Navitas Semiconductor Corporation (Nasdaq: NVTS), the industry

leader in next-generation power semiconductors, today announced

unaudited financial results for the fourth quarter and full year

ended December 31, 2023.

“I am pleased to announce a record fourth quarter that caps off

a year of more than doubling revenue for Navitas as we demonstrated

strength across multiple markets,” said Gene Sheridan, CEO and

co-founder. “While we are not immune to first half 2024 market

headwinds, we see revenue growth accelerating in the second half

based on our strong customer pipeline including major new wins in

AI data centers, home appliances, solar inverters and a major

satellite internet roll-out - all of which positions Navitas for

strong growth in 2024 and beyond.”

4Q23 Financial Highlights

- Revenue: Total revenue grew to $26.1 million

in the fourth quarter of 2023, a 111% increase from $12.3 million

in the fourth quarter of 2022 and a 19% increase from $22.0 million

in the third quarter of 2023.

- Gross Margin: GAAP gross margin for the fourth

quarter of 2023 was 42.2%, compared to 40.6% in the fourth quarter

of 2022 and 32.3% for the third quarter of 2023. Non-GAAP gross

margin for the fourth quarter of 2023 was 42.2% compared to 40.6%

for the fourth quarter of 2022 and 42.1% for the third quarter of

2023.

- Loss from Operations: GAAP loss from

operations for the quarter was $26.8 million, compared to a loss of

$31.2 million for the fourth quarter of 2022 and a loss of $28.6

million for the third quarter of 2023. On a non-GAAP basis, loss

from operations for the quarter was $9.7 million compared to a loss

of $12.4 million for the fourth quarter of 2022 and a loss of $8.7

million for the third quarter of 2023.

- Cash: Cash and

cash equivalents were $152.8 million as of December 31, 2023.

FY 2023 Financial Highlights

- Revenue: Total revenue grew to $79.5 million

in 2023, a 109% increase from $37.9 million in 2022.

- Gross Margin: GAAP gross margin for 2023 was

39.1%, compared to 31.5% in 2022. Non-GAAP gross margin for 2023

was 41.8% compared to 40.8% for 2022.

- Loss from

Operations: GAAP loss from operations for the year was

$118.1 million, compared to a loss of $123.6 million for 2022. On a

non-GAAP basis, loss from operations for the year was $40.3 million

compared to a loss of $41.2 million for 2022.

Market, Customer and Technology Highlights:

- Electric Vehicle:

Introduction of new GaNSafe technology plus new Gen-3 Fast silicon

carbide is fueling demand for EV on-board and roadside chargers.

SiC-based on-board chargers are in or moving to production this

year with customers including top EV brands such as Zeekr, Volvo

and Smart. Announced joint design center with Shinry – one of the

top EV on-board charger suppliers for Hyundai, BYD, Honda, Geely

and others.

- Solar/Energy Storage: Displacement of silicon

with GaNSafe and Gen 3 Fast SiC technologies continued with

significant developments in 3 of the top 5 US solar OEMs, and the

majority of the world’s top 10 solar manufacturers. SiC is shipping

into this market today and GaN adoption is expected to ramp in late

2024.

- Home Appliance / Industrial: Major new tier 1

home appliance win will drive additional revenues in late ‘24 -

Navitas now engaged with 7 of the world’s top 10 home appliance

OEMs. Customer designs are in process at 2 of the top 3 global

leaders in industrial pumps and a top 3 global leader in heat

pumps.

- Datacenter: New GaNSafe and Gen 3 Fast SiC and

Navitas’ dedicated design center is now achieving an unprecedented

4.5 kW, more than double the power density of legacy silicon

solutions, to deliver accelerating power demands of AI data

centers. Over 20 customer designs are expected to ramp production

in 2024.

- Mobile: Navitas now powers 5 newly released

OPPO models and 8 newly released Xiaomi models with chargers

ranging from 67 W to 120 W. Additional Samsung models now include

powering the new Galaxy S24.

- Other New Markets:

GaN ICs have been designed into the ground-based terminal for a

major internet satellite implementation to ramp in 2H24.

Business Outlook

First quarter 2024 net revenues are expected to be $23 million

plus or minus $500 thousand. Gross margin for the first quarter is

expected to be 41% plus or minus 50 basis points and operating

expenses, excluding stock-based compensation and amortization of

intangible assets, are expected to be approximately $21.5 million

in the first quarter of 2024. Weighted-average basic share count is

expected to be approximately 180 million shares for the first

quarter of 2024.

