Nano Labs Ltd (Nasdaq: NA) (“we,” the “Company” or “Nano Labs”), a

leading fabless integrated circuit design company and product

solution provider in China, today announced its unaudited financial

results as of June 30, 2024 and for the first half of 2024 then

ended.

First Half of 2024 Financial

Highlights

- Net revenue was RMB24.7 million (US$3.5 million) for the first

half of 2024, compared to RMB52.3 million in the same period of

2023.

- Gross profit was RMB30.1 thousand (US$4.2 thousand) for the

first half of 2024, compared to a gross loss of RMB62.9 million in

the same period of 2023.

- Loss from operations was RMB58.7 million (US$8.2 million) for

the first half of 2024, compared to a loss from operations of

RMB136.4 million in the same period of 2023.

- Net loss was RMB59.1 million (US$8.3 million) for the first

half of 2024, compared to a net loss of RMB134.3 million in the

same period of 2023.

- Net loss per share (both basic and diluted) was RMB0.85

(US$0.12) for the first half of 2024, compared to a net loss per

share (both basic and diluted) of RMB2.41 in the same period of

2023.

Mr. Jianping Kong, Chairman and Chief Executive

Officer of the Company, commented, “the first half of 2024 have

shown clear signs of industry recovery and emerging market

opportunities. In response to the exciting bullish market, our

company has been heavily investing in the research and development

of our upgraded Cuckoo series products. In May, we announced the

successful mass production of the Cuckoo 3.0 chip, which

significantly outperforms its predecessor, the Cuckoo 2.0 chip.

This breakthrough positions us to capitalize on new market

opportunities. Our company will continue to launch various models

equipped with the Cuckoo 3.0 chip for different application

scenarios in the second half of this year and the first half of

2025. We expect this will substantially boost our sales.

Additionally, our company is continuously

improving packaging technology and IP to boost the efficiency of

chip production. We are also actively developing promising AI

computing and ZK computing chips.

At the same time, our iPollo Metaverse's

photograph studio service is steadily advancing, with deep

cooperation with various institutions and organizations. We believe

this venture has the potential for explosive growth in the

future.”

Mr. Bing Chen, Chief Financial Officer,

commented, “for the first half of 2024, our net revenue was RMB24.7

million (US$3.5 million). In addition, the net loss was RMB59.1

million (US$8.3 million) for the six months ended June 30, 2024,

compared to a net loss of RMB134.3 million in the same period of

2023. Looking ahead, we are committed to overcoming current

challenges and improving our performance.”

First Half of 2024 Financial

Results

Net Revenues

Net revenue was RMB24.7 million (US$3.5 million)

for the first half of 2024, compared to RMB52.3 million for the

same period of 2023. The decrease in net revenues was primarily due

to the drop of sales volume of iPollo V1 Series. The revenues in

3D-printing products, our new products, was RMB459.2 thousand for

the first half of 2024, compared to RMB22.0 thousand for the same

period of 2023.

Cost of Revenues

Cost of revenues was RMB24.7 million (US$3.5

million) for the first half of 2024, compared to RMB115.2 million

for the same period of 2023. The change was mainly due to the

decrease in sales volume and less inventory write-down

recorded.

The cost of 3D-printing products was RMB338.7

thousand for the first half of 2024, compared to RMB10.2 thousand

for the same period of 2023.

Operating Expenses

Total operating expenses decreased by 20.1% to

RMB58.7 million (US$8.2 million) for the first half of 2024, from

RMB73.5 million for the same period of 2023.

- Selling and

marketing expenses decreased by 54.4% to RMB4.3 million (US$0.6

million) for the first half of 2024, from RMB9.5 million for the

same period of 2023. The decrease in selling and marketing expenses

was primarily due to the decrease in sales commission and product

shipping expenses.

- General and

administrative expenses decreased by 18.0% to RMB25.5 million

(US$3.6 million) for the first half of 2024, from RMB31.0 million

for the same period of 2023. The decrease in general and

administrative expenses was primarily due to (1) the decrease in

office lease expenses mainly attributable to the relocation of the

head office and (2) the decrease in employee salary expenses as the

number and salaries of general and administrative staff

decreased.

