UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Schedule

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| |

☒ |

Preliminary

Proxy Statement |

| |

☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☐ |

Definitive

Proxy Statement |

| |

☐ |

Definitive

Additional Materials |

| |

☐ |

Soliciting

Material Pursuant to §240.14a-12 |

EightCo

holdings Inc.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| |

☒ |

No

fee required |

| |

☐ |

Fee

paid previously with preliminary materials |

| |

☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

eightco

holdings Inc.

200

9th Avenue North, Suite 220

Safety Harbor, FL 34695

(866) 980-2818

Notice

of Special Meeting of Stockholders

To Be Held on June 30, 2023

To

the Stockholders of Eightco Holdings Inc.:

Notice

is hereby given that a special meeting of stockholders (the “Special Meeting”) of Eightco Holdings Inc. (f/k/a Cryptyde,

Inc.) (the “Company”) will be held virtually via the Internet at www.virtualshareholdermeeting.com/ on June 30,

2023 at 10:00 a.m. Eastern Time. At the Special Meeting, stockholders will consider and vote on the following matters:

| |

1. |

A

proposal to authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of shares of our common stock (“Common

Stock”) underlying a convertible promissory note and warrant issued by us pursuant to the terms of that certain Securities

Purchase Agreement, dated March 15, 2023, by and among the Company and the investor named therein, in an amount equal to or in excess

of 20% of our Common Stock outstanding immediately prior to the issuance of such convertible promissory note and warrant (including

upon the operation of anti-dilution provisions contained in such convertible promissory note and warrant)(the “March

2023 SPA Issuance Proposal”); and |

| |

2. |

A proposal to adjourn

the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in

the event that there are insufficient votes for, or otherwise in connection with, the approval of the March 2023 SPA Issuance Proposal (the “Adjournment Proposal”). |

Each

of the March 2023 SPA Issuance Proposal and the Adjournment Proposal was approved by our board of directors (the

“Board”) and requires the affirmative vote of holders of a majority of the voting power of the shares present in person

or represented by proxy and entitled to vote at the Special Meeting on said proposal to be approved.

Stockholders

are referred to the proxy statement for more detailed information with respect to the matters to be considered at the Special

Meeting. After careful consideration, the Board recommends a vote “FOR” the March 2023 SPA Issuance Proposal and

“FOR” the Adjournment Proposal.

As

noted above, our Special Meeting will be a “virtual meeting” of stockholders, which will be conducted exclusively via the

Internet at a virtual web conference. There will not be a physical meeting location, and stockholders will not be able to attend the

Special Meeting in person. This means you can attend the Special Meeting online, vote your shares electronically during the Special Meeting

and submit questions online during the Special Meeting by accessing www.virtualshareholdermeeting.com/ shortly prior to the scheduled

start of the meeting and entering the 16-digit control number found on the proxy card or voting instruction form. We believe that hosting

a “virtual meeting” will enable greater stockholder attendance and participation from any location around the world.

The

Board has fixed the close of business on May 9, 2023 as the record date for determining the stockholders entitled to notice

of, and to vote at, the Special Meeting or any adjournments thereof. Only the stockholders of record of our Common Stock are entitled

to receive notice of, and to vote at, the Special Meeting or any adjournments thereof.

Accordingly,

we urge you to review the accompanying material carefully and to promptly return the enclosed proxy card or voting instruction form.

On the following pages, we provide answers to frequently asked questions about the Special Meeting.

Hard

copies of the Company’s proxy statement to security holders in connection with the Special Meeting are being mailed to stockholders

of record as of the close of business on May 9, 2023, beginning on or about May , 2023. The Company’s proxy

statement to security holders is also available at www.proxyvote.com.

The

Company held a special meeting of stockholders on March 15, 2023, at which the Company’s stockholders approved an amendment to

the Certificate of Incorporation to effect a reverse stock split of the Company’s Common Stock at a ratio in the range of 1-for-2

to 1-for-50, with such ratio to be determined by the Board (the “Reverse Stock Split”). On April 3, 2023, the Board determined

to effect the Reverse Stock Split at a ratio of 1-for-50, and the Board approved the corresponding Certificate of Amendment. Unless stated

otherwise, numbers of shares, exercise prices, and conversion prices reported in this proxy statement shall reflect the effect of the

Reverse Stock Split.

A

complete list of registered stockholders entitled to vote at the Special Meeting will be available for inspection by stockholders at

the principal executive offices of the Company during regular business hours for the 10 calendar days prior to and during the Special

Meeting and online during the Special Meeting.

YOUR

VOTE AND PARTICIPATION IN THE COMPANY’S AFFAIRS ARE IMPORTANT.

We

encourage all stockholders to attend the virtual Special Meeting. However, whether or not you plan to attend the virtual Special Meeting,

we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. Please review the

instructions of each of your voting options described in the proxy statement.

If

your shares are registered in your name, even if you plan to attend the Special Meeting or any postponement or adjournment of the Special

Meeting online, we request that you vote by telephone, over the Internet, or complete, sign and mail your proxy card to ensure that your

shares will be represented at the Special Meeting.

If

your shares are held in the name of a broker, trust, bank or other nominee, and you receive notice of the Special Meeting through your

broker or through another intermediary, please vote or complete and return the materials in accordance with the instructions provided

to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee

holder to attend the Special Meeting and vote online. Failure to do so may result in your shares not being eligible to be voted by proxy

at the Special Meeting.

Thank

you for your ongoing support and continued interest in Eightco Holdings Inc.

By

Order of the Board of Directors,

_____________________________

Brian

McFadden

Chief Executive Officer

Safety Harbor, Florida

May , 2023

Important

Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to be Held on June 30, 2023; the

Notice of Special Meeting and proxy statement are also available at www.proxyvote.com.

TABLE OF CONTENTS

Eightco

holdings Inc.

200

9th Avenue North, Suite 220

Safety Harbor, FL 34695

(866) 980-2818

Proxy

Statement

Special Meeting Of Stockholders

To Be Held on June 30, 2023

Information

Concerning Solicitation and Voting

This

proxy statement and the accompanying proxy card are being furnished in connection with the solicitation of proxies by the Board of Directors

of Eightco Holdings Inc. (the “Board”) for use at the special meeting of stockholders (the “Special Meeting”)

to be held on June 30, 2023 at 10:00 a.m. Eastern Time, and at any adjournment thereof. The Special Meeting will be a virtual

meeting held via the Internet at www.virtualshareholdermeeting.com/. There will not be a physical meeting location, and stockholders

will not be able to attend the Special Meeting in person. As always, we encourage you to vote your shares prior to the Special Meeting

regardless of whether you intend to attend.

