false

0001499961

0001499961

2024-10-02

2024-10-02

0001499961

muln:CommonStockParValue0.001Member

2024-10-02

2024-10-02

0001499961

muln:RightsToPurchaseSeriesA1JuniorParticipatingPreferredStockMember

2024-10-02

2024-10-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

October 2, 2024 |

MULLEN AUTOMOTIVE INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-34887 |

|

86-3289406 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1405 Pioneer Street, Brea, California 92821

(Address, including

zip code, of principal executive offices)

| Registrant’s telephone number, including area code |

(714) 613-1900 |

(Former name or former

address, if changed since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 |

|

MULN |

|

The Nasdaq Stock Market, LLC

(Nasdaq Capital Market) |

| Rights to Purchase Series A-1 Junior Participating Preferred Stock |

|

None |

|

The Nasdaq Stock Market, LLC

(Nasdaq Capital Market) |

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. | Results of Operations and Financial Condition. |

On October 2, 2024, Mullen Automotive Inc. (the

“Company”) issued a press release announcing certain preliminary financial results for the fiscal quarter ended September

30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report and incorporated herein by reference.

The information in this Item 2.02 and Exhibit

99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of

1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities

Act”), except as shall be expressly set forth by specific reference in such filing.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

On October 2, 2024, pursuant to the terms of the

Securities Purchase Agreement dated May 14, 2024 between the Company and certain investors (the “Securities Purchase Agreement”),

which was previously disclosed in the Company’s Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission

on May 14, 2024 (the “Form 10-Q”), certain investors partially exercised the additional investment right and purchased

additional 5% Original Issue Discount Senior Secured Notes that are convertible into shares of the Company’s common stock, par value

$0.001 per share (the “Common Stock”), in the initial aggregate principal amount of $621,053 (or $590,000 excluding

the 5% original issue discount) (the “Notes”) and also received five-year warrants exercisable on a cash basis for

an aggregate of 2,264. shares of Common Stock (the “Warrants”). The Warrants may also be exercised on a cashless basis

pursuant to the formula set forth therein and as further described in the Form 10-Q. The Notes and Warrants have the same terms and conditions

as the previously issued notes and warrants as described in the Form 10-Q. The Notes issued on October 2, 2024 together with the Notes

in the initial aggregate principal amount of $12.5 million (or $11.9 million excluding the 5% original issue discount) issued on September

25 and 27, 2024, which were previously reported by the Company in a Current Report on Form 8-K filed with the Securities and Exchange

Commission on October 1, 2024, totals approximately $13.2 million (or $12.5 million excluding the 5% original issue discount) of the additional

investment right set forth in the Securities Purchase Agreement.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The disclosure required by this Item is included

above in Item 2.03 of this Current Report on Form 8-K and is incorporated herein by reference. The Notes and Warrants issued to the investors

pursuant to the Securities Purchase Agreement, and upon conversion or exercise, as applicable, the shares of Common Stock will be issued

pursuant to the exemption from registration for transactions by an issuer not involving any public offering under Section 4(a)(2) of the

Securities Act.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

MULLEN AUTOMOTIVE INC. |

| |

|

|

| Date: October 2, 2024 |

By: |

/s/ David Michery |

| |

|

David Michery |

| |

|

Chief Executive Officer |

Exhibit 99.1

Mullen Announces Significant Revenue Increase

and Reduction

in Spending

For quarter ended Sept. 30, 2024, Company expects

to report approximately $4.5 million in revenue compared to $65,235.00 reported in quarter ended June 30, 2024, an increase of 6791% compared

to prior quarter

Mullen reported a monthly cash burn (operating

and investing cashflows) of $12.8 million for the quarter ended June 30, 2024, as compared to a monthly cash burn of $18.1 million for

the quarter ended March 31, 2024, representing a decrease of 30% or $5.3 million per month. Company’s monthly cash burn for the

quarter ended Sept. 30, 2024, is approximately $12.7 million per month

The Company plans to continue to improve its

cash burn with operating reductions throughout 2025 with the expectation to achieve breakeven on a cash basis by end of December 2025

