UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number: 001-38235

NaaS Technology Inc.

(Translation of registrant’s name into English)

Newlink Center, Area G, Building 7, Huitong

Times Square,

No.1 Yaojiayuan South Road, Chaoyang District,

Beijing, China

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Information Contained in This Report on Form 6-K

On December 16, 2024, NaaS Technology Inc. entered into a

Share Subscription Facility Agreement (the “SSFA”) with TopLiquidity Management Limited, a limited liability company

incorporated in the British Virgin Islands (“TopLiquidity”). In accordance with terms of the SSFA, the Company may

request draw down with an initially agreed amount that corresponds to up to 2,400,000 ADSs of the Company, which can be increased to

an amount that corresponds to up to 4,800,000 ADSs of the Company at TopLiquidity’s election (the “Total

Commitment”), pursuant to the adjustment mechanism set forth in the SSFA. Subject to terms, conditions and adjustments as set

forth in the SSFA, the Company has the right to issue to TopLiquidity at a time and amount at its sole discretion, and TopLiquidity

is obligated to purchase, the number of ADSs requested by the Company through draw down notices issued the Company (each, a

“Draw Down,” and each of such notices, a “Draw Down Notice”), upon acceptance of each draw down by

TopLiquidity and provided that the aggregate amount of the Draw Downs does not exceed the Total Commitment and in no event

TopLiquidity will hold in excess of 19.9% of the total number of our issued and outstanding shares. The amount of each Draw Down and

the number of ADSs pursuant to such Draw Down will be subject to the following adjustments: (i) the number of ADSs to be issued

and sold to TopLiquidity pursuant to each Draw Down shall not exceed five hundred percent (500%) of the average daily trading volume

for the ten (10) trading days prior to the date of such Draw Down Notice; and (ii) TopLiquidity may, by delivering a

written confirmation (“Draw Down Confirmation”) to us acknowledging receipt of a Draw Down Notice before the close of

the first trading day following the date of each Draw Down Notice, request to adjust the amount of such Draw Down to a number that

is no less than fifty percent (50%) of the amount set forth in such Draw Down Notice and not exceeding two hundred percent (200%) of

the amount set forth in such Draw Down Notice. For each Draw Down, subject to preceding adjustments, TopLiquidity shall purchase the

number of ADSs, as requested by the Company and accepted by TopLiquidity, at a purchase price based on a per share subscription

price equal to ninety percent (90%) of the daily Volume-Weighted Average Price of each trading day during the period of five

(5) consecutive trading days starting on date on which TopLiquidity receives the ADSs (the “Draw Down Pricing

Period”). No fractional shares will be issued. In any given Draw Down Pricing Period, we may only issue one Draw Down Notice.

Delivery of the ADSs will be made from time to time during the term of the SSFA, which runs from December 16, 2024 (the “Effective Date”) until the earlier of (i) the date which falls 12 months following the Effective

Date; (ii) completion or, as agreed by the parties hereto in writing, abandonment of the Subscription; and (iii) the date as terminated

in accordance with the provisions of the SSFA, and for each Draw Down, before the close of the

first trading day following the date of the Draw Down Confirmation, subject to the satisfaction of certain condition.

The ADSs to be issued by the Company to TopLiquidity under the SSFA

will be issued pursuant to the Company’s shelf registration statement on Form F-3 (File No. 333- 273515). Concurrently

with the filing of this current report on Form 6-K, the Company is filing a prospectus supplement (the “Prospectus Supplement”)

with the U.S. Securities and Exchange Commission in connection with the offering of the ADSs under the SSFA.

This current report on Form 6-K shall not constitute an offer

to sell or the solicitation of any offer to buy the ADSs of the Company, nor shall there be an offer, solicitation or sale of the shares

of Common Stock in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of such state.

The foregoing description of the SSFA is qualified in its entirety

by reference to the SSFA, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Forward Looking Statements

The information

in this Form 6-K includes “forward-looking statements” within the meaning of the “safe harbor” provisions

of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words

such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,”

“expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions

that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include,

but are not limited to, statements regarding the amount of draw down that the Company may request from TopLiquidity, if any, and the amount

of ADSs the Company may issue to TopLiquidity. These forward-looking statements are subject to a number of risks and uncertainties, including

but not limited to NaaS' goals and strategies; its future business development, financial conditions and results of operations; its ability

to continuously develop new technology, services and products and keep up with changes in the industries in which it operates; growth

of China's EV charging industry and EV charging service industry and NaaS' future business development; demand for and market acceptance

of NaaS' products and services; NaaS' ability to protect and enforce its intellectual property rights; NaaS' ability to attract and retain

qualified executives and personnel; the COVID-19 pandemic and the effects of government and other measures that have been or will be taken

in connection therewith; U.S.-China trade war and its effect on NaaS' operation, fluctuations of the RMB exchange rate, and NaaS' ability

to obtain adequate financing for its planned capital expenditure requirements; NaaS' relationships with end-users, customers, suppliers

and other business partners; competition in the industry; relevant government policies and regulations related to the industry; and fluctuations

in general economic and business conditions in China and globally. Further information regarding these and other risks is included in