Except

where the context otherwise requires, references to “Eightco Holdings,” “Eightco,” “the Company,”

“we,” “us,” “our” and similar terms refer to Eightco Holdings Inc. In addition, unless the context

otherwise requires, references to “stockholders” are to the holders of our common stock, par value $0.001 per share (“Common

Stock”)

The

Company held a special meeting of stockholders on March 15, 2023, at which the Company’s stockholders approved an amendment to

the Certificate of Incorporation to effect a reverse stock split of the Company’s Common Stock at a ratio in the range of 1-for-2

to 1-for-50, with such ratio to be determined by the Board (the “Reverse Stock Split”). On April 3, 2023, the Board determined

to effect the Reverse Stock Split at a ratio of 1-for-50, and the Board approved the corresponding Certificate of Amendment. Unless stated

otherwise, numbers of shares, exercise prices, and conversion prices reported in this proxy statement shall reflect the effect of the

Reverse Stock Split.

This

proxy statement summarizes information about the proposals to be considered at the Special Meeting and other information you may find

useful in determining how to vote. The proxy card is a means by which you actually authorize the proxies to vote your shares in accordance

with your instructions. Hard copies of this proxy statement, along with the notice and either a proxy card or a voting instruction card,

are being mailed to our stockholders of record as of the close of business on May 9, 2023, beginning on or about May ,

2023.

Important

Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to be Held on June 30, 2023. The

Notice of Special Meeting and proxy statement are also available at www.proxyvote.com.

Questions

and Answers about the Special Meeting

| A. |

A

proxy is a person you appoint to vote on your behalf. By using the methods discussed below, you will be appointing Brian McFadden

and Brett Vroman, or either of them, as your proxy. The proxy agent will vote on your behalf and will have the authority to appoint

a substitute to act as proxy. If you are unable to attend the Special Meeting, please vote by proxy so that your shares may be voted. |

| Q. |

What

is a proxy statement? |

| A. |

A

proxy statement is a document that regulations of the Securities and Exchange Commission (the “SEC”) require that we

give to you when we ask you to sign a proxy card to vote your stock at the Special Meeting. |

| Q. |

Why

did I receive these proxy materials? |

| A. |

Our

Board has made these materials available to you in connection with the solicitation of proxies for use at the Special Meeting to

be held virtually on June 30, 2023 at 10:00 a.m. Eastern Time. As a holder of Common Stock, you are invited to attend the

Special Meeting and are requested to vote on the items of business described in this proxy statement. This proxy statement includes

information that we are required to provide to you under SEC rules and that is designed to assist you in voting your shares. |

| Q. |

What

is the purpose of the Special Meeting? |

| A. |

At

the Special Meeting, stockholders will be asked to consider and vote on the following matters: |

| |

1. |

A

proposal to authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of shares of our Common Stock underlying

a convertible promissory note and warrant issued by us pursuant to the terms of that certain Securities Purchase Agreement, dated

March 15, 2023 (the “March SPA”), by and among the Company and the investor named therein, in an amount equal to or in

excess of 20% of our Common Stock outstanding immediately prior to the issuance of such convertible promissory note and warrant (including

upon the operation of anti-dilution provisions contained in such convertible promissory note and warrant)(the “March

2023 SPA Issuance Proposal” or “Proposal 1”); and |

| |

2. |

A proposal to adjourn

the Special Meeting to a later date or dates (the “Adjournment”), if necessary or appropriate, to permit further solicitation

and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the March

2023 SPA Issuance Proposal (the “Adjournment Proposal” or “Proposal 2”). |

Other

than these proposals, no other proposals will be presented for a vote at the Special Meeting.

| Q. |

Why

is the Special Meeting a virtual, online meeting? |

| A. |

The

Special Meeting will be a virtual meeting of stockholders where stockholders will participate by accessing a website using the Internet.

There will not be a physical meeting location. We believe that hosting a virtual meeting will facilitate stockholder attendance and

participation at the Special Meeting by enabling stockholders to participate remotely from any location around the world. Our virtual

meeting will be governed by Rules of Conduct and Procedures which will be available during the online meeting at www.virtualshareholdermeeting.com/.

We have designed the virtual Special Meeting to provide the same rights and opportunities to participate as stockholders have

at an in-person meeting, including the right to vote and submit questions through the virtual meeting platform. |

| Q. |

How

do I virtually attend the Special Meeting? |

| A. |

We

will host the Special Meeting live online. The webcast of the Special Meeting will start at 10:00 a.m. Eastern Time, on June 30,

2023. Online access to the webcast will open fifteen (15) minutes prior to the start of the Special Meeting to allow time for

you to log-in and test your device’s audio system. To be admitted to the virtual Special Meeting, you will need to log-in at

www.virtualshareholdermeeting.com/ using the 16-digit control number on the proxy card or voting instruction form. |

Beginning

fifteen (15) minutes prior to, and during, the Special Meeting, we will have technicians standing by and ready to assist you with any

technical difficulties you may have accessing or hearing the virtual meeting. If you encounter any difficulties accessing the virtual

meeting or during the virtual meeting, please call the technical support team at the phone number available on www.virtualshareholdermeeting.com/.

| Q. |

Who

is entitled to vote at the Special Meeting, and how many votes do they have? |

| A. |

Stockholders

of record, including holders of our Common Stock at the close of business on May 9, 2023 (the “Record Date”)

may vote at the Special Meeting. There were shares of Common Stock outstanding on the Record Date. A complete list of registered

stockholders entitled to vote at the Special Meeting will be available for inspection at the principal executive offices of the Company

during regular business hours for the 10 calendar days prior to the Special Meeting. The list will also be available online during

the Special Meeting. |

Pursuant

to the rights of our stockholders contained in our charter documents, each share of our Common Stock is entitled to one vote on all matters

listed in this proxy statement.

| Q. |

What

is the difference between a stockholder of record and a “street name” holder? |

| A. |

If

your shares are registered directly in your name with our transfer agent, Nevada Agency and Transfer Company, you are considered

the stockholder of record with respect to those shares. The notice of the Special Meeting has been sent directly to you by us. |

If

your shares are held in a stock brokerage account or by a bank or other nominee, the nominee is considered the record holder of those

shares. You are considered the beneficial owner of these shares, and your shares are held in “street name.” A notice or proxy

statement and voting instruction card have been forwarded to you by your nominee. As the beneficial owner, you have the right to direct

your nominee concerning how to vote your shares by using the voting instructions they included in the mailing or by following their instructions

for voting by telephone or the Internet.

