– Conference Call Today at 4:30 p.m.

ET

Omeros Corporation (Nasdaq: OMER), a clinical-stage

biopharmaceutical company committed to discovering, developing and

commercializing small-molecule and protein therapeutics for

large-market and orphan indications targeting immunologic disorders

including complement-mediated diseases, as well as cancers and

addictive and compulsive disorders, today announced recent

highlights and developments as well as financial results for the

second quarter ended June 30, 2024, which include:

- Net loss for the second quarter of 2024 was $56.0 million, or

$0.97 per share, compared to a net loss of $37.3 million, or $0.59

per share for the second quarter of 2023. For the six months ended

June 30, 2024, our net loss was $93.2 million, or $1.60 per share,

compared to a net loss of $71.0 million, or $1.13 per share in the

prior year period. The second quarter of 2024 includes a $17.6

million charge for narsoplimab drug substance delivered during the

quarter, the manufacturing of which commenced in October 2023, a

$21.2 million payment for term loan-related debt repurchase, and

$1.9 million of term loan-related transaction costs. These

significant cash outlays, representing a total of $40.7 million

dollars, are not expected to be repeated in the foreseeable

future.

- On June 3, 2024, we entered into a Credit and Guaranty

Agreement (the “Credit Agreement”) with funds managed by Athyrium

Capital Management (collectively, “Athyrium”) and funds managed by

Highbridge Capital Management (collectively, “Highbridge”) as

lenders (the “Lenders”). Under the Credit Agreement, we entered

into an initial senior secured term loan of $67.1 million (the

“Initial Term Loan”) and paid $21.2 million to the Lenders in

exchange for $118.1 million aggregate principal amount of Omeros’

existing 5.25 percent convertible senior notes due on February 15,

2026 (the “2026 Notes”) held by the Lenders and representing 55

percent of our total 2026 Notes. The Credit Agreement also provides

for a $25.0 million delayed draw term loan available to be drawn on

request by Omeros on or prior to June 3, 2025 contingent on

regulatory approval of narsoplimab in hematopoietic stem cell

transplant-associated thrombotic microangiopathy (“TA-TMA”). All

loans under the Credit Agreement have a stated maturity date of

June 3, 2028.

- The purchase price in the debt exchange and repurchase of our

outstanding 2026 Notes represents a discount from notional value of

approximately 25 percent.

- Neither the Initial Term Loan nor the delayed draw term loan

includes equity consideration for the Lenders, preventing any

shareholder dilution as a consequence of these transactions.

- After giving effect to the repurchase, we had approximately $98

million principal amount of our 2026 Notes outstanding.

- At June 30, 2024, we had $158.9 million of cash and short-term

investments available for operations and debt servicing, a decrease

of $12.9 million from December 31, 2023.

- As previously disclosed, we submitted an analysis plan to

assess our existing clinical trial data along with other evidence

proposed to be included in a resubmission of our biologics license

application (“BLA”) for narsoplimab in TA-TMA. We are engaged in

ongoing discussions with the FDA regarding the analysis plan and

the other evidence proposed to be included in the submission. An

additional meeting with FDA has been scheduled and we expect to

provide a further update on our plans for resubmission and

anticipated timing when more definitive information becomes

available.

- We continued advancing our lead MASP-3 inhibitor antibody

zaltenibart (also known as OMS906) through a Phase 2 development

program in paroxysmal nocturnal hemoglobinuria (“PNH”) comprised of

two fully enrolled clinical trials and a long-term extension study

in which patients who have completed either of the first two

studies are eligible to enroll. Patients continue to accrue to the

extension study and we remain on track to initiate our Phase 3

program for zaltenibart in PNH later this year.

- Enrollment is ongoing in our Phase 2 clinical trial evaluating

zaltenibart for the treatment of complement 3 glomerulopathy

(“C3G”). A Phase 3 program in C3G is planned to begin in early

2025.

“Throughout the second quarter, we continued rapidly progressing

our clinical programs while significantly strengthening our balance

sheet,” said Gregory A. Demopulos, M.D., Omeros’ chairman and chief

executive officer. “Through the term loan and note repurchase

transaction completed in June, we reduced by more than half the

outstanding balance of our 2026 convertible notes at a substantial

discount to par value without diluting shareholders. With the new

secured term loan in place, a substantial portion of our

outstanding debt is now maturing in 2028, the Company is well

positioned to address the remaining balance of our 2026 convertible

notes, and we have access to an additional term loan of up to $25

million to fund the commercial launch of narsoplimab in TA-TMA.