NaaS' filings with the SEC. These forward-looking statements should not be relied upon as representing the Company’s assessments

as of any date subsequent to the date of this document. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Incorporation by Reference

This current report on Form 6-K, including the exhibit hereto,

is incorporated by reference into the registration statement on Form F-3 of the Company (File No. 333-273515) and

shall be a part thereof from the date on which this current report is furnished, to the extent not superseded by documents or reports

subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| NaaS Technology Inc. |

|

| |

|

|

|

| By |

: |

/s/ Steven Sim |

|

| Name |

: |

Steven Sim |

|

| Title |

: |

Chief Financial Officer |

|

Date: December 16, 2024

Exhibit 10.1

NAAS

Share Subscription Facility Agreement

THIS AGREEMENT is dated December 16, 2024

BETWEEN:

| (1) | NAAS TECHNOLOGY INC., an exempted company incorporated under the laws of the Cayman Islands (the “Company”

or “NAAS”); and |

| (2) | TOPLIQUIDITY MANAGEMENT LIMITED, a limited liability company incorporated in the British Virgin Islands,

whose address is at Sea Meadow House, P.O. Box 116 Road Town, Tortola, British Virgin Islands VG1110 (the “Investor”). |

WHEREAS:

| (1) | The Company is looking for investor to purchase its American depositary shares (each, an “ADS”)

(the “Subscription”). |

| (2) | The Investor has agreed to provide the Company with a Share Subscription Facility. |

NOW IT IS HEREBY AGREED AS FOLLOWS:

| 1.1 | The securities in the Share Subscription Facility refer

to the freely tradable and unrestricted ADSs of NAAS. |

| 2.1 | The term of this Agreement shall run from the date when

this Agreement is signed by both parties (the “Effective Date”) until the earlier of (i) the date which falls

12 months following the Effective Date; (ii) completion or, as agreed by the parties hereto in writing, abandonment of the Subscription;

and (iii) the date as terminated in accordance with the provisions of this Agreement (such period, the “Draw Down

Period”). The Draw Down Period may be extended or terminated as agreed to by the parties to this Agreement in writing. |

| 3.1 | The total commitment of the Subscription is 2,400,000 ADSs of the Company (the “Total Commitment”), subject to

adjustment set forth in Section 7.2. |

| 4.1 | The Investment will be made in the form of Share Subscription Facility pursuant to the terms and conditions set forth herein (“SSF”).

This SSF, subject to certain restrictions, can be drawn down (each, a “Draw Down”) with the Company transferring securities,

during the Draw Down Period, to the Investor in return for funds to be received according to the amount of ADSs specified in the applicable

Draw Down Notice. |

| 5.1 | The use of proceeds of the Subscription is working capital for the Company to further expand its business. |

| 6.1 | At any time during the Draw Down Period, the Company may,

in its sole discretion, issue a “Draw Down Notice”. The Investor has the right to accept or reject such Draw

Down request in its sole discretion. If the Investor accepts the Draw Down request, the Investor shall provide the Company with a written

confirmation before the close of the first trading day following the date of each Draw Down Notice (the “Draw Down Confirmation”)

acknowledging receipt of such Draw Down Notice and, if applicable, indicating any request of adjustment as provided in Section 7.2(2) below. |

| 6.2 | Before the close of the first trading day following

the date of the Draw Down Confirmation, the Company shall instruct the Depositary to issue the number of ADSs applicable to such Draw

Down to the account designated by the Investor. A “Draw Down Pricing Period” shall mean a period of five (5) consecutive

trading days commencing on the the date on which the Investor receives the ADSs. |

| 6.3 | Only one Draw Down shall be allowed in each Draw Down Pricing Period. The Investor shall deliver to the Company the amount corresponding

to the ADSs received in accordance with pricing by wire transfer within two (2) trading days following the end of each Draw Down