| Q. |

What

is a broker non-vote? |

| A. |

Broker

non-votes occur when shares are held indirectly through a broker, bank or other intermediary on behalf of a beneficial owner (referred

to as held in “street name”) and the broker submits a proxy but does not vote for a matter because the broker has not

received voting instructions from the beneficial owner and (i) the broker does not have discretionary voting authority on the matter

or (ii) the broker chooses not to vote on a matter for which it has discretionary voting authority. If you do not give your broker

instructions (these shares are often referred to as broker non-votes) and the proposal involves a “routine” matter, then

Nasdaq rules provide brokers with discretionary power to vote your shares. None of the proposals being presented to stockholders

at the Special Meeting is considered a “routine matter.” Therefore, if you do not provide voting instructions to your

broker regarding a proposal, your broker will not be permitted to exercise discretionary voting authority to vote your shares on

that proposal. |

| Q. |

If

I am a beneficial owner of shares, can my brokerage firm vote my shares? |

| A. |

If

you are a beneficial owner and do not vote via the Internet or telephone or by returning a signed voting instruction card to your

broker, your shares may be voted only with respect to so-called “routine” matters where your broker has discretionary

voting authority over your shares. None of the proposals being presented to stockholders at the Special Meeting is considered a “routine”

matter. Therefore, if you do not provide voting instructions to your broker regarding a proposal, your broker will not be permitted

to exercise discretionary voting authority to vote your shares on that proposal. |

We

encourage you to provide instructions to your brokerage firm via the Internet or telephone or by returning your signed voting instruction

card. This ensures that your shares will be voted at the Special Meeting with respect to the proposal described in this proxy statement.

| A. |

If

you are the “record holder” of your shares, meaning that your shares are registered in your name in the records of our

transfer agent, Nevada Agency and Transfer Company, you may vote your shares during the Special Meeting or by proxy prior to the

Special Meeting as follows: |

| |

1. |

Over

the Internet prior to the Special Meeting: To vote over the Internet prior to the Special Meeting, please go to the following

website: www.proxyvote.com, and follow the instructions at that site for submitting your proxy electronically. If you vote over the

Internet prior to the Special Meeting, you do not need to complete and mail your proxy card or vote your proxy by telephone. You

must submit your Internet proxy before 11:59 p.m. Eastern Time, on June 29, 2023, the day before the Special Meeting, for

your proxy to be valid and your vote to count. |

| |

2. |

By

Telephone prior to the Special Meeting: To vote by telephone, please call 1-800-690-6903 in the United States, and follow the

instructions provided on the proxy card. If you vote by telephone, you do not need to complete and mail your proxy card or vote your

proxy over the Internet. You must submit your telephonic proxy before 11:59 p.m. Eastern Time, on June 29, 2023, the day

before the Special Meeting, for your proxy to be valid and your vote to count. |

| |

3. |

By

Mail prior to the Special Meeting: To vote by mail, you must mark, sign and date the proxy card and then mail the proxy card

in accordance with the instructions on the proxy card. If you vote by mail, you do not need to vote your proxy over the Internet

or by telephone. The proxy card must be received not later than June 29, 2023, the day before the Special Meeting, for your

proxy to be valid and your vote to count. If you return your proxy card but do not specify how you want your shares voted on any

particular matter, they will be voted in accordance with the recommendations of our Board. |

| |

4. |

Over

the Internet during the Special Meeting: If you attend the Special Meeting virtually, you may vote your shares online (up until

the closing of the polls) by following the instructions available at www.virtualshareholdermeeting.com/ during the Special

Meeting. You will need your 16-digit control number included on the proxy card or voting instruction form. If you vote by proxy prior

to the Special Meeting and also virtually attend the Special Meeting, there is no need to vote again at the Special Meeting unless

you wish to change your vote. |

If

your shares are held in “street name,” meaning they are held for your account by an intermediary, such as a bank, broker

or other nominee, then you are deemed to be the beneficial owner of your shares and the broker that actually holds the shares for you

is the record holder and is required to vote the shares it holds on your behalf according to your instructions. The proxy materials,

as well as voting and revocation instructions, should have been forwarded to you by the bank, broker or other nominee that holds your

shares. In order to vote your shares, you will need to follow the instructions that your bank, broker or other nominee provides you.

The voting deadlines and availability of telephone and Internet voting for beneficial owners of shares held in “street name”

will depend on the voting processes of the bank, broker or other nominee that holds your shares. Therefore, we urge you to carefully

review and follow the voting instruction card and any other materials that you receive from that organization.

Even

if you plan to attend the Special Meeting online, we urge you to vote your shares by proxy in advance of the Special Meeting so that

if you should become unable to attend the Special Meeting your shares will be voted as directed by you.

| Q. |

How

will my proxy vote my shares? |

| A. |

If

you are a stockholder of record, your proxy will vote according to your instructions. If you choose to vote by mail and complete

and return the enclosed proxy card but do not indicate your vote, your proxy will vote: |

| |

● |

“FOR”

the March 2023 SPA Issuance Proposal; and |

| |

● |

“FOR”

the Adjournment Proposal. |

We

do not intend to bring any other matter for a vote at the Special Meeting, and we do not know of anyone else who intends to do so. Your

proxies are authorized to vote on your behalf, however, using their best judgment, on any other business that properly comes before the

Special Meeting.

If

your shares are held in the name of a bank, broker or other nominee, you will receive separate voting instructions from your bank, broker

or other nominee describing how to vote your shares. The availability of Internet voting will depend on the voting process of your bank,

broker or other nominee. Please check with your bank, broker or other nominee and follow the voting instructions your bank, broker or

other nominee provides.

| A. |

If

your shares are registered directly in your name, you may revoke your proxy and change your vote at any time before the vote is taken

at the Special Meeting. To do so, you must do one of the following: |

| |

1. |

Vote

over the Internet or by telephone as instructed above under “Over the Internet Prior to the Special Meeting” or

“By Telephone Prior to the Special Meeting.” Only your latest Internet or telephone vote is counted. |

| |

2. |

Sign,

date and return a new proxy card. Only your latest dated and timely received proxy card will be counted. |

| |

3. |

Attend

the Special Meeting virtually and vote online as instructed above under “Over the Internet during the Special Meeting.”

Your virtual attendance at the Special Meeting, without voting online during the Special Meeting, will not revoke your proxy. |

| |

4. |

Give

our corporate secretary written notice before the Special Meeting that you want to revoke your proxy. |

If

your shares are held in “street name,” you may submit new voting instructions by contacting your bank, broker or other nominee.