Although the lengthy regulatory process is a continuing source of

frustration for our team, our shareholders and, most especially,

the TA-TMA patients in need of an effective treatment for this

often-lethal condition, we believe that the evidence we have

proposed to submit with our BLA is highly compelling and we remain

dedicated to making narsoplimab the first approved product for the

treatment of TA-TMA. We look forward to providing a further update

on the outcome of our ongoing discussions with FDA. In parallel,

our MASP-3 inhibitor zaltenibart continues to advance rapidly,

generating consistently – and compared to other marketed and

developing alternative pathway inhibitors – strong data, and it

remains on track to initiate a Phase 3 program in PNH later this

year and, in C3G, early in 2025.”

Second Quarter and Recent Clinical Developments

- Recent developments regarding narsoplimab, our lead monoclonal

antibody targeting mannan-binding lectin-associated serine

protease-2 (“MASP-2”), include the following:

- We previously submitted to FDA an analysis plan to assess

already existing clinical trial data, existing data from an

historical control population available from an external source,

data from the narsoplimab expanded access (i.e., compassionate use)

program, and data directed to the mechanism of action of

narsoplimab. We are having ongoing discussions with the agency

regarding the proposed analysis plan and FDA’s requirements for our

resubmission of our BLA. An additional meeting with FDA has been

scheduled and we expect to provide a further update on our plans

for resubmission and the anticipated timing when more definitive

information becomes available.

- FDA recently announced the establishment of the Rare Disease

Innovation Hub, which will serve as a single point of connection

and engagement within the FDA to support the development of

treatments and products for rare diseases. The hub will have a

particular focus on products intended for smaller populations or

for diseases where the natural history is variable and not fully

understood. FDA’s focus on these issues and their responsiveness to

the rare disease community’s advocacy is encouraging, and we view

the establishment of the hub as a tangible demonstration of FDA’s

commitment to recognizing and addressing the unique challenges

faced in developing therapies for these conditions.

- In addition to previous publications on narsoplimab in TA-TMA,

international transplant experts are preparing two manuscripts –

one directed to the results of a survival comparison between our

pivotal trial of narsoplimab in TA-TMA and an external control

population of TA-TMA patients and the second detailing the survival

data obtained from narsoplimab treatment of TA-TMA patients in our

expanded access program. Physicians continue to request access to

narsoplimab under this program for their patients with TA-TMA.

Given that there is no approved treatment for this life-threatening

condition, we continue to do what we can to help these

patients.

- Recent developments regarding OMS1029, our long-acting,

next-generation MASP-2 inhibitor, include:

- Both the single- and multiple-ascending-dose Phase 1 studies of

OMS1029 have now been completed. The results support once-quarterly

dosing, administered either subcutaneously or intravenously. Data

from the multiple-ascending-dose study will be utilized to inform

dose selection for continued clinical development. Consistent with

the results of the single-ascending-dose Phase 1 clinical trial of

OMS1029 completed in early 2023, OMS1029 was generally well

tolerated at all doses evaluated in the multiple-ascending-dose

study, with no significant safety concern identified to date.

- We continue to evaluate large market indications for Phase 2

clinical development of OMS1029. These include neovascular

age-related macular degeneration, sometimes referred to as “wet

AMD.” MASP-2 inhibition previously showed efficacy in a

pre-clinical murine model of wet AMD and we are currently engaged

in a primate study comparing OMS1029 to Eylea (afibercept), a

product currently approved to treat wet AMD. If shown to be

effective, OMS1029 administered systemically (e.g., either

intravenously or subcutaneously) could represent a significantly

more attractive treatment experience compared to Eylea and other

currently approved treatments for wet AMD, which require frequent

injections directly into the posterior chamber of the eye.

- Recent developments regarding OMS906, our lead monoclonal

antibody targeting mannan-binding lectin-associated serine

protease-3 (“MASP-3”), the key activator of the alternative

pathway, include:

- The United States Adopted Names Council (“USAN”), in

consultation with the World Health Organization’s International

Nonproprietary Names Expert Committee (“INN”), recently selected

the nonproprietary name “zaltenibart” for OMS906. The USAN Council,

by working closely with the INN Programme of the World Health

Organization and various national nomenclature groups, aims for

global standardization and unification of drug nomenclature to

ensure that drug information is communicated accurately and

unambiguously. Going forward, we will use the name zaltenibart to

refer to our lead MASP-3 antibody in publications, at conferences

and across other forums.