Pricing Period. |

| 7.1 | The Investor agrees to honor each Draw Down request from

the Company based upon a per share subscription price equal to ninety percent (90%) of the average Volume-Weighted Average Price

of each trading day during the applicable Draw Down Pricing Period (“Purchase Price”). |

| 7.2 | Regardless of the amount of a Draw Down requested by the Company in a Draw Down Notice, the final number of ADSs to be issued and

sold pursuant to such Draw Down Notice shall be subject to the following adjustments: |

| (1) | it shall not exceed five hundred percent (500%) of

the average daily trading volume for the ten (10) trading days prior to the date of the Draw Down Notice; and |

| (2) | the Investor may, by indicating in the applicable Draw Down Confirmation, request to adjust the amount of such Draw Down to a number

that is no less than fifty percent (50%) of the amount set forth in such Draw Down Notice and not exceeding two hundred percent (200%)

of the amount set forth in such Draw Down Notice. Any surplus to one hundred percent (100%) of the amount set forth in the applicable

Draw Down Notice, if requested by the Investor pursuant to preceding clause, shall be deemed as an increasement adjusted to the amount

of the Total Commitment. |

| 8.1 | The Company has sufficient authorized capital and shares to satisfy each Draw Down Notice, regardless of whether or not the Company’s

outstanding convertible notes are exercised. |

| 8.2 | The Company has prepared and filed the Registration Statement that included the Shares hereunder in conformity

with the requirements of the Securities Act, whichi Registration Statement was declared effective on September 21, 2023, including

such amendments and supplements thereto as may have been required to the date of this Agreement. |

| 8.3 | Each of the Company and the Investor may terminate this SSF if a Material Adverse Effect or a Material Change in Ownership has occurred,

provided that such termination shall not relieve the Investor from liability for any Purchase Price incurred prior to the termination. |

| 8.4 | Each of the Company and the Investor reserves the right to not proceed with a Draw Down Notice if a Material Adverse Effect, an Abnormal

Volume, or a Material Change in Ownership has occurred. |

| 8.5 | The Investor agrees not to sell shares in the Company which it does not own prior to an existing Draw Down Notice. |

| 8.6 | The Investor covenants to never hold in excess of 19.9% of the outstanding shares of the Company. |

| 8.7 | No warrants or call options are included in this agreement. |

| 8.8 | The Investor, as a “long only” investor, hereby represents and warrants to the Company that it will not, directly or indirectly,

effect or agree to effect any short sale of the Company’s shares or ADSs, whether against the box, establish any "put equivalent

position" with respect to the Company’s shares or ADSs, borrow or pre-borrow any of the Company’s shares or ADSs, or

grant any other right (including, without limitation, any put or call option) with respect to the Company’s shares or ADSs, or do

any of the foregoing with respect to any shares that includes, relates to, or derives any significant part of its value from the Company’s

shares or American depositary shares or otherwise seek to hedge its position in the Company’s shares or ADSs. |

| 9.1 | The Company and Investor each undertakes to the other, that it will not, and will procure that its agents

will not, at any time after the date of this Agreement, divulge or communicate to any person any confidential information concerning the

business, accounts, finance or contractual arrangements or other dealings, transactions or affairs of the Company which may be within

or may come to its knowledge (“Confidential Information”) and it will use its best endeavors to prevent the publication

or disclosure of any such confidential information concerning such matters; provided that such Confidential Information shall not include

any information that is in the public domain other than caused by the breach of the confidentiality obligations hereunder. |

| 9.2 | Notwithstanding the foregoing, any party may disclose any Confidential Information to its current or bona

fide prospective investors, employees, investment bankers, lenders, partners, accountants, and attorneys, in each case only where such

persons or entities have the need to know such information and are subject to appropriate non-disclosure obligations. |

| 9.3 | In the event that any party is requested or becomes legally compelled (including without limitation, pursuant

to securities laws and regulations and applicable listing rules) to disclose any Confidential Information, such party (the “Disclosing

Party”) shall, to the extent legally permissible, provide the other part (the “Non-Disclosing Party”) with

prompt written notice of that fact together with the proposed time and manner that such disclosure is to be made as well as the scope

of information that it is compelled to disclose. The Disclosing Party shall also use all reasonable efforts to seek (with the cooperation

with reasonable efforts of the other parties) a protective order, confidential treatment or other appropriate remedy (if such order, treatment

or remedy is available under applicable laws and regulations). In such event, the Disclosing Party shall furnish only that portion of

the information which is legally required to be disclosed and shall exercise reasonable efforts to keep confidential such information

to the extent reasonably requested by any Non-Disclosing Party. |

| 10.1 |

Each party acknowledges, understands, and agrees that: this Agreement may have tax consequences, and each party is solely responsible

