UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement

Pursuant

to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. 3)

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☒ |

Definitive

Proxy Statement |

| |

|

| ☐ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

OptimumBank

Holdings, Inc.

(Name

of Registrant as Specified in Its Charter)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

|

| |

1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

5) |

Total

fee paid: |

| |

|

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

|

| |

1) |

Amount

previously paid: |

| |

|

|

| |

2) |

Form,

Schedule or Registration Statement No.: |

| |

|

|

| |

3) |

Filing

Party: |

| |

|

|

| |

4) |

Date

Filed: |

PROXY

STATEMENT

2024

ANNUAL MEETING OF SHAREHOLDERS

GENERAL MEETING INFORMATION

Date:

May 29, 2024

Time:

10:00 a.m., Eastern Time |

PROXY

VOTING OPTIONS

YOUR

VOTE IS IMPORTANT!

Whether

or not you expect to attend in person, we urge you to vote your shares via the Internet, or by signing, dating, and returning the enclosed

proxy card at your earliest convenience. This will ensure the presence of a quorum at the meeting. Promptly voting your shares will save

us the expense and extra work of additional solicitation. Submitting your proxy now will not prevent you from voting your stock at the

meeting if you want to do so, as your vote by proxy is revocable at your option.

Voting

by the Internet is fast and convenient, and your vote is immediately confirmed and tabulated. Most important, by using the Internet,

you help us reduce postage and proxy tabulation costs.

Or,

if you prefer, you can return the enclosed Proxy Card in the envelope provided.

PLEASE

DO NOT RETURN THE ENCLOSED PROXY CARD IF YOU ARE VOTING OVER THE INTERNET.

VOTE

BY INTERNET:

http://www.cstproxyvote.com

24

hours a day / 7 days a week

INSTRUCTIONS:

Read

the accompanying Proxy Statement.

Go

to the following website:

http://www.optimumbank.com/stockholder-information/

Have

your Proxy Card in hand and follow the instructions. |

|

|

OPTIMUMBANK

HOLDINGS, INC.

NOTICE

OF ANNUAL MEETING OF SHAREHOLDERS

April

29, 2024

OPTIMUMBANK

HOLDINGS, INC.

NOTICE

OF ANNUAL MEETING OF SHAREHOLDERS

To

be held on May 29, 2024

To

the Shareholders:

The

annual meeting of the shareholders of OptimumBank Holdings, Inc. will be held at the executive offices of OptimumBank, 2929 East Commercial

Boulevard, Fort Lauderdale, Suite 303, Florida 33308, on Wednesday, May 29, 2024, at 10:00 a.m. for the following purposes:

1.

To elect seven (7) directors;

2.

To ratify the selection of Hacker, Johnson & Smith, P.A. as the Company’s independent auditor for fiscal year 2024; and

Only

shareholders of record at the close of business on April 9, 2024, are entitled to notice of, and to vote at, this meeting. Also enclosed

is a copy of our Annual Report on Form 10-K for 2023, which contains important information about our company.

| |

By

order of the Board of Directors |

| |

|

| |

Moishe

Gubin, Chairman |

| |

Fort

Lauderdale, Florida |

| |

April

29, 2024 |

IMPORTANT

Whether

or not you expect to attend in person, we urge you to vote your shares at your earliest convenience. This will ensure the presence of

a quorum at the meeting. Promptly voting your shares via the Internet, or by signing, dating, and returning the enclosed proxy card will

save our company the expenses and extra work of additional solicitation. An addressed envelope for which no postage is required if mailed

in the United States is enclosed if you wish to vote by mail. Submitting your proxy now will not prevent you from voting your shares

at the meeting if you desire to do so, as your proxy is revocable at your option.

Important

Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on May 29, 2024. Our Proxy Statement

and Annual Report on Form 10-K for 2023 are available at http://www.optimumbank.com/stockholder-information/

OPTIMUMBANK

HOLDINGS, INC.

2929

East Commercial Boulevard

Fort

Lauderdale, Florida 33308

PROXY

STATEMENT

2024

ANNUAL MEETING OF SHAREHOLDERS

TO

BE HELD ON MAY 29, 2024

This

Proxy Statement will be first mailed to shareholders on or about April 24, 2024. It is furnished in connection with the solicitation

of proxies by the Board of Directors of OptimumBank Holdings, Inc. (the “Company”) to be voted at the annual meeting of the

shareholders of the Company, which will be held at 10:00 a.m. on Tuesday, May 29, 2024, at the executive offices of OptimumBank (the

“Bank”), 2929 East Commercial Boulevard, Suite 303, Fort Lauderdale, Florida 33308, for the purposes set forth in the accompanying

Notice of Annual Meeting of Shareholders. Shareholders who execute proxies retain the right to revoke them at any time before the shares

are voted by proxy at the meeting. A shareholder may revoke a proxy by delivering a signed statement to the Secretary of the Company

at or prior to the annual meeting or by executing and delivering another proxy dated as of a later date. The Company will pay the cost

of solicitation of proxies.

Shareholders

of record at the close of business on April 9, 2024 will be entitled to vote at the meeting on the basis of one vote for each share held.

The total number of record holders of Optimumbank Holding’s common stock outstanding on the Record Date was approximately 1,149

with 9,634,821 shares of common stock outstanding.

QUESTIONS

AND ANSWERS ABOUT THE ANNUAL MEETING

When

and where will the annual meeting take place?

