false

0001496099

0001496099

2024-01-18

2024-01-18

0001496099

us-gaap:CommonStockMember

2024-01-18

2024-01-18

0001496099

NMFC:Notes8.250PercentDue2028Member

2024-01-18

2024-01-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 18, 2024

New Mountain Finance Corporation

(Exact name of registrant as specified in its

charter)

| Delaware |

|

814-00832 |

|

27-2978010 |

(State or other jurisdiction

of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

1633 Broadway, 48th Floor, New York, NY 10019

(Address of principal executive offices) (Zip

code)

Registrant’s telephone number, including

area code: (212) 720-0300

None

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol (s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.01 per share |

|

NMFC |

|

NASDAQ Global Select Market |

| 8.250% Notes due 2028 |

|

NMFCZ |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. |

Results of Operations and Financial Condition. |

Preliminary Estimates of Results as of December 31,

2023

On January 18, 2024,

New Mountain Finance Corporation (the “Company”, “we” or “our”) issued a press release to

announce preliminary estimates of its financial condition and results of operations as of and for the three months ended

December 31, 2023, which are estimated as of January 17, 2024 and are set forth below. The press release is attached as

Exhibit 99.1 to this Form 8-K and is incorporated by reference herein.

We estimate that our net investment

income per share for the three months ended December 31, 2023 was between $0.39 per share and $0.40 per share, calculated using 101,638,346

weighted average shares for the three months ended December 31, 2023.

We estimate that our net asset value per share as of December 31, 2023 was between $12.85 per share and $12.90 per share. This estimate

is net of the $0.10 per share special dividend that was paid on December 29, 2023.

We estimate that our statutory leverage ratio as

of December 31, 2023 was 1.14x and our statutory leverage ratio net of available cash was 1.10x.

The

information disclosed under this Item 2.02, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into

any filing made by the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by

specific reference in such filing.

Forward-Looking Statements

Item 2.02 of this Form 8-K

contains forward-looking statements with respect to the business and investments of the Company, including, but not limited to, the preliminary

estimates of its financial information and results for the three months ended December 31, 2023, which are based on current information

available to the Company as of the date hereof. The preliminary financial estimates furnished above are based on the Company management’s

preliminary determinations and current expectations as of January 17, 2024, and such information is inherently uncertain. The preliminary

financial estimates provided herein have been prepared by, and are the responsibility of, management. Neither Deloitte & Touche

LLP, our independent registered public accounting firm, nor any other independent accountants have audited, reviewed, compiled, or performed

any procedures with respect to the preliminary financial data set forth above. Accordingly, Deloitte & Touche LLP does not express

an opinion or any form of assurance with respect thereto and assumes no responsibility for, and disclaims any association with, this information.

The preliminary financial

estimates may not align with the Company’s actual results of operations for the period, which will not be known until the Company

completes its customary financial year-end closing, including the determination of the fair value of the Company’s portfolio investments,

final adjustments and other developments that arise between now and the time that our financial results for the fiscal year ended December 31,

2023 are finalized. Actual results could differ materially from the current preliminary financial estimates based on adjustments made

during the Company’s year-end closing and audit procedures, and the Company’s reported information in its Annual Report on

Form 10-K for the fiscal year ended December 31, 2023 may differ from this information, and any such differences may be material.

In addition, the information furnished above does not include all of the information regarding the Company’s financial condition

and results of operations for the three months ended December 31, 2023 that may be important to readers. As a result, readers are

cautioned not to place undue reliance on the information furnished in Item 2.02 and should view this information in the context of the

Company’s full fourth quarter 2023 results when such results are disclosed by the Company in its Annual Report on Form 10-K

for the fiscal year ended December 31, 2023. The information furnished in this Item 2.02 is based on our management’s current

expectations that involve substantial risks and uncertainties that could cause actual results to differ materially from the results expressed

in, or implied by, such information.

Item 7.01 Regulation FD Disclosure.

The information contained in Item 2.02 of this Current Report on Form 8-K is incorporated by reference herein.

The information disclosed under this Item 7.01, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, and shall not be deemed incorporated

by reference into any filing made by the Company under the Securities Act, or the Exchange Act, except as expressly set forth by specific

reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

NEW MOUNTAIN FINANCE CORPORATION |

| |

|

|

| Date: January 18, 2024 |

By: |

/s/ Joseph W. Hartswell |

| |

|

Name: |

Joseph W. Hartswell |

| |

|

Title: |

Chief Compliance Officer and Corporate Secretary |

Exhibit 99.1

New Mountain Finance Corporation Announces Preliminary

Estimates of Fourth Quarter 2023 Operating Results

NEW YORK--(BUSINESS WIRE)—January 18, 2024--New

Mountain Finance Corporation (NASDAQ: NMFC) (“NMFC”, “the Company”, “we” or “our”)

today announced its preliminary estimates of its financial condition and results of operations as of and for the three months ended

December 31, 2023, which are estimated as of January 17, 2024.