You may also vote online during the Special Meeting, which will have the effect of revoking any previously submitted voting instructions

if you follow the procedures described under “How do I vote?” above.

| Q. |

How

are abstentions and broker non-votes treated for purposes of the Special Meeting? |

| A. |

Abstentions

are included in the determination of the number of shares present at the Special Meeting for determining a quorum at the meeting.

An abstention is not an “affirmative vote” but an abstaining stockholder is considered “entitled to vote”

at the Special Meeting. |

Broker

non-votes would be included in the determination of the number of shares present at the Special Meeting for determining a quorum at the

meeting. Because your broker will not have discretionary voting authority with respect to Proposals 1 or 2, broker non-votes

will not be available at the Special Meeting.

If

your shares are held in the name of a bank, broker or other nominee, you should check with your bank, broker or other nominee and follow

the voting instructions provided. Attendance at the Special Meeting alone will not revoke your proxy.

| A. |

All

votes will be tabulated by the inspector of election appointed for the Special Meeting. |

| Q. |

How

many shares must be represented to have a quorum and hold the Special Meeting? |

| A. |

The

holders of one third of the voting power of the stock issued, outstanding and entitled to vote at the Special Meeting, present in

person or represented by proxy, constitute a quorum for the transaction of business at the Special Meeting. For purposes of determining

whether a quorum exists, we count as present any shares that are voted over the Internet, by telephone, by completing and submitting

a proxy card by mail or that are represented virtually at the meeting. Further, for purposes of establishing a quorum, we will count

as present shares that a stockholder holds even if the stockholder votes to abstain or only votes on one of the proposals. If a quorum

is not present, we expect to adjourn the Special Meeting until we obtain a quorum, notwithstanding any voting results or lack

thereof with respect to Proposal 2. |

| Q. |

What

vote is required to approve each proposal and how are votes counted? |

| A. |

Proposal

1 — The March 2023 SPA Issuance Proposal: The affirmative vote of a majority of the voting power of the shares

of Common Stock present in person or represented by proxy at the Special Meeting and entitled to vote on the March 2023 SPA Issuance

Proposal is required for approval of the March 2023 SPA Issuance Proposal. |

Proposal 2 – The Adjournment

Proposal: The affirmative vote of a majority of the voting power of the shares of Common Stock present in person or represented by

proxy at the Special Meeting and entitled to vote on the Adjournment Proposal is required for approval of the Adjournment Proposal.

The principal terms of the March 2023

SPA Issuance and the Adjournment have been approved by the Board. Marking “ABSTAIN” on your proxy

or ballot with respect to the March 2023 SPA Issuance Proposal or the Adjournment Proposal has the same

effect as a vote against such proposal. We expect that the directors and executive officers will vote all their shares in favor of the

March 2023 SPA Issuance Proposal and the Adjournment Proposal.

| Q. |

What

are the consequences if the March 2023 SPA Issuance Proposal is not approved by stockholders? |

| A. |

If

stockholders fail to approve the March 2023 SPA Issuance Proposal, we may be required to repay our obligations under the Note in

cash. If, despite the Company’s reasonable best efforts the March 2023 SPA Issuance Proposal is not approved by the Company’s

stockholders on or prior to June 30, 2023, the Company shall cause an additional stockholder meeting to be held every three (3) months

thereafter until such approvals are obtained or the Note and Warrant are no longer outstanding. |

| |

|

| Q. |

Who

is soliciting proxies, how are they being solicited, and who pays the cost? |

| |

|

| A. |

Proxies

are being solicited by the Board on behalf of the Company. In addition, we have engaged Kingsdale Advisors (“Kingdsale”),

the proxy solicitation firm hired by the Company, at an approximate cost of $10,500, plus reimbursement expenses, to solicit proxies

on behalf of our Board. Kingsdale may solicit the return of proxies, either by mail, telephone, telecopy, e-mail or through personal

contact. The fees of Kingsdale as well as the reimbursement of expenses of Kingsdale will be borne by us. Our officers, directors,

and employees may also solicit proxies personally or in writing, by telephone, e-mail, or otherwise. These officers and employees

will not receive additional compensation but will be reimbursed for out-of-pocket expenses. Brokerage houses and other custodians,

nominees, and fiduciaries, in connection with shares of the Common Stock registered in their names, will be asked to forward solicitation

material to the beneficial owners of shares of Common Stock. We will reimburse brokerage houses and other custodians, nominees, and

fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation materials and collecting voting instructions. |

| Q. |

How

does the Board recommend that I vote on the proposals? |

| A. |

Our

Board recommends that you vote: |

| |

● |

FOR

the approval of the March 2023 SPA Issuance Proposal; and |

| |

● |

FOR the

approval of the Adjournment Proposal. |

| Q. |

Do

I have any dissenters’ or appraisal rights or cumulative voting rights with respect to any of the matters to be voted on at

the Special Meeting? |

| A. |

No.

None of our stockholders have any dissenters’ or appraisal rights or cumulative voting rights with respect to the matter to

be voted on at the Special Meeting. |

| |

| Q. |

Where

can I find the voting results? |

| A. |

The

Company expects to publish the voting results of the Special Meeting in a Current Report on Form 8-K, which it expects to file with

the SEC within four business days following the date of the Special Meeting. |

| |

Q. |

What

are the costs of soliciting these proxies? |

| A. |

We

will bear the cost of soliciting proxies. In addition to solicitation by mail, our directors, officers and employees may solicit

proxies by telephone, e-mail, facsimile, and in person without additional compensation. We may reimburse brokers or persons holding

stock in their names, or in the names of their nominees, for their expenses in sending proxies and proxy material to beneficial owners. |

| Q. |

How

many shares of Common Stock and Preferred Stock are outstanding? |

| A. |

As

of May 4, 2023, there are 2,371,949 shares of Common Stock outstanding. There are no shares of any series

of preferred stock currently outstanding. |

| Q. |

How

do I submit a question at the Special Meeting? |

| A. |

If

you wish to submit a question, on the day of the Special Meeting, beginning at 10:00 a.m. Eastern Time on June 30, 2023, you

may log into the virtual meeting platform and follow the instructions there. Our virtual meeting will be governed by our Rules of

Conduct and Procedures that will be available during the online meeting. The Rules of Conduct and Procedures will address the ability

of stockholders to ask questions during the meeting, including rules on permissible topics, and rules for how questions and comments

will be recognized and disclosed to meeting participants. We will answer appropriate questions that are pertinent to the matters

to be voted on by the stockholders at the Special Meeting after the meeting. If there are any matters of individual concern to a

stockholder and not of general concern to all stockholders, or if a question was not otherwise answered, such matters may be raised

separately after the Special Meeting by contacting Investor Relations at (617) 819-1289. |

The

information provided above in this “Question and Answer” format is for your convenience only and is merely a summary of the

information contained in this proxy statement. We urge you to carefully read this entire proxy statement, including the documents we

refer to in this proxy statement. If you have any questions, or need additional materials, please feel free to contact the firm assisting

us in the solicitation of proxies, Kingsdale, if you have any questions or need assistance in voting your shares. Banks, brokers and

shareholders may call Kingsdale at 1-855-682-2019 (or call collect outside North America at +1-917-473-0932) or may send an email to

contactus@kingsdaleadvisors.com.