The

annual meeting will be held on May 29, 2024, at 10:00 a.m. (local time), at the executive offices of the Bank, 2929 East Commercial Boulevard,

Suite 303, Fort Lauderdale, Florida 33308. Through our adoption of upgraded technology, we are excited to be able to welcome attendees

from all over the world! Register to join via the live stream at https://bit.ly/OptimumBankShareholderMeeting.

Why

did I receive this proxy statement?

You

received this proxy statement because you held shares of the Company’s common stock on April 9, 2024 (the “Record Date”)

and are entitled to vote at the annual meeting. The Board of Directors is soliciting your proxy to vote at the meeting.

What

am I voting on?

You

are being asked to vote on two items:

1.

To elect seven (7) directors (see page 15);

2.

To ratify the selection of Hacker, Johnson & Smith, P.A. as the Company’s independent auditor for fiscal year 2024 (see page

19).

How

do I vote?

Shareholders

of Record

If

you are a shareholder of record, there are three ways to vote:

●

By internet at http://www.cstproxyvote.com;

●

If you request printed copies of the proxy materials, you may vote by proxy by completing and returning your proxy card in the postage-paid

envelope provided by the Company; or

●

By voting in person at the meeting.

Street

Name Holders

Shares

which are held in a brokerage account in the name of the broker are said to be held in “street name.”

If

your shares are held in street name, you should follow the voting instructions provided by your broker. If you requested printed copies

of the proxy materials, you may complete and return a voting instruction card to your broker, or, in many cases, your broker may also

allow you to vote via the Internet. Check your notice from your broker for more information. If you hold your shares in street name and

wish to vote at the meeting, you must obtain a legal proxy from your broker and bring that proxy to the meeting.

Regardless

of how your shares are registered, if you request printed copies of the proxy materials, complete and properly sign the accompanying

proxy card and return it to the address indicated, it will be voted as you direct.

What

is the deadline for voting via Internet?

Internet

voting is available through 11:59 p.m. (Eastern Daylight Time) on Tuesday, May 28, 2024 (the day before the annual meeting).

What

are the voting recommendations of the Board of Directors?

The

Board of Directors recommends that you vote in the following manner:

1.

FOR each of the persons nominated by the Board of Directors to serve as Directors;

2.

FOR ratifying the selection of Hacker, Johnson & Smith, P.A. as the Company’s independent auditor for fiscal year 2024.

Unless

you give contrary instructions in your proxy, the persons named as proxies will vote your shares in accordance with the recommendations

of the Board of Directors.

Will

any other matters be voted on?

We

do not know of any other matters that will be brought before the shareholders for a vote at the annual meeting. If any other matter is

properly brought before the meeting, your proxy would authorize Moishe Gubin and Joel Klein of the Company to vote on such matters in

their discretion.

Who

is entitled to vote at the meeting?

Only

shareholders of record at the close of business on the Record Date are entitled to receive notice of and to vote at the annual meeting.

If you were a shareholder of record on that date, you will be entitled to vote all of the shares that you held on that date at the annual

meeting, or any postponement or adjournment of the meeting.

How

many votes do I have?

You

will have one vote for each share of the Company’s common stock that you owned on the Record Date.

How

many votes can be cast by all shareholders?

The

Company had 9,634,821.08 outstanding shares of common stock on the Record Date. Each of these shares is entitled to one vote. There is

no cumulative voting.

How

many votes must be present to hold the meeting?

The

holders of a majority of the Company’s common stock outstanding on the Record Date must be present at the meeting in person or

by proxy in order to fulfill the quorum requirement necessary to hold the meeting. This means at least 4,817,412 shares must be present

in person or by proxy.

If

you vote, your shares will be part of the quorum. Abstentions and broker non-votes will also be counted in determining the quorum. A

broker non-vote occurs when a bank or broker holding shares in street name submits a proxy that states that the broker does not vote

for some or all of the proposals because the broker has not received instructions from the beneficial owners on how to vote on the proposals

and does not have discretionary authority to vote in the absence of instructions.

We

urge you to vote by proxy even if you plan to attend the meeting so that we will know as soon as possible that a quorum has been achieved.

What

vote is required to approve each proposal?

For

the election of Directors (Proposal No. 1), the affirmative vote of a plurality of the votes present in person or by proxy and entitled

to vote at the meeting is required. A proxy that has properly withheld authority with respect to the election of one or more Directors

will not be voted with respect to the Director or Directors indicated, although it will be counted for the purposes of determining whether

there is a quorum.

For

the ratification of the appointment of Hacker, Johnson & Smith, P.A. (Proposal No. 2), the affirmative vote of a majority of the

shares represented in person or by proxy and entitled to vote at the meeting will be required for approval. An abstention with respect

to this proposal will be counted for the purposes of determining the number of shares entitled to vote that are present in person or

by proxy. Accordingly, an abstention will have the effect of a negative vote.

Can

I change my vote?

Yes.

If you are a shareholder of record, you may change your vote at any time before your proxy is voted at the annual meeting. You can do

this in one of three ways. First, you can send a written notice stating that you would like to revoke your proxy. Second, you can submit

new proxy instructions either on a new proxy card or via the Internet. Third, you can attend the meeting, and vote in person. Your attendance

alone will not revoke your proxy. If you have instructed a broker to vote your shares, you must follow directions received from your

broker to change those instructions.

Who

can attend the annual meeting?