- Our Phase 2 trial evaluating two doses of zaltenibart in PNH

patients who have had an unsatisfactory response to the C5

inhibitor ravulizumab has continued to produce encouraging data.

The study utilizes a “switch-over” design, enrolling PNH patients

who are receiving ravulizumab and adding zaltenibart to provide

combination therapy with ravulizumab for 24 weeks. Those patients

who demonstrate a hemoglobin response with the combination therapy

are then switched to zaltenibart monotherapy. In June, at the

annual congress of the European Hematology Association, interim

analysis results from the combination therapy portion of the trial

were presented by Dr. Morag Griffin, an internationally recognized

PNH expert from St. James University Hospital in England. During

the adjunctive therapy period, the statistically significant mean

hemoglobin improvement from baseline was 3.27 g/dL and 10 of 12

patients advanced to monotherapy. Absolute reticulocyte count also

demonstrated statistically significant improvement. Zaltenibart was

safe and well tolerated. An abstract providing results of the

zaltenibart monotherapy stage has been submitted to the American

Society of Hematology for presentation at their annual meeting in

December. The efficacy and safety profiles of zaltenibart as

monotherapy remain strong, including demonstration of sustained and

clinically meaningful improvements in hemoglobin levels and

absolute reticulocyte counts as well as prevention of both

extravascular and intravascular hemolysis.

- Our Phase 2 study of zaltenibart in PNH patients who have not

previously received treatment with a complement inhibitor (i.e.,

naïve patients) is also ongoing and continues to progress well.

Results from an interim analysis of subcutaneous zaltenibart

treatment were presented at the American Society of Hematology

meeting held in December 2023. Following that presentation, we

amended the study protocol to identify the plasma concentrations

and the level of MASP-3 inhibition required to inhibit breakthrough

hemolysis. These data, in combination with data derived from our

“switch-over” PNH study and from our Phase 1 studies in healthy

subjects, are expected to provide all the data needed to finalize

selection of the zaltenibart dose for our upcoming Phase 3 clinical

trials.

- We plan to conduct two trials in our Phase 3 program for

zaltenibart in PNH. Similar to our Phase 2 program, one will enroll

complement inhibitor-naïve patients and the other will employ a

“switch over” design. Through our recent advisory boards with

experts in PNH and focus-group PNH patients, we have received

valuable input to inform the design of our Phase 3 studies and our

positioning of zaltenibart in the marketplace, if approved. The

zaltenibart drug substance necessary to supply our Phase 3 clinical

trials has been manufactured, upcoming pre-Phase 3 meetings with

both European and U.S. regulators have been scheduled or requested,

and the other activities required to initiate our Phase 3 program

have also been completed or are progressing as planned. We remain

on track to initiate the program later this year.

- Recent developments regarding OMS527, our phosphodiesterase 7

(“PDE7”) inhibitor program focused on addictions and compulsive

disorders as well as movement disorders, include:

- In April 2023 we were awarded a three-year, $6.69 million grant

by the National Institute on Drug Abuse (“NIDA”) to pursue

development of our lead orally administered PDE7 inhibitor compound

for the treatment of cocaine use disorder (“CUD”). We expect to

complete by the end of this year a grant-funded preclinical cocaine

interaction study, which is a safety prerequisite to initiation of

the randomized, placebo-controlled, inpatient clinical study

evaluating the safety and effectiveness of OMS527 in patients with

CUD, which is also contemplated to be funded with proceeds of the

NIDA award.

Financial Results

Net loss for the second quarter of 2024 was $56.0 million, or

$0.97 per share, compared to a net loss of $37.3 million, or $0.59

per share for the second quarter of 2023. For the six months ended

June 30, 2024, our net loss was $93.2 million, or $1.60 per share,

compared to a net loss of $71.0 million, or $1.13 per share in the

prior year period. The second quarter of 2024 includes a $17.6

million charge for narsoplimab drug substance that was delivered

during the quarter, the manufacturing of which commenced in October

2023, a $21.2 million payment for debt repurchase, and $1.9 million

of costs related to the debt transaction. We expense all

manufacturing activities until approval in the U.S. and Europe is

reasonably assured.

At June 30, 2024, we had $158.9 million of cash and short-term

investments available for operations and debt service, a decrease

of $12.9 million from December 31, 2023.