Proposal

1: Approval of March 2023 Spa proposal

Background

and Description of Proposal

Transaction

On

March 15, 2023, the Company entered into the March SPA with an accredited investor (“March Investor”) for the issuance and

sale of a Senior Secured Convertible Note with an initial principal amount of $5,555,000 (the “Note”) at an initial

conversion price of $6.245 per share of the Common Stock, and a warrant (the “Warrant”) to purchase initially up to

889,512 shares of Common Stock with an initial exercise price of $6.245 per share of Common Stock (the “Private Placement”).

The purchase price of the Note and the Warrant was $5,000,000.

In

connection with the Private Placement, the Company entered into a Registration Rights Agreement (the “Registration Rights Agreement”),

a Security and Pledge Agreement (the “Pledge Agreement”), and various ancillary certificates, disclosure schedules and exhibits

in support thereof in connection with the closing of the March SPA.

On

March 20, 2023, the March SPA closed.

Reasons

for the Private Placement

As

of February 7, 2023, our cash and cash equivalents were approximately $2,734,000. In February 2023, our Board

determined that it was necessary to raise additional funds for general corporate purposes.

We

believe that the offering with the March Investor, which yielded gross proceeds of $5,000,000, was necessary in light of our cash and

funding requirements at the time. In addition, at the time of the Private Placement, our Board considered numerous alternatives to the

transaction, none of which proved to be feasible or, in the opinion of our Board, would have resulted in aggregate terms equivalent to,

or more favorable than, the terms obtained in the Private Placement.

Senior

Secured Convertible Note

The

Company issued the Note upon the closing of the March SPA. The entire outstanding principal balance and any outstanding fees or interest

shall be due and payable in full on January 15, 2024 (“Maturity Date”). The Note shall not bear interest, provided, however,

that the Note will bear interest at 18% per annum upon the occurrence of an event of default (as described below).

The

Maturity Date may be extended at the sole option of the March Investor for so long as certain events of default are continuing or for

so long as an event is continuing that if not cured and with the passage of time would result in an event of default.

The

Note is convertible at the option of the March Investor into shares of Common Stock and had an initial conversion price of $6.245

per share, subject to adjustment for stock splits, combinations or similar events (each a “Note Stock Combination Event”).

If on the on the fifth trading day immediately following a Note Stock Combination Event, the conversion price then in effect on such

fifth trading day (after giving effect to a proportional adjustment of the conversion price), is greater than the lowest weighted average

price of the Common Stock during the twenty consecutive trading day period ending and including the trading day immediately preceding

the fifth trading day after such Stock Combination Event (the “Note Event Market Price”), then the conversion price shall

be adjusted to the Note Event Market Price.

The

Company effected the Reverse Stock Split on April 3, 2023, which constituted a Note Stock Combination Event. Accordingly, on April 11,

2023, the conversion price of the Note was adjusted to $2.0101 per share.

The

Note contains certain limitations on conversion. It provides that no conversion may be made if, after giving effect to the conversion,

the March Investor would own in excess of 9.99% of the Company’s outstanding shares of Common Stock. This percentage may be increased

or decreased to a percentage not to exceed 9.99%, at the option of the March Investor, except any increase will not be effective until

61 days prior notice to the Company.

The

conversion price of the Note is subject to anti-dilution adjustment which, subject to specified exceptions, in the event that the Company

issues or is deemed to have issued certain securities at a price lower than the then applicable conversion price, immediately reduces

the conversion price of the Note to equal the price at which the Company issues or is deemed to have issued its Common Stock.

If

there is an event of default, then the March Investor has the right to request redemption of all or any portion of the Note, at 130%

of the sum of the outstanding principal, interest and late fees to be redeemed, provided that if certain conditions specified in the

Note are not satisfied, then the March Investor has the right to request redemption of all or any portion of the Note, at 130% of the

greater of (i) the sum of the outstanding principal, interest and late fees to be redeemed and (ii) the product of (a) the number of

shares into which the Note (including all principal, interest and late fees) subject to redemption may be converted and (b) the greatest

closing sale price for the Common Stock beginning on the date immediately preceding the event of default and ending on the date the Company

makes the entire payment required to be made upon the redemption provided, however, that if no Cash Release Event (as defined in the

Note) has occurred on or prior to the applicable of default redemption date, the principal amount used in calculating the applicable

event of default redemption price on such event of default redemption date shall be decreased by the holder’s pro rata portion

of $222,000.

Warrant

The

Warrant was issued upon closing and is immediately exercisable and, in the aggregate, initially entitled the March Investor to

timely purchase up to 889,512 shares of Common Stock. The Warrant had an initial exercise price of $6.245 per share payable

in cash, or while each share of Common Stock issuable upon exercise of the Warrant is not registered for resale with the SEC or such

prospectus is not available for resale, by way of a “cashless exercise” or an “alternative cashless exercise,”

at the option of the March Investor. An “alternative cashless exercise” will provide the March Investor with 0.7 shares of

Common Stock for each share that would have been issuable to the March Investor upon such exercise had the Holder elected to pay the

exercise price in cash. The Warrant will expire on the fifth anniversary of its date of issuance.

The

exercise price of the Warrant is subject to adjustment for stock splits, combinations or similar events (each a “Warrant Stock

Combination Event”). If on the on the fifth trading day immediately following a Warrant Stock Combination Event, the exercise price

is greater than the lowest weighted average price of the Common Stock during the twenty consecutive trading day period ending on, and

including, the trading day immediately preceding the fifth trading day after such Warrant Stock Combination Event (the “Warrant

Event Market Price”) then the exercise price shall be adjusted to the Warrant Event Market Price. Upon each such adjustment of

the exercise price hereunder, the number of underlying shares of Common Stock shall, subject to specified exceptions, be increased (but

in no event decreased) to the number of shares of Common Stock determined by multiplying the exercise price in effect immediately prior

to such adjustment by the number of underlying shares of Common Stock acquirable upon exercise of the Warrant immediately prior to such

adjustment and dividing the product thereof by the exercise price resulting from such adjustment.

