OFS Credit Company Announces Results of Stockholder Elections for the Distribution for the Fiscal Quarter Ending October 31, 2023

21 October 2023 - 7:00AM

Business Wire

OFS Credit Company, Inc. (NASDAQ: OCCI) (“OFS Credit”, the

“Company”, “we”, “us” or “our”), an investment company that

primarily invests in collateralized loan obligation (“CLO”) equity

and debt securities, today announced the results of stockholder

elections for the $0.55 per common share distribution declared by

the Company’s Board of Directors on September 1, 2023. Stockholders

had until October 17, 2023, to elect whether to receive the

distribution in cash (up to an aggregate maximum cash amount of 20%

of the total distribution), excluding any cash paid for fractional

shares, or in shares of the Company’s common stock. The

distribution is payable on October 31, 2023 to common stockholders

of record as of September 15, 2023.

The distribution will consist of approximately $1.6 million in

cash and 943,866 shares of common stock, or approximately 6.3% of

the Company’s outstanding common stock prior to the distribution.

The amount of cash elected to be received was greater than the cash

limit of 20% of the aggregate distribution amount, therefore

resulting in the payment of a combination of cash and stock to

stockholders who elected to receive cash. The number of shares of

common stock comprising the stock portion was calculated based on a

price of $6.98 per share, which equaled the volume weighted average

trading price per share of the Company’s common stock on the Nasdaq

Capital Market on October 16, 17 and 18, 2023.

Stockholders who elected to receive the distribution solely in

shares of common stock and stockholders who did not make an

election will receive approximately 0.078797 shares of common stock

for each share of common stock they owned on the record date of

September 15, 2023. Holders of approximately 39% of the Company’s

common stock elected to receive only stock or did not make an

election.

Stockholders electing to receive the distribution in all cash

will receive cash in the amount of $0.178931 per common share, or

approximately 32.5% of the $0.55 distribution, and $0.371069 shares

of common stock, or approximately 67.5% of the total distribution

for each share of common stock they owned on the record date of

September 15, 2023. Cash in lieu of fractional shares will be

issued, if applicable. Total outstanding shares of the Company’s

common stock following the distribution will be approximately

15,917,016 (including shares issued under the Company’s

At-the-Market offering through October 20, 2023).

Stockholders who hold their shares through a bank, broker or

nominee and have questions regarding the distribution should

contact their bank, broker or nominee directly.

Registered stockholders with questions regarding the

distribution may call the Company's transfer agent, American Stock

Transfer & Trust Company, LLC, at (718) 765-8730.

About OFS Credit Company, Inc.

OFS Credit is a non-diversified, externally managed closed-end

management investment company. The Company’s investment objective

is to generate current income, with a secondary objective to

generate capital appreciation primarily through investment in CLO

debt and subordinated securities. The Company's investment

activities are managed by OFS Capital Management, LLC, an

investment adviser registered under the Investment Advisers Act of

19401, as amended, and headquartered in Chicago, Illinois with

additional offices in New York and Los Angeles.

Forward-Looking Statements

Statements in this press release regarding management's future

expectations, beliefs, intentions, goals, strategies, plans or

prospects may constitute forward-looking statements.

Forward-looking statements can be identified by terminology such as

“anticipate”, “believe”, “could”, “could increase the likelihood”,

“estimate”, “expect”, “intend”, “is planned”, “may”, “should”,

“will”, “will enable”, “would be expected”, “look forward”, “may

provide”, “would” or similar terms, variations of such terms or the

negative of those terms. Such forward-looking statements involve

known and unknown risks, uncertainties and other factors including

those risks, uncertainties and factors referred to in documents

that may be filed by OFS Credit from time to time with the

Securities and Exchange Commission, as well as the impact of rising

interest rates and elevated inflation rates, the ongoing war

between Russia and Ukraine or current conflict in Israel,

instability in the U.S. and international banking systems, the risk

of recession and related market volatility on our business, our

portfolio companies, our industry and the global economy. As a

result of such risks, uncertainties and factors, actual results may

differ materially from any future results, performance or

achievements discussed in or implied by the forward-looking

statements contained herein. OFS Credit is providing the

information in this press release as of this date and assumes no

obligations to update the information included in this press

release or revise any forward-looking statements, whether as a

result of new information, future events or otherwise.

1 Registration does not imply a certain level of skill or

training

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231020673122/en/

INVESTOR RELATIONS: OFS Credit Company, Inc. Steve

Altebrando, 646-652-8473 saltebrando@ofsmanagement.com

MEDIA RELATIONS: Bill Mendel 212-397-1030

bill@mendelcommunications.com

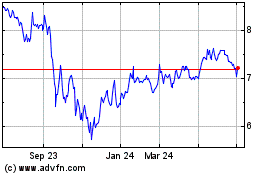

OFS Credit (NASDAQ:OCCI)

Historical Stock Chart

From Dec 2024 to Jan 2025

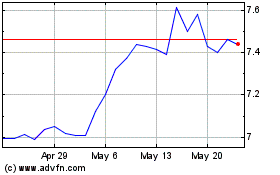

OFS Credit (NASDAQ:OCCI)

Historical Stock Chart

From Jan 2024 to Jan 2025