Form 424B3 - Prospectus [Rule 424(b)(3)]

05 June 2024 - 7:02AM

Edgar (US Regulatory)

Filed

Pursuant to Rule 424(b)(3)

Registration

No. 333-279350

PROSPECTUS

SUPPLEMENT NO. 1

(to

prospectus dated May 23, 2024)

Oncocyte

Corporation

5,419,788

Shares of Common Stock

This

prospectus supplement amends and supplements the information contained in the prospectus dated May 23, 2024 (the

“Prospectus”) covering resale by the selling stockholders named in the Prospectus of up to 5,419,788 shares of common

stock, no par value per share (“Common Stock”), consisting of (i) 5,076,900 shares of Common Stock that were issued

pursuant to the securities purchase agreement, dated as of April 11, 2024, by and among us and the purchasers named therein (the

“Purchase Agreement”), and (ii) 342,888 shares of Common Stock issuable upon the exercise of pre-funded warrants that

were issued pursuant to the Purchase Agreement. This prospectus supplement is not complete without, and may not be utilized except

in connection with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in

conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus

supplement, you should rely on the information in this prospectus supplement.

Our

common stock is traded on The Nasdaq Capital Market under the symbol “OCX.” On June 3, 2024, the last reported closing sale

price of our common stock on The Nasdaq Capital Market was $2.70 per share.

Investing

in our securities involves significant risks. Please read the information under the heading “Risk Factors” in the Prospectus

beginning on page 4 of the Prospectus, and under similar headings in other documents incorporated by reference into this prospectus

supplement and the Prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined

if the Prospectus or this prospectus supplement is accurate or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus supplement is June 4, 2024

EXPLANATORY

NOTE

The

following section is provided to correct typographical errors of the names of certain selling stockholders and the number of shares

of common stock beneficially owned by certain selling stockholders in the selling stockholders table in the Prospectus and supersedes

the table appearing under the caption “Selling Stockholders” beginning on page 7 of the Prospectus. We may amend or

supplement the information in this prospectus supplement from time to time in the future to update or change the information with respect

to the selling stockholders.

SELLING

STOCKHOLDERS

The

common stock being offered by the selling stockholders are those previously issued to the selling stockholders, and those issuable to

the selling stockholders upon exercise of the Pre-Funded Warrants, as applicable. For additional information regarding the issuances

of those shares of common stock and the Pre-Funded Warrants, see “April 2024 PIPE” above. We are registering the shares of

common stock in order to permit the selling stockholders to offer the shares for resale from time to time. Except as described below

under “Relationships with the Selling Stockholders,” the selling stockholders have not had any material relationship with

us within the past three years.

The

table below lists the selling stockholders and other information regarding the beneficial ownership of the shares of common stock by

each of the selling stockholders. The second column lists the number of shares of common stock beneficially owned by each selling stockholders,

based on its ownership of the shares of common stock and Pre-Funded Warrants, as of June 3, 2024, assuming exercise of the Pre-Funded

Warrants held by the selling stockholders on that date, without regard to any limitations on exercises.

The

fourth column lists the shares of common stock being offered by this prospectus by the selling stockholders.

In

accordance with the terms of the Registration Rights Agreement with the selling stockholders, this prospectus generally covers the resale

of the sum of (i) the number of shares of common stock issued to the selling stockholders in the “April 2024 PIPE” described

above and (ii) the maximum number of shares of common stock issuable upon exercise of the Pre-Funded Warrants, determined as if such

outstanding Pre-Funded Warrants were exercised in full as of the trading day immediately preceding the date this registration statement

was initially filed with the SEC, each as of the trading day immediately preceding the applicable date of determination and all subject

to adjustment as provided in the Registration Rights Agreement, without regard to any limitations on the exercise of the Pre-Funded Warrants.