The

Company effected the Reverse Stock Split on April 3, 2023, which constituted a Warrant Stock Combination Event. Accordingly, on April

11, 2023, the exercise price of the Warrant was adjusted to $2.0101 per share, and the number of shares underlying the Warrant

was increased to 2,763,545.

The

Warrant will require payments to be made by the Company for failure to deliver the shares of Common Stock issuable upon exercise. The

Warrant also contains limitations on exercise, including the limitation that the March Investor may not exercise its Warrant to the extent

that upon exercise the March Investor, together with its affiliates, would own in excess of 9.99% of the Company’s outstanding

shares of Common Stock (subject to an increase or decrease, upon at least 61-days’ notice by the March Investor to the Company,

of up to 9.99%).

The

exercise price of the Warrant will also subject to anti-dilution adjustment which, subject to specified exceptions, in the event that

the Company issues or is deemed to have issued certain securities at a price lower than the then applicable exercise price, immediately

reduces the exercise price of the Warrant to equal the price at which the Company issues or is deemed to have issued its Common Stock.

The Company may not enter into a fundamental transaction unless the successor entity assumes the obligations of the Company under the

Warrant. Upon the occurrence of a fundamental transaction involving a change of control, the holder of the Warrant will have the right

to have the Warrant repurchased for a purchase price in cash equal to the Black-Scholes value (as calculated pursuant to the Warrant)

of the then unexercised portion of the Warrant.

If

the Company issues options, convertible securities, warrants, stock, or similar securities to holders of its Common Stock, the holder

of the Warrant shall have the right to acquire the same as if it had exercised its Warrant.

The

March Investor is entitled to receive any dividends paid or distributions made to the holders of the Common Stock on an “as if

exercised” to Common Stock basis.

Effect

of Issuance of Securities

The

potential issuance of 2,763,545 shares of Common Stock underlying the Note and 2,763,545 shares of Common Stock underlying

the Warrant, plus any additional shares of Common Stock issued pursuant to the anti-dilution provisions contained in the Warrant or Note,

would result in an increase in the number of shares of Common Stock outstanding, and our stockholders would incur dilution of their percentage

ownership to the extent that the investors convert the Note or exercise the Warrant, or to the extent that additional shares of Common

Stock are issued pursuant to the anti-dilution terms of the Warrant. Because of potential adjustments to the number of shares of Common

Stock issuable upon conversion of the Note and exercise of the Warrant, the exact magnitude of the dilutive effect of the Note and Warrant

cannot be conclusively determined. However, the dilutive effect may be material to our current stockholders.

Approval

of the March 2023 SPA Issuance Proposal

Nasdaq

Listing Rule 5635(d) requires us to obtain stockholder approval prior to a transaction, other than a public offering, involving the sale,

issuance or potential issuance by the Company of Common Stock (or securities convertible into or exercisable for Common Stock), which

equals 20% or more of the Common Stock or 20% or more of the voting power outstanding immediately prior to the issuance at a price that

is less than the lower of: (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the

binding agreement in connection with such transaction; or (ii) the average Nasdaq Official Closing Price of the Common Stock (as reflected

on Nasdaq.com) for the five trading days immediately preceding the signing of such binding agreement. In the case of the Private Placement,

the 20% threshold is determined based on the shares of our Common Stock outstanding immediately preceding the execution of the March

SPA, which was signed on March 15, 2023. The March SPA closed on March 20, 2023. However, the shares of our Common Stock issuable upon

exercise of the Warrant and conversion of the Note may not be issued, to the extent such issuance would constitute an issuance of 20%

or more of the shares of Common Stock outstanding immediately prior to the execution of the March SPA until we have obtained stockholder

approval.

Immediately

prior to the execution the March SPA, we had 1,502,948 shares of Common Stock outstanding. Therefore, the potential issuance of

the 2,763,545 and 2,763,545 shares of our Common Stock underlying the Note and underlying the Warrant, respectively, would

have together constituted approximately 367.75% of the shares of Common Stock outstanding on such date. We are seeking stockholder

approval under Nasdaq Listing Rule 5635(d) for the sale, issuance or potential issuance by us of our Common Stock (or securities convertible

into or exercisable for our Common Stock) in excess of 300,590 shares, which is 20% of the shares of Common Stock outstanding

immediately prior to the execution of the March SPA, including, without limitation, as a result of the anti-dilution feature of the Warrant,

since such feature may reduce the per share exercise price and result in the issuance of shares at less than the greater of market price

or book value per share.

Any

transaction requiring approval by our stockholders under Nasdaq Listing Rule 5635(d) would likely result in a significant increase in

the number of shares of our Common Stock outstanding, and, as a result, would likely lead to our current stockholders owning a smaller

percentage of our outstanding shares of Common Stock.

Future

issuances of securities in connection with the Private Placement, if any, may cause a significant reduction in the percentage interests

of our current stockholders in voting power, any liquidation value, our book and market value, and any future earnings. Further, the

issuance or resale of Common Stock issued to the Note and Warrant holders could cause the market price of our Common Stock to decline.

The increased number of issued shares could discourage the possibility of, or render more difficult, certain mergers, tender offers,

proxy contests or other change of control or ownership transactions.

Under

the Nasdaq Listing Rules, we are not permitted (without risk of delisting) to undertake a transaction that could result in a change in

control of us without seeking and obtaining separate stockholder approval. We are not required to obtain stockholder approval for the

Private Placement under Nasdaq Listing Rule 5635(b) because the Note and Warrant holders have agreed that, for so long as they hold any

shares of our Common Stock, neither they nor any of their affiliates will acquire shares of our Common Stock which result in them and

their affiliates, collectively, beneficially owning or controlling more than 9.99% of the total outstanding shares of our Common Stock.

Potential

Consequences if the March 2023 SPA Issuance Proposal is Not Approved

The

March 2023 SPA, Warrant, and Note are binding obligations on us. The failure of our stockholders to approve the March 2023 SPA Issuance

Proposal will not negate the existing terms or the Company’s binding obligation under the March 2023 SPA, Warrant, and Note. However,

if the March 2023 SPA Issuance Proposal is not approved by our stockholders, we may be required to repay our obligations under the Note

in cash, rather than by the conversion of the Note or exercise of the Warrant into shares of Common Stock.

If

we are required to repay our obligations to the March Investor in cash rather than Common Stock, we may not have the capital necessary

to fully satisfy our ongoing business needs, the effect of which would adversely impact future operating results. Additionally, it may

be necessary for the Company to acquire additional financing in order to repay the obligations to the March Investor under the Note in

cash, which may result in additional transaction expenses. Failure to acquire additional financing in order to repay these obligations

may result in a default on such obligations.

