0000087050

false

0000087050

2023-08-10

2023-08-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 10, 2023

NEONODE INC.

(Exact name of issuer of securities held pursuant

to the plan)

Commission File Number 1-35526

| Delaware |

|

94-1517641 |

(State or other jurisdiction

of incorporation) |

|

(I.R.S. Employer

Identification No.) |

Karlavägen 100, 115 26 Stockholm, Sweden

(Address of Principal Executive Office, including

Zip Code)

+46 (0) 86671717

Registrant’s telephone number, including

area code:

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.001 per share |

|

NEON |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial

Condition.

On August 10, 2023, Neonode Inc. (the “Company”)

reported its earnings for the three months ended June 30, 2023 (the “Earnings Release”) and posted on the Neonode website

the Second Quarter 2023 Presentation (the “Presentation”). A copy of the Earnings Release and the Presentation are attached

hereto as Exhibits 99.1 and 99.2, respectively, and are incorporated herein by reference.

The information furnished pursuant to this Item

2.02, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section, or incorporated

by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except

as shall be expressly set forth by specific reference in such a filing.

Item 7.01 Regulation FD Disclosure

As previously announced, the Company will conduct

a conference call today, Thursday, August 10, 2023 at 10:00 a.m. ET. The presentation slides to be used during the call, attached hereto

as Exhibit 99.2, will be available on the “Investor Relations” section of the Company’s website at www.neonode.com immediately

prior to the call. The information contained in, or that can be accessed through the Company’s website is not a part of this filing.

The information furnished pursuant to this Item

7.01, including Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject

to the liabilities under that Section, or incorporated by reference in any filing under the Securities Act or the Exchange Act, except

as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| Date: August 10, 2023 |

NEONODE INC. |

| |

|

|

| |

By: |

/s/ Fredrik Nihlén |

| |

Name: |

Fredrik Nihlén |

| |

Title: |

Chief Financial Officer |

2

Exhibit 99.1

Press Release

For Release, 09:10AM EDT August 10, 2023

Neonode Reports Quarter Ended June 30, 2023 Financial Results

STOCKHOLM, SWEDEN, August 10, 2023 — Neonode Inc. (NASDAQ:

NEON) today reported financial results for the three and six months ended June 30, 2023.

FINANCIAL SUMMARY FOR THE THREE MONTHS ENDED JUNE 30, 2023:

| ● | Revenue of $1.2 million, a decrease of 5.3% compared to the same period in the prior year. |

| ● | Operating expenses of $2.8 million, a decrease of 1.9% compared to the same period in the prior year. |

| ● | Net loss of $1.5 million, or $0.10 per share, compared to $1.5 million, or $0.11 per share, for the same period in the prior year. |

| ● | Cash used by operations of $0.6 million compared to $2.9 million for the same period in the prior year. |

| ● | Cash and accounts receivable of $21.6 million as of June 30, 2023 compared to $16.3 million as of December 31, 2022. |

FINANCIAL SUMMARY FOR THE SIX MONTHS ENDED JUNE 30, 2023:

| ● | Revenue of $2.5 million, a decrease of 5.1% compared to the same period in the prior year. |

| ● | Operating expenses of $5.6 million, an increase of 1.4% compared to the same period in the prior year. |

| ● | Net loss of $2.9 million, or $0.19 per share, compared to $2.9 million, or $0.22 per share, for the same period in the prior year. |

| ● | Cash used by operations of $2.3 million compared to $5.2 million for the same period in the prior year. |

THE CEO’S COMMENTS

“Our licensing revenues in Q2 were at the same level as in Q1

and 15% higher than in the same period last year, showing good stability. Our product sales revenues in Q2 were low and much below expectations,

which we are addressing with different kinds of activities and changes in our strategies and tactics to ensure that we come back to a

growth path for this business in the coming quarters”, said Dr. Urban Forssell, Neonode’s CEO.

“The changes we have started to implement include an increased

focus on markets and sectors where we have good traction, supported by intensified marketing – both online and through participation

in tradeshows and other types of events – to create beachheads from which we may continue to grow our licensing and products businesses.

