New Providence Acquisition Corp. II Announces Intention to Liquidate

09 November 2024 - 8:13AM

New Providence Acquisition Corp. II (Nasdaq: NPAB) (the “Company”)

announced today that its board of directors (the “Board”) has

determined that the Company will (i) abandon and not implement

the proposal to extend the date by which the Company must

consummate an initial business combination from November 9,

2024 to November 9, 2025, which proposal was approved by the

Company’s stockholders at the special meeting of stockholders held

on November 1, 2024, (ii) cease all operations except for the

purpose of winding up as soon as practicable, (iii) as

promptly as reasonably possible redeem the shares of its Class A

common stock (the “Public Shares”) that were included in the units

issued in the Company’s initial public offering (the “IPO”) at a

per-share price, payable in cash, equal to the aggregate amount

then on deposit in the trust account established in connection with

the IPO (the “Trust Account”) including interest earned on the

funds held in the Trust Account and not previously released to the

Company to pay its franchise and income taxes (less up to $100,000

of interest to pay dissolution expenses), divided by the number of

outstanding Public Shares, which redemption will completely

extinguish public stockholders’ rights as stockholders (including

the right to receive further liquidating distributions, if any),

subject to applicable law (the “Redemption”), and (iv) as

promptly as reasonably possible following the Redemption, subject

to the approval of the Company’s remaining stockholders and the

Board, liquidate the funds held in the Trust Account (the

“Liquidation”) and dissolve the Company (the “Dissolution”),

subject in each case to its obligations under Delaware law to

provide for claims of creditors and the requirements of other

applicable law. There will be no redemption rights or liquidating

distributions with respect to the Company’s warrants, which will

expire worthless. New Providence Acquisition II LLC, the

Company’s sponsor, has agreed to waive its redemption rights with

respect to the shares of the Company’s Class B common stock issued

prior to the IPO, including shares of the Company’s Class A common

stock issued upon conversion of such Class B common stock.

In order to provide for the disbursement of

funds from the Trust Account, the Company will instruct Continental

Stock Transfer & Trust Company (“Continental”), as its

trustee, to take all necessary actions to effect the Liquidation.

The proceeds thereof, less $100,000 of interest to pay dissolution

expenses and net of franchise and income taxes payable, will be

held in a trust operating account while awaiting disbursement to

the holders of the Public Shares. The Company expects to

redeem all of the outstanding Public Shares for an estimated

redemption price of approximately $10.89 per share (the “Redemption

Amount”) after the payment of up to $100,000 of dissolution

expenses, but before the payment of taxes. All other costs and

expenses associated with implementing the Dissolution will be

funded from proceeds held outside of the Trust Account. Record

holders of Public Shares will receive their pro rata portion of the

proceeds of the Trust Account by delivering their Public Shares to

Continental, the Company’s transfer agent. Beneficial owners of

Public Shares held in “street name,” however, will not need to take

any action in order to receive the Redemption Amount. The

Redemption Amount is expected to be paid out within ten business

days after the instruction to Continental to commence the

Redemption and Liquidation.

About New Providence Acquisition Corp.

II

New Providence Acquisition Corp. II is a blank

check company incorporated in Delaware for the purpose of effecting

a merger, capital stock exchange, asset acquisition, share

purchase, reorganization or similar business combination with one

or more businesses. The Company has not yet selected any specific

business combination target.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of the safe harbor provisions of the

United States Private Securities Litigation Reform Act of 1995.

Certain of these forward-looking statements can be identified by

the use of words such as “believes,” “expects,” “intends,” “plans,”

“estimates,” “assumes,” “may,” “should,” “will,” “seeks,” or other

similar expressions. These statements are based on current

expectations on the date of this press release and involve a number

of risks and uncertainties that may cause actual results to differ

significantly. The Company does not assume any obligation to update

or revise any such forward-looking statements, whether as the

result of new developments or otherwise. Readers are cautioned not

to put undue reliance on forward-looking statements.

Contact:

Please send inquiries to

info@npa-corp.com.

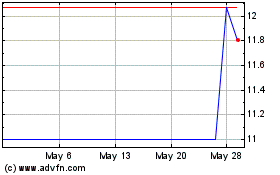

New Providence Acquisiti... (NASDAQ:NPABU)

Historical Stock Chart

From Jan 2025 to Feb 2025

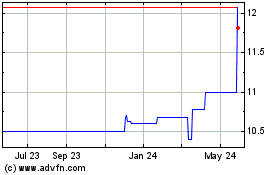

New Providence Acquisiti... (NASDAQ:NPABU)

Historical Stock Chart

From Feb 2024 to Feb 2025