The fifth column assumes the sale of all of the shares offered by the selling stockholders pursuant to this prospectus. The selling stockholders

may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

Unless

otherwise indicated, all information contained in the table below and the footnotes thereto is based upon information provided to us

by the selling shareholders. The percentage of shares owned prior to and after the offering is based on 13,364,637 shares of common stock

outstanding as of June 3, 2024. Unless otherwise indicated in the footnotes to this table, we believe that each selling shareholder has

sole voting and investment power with respect to the common stock indicated as beneficially owned. Except as otherwise indicated below,

based on the information provided to us by the selling shareholders, and to the best of our knowledge, no selling shareholder is a broker-dealer

or an affiliate of a broker-dealer.

| |

|

Shares

of Common Stock Beneficially Owned Before Offering |

|

Maximum

Number of Shares of Common Stock |

|

Shares

of Common Stock Beneficially Owned After Offering |

|

| Selling

Shareholders |

|

Number |

|

Percentage |

|

Offered |

|

Number |

|

Percentage |

|

| Broadwood

Partners, L.P. (1) |

|

|

5,079,316 |

(2) |

|

37.58 |

% |

|

2,420,000 |

(3) |

|

2,659,316 |

|

|

19.68 |

% |

| Bigger

Capital Fund, LP(4) |

|

|

257,167 |

(5) |

|

*

|

% |

|

257,167 |

(6) |

|

- |

|

|

*

|

% |

| Bio-Rad

Laboratories, Inc. (7) |

|

|

1,200,109 |

(8) |

|

8.98 |

% |

|

1,200,109 |

(9) |

|

- |

|

|

*

|

% |

| Newtown

Road 130 Holdings LLC (10) |

|

|

431,433 |

(11) |

|

3.22 |

% |

|

120,011 |

(12) |

|

242,844 |

|

|

1.81 |

% |

| Proactive

Capital Partners, LP(13) |

|

|

34,289 |

(14) |

|

*

|

% |

|

34,289 |

(15) |

|

- |

|

|

*

|

% |

| Iroquois

Master Fund Ltd. (16) |

|

|

68,578 |

(17) |

|

*

|

% |

|

68,578 |

(18) |

|

- |

|

|

*

|

% |

| Iroquois

Capital Investment Group LLC(19) |

|

|

102,867 |

(20) |

|

*

|

% |

|

102,867 |

(21) |

|

- |

|

|

*

|

% |

| Special

Situations Cayman Fund, L.P. (22) |

|

|

1,448,611 |

(23) |

|

10.45 |

% |

|

154,869 |

(24) |

|

762,834 |

|

|

5.64 |

% |

| Special

Situations Fund III Q.P. L.P. |

|

|

1,448,611 |

(25) |

|

10.45 |

% |

|

530,908 |

(26) |

|

762,834 |

|

|

5.64 |

% |

| 3i,

LP(27) |

|

|

171,444 |

(28) |

|

1.28 |

% |

|

171,444 |

(29) |

|

- |

|

|

*

|

% |

| James

Satloff ttee Dustin Nathaniel Satloff Trust u/a 6/1/93 (30) |

|

|

254,311 |

(31) |

|

1.90 |

% |

|

34,289 |

(32) |

|

82,866 |

|

|

* |

% |

| James

Satloff ttee Theodore Jean Satloff Trust u/a 10/4/96 (30) |

|

|

254,311 |

(33) |

|

1.90 |

% |

|

34,289 |

(34) |

|

82,866 |

|

|

* |

% |

| James

Satloff ttee Emily U Satloff Family Trust u/a 3/25/93 (30) |

|

|

254,311 |

(35) |

|

1.90 |

% |

|

34,289 |

(36) |

|

82,866 |

|

|

* |

% |

| James

Satloff (30) |

|

|

254,311 |

(37) |

|

1.90 |

% |

|

68,578 |

(38) |

|

82,866 |

|

|

* |

% |

| Joshua

Riggs |

|

|

3,390 |

(39) |

|

*

|

% |

|

3,390 |

(40) |

|

- |

|

|

*

|

% |

| Ekkehard