- Research and

development expenses decreased by 12.2% to RMB28.9 million (US$4.1

million) for the first half of 2024, from RMB33.0 million for the

same period of 2023. The decrease in research and development

expenses was primarily due to the decrease in salary expenses.

Loss from Operations

As a result of the foregoing, loss from

operations decreased by 57.0% to RMB58.7 million (US$8.2 million)

for the first half of 2024 from RMB136.4 million for the same

period of 2023.

Finance Expense (Income)

Finance income was RMB0.6 million (US$0.1

million) for the first half of 2024, compared with finance expense

of RMB1.6 million for the same period of 2023.

Interest expense

Interest expense was RMB2.0 million (US$0.3

million) for the first half of 2024, compared to nil for the same

period of 2023. The change was due to the completion of

construction in progress and cease of interest capitalization

during the first half of 2024.

Net Loss

Net loss was RMB59.1 million (US$8.3 million)

for the first half of 2024, compared with RMB134.3 million in the

same period of 2023.

Basic and Diluted Loss Per Ordinary

Share attributable to Nano Labs Ltd

Basic and diluted loss per share was RMB0.85

(US$0.12) for the first half of 2024, compared with basic and

diluted loss per share of RMB2.41 for the same period of 2023.

Financial Condition

As of June 30, 2024, the Company had cash and

cash equivalents of RMB23.5 million (US$3.3 million), compared with

RMB48.2 million as of December 31, 2023. As of June 30, 2024, the

Company had total current assets of RMB110.8 million (US$15.5

million), compared with RMB125.5 million as of December 31,

2023.

As of June 30, 2024, the Company had short-term

debts, current portion of long-term debts and accounts payable in

total of RMB42.8 million (US$6.0 million), compared with RMB40.3

million as of December 31, 2023. As of June 30, 2024, the Company

had total current liabilities excluding advance from customers of

RMB130.8 million (US$18.4 million), compared with RMB134.7 million

as of December 31, 2023.

In August and September, 2024, the Company

entered into related party loan agreements with two shareholders to

borrow interest-free loans in the total amount of US$8.5 million

(RMB60.6 million) in cash (“the Loans”) to fund the Company’s

working capital. The Loans are due on the one-year anniversary of

the agreement dates. The proceeds have been fully received through

September 5, 2024 to September 12, 2024.

Exchange Rate

This press release contains translations of

certain Renminbi (RMB) amounts into U.S. dollars (US$) solely for

the convenience of the reader. Unless otherwise specified, all

translations of Renminbi amounts into U.S. dollar amounts in this

press release are made at RMB7.1268 to US$1.00, the central parity

rate on June 30, 2024 published by the People’s Bank of China.

Non-GAAP Financial Measures

In evaluating our business, we consider and use

adjusted net income/(loss) as an additional non-GAAP measure to

review and assess our operating performance. The presentation of

the non-GAAP financial measure is not intended to be considered in

isolation or as a substitute for the financial information prepared

and presented in accordance with U.S. GAAP. We define adjusted net

income/(loss) as net income/(loss) excluding share-based

compensation expense.

We present the non-GAAP financial measure

because they are used by our management to evaluate our operating

performance and formulate business plans. Non-GAAP financial

measures enable our management to assess our operating results

without considering the impact of non-cash charges and

non-operating items. We also believe that the use of the non-GAAP

measure facilitates investors’ assessment of our operating

performance.

The non-GAAP financial measure is not defined

under U.S. GAAP and is not presented in accordance with U.S. GAAP.

The non-GAAP financial measure has limitations as analytical tools.

One of the key limitations of using the non-GAAP financial measure

is that they do not reflect all items of income and expense that

affect our operations. Share-based compensation expenses have

been and may continue to be incurred in our business and are not

reflected in the presentation of adjusted net income/(loss).

Further, the non-GAAP measure may differ from the non-GAAP

information used by other companies, including peer companies, and

therefore their comparability may be limited.

Conference Call

The Company will host an earnings conference call to discuss its

financial results at 8:30 am U.S. Eastern Time (8:30 pm Beijing

Time) on September 18, 2024.

For participants who wish to join the call, please access the

link provided below to complete the online registration

process.