Any

person who was a shareholder of the Company on April 9, 2024 may attend the meeting. If you own shares in street name, you should ask

your broker or bank for a legal proxy to bring with you to the meeting. If you do not receive the legal proxy in time, bring your most

recent brokerage statement so that we can verify your ownership of the Company’s stock and admit you to the meeting. However, you

will not be able to vote your shares at the meeting without a legal proxy.

What

happens if I sign and return the proxy card but do not indicate how to vote on an issue?

If

you return a proxy card without indicating your vote, your shares will be voted as follows:

1.

FOR each of the persons nominated by the Board of Directors to serve as Directors;

2.

FOR ratifying the selection of Hacker, Johnson & Smith, P.A. as the Company’s independent auditor for fiscal year 2024.

Who

can help answer my questions?

If

you are a shareholder, and would like additional copies, without charge, of this proxy statement or if you have questions about the annual

meeting, including the procedures for voting your shares, you should contact:

Mary

Franco, Operations Assistant - (954) 900-2805

PROPOSAL

NO. 1

ELECTION

OF DIRECTORS

Our

Board of Directors currently has 7 members, and directors are elected annually to one-year terms. Each of our current directors have

been nominated for election by the Board to hold office until the 2025 annual meeting and the election of their successors.

All

of the nominees currently serve on our Board. Each of the nominees has previously been elected by the shareholders.

The

accompanying proxy will be voted in favor of the following persons to serve as directors unless the shareholder indicates to the contrary

on the proxy. The election of the Company’s Directors requires a plurality of the votes cast in person or by proxy at the meeting.

Management expects that each of the nominees will be available for election, but if any of them is unable to serve at the time the election

occurs, the proxy will be voted for the election of another nominee to be designated by the Board of Directors.

Moishe

Gubin, age 47, has served as a Director of the Company and OptimumBank since March 2010. Mr. Gubin is Chief Executive Officer of

Strawberry Fields REIT, Inc. (NYSE American: STRW), an owner of a portfolio of healthcare properties. Mr. Gubin has been the CEO of this

company and its predecessor since 2008. From 2004 to 2014, Mr. Gubin was the Chief Financial Officer and manager of Infinity Healthcare

Management, LLC, a company engaged in managing skilled nursing facilities and other health care facilities. Mr. Gubin graduated from

Touro Liberal Arts and Science College, in New York, New York, with a BS in Accounting and Information Systems and a Minor in Jewish

Studies. Mr. Gubin is the founder of the Midwest Torah Center Inc., a non-profit spiritual outreach center (www.midwesttorah.org).

He also attended Yeshiva Bais Israel where he received a BA in Talmudic Literature. Mr. Gubin has been a licensed Certified Public Accountant

in the State of New York since 2010. As a long-time director and significant shareholder of the Company, Mr. Gubin brings extensive experience

with the Company and a shareholder perspective to the Board. Mr. Gubin’s experience in accounting provides the Board with expertise

in accounting matters and his experience as the CEO of a large healthcare company provides the Board’s with the general management

expertise.

Joel

Klein, age 77, became a Director of the Company and OptimumBank in February 2012. Since February 2020, Mr. Klein has also been serving

as the Company’s interim Chief Financial Officer, until the Company designates his replacement. Mr. Klein worked in accounting

and finance for more than 41 years, including six years as a CPA in public accounting. From 1989 to 1990, he was the Chief Financial

Officer of Choice Drug Systems, Inc., a medical supply company primarily to skilled nursing facilities. From 1991 to 1994, he was a Vice-President

of Equilease Corporation, an equipment leasing company. He then served as a Vice President of The Stamford Capital Group, Inc., an independent

corporate advisory company, from 1994 to 2005, providing high quality advisory services to medium market clients, particularly mergers

and acquisitions, divestitures, management buy outs and other strategic financial advisory services. From 2006 to 2010, he was the Chief

Financial Officer of Taxi Affiliation Services, LLC, a taxi company located in Chicago, Illinois. Mr. Klein has been a private investor

since 2010. Mr. Klein received a Bachelor of Science degree in Accounting from Brooklyn College in 1969. He has been licensed as a CPA

in the State of New York since 1972. Mr. Klein’s significant experience in finance and accounting provides the Board with expertise

in financing management and accounting issues. His long service as director also aids the Board by providing a deep understanding of

the Company’s business.

Martin

Z. Schmidt, age 76, became a Director of the Company and OptimumBank in August 2015. Mr. Schmidt has been in the financial and estate

planning, securities and insurance industries since 1975. From 1993 to 2000, he served as a Vice President and Branch Manager for multiple

branches of Advest, Inc., a major regional securities and investment management firm. In 2007, he served in a marketing capacity and

liaison to the national senior accounting firms for Twenty-First Securities, Inc., introducing market based solutions for tax and corporate

based problems within their institutional client base. Since 2013, he has been an independent financial consultant with National Holdings

Corp/Gilman Ciocia. Mr. Schmidt served with the 423rd Military Police, U.S. Army Reserve, for five years, completed 3 years

of coursework towards an MBA in Management Science and Statistics at the Lubin Graduate School of Business Administration in 1973, and

graduated Brooklyn College with a B.A. in Economics in 1969. Mr. Schmidt’s significant experience in the financial services industry

provides the Board with expertise in operating a financing services business.

