EBITDA |

|

|

5,096 |

|

|

|

9,843 |

|

|

|

14,876 |

|

|

|

22,480 |

|

| Share-based compensation expense (1) |

|

|

(24 |

) |

|

|

(104 |

) |

|

|

(121 |

) |

|

|

(878 |

) |

| Acquisition-related expenses of business combinations (2) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

405 |

|

| Adjusted EBITDA |

|

|

5,072 |

|

|

|

9,739 |

|

|

|

14,755 |

|

|

|

22,007 |

|

| (1) |

Share-based compensation expense represents the cost of equity-settled and share-based payments to employees.

|

| (2) |

Acquisition-related expenses of business combinations represents expenses incurred in connection with the

acquisition of our option to buy Link3D. |

| (*) |

The year 2021 has been restated to reflect the final accounting of the business combination with RS Print.

Impact on the nine months ended September 30 income taxes and net profit is (46)k€. |

The year 2021 has been

restated to reflect the final accounting of the business combination with RS Print. Impact on the three months ended September 30 income taxes and net profit is 5 k€.

Segment P&L (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In 000€ |

|

Materialise

Software |

|

|

Materialise

Medical |

|

|

Materialise

Manufacturing |

|

|

Total

segments |

|

|

Unallocated (1) |

|

|

Consolidated |

|

| For the three months ended September 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

10,863 |

|

|

|

21,391 |

|

|

|

26,033 |

|

|

|

58,288 |

|

|

|

0 |

|

|

|

58,288 |

|

| Segment (adj) EBITDA |

|

|

202 |

|

|

|

4,765 |

|

|

|

2,530 |

|

|

|

7,497 |

|

|

|

(2,425 |

) |

|

|

5,072 |

|

| Segment (adj) EBITDA % |

|

|

1.9 |

% |

|

|

22.3 |

% |

|

|

9.7 |

% |

|

|

12.9 |

% |

|

|

|

|

|

|

8.7 |

% |

| For the three months ended September 30, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

10,468 |

|

|

|

18,910 |

|

|

|

22,817 |

|

|

|

52,196 |

|

|

|

(0 |

) |

|

|

52,195 |

|

| Segment (adj) EBITDA |

|

|

3,708 |

|

|

|

5,251 |

|

|

|

3,546 |

|

|

|

12,506 |

|

|

|

(2,767 |

) |

|

|

9,739 |

|

| Segment (adj) EBITDA % |

|

|

35.4 |

% |

|

|

27.8 |

% |

|

|

15.5 |

% |

|

|

24.0 |

% |

|

|

|

|

|

|

18.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In 000€ |

|

Materialise

Software |

|

|

Materialise

Medical |

|

|

Materialise

Manufacturing |

|

|

Total

segments |

|

|

Unallocated (1) |

|

|

Consolidated |

|

| For the nine months ended September 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

31,989 |

|

|

|

60,592 |

|

|

|

76,739 |

|

|

|

169,319 |

|

|

|

0 |

|

|

|

169,319 |

|

| Segment (adj) EBITDA |

|

|

2,955 |

|

|

|

12,466 |

|

|

|

6,722 |

|

|

|

22,144 |

|

|

|

(7,388 |

) |

|

|

14,755 |

|

| Segment (adj) EBITDA % |

|

|

9.2 |

% |

|

|

20.6 |

% |

|

|

8.8 |

% |

|

|

13.1 |

% |

|

|

|

|

|

|

8.7 |

% |

| For the nine months ended September 30, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

30,719 |

|

|

|

52,686 |

|

|

|

65,199 |

|

|

|

148,604 |

|

|

|

(142 |

) |

|

|

148,461 |

|

| Segment (adj) EBITDA |

|

|

10,266 |

|

|

|

14,313 |

|

|

|

5,252 |

|

|

|

29,831 |

|

|

|

(7,826 |

) |

|

|

22,004 |

|

| Segment (adj) EBITDA % |

|

|

33.4 |

% |

|

|

27.2 |

% |

|

|

8.1 |

% |

|

|

20.1 |

% |

|

|

|

|

|

|

14.8 |

% |

| (1) |

Unallocated segment adjusted EBITDA consists of corporate research and development and corporate other

operating income (expense), and the added share-based compensation expenses, acquisition related expenses of business combinations, impairments and fair value of business combinations that are included in Adjusted EBITDA. |

Reconciliation of Net Profit (Loss) to Segment adjusted EBITDA (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

for the three months ended

September 30, |

|

|

for the nine months ended

September 30, |

|

| In 000€ |

|

2022 |

|

|

2021 (*) |

|

|

2022 |

|

|

2021 (*) |

|

| Net profit (loss) for the period (*) |

|

|

1,413 |

|

|

|

8,657 |

|

|

|

2,435 |

|

|

|

8,382 |

|

| Income taxes (*) |

|

|

478 |

|

|

|

75 |

|

|

|

1,377 |

|

|

|

101 |

|

| Financial cost |

|

|

2,110 |

|

|

|

(2,334 |

) |

|

|

4,671 |

|

|

|

3,182 |

|

| Financial income |

|

|

(4,283 |

) |

|

|

(1,869 |

) |

|

|

(9,800 |

) |

|

|

(4,426 |

) |

| Share in loss of joint venture |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Operating (loss) profit |

|

|

(282 |

) |

|

|

4,529 |

|

|

|

(1,318 |

) |

|

|

7,239 |

|

| Depreciation and amortization |

|

|

5,378 |

|

|

|

5,314 |

|

|

|

16,194 |

|

|

|

15,240 |

|

| Corporate research and development |

|

|

592 |

|

|

|

710 |

|

|

|

2,057 |

|

|

|

2,191 |

|

| Corporate headquarter costs |

|

|

2,491 |

|

|

|

2,463 |

|

|

|

7,103 |

|

|

|

6,907 |

|

| Other operating income (expense) |

|

|

(681 |

) |

|

|

(511 |

) |

|

|

(1,892 |

) |

|

|

(1,745 |

) |

| Segment adjusted EBITDA |

|

|

7,497 |

|

|

|

12,506 |

|

|

|

22,144 |

|

|

|

29,831 |

|

| (*) |

The year 2021 has been restated to reflect the final accounting of the business combination with RS Print.

Impact on the nine months ended September 30 income taxes and net profit is (46)k€. |

The year 2021 has been

restated to reflect the final accounting of the business combination with RS Print. Impact on the three months ended September 30 income taxes and net profit is 5 k€.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

| MATERIALISE NV |

|

|

| By: |

|

/s/ Wilfried Vancraen |

| Name: |

|

Wilfried Vancraen |

| Title: |

|

Chief Executive Officer |

Date: October 27, 2022

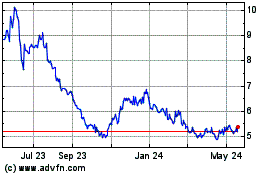

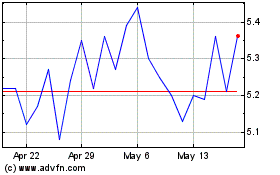

Materialise NV (NASDAQ:MTLS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Materialise NV (NASDAQ:MTLS)

Historical Stock Chart

From Nov 2023 to Nov 2024