BREA, Calif., October 02, 2024– via InvestorWire

– Mullen Automotive, Inc. (NASDAQ: MULN) (“Mullen” or the “Company”), an electric

vehicle (“EV”) manufacturer, announces today that it expects $4.5 million in revenue for quarter ended Sept. 30, 2024,

compared to $65,235.00 reported in quarter ended June 30, 2024, an increase of 6791% compared to prior quarter. The Company also provides

an operational update, which includes initiatives it has recently taken to reduce overall operating expenses.

Mullen operational updates include:

| ● | As of today, Company received $11.9 million,

and expects to receive an additional $600,000 from investors, representing 25% of their additional investment right |

| ● | Company has an additional investment commitment

of $150 million through the use of its equity line, which allows it to offer common stock, subject to market and other conditions |

| ● | For quarter ended Sept. 30, 2024, Company

expects to report approximately $4.5 million in revenue compared to $65,235.00 reported in quarter ended June 30, 2024, an increase

of 6791% compared to prior quarter |

| ● | Mullen reported a monthly cash burn (operating

and investing cashflows) of $12.8 million for the quarter ended June 30, 2024, as compared to a monthly cash burn of $18.1 million for

the quarter ended March 31, 2024, representing a decrease of 30% or $5.3 million per month. The Company’s monthly cash burn for

the quarter ended Sept. 30, 2024, is approximately $12.7 million per month |

| ● | The Company plans to continue to improve its

cash burn with operating reductions throughout 2025 with the expectation to achieve breakeven on a cash basis by December 2025 |

“Our revenue is up significantly, and our

cash burn continues to decrease,” said David Michery, CEO and chairman of Mullen Automotive. “We are going into the remainder

of 2024 with strong momentum, and I am focused on closing out the calendar year on an extremely positive trajectory.”

About Mullen

Mullen Automotive (NASDAQ: MULN) is a Southern

California-based automotive company building the next generation of commercial electric vehicles (“EVs”) with two United States-based

vehicle plants located in Tunica, Mississippi, (120,000 square feet) and Mishawaka, Indiana (650,000 square feet). In August 2023, Mullen

began commercial vehicle production in Tunica. In September 2023, Mullen received IRS approval for federal EV tax credits on its commercial

vehicles with a Qualified Manufacturer designation that offers eligible customers up to $7,500 per vehicle. As of January 2024, both the

Mullen ONE, a Class 1 EV cargo van, and Mullen THREE, a Class 3 EV cab chassis truck, are California Air Resource Board (“CARB”)

and EPA certified and available for sale in the U.S. Recently, CARB issued HVIP approval on the Mullen THREE, Class 3 EV truck, providing

up to $45,000 cash voucher at time of vehicle purchase. The Company has also recently expanded its commercial dealer network to seven

dealers with the addition of Papé Kenworth. Other previously announced dealers include Pritchard EV, National Auto Fleet Group,

Ziegler Truck Group, Range Truck Group, Eco Auto, and Randy Marion Auto Group, providing sales and service coverage in key Midwest, West

Coast, Pacific Northwest, New England and Mid-Atlantic markets. The Company has also announced Foreign Trade Zone (“FTZ”)

status approval for its Tunica, Mississippi, commercial vehicle manufacturing center. FTZ approval provides a number of benefits, including

deferment of duties owed and elimination of duties on exported vehicles.

To learn more about the Company, visit www.MullenUSA.com.

