UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Nisun International Enterprise Development Group

Co., Ltd

(Name of Issuer)

Class A Common Shares

(Title of Class of Securities)

G6593L122

(CUSIP Number)

Bodang Liu

NiSun International Enterprise Management Group Co., Ltd.

P. O. Box 31119 Grand Pavilion, Hibiscus Way,

802 West Bay

Road,Grand Cayman, KYl-1205 Cayman Islands

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

August 8,

2024

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f)

or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

| * | The remainder of this cover page shall be filled out for

a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. G6593L122 |

SCHEDULE 13D |

|

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Bodang Liu |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐

(b) ☐ |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

PF |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) or 2(e) ☐ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

A citizen of the People’s Republic of China |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7. |

SOLE VOTING POWER

826,540(1) |

| 8. |

SHARED VOTING POWER

|

| 9. |

SOLE DISPOSITIVE

POWER

826,540(1) |

| 10. |

SHARED DISPOSITIVE POWER

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

826,540(1) |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ☐

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

20.57%(2) |

| 14. |

TYPE OF REPORTING PERSON (see instructions)

IN |

| (1) | As of the date hereof, Mr. Bodang Liu may be deemed to beneficially

own an aggregate of 826,540 Common Shares of the Issuer, consisting of (i) 48,700 Common Shares held directly by Mr. Liu and (ii) 777,840

Common Shares held directly by NiSun International Enterprise Management Group Co., Ltd, a Cayman Islands company (“NiSun Cayman”),

of which Mr. Liu is the Sole Director and beneficial owner. |

| (2) | Based upon 4,017,596 Common Shares of the Issuer, issued

and outstanding as of July 11, 2024, as reported in the Annual Report on Form 20-F (the “Form 20-F”) of the Issuer filed

with the Securities and Exchange Commission (the “SEC”) on July 12, 2024. The number of Common Shares issued and outstanding

reflects the 1-for-10 reverse share split of the Issuer’s issued and outstanding Common Shares, which became effective on May 18,

2023. |

| CUSIP No. G6593L122 |

SCHEDULE 13D |

|

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

NiSun International Enterprise Management Group Co., Ltd. |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐

(b) ☐ |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

PF |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) or 2(e) ☐ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7. |

SOLE VOTING POWER

777,840 (1) |

| 8. |

SHARED VOTING POWER

|

| 9. |

SOLE DISPOSITIVE POWER

777,840(1) |

| 10. |

SHARED DISPOSITIVE POWER

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

777,840(1) |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ☐

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.36%(2) |

| 14. |

TYPE OF REPORTING PERSON (see instructions)

CO |

| (1) | As of the date hereof, Mr. Bodang Liu may be deemed to beneficially

own the 777,840 Common Shares held directly by NiSun Cayman, of which Mr. Liu is the Sole Director and beneficial owner. |

| (2) | Based upon 4,017,596 Common Shares, issued and outstanding,

of the Issuer as of July 11, 2024, as reported in the Form 20-F of the Issuer filed with the SEC on July 12, 2024. The number of Common

Shares issued and outstanding reflects the 1-for-10 reverse share split of the Issuer’s issued and outstanding Common Shares, which

became effective on May 18, 2023. |

| CUSIP No. G6593L122 |

SCHEDULE 13D |

|

This Amendment No. 1 (the “Amendment”)

amends the Schedule 13D originally filed on July 10, 2019 (the “Schedule 13D”) by Bodang Liu and NiSun International Enterprise

Management Group Co., Ltd (collectively, the “Reporting Persons”) relating to the Class A common shares, par value $0.01 per

share (the “Common Shares”), of Nisun International Enterprise Development Group Co., Ltd, a British Virgin Islands company

(the “Issuer”). Except as specifically amended by this Amendment, the Schedule 13D remains unchanged. Capitalized terms used

but not defined in this Amendment shall have the meanings set forth in the Schedule 13D.

Item 1. Security and Issuer.

Item 1 is amended and restated as follows:

This statement relates to the Common Shares of the

Issuer.

The address of the principal executive offices of

the Issuer is: 21F, 55 Loushanguan Rd, Changning District Shanghai 200336, People’s Republic of China.

On May 18, 2023, the Issuer effected a one-for-ten

reverse split of its Common Shares. Unless indicated otherwise by the context, all share amounts in this Amendment have been adjusted

to give retroactive effect to the reverse share split.