To help us drive these changes and become more effective in our marketing and sales efforts we have recruited experienced core competence to strengthen our sales and engineering teams in Stockholm. We remain optimistic about our ability to grow our business and return to profitability,” concluded Dr. Forssell.

FINANCIAL OVERVIEW FOR THE QUARTER ENDED JUNE 30, 2023

Net revenues for the quarter ended June 30, 2023 were $1.2 million,

a 5.3% decrease compared to the same period in 2022. For the 2023 period, license revenues were $1.1 million, an increase of 14.8% compared

to the 2022 period. The increase is primarily volume related as the global supply chain challenges related to semiconductor supply shortages

that hampered our printer and automotive customers’ production and sales for the last two years have improved and the demand for

our customers’ products remains strong.

Revenues from product sales for the quarter ended June 30, 2023 were

$0.1 million, a 60.0% decrease compared to the same period in 2022. The reason for the decrease is mainly low customer demand, which we

are addressing with focused marketing and sales campaigns and updates to our partner network.

Gross margin related to products was 66.7% for the second quarter of

2023 compared to 55.7% in the same period in 2022. The gross margin for products is higher for lower order volumes and also varies with

the product mix.

Our operating expenses decreased by 1.9% for the second quarter of

2023 compared to the same period in 2022, primarily due to lower payroll and related costs.

Net loss attributable to Neonode for the three months ended June 30,

2023 was $1.5 million, or $0.10 per share, compared to a net loss of $1.5 million, or $0.11 per share, for the same period in 2022. Cash

used by operations was $0.6 million in the second quarter of 2023 compared to $2.9 million for the same period in 2022. The decrease is

primarily the result of less component purchases.

Cash and accounts receivable totaled $21.6 million and working capital

was $24.0 million as of June 30, 2023 compared to $16.3 million and $19.1 million as of December 31, 2022, respectively.

For more information, please contact:

Chief Financial Officer

Fredrik Nihlén

E-mail: fredrik.nihlen@neonode.com

Phone: +46 703 97 21 09

Chief Executive Officer

Urban

Forssell

E-mail:

urban.forssell@neonode.com

Phone:

+46 734 10 03 59

About

Neonode

Neonode Inc. (NASDAQ:NEON) is a publicly traded company, headquartered in Stockholm, Sweden and established in 2001. The company provides

advanced optical sensing solutions for contactless touch, touch, gesture control, and in-cabin monitoring. Building on experience

acquired during years of advanced R&D and technology licensing, Neonode’s technology is currently deployed in more than 80

million products and the company holds more than 100 patents worldwide. Neonode’s customer base includes some of the world’s

best-known Fortune 500 companies in the consumer electronics, office equipment, automotive, elevator, and self-service kiosk markets.

NEONODE and the NEONODE logo are trademarks of Neonode Inc. registered

in the United States and other countries.

For further information please visit www.neonode.com

Follow us at:

Cision

LinkedIn

Twitter

Safe Harbor Statement

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. These include, but are not limited to, statements

relating to our expectations for growth and the growing demand for our products, future performance or future events. These statements

are based on current assumptions, expectations and information available to Neonode management and involve a number of known and unknown

risks, uncertainties and other factors that may cause Neonode’s actual results, levels of activity, performance or achievements

to be materially different from any expressed or implied by these forward-looking statements.

These risks, uncertainties, and factors include risks related to

our reliance on the ability of our customers to design, manufacture and sell their products with our touch technology, the length of a

customer’s product development cycle, our dependence and our customers’ dependence on suppliers, the COVID-19 pandemic, the

global economy generally and other risks discussed under “Risk Factors” and elsewhere in Neonode’s public filings with

the SEC from time to time, including Neonode’s annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports

on Form 8-K. You are advised to carefully consider these various risks, uncertainties and other factors. Although Neonode management believes

that the forward-looking statements contained in this press release are reasonable, it can give no assurance that its expectations will

be fulfilled. Forward-looking statements are made as of today’s date, and Neonode undertakes no duty to update or revise them.