Navitas Q4 and FY 2023 Financial Results Conference Call

and Webcast Information:When: Thursday,

February 29th, 2024Time: 2:00 p.m. Pacific / 5:00

p.m. EasternToll Free Dial-in: (800) 715-9871 or

(646) 307-1963, Conference ID: 6680139Live

Webcast:

https://edge.media-server.com/mmc/p/n4aaj82bReplay:

A replay of the call will be accessible from the Investor Relations

section of the Company’s website at

https://ir.navitassemi.com/.

Non-GAAP Financial Measures

This press release and statements in our public webcast include

financial measures that are not calculated in accordance with

generally accepted accounting principles (“GAAP”), which we refer

to as “non-GAAP financial measures,” including (i) non-GAAP gross

margin, (ii) non-GAAP operating expenses, (iii) non-GAAP research

and development expense, (iv) non-GAAP selling, general and

administrative expense, (v) non-GAAP loss from operations, (vi)

non-GAAP operating margin, and (vi) non-GAAP loss and loss per

share. Each of these non-GAAP financial measures are adjusted from

GAAP results to exclude certain expenses which are outlined in the

“Reconciliation of GAAP Results to Non-GAAP Financial Measures”

tables below. We believe these non-GAAP financial measures provide

investors with useful supplemental information about our operating

performance and enable comparison of financial trends and results

between periods where certain items may vary independent of

business performance. We believe these non-GAAP financial measures

offer an additional view of our operations that, when coupled with

the GAAP results and the reconciliations to corresponding GAAP

financial measures, provide a more complete understanding of the

results of operations. However, these non-GAAP financial measures

should be considered as a supplement to, and not as a substitute

for, or superior to, the corresponding measures calculated in

accordance with GAAP.

Cautionary Statement Regarding Forward-Looking

Statements

This press release, including the paragraph headed “Business

Outlook,” includes “forward-looking statements” within the meaning

of Section 21E of the Securities Exchange Act of 1934, as amended.

The term “customer pipeline” and related information constitute

forward-looking statements. Other forward-looking statements may be

identified by the use of words such as “we expect” or “are expected

to be,” “estimate,” “plan,” “project,” “forecast,” “intend,”

“anticipate,” “believe,” “seek,” or other similar expressions that

predict or indicate future events or trends or that are not

statements of historical matters. Customer pipeline and other

forward-looking statements are made based on estimates and

forecasts of financial and performance metrics, projections of

market opportunity and market share and current indications of

customer interest, all of which are based on various assumptions,

whether or not identified in this press release. All such

statements are based on current expectations of the management of

Navitas and are not predictions of actual future performance.

Forward-looking statements are provided for illustrative purposes

only and are not intended to serve as, and must not be relied on by

any investor as, a guarantee, an assurance, a prediction or a

definitive statement of fact or probability. Actual events and

circumstances are difficult or impossible to predict and will

differ from assumptions and expectations. Many actual events and

circumstances that affect performance are beyond the control of

Navitas, and forward-looking statements are subject to a number of

risks and uncertainties, including the possibility that the

expected growth of our business will not be realized, or will not

be realized within expected time periods, due to, among other

things, the failure to successfully integrate acquired businesses

into our business and operational systems; the effect of

acquisitions on customer and supplier relationships, or the failure

to retain and expand those relationships; the success or failure of

other business development efforts; Navitas’ financial condition

and results of operations; Navitas’ ability to accurately predict

future revenues for the purpose of appropriately budgeting and

adjusting Navitas’ expenses; Navitas’ ability to diversify its

customer base and develop relationships in new markets; Navitas’

ability to scale its technology into new markets and applications;

the effects of competition on Navitas’ business, including actions

of competitors with an established presence and resources in

markets we hope to penetrate, including silicon carbide markets;

the level of demand in our customers’ end markets and our

customers’ ability to predict such demand, both generally and with

respect to successive generations of products or technology;

Navitas’ ability to attract, train and retain key qualified

personnel; changes in government trade policies, including the

imposition of tariffs and the regulation of cross-border

investments, particularly involving the United States and China;

other regulatory developments in the United States, China and other

countries; the impact of the COVID-19 pandemic or other epidemics

on Navitas’ business and the economies that affect our business,

including but not limited to Navitas’ supply chain and the supply

chains of customers and suppliers; and Navitas’ ability to protect

its intellectual property rights.