Registration

Link: https://s1.c-conf.com/diamondpass/10041922-qbgnye.html

Upon registration, participants will receive the dial-in number

and unique PIN, which can be used to join the conference call. If

participants register and forget their PIN or lose their

registration confirmation email, they may simply re-register and

receive a new PIN. All participants are encouraged to dial in 15

minutes prior to the start time.

A live and archived webcast of the conference call will be

accessible on the Company's investor relations website at:

https://ir.nano.cn/.

A telephone replay of the call will be available until September

25, 2024 via the following dial-in details:

Dial-in Numbers:

|

US/Canada: |

1855 883 1031 |

|

Hong Kong: |

800 930 639 |

|

China: |

400 1209 216 |

| Replay PIN: |

10041922 |

|

|

About Nano Labs Ltd

Nano Labs Ltd is a leading fabless integrated

circuit (“IC”) design company and product solution provider in

China. Nano Labs is committed to the development of high throughput

computing (“HTC”) chips, high performance computing (“HPC”) chips,

distributed computing and storage solutions, smart network

interface cards (“NICs”) vision computing chips and distributed

rendering. Nano Labs has built a comprehensive flow processing unit

(“FPU”) architecture which offers solution that integrates the

features of both HTC and HPC. Nano Lab’s Cuckoo series are one of

the first near-memory HTC chips available in the market*. For more

information, please visit the Company’s website at: ir.nano.cn.

*According to an industry report prepared by

Frost & Sullivan.

Forward-Looking Statements

This report contains forward-looking statements

within the meaning of Section 21E of the Securities Exchange Act of

1934, as amended, and as defined in the U.S. Private Securities

Litigation Reform Act of 1995. These forward-looking statements

include, without limitation, the Company’s plan to appeal the

Staff’s determination, which can be identified by terminology such

as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,”

“intend,” “plan,” “believe,” “potential,” “continue,” “is/are

likely to” or other similar expressions. Such statements are based

upon management’s current expectations and current market and

operating conditions, and relate to events that involve known or

unknown risks, uncertainties and other factors, all of which are

difficult to predict and many of which are beyond the Company’s

control, which may cause the Company’s actual results, performance

or achievements to differ materially from those in the

forward-looking statements. Further information regarding these and

other risks, uncertainties or factors is included in the Company’s

filings with the Securities and Exchange Commission. The Company

does not undertake any obligation to update any forward-looking

statement as a result of new information, future events or

otherwise, except as required under law.

For investor and media inquiries, please

contact:

Nano Labs LtdEmail: ir@nano.cn

Ascent Investor Relations LLCTina XiaoPhone:

+1-646-932-7242Email: investors@ascent-ir.com

|

Consolidated Balance Sheets |

|

(Unaudited) |

|

|

|

|

|

|

|

| |

As of December 31, |

|

As of June 30, |

|

|

2023 |

|

2024 |

|

|

RMB |

|

RMB |

|

US$ |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

48,164,664 |

|

|

23,506,562 |

|

|

3,298,333 |

|

|

Restricted cash |

417,990 |

|

|

418,201 |

|

|

58,680 |

|

|

Accounts receivable, net |

1,739,065 |

|

|

486,251 |

|

|

68,229 |

|

|

Inventories, net |

12,874,986 |

|

|

8,777,977 |

|

|

1,231,686 |

|

|

Prepayments |

24,386,010 |

|

|

23,847,057 |

|

|

3,346,110 |

|

|

Other current assets |

37,908,092 |

|

|

53,747,621 |

|

|

7,541,621 |

|

| Total current

assets |

125,490,807 |

|

|

110,783,669 |

|

|

15,544,659 |

|

| Non-current

assets: |

|

|

|

|

|

|

Property, plant and equipment, net |

169,653,582 |

|

|

199,842,200 |

|

|

28,040,944 |

|

|

Intangible asset, net |

47,731,288 |

|

|

47,238,366 |

|

|

6,628,272 |

|

|

Operating lease right-of-use assets |

7,424,554 |

|

|

7,041,815 |

|

|

988,075 |

|

| Total non-current

assets |

224,809,424 |

|

|

254,122,381 |

|

|

35,657,291 |

|

| |

|

|

|

|

|

| TOTAL

ASSETS |

350,300,231 |

|

|

364,906,050 |

|

|

51,201,950 |

|

| |

|

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS' DEFICIT |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