NEONODE INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share amounts)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

(Audited) | |

| ASSETS | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 20,291 | | |

$ | 14,816 | |

| Accounts receivable and unbilled revenues, net | |

| 1,301 | | |

| 1,448 | |

| Inventory | |

| 3,671 | | |

| 3,827 | |

| Prepaid expenses and other current assets | |

| 660 | | |

| 707 | |

| Total current assets | |

| 25,923 | | |

| 20,798 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 289 | | |

| 282 | |

| Operating lease right-of-use assets, net | |

| 83 | | |

| 118 | |

| Total assets | |

$ | 26,295 | | |

$ | 21,198 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 508 | | |

$ | 334 | |

| Accrued payroll and employee benefits | |

| 848 | | |

| 951 | |

| Accrued expenses | |

| 468 | | |

| 200 | |

| Contract liabilities | |

| 22 | | |

| 36 | |

| Current portion of finance lease obligations | |

| 54 | | |

| 95 | |

| Current portion of operating lease obligations | |

| 66 | | |

| 83 | |

| Total current liabilities | |

| 1,966 | | |

| 1,699 | |

| | |

| | | |

| | |

| Finance lease obligations, net of current portion | |

| 31 | | |

| 46 | |

| Operating lease obligations, net of current portion | |

| 17 | | |

| 35 | |

| Total liabilities | |

| 2,014 | | |

| 1,780 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock, 25,000,000 shares authorized, with par value of $0.001; 15,359,481 and 14,455,765 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively | |

| 15 | | |

| 14 | |

| Additional paid-in capital | |

| 235,135 | | |

| 227,235 | |

| Accumulated other comprehensive loss | |

| (446 | ) | |

| (340 | ) |

| Accumulated deficit | |

| (210,423 | ) | |

| (207,491 | ) |

| Total stockholders’ equity | |

| 24,281 | | |

| 19,418 | |

| Total liabilities and stockholders’ equity | |

$ | 26,295 | | |

$ | 21,198 | |

NEONODE INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

| | |

Three months ended

June 30, | | |

Six months ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues: | |

| | |

| | |

| | |

| |

| License fees | |

$ | 1,094 | | |

$ | 953 | | |

$ | 2,242 | | |

$ | 2,057 | |

| Products | |

| 84 | | |

| 210 | | |

| 186 | | |

| 357 | |

| Non-recurring engineering | |

| 22 | | |

| 104 | | |

| 25 | | |

| 171 | |

| Total revenues | |

| 1,200 | | |

| 1,267 | | |

| 2,453 | | |

| 2,585 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues: | |

| | | |

| | | |

| | | |

| | |

| Products | |

| 28 | | |

| 93 | | |

| 75 | | |

| 144 | |

| Non-recurring engineering | |

| 9 | | |

| 17 | | |

| 9 | | |

| 26 | |

| Total cost of revenues | |

| 37 | | |

| 110 | | |

| 84 | | |

| 170 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total gross margin | |

| 1,163 | | |

| 1,157 | | |

| 2,369 | | |

| 2,415 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 1,063 | | |

| 1,146 | | |

| 1,865 | | |

| 2,169 | |

| Sales and marketing | |

| 689 | | |

| 644 | | |

| 1,281 | | |

| 1,260 | |

| General and administrative | |

| 1,038 | | |

| 1,053 | | |

| 2,422 | | |

| 2,063 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating expenses | |

| 2,790 | | |

| 2,843 | | |

| 5,568 | | |

| 5,492 | |

| Operating loss | |

| (1,627 | ) | |

| (1,686 | ) | |

| (3,199 | ) | |

| (3,077 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest income (expense), net | |

| 169 | | |

| (4 | ) | |

| 327 | | |

| (6 | ) |

| Other income | |

| - | | |

| 21 | | |

| - | | |

| 21 | |

| Total other income, net | |

| 169 | | |

| 17 | | |

| 327 | | |

| 15 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before provision for income taxes | |

| (1,458 | ) | |

| (1,669 | ) | |

| (2,872 | ) | |

| (3,062 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| 49 | | |

| 28 | | |

| 60 | | |

| 72 | |

| Net loss including noncontrolling interests | |

| (1,507 | ) | |

| (1,697 | ) | |

| (2,932 | ) | |

| (3,134 | ) |

| Less: net loss attributable to noncontrolling interests | |

| - | | |

| 149 | | |

| - | | |

| 206 | |

| Net loss attributable to Neonode Inc. | |

$ | (1,507 | ) | |

$ | (1,548 | ) | |

$ | (2,932 | ) | |

$ | (2,928 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted loss per share | |