Avi

M. Zwelling, age 51, became a Director of the Company and OptimumBank in December 2017. Mr. Zwelling is the managing partner of Zwelling

Law, PLLC, which has offices in Boca Raton, Florida and Chicago, Illinois. The firm handles commercial litigation, insurance defense,

banking, and real estate matters. Mr. Zwelling graduated from Columbia University in New York, New York, with a B.A. in Comparative Religion,

and earned a law degree from the Benjamin N. Cardozo School of Law, also in New York, New York. Mr. Zwelling has been providing legal

services to the Company since 2012. As an experienced attorney, Mr. Zwelling’s knowledge and expertise in legal matters assists

the Board in addressing legal issues faced by the Company.

Thomas

Procelli, age 69, has served as a Director of the Company since July 2017 and OptimumBank since October 2012. Mr. Procelli is Chief

Financial Officer for Better Living Solutions, a Tallahassee counseling and wellness outpatient center specializing in eating disorder

treatment and offers financial institution and business support services through his firm TAP Independent Consulting. Mr. Procelli served

as an Executive Vice President since the founding of OptimumBank in October 2000 through September 2015 in the positions of Chief Technology

Officer and Chief Operating Officer. Mr. Procelli has been in banking for over 40 years having a diverse background in operations, information

systems, compliance and audit. Outside of banking, he has worked in public accounting at the firm of Coopers and Lybrand and in mortgage

origination software product development at Fiserv. He received his MBA in Finance in 1979 and his BBA degree in Accounting in 1976 from

Hofstra University located in Hempstead, New York. Mr. Procelli’s 15 years of service as an executive of OptimumBank provides the

Board with the benefit of his expertise in banking and accounting matters, as well as insight into the operations of OptimumBank.

Michael

Blisko, age 48, has served as a Director since May 2021. Mr. Blisko has been the Chief Executive Officer for Infinity Healthcare

Management, LLC, a company that provides consultation services to skilled nursing facilities and other health care facilities with over

10,000 beds. Mr. Blisko is currently a director of Strawberry Fields REIT, Inc. (NYSE American: STRW), an owner of a portfolio of healthcare

properties. Mr. Blisko is a principal of related healthcare companies, including United Rx, a long-term pharmacy, Xcel Med, and Bella

Monte Recovery. Currently, Mr. Blisko is on the national executive committee for Post-Acute Care for the American Healthcare Association

(AHCA) in Washington D.C. Mr. Blisko founded and currently serves on the Board of Directors of The Ambassador Group which represents

regional Post-Acute Operators serving over one hundred thousand residents throughout the country. Mr. Blisko is on the Deans Advisory

Board for Hofstra University Graduate School for Health and Applied Sciences. Mr. Blisko holds a master’s degree in Healthcare

Administration from Hofstra University and a BA in Talmudic Letters from Bais Yisroel, Jerusalem. As a significant shareholder of the

Company, Mr. Blisko provides a shareholder perspective to the Board. Mr. Blisko’s experience as an executive of several healthcare

companies provides the Board with the general management expertise.

Steven

Newman, age 47, became a Director of the Company and OptimumBank in August 2022. Mr. Newman has been the Chief Executive Officer

of The Newman Group, LLC, a licensed real estate brokerage firm based in South Florida which he founded in 2002. Mr. Newman is also the

Chairman of the Board of Freight Factoring Specialists, LLC, a middle market, full-service factoring company serving the transportation

industry, which he founded in 2015. Mr. Newman has been an active real estate investor and served as a board member of several non-profit

organizations. Mr. Newman received his BA in Sociology from Queens College at the City University of New York in 1998. As an active participant

in the South Florida real estate industry, Mr. Newman will provides the Company and the Bank the benefit of his experience and knowledge

of the local real estate market, as well as the benefit of his ability as a successful business executive.

The

following table provides the composition of our board members and nominees. Under NASDAQ rules, each NASDAQ-listed company must have,

or explain why it does not have, at least two members of its Board of Directors who are “Diverse,” including (1) at least

one Diverse director who self-identifies as Female; and (2) at least one Diverse director who self-identifies as an “Underrepresented

Minority” or LGBTQ+. Diverse means an individual who self-identifies as female, an Underrepresented Minority, or LGBTQ+. Each of

the categories listed in the below table has the meaning as it is used in NASDAQ Rule 5605(f).

| | |

Board

Diversity Matrix As of December 31, 2023 | |

| Total Number of Directors | |

| 7 | |

| | |

Female | |

Male | |

Non-Binary | |

Did Not Disclose Gender | |

| Gender Identity | |

| |

| |

| |

| |

| Directors | |

- | |

7 | |

- | |

- | |

| | |

| |

| |

| |

| |

| Demographic Background | |

| |

| |

| |

| |

| African American or Black | |

- | |

- | |

- | |

- | |

| Alaskan Native or Native American | |

- | |

- | |

- | |

- | |

| Asian | |

- | |

- | |

- | |

- | |

| Hispanic or Latinx | |

- | |

- | |

- | |

- | |

| Native Hawaiian or Pacific Islander | |

- | |

- | |

- | |

- | |

| White | |

- | |

7 | |

- | |

- | |

| Two or More Races or Ethnicities | |

- | |

- | |

- | |

- | |

| LGBTQ+ | |

- | |

| Did Not Disclose Demographic Background | |

- | |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

“FOR” ALL DIRECTOR NOMINEES.