These and other risk factors are discussed under Part 1, Item 1A

“Risk Factors” section in the Company’s annual reports on Form

10-K, and other SEC reports. If any of the risks described above,

and discussed in more detail in our SEC reports, materialize or if

our assumptions underlying forward-looking statements prove to be

incorrect, actual results could differ materially from the results

implied by these forward-looking statements. There may be

additional risks that Navitas is not aware of or that Navitas

currently believes are immaterial that could also cause actual

results to differ materially from those contained in

forward-looking statements. In addition, forward-looking statements

reflect Navitas’ expectations, plans or forecasts of future events

and views as of the date of this press release. Navitas anticipates

that subsequent events and developments will cause Navitas’

assessments to change. However, while Navitas may elect to update

these forward-looking statements at some point in the future,

Navitas specifically disclaims any obligation to do so. These

forward-looking statements should not be relied upon as

representing Navitas’ assessments as of any date subsequent to the

date of this press release.

About Navitas

Navitas Semiconductor (Nasdaq: NVTS) is the only pure-play,

next-generation power-semiconductor company, founded in 2014.

GaNFast™ power ICs integrate gallium nitride (GaN) power and drive,

with control, sensing, and protection to enable faster charging,

higher power density, and greater energy savings. Complementary

GeneSiC™ power devices are optimized high-power, high-voltage, and

high-reliability silicon carbide (SiC) solutions. Focus markets

include EV, solar, energy storage, home appliance / industrial,

data center, mobile and consumer. Over 250 Navitas patents are

issued or pending. Navitas was the world’s first semiconductor

company to be CarbonNeutral®-certified.

Navitas Semiconductor, GaNFast, GaNSense, GeneSiC and the

Navitas logo are trademarks or registered trademarks of Navitas

Semiconductor Limited and affiliates. All other brands, product

names and marks are or may be trademarks or registered trademarks

used to identify products or services of their respective

owners.

Contact InformationStephen Oliver, VP Corporate

Marketing & Investor Relationsir@navitassemi.com

PR image:

| |

|

|

|

|

|

|

|

|

NAVITAS SEMICONDUCTOR CORPORATION |

|

CONSOLIDATED STATEMENTS OF OPERATIONS (GAAP) -

UNAUDITED |

|

(dollars in thousands, except per-share

amounts) |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Year Ended |

|

|

December 31, |

|

December 31, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

NET REVENUES |

$ |

26,058 |

|

|

$ |

12,349 |

|

|

$ |

79,456 |

|

|

$ |

37,943 |

|

|

COST OF REVENUES (exclusive of amortization of intangibles included

below) |

|

15,069 |

|

|

|

7,341 |

|

|

|

48,392 |

|

|

|

25,996 |

|

|

GROSS PROFIT |

|

10,989 |

|

|

|

5,008 |

|

|

|

31,064 |

|

|

|

11,947 |

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

Research and development |

|

18,087 |

|

|

|

15,945 |

|

|

|

68,825 |

|

|

|

50,318 |

|

|

Selling, general and administrative |

|

14,923 |

|

|

|

15,763 |

|

|

|

61,551 |

|

|

|

78,353 |

|

|

Amortization of intangible assets |

|

4,774 |

|

|

|

4,499 |

|

|

|

18,820 |

|

|

|

6,913 |

|

|

Total operating expenses |

|

37,784 |

|

|

|

36,207 |

|

|

|

149,196 |

|

|

|

135,584 |

|

|

LOSS FROM OPERATIONS |

|

(26,795 |

) |

|

|

(31,199 |

) |

|

|

(118,132 |

) |

|

|

(123,637 |

) |

|

OTHER INCOME (EXPENSE), net: |

|

|

|

|

|

|

|

|

Interest income, net |

|

1,964 |

|

|

|

721 |

|

|

|

5,368 |

|

|

|

1,387 |

|

|

Gain from change in fair value of warrants |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