Scheutz |

|

|

10,404 |

(41) |

|

*

|

% |

|

5,085 |

(42) |

|

5,085 |

|

|

*

|

% |

| John

P. Gutfreund(10) |

|

|

431,433

|

(43) |

|

3.22 |

% |

|

68,578 |

(44) |

|

242,844 |

|

|

1.81 |

% |

| Emanuel

Neuman |

|

|

17,145

|

(45) |

|

*

|

% |

|

17,145 |

(46) |

|

- |

|

|

*

|

% |

| Ann

Unterberg(47) |

|

|

106,252

|

(48) |

|

* |

% |

|

34,289 |

(49) |

|

71,963 |

|

|

*

|

% |

| Andrew

Arno(50) |

|

|

84,662 |

(51) |

|

* |

% |

|

33,898 |

(52) |

|

50,764 |

|

|

*

|

% |

| Mary

Debare |

|

|

36,298

|

(53) |

|

* |

% |

|

25,716 |

(54) |

|

10,581 |

|

|

*

|

% |

*

Less than 1%

| (1) |

The

shares of common stock are directly owned by Broadwood Partners, L.P. (“Broadwood”). Broadwood Capital, Inc. is the general

partner of Broadwood. Neal Bradsher is the President of Broadwood Capital, Inc. Broadwood Capital, Inc. shares voting power over

and may be deemed to beneficially own the shares of common stock owned by Broadwood. Mr. Bradsher shares voting power over and may

be deemed to beneficially own the shares of common stock owned by Broadwood. |

| (2) |

Includes

5,079,316 shares of common stock consisting of (i) 2,509,066 shares of common stock, (ii) 150,093 shares of common stock underlying

certain warrants, (iii) 157 shares of common stock owned by Neal Bradsher, and (iv) 2,420,000 PIPE Shares. |

| (3) |

The

shares that may be sold under this prospectus are comprised of 2,420,000 PIPE Shares. |

| (4) |

The

shares of common stock are directly owned by Bigger Capital Fund, LP (“Bigger Capital”). Michael Bigger, the managing

member of Bigger Capital, may be deemed to beneficially own the shares of common stock owned by Bigger Capital. The address of the

principal business office of Bigger Capital is 11700 West Charleston BLVD. #170-659, Las Vegas, NV, 89135. |

| (5) |

Includes

257,167 shares of common stock consisting of 257,167 PIPE Shares |

| (6) |

The

shares that may be sold under this prospectus are comprised of 257,167 PIPE Shares. |

| (7) |

The

shares of common stock are directly owned by Bio-Rad Laboratories, Inc. (“Bio-Rad”). Norman Schwartz has voting and investment

control over the securities held by Bio-Rad and may be deemed to beneficially own the shares of common stock owned by Bio-Rad. The

address of the principal business office of Bio-Rad is 1000 Alfred Nobel Dr., Hercules, California 94547. |

| (8) |

Includes

1,200,109 shares of common stock consisting of 1,200,109 PIPE Shares |

| (9) |

The

shares that may be sold under this prospectus are comprised of 1,200,109 PIPE Shares. |

| (10) |

Includes

shares of common stock held by John P. Gutfreund, his minor children and Newtown Road 130 Holdings LLC (“Newtown”). Mr.

Gutfreund is the managing member and a control person of Newtown and may be deemed to beneficially own any securities directly owned

by Newtown. |

| (11) |

Includes

431,433 shares of common stock, consisting of (i) 153,969 shares of common stock, (ii) 120,011 PIPE Shares, (iii) 49,625 shares of

common stock underlying certain warrants, (iv) 68,578 PIPE Shares held by Mr. Gutfreund, (v) 35,750 shares of common stock held by

