Outlook Therapeutics, Inc. (Nasdaq: OTLK), a biopharmaceutical

company that achieved regulatory approval in the European Union

(EU) and the United Kingdom (UK) for the first authorized use of an

ophthalmic formulation of bevacizumab for the treatment of wet

age-related macular degeneration (wet AMD), today announced

financial results for the first quarter of fiscal year 2025 and

provided a corporate update.

“With all of the recent progress made at Outlook

Therapeutics and the upcoming milestones over the next few months,

we expect to be a very different company by the end of 2025,”

commented Lawrence Kenyon, Chief Financial Officer and Interim

Chief Executive Officer of Outlook Therapeutics. “In 2025, we plan

to start realizing our goal of providing patients, physicians and

payers with an approved ophthalmic formulation of bevacizumab. This

year, we anticipate beginning to generate the first revenue for

Outlook Therapeutics with the launch of LYTENAVA™ in Germany and

the UK and our BLA is on track for resubmission this quarter.”

Upcoming Anticipated

Milestones

- Resubmission of the ONS-5010 BLA

targeted for Q1 CY2025;

- Initial commercial launches in

Germany and the UK planned to commence in Q2 CY2025; and

- Potential for US FDA approval of

ONS-5010 in Q3 CY2025.

LYTENAVA™ (bevacizumab gamma) European

Commercial Update

In May 2024, the European Commission granted

Marketing Authorization for LYTENAVA™ (bevacizumab gamma) for the

treatment of wet AMD in the EU. Additionally, in July 2024, the UK

Medicines and Healthcare products Regulatory Agency (MHRA) granted

Marketing Authorization for LYTENAVA™ (bevacizumab gamma) for the

same indication in the UK. In December 2024, the National Institute

for Health and Care Excellence (NICE) recommended LYTENAVA™

(bevacizumab gamma) as an option for the treatment of wet AMD.

Plans for a potential 2025 launch in Germany and the UK are

ongoing. Outlook Therapeutics remains confident that ONS-5010 /

LYTENAVA™ is an important therapy for the treatment of wet AMD in

place of off-label repackaged bevacizumab that has not received

regulatory approval for use in retina diseases such as wet AMD.

Outlook Therapeutics intends to launch LYTENAVA™ (bevacizumab

gamma) in Germany and the UK in the second quarter of calendar year

2025.

LYTENAVA™ (bevacizumab gamma) is the first and

only authorized ophthalmic formulation of bevacizumab for use in

treating wet AMD in adults in the EU and UK. Currently, over

2.5 million injections of off-label, repackaged bevacizumab are

administered to patients across Europe each year, with about one

third of these injections in Germany alone. In Germany, there are

an estimated 1.6 million anti-VEGF retina injections each year,

with over half of those injections representing use of off-label,

repackaged bevacizumab. For Germany, LYTENAVA™ (bevacizumab gamma)

represents an opportunity for patients there to receive an

approved, cGMP produced bevacizumab for the first time. The UK

market represents approximately 1.3 million anti-VEGF retina

injections each year, but use of repackaged bevacizumab is not

authorized. In the UK, LYTENAVA™ (bevacizumab gamma) represents the

first time that most patients will have access to the therapy.

Authorization may also be sought in other

European countries, Japan, and elsewhere. Outlook

Therapeutics has entered into a strategic collaboration with

Cencora (formerly AmerisourceBergen) to support the commercial

launch of LYTENAVA™ globally following regulatory approvals. The

collaborative and integrated approach is designed to support market

access and efficient distribution of LYTENAVA™ to benefit all

stakeholders, including retina specialists, providers and

patients.

ONS-5010 / LYTENAVA™ (bevacizumab-vikg)

Clinical and Regulatory Update

Outlook Therapeutics believes that the complete

data set for NORSE EIGHT, combined with the data from the other

NORSE clinical trials, provides the required clinical evidence to

support approval of the ONS-5010 BLA in the US. Outlook

Therapeutics plans to resubmit the BLA for ONS-5010 in the first

quarter of calendar 2025. If approved by the U.S. Food and Drug

Administration (FDA), Outlook Therapeutics plans to

commercialize ONS-5010 / LYTENAVA™ (bevacizumab-vikg) directly in

the US.