51,763 |

|

|

Gain (loss) from change in fair value of earnout liabilities |

|

(8,285 |

) |

|

|

9,547 |

|

|

|

(33,788 |

) |

|

|

121,709 |

|

|

Other income (expense) |

|

33 |

|

|

|

67 |

|

|

|

84 |

|

|

|

(1,147 |

) |

|

Total other income (expense), net |

|

(6,288 |

) |

|

|

10,335 |

|

|

|

(28,336 |

) |

|

|

173,712 |

|

|

INCOME (LOSS) BEFORE INCOME TAXES |

|

(33,083 |

) |

|

|

(20,864 |

) |

|

|

(146,468 |

) |

|

|

50,075 |

|

|

INCOME TAX (BENEFIT) PROVISION |

|

(505 |

) |

|

|

(12,950 |

) |

|

|

(517 |

) |

|

|

(22,812 |

) |

|

NET INCOME (LOSS) |

|

(32,578 |

) |

|

|

(7,914 |

) |

|

|

(145,951 |

) |

|

|

72,887 |

|

|

LESS: Net income (loss) attributable to noncontrolling

interest |

|

— |

|

|

|

(789 |

) |

|

|

(518 |

) |

|

|

(1,026 |

) |

|

NET INCOME (LOSS) ATTRIBUTABLE TO CONTROLLING INTEREST |

$ |

(32,578 |

) |

|

$ |

(7,125 |

) |

|

$ |

(145,433 |

) |

|

$ |

73,913 |

|

|

NET INCOME (LOSS) PER SHARE: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.18 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.86 |

) |

|

$ |

0.55 |

|

|

Diluted |

$ |

(0.18 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.86 |

) |

|

$ |

0.51 |

|

|

SHARES USED IN PER-SHARE CALCULATION: |

|

|

|

|

|

|

|

|

Basic |

|

178,780 |

|

|

|

152,416 |

|

|

|

168,927 |

|

|

|

133,668 |

|

|

Diluted |

|

178,780 |

|

|

|

152,416 |

|

|

|

168,927 |

|

|

|

145,743 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

NAVITAS SEMICONDUCTOR CORPORATION |

|

RECONCILIATION OF GAAP RESULTS TO NON-GAAP FINANCIAL

MEASURES |

|

(dollars in thousands, except per-share

amounts) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Year Ended |

| |

December 31, |

|

December 31, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

RECONCILIATION OF GROSS PROFIT MARGIN |

|

|

|

|

|

|

|

|

GAAP gross profit |

$ |

10,989 |

|

|

$ |

5,008 |

|

|

$ |

31,064 |

|

|

$ |

11,947 |

|

|

GAAP gross profit margin |

|

42.2 |

% |

|

|

40.6 |

% |

|

|

39.1 |

% |

|

|

31.5 |

% |

|

Inventory write-off related to discontinued products |

|

— |

|

|

|

— |

|

|

|

2,024 |

|

|

|

— |

|

|

Other operational charges |

|

— |

|

|

|

— |

|

|

|

122 |

|

|

|

172 |

|

|

Reserves for write-down of inventory |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,833 |

|

|

Inventory write-off related to purchase accounting step-up |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