Further

Information

The

terms of the March SPA, the Note and the Warrant are only briefly summarized above. For further information, please refer to the forms

of the March SPA, the Note and the Warrant, which were filed with the SEC as exhibits to our Current Report on Form 8-K filed on March

16, 2023 and are incorporated herein by reference. The discussion herein is qualified in its entirety by reference to the filed documents.

Required

Vote and Board Recommendation

If

a quorum is present and voting, the affirmative vote of a majority of the voting power of the shares of Common Stock present in person

or represented by proxy at the Special Meeting and entitled to vote on the March 2023 SPA Issuance Proposal is required for approval

of the March 2023 SPA Issuance Proposal.

The

Board unanimously recommends that you vote

“FOR”

the March 2023 SPA Issuance Proposal.

Proposal

2: Approval of the Adjournment Proposal

Background

and Description of Proposal

The

Board has approved a proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to permit further

solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of

the March 2023 SPA Issuance Proposal.

The

approval of the March 2023 SPA Issuance Proposal requires the affirmative vote of holders

of a majority of the voting power of the shares present in person or represented by proxy and entitled to vote at the Special Meeting

on said proposal to be approved. The Board believes that if the number of votes received with respect to either proposal is less than

said majority and is therefore insufficient to approve such proposal, then it may be in the best interests of the stockholders to adjourn

the Special Meeting to enable the Board to continue to seek to obtain a sufficient number of additional votes to approve the March 2023

SPA Issuance Proposal.

In

the Adjournment Proposal, we are asking stockholders to authorize the holder of any proxy solicited by the Board to vote in favor of

adjourning the Special Meeting or any adjournment thereof. If our stockholders approve this proposal, we could adjourn the Special Meeting,

and any adjourned session of the Special Meeting, to use the additional time to solicit additional proxies in favor of the March 2023

SPA Issuance Proposal.

Additionally,

approval of the Adjournment Proposal could mean that, in the event we receive proxies indicating that a majority of the voting power

of the shares present in person or represented by proxy and entitled to vote at the Special Meeting will be against the March 2023 SPA

Issuance Proposal, we could adjourn the Special Meeting without a vote on the March 2023 SPA Issuance

Proposal and use the additional time to solicit the holders of those shares to change their vote in

favor of the March 2023 SPA Issuance Proposal.

Required

Vote and Board Recommendation

If

a quorum is present and voting, the affirmative vote of a majority of the voting power of the shares present in person or represented

by proxy and entitled to vote at the Special Meeting is required to approve the Adjournment Proposal.

The

Board unanimously recommends that you vote

“FOR”

the Adjournment Proposal.

SECURITY

Ownership of Certain Beneficial Owners and Management4

The

following table sets forth certain information regarding the beneficial ownership of our Common Stock as of May 4, 2023 by (1)

each named executive officer and director of our company, (2) all directors and executive officers of our company as a group, and (3)

each person known by us to own more than 5% of our common stock.

The

following table sets forth information regarding the beneficial ownership of our common stock as of May 4, 2023:

| |

● |

each

person known by the Company to be a beneficial owner of more than 5% of the common stock of the Company; |

| |

|

|

| |

● |

each

of the Company’s officers and directors; and |

| |

|

|

| |

● |

all

executive officers and directors of the Company as a group. |

The

address of the executive officers and directors is 200 9th Avenue North, Suite 220, Safety Harbor, Florida, 34695.

Beneficial

ownership is determined according to the rules of the Securities and Exchange Commission, which generally provide that a person has beneficial

ownership of a security if he, she, or it possesses sole or shared voting or investment power over that security, including options and

warrants that are currently exercisable or exercisable within 60 days of May 4, 2023.

The

beneficial ownership percentages set forth in the table below are based on approximately 2,371,949 shares of Common Stock issued

and outstanding as of May 4, 2023.

Unless

otherwise indicated, the Company believes that all persons named in the table have sole voting and investment power with respect to all

shares of Common Stock beneficially owned by them.

| | |

Beneficial Ownership | |

| Name and Address of Beneficial Owner(1) | |

Number of Shares | | |

Percentage | |

| 5% Stockholders | |

| | | |

| | |

| Hudson Bay Master Fund, Ltd.(2) | |

| 245,481 | | |

| 9.99 | % |

| BHP Capital NY, Inc.(3) | |

| 263,257 | | |

| 9.99 | % |

| Palladium Holdings, LLC(4) | |

| 258,817 | | |

| 9.99 | % |

| Current Executive Officers and Directors | |

| | | |

| | |

| Brian McFadden(5) | |

| 5,634 | | |

| * | |

| Brett Vroman(6) | |

| 6,440 | | |

| * | |

| Kevin O’Donnell(7) | |

| 5,007 | | |

| * | |

| Frank Jennings(8) | |

| 1,715 | | |

| * | |

| Louis Foreman(9) | |

| 2,366 | | |

| * | |

| Mary Ann Halford(10) | |

| 1,565 | | |

| * | |

| Total Executive Officers and Directors | |

| 22,727 | | |

| * | % |

| (1) |

Based

on 2,371,949 shares of common stock issued and outstanding as of May 4, 2023. All shares reported are shares of the

Company’s common stock. |

| |

|

| (2) |

Includes:

160,162 shares of common stock and an aggregate of 85,319 shares of common stock issuable upon conversion of the January 2022 Note

and the March 2023 Note and upon exercise of the January 2022 Warrant and the March 2023 Warrant and excludes an aggregate of 7,462,028

shares of common stock issuable upon conversion of the January 2022 Note and the March 2023 Note and upon exercise of the January

2022 Warrant and the March 2023 Warrant. Pursuant

to the terms of the January 2022 Note, January 2022 Warrant, March 2023 Note and March 2023 Warrant, Hudson Bay may not convert the

January 2022 Note, exercise the January 2022 Warrant, convert the March 2023 Note or exercise the March 2023 Warrant to the extent

(but only to the extent) Hudson Bay or any of its affiliates would beneficially own upon such conversion or exercise a number of

shares of our common stock which would exceed 9.99% of the outstanding shares of common stock of the Company. The number of shares

and percentage reflect these limitations as of May 4, 2023. Hudson Bay Capital Management LP is the investment manager of

Hudson Bay Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital

Management LP, and Sander Gerber has sole voting and investment power over these securities. Each of Hudson Bay and Sander Gerber

disclaims beneficial ownership over these securities. The selling stockholder’s address is c/o Hudson Bay Capital Management