CORPORATE

GOVERNANCE

Director

Independence

The

Board of Directors analyzed the independence of each director and determined that Moishe Gubin, Thomas Procelli, Martin Schmidt, Avi

Zwelling, Michael Blisko, and Steve Newman each meet the standards of independence under the listing standards of The NASDAQ

Stock Market (“NASDAQ”).

The

Board of Directors Meetings and Committees

The

Company’s Board of Directors met eleven (11) times during 2023. The independent directors met once in executive session without

management during 2023. Each of the current members of the Board of Directors attended at least 75% of the meetings of the Board and

committees on which he served held while he has been a Director. The Company’s Board of Directors has established several standing

committees, including the following:

Compensation

Committee

The

Compensation Committee currently consists of Moishe Gubin (Chairman), Thomas Procelli, and Avi Zwelling. Messrs. Gubin, Zwelling, and

Procelli are independent under the NASDAQ listing standards. The Compensation Committee reviews and recommends to the Board of Directors

the compensation arrangements for executive management and non-employee directors. The Compensation Committee met two (2) times during

2023 and operates under a written charter. A copy of the current Compensation Committee Charter can be viewed on the Company’s

website at www.optimumbank.com/information-center/corporate-governance.

In

2023, no executive officer had a role in determining or recommending the amount or form of outside director compensation. The Compensation

Committee does not delegate its authority to any other persons. The Compensation Committee does not use consultants to determine or recommend

the amount or form of compensation arrangements.

Nominating

Committee

The

Nominating Committee currently consists of Mr. Gubin (Chairman), Mr. Procelli, and Mr. Zwelling. The committee evaluates new candidates

and current directors and recommends candidates to the Board to fill vacancies occurring between annual shareholder meetings. A copy

of the charter for the Nominating Committee can be viewed on the Company’s website at www.optimumbank.com/information-center/corporate-governance.

All

of the director nominees of the Company set forth in the Proposal entitled “Election of Directors” were recommended by a

majority of the independent directors of the Company. The Nominating Committee held two (2) meeting during 2023.

The

Nominating Committee will initially consider nominating the Company’s existing directors for re-election to the Board as appropriate

or other director nominees proposed, as appropriate, by the directors, and in doing so considers each director’s independence,

if required, share ownership, skills, performance and attendance at a minimum of 75% of the Board and respective committee meetings.

In evaluating any candidates for potential director nomination, the Nominating Committee will consider candidates that are independent,

if required, who possess personal and professional integrity, have good business judgment, relevant experience and skills, including

banking, financial, real estate and/or legal expertise, who would be effective as a director in conjunction with the full Board, who

would commit to attend Board and committee meetings, and whose interests are aligned with the long-term interests of the Company’s

shareholders.

The

Nominating Committee will consider director candidates recommended by shareholders, provided the recommendation is in writing and delivered

to the Corporate Secretary of the Company at the principal executive offices of the Company not later than the close of business on the

120th day prior to the first anniversary of the date on which the Company first mailed its proxy materials to shareholders

for the preceding year’s annual meeting of shareholders. For the 2025 annual meeting, recommendations must be received by October

29, 2024. The nomination and notification must contain the nominee’s name, address, principal occupation, total number of shares

owned, consent to serve as a director, and all information relating to the nominee and the nominating shareholder as would be required

to be disclosed in solicitation of proxies for the election of such nominee as a director pursuant to the SEC’s proxy rules. In

order for stockholders to give timely notice of nominations for directors for inclusion on a universal proxy card in connection with

the 2025 annual meeting, notice must be submitted by the same deadline as disclosed above and must include the information in the notice

required by our Bylaws and by Rule 14a-19(b)(2) and Rule 14a-19(b)(3) under the Exchange Act.

Audit

Committee

The

Audit Committee of the Board of Directors is responsible for the oversight of the Company’s financial and accounting reporting

processes and the audits of the Company’s financial statements. The Audit Committee is currently composed of three non-employee

directors consisting of Thomas Procelli (Chairman), Martin Schmidt and Avi Zwelling. The Audit Committee operates under a written charter

adopted and approved by the Board of Directors. A copy of the current Audit Committee Charter can be viewed on the Company’s website

at www.optimumbank.com/information-center/corporate-governance.

The

Board determined that all of the members of the Audit Committee were financially literate and independent in accordance with the NASDAQ

listing standards applicable to audit committee members. The Board has determined that Thomas Procelli is an “audit committee financial

expert” as defined by SEC rules. The Audit Committee met four (4) times during 2023. A Report from the Audit Committee is included

on page 19.

Attendance

by Directors at Annual Shareholders’ Meetings

The

Company expects its directors to attend the annual meeting. All of the current directors attended the 2023 annual meeting (held in June

2023).

Shareholder

Communications with the Board of Directors

The

Board of Directors has adopted a formal process by which shareholders may communicate with the Board. Shareholders who wish to communicate

with the Board may do so by sending written communications addressed to: Board of Directors, OptimumBank Holdings, Inc., at 2929 East

Commercial Boulevard, Suite 303, Fort Lauderdale, Florida 33308, Attention: Mary Franco. All communications will be compiled by the Corporate

Secretary and submitted to the members of the Board. Concerns about accounting or auditing matters or possible violations of the Company’s

Code of Ethics should be reported under the procedures outlined in the Company’s Whistleblower Policy. Our Whistleblower Policy

is available on the Company’s website at www.optimumbank.com/information-center/corporate-governance.

