false

0001649989

0001649989

2024-12-27

2024-12-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): December 27, 2024

Outlook Therapeutics,

Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

001-37759 |

38-3982704 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

111 S. Wood Avenue, Unit #100

Iselin, New Jersey |

08830 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area code:

(609) 619-3990

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock |

|

OTLK |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 2.02 |

Results of Operations and Financial Condition |

On December 27, 2024, Outlook Therapeutics, Inc.

issued a press release announcing its financial results for its fourth fiscal quarter and year ended September 30, 2024. A copy of the

press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in this Item 2.02

and in the accompanying Exhibit 99.1 shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as

amended, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Outlook Therapeutics, Inc. |

| |

|

| Date: December 27, 2024 |

By: |

/s/ Lawrence A. Kenyon |

| |

|

Lawrence A. Kenyon |

| |

|

Chief Financial Officer |

Exhibit 99.1

Outlook Therapeutics®

Reports Financial Results for Fiscal Year 2024 and Provides Corporate Update

| · | LYTENAVA™

is the first and only approved ophthalmic formulation of bevacizumab for the treatment of

wet AMD in the European Union (EU) and United Kingdom (UK); First commercial launch anticipated

in H1 CY25 |

| · | Received

NICE recommendation of LYTENAVA™ (bevacizumab gamma) for the treatment of wet AMD |

ISELIN, N.J.,

December 27, 2024 — (GLOBE NEWSWIRE) Outlook Therapeutics, Inc. (Nasdaq: OTLK), a biopharmaceutical company that achieved

regulatory approval in the European Union and the United Kingdom earlier this year for the first authorized use of an ophthalmic formulation

of bevacizumab for the treatment of wet age-related macular degeneration (wet AMD), today announced financial results for fiscal year

2024 and provided a corporate update.

“Over the

course of the past year, our team has continued to execute and progress the development of ONS-5010/LYTENAVA™ in Europe and the

United States. Following the receipt of our first positive reimbursement decision worldwide for LYTENAVA™ from NICE in the United

Kingdom, our team continues to make preparations for commercial launch in the UK and Germany, which is expected in the first half of

calendar 2025,” commented Lawrence Kenyon, Chief Financial Officer and Interim Chief Executive Officer of Outlook Therapeutics.

“We expect to receive the month 3 NORSE EIGHT efficacy data in January 2025 and are continuing preparations for the planned resubmission

of our BLA in the first quarter of calendar 2025. We believe that 2025 holds significant opportunity for Outlook Therapeutics and we

remain confident in the potential of ONS-5010/LYTENAVA™ to provide a meaningful impact globally for the treatment of wet AMD.”

Upcoming Anticipated Milestones

| · | Final efficacy data from NORSE EIGHT expected

in January 2025; |

| · | Resubmission of the ONS-5010 BLA targeted for

Q1 CY2025; |

| · | Initial commercial launches in Europe planned

to commence in first half of CY2025; and |

| · | Potential for US FDA approval of ONS-5010 in

second half of CY2025. |

ONS-5010 / LYTENAVA™

(bevacizumab-vikg) Clinical and Regulatory Update

In May 2024, the

European Commission granted Marketing Authorization for LYTENAVA™ (bevacizumab gamma) for the treatment of wet AMD in the EU. Additionally,

in July 2024, the UK Medicines and Healthcare products Regulatory Agency (MHRA) granted Marketing Authorization for LYTENAVA™ (bevacizumab

gamma) for the same indication in the UK. In December 2024, the National Institute for Health and Care Excellence (NICE) recommended

LYTENAVA™ (bevacizumab gamma) as an option for the treatment of wet AMD. Plans for a potential 2025 launch in the UK and Germany

are ongoing. Outlook Therapeutics remains confident that ONS-5010/ LYTENAVA™ is an important therapy for the treatment of wet AMD

in place of off-label repackaged bevacizumab that has not received regulatory approval for use in retina diseases such as wet AMD.

Previously, the

Company reported that in the NORSE EIGHT trial, ONS-5010 did not meet the pre-specified non-inferiority endpoint at week 8 set forth

in the special protocol assessment (SPA) with the U.S. Food and Drug Administration (FDA). However, the preliminary data from the trial

demonstrated an improvement in vision and the presence of biologic activity, as well as a continued favorable safety profile for ONS-5010.

Analysis of the data is ongoing as the month 3 data from NORSE EIGHT is being collected, which is expected to be available in January

2025. Upon receipt of the full month 3 efficacy and safety results for NORSE EIGHT, Outlook Therapeutics plans to resubmit the BLA for

ONS-5010 in the first quarter of calendar 2025.