$ | (0.10 | ) | |

$ | (0.11 | ) | |

$ | (0.19 | ) | |

$ | (0.22 | ) |

| Basic and diluted – weighted average number of common shares outstanding | |

| 15,359 | | |

| 13,578 | | |

| 15,285 | | |

| 13,577 | |

NEONODE INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(In thousands)

| | |

Three months ended

June 30, | | |

Six months ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net loss | |

$ | (1,507 | ) | |

$ | (1,697 | ) | |

$ | (2,932 | ) | |

$ | (3,134 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss): | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustments | |

| (141 | ) | |

| 41 | | |

| (106 | ) | |

| 74 | |

| Other comprehensive loss | |

| (1,648 | ) | |

| (1,656 | ) | |

| (3,038 | ) | |

| (3,060 | ) |

| Less: comprehensive loss attributable to noncontrolling interests | |

| - | | |

| 149 | | |

| - | | |

| 206 | |

| Other comprehensive loss attributable to Neonode Inc. | |

$ | (1,648 | ) | |

$ | (1,507 | ) | |

$ | (3,038 | ) | |

$ | (2,854 | ) |

NEONODE INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’

EQUITY

(In thousands)

| | |

Common

Stock Shares

Issued | | |

Common

Stock

Amount | | |

Additional

Paid-in

Capital | | |

Accumulated

Other

Comprehensive

Income

(Loss) | | |

Accumulated

Deficit | | |

Total

Neonode Inc.

Stockholders’

Equity | | |

Noncontrolling

Interests | | |

Total

Stockholders’

Equity | |

Balances, December

31, 2022 | |

| 14,456 | | |

$ | 14 | | |

$ | 227,235 | | |

$ | (340 | ) | |

$ | (207,491 | ) | |

$ | 19,418 | | |

$ | - | | |

$ | 19,418 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 18 | | |

| - | | |

| - | | |

| 18 | | |

| - | | |

| 18 | |

| Issuance of shares for cash, net of offering costs | |

| 903 | | |

| 1 | | |

| 7,865 | | |

| - | | |

| - | | |

| 7,866 | | |

| - | | |

| 7,866 | |

| Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| 35 | | |

| - | | |

| 35 | | |

| - | | |

| 35 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,425 | ) | |

| (1,425 | ) | |

| - | | |

| (1,425 | ) |

| Balances, March 31, 2023 | |

| 15,359 | | |

$ | 15 | | |

$ | 235,118 | | |

$ | (305 | ) | |

$ | (208,916 | ) | |

$ | 25,912 | | |

$ | - | | |

$ | 25,912 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 17 | | |

| - | | |

| - | | |

| 17 | | |

| - | | |

| 17 | |

| Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| (141 | ) | |

| - | | |

| (141 | ) | |

| - | | |

| (141 | ) |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,507 | ) | |

| (1,507 | ) | |

| - | | |

| (1,507 | ) |

| Balances, June 30, 2023 | |

| 15,359 | | |

$ | 15 | | |

$ | 235,135 | | |

$ | (446 | ) | |

$ | (210,423 | ) | |

$ | 24,281 | | |

$ | - | | |

$ | 24,281 | |

| |

|

Common

Stock Shares

Issued |

|

|

Common

Stock

Amount |

|

|

Additional

Paid-in

Capital |

|

|

Accumulated

Other

Comprehensive

Income

(Loss) |

|

|

Accumulated

Deficit |

|

|

Total

Neonode Inc.