Mr. Gutfreund, (vi) 1,250 shares of common stock held for the benefit of the minor children of Mr. Gutfreund and (vii) 2,250 shares

of common stock underlying certain warrants held by Mr. Gutfreund. |

| (12) |

The

shares that may be sold under this prospectus are comprised of 120,011 PIPE Shares. |

| (13) |

The

shares of common stock are directly owned by Proactive Capital Partners, LP (“Proactive Capital”). Jeffrey S. Ramson

has voting and investment control over the securities held by Proactive Capital and may be deemed to beneficially own the shares

of common stock owned by Proactive Capital. The address of the principal business office of Proactive Capital is 950 3rd

Avenue, Suite 2700, New York, N.Y. 10022. |

| (14) |

Includes

34,289 shares of common stock consisting of 34,289 PIPE Shares |

| (15) |

The

shares that may be sold under this prospectus are comprised of 34,289 PIPE Shares. |

| (16) |

The

shares of common stock are directly owned by Iroquois Master Fund Ltd (“IMF”). Kimberly Page has sole voting and dispositive

power over the shares held by IMF. As such, Ms. Page may be deemed to be the beneficial owner of all shares of common stock held

by IMF. The address of the principal business office of IMF is 2 Overhill Road, Suite 400, Scarsdale, NU 10583. |

| (17) |

Includes

68,578 shares of common stock consisting of 68,578 PIPE Shares. |

| |

|

| (18) |

The

shares that may be sold under this prospectus are comprised of 68,578 PIPE Shares. |

| (19) |

The

shares of common stock are directly owned by Iroquois Capital Investment Group LLC (“ICIG”). Mr. Abbe exercises sole

voting and dispositive power over the shares held by ICIG. As such, Mr. Abbe may be deemed to be the beneficial owner of all shares

of common stock held by ICIG. The address of the principal business office of ICIG is 2 Overhill Road, Suite 400, Scarsdale, NU 10583. |

| (20) |

Includes

102,867 shares of common stock consisting of 102,867 PIPE Shares. |

| (21) |

The

shares that may be sold under this prospectus are comprised of 102,867 PIPE Shares. |

| (22) |

Includes

shares of common stock held by Special Situations Cayman Fund, L.P. (“Cayman”), Special Situations Fund III QP, L.P.

(“SSFQP”), AWM Investment Company, Inc. (“AWM”), Special Situations Private Equity Fund, L.P. (“SSPE”)

and Special Situations Life Sciences Fund, L.P. (“SSLS”). AWM is the investment adviser to Cayman and SSFQP. David Greenhouse

and Adam Stettner are the principal owners of AWM. Through their control of AWM, Messrs. Greenhouse and Stettner share voting and

investment control over the portfolio securities of each of Cayman and SSFQP. Messrs. Greenhouse and Stettner disclaim any beneficial

ownership of the reported shares other than to the extent of any pecuniary interest in each of them may have therein. AWM is also

the investment adviser to SSPE and SSLS. The principal place of business for each of AWM, Cayman, SSFQP, SSPE, and SSLS is 527 Madison

Avenue, Suite 2600, New York NY 10022. |

| (23) |

Includes

1,448,611 shares of common stock consisting of (i) 608,049 shares of common stock, (ii) 77,435 PIPE shares, (iii) 77,434 shares of

common stock issuable upon the exercise of the Pre-Funded Warrants, (iv) 117,261 shares of common stock underlying certain warrants,

(v) 18,762 shares of common stock underlying certain warrants held by SSPE, and (vi) 18,762 shares of common stock underlying certain

warrants held by SSLS, (vii) 265,454 PIPE shares held by SSFQP, and (viii) 265,454 shares of common stock issuable upon the exercise

of the Pre-Funded Warrants held by SSFQP. |

| (24) |

The

shares that may be sold under this prospectus are comprised of 77,435 PIPE Shares and 77,434 shares of common stock issuable upon

the exercise of the Pre-Funded Warrants. |

| (25) |

Includes

1,448,611 shares of common stock consisting of (i) 608,049 shares of common stock, (ii) 265,454 PIPE shares, (iii) 265,454 shares

of common stock issuable upon the exercise of the Pre-Funded Warrants, (iv) 117,261 shares of common stock underlying certain warrants,