LYTENAVA™

(bevacizumab gamma) is the first and only authorized ophthalmic formulation of bevacizumab for use in treating wet AMD in adults in the

EU and UK and has an initial 10 years of market exclusivity. Authorization may also be sought in other European countries, Japan, and

elsewhere. As part of a multi-year planning process, Outlook Therapeutics entered into a strategic collaboration with Cencora (formerly

AmerisourceBergen) to support the commercial launch of LYTENAVA™ globally following regulatory approvals. The collaboration and

integrated approach is designed to support market access and efficient distribution of LYTENAVA™ to benefit all stakeholders, including

retina specialists, providers and patients.

In the EU and the

UK and other regions outside of the US, Outlook Therapeutics is planning to commercialize LYTENAVA™ (bevacizumab gamma) directly

and is also assessing potential licensing and partnering options. Additionally, if approved by the FDA, Outlook Therapeutics plans to

commercialize ONS-5010/LYTENAVA™ (bevacizumab-vikg) directly in the US.

Financial Highlights

for the 2024 Fiscal Year Ended September 30, 2024

For the fiscal

year ended September 30, 2024, Outlook Therapeutics reported a net loss of $75.4 million, or $4.06 per basic and diluted share, compared

to a net loss of $59.0 million, or $4.72 per basic and diluted share, for the prior fiscal year.

As of September

30, 2024, Outlook Therapeutics had cash and cash equivalents of $14.9 million.

About ONS-5010

/ LYTENAVA™ (bevacizumab-vikg, bevacizumab gamma)

ONS-5010/LYTENAVA™

is an ophthalmic formulation of bevacizumab for the treatment of wet AMD. LYTENAVA™ (bevacizumab gamma) is the subject of

a centralized Marketing Authorization granted by the European Commission in the European Union (EU) and Marketing Authorization granted

by the Medicines and Healthcare products Regulatory Agency (MHRA) in the United Kingdom (UK) for the treatment of wet age-related macular

degeneration (wet AMD).

In the United States,

ONS-5010/LYTENAVA™ (bevacizumab-vikg) is investigational and is being evaluated in an ongoing non-inferiority study for the treatment

of wet AMD.

Bevacizumab-vikg

(bevacizumab gamma in the EU and UK) is a recombinant humanized monoclonal antibody (mAb) that selectively binds with high affinity to

all isoforms of human vascular endothelial growth factor (VEGF) and neutralizes VEGF’s biologic activity through a steric blocking

of the binding of VEGF to its receptors Flt-1 (VEGFR-1) and KDR (VEGFR-2) on the surface of endothelial cells. Following intravitreal

injection, the binding of bevacizumab to VEGF prevents the interaction of VEGF with its receptors on the surface of endothelial cells,

reducing endothelial cell proliferation, vascular leakage, and new blood vessel formation in the retina.

About Outlook Therapeutics, Inc.

Outlook Therapeutics is a biopharmaceutical company focused on the development and commercialization of ONS-5010/LYTENAVA™ (bevacizumab-vikg;

bevacizumab gamma), for the treatment of retina diseases, including wet AMD. LYTENAVA™ (bevacizumab gamma) is the first ophthalmic

formulation of bevacizumab to receive European Commission and MHRA Marketing Authorization for the treatment of wet AMD. Outlook Therapeutics

is working to initiate its commercial launch of LYTENAVA™ (bevacizumab gamma) in the EU and the UK as a treatment for wet AMD,

expected in the first half of calendar 2025. In the United States, ONS-5010/LYTENAVA™ is investigational, is being evaluated in

an ongoing non-inferiority study for the treatment of wet AMD, and if successful, the data may be sufficient for Outlook to resubmit

a BLA to the FDA in the United States. If approved in the United States, ONS-5010/LYTENAVA™, would be the first approved ophthalmic

formulation of bevacizumab for use in retinal indications, including wet AMD.

Forward-Looking Statements

This press release contains forward-looking statements. All statements other than statements of historical facts are “forward-looking

statements,” including those relating to future events. In some cases, you can identify forward-looking statements by terminology

such as “anticipate,” “believe,” “continue,” “expect,” “may,” “plan,”

“potential,” “target,” “will,” or “would” the negative of terms like these or other comparable

terminology, and other words or terms of similar meaning. These include, among others, plans for commercial launch of ONS-5010 in the