Stockholders’

Equity |

|

|

Noncontrolling

Interests |

|

|

Total

Stockholders’

Equity |

|

Balances, December

31, 2021 |

|

|

13,576 |

|

|

$ |

14 |

|

|

$ |

226,880 |

|

|

$ |

(408 |

) |

|

$ |

(202,608 |

) |

|

$ |

23,878 |

|

|

$ |

(4,041 |

) |

|

$ |

19,837 |

|

| Stock-based compensation |

|

|

- |

|

|

|

- |

|

|

|

39 |

|

|

|

- |

|

|

|

- |

|

|

|

39 |

|

|

|

- |

|

|

|

39 |

|

| Foreign currency translation adjustment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

33 |

|

|

|

- |

|

|

|

33 |

|

|

|

- |

|

|

|

33 |

|

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,380 |

) |

|

|

(1,380 |

) |

|

|

(57 |

) |

|

|

(1,437 |

) |

| Balances, March 31, 2022 |

|

|

13,576 |

|

|

$ |

14 |

|

|

$ |

226,919 |

|

|

$ |

(375 |

) |

|

$ |

(203,988 |

) |

|

$ |

22,570 |

|

|

$ |

(4,098 |

) |

|

$ |

18,472 |

|

| Stock-based compensation |

|

|

4 |

|

|

|

- |

|

|

|

45 |

|

|

|

- |

|

|

|

- |

|

|

|

45 |

|

|

|

- |

|

|

|

45 |

|

| Foreign currency translation adjustment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

41 |

|

|

|

- |

|

|

|

41 |

|

|

|

- |

|

|

|

41 |

|

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,548 |

) |

|

|

(1,548 |

) |

|

|

(149 |

) |

|

|

(1,697 |

) |

| Balances, June 30, 2022 |

|

|

13,580 |

|

|

$ |

14 |

|

|

$ |

226,964 |

|

|

$ |

(334 |

) |

|

$ |

(205,536 |

) |

|

$ |

21,108 |

|

|

$ |

(4,247 |

) |

|

$ |

16,861 |

|

NEONODE INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

| | |

Six months ended

June 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | |

| |

| Net loss (including noncontrolling interests) | |

$ | (2,932 | ) | |

$ | (3,134 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Stock-based compensation expense | |

| 35 | | |

| 84 | |

| Depreciation and amortization | |

| 37 | | |

| 87 | |

| Amortization of operating lease right-of-use assets | |

| 33 | | |

| 224 | |

| Recoveries of bad debt | |

| - | | |

| (79 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable and unbilled revenue, net | |

| 140 | | |

| 253 | |

| Inventory | |

| 17 | | |

| (2,312 | ) |

| Prepaid expenses and other current assets | |

| 27 | | |

| 232 | |

| Accounts payable, accrued payroll and employee benefits, and accrued expenses | |

| 374 | | |

| (287 | ) |

| Contract liabilities | |

| (13 | ) | |

| 12 | |

| Operating lease obligations | |

| (33 | ) | |

| (294 | ) |

| Net cash used in operating activities | |

| (2,315 | ) | |

| (5,214 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of property and equipment | |

| (36 | ) | |

| (47 | ) |

| Net cash used in investing activities | |

| (36 | ) | |

| (47 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from issuance of common stock, net of offering costs | |

| 7,866 | | |

| - | |

| Principal payments on finance lease obligations | |

| (52 | ) | |

| (99 | ) |

| Net cash provided by (used in) financing activities | |

| 7,814 | | |

| (99 | ) |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| 12 | | |

| 403 | |

| | |

| | | |

| | |

| Net decrease in cash and cash equivalents | |

| 5,475 | | |

| (4,957 | ) |

| Cash and cash equivalents at beginning of period | |

| 14,816 | | |

| 17,383 | |

| Cash and cash equivalents at end of period | |

$ | 20,291 | | |

$ | 12,426 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid for income taxes | |

$ | 60 | | |

$ | 2 | |

| Cash paid for interest | |

$ | 6 | | |

$ | 6 | |

| | |

| | | |

| | |

| Supplemental disclosure of non-cash investing and financial activities: | |

| | | |

| | |

| Property and equipment obtained in exchange for lease obligations | |

$ | - | | |

$ | 24 | |

8

Exhibit 99.2

Q2 2023 Earnings Call | August 10, 2023 2023 - 08 - 09 1 © Neonode 2001 - 2021 · www.neonode.com · Nasdaq (NEON) 2023 - 08 - 09 1 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON)

