NorthEast Community Bancorp, Inc. Announces Quarterly Cash Dividend

21 June 2024 - 5:00AM

NorthEast Community Bancorp, Inc. (the “Company”) (Nasdaq: NECB)

announced today that its Board of Directors has declared a

quarterly cash dividend of $0.10 per common share. The dividend

will be paid on or about August 6, 2024 to shareholders of record

as of the close of business on July 5, 2024.

About NorthEast Community Bancorp,

Inc.

NorthEast Community Bancorp, headquartered at

325 Hamilton Avenue, White Plains, New York 10601, is the holding

company for NorthEast Community Bank, which conducts business

through its eleven branch offices located in Bronx, New York,

Orange, Rockland, and Sullivan Counties in New York and Essex,

Middlesex, and Norfolk Counties in Massachusetts and three loan

production offices located in New City, New York, White Plains, New

York, and Danvers, Massachusetts. For more information about

NorthEast Community Bancorp and NorthEast Community Bank, please

visit www.necb.com.

Cautionary Note About Forward-Looking

Statements

This press release contains certain

forward-looking statements. Forward-looking statements include

statements regarding anticipated future events and can be

identified by the fact that they do not relate strictly to

historical or current facts. They often include words such as

“believe,” “expect,” “anticipate,” “estimate,” and “intend” or

future or conditional verbs such as “will,” “would,” “should,”

“could,” or “may.” These statements are based upon the current

beliefs and expectations of the Company’s management and are

subject to significant risks and uncertainties. Actual results may

differ materially from those set forth in the forward-looking

statements as a result of numerous factors. Factors that could

cause actual results to differ materially from expected results

include, but are not limited to, changes in market interest rates,

regional and national economic conditions (including higher

inflation and its impact on regional and national economic

conditions), legislative and regulatory changes, monetary and

fiscal policies of the United States government, including policies

of the United States Treasury and the Federal Reserve Board, the

quality and composition of the loan or investment portfolios,

demand for loan products, decreases in deposit levels necessitating

increased borrowing to fund loans and securities, competition,

demand for financial services in NorthEast Community Bank’s market

area, changes in the real estate market values in NorthEast

Community Bank’s market area, the impact of failures or disruptions

in or breaches of the Company’s operational or security systems,

data or infrastructure, or those of third parties, including as a

result of cyberattacks or campaigns, and changes in relevant

accounting principles and guidelines. Additionally, other risks and

uncertainties may be described in our annual and quarterly reports

filed with the U.S. Securities and Exchange Commission (the “SEC”),

which are available through the SEC’s website located at

www.sec.gov. These risks and uncertainties should be considered in

evaluating any forward-looking statements and undue reliance should

not be placed on such statements. Except as required by applicable

law or regulation, the Company does not undertake, and specifically

disclaims any obligation, to release publicly the result of any

revisions that may be made to any forward-looking statements to

reflect events or circumstances after the date of the statements or

to reflect the occurrence of anticipated or unanticipated

events.

|

CONTACT: |

|

Kenneth A. Martinek |

|

|

|

Chairman and Chief Executive Officer |

|

PHONE: |

|

(914) 684-2500 |

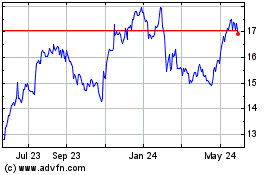

NorthEast Community Banc... (NASDAQ:NECB)

Historical Stock Chart

From Jan 2025 to Feb 2025

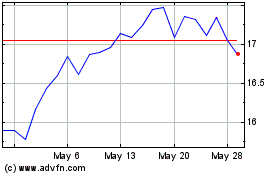

NorthEast Community Banc... (NASDAQ:NECB)

Historical Stock Chart

From Feb 2024 to Feb 2025