for its own compliance with its tax obligations. |

| 11. | Limitation of Liability |

| 11.1 |

Aggregate Liability Cap: In no event shall the liability of the Investor under this Agreement exceed the total amount of the Investor’s

actual capital contribution to the Company, except in cases of gross negligence, willful misconduct, or fraud by the Investor. |

| 11.2 |

Exclusion of Certain Damages: Neither party shall be liable to the other for any indirect, incidental, consequential, special, or punitive

damages, including, without limitation, loss of profits, revenue, data, or use, arising from or related to this Agreement, even if such

party has been advised of the possibility of such damages. This limitation applies regardless of whether the claims are based in contract,

tort, or any other legal theory. |

| 11.3 |

Exclusions from Limitation: The limitations set forth in this section shall not apply to: |

| (3) | Liability arising from a party's gross negligence, willful misconduct, or fraud; |

| (4) | Any indemnification obligations expressly set forth in this Agreement. |

| 12.1 |

To the fullest extent permitted by applicable law, the Company will indemnify, defend and hold harmless the Investor, its related entities

as well as its respective employees, officers, directors, contractors, consultants, parent companies, subsidiaries, Affiliates, agents,

representatives, predecessors, successors and assigns (the Indemnified Parties) from and against any and all claims, demands, actions,

damages, losses, costs and expenses (including professional and legal fees on a full indemnity basis) that arise from: |

| (1) | the Investor’s purchase of shares; |

| (2) | Any breach of any representation, warranty, or covenant by the Investor in the Subscription documents. |

| |

Notwithstanding anything provided above, absent of gross negligence, willful misconduct, or fraud, in no event shall the liability of

the Company under this Agreement exceed the total amount of the Investor’s actual capital contribution to the Company under this

Agreement. |

| 13.1 | All notices or other communications required to be served or given pursuant to this Agreement shall be: |

| (1) | in writing and may be sent by prepaid postage, (by airmail if to another country) and email; |

| (2) | sent to the parties hereto at

the address and email address set out in Clause 13.2 below, and to such other address and email address as may from time to time

be designated in writing by the receiving party; and |

| (3) | shall be deemed to have been given and received by the relevant party (a) within two days after the

date of posting, if sent by local mail; (b) within four days after the date of posting, if sent by airmail; or (c) at the time

of transmission by the sender (as recorded on the device from which the sender sent the email), if delivered by email. |

| 13.2 | The addresses and email addresses of the parties for the purpose of Clause 13.1 are as follows: |

| |

To the Company: |

Name: |

Steven Sim |

| |

|

Email: |

steven@newlink.com |

| |

|

Address: |

Newlink Center, Area G, Building 7, Huitong Time Square,No. 1, Yaojiayuan South Road, Chaoyang District, Beijing |

| |

|

|

|

| |

To the Investor: |

Name: |

YANG LU |

| |

|

Email: |

info@topliquiditymanagement.com

|

| |

|

Address: |

Sea Meadow House, P.O. Box 116 Road Town, Tortola, British Virgin Islands VG1110 |

| 14.1 | For purposes of this Agreement, “Force Majeure Event” means any act or event that prevents

a party (“Nonperforming Party”), in whole or in part, from performing its obligations under this Agreement, or satisfying

any conditions to any other party’s obligations under this Agreement, provided that such act or event is beyond the reasonable control

of and not the fault of the Nonperforming Party, and provided that the Nonperforming Party has been unable to avoid or overcome such act

or event by the exercise of due diligence. Force Majeure Event includes an act of God (including flood, drought, earthquake, landslide,

hurricane, cyclone, typhoon, epidemic, famine or plague), any shipwreck or plane crash, fire, explosion, riot or civil disturbance, war,

act of public enemy, terrorist act, military action, or any action of a court or government authority, or an industry-wide, region-wide

or nationwide strike, work-to-rule action, go-slow or similar labour difficulty, or abnormal suspension of trading on Nasdaq, brokerage

outage, or delisting of the Company that is not due to actions or omissions of the Company. |

| 14.2 | If a Force Majeure Event occurs, the Nonperforming Party is excused from such performance as is prevented

by the Force Majeure Event, but only to the extent prevented. The Nonperforming Party shall use its best efforts to resume performance

under this Agreement as soon as the Force Majeure Event ceases. |

| 15. | No Partnership or Agency |

| 15.1 |

Nothing into this Agreement is intended to or shall operate to create a partnership or joint venture of any kind between the parties,

and save as is otherwise set out in this Agreement, neither party is authorized to act as agent for the other and neither party shall

have authority to act in the name or on behalf of or otherwise to bind the other in any way (including but not limited to the making