Item 2. Identity and Background

There have been no material changes to the

information previously reported in the Schedule 13D with respect to the Reporting Persons.

Item 3. Source or Amount of Funds or Other Consideration.

Item 3 is hereby amended and supplemented as follows:

Mr. Bodang Liu purchased an aggregate of 48,700

Common Shares on August 8, 2024 and August 9, 2024 in open market transactions. The aggregate consideration paid to purchase such

Common Shares was $463,145.60 in cash, and the source of such funds was the Reporting Person’s personal funds.

Item 4. Purpose of Transaction.

Item 4 is hereby amended and supplemented as follows:

The Reporting Person, Bodang Liu, acquired the securities

described in this Amendment for investment purposes and intends to review his investment in the Issuer on a continuing basis. The Reporting

Person may from time to time acquire additional shares of the Issuer, or retain or sell all or a portion of the shares then held by the

Reporting Person, in the open market, block trades, underwritten public offerings or privately negotiated transactions. Any actions the

Reporting Person might undertake with respect to his investment in the Issuer may be made at any time and from time to time and will be

dependent upon the Reporting Person’s review of numerous factors, including, but not limited to, ongoing evaluation of the Issuer’s

business, financial condition, operations, prospects, price levels of the Issuer’s securities; general market, industry and economic

conditions; the relative attractiveness of alternative business and investment opportunities; and other factors and future developments.

The Reporting Person currently has no plans or proposals

that relate to or would result in any of the actions specified in clause (a) through (j) of Item 4 of Schedule 13D. Depending upon the

foregoing factors and to the extent deemed advisable in light of his overall investment portfolio and strategies, or other factors, the

Reporting Person may, at any time and from time to time, formulate other plans or proposals regarding the Issuer or the Common Shares

of the Issuer, or any other actions that could involve one or more of the types of transactions or have one or more of the results described

in paragraphs (a) through (j) of Item 4 of Schedule 13D. The foregoing is subject to change at any time, and there can be no assurance

that the Reporting Person will take any of the actions set forth above.

| CUSIP No. G6593L122 |

SCHEDULE 13D |

|

Item 5. Interest in Securities of the Issuer.

Item 5 is hereby amended and restated as follows:

| |

(a) |

The aggregate number and percentage of the class of Common Shares beneficially owned by each Reporting Person are stated in Items 11 and 13 on the cover pages hereto. |

| |

|

|

| |

(b) |

The Reporting Person, Bodang Liu, has sole voting power and sole disposition power over the shares identified in Item 5(a). |

| (c) | Transactions in the Common

Shares of the Issuer that were effected during the past 60 days by the Reporting Person are described below. |

Transaction Date | |

Effecting

Person(s) | |

Shares

Acquired | | |

Price

Per Share(1) | | |

Description

of Transaction |

| 08/08/2024 | |

Bodang Liu | |

| 22,000 | | |

$ | 8.98 | | |

Open market purchases |

| 08/09/2024 | |

Bodang Liu | |

| 26,700 | | |

$ | 9.94 | | |

Open market purchases |

| (1) | Average price per share includes commissions. |

Except as described herein, the Reporting Person

has not effected any transactions in the Common Shares of the Issuer during the past sixty days.

| (d) | Except as described herein,

no other person has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the

Common Shares. |

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer.

Not applicable

Item 7. Material to Be Filed as Exhibits.

Not Applicable

| CUSIP No. G6593L122 |

SCHEDULE

13D |

|

SIGNATURE

After reasonable inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated:

August 12, 2024 |

|

|

| |

|

|

| |

By: |

/s/ Bodang Liu |

| |

Name: |

Bodang Liu |

| |

|

| |

NiSun International Enterprise Management Group Co., Ltd. |

| |

|

| |

By: |

/s/ Bodang Liu |

| |

Name: |

Bodang Liu |

| |

Title: |

Director |

6

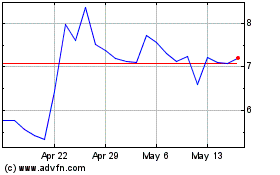

NiSun International Ente... (NASDAQ:NISN)

Historical Stock Chart

From Dec 2024 to Dec 2024

NiSun International Ente... (NASDAQ:NISN)

Historical Stock Chart

From Dec 2023 to Dec 2024