We estimate that our net investment income per share for the three months ended

December 31, 2023 was between $0.39 per share and $0.40 per share, calculated using 101,638,346 weighted average shares for the three

months ended December 31, 2023. We estimate that our net asset value per share as of December 31, 2023 was between $12.85 per share and $12.90 per share. This estimate

is net of the $0.10 per share special dividend that was paid on December 29, 2023. We estimate that our statutory leverage ratio

as of December 31, 2023 was 1.14x and our statutory leverage ratio net of available cash was 1.10x.

NMFC will release its finalized fourth quarter 2023 operating results

on February 26, 2024.

ABOUT NEW MOUNTAIN FINANCE CORPORATION

New Mountain Finance Corporation (NASDAQ: NMFC) is a leading business

development company (BDC) focused on providing direct lending solutions to U.S. middle market companies backed by top private equity sponsors.

Our portfolio consists primarily of senior secured loans, and select junior capital positions, to growing businesses in defensive industries

that offer attractive risk-adjusted returns. Our differentiated investment approach leverages the deep sector knowledge and operating

resources of New Mountain Capital, a global investment firm with over $45 billion of assets under management as of September 30,

2023.

ABOUT NEW MOUNTAIN CAPITAL

New Mountain Capital is a New York-based investment

firm that emphasizes business building and growth, rather than debt, as it pursues long-term capital appreciation. The firm currently

manages private equity, credit and net lease investment strategies with over $45 billion in assets under management. New Mountain seeks

out what it believes to be the highest quality growth leaders in carefully selected industry sectors and then works intensively with management

to build the value of these companies.

FORWARD-LOOKING STATEMENTS

Statements included herein may contain “forward-looking

statements” with respect to the business and investments of the Company, including, but not limited to, the preliminary estimates

of its financial information and results for the three months ended December 31, 2023, which are based on current information available

to the Company as of the date hereof. The preliminary financial estimates furnished above are based on our management’s preliminary

determinations and current expectations as of January 17, 2024, and such information is inherently uncertain. The preliminary financial

estimates provided herein have been prepared by, and are the responsibility of, management. Neither Deloitte & Touche LLP, our

independent registered public accounting firm, nor any other independent accountants have audited, reviewed, compiled, or performed any

procedures with respect to the preliminary financial data set forth above. Accordingly, Deloitte & Touche LLP does not express

an opinion or any form of assurance with respect thereto and assumes no responsibility for, and disclaims any association with, this information.

The preliminary financial estimates may not

align with the Company’s actual results of operations for the period, which will not be known until the Company completes its customary

financial year-end closing, including the determination of the fair value of the Company’s portfolio investments, final adjustments

and other developments that arise between now and the time that our financial results for the fiscal year ended December 31, 2023

are finalized. Actual results could differ materially from the current preliminary financial estimates based on adjustments made during

the Company’s year-end closing and audit procedures, and the Company’s reported information in its Annual Report on Form 10-K

for the fiscal year ended December 31, 2023 may differ from this information, and any such differences may be material. In addition,

the information provided above does not include all of the information regarding the Company’s financial condition and results of

operations for the three months ended December 31, 2023 that may be important to readers. As a result, readers are cautioned not

to place undue reliance on the information herein and should view this information in the context of the Company’s full fourth quarter

2023 results when such results are disclosed by the Company in its Annual Report on Form 10-K for the fiscal year ended December 31,

2023. The information provided above is based on our management’s current expectations that involve substantial risks and uncertainties

that could cause actual results to differ materially from the results expressed in, or implied by, such information.

Contact

New Mountain Finance Corporation

Investor Relations

Laura C. Holson, Authorized Representative

NMFCIR@newmountaincapital.com

(212) 220-3505

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NMFC_Notes8.250PercentDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

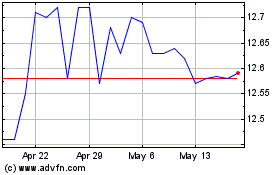

New Mountain Finance (NASDAQ:NMFC)

Historical Stock Chart

From Apr 2024 to May 2024

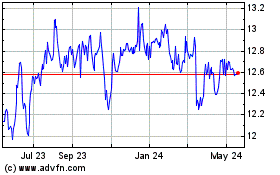

New Mountain Finance (NASDAQ:NMFC)

Historical Stock Chart

From May 2023 to May 2024