539 |

|

|

Non-GAAP gross profit |

$ |

10,989 |

|

|

$ |

5,008 |

|

|

$ |

33,210 |

|

|

$ |

15,491 |

|

|

Non-GAAP gross profit margin |

|

42.2 |

% |

|

|

40.6 |

% |

|

|

41.8 |

% |

|

|

40.8 |

% |

|

RECONCILIATION OF OPERATING EXPENSES |

|

|

|

|

|

|

|

|

GAAP Research and development |

$ |

18,087 |

|

|

$ |

15,945 |

|

|

$ |

68,825 |

|

|

$ |

50,318 |

|

|

Stock-based compensation expenses |

|

(6,669 |

) |

|

|

(4,096 |

) |

|

|

(26,806 |

) |

|

|

(19,853 |

) |

|

Non-GAAP Research and development |

|

11,418 |

|

|

|

11,849 |

|

|

|

42,019 |

|

|

|

30,465 |

|

|

GAAP Selling, general and administrative |

|

14,923 |

|

|

|

15,763 |

|

|

|

61,551 |

|

|

|

78,353 |

|

|

Stock-based compensation expenses |

|

(5,549 |

) |

|

|

(7,056 |

) |

|

|

(27,222 |

) |

|

|

(43,435 |

) |

|

Termination of distributor |

|

— |

|

|

|

— |

|

|

|

(483 |

) |

|

|

— |

|

|

Payroll taxes on vesting of employee stock-based compensation |

|

35 |

|

|

|

(438 |

) |

|

|

(663 |

) |

|

|

(592 |

) |

|

Acquisition-related expenses |

|

(2 |

) |

|

|

(2,640 |

) |

|

|

(1,487 |

) |

|

|

(8,082 |

) |

|

Other |

|

(105 |

) |

|

|

(22 |

) |

|

|

(210 |

) |

|

|

(22 |

) |

|

Non-GAAP Selling, general and administrative |

|

9,302 |

|

|

|

5,607 |

|

|

|

31,486 |

|

|

|

26,222 |

|

|

Total Non-GAAP operating expenses |

$ |

20,720 |

|

|

$ |

17,456 |

|

|

$ |

73,505 |

|

|

$ |

56,687 |

|

|

RECONCILIATION OF LOSS FROM OPERATIONS |

|

|

|

|

|

|

|

|

GAAP loss from operations |

$ |

(26,795 |

) |

|

$ |

(31,199 |

) |

|

$ |

(118,132 |

) |

|

$ |

(123,637 |

) |

|

GAAP operating margin |

|

(102.8 |

)% |

|

|

(252.6 |

)% |

|

|

(148.7 |

)% |

|

|

(325.8 |

)% |

|

Add: Stock-based compensation expenses included in: |

|

|

|

|

|

|

|

|

Research and development |

|

6,669 |

|

|

|

4,096 |

|

|

|

26,806 |

|

|

|

19,853 |

|

|

Selling, general and administrative |

|

5,549 |

|

|

|

7,056 |

|

|

|

27,222 |

|

|

|

43,435 |

|

|

Total |

|

12,218 |

|

|

|

11,152 |

|

|

|

54,028 |

|

|

|

63,288 |

|

|

Amortization of acquisition-related intangible assets |

|

4,774 |

|

|

|

4,499 |

|

|

|

18,820 |

|

|

|

6,913 |

|

|

Inventory write-off related to discontinued products |

|

— |

|

|

|

— |

|

|

|

2,024 |

|

|

|

— |

|

|

Termination of distributor |

|

— |

|

|

|

— |

|

|

|

483 |

|

|

|

— |

|

|

Payroll taxes on vesting of employee stock-based compensation |

|

(35 |

) |

|

|

438 |

|

|

|

663 |

|

|

|

592 |

|

|

Other operational charges |

|

— |

|

|

|

— |

|

|

|

122 |

|

|

|

172 |

|

|

Acquisition-related expenses |

|

2 |

|

|

|

2,640 |

|

|

|

1,487 |

|

|

|

8,082 |

|

|

Reserves for write-down of inventory |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,833 |

|

|

Inventory write-off related to purchase accounting step-up |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

539 |

|

|

Other |

|

105 |

|

|

|

22 |

|

|

|

210 |

|

|

|

22 |

|

|

Non-GAAP loss from operations |

$ |

(9,731 |

) |

|

$ |

(12,448 |

) |

|

$ |

(40,295 |

) |

|

$ |

(41,196 |

) |

|

Non-GAAP operating margin |

|

(37.3 |

)% |

|

|

(100.8 |

)% |

|

|

(50.7 |

)% |

|

|

(108.6 |

)% |

|

RECONCILIATION OF NET LOSS PER SHARE |

|

|

|

|

|

|

|

|

GAAP net income (loss) attributable to controlling interest |

$ |

(32,578 |

) |

|

$ |

(7,125 |

) |

|

$ |

(145,433 |

) |

|

$ |

73,913 |

|

|

Adjustments to GAAP net income (loss) |

|

|

|

|

|

|

|

|

Loss (Gain) from change in fair value of earnout liabilities |

|

8,285 |

|

|

|

(9,547 |

) |

|

|

33,788 |

|

|

|

(121,709 |

) |

|

Total stock-based compensation |

|

12,218 |

|

|

|

11,152 |

|

|

|

54,028 |

|

|

|

63,288 |

|

|

Amortization of acquisition-related intangible assets |

|

4,774 |

|

|

|

4,499 |

|

|

|

18,820 |

|

|

|

6,913 |

|

|

Inventory write-off related to discontinued products |

|

— |

|

|

|

— |

|

|

|

2,024 |

|

|

|

— |

|

|

Termination of distributor |

|

— |

|

|

|

— |

|

|

|

483 |

|

|

|

— |

|

|

Payroll taxes on vesting of employee stock-based compensation |

|

(35 |

) |

|

|

438 |

|

|

|

663 |

|

|

|

592 |

|

|

Other operational charges |

|

— |

|

|

|

— |

|

|

|

122 |

|

|

|

172 |

|

|

Acquisition-related expenses |

|

2 |

|

|

|

2,640 |

|

|

|

1,487 |

|

|

|

8,082 |

|

|

Reserves for write-down of inventory |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,833 |

|

|

Inventory write-off related to purchase accounting step-up |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

539 |

|

|

Gain from change in fair value of warrants |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(51,763 |