Hedging

Policy

The

Company has not adopted a policy concerning hedging of the Company’s shares, although it plans to do so following the annual meeting.

Accordingly, executive officers and directors of the Company are currently permitted to engage in hedging shares of the Company’s

common stock, including, but not limited to, engaging in short sales or trading in puts, calls, covered calls or other derivative products.

Board

Leadership Structure and Role in Risk Oversight

The

Company’s policy is to separate the roles of Chairman and Chief Executive Officer of the Company. At the present time, Moishe Gubin

serves as the Chairman of the Board.

The

Board believes that risk management is an important component of the Company’s corporate strategy. While we assess specific risks

at the Company’s committee levels, the Board, as a whole, oversees the Company’s risk management process, and discusses and

reviews with management major policies with respect to risk assessment and risk management. The Board is regularly informed through committee

reports about the Company’s risks. The Audit Committee reviews and assesses the Company’s processes to manage financial reporting

risk. It also reviews the Company’s policies for risk assessment and assesses steps management has taken to control significant

risks. The Compensation Committee oversees risks relating to compensation practices and policies.

ROPOSAL

NO. 2

RATIFICATION

OF INDEPENDENT AUDITOR

The

Audit Committee has selected Hacker, Johnson & Smith, P.A. (“Hacker Johnson”) as the Company’s independent auditor

for fiscal year 2024, and the Board asks shareholders to ratify that selection. Although current law, rules, and regulations, as well

as the charter of the Audit Committee, require the Audit Committee to engage, retain, and oversee the Company’s independent auditor,

the Board considers the selection of the independent auditor to be an important matter of shareholder concern and is submitting the selection

of Hacker Johnson for ratification by shareholders as a matter of good corporate governance.

Assuming

the existence of a quorum, the affirmative vote of the majority of the shares represented in person or by proxy and entitled to vote

at the meeting is required to approve this matter.

THE

BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE RATIFICATION OF HACKER, JOHNSON & SMITH, P.A. AS THE COMPANY’S

INDEPENDENT AUDITOR FOR FISCAL YEAR 2024.

AUDIT

COMMITTEE REPORT

The

Audit Committee has reviewed and discussed the audited financial statements of the Company for the fiscal year ended December 31, 2023

with the Company’s management and has discussed with the independent auditors, Hacker, Johnson & Smith, P.A., communications

pursuant to applicable auditing standards. In addition, Hacker, Johnson & Smith, P.A. has provided the Audit Committee with the written

disclosures and the letter required by applicable requirements of the PCAOB regarding the independent auditor’s communications

with the Audit Committee concerning independence, and the Audit Committee has discussed with Hacker, Johnson & Smith, P.A., the independent

auditor’s independence.

Based

on these reviews and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be

included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and selected Hacker, Johnson &

Smith, P.A. as the Company’s independent auditor for 2024.

| AUDIT

COMMITTEE |

|

| |

|

| Thomas

Procelli (Chairman) |

|

| |

|

| Martin

Schmidt |

|

| |

|

| Avi

Zwelling |

|

INDEPENDENT

ACCOUNTANTS

Hacker,

Johnson & Smith, P.A., the Company’s independent registered public accounting firm, audited the Company’s consolidated

financial statements for the fiscal year ended December 31, 2023.

Audit

Fees

The

following table is a summary of the fees billed to the Company by Hacker, Johnson & Smith, P.A. for professional services rendered

for the years ended December 31, 2022 and 2023:

| Fee Category | |

2022 Fees | | |

2023 Fees | |

| | |

| | |

| |

| Audit Fees | |

$ | 91,000 | | |

$ | 100,000 | |

Audit

Fees. Consists of fees billed for professional services rendered for the audit of the Company’s financial statements

and review of the interim financial statements included in quarterly reports and services that are normally provided by Hacker, Johnson

& Smith, P.A. in connection with statutory and regulatory filings or engagements.

Pre-approved

Services. Consistent with SEC rules regarding auditor independence, the Company’s Audit Committee Charter requires the Audit

Committee to pre-approve all audit services and non-audit services permitted by law and Audit Committee policy (including the fees and

terms of such services) to be performed for the Company by the independent auditors, subject to the “de minimis” exceptions

for non-audit services described in SEC rules that are approved by the Audit Committee prior to the completion of the audit. The Audit

Committee may delegate pre-approval authority to a member of the committee. The decisions of any committee member to whom pre-approval

is delegated must be presented to the Audit Committee at its next scheduled meeting.

A

representative from Hacker, Johnson & Smith, P.A., independent public auditors for the Company for 2022 and 2023, is expected to

be present at the annual meeting, will have an opportunity to make a statement, and will be available to respond to appropriate questions.

MANAGEMENT

Officers

of the Company

Since

June 2016, Timothy Terry, President and Chief Executive Officer of the Bank, has been acting as the Principal Executive Officer for the

Company, and since February 2020, Joel Klein , a director of the Company has been acting as the Principal Financial Officer for

the Company.

The

background of Mr. Terry is set forth below. The background of Mr. Klein is set forth in the section of this proxy statement entitled

“Proposal No. 1 – Election of Directors.”

Timothy

Terry, age 68, was appointed President and Chief Executive Officer of the Bank in February 2013. Mr. Terry has been in banking for

36 years and he previously was a President/CEO of Putnam State Bank in Palatka, Florida. Prior to joining OptimumBank, he served as President,

CEO and Senior Loan Officer for Enterprise Bank of Florida in North Palm Beach, Florida, and held senior lending, branch administration

& sales management positions at Palm Beach National Bank & Trust, Flagler National Bank of the Palm Beaches and Comerica Bank.