Today’s Presenters 2023 - 08 - 09 2 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON) • Urban For s se ll, CEO • Fr e drik Nihl é n, CFO

Legal Disclaimer 2023 - 08 - 09 3 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON) This presentation contains, and related oral and written statements of Neonode Inc. (the “Company”) and its management may contain, forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward - looking statements include information about current expectations, strategy, plans, potential financial performance or future events. They also may include statements about market opportunity and sales growth, financial results, use of cash, product development and introduction, regulatory matters and sales efforts. Forward - looking statements are based on assumptions, expectations and information available to the Company and its management and involve a number of known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, levels of activity, performance or achievements to be materially different from any expressed or implied by these forward - looking statements. These uncertainties and risks include, but are not limited to, our ability to secure financing when needed on acceptable terms, risks related to new product development, our ability to protect our intellectual property, our ability to compete, general economic conditions including as a result of the ongoing COVID - 19 pandemic or geopolitical conflicts such as the war in Ukraine, as well as other risks outlined in filings of the Company with the U.S. Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Prospective investors are advised to carefully consider these various risks, uncertainties and other factors. Any forward - looking statements included in this presentation are made as of today’s date. The Company and its management undertake no duty to update or revise forward - looking statements. This presentation has been prepared by the Company based on its own information, as well as information from public sources. Certain of the information contained herein may be derived from information provided by industry sources. The Company believes such information is accurate and that the sources from which it has been obtained are reliable. However, the Company has not independently verified such information and cannot guarantee the accuracy of such information.

A g enda 2023 - 08 - 09 4 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON) 1. Summary 2. Q2 2 0 23 Financial Re s u lts 3. Business Update 4. Q&A N e onod e I n c . Q2 20 2 3 | A u g u st 1 0 , 20 2 3

Summary of Key Points Q2 2023 - 08 - 09 5 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON) • Lice n sing r ev e nu e s sta b le • Wor l dwide se m ic o nductor s u p p ly s h ortag e si t u a t ion h a s im p rov e d • Demand for our printer and automotive customers’ products remains strong • Product s a les re v e n ues below ta rgets • Weake r cust o m er d e mand th an ex p e c ted • D e layed pr o duct lau n c hes in sev e ral pr o je c ts • We are adjusting our strategies and tactics to improve sales in the coming quarters • Increased focus on markets and segments where traction is good • I ntensified mark e ting efforts • Development of tailored solutions to sharpen our customer offer

A g enda 2023 - 08 - 09 6 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON) 1. Summary 2. Q2 2 0 23 Fin a n c i a l R e s u lts 3. Business Update 4. Q&A N e onod e I n c . Q2 20 2 3 | A u g u st 1 0 , 20 2 3

$1.2 million R e v e n u e T o t a l Q2 2023 但 5 % Y oY $0.1 million Revenue Products Q2 2023 但 60 % Y oY $1.1 million R e v e n u e Lic e n s e Q2 2023 似 15 % Y oY 1,400 1,200 1,000 800 600 400 200 0 - 200 A M E R A P A C EM E A A M E R APAC EM E A A M E R APAC EM E A A M E R APAC EM E A A M E R APAC EM E A A M E R APAC EM E A A M E R APAC EM E A A M E R APAC EM E A A M E R APAC EM E A A M E R APAC EM E A A M E R APAC E M E A A M E R APAC EM E A A M E R APAC EM E A A M E R APAC EM E A Q 2 - 22 Q 3 - 22 Q 4 - 22 Q 1 - 23 Q 2 - 23 T h o us a nd s Q2/’23 Financial Results – Revenues Revenues by Revenue Stream and Region Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Q2 - 21 L i c e n s e fe e s Q3 - 21 Q4 - 21 Q1 - 22 Products NRE Thousands Revenues by Revenue Stream 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0 - 200 Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Q2 - 21 Q3 - 21 Q4 - 21 Q1 - 22 Q2 - 22 Q3 - 22 Q4 - 22 Q1 - 23 Q2 - 23 License fees Products NRE 2023 - 08 - 09 7 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON)

