Orthofix Announces New Term Loan

07 November 2024 - 11:05PM

Business Wire

New Financing Replaces Existing Term Loan

and Seeks to Further Optimize the Company’s Capital Structure to

Support Long-Term, Profitable Growth

Orthofix Medical Inc. (NASDAQ:OFIX), a leading global medical

technology company, today announced the entry into a new credit

agreement providing the Company with up to $275 million in a

senior-secured term loan with a 48-month interest only period. The

term loan is agented by Oxford Finance LLC (“Oxford”) and provides

non-dilutive capital and financial flexibility to support

Orthofix’s continued focus on profitable growth. The proceeds from

the initial funding of the term loan will be used to retire the

Company’s existing credit facility and pay related fees and

expenses. The remaining capacity will bolster the Company’s access

to capital.

Under the terms of the new loan, $160 million of the loan will

be funded up-front and the remaining $115 million will be available

after January 1, 2025, of which $65 million is at borrower’s option

from January 1, 2025 through June 30, 2026 and $50 million is at

lender’s discretion through January 1, 2029.

“The completion of this refinancing initiative is an important

step in Orthofix’s trajectory and provides us with more favorable

terms under which we can continue to invest in the growth and

evolution of the Company,” said Julie Andrews, Chief Financial

Officer. “Our performance to date in 2024 has been characterized by

steady financial improvements throughout the year, including

significant progress in adjusted EBITDA and becoming free cash flow

positive, both of which underpin our confidence in our ability to

drive long-term profitable growth.”

Massimo Calafiore, President and Chief Executive Officer, added,

“On the heels of our strong third quarter, it’s clear that

Orthofix’s focus on executing a clear strategy for profitable

growth is delivering compelling results. Through our focus on

bringing to market a comprehensive portfolio of transformative

solutions and delivering unmatched customer service, which

collectively are helping us drive more profitable sales, we have

significantly improved our operating and financial position and

paved the way for sustainable growth. As we look to 2025 and

beyond, we plan to build on our progress by further sharpening our

commercial focus, operating with discipline for margin expansion

and ensuring we are best positioned to create value for our

shareholders over the long term.”

The lending group includes Oxford Finance and K2

HealthVentures.

“We are proud to partner with Orthofix as they advance their

mission to enhance mobility and improve quality of life for

patients worldwide," said Garrett Henn, Managing Director and

Co-Head of Enterprise Lending at Oxford. "Our partnership

underscores our confidence in Orthofix’s experienced leadership

team and their strategy to drive sustainable, long-term growth and

profitability.”

Further details regarding the new debt facility agreement are

included in the Company’s Form 10-Q filed with the U.S. Securities

and Exchange Commission on November 7, 2024 and in the Form 8-K

that will be filed by the Company.

About Orthofix

Orthofix is a global medical technology company headquartered in

Lewisville, Texas. By providing medical technologies that heal

musculoskeletal pathologies, we deliver exceptional experiences and

life-changing solutions to patients around the world. Orthofix

offers a comprehensive portfolio of spinal hardware, bone growth

therapies, specialized orthopedic solutions, biologics and enabling

technologies, including the 7D FLASH™ navigation system. To learn

more, visit Orthofix.com and follow on LinkedIn.

About Oxford Finance LLC

Oxford Finance LLC is a specialty finance firm providing senior

secured loans to public and private life sciences, healthcare

services, healthtech, business services and SaaS companies

worldwide. For over 20 years, Oxford has delivered flexible

financing solutions to over 700 companies, allowing borrowers to

maximize their equity by leveraging their assets. Since 2002,

Oxford has originated more than $13 billion in loans. Oxford is

headquartered in Alexandria, Virginia, with additional offices

serving the greater San Diego, San Francisco, Boston and New York

City metropolitan areas. For more information, visit

https://oxfordfinance.com.

Forward-Looking Statements

This news release may include forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and Section 27A of the Securities Act of 1933, as

amended. In some cases, you can identify forward-looking statements

by terminology such as “may,” “will,” “should,” “expects,” “plans,”

“anticipates,” “believes,” “estimates,” “projects,” “intends,”

“predicts,” “potential,” “continue” or other comparable

terminology. Orthofix cautions you that statements included in this

news release that are not a description of historical facts are

forward-looking statements that are based on the Company’s current

expectations and assumptions. Each forward-looking statement

contained in this news release is subject to risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statement. Applicable risks

and uncertainties include, among others: the risks identified under

the heading “Risk Factors” in Orthofix Medical Inc.’s Annual Report

on Form 10-K for the fiscal year ended December 31, 2023, which was

filed with the Securities and Exchange Commission (SEC) on March 5,

2024, as well as any subsequent Quarterly Report on Form 10-Q or

Current Report on Form 8-K filed with the SEC. The Company’s public

filings with the SEC are available at www.sec.gov. You are

cautioned not to place undue reliance on forward-looking

statements, which speak only as of the date when made. Orthofix

does not intend to revise or update any forward-looking statement

set forth in this news release to reflect events or circumstances

arising after the date hereof, except as may be required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107942519/en/

Investor Relations Julie Dewey JulieDewey@Orthofix.com

209.613.6945 Media Relations Denise Landry

DeniseLandry@Orthofix.com 214.937.2529

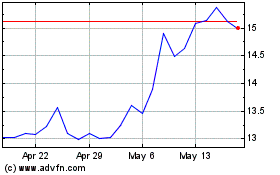

Orthofix Medical (NASDAQ:OFIX)

Historical Stock Chart

From Nov 2024 to Dec 2024

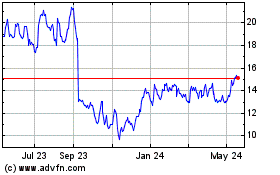

Orthofix Medical (NASDAQ:OFIX)

Historical Stock Chart

From Dec 2023 to Dec 2024