Mr. Terry received his BBA degree in finance from Western Michigan University located in Kalamazoo, Michigan. He is also a graduate of

the American Bankers Association Stonier Graduate School of Banking at the University of Delaware.

MANAGEMENT

COMPENSATION

The

following table shows the compensation paid by the Company and the Bank for 2022 and 2023 to the persons acting as principal executive

officer and principal financial officer during this period.

Summary

Compensation Table

| |

| | |

| | |

| | |

All Other | | |

Total | |

| Name and Principal Position | |

Year | | |

Salary ($) | | |

Bonus ($) | | |

Compensation($) | | |

Compensation($) | |

| | |

| | |

| | |

| | |

| | |

| |

| Timothy Terry (1) | |

2023 | | |

$ | 365,000 | | |

$ | 50,000 | | |

$ | - | | |

$ | 415,000 | |

| President and Chief Executive Officer | |

2022 | | |

$ | 266,000 | | |

$ | 11,571 | | |

$ | - | | |

$ | 277,571 | |

| | |

2021 | | |

$ | 250,000 | | |

$ | 20,000 | | |

$ | - | | |

$ | 270,000 | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Joel Klein(2) | |

2023 | | |

$ | - | | |

$ | 22,400 | | |

$ | - | | |

$ | 22,400 | |

| Acting Principal Financial Officer | |

2022 | | |

$ | - | | |

$ | 20,000 | | |

$ | - | | |

$ | 20,000 | |

| | |

2021 | | |

$ | - | | |

$ | 14,100 | | |

$ | - | | |

$ | 14,100 | |

| (1)

|

For

2023, Mr. Terry received a restricted stock grant with a value of $50,000. |

| |

|

| (2)

|

All

of Mr. Klein’s compensation was in the form of director’s fee. |

Stock

Options

No

stock options were granted to any of the executive officers in 2023 or 2022. None of the Company’s executive officers holds any

stock options.

Stock

Grants

In

2023, the Company made a restricted stock grant to Mr. Terry of 12,225 shares of common stock, valued at $50,000.

Director

Compensation

Each

Director receives compensation for serving on the Board of Directors and committees of the Board. Mr. Gubin, who serves as Chairman of

the Board, receives a $15,000 as an annual retainer, and all other directors receive $7,500 as an annual retainer. Additionally, Mr.

Gubin receives $1,650 for each Board meeting attended, and all other directors receive $1,100 for each Board meeting attended. For Audit

Committee meetings, the Chairman receives compensation of $400 for each meeting attended, and the other members receive $300. For Compensation

Committee meetings, Mr. Gubin, as Chairman, receives compensation of $350 for each meeting attended and the other members receive $200.

Mr.

Gubin also receives $275,223 per year for additional services as a director, payable in shares of the Company’s common stock (based

on the fair market value on the date of issuance). These additional services include his generally spending approximately one week per

month in the Bank’s offices. He is also actively involved in the Bank’s marketing efforts for new loan business and deposits

and in the Company’s investor relations efforts.

Director

Compensation Table For 2023

| |

Cash | | |

Stock | | |

All

Other | | |

| |

| Name | |

Compensation($) | | |

Awards($) | | |

Compensation

($) | | |

Total($) | |

| Moishe

Gubin | |

$ | 39,300 | | |

$ | 275,223

| (1) | |

$ | - | | |

$ | 314,523 | |

| Joel

Klein | |

| 22,400 | | |

| - | | |

| - | | |

| 22,400 | |

| Martin

Schmidt | |

| 30,600 | | |

| - | | |

| - | | |

| 30,600 | |

| Thomas

Procelli | |

| 26,500 | | |

| - | | |

| - | | |

| 26,500 | |

| Avi

M. Zwelling | |

| 29,700 | | |

| - | | |

| - | | |

| 29,700 | |

| Michael

Blisko | |

| 21,000 | | |

| - | | |

| - | | |

| 21,000 | |

| Steve

Newman | |

| 11,300 | | |

| - | | |

| - | | |

| 11,300 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total | |

$ | 180,800 | | |

$ | 275,223 | | |

$ | - | | |

$ | 456,023 | |

| (1) |

This

amount represents the fair value of the stock grant made to Mr. Gubin in payment of a portion of his director’s fees in 2023.

|

SECURITY

OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

This

following table sets forth information regarding the beneficial ownership of the common stock as of April 9, 2024, for:

| |

● |

each

of the directors and executive officers of the Company and the Bank; |

| |

|

|

| |

● |

all

of the directors and executive officers of the Company and the Bank as a group; and |

| |

|

|

| |

● |

each

other person known by the Company to own beneficially more than 5% of the Company common stock. |

Beneficial

ownership is determined in accordance with the rules of the Securities and Exchange Commission and includes voting and investment power

with respect to the securities. The persons named in the table have sole voting and investment power or have shared voting and investment

power with a spouse with respect to all shares of common stock shown as beneficially owned by them, unless otherwise indicated in these

footnotes.