67% Adjusted Gross Margin TSMs* Q2 2023 似 11pp YoY 67% G r o s s M a r g i n Products Q2 2023 似 11pp YoY * See reconciliation in Appendix ”Non - GAAP Financial Measures” - 25 0 % - 20 0 % - 15 0 % - 10 0 % - 50% 0% 50% 100 50 0 - 50 - 100 - 150 - 200 20 0 100% 150 Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Q2 - 21 Q3 - 21 Q4 - 21 Q1 - 22 Q2 - 22 Q3 - 22 Q4 - 22 Q1 - 23 Q2 - 23 T h o us a nd s Q2/’23 Financial Results – Gross Profit/Margin Gross Profit/Margin Products Gross profit Gross margin 0% 10% 20% 50% 40% 30% 60% 70% 0 50 100 150 200 250 Q4 - 22 Q1 - 23 Q2 - 23 T h o us a nd s Gross Profit/Margin TSMs Adjusted* Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Q2 - 21 Q3 - 21 Q4 - 21 Q1 - 22 Q2 - 22 Q3 - 22 Gross profit Gross margin 2023 - 08 - 09 8 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON)

Q2/’23 Financial Results – Operating Expenses $2.8 million Operating Expenses Q2 2023 但 2% YoY - 3 ,000 - 3 ,500 2023 - 08 - 09 9 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON) - 2 ,500 - 2 ,000 - 1,500 - 1,000 - 500 0 Q 1 - 20 Q 2 - 20 Q 3 - 20 Q 4 - 20 T h o us a nd s Operating Expenses Q1 - 21 Q2 - 21 Q3 - 21 Q4 - 21 Q1 - 22 Q2 - 22 Q3 - 22 Q4 - 22 Q1 - 23 Q2 - 23

Q2/’23 Financial Results – Cash $21.6 million Cash and Accounts Receivables Jun. 30, 2023 似 5.3 Million Dec. 31, 2022 $0.6 million Net Cash Burn O p e r a t i n g A ct i v i t i e s Q2 2023 但 79 % Y oY - 3 ,000 - 3 ,500 2023 - 08 - 09 10 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON) - 2 ,500 - 2 ,000 - 1 ,500 - 1 ,000 - 500 0 Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Q2 - 21 Q3 - 21 Q4 - 21 Q1 - 22 Q2 - 22 Q3 - 22 Q4 - 22 Q1 - 23 Q2 - 23 T h o us a nd s Net cash used in operating activities

A g enda 2023 - 08 - 09 11 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON) 1. Summary 2. Q2 2 0 23 Financial Re s u lts 3. Bu s i n e s s Up d ate 4. Q&A N e onod e I n c . Q2 20 2 3 | A u g u st 1 0 , 20 2 3

Touchless Solutions 2023 - 08 - 09 12 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON)

Luxury Hotel, The Maybourne Riviera, Installs Contactless Controls 2023 - 08 - 09 13 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON)

MyScript Collaboration Provides Handwriting Recognition Solutions to Integrators 2023 - 08 - 09 14 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON)

Neonode and NXO Sign Value - added Reseller Agreement 2023 - 08 - 09 15 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON)

Rugged Touch Solutions 2023 - 08 - 09 16 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON)

Me d t ech 2023 - 08 - 09 17 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON)

Automotive Commercial Vehicle and Off Highway 2023 - 08 - 09 18 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON)

HUD Obstruction Detection 2023 - 08 - 09 19 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON)

Driver and In - cabin Monitoring 2023 - 08 - 09 20 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON)

Events Q2 2023 2023 - 08 - 09 21 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON) • • • IM S & H UD Ex p o , C h ina • M e d - T e c h I n nov a t io n E xpo, UK • Car. HM I Europ e , G e rm a ny • InCa b in . S e nsing Europ e , G e rm a ny • A u t o S e ns InC a b i n , B e lgium IVT Ex p o , G ermany W o rld El e v ato r Esc alato r Ex p o , C h ina Upcoming Major Events: • • CES 202 4, L as Ve gas, N V NRF 202 4, Ne w Yo rk, N Y