Short-term debts |

20,000,000 |

|

|

20,000,000 |

|

|

2,806,309 |

|

|

Current portion of long-term debts |

3,410,000 |

|

|

4,580,000 |

|

|

642,645 |

|

|

Accounts payable |

16,875,586 |

|

|

18,204,768 |

|

|

2,554,410 |

|

|

Advance from customers |

107,826,617 |

|

|

101,190,688 |

|

|

14,198,615 |

|

|

Operating lease liabilities, current |

3,479,752 |

|

|

2,892,871 |

|

|

405,914 |

|

|

Other current liabilities |

90,978,171 |

|

|

85,149,822 |

|

|

11,947,834 |

|

| Total current

liabilities |

242,570,126 |

|

|

232,018,149 |

|

|

32,555,727 |

|

| Non-current

liabilities: |

|

|

|

|

|

|

Long-term debts |

120,260,783 |

|

|

158,660,063 |

|

|

22,262,455 |

|

|

Operating lease liabilities, non-current |

3,730,672 |

|

|

3,938,710 |

|

|

552,662 |

|

| Total non-current

liabilities |

123,991,455 |

|

|

162,598,773 |

|

|

22,815,117 |

|

| Total

liabilities |

366,561,581 |

|

|

394,616,922 |

|

|

55,370,844 |

|

| Shareholders'

deficit: |

|

|

|

|

|

|

Class A ordinary shares ($0.0002 par value; 121,410,923 shares

authorized; 41,927,302 and 46,275,127 shares issued as of December

31, 2023 and June 30, 2024, respectively; 37,242,359 and 41,672,037

shares outstanding as of December 31, 2023 and June 30, 2024,

respectively)* |

50,106 |

|

|

56,398 |

|

|

7,914 |

|

|

Class B ordinary shares ($0.0002 par value; 28,589,078 shares

authorized; 28,589,078 shares issued and outstanding as of December

31, 2023 and June 30, 2024)* |

36,894 |

|

|

36,894 |

|

|

5,177 |

|

|

Additional paid-in capital |

428,310,028 |

|

|

459,199,604 |

|

|

64,432,789 |

|

|

Accumulated deficit |

(452,031,693 |

) |

|

(509,265,433 |

) |

|

(71,457,798 |

) |

|

Statutory reserves |

6,647,109 |

|

|

6,647,109 |

|

|

932,692 |

|

|

Accumulated other comprehensive income |

2,254,558 |

|

|

7,055,364 |

|

|

989,976 |

|

| Total Nano Labs Ltd

shareholders' deficit |

(14,732,998 |

) |

|

(36,270,064 |

) |

|

(5,089,250 |

) |

|

Noncontrolling interests |

(1,528,352 |

) |

|

6,559,192 |

|

|

920,356 |

|

| Total shareholders'

deficit |

(16,261,350 |

) |

|

(29,710,872 |

) |

|

(4,168,894 |

) |

| |

|

|

|

|

|

| TOTAL LIABILITIES AND

SHAREHOLDERS' DEFICIT |

350,300,231 |

|

|

364,906,050 |

|

|

51,201,950 |

|

| |

*After giving effect of the 2-for-1 reverse stock split

effective on January 31, 2024.

