Organovo Announces Select Preliminary Second-Quarter 2017 Results; Company Updates Full-Year Fiscal 2017 Outlook

11 October 2016 - 11:05PM

Organovo Holdings, Inc. (NASDAQ:ONVO) (“Organovo”), a

three-dimensional biology company focused on delivering scientific

and medical breakthroughs using its 3D bioprinting technology,

today reported preliminary unaudited revenue and net cash

utilization results for the fiscal second quarter of 2017 and

updated its full-year fiscal 2017 outlook. The Company

expects to release full fiscal second-quarter financial results on

November 3, 2016.

Organovo’s preliminary fiscal second quarter total revenue was

approximately $1.4 million, consisting largely of product and

service revenue(1). This result reflects a 357 percent

increase in total revenue versus the comparable period of fiscal

2016 and a 54 percent increase versus the fiscal first quarter of

2017.

Selected Organovo Financial

Highlights

Revenue

- Product and service revenue was approximately $1.0 million, up

400 percent from the prior-year period, largely driven by an

increase in customer contracts for the Company’s tissue research

services.

- Collaborations and grant revenue(2) totaled approximately $0.4

million, primarily supported by a milestone achievement from the

Company’s agreement with Merck & Co. to develop multiple custom

tissue models.

Liquidity & Capital Resources

- The Company’s preliminary cash and cash equivalents balance was

approximately $51.7 million as of the end of the fiscal second

quarter, which compares to $53.5 million for the fiscal first

quarter. Organovo’s preliminary net cash utilization(3)

during the period was approximately $6.8 million. During the

fiscal second quarter, the Company generated net proceeds of

approximately $4.5 million from the issuance of 997,181 shares of

common stock in at-the-market (“ATM”) offerings at a weighted

average price of $4.67 per share and approximately $0.5 million

from the exercise of stock options and warrants.

Fiscal-Year 2017 Outlook

The Company updated its full-year fiscal 2017 outlook for total

revenue and net cash utilization. The Company now expects:

- Total revenue of between $4.5 million and $6.2 million for

fiscal-year 2017. Fiscal 2016 total revenue was $1.5

million.

- Net cash utilization of between $31.0 million and $34.0 million

for fiscal-year 2017. The Company had a cash and cash

equivalents balance of $62.1 million for its fiscal year ended

March 31, 2016.

|

|

Fiscal-Year 2017 Outlook (August

2016) |

Fiscal-Year 2017 Outlook (October

2016) |

|

Fiscal-Year 2017 Total

Revenue |

$4 million - $6 million |

$4.5 million - $6.2 million |

|

Net Cash Utilization |

$32.5 million - $36.5 million |

$31.0 million - $34.0 million |

Long-Range Outlook

The Company affirmed its long-range outlook for potential

revenue from its liver and kidney tissue products. The

Company continues to expect:

- As it penetrates the toxicology market, Organovo’s

ExVive™ Human Liver Tissue service will grow into the tens of

millions in annual revenue, and has $100 million+ revenue potential

in the future (inside of a total addressable market of over $1

billion).

- As it penetrates the toxicology market, Organovo’s ExVive Human

Kidney Tissue service will grow into the tens of millions in annual

revenue, and has $100 million+ revenue potential in the future

(inside of a total addressable market of over $2 billion).

Definitions & Supplemental Financial

Measures

(1) Product and service revenue includes tissue research service

agreements and product sales, including product sales from the

Company’s wholly-owned subsidiary, Samsara Sciences Inc.

(2) Collaborations revenue consists of license and collaboration

agreements that contain multiple elements, which may include

non-refundable up-front fees, payments for reimbursement of

third-party research costs, payments for ongoing research, payments

associated with achieving specific development milestones and

royalties based on specified percentages of net product sales, if

any.

(3) In addition to disclosing financial results that are

determined in accordance with U.S. GAAP, the Company provides net

cash utilization as a supplemental measure to help investors

evaluate the Company’s fundamental operational performance.

The Company defines net cash utilization as the net decrease

in cash and cash equivalents during the reporting period (which was

($1.8 million) during the second quarter of fiscal 2017) less

proceeds from the sale of common stock and the exercise of warrants

and stock options during the reporting period (which was $5.0

million during the second quarter of fiscal 2017). Net cash

utilization is an operational measure that should be considered as

additional financial information regarding our operations.