Estimated Preliminary Results for the Fourth Quarter

Ended Sept. 30, 2024 (Unaudited)

Set forth above are certain estimated preliminary

financial results and other key business metrics for the fourth quarter ended Sept. 30, 2024. These estimates are based on the information

available to us at this time. Our actual results may differ materially from the estimated preliminary results presented due to the completion

of our financial closing and accounting procedures, including final adjustments, the completion of the preparation and audit of the Company’s

financial statements and the subsequent occurrence or identification of events prior to the filing of the audited consolidated financial

statements for the fiscal year ended Sept. 30, 2024, in its Annual Report on Form 10-K. The estimated preliminary financial results and

other key business metrics have not been audited or reviewed by our independent registered public accounting firm. These estimates should

not be viewed as a substitute for our full interim or annual financial statements. Accordingly, you should not place undue reliance on

this preliminary data. In addition, any such statements regarding the Company’s financial performance are not necessarily indicative

of the Company’s financial performance that may be expected to occur for the fiscal quarter ending Sept. 30, 2024, or for any future

fiscal period.

Forward-Looking Statements

Certain statements in this press release that

are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Exchange Act of 1934, as amended.

Any statements contained in this press release that are not statements of historical fact may be deemed forward-looking statements. Words

such as "continue," "will," "may," "could," "should," "expect," "expected,"

"plans," "intend," "anticipate," "believe," "estimate," "predict," "potential"

and similar expressions are intended to identify such forward-looking statements. All forward-looking statements involve significant risks

and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements,

many of which are generally outside the control of Mullen and are difficult to predict. Examples of such risks and uncertainties include,

but are not limited to, whether the Company will be successful with cost-cutting initiatives or achieve anticipated expense reduction

within expected timeframes, how long governmental incentives for electric vehicles will remain in place, and the resultant selling prices

of Mullen vehicles. Additional examples of such risks and uncertainties include but are not limited to: (i) Mullen’s ability (or

inability) to obtain additional financing in sufficient amounts or on acceptable terms when needed; (ii) Mullen's ability to maintain

existing, and secure additional, contracts with manufacturers, parts and other service providers relating to its business; (iii) Mullen’s

ability to successfully expand in existing markets and enter new markets; (iv) Mullen’s ability to successfully manage and integrate

any acquisitions of businesses, solutions or technologies; (v) unanticipated operating costs, transaction costs and actual or contingent

liabilities; (vi) the ability to attract and retain qualified employees and key personnel; (vii) adverse effects of increased competition

on Mullen’s business; (viii) changes in government licensing and regulation that may adversely affect Mullen’s business; (ix)

the risk that changes in consumer behavior could adversely affect Mullen’s business; (x) Mullen’s ability to protect its intellectual

property; and (xi) local, industry and general business and economic conditions. Additional factors that could cause actual results to

differ materially from those expressed or implied in the forward-looking statements can be found in the most recent annual report on Form

10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed by Mullen with the Securities and Exchange Commission. Mullen

anticipates that subsequent events and developments may cause its plans, intentions and expectations to change. Mullen assumes no obligation,

and it specifically disclaims any intention or obligation, to update any forward-looking statements, whether as a result of new information,

future events or otherwise, except as expressly required by law. Forward-looking statements speak only as of the date they are made and

should not be relied upon as representing Mullen’s plans and expectations as of any subsequent date.

Contact:

Mullen Automotive, Inc.

+1 (714) 613-1900

www.MullenUSA.com

Corporate Communications:

InvestorBrandNetwork (IBN)

Los Angeles, California

www.InvestorBrandNetwork.com

310.299.1717 Office

Editor@InvestorBrandNetwork.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=muln_CommonStockParValue0.001Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=muln_RightsToPurchaseSeriesA1JuniorParticipatingPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

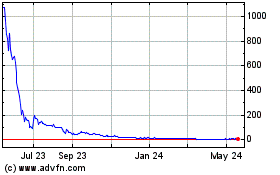

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Oct 2024 to Nov 2024

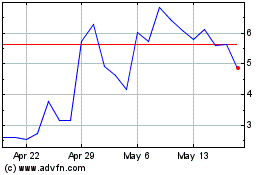

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Nov 2023 to Nov 2024