For the second quarter of 2024, we earned OMIDRIA royalties of

$10.9 million on Rayner’s U.S. net sales of $36.4 million. This

compares to earned OMIDRIA royalties of $10.7 million during the

second quarter of 2023 on U.S. net sales of $35.7 million.

Total operating expenses for the second quarter of 2024 were

$59.2 million compared to $40.9 million for the second quarter of

2023. The difference was primarily due to a $17.6 million charge

for delivery of narsoplimab drug substance and $1.9 million of

costs related to the debt transaction. In addition, zaltenibart

clinical research costs also increased but were offset by decreased

clinical expenditures on narsoplimab due to the termination of our

IgA nephropathy program.

Interest expense during the second quarter of 2024 was $9.2

million compared to $7.9 million during the prior year quarter. The

increase was due to the additional $115.5 million of borrowing

under the royalty obligation with DRI Healthcare Acquisitions LP in

February 2024. These increases were partially offset by decreased

interest upon retiring the 2023 convertible notes in November 2023

and repurchasing and retiring the majority of the 2026 Notes in

December 2023 and June 2024.

During the second quarter of 2024, we earned $3.2 million in

interest and other income compared to $4.5 million in the second

quarter of 2023. The difference is primarily due to lesser cash and

investments available to invest in the second quarter.

Net income from discontinued operations, net of tax, was $9.1

million, or $0.15 per share, in the second quarter of 2024 compared

to $7.0 million, or $0.11 per share, in the second quarter of 2023.

The increase was primarily attributable to increased non-cash

interest earned on the OMIDRIA contract royalty asset and higher

remeasurement adjustments in the current quarter.

Conference Call Details

Omeros’ management will host a conference call and webcast to

discuss the financial results and to provide an update on business

activities. The call will be held today at 1:30 p.m. Pacific Time;

4:30 p.m. Eastern Time.

For online access to the live webcast of the conference call, go

to Omeros’ website at

https://investor.omeros.com/upcoming-events.

To access the live conference call via phone, participants must

register at the following URL to receive a unique pin:

https://register.vevent.com/register/BIcbf11bdb8ab84f58a90a501bd3a6beb9.

Once registered, you will have two options: (1) Dial in to the

conference line provided at the registration site using the PIN

provided to you, or (2) choose the “Call Me” option, which will

instantly dial the phone number you provide. Should you lose your

PIN or registration confirmation email, simply re-register to

receive a new PIN.

A replay of the call will be made accessible online at

https://investor.omeros.com/archived-events.

About Omeros Corporation

Omeros is an innovative biopharmaceutical company committed to

discovering, developing and commercializing small-molecule and

protein therapeutics for large-market and orphan indications

targeting immunologic disorders including complement-mediated

diseases, as well as cancers and addictive and compulsive

disorders. Omeros’ lead MASP-2 inhibitor narsoplimab targets the

lectin pathway of complement and is the subject of a biologics

license application pending before FDA for the treatment of

hematopoietic stem cell transplant-associated thrombotic

microangiopathy. Omeros’ long-acting MASP-2 inhibitor OMS1029 is

currently in a Phase 1 multi-ascending-dose clinical trial. OMS906,

Omeros’ inhibitor of MASP-3, the key activator of the alternative

pathway of complement, is advancing toward Phase 3 clinical trials

for paroxysmal nocturnal hemoglobinuria and complement 3

glomerulopathy. Funded by the National Institute on Drug Abuse,

Omeros’ lead phosphodiesterase 7 inhibitor OMS527 is in clinical

development for the treatment of cocaine use disorder and, in

addition, is being developed as a therapeutic for other addictions

as well as for a major complication of treatment for movement

disorders. Omeros also is advancing a broad portfolio of novel

immuno-oncology programs comprised of two cellular and three

molecular platforms. For more information about Omeros and its

programs, visit www.omeros.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, which are

subject to the “safe harbor” created by those sections for such

statements. All statements other than statements of historical fact

are forward-looking statements, which are often indicated by terms

such as “anticipate,” “believe,” “could,” “estimate,” “expect,”

“goal,” “intend,” “likely,” “look forward to,” “may,” “objective,”

“plan,” “potential,” “predict,” “project,” “should,” “slate,”