This operational measure should not be considered without also

considering our results prepared in accordance with U.S. GAAP, and

should not be considered as a substitute for, or superior to, our

U.S. GAAP results. The Company believes net cash utilization

is a relevant and useful operational measure because it provides

information regarding our cash utilization rate.

Management uses net cash utilization to manage the

business, including in preparing its annual operating budget,

financial projections and compensation plans. The Company

believes that net cash utilization is also useful to investors

because similar measures are frequently used by securities

analysts, investors and other interested parties in their

evaluation of companies in similar industries. However, there

is no standardized measurement of net cash utilization, and net

cash utilization as the Company presents it may not be comparable

with similarly titled operational measures used by other

companies. Due to these limitations, the Company’s management

does not view net cash utilization in isolation but also uses other

measurements, such as cash used in operating activities and

revenues to measure operating performance.

About Organovo Holdings,

Inc.Organovo designs and creates functional,

three-dimensional human tissues for use in medical research and

therapeutic applications. The Company develops 3D human

tissue models through internal development and in collaboration

with pharmaceutical, academic and other partners.

Organovo's 3D human tissues have the potential to accelerate

the drug discovery process, enabling treatments to be developed

faster and at lower cost. The Company’s ExVive Human Liver

and Kidney Tissues are used in toxicology and other preclinical

drug testing. The Company also actively conducts early

research on specific tissues for therapeutic use in direct surgical

applications. In addition to numerous scientific

publications, the Company’s technology has been featured

in The Wall Street Journal, Time Magazine, The Economist,

Forbes, and numerous other media outlets. Organovo is

changing the shape of life science research and transforming

medical care. Learn more at www.organovo.com.

Forward-Looking Statements Any statements

contained in this press release that do not describe historical

facts constitute forward-looking statements as that term is defined

in the Private Securities Litigation Reform Act of 1995. Any

forward-looking statements contained herein are based on current

expectations, but are subject to a number of risks and

uncertainties. Forward-looking statements include, but are

not limited to, statements regarding the Company’s select

preliminary financial results for the second quarter of fiscal year

2017, the Company’s fiscal year 2017 outlook and the Company’s

long-range outlook. The Company’s select quarterly financial

results for the second quarter of fiscal year 2017 are preliminary

and subject to adjustments in the ongoing review by the Company and

its external auditors. The factors that could cause the

Company’s actual future results to differ materially from current

expectations include, but are not limited to, risks and

uncertainties relating to the Company’s ability to develop, market

and sell products and services based on its technology; the

expected benefits and efficacy of the Company’s products, services

and technology; the market acceptance of the Company’s products and

services; the Company’s business, research, product development,

regulatory approval, marketing and distribution plans and

strategies; the Company’s ability to successfully complete the

contracts and recognize the revenue represented by the contracts

included in its previously reported total contract bookings; the

Company’s ability to secure additional contracted collaborative

relationships; the risk of further adjustments to the Company’s

select preliminary financial results; and the Company’s ability to

meet its fiscal year 2017 outlook and/or its long-range

outlook. These and other factors are identified and described

in more detail in the Company’s filings with the SEC,

including its Annual Report on Form 10-K filed with

the SEC on June 9, 2016 and its Quarterly Report on

Form 10-Q filed with the SEC on August 4, 2016. You should

not place undue reliance on these forward-looking statements, which

speak only as of the date that they were made. These

cautionary statements should be considered with any written or oral

forward-looking statements that the Company may issue in the

future. Except as required by applicable law, including the

securities laws of the United States, the Company does

not intend to update any of the forward-looking statements to

conform these statements to reflect actual results, later events or

circumstances or to reflect the occurrence of unanticipated

events.

Investor Contact:

Steve Kunszabo

Organovo Holdings, Inc.

+1 (858) 224-1092

skunszabo@organovo.com

Press Contact:

Jessica Yingling

Little Dog Communications

+1 (858) 344-8091

jessica@litldog.com

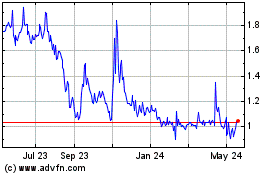

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Oct 2024 to Nov 2024

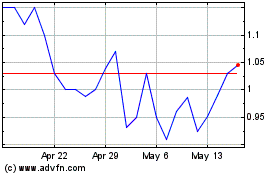

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Nov 2023 to Nov 2024