) |

|

Release of tax valuation allowance |

|

— |

|

|

|

(10,754 |

) |

|

|

— |

|

|

|

(20,669 |

) |

|

Other expense |

|

72 |

|

|

|

(45 |

) |

|

|

126 |

|

|

|

1,169 |

|

|

Non-GAAP net loss |

$ |

(7,262 |

) |

|

$ |

(8,742 |

) |

|

$ |

(33,892 |

) |

|

$ |

(36,640 |

) |

|

Average shares outstanding for calculation of non-GAAP net loss per

share (basic and diluted) |

|

178,780 |

|

|

|

152,416 |

|

|

|

168,927 |

|

|

|

133,668 |

|

|

Non-GAAP net loss per share (basic and diluted) |

$ |

(0.04 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.27 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

NAVITAS SEMICONDUCTOR CORPORATION |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(dollars in thousands) |

| |

|

|

|

|

(Unaudited) |

|

|

| |

|

|

|

|

December 31, 2023 |

|

December 31, 2022 |

|

ASSETS |

|

|

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

$ |

152,839 |

|

|

$ |

110,337 |

|

|

Accounts receivable, net |

|

|

|

|

|

25,858 |

|

|

|

9,127 |

|

|

Inventories |

|

|

|

|

|

23,166 |

|

|

|

19,061 |

|

|

Prepaid expenses and other current assets |

|

|

|

|

|

6,619 |

|

|

|

3,623 |

|

|

Total current assets |

|

|

|

|

|

208,482 |

|

|

|

142,148 |

|

|

PROPERTY AND EQUIPMENT, net |

|

|

|

|

|

9,154 |

|

|

|

6,532 |

|

|

OPERATING LEASE RIGHT OF USE ASSETS |

|

|

|

|

|

8,268 |

|

|

|

6,381 |

|

|

INTANGIBLE ASSETS, net |

|

|

|

|

|

91,099 |

|

|

|

105,620 |

|

|

GOODWILL |

|

|

|

|

|

163,215 |

|

|

|

161,527 |

|

|

OTHER ASSETS |

|

|

|

|

|

5,328 |

|

|

|

3,054 |

|

|

Total assets |

|

|

|

|

$ |

485,546 |

|

|

$ |

425,262 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

Accounts payable and other accrued expenses |

|

|

|

|

$ |

26,637 |

|

|

$ |

14,653 |

|

|

Accrued compensation expenses |

|

|

|

|

|

10,902 |

|

|

|

3,907 |

|

|

Current portion of operating lease liabilities |

|

|

|

|

|

1,892 |

|

|

|

1,305 |

|

|

Deferred revenue |

|

|

|

|

|

10,953 |

|

|

|

486 |

|

|

Total current liabilities |

|

|

|

|

|

50,384 |

|

|

|

20,351 |

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

|

OPERATING LEASE LIABILITIES NONCURRENT |

|

|

|

|

|

6,653 |

|

|

|

5,263 |

|

|

EARNOUT LIABILITY |

|

|

|

|

|

46,852 |

|

|

|

13,064 |

|

|

DEFERRED TAX LIABILITIES |

|

|

|

|

|

1,040 |

|

|

|

1,824 |

|

|

Total liabilities |

|

|

|

|

|

104,929 |

|

|

|

40,502 |

|

|

STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

|

Total stockholders’ equity of Navitas Semiconductor

Corporation |

|

|

|

|

|

380,617 |

|

|

|

381,132 |

|

|

Noncontrolling interest |

|

|

|

|

|

— |

|

|

|

3,628 |

|

|

Total equity |

|

|

|

|

|

380,617 |

|

|

|

384,760 |

|

|

Total liabilities stockholders’ equity |

|

|

|

|

$ |

485,546 |

|

|

$ |

425,262 |

|

A photo accompanying this announcement is available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/e9f46359-dfc9-4b4b-9c1d-9f731a01fddc

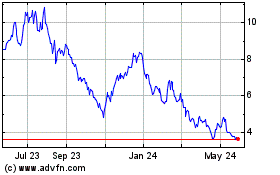

Navitas Semiconductor (NASDAQ:NVTS)

Historical Stock Chart

From Jan 2025 to Feb 2025

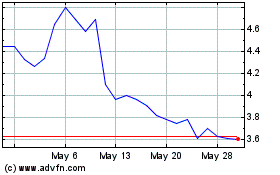

Navitas Semiconductor (NASDAQ:NVTS)

Historical Stock Chart

From Feb 2024 to Feb 2025