“target,” “will,” “would” and similar expressions and variations

thereof. Forward-looking statements, including statements regarding

the anticipated next steps in relation to the biologics license

application for narsoplimab, the timing of regulatory events, the

availability of clinical trial data, the prospects for obtaining

FDA approval of narsoplimab in any indication, expectations

regarding the initiation or continuation of clinical trials

evaluating Omeros’ drug candidates and the anticipated availability

of data therefrom, expectations regarding future cash expenditures,

and expectations regarding the sufficiency of our capital resources

to fund operations, are based on management’s beliefs and

assumptions and on information available to management only as of

the date of this press release. Omeros’ actual results could differ

materially from those anticipated in these forward-looking

statements for many reasons, including, without limitation,

unanticipated or unexpected outcomes of regulatory processes in

relevant jurisdictions, unproven preclinical and clinical

development activities, our financial condition and results of

operations, regulatory processes and oversight, challenges

associated with manufacture or supply of our investigational or

clinical products, changes in reimbursement and payment policies by

government and commercial payers or the application of such

policies, intellectual property claims, competitive developments,

litigation, and the risks, uncertainties and other factors

described under the heading “Risk Factors” in our Annual Report on

Form 10-K filed with the Securities and Exchange Commission on

April 1, 2024. Given these risks, uncertainties and other factors,

you should not place undue reliance on these forward-looking

statements, and we assume no obligation to update these

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable

law.

OMEROS CORPORATION

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS

(In thousands, except share

and per share data)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Costs and expenses:

Research and development

$

45,349

$

29,639

$

72,119

$

54,249

Selling, general and administrative

13,808

11,260

26,072

22,363

Total costs and expenses

59,157

40,899

98,191

76,612

Loss from operations

(59,157

)

(40,899

)

(98,191

)

(76,612

)

Interest expense

(9,215

)

(7,932

)

(17,446

)

(15,865

)

Interest and other income

3,247

4,537

6,662

8,500

Net loss from continuing operations

(65,125

)

(44,294

)

(108,975

)

(83,977

)

Net income from discontinued operations,

net of tax

9,084

7,000

15,760

12,982

Net loss

$

(56,041

)

$

(37,294

)

$

(93,225

)

$

(70,995

)

Basic and diluted net income (loss) per

share:

Net loss from continuing operations

$

(1.12

)

$

(0.70

)

$

(1.87

)

$

(1.34

)

Net income from discontinued

operations

0.15

0.11

0.27

0.21

Net loss

$

(0.97

)

$

(0.59

)

$

(1.60

)

$

(1.13

)

Weighted-average shares used to compute

basic and diluted net income (loss) per share

57,944,016

62,837,125

58,374,716

62,832,991

OMEROS CORPORATION

UNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEET

(In thousands)

June 30,

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

2,120

$

7,105

Short-term investments

156,792

164,743

OMIDRIA contract royalty asset,

current

29,665

29,373

Receivables

8,080

8,096

Prepaid expense and other assets

6,273

8,581

Total current assets

202,930

217,898

OMIDRIA contract royalty asset,

non-current

133,428

138,736

Right of use assets

16,868

18,631

Property and equipment, net

2,034

1,950

Restricted investments

1,054

1,054

Total assets

$

356,314

$

378,269

Liabilities and shareholders’ equity

(deficit)

Current liabilities:

Accounts payable

$

6,502

$

7,712

Accrued expenses

27,966

31,868

OMIDRIA royalty obligation, current

19,434

8,576

Lease liabilities, current

5,573

5,160

Total current liabilities

59,475

53,316

Convertible senior notes, net

96,888

213,155

Long-term debt, net

94,506

—

OMIDRIA royalty obligation

212,323

116,550

Lease liabilities, non-current

15,632

18,143

Other accrued liabilities, non-current

2,088

2,088

Shareholders’ equity (deficit):

Common stock and additional paid-in

capital

722,157

728,547

Accumulated deficit

(846,755

)

(753,530

)

Total shareholders’ deficit

(124,598

)

(24,983

)

Total liabilities and shareholders’

equity (deficit)

$

356,314

$

378,269

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807546625/en/

Jennifer Cook Williams Cook Williams Communications, Inc.

Investor and Media Relations IR@omeros.com

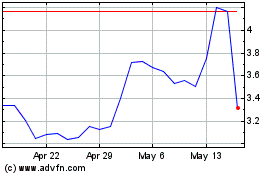

Omeros (NASDAQ:OMER)

Historical Stock Chart

From Nov 2024 to Dec 2024

Omeros (NASDAQ:OMER)

Historical Stock Chart

From Dec 2023 to Dec 2024