A g enda 2023 - 08 - 09 22 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON) 1. Summary 2. Q2 2 0 23 Financial Re s u lts 3. Business Update 4. Q&A N e onod e I n c . Q2 20 2 3 | A u g u st 1 0 , 20 2 3

inf o @ n e o nod e . c o m neonode.com Subsc r ibe to N e o node n e w s let t e r Thank you. 2023 - 08 - 09 23 © Neonode 2001 - 2021 · www.neonode.com · Nasdaq (NEON) 2023 - 08 - 09 23 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON)

Appendix 2023 - 08 - 09 24 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON)

Non - GAAP Financial Measures In addition to presenting our financial results in accordance with accounting principles generally accepted in the United States (“GAAP”), we use adjusted gross margin to measure our financial performance. We define adjusted gross margin as gross margin excluding AirBar sales revenues and costs and adjusting for costs and lost revenues caused by a quality issue and one - time write - down of inventory. We believe adjusted gross margin is a meaningful measure because it reflects the performance of our TSM business, which is our current focus. Non - GAAP financial measures should not be considered as alternatives to the most directly comparable GAAP financial measures. Our use of adjusted gross margin, a non - GAAP financial measure, has important limitations as an analytical tool because it excludes some, but not all, items that affect the most directly comparable GAAP financial measure. You should not consider adjusted gross margin in isolation or as substitutes for analysis of our results as reported under GAAP. Our definition of non - GAAP adjusted gross margin may not be comparable to similarly titled measures of other companies, thereby diminishing its utility. 2023 - 08 - 09 25 © Neonode 2001 - 2023 · www.neonode.com · Nasdaq (NEON) The following tables presents a reconciliation of adjusted gross margin to gross margin, the most directly comparable GAAP financial measure. Q2 - 23 Q1 - 23 Q4 - 22 Q3 - 22 Q2 - 22 Q1 - 22 Q4 - 21 Q3 - 21 Q2 - 21 Q1 - 21 Q4 - 20 Q3 - 20 Q2 - 20 Q1 - 20 kUSD 84 102 483 155 210 147 118 136 346 355 502 284 66 98 Revenue Products - 28 - 47 - 552 - 80 - 93 - 51 - 342 - 98 - 212 - 270 - 496 - 198 - 72 - 36 Cost of Sales Products 56 55 - 69 75 117 96 - 224 38 134 85 6 86 - 6 62 Gross Profit Products - - - - - - 92 12 - 14 - - - - - Lost revenues TSM quality issue - - - - - - - 61 27 4 - - - - - Cost of sales TSM quality issue - - 294 - - - 154 - - - - - - - Inventory write - down TSM quality issue - - 4 - - - - 13 - - - - 43 - 21 - 60 - 0 1 Revenue AirBar - - - - - - 149 - 7 - 4 39 123 86 27 - 23 Cost of Sales AirBar 56 51 225 75 117 83 110 70 120 81 109 112 21 40 Adjusted Gross Profit Products 67% 54% - 14% 48% 56% 65% - 190% 28% 39% 24% 1% 30% - 9% 63% Gross Margin Products 67% 52% 47% 48% 56% 62% 52% 47% 36% 26% 23% 50% 32% 40% Adjusted Gross Margin Products

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

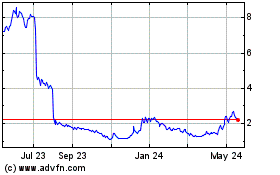

Neonode (NASDAQ:NEON)

Historical Stock Chart

From Dec 2024 to Jan 2025

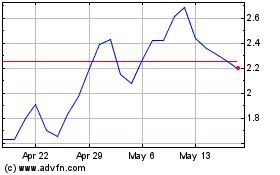

Neonode (NASDAQ:NEON)

Historical Stock Chart

From Jan 2024 to Jan 2025