(v) 18,762 shares of common stock underlying certain warrants held by SSPE, and (vi) 18,762 shares of common stock underlying certain

warrants held by SSLS, (vii) 77,435 PIPE shares held by Cayman, and (viii) 77,434 shares of common stock issuable upon the exercise

of the Pre-Funded Warrants held by Cayman. |

| (26) |

The

shares that may be sold under this prospectus are comprised of 265,454 PIPE Shares and 265,454 shares of common stock issuable upon

the exercise of the Pre-Funded Warrants. |

| (27) |

The

shares of common stock are directly owned by 3i, LP (“3i”). Maier Joshua Tarlow is the manager of 3i Management, LLC,

the general partner of 3i, and has sole voting control and investment discretion over securities beneficially owned directly or indirectly

by 3i Management, LLC and 3i. The principal business address of 3i is 2 Wooster Street, 2nd Floor, New York, NY 10013. 3i’s

principal business is that of a private investor. |

| (28) |

Includes

171,444 shares of common stock consisting of 171,444 PIPE shares. |

| (29) |

The

shares that may be sold under this prospectus are comprised of 171,444 PIPE Shares. |

| (30) |

Includes

shares of common stock held by James Satloff ttee Theodore Jean Satloff Trust u/a 10/4/96 (“Theodore”), James Satloff

ttee Emily U Satloff Family Trust u/a 3/25/93 (“Emily”), James Satloff ttee Dustin Nathaniel Satloff Trust u/a 6/1/93

(“Dustin Nathaniel,” and together with Theodore and Emily, the “Satloff Trusts”) and James Satloff. James

Satloff may be deemed to beneficially own the shares of common stock owned by the Satloff Trusts. |

| (31) |

Includes

254,311 shares of common stock, consisting of (i) 16,573 shares of common stock, (ii) 34,289 PIPE Shares, (iii) 16,573 shares of

common stock held by Emily, (iv) 16,573 shares of common stock held by Theodore, (v) 33,147 shares of common stock held by James

Satloff, (vi) 34,289 PIPE Shares held by Emily, (vii) 34,289 PIPE Shares held by Theodore, and (viii) 68,578 PIPE Shares held by

James Satloff. |

| (32) |

The

shares that may be sold under this prospectus are comprised of 34,289 PIPE Shares. |

| (33) |

Includes

254,311 shares of common stock, consisting of (i) 16,573 shares of common stock, (ii) 34,289 PIPE Shares, (iii) 16,573 shares of

common stock held by Emily, (iv) 16,573 shares of common stock held by Dustin Nathaniel, (v) 33,147 shares of common stock held by

James Satloff, (vi) 34,289 PIPE Shares held by Emily, (vii) 34,289 PIPE Shares held by Dustin Nathaniel, (viii) 68,578 PIPE Shares

held by James Satloff. |

| (34) |

The

shares that may be sold under this prospectus are comprised of 34,289 PIPE Shares. |

| (35) |

Includes

254,311 shares of common stock, consisting of (i) 16,573 shares of common stock, (ii) 34,289 PIPE Shares, (iii) 16,573 shares of

common stock held by Theodore, (iv) 16,573 shares of common stock held by Dustin Nathaniel (v) 33,147 shares of common stock held

by James Satloff, (vi) 34,289 PIPE Shares held by Theodore, (vii) 34,289 PIPE Shares held by Dustin Nathaniel, (viii) 68,578 PIPE