LP, 28 Havemeyer Place, 2nd Place, Greenwich, CT 06830. All shares reported are shares of the Company’s common stock. |

| |

|

| (3) |

Includes

263,257 shares of common stock issuable upon the exercise of the BHP Warrants and excludes 464,743 shares of common

stock issuable upon the exercise of the BHP Warrants. Pursuant to the terms of the BHP Warrants, BHP may not exercise the BHP Warrants

to the extent (but only to the extent) BHP or any of its affiliates would beneficially own upon such exercise a number of shares

of our common stock which would exceed 9.99% of the outstanding shares of common stock of the Company. The number of shares and percentage

reflect these limitations as of May 2, 2023. Bryan Pantofel is the President of BHP and has sole voting and investment power over

these securities. BHP’s address is 45 SW 9th Street, Suite 1603, Miami, Florida 33130. All shares reported are shares of the

Company’s common stock. |

| |

|

| (4) |

Includes (i) 40,000 shares of common stock and (ii) 218,817 shares of common

stock issuable upon the exercise of a warrant held by Palladium Holdings, LLC (the “Palladium Warrant”) and excludes 2,267

shares of common stock issuable upon exercise of the Palladium Warrant. Pursuant to the terms of the Palladium Warrant and to the extent

(but only to the extent) Palladium Holdings, LLC or any of its affiliates would beneficially own upon such exercise a number of shares

of our common stock which would exceed 9.99% of the outstanding shares of common stock of the Company. The number of shares and percentage

reflect these limitations as of May 4, 2023. Joel Padowitz is the Managing Member of Palladium Holdings, LLC and has sole voting and investment

power over these securities. Palladium Holdings, LLC’s address is 152 West 57th Street, Floor 22, New York, NY 10019. All shares

reported are shares of the Company’s common stock. |

| |

|

| (5) |

Mr.

McFadden’s address is 200 9th Avenue North, Suite 220, Safety Harbor, Florida 34695. All shares reported are shares of the

Company’s common stock. |

| (6) |

Mr.

Vroman’s address is 200 9th Avenue North, Suite 220, Safety Harbor, Florida 34695. All shares reported are shares of the Company’s

common stock. |

| |

|

| (7) |

Mr.

O’Donnell’s address is 200 9th Avenue North, Suite 220, Safety Harbor, Florida 34695. All shares reported are shares

of the Company’s common stock. |

| |

|

| (8) |

Mr.

Jennings’ address is 200 9th Avenue North, Suite 220, Safety Harbor, Florida 34695. All shares reported are shares of the Company’s

common stock. |

| |

|

| (9) |

Mr.

Foreman’s address is 200 9th Avenue North, Suite 220, Safety Harbor, Florida 34695. All shares reported are shares of the Company’s

common stock. |

| |

|

| (10) |

Ms.

Halford’s address is 200 9th Avenue North, Suite 220, Safety Harbor, Florida 34695. All shares reported are shares of the Company’s

common stock. |

| |

|

| * |

Less

than 1%. |

Other

Matters

As

of the date of this proxy statement, we know of no matter not specifically referred to above as to which any action is expected to be

taken at the Special Meeting. The persons named as proxies will vote the proxies, insofar as they are not otherwise instructed, regarding

such other matters and the transaction of such other business as may be properly brought before the meeting, as seems to them to be in

the best interest of our company and our stockholders.

Stockholder

Proposals for our 2023 Annual Meeting of Stockholders

Stockholder

Proposals Included in Proxy Statement

Pursuant

to Rule 14a-8 under the Exchange Act, in order to be considered for inclusion in our proxy statement and proxy card relating to our 2023

annual meeting of stockholders, stockholder proposals must be received by us a reasonable time before we begin to print and send our

proxy materials. Upon receipt of any such proposal, we will determine whether or not to include such proposal in the proxy statement

and proxy card in accordance with regulations governing the solicitation of proxies.

Stockholder

Proposals Not Included in Proxy Statement

In

addition, our bylaws establish an advance notice procedure for nominations for election to our Board and other matters that stockholders

wish to present for action at an annual meeting other than those to be included in our proxy statement. In general, we must receive other

proposals of stockholders (including director nominations) intended to be presented at the 2023 annual meeting of stockholders but not

included in the proxy statement not earlier than the close of business on the 120th day prior to such annual meeting and not later than

the close of business on (i) the 90th day prior to such annual meeting, or (ii) the tenth day following the day on which public announcement

of the date of such annual meeting is first made, whichever is later. If the stockholder fails to give notice by these dates, then the

persons named as proxies in the proxies solicited by the Board for the 2023 annual meeting of stockholders may exercise discretionary

voting power regarding any such proposal. Stockholders are advised to review our bylaws which also specify requirements as to the form

and content of a stockholder’s notice.

Any

proposals, notices or information about proposed director candidates should be sent to Eightco Holdings Inc., 200 9th Avenue North, Suite

220, Safety Harbor, Florida, 34695.

Householding

of Proxy Materials

Some

brokers and other nominee record holders may be “householding” our proxy materials. This means a single notice and, if applicable,

the proxy materials, will be delivered to multiple stockholders sharing an address unless contrary instructions have been received. We

will promptly deliver a separate copy of the notice and, if applicable, the proxy materials and our most recent annual report to stockholders

to you if you write at Eightco Holdings Inc., 200 9th Avenue North, Suite 220, Safety Harbor, Florida, 34695 or call us at (866) 980-2818.

If you would like to receive separate notices and copies of our proxy materials and annual reports in the future, or if you are receiving

multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record

holder, or you may contact us at the above address and telephone number.

Where

You Can Find Additional Information

We

are subject to the informational requirements of the Exchange Act and, therefore, we file annual, quarterly and current reports, proxy

statements and other information with the SEC. Our SEC filings are available to the public on the SEC’s website at www.sec.gov.

The SEC’s website contains reports, proxy and information statements and other information regarding issuers, such as us, that

file electronically with the SEC. You may also read and copy any document we file with the SEC at the SEC’s Public Reference Room

at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may also obtain copies of these documents at prescribed rates by writing

to the SEC. Please call the SEC at 1-800-SEC-0330 for further information on the operation of its Public Reference Room.

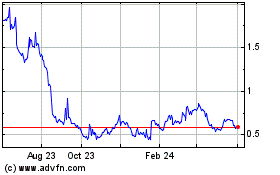

Eightco (NASDAQ:OCTO)

Historical Stock Chart

From Oct 2024 to Nov 2024

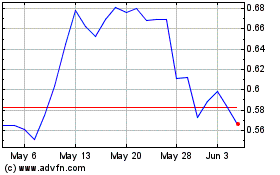

Eightco (NASDAQ:OCTO)

Historical Stock Chart

From Nov 2023 to Nov 2024