EU and UK and the timing thereof, including the potential to launch with a partner, plans to continue analyzing data for the NORSE EIGHT

trial and the potential to resubmit the BLA for ONS-5010 and the timing thereof, expectations concerning Outlook Therapeutics’

ability to remediate or otherwise resolve deficiencies identified in the CRL issued by the FDA, including with respect to an additional

clinical trial and CMC issues, expectations concerning decisions of regulatory bodies and the timing thereof, the potential of ONS-5010/LYTENAVA™

as a treatment for wet AMD, the market opportunity for ONS-5010, expectations concerning the relationship with Cencora and the benefits

and potential expansion thereof, and other statements that are not historical fact. Although Outlook Therapeutics believes

that it has a reasonable basis for the forward-looking statements contained herein, they are based on current expectations about future

events affecting Outlook Therapeutics and are subject to risks, uncertainties and factors relating to its operations and business

environment, all of which are difficult to predict and many of which are beyond its control. These risk factors include those risks associated

with developing and commercializing pharmaceutical product candidates, risks of conducting clinical trials and risks in obtaining necessary

regulatory approvals, including the risk that the data from the NORSE EIGHT trial does not support the resubmission or subsequent filing

by the FDA of the ONS-5010 BLA, the content and timing of decisions by regulatory bodies, the sufficiency of Outlook Therapeutics’

resources, as well as those risks detailed in Outlook Therapeutics’ filings with the Securities and Exchange Commission (the SEC),

including the Annual Report on Form 10-K for the fiscal year ended September 30, 2023, filed with the SEC on December

22, 2023, and future quarterly reports Outlook Therapeutics files with the SEC, which include uncertainty of market conditions

and future impacts related to macroeconomic factors, including as a result of the ongoing overseas conflicts, high interest rates, inflation

and potential future bank failures on the global business environment. These risks may cause actual results to differ materially from

those expressed or implied by forward-looking statements in this press release. All forward-looking statements included in this press

release are expressly qualified in their entirety by the foregoing cautionary statements. You are cautioned not to place undue reliance

on these forward-looking statements, which speak only as of the date hereof. Outlook Therapeutics does not undertake any obligation

to update, amend or clarify these forward-looking statements whether as a result of new information, future events or otherwise, except

as may be required under applicable securities law.

Investor Inquiries:

Jenene Thomas

Chief Executive Officer

JTC Team, LLC

T: 908.824.0775

OTLK@jtcir.com

Outlook Therapeutics, Inc.

Consolidated Statements of Operations

(Amounts in thousands, except per share data)

| | |

Year ended September 30, | |

| | |

2024 | | |

2023 | |

| Operating expenses: | |

| | | |

| | |

| Research and development | |

$ | 41,763 | | |

$ | 26,453 | |

| General and administrative | |

| 29,940 | | |

| 26,673 | |

| Loss from operations | |

| (71,703 | ) | |

| (53,126 | ) |

| Loss on equity method investment | |

| 101 | | |

| 11 | |

| Interest income | |

| (906 | ) | |

| (971 | ) |

| Interest expense | |

| 3,157 | | |

| 2,531 | |

| Loss on extinguishment of debt | |

| — | | |

| 578 | |

| Change in fair value of promissory notes | |

| 2,457 | | |

| 3,756 | |

| Warrant related expenses | |

| 37,490 | | |

| — | |

| Change in fair value of warrant liability | |

| (38,638 | ) | |

| (51 | ) |

| Loss before income taxes | |

| (75,364 | ) | |

| (58,980 | ) |

| Income tax expense | |

| 3 | | |

| 3 | |

| Net loss | |

$ | (75,367 | ) | |

$ | (58,983 | ) |

| | |

| | | |

| | |

| Per share information: | |

| | | |

| | |

| Net loss per share of common stock, basic and diluted | |

$ | (4.06 | ) | |

$ | (4.72 | ) |

| Weighted average shares outstanding, basic and diluted | |

| 18,549 | | |

| 12,509 | |

Consolidated Balance Sheet Data

(Amounts in thousands)

| | |

September 30, | |

| | |

2024 | | |

2023 | |

| Cash and cash equivalents | |

$ | 14,928 | | |

$ | 23,392 | |

| Total assets | |

$ | 28,823 | | |

$ | 32,301 | |

| Current liabilities | |

$ | 42,554 | | |

$ | 46,732 | |

| Total stockholders' deficit | |

$ | (73,077 | ) | |

$ | (14,438 | ) |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

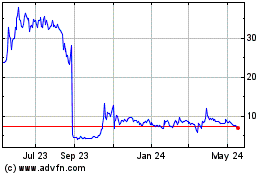

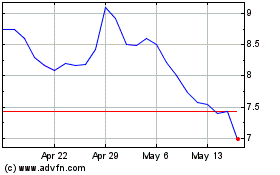

Outlook Therapeutics (NASDAQ:OTLK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Outlook Therapeutics (NASDAQ:OTLK)

Historical Stock Chart

From Feb 2024 to Feb 2025