Shares held by James Satloff. |

| (36) |

The

shares that may be sold under this prospectus are comprised of 34,289 PIPE Shares. |

| (37) |

Includes

254,311 shares of common stock, consisting of (i) 33,147 shares of common stock, (ii) 68,578 PIPE Shares, (iii) 16,573 shares of

common stock held by Theodore, (iv) 16,573 shares of common stock held by Dustin Nathaniel, (v) 16,573 shares of common stock held

by Emily, (vi) 34,289 PIPE Shares held by Theodore, (vii) 34,289 PIPE Shares held by Dustin Nathaniel, (viii) 34,289 PIPE Shares

held by Emily. |

| (38) |

The

shares that may be sold under this prospectus are comprised of 68,578 PIPE Shares. |

| (39) |

Includes

3,390 shares of common stock comprised of 3,390 PIPE Shares. |

| (40) |

The

shares that may be sold under this prospectus are comprised of 3,390 PIPE Shares. |

| (41) |

Includes

10,404 shares of common stock consisting of (i) 5,319 shares of common stock, and (ii) 5,085 PIPE Shares. |

| (42) |

The

shares that may be sold under this prospectus are comprised of 5,085 PIPE Shares. |

| (43) |

Includes

431,433 shares of common stock, consisting of (i) 35,750 shares of common stock, (ii) 68,578 PIPE Shares, (iii) 2,250 shares of common

stock underlying certain warrants, (iv) 120,011 PIPE Shares held by Newtown, (v) 153,969 shares of common stock held by Newtown,

(vi) 1,250 shares of common stock held for the benefit of the minor children of Mr. Gutfreund and (vii) 49,625 shares of common stock

underlying certain warrants held by Newtown. |

| (44) |

The

shares that may be sold under this prospectus are comprised of 68,578 PIPE Shares. |

| (45) |

Includes

17,145 shares of common stock consisting of 17,145 PIPE Shares |

| (46) |

The

shares that may be sold under this prospectus are comprised of 17,145 PIPE Shares. |

(47)

|

Includes

shares of common stock held by Ann Unterberg and Marital Trust under Article Five Thomas I Unterberg 2022 Revocable Trust Ann Berninger

Unterberg trustee (the “Unterberg Trust”). Ms. Unterberg is the trustee and beneficiary of the trust and as such may

be deemed to be the beneficial owner of all shares of common stock held by the Unterberg Trust. |

| |

|

| (48) |

Includes

106,252 shares of common stock consisting of (i) 34,440 shares of common stock, (ii) 37,523 shares of common stock held by the Unterberg

Trust, and (iii) 34,289 PIPE Shares. |

| (49) |

The

shares that may be sold under this prospectus are comprised of 34,289 PIPE Shares. |

| |

|

| (50) |

Includes

shares of common stock held by Andrew Arno, JBA Investments LLC (“JBA”) and MJA Investments LLC (“MJA”).

Mr. Arno is the Manager of JBA and MJA and exercises sole voting and dispositive power over the shares held by JBA and MJA. As such,

Mr. Arno may be deemed to be the beneficial owner of all shares of common stock held by JBA and MJA. |

|

(51) |

Includes

84,662 shares of common stock consisting of (i) 35,156 shares of common stock, (ii) 7,804 shares of common stock held by JBA, (iii)

7,804 shares of common stock held by MJA, and (iv) 33,898 PIPE Shares. |

| (52) |

The

shares that may be sold under this prospectus are comprised of 33,898 PIPE Shares. |

| (53) |

Includes

36,298 shares of common stock consisting of (i) 10,581 shares of common stock, and (ii) 25,716 PIPE Shares. |

| (54) |

The

shares that may be sold under this prospectus are comprised of 25,716 PIPE Shares. |

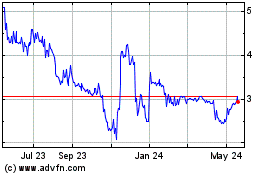

Oncocyte (NASDAQ:OCX)

Historical Stock Chart

From May 2024 to Jun 2024

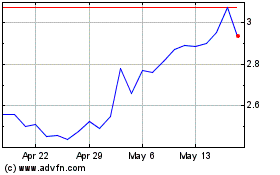

Oncocyte (NASDAQ:OCX)

Historical Stock Chart

From Jun 2023 to Jun 2024