of any representation or warranty, the assumption of any obligation or liability, or the exercise of any right or power). |

| 16.1 |

“Material Adverse Effect” shall mean any effect on the business, operations, properties, financial condition, or prospects

of the Company that is material and adverse to the Company and its subsidiaries and affiliates, taken as a whole, and/or any condition,

circumstance or situation that would prohibit or otherwise interfere with the ability of the Company to enter into and perform any of

its obligations under this Agreement in any material respect. |

| 16.2 |

“Material Change in Ownership” shall mean that the officers and directors of the Company shall own less than five

percent (5%) of the outstanding shares of the Company. |

| 16.3 |

“Abnormal Volume” shall mean that the transaction volume concerning the shares deviate significantly (either increase

or decrease) from its trailing 60-day average volume. |

| 16.4 |

“Registration Statement” shall mean means the effective registration statement with the United States Securities and

Exchange Commission on Form F-3 (File No. 333-273515), as amended, including all information, documents and exhibits filed

with or incorporated by reference into such registration statement, which registers the sale of the Securities and includes any Rule 462(b) Registration

Statement. |

| 16.5 |

“Depositary Agreement” means the deposit agreement dated as of October 19, 2017 (as amended as of May 31,

2022 and as further amended from time to time among the Company, the Depositary, as depositary and all holders from time to time of ADRs

issued thereunder. |

| 16.6 |

“Depositary”

means JPMorgan Chase Bank, N.A., as depositary under the Deposit Agreement. |

| 17.1 | The Investor shall be entitled to a commitment fee equal to two percent (2%) of the aggregate amount of Purchase Price received by

the Company under this SSF (the “Commitment Fee”), which shall be deducted from the Investor’s payment for the

last Draw Down under this SSF. |

| 17.2 | The Company shall pay legal fees incurred by the Investor not to exceed USD 20,000. A deposit of USD 10,000 will be made by the Company

at the time the Agreement is signed, against payment of the legal fees. |

| 17.3 | If at any time any one or more of the provisions of this Agreement is or becomes illegal, invalid, or unenforceable in any respect

under the laws of any relevant jurisdiction, neither the legality, validity or enforceability of the remaining provisions of this Agreement

in that jurisdiction nor the legality, validity or enforceability of such provision under the laws of any other jurisdictions shall in

any way be affected or impaired thereby. |

| 17.4 | This Agreement shall not be amended, supplemented, or modified except by instruments in writing signed by both parties hereto. |

| 17.5 | None of the rights of the parties under this Agreement may be assigned or transferred without the prior approval of the other party

in writing. Company and Investor shall perform this Agreement on its own and shall not entrust any third party. |

| 17.6 | This Agreement constitutes the entire agreement between the parties hereto with respect to the matters dealt with herein and supersedes

any previous agreements, arrangements, statements, understandings, or transactions between the parties hereto in relation to the matters

hereof. |

| 17.7 | This Agreement may be executed in any number of counterparts, all of which taken together shall constitute one and the same instrument

and any parties hereto may execute this Agreement by signing any such counterparts. |

| 17.8 | This Agreement shall be governed by and construed in accordance with the laws of the British Virgin Islands. Both parties hereto agree

that any dispute arising out of or related to this Agreement shall be settled through friendly consultations between the parties. If the

dispute cannot be settled through consultations, both parties irrevocably agree that the courts of the British Virgin Islands are to have

exclusive jurisdiction to settle any disputes arising out of or in connection with this Agreement. Accordingly, any proceedings arising

out of or in connection with this Agreement shall be brought in such courts. |

[The remainder of this page is intentionally

left blank.]

IN WITNESS whereof this Agreement has been duly

executed by all parties hereto the day and year first above written.

| THE COMPANY |

|

| |

|

| NAAS TECHNOLOGY INC. |

|

| By: |

/s/ Yang Wang |

|

| |

|

|

| Name: |

YANG WANG |

|

| |

|

|

| Title: |

Director |

|

THE INVESTOR

TOPLIQUIDITY MANAGEMENT

LIMITED

| By: |

/s/ Yang Lu |

|

| |

|

|

| Name: |

YANG LU |

|

| |

|

|

| Title: |

Authorized Signatory |

|

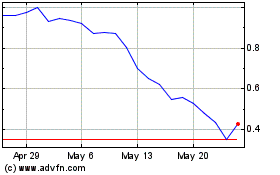

NaaS Technology (NASDAQ:NAAS)

Historical Stock Chart

From Jan 2025 to Feb 2025

NaaS Technology (NASDAQ:NAAS)

Historical Stock Chart

From Feb 2024 to Feb 2025