| Name of Beneficial Owners | |

Number of Shares Beneficially Owned | | |

Percent of Class1 | |

| Directors and Executive Officers | |

| | | |

| | |

| Moishe Gubin, Director | |

| 702,529 | | |

| 7.29 | % |

| Joel Klein, Director and Interim Chief Financial Officer | |

| 94,404 | | |

| 0.98 | % |

| Thomas Procelli, Director | |

| 3,591 | | |

| 0.04 | % |

| Martin Schmidt, Director | |

| 33,500 | | |

| 0.35 | % |

| Avi Zwelling, Director | |

| 31,118 | | |

| 0.32 | % |

| Steven Newman, Director | |

| 29,055 | | |

| 0.30 | % |

| Michael Blisko, Director | |

| 598,388 | | |

| 6.21 | % |

| Timothy Terry, President, Chief Executive Officer | |

| 47,349 | | |

| 0.49 | % |

| All directors and executive officers as a group | |

| 1,539,934 | | |

| 15.98 | % |

| | |

| | | |

| | |

| Other Greater than 5% Shareholders | |

| | | |

| | |

| Chan Heng Fai Ambrose, Director | |

| 598,000 | | |

| 6.21 | % |

| AB Financial Services Opportunities | |

| 500,000 | | |

| 5.19 | % |

DELINQUENT

SECTION 16(A) REPORTS

Section

16(a) of the Exchange Act requires the Company’s executive officers and directors, as well as persons who own 10% or more of a

class of the Company’s equity securities, to file reports of their ownership of the Company’s securities, as well as statements

of changes in such ownership, with the SEC. The Company believes that all such filings required during 2023 were made on a timely basis.

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

Since

January 1, 2023, except as described below, there have been no transactions or any proposed transactions in which the Company was or

is a party, in which the amount involved exceeded $120,000, and in which a director, director nominee, executive officer, holder of more

than 5% of the Company’s common stock or any member of the immediate family of any of the foregoing persons had or will have a

direct or indirect material interest.

Purchase

of Shares by Affiliates

None.

Loans

to Officers, Directors and Affiliates

The

Bank offers loans in the ordinary course of business to its directors and employees, including executive officers, their related interests

and immediate family members. Applicable law and Bank policy require that these loans be on substantially the same terms, including interest

rates and collateral, as those prevailing at the time for comparable transactions with unrelated parties, and must not involve more than

the normal risk of repayment or present other unfavorable features. Loans to individual employees, directors and executive officers must

also comply with the Bank’s lending policies and statutory lending limits, and directors with a personal interest in any loan application

are excluded from the consideration of such loan application.

SHAREHOLDER

PROPOSALS FOR 2025 ANNUAL MEETING

Proposals

of shareholders of the Company that are intended to be presented by such shareholders at the Company’s 2025 annual meeting of shareholders

and that shareholders desire to have included in the Company’s proxy materials relating to such meeting must be received by the

Company at its corporate offices no later than December 31, 2024, which is 120 calendar days prior to the anniversary of this

year’s mailing date. Upon timely receipt of any such proposal, the Company will determine whether or not to include such proposal

in the proxy statement and proxy in accordance with applicable regulations governing the solicitation of proxies.

If

a shareholder wishes to present a proposal at the Company’s 2025 annual meeting or to nominate one or more Directors and the proposal

is not intended to be included in the Company’s proxy statement relating to that meeting, the shareholder must give advance written

notice to the Company by January 1, 2025, as required by SEC Rule 14a-4(c)(1).

Any

shareholder filing a written notice of nomination for Director must describe various matters regarding the nominee and the shareholder,

including such information as name, address, occupation and shares held. Any shareholder filing a notice to bring other business before

a shareholder meeting must include in such notice, among other things, a brief description of the proposed business and the reasons for

the business, and other specified matters. Copies of those requirements will be forwarded to any shareholder upon written request.

SOLICITATION

OF PROXIES

The

proxy accompanying this Proxy Statement is solicited by the Board of Directors of the Company. All of the costs of solicitation of proxies

will be paid by the Company. We may also reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable out-of-pocket

expenses incurred by them in sending proxy materials to the beneficial owners of the Company’s shares of common stock. In addition

to solicitations by mail, the Company’s directors, officers and employees, including those of the Bank, may solicit proxies personally,

by telephone or otherwise, but will not receive any additional compensation for their services.

OTHER

MATTERS

Management

does not know of any matters to be presented at the meeting other than those set forth above. However, if other matters come before the

meeting, it is the intention of the persons named in the accompanying proxy to vote the shares represented by the proxy in accordance

with the recommendations of management on such matters, and discretionary authority to do so is included in the proxy.

HOW

TO OBTAIN EXHIBITS TO FORM 10-K AND OTHER INFORMATION

A

copy of the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2023 is included with this proxy statement.

We will mail without charge copies of any particular exhibit to the Company’s Form 10-K upon written request. Requests should be

sent to OptimumBank Holdings, Inc., Attn: Mary Franco, 2929 East Commercial Boulevard, Suite 303, Fort Lauderdale, FL 33308. Our proxy

statement, annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, as well as any amendment to

those reports, are also available free of charge through the SEC’s website, www.sec.gov.

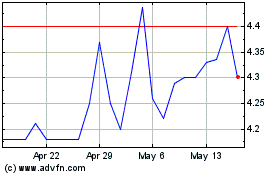

OptimumBank (NASDAQ:OPHC)

Historical Stock Chart

From Feb 2025 to Mar 2025

OptimumBank (NASDAQ:OPHC)

Historical Stock Chart

From Mar 2024 to Mar 2025