|

Consolidated Statements of Operations and Comprehensive

Income (Loss) |

|

(Unaudited) |

|

|

|

|

|

|

|

| |

For the six months ended June 30, |

|

|

2023 |

|

2024 |

|

|

RMB |

|

RMB |

|

US$ |

|

Net revenues |

52,268,716 |

|

|

24,739,480 |

|

|

3,471,331 |

|

| Cost of

revenues |

115,167,091 |

|

|

24,709,417 |

|

|

3,467,112 |

|

| Gross profit

(loss) |

(62,898,375 |

) |

|

30,063 |

|

|

4,219 |

|

| |

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

Selling and marketing expenses |

9,501,537 |

|

|

4,334,564 |

|

|

608,206 |

|

|

General and administrative expenses |

31,041,335 |

|

|

25,453,212 |

|

|

3,571,478 |

|

|

Research and development expenses |

32,953,337 |

|

|

28,934,228 |

|

|

4,059,919 |

|

|

Total operating expenses |

73,496,209 |

|

|

58,722,004 |

|

|

8,239,603 |

|

| |

|

|

|

|

|

| Loss from

operations |

(136,394,584 |

) |

|

(58,691,941 |

) |

|

(8,235,384 |

) |

| |

|

|

|

|

|

| Other expenses

(income): |

|

|

|

|

|

|

Finance expenses (income) |

1,600,591 |

|

|

(607,804 |

) |

|

(85,284 |

) |

|

Interest expenses |

- |

|

|

2,009,586 |

|

|

281,976 |

|

|

Interest income |

(335,986 |

) |

|

(96,679 |

) |

|

(13,566 |

) |

|

Other income |

(3,339,708 |

) |

|

(851,374 |

) |

|

(119,461 |

) |

| Total other expenses

(income) |

(2,075,103 |

) |

|

453,729 |

|

|

63,665 |

|

| |

|

|

|

|

|

| Loss before income tax

provision |

(134,319,481 |

) |

|

(59,145,670 |

) |

|

(8,299,049 |

) |

|

Income tax provision |

- |

|

|

- |

|

|

- |

|

| Net loss |

(134,319,481 |

) |

|

(59,145,670 |

) |

|

(8,299,049 |

) |

| Less: net loss

attributable to noncontrolling interests |

- |

|

|

(1,911,930 |

) |

|

(268,273 |

) |

| Net loss attributable

to Nano Labs Ltd |

(134,319,481 |

) |

|

(57,233,740 |

) |

|

(8,030,776 |

) |

|

|

|

|

|

|

|

| Comprehensive income

(loss): |

|

|

|

|

|

|

Net loss |

(134,319,481 |

) |

|

(59,145,670 |

) |

|

(8,299,049 |

) |

|

Other comprehensive income: |

|

|

|

|

|

|

Foreign currency translation adjustment |

1,771,255 |

|

|

4,800,723 |

|

|

673,616 |

|

| Total comprehensive

loss |

(132,548,226 |

) |

|

(54,344,947 |

) |

|

(7,625,433 |

) |

|

Comprehensive loss attributable to noncontrolling interests |

- |

|

|

(1,912,013 |

) |

|

(268,285 |

) |

| Comprehensive loss

attributable to Nano Labs Ltd |

(132,548,226 |

) |

|

(52,432,934 |

) |

|

(7,357,148 |

) |

| |

|

|

|

|

|

| Net loss per ordinary

share attributable to Nano Labs Ltd |

|

|

|

|

|

|

Basic* |

(2.41 |

) |

|

(0.85 |

) |

|

(0.12 |

) |

|

Diluted* |

(2.41 |

) |

|

(0.85 |

) |

|

(0.12 |

) |

| |

|

|

|

|

|

| Weighted average

number of shares used in per share calculation: |

|

|

|

|

|

|

Basic* |

55,748,336 |

|

|

67,666,712 |

|

|

67,666,712 |

|

|

Diluted* |

55,748,336 |

|

|

67,666,712 |

|

|

67,666,712 |

|

|

|

*After giving effect of the 2-for-1 reverse stock split

effective on January 31, 2024.

|

Non-GAAP Reconciliation |

|

(Unaudited) |

|

|

For the Six Months Ended June 30, |

|

|

2023 |

|

2024 |

|

|

RMB |

RMB |

US$ |

|

Net loss |

(134,319,481 |

) |

|

(59,145,670 |

) |

(8,299,049 |

) |

|

Add: |

|

|

|

|

Share-based compensation expenses |

137,598 |

|

|

285,507 |

|

40,061 |

|

|

Non-GAAP adjusted net loss |

(134,181,883 |

) |

|

(58,860,163 |

) |

(8,258,988 |

) |

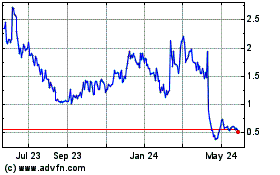

Nano Labs (NASDAQ:NA)

Historical Stock Chart

From Oct 2024 to Nov 2024

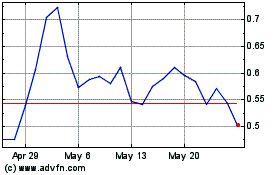

Nano Labs (NASDAQ:NA)

Historical Stock Chart

From Nov 2023 to Nov 2024