In November 2024, Outlook Therapeutics reported

that in the NORSE EIGHT clinical trial, the second of two adequate

and well controlled clinical trials evaluating ONS-5010 in wet AMD

patients, ONS-5010 did not meet the pre-specified non-inferiority

endpoint at week 8 set forth in the special protocol assessment

(SPA) with the FDA. NORSE EIGHT is a randomized, controlled,

parallel-group, masked, non-inferiority study of approximately 400

newly diagnosed, wet AMD subjects randomized in a 1:1 ratio to

receive 1.25 mg ONS-5010 / LYTENAVA™ or 0.5 mg ranibizumab

intravitreal injections. Subjects received injections at Day 0

(randomization), Week 4, and Week 8 visits. The primary endpoint is

the mean change in best corrected visual acuity (BCVA) from

baseline to week 8.

In January 2025, Outlook Therapeutics announced

results from the completed analysis of the 12-week safety and

efficacy results for NORSE EIGHT, which indicated that ONS-5010

demonstrated clinically meaningful anatomic and functional

improvements at each study timepoint. Results from the 12-week

analysis demonstrated the difference in the mean between ONS-5010

and ranibizumab was -1.009 best corrected visual acuity (BCVA)

letters with a 95% confidence interval of (-2.865, 0.848) in the

NORSE EIGHT trial. Applying the statistical parameters from the

week 8 primary endpoint with the lower bound of the non-inferiority

margin at -3.5 with a 95% confidence interval, the noninferiority

margin was met at week 12, indicating that the two study arms are

not different at this timepoint. In the intent-to-treat (ITT)

population, NORSE EIGHT demonstrated a mean 5.5 letter improvement

in BCVA in the ONS-5010 arm and 6.5 letter improvement in BCVA in

the ranibizumab arm. BCVA data across all study timepoints

demonstrated an improvement in vision, increasing over time, and

the presence of biologic activity. Overall, in NORSE EIGHT,

ONS-5010 demonstrated mean visual acuity improvements of +3.3

letters at week 4, +4.2 letters at week 8, and +5.5 letters at week

12. Additionally, the complete NORSE EIGHT data set showed that

anatomical response was similar between treatments, with a

reduction in central retinal thickness of -123.9 microns for

ONS-5010 treated eyes and -127.3 microns for the ranibizumab group,

virtually no difference between the arms. Central retinal thickness

is a key indicator of effectiveness used by retina specialists in

the treatment of wet AMD.

Financial Highlights for the Fiscal

First Quarter Ended December 31, 2024

For the fiscal first quarter ended December 31,

2024, Outlook Therapeutics reported net income attributable to

common stockholders of $17.4 million, or $0.72 per basic and

diluted share, compared to a net loss attributable to common

stockholders of $11.2 million, or $0.86 per basic and diluted

share, for the same period last year. For the fiscal first quarter

ended December 31, 2024, Outlook Therapeutics also reported an

adjusted net loss attributable to common stockholders1 of $21.6

million, or $0.89 per basic and diluted share, as compared to an

adjusted net loss attributable to common stockholders of $10.1

million, or $0.78 per basic and diluted share, for fiscal first

quarter of 2024.

Adjusted net loss attributable to common

stockholders for the fiscal first quarter ended December 31, 2024

includes $1.3 million of loss from change in fair value of warrant

liability and $40.3 million of gain from change in fair value of

convertible promissory notes. Adjusted net loss attributable to

common stockholders includes $1.0 million of loss from change in

fair value of warrant liability and $0.1 million of loss from

change in fair value of convertible promissory notes for the fiscal

first quarter ended December 31, 2023.

1 Adjusted net loss attributable to common

stockholders and adjusted net loss attributable to common

stockholders per share of common stock – basic and diluted are

non-U.S. GAAP financial measures. See “Non-GAAP Financial Measures”

below.

In January 2025, Outlook Therapeutics received

$17.8 million in gross proceeds from its previously announced

warrant exercise inducement with certain holders of existing

warrants to purchase the Company’s common stock. As of December 31,

2024, Outlook Therapeutics had cash and cash equivalents of $5.7

million, excluding the proceeds received from the warrant exercise

inducement in January 2025.

About ONS-5010 / LYTENAVA™

(bevacizumab-vikg, bevacizumab gamma)

ONS-5010 / LYTENAVA™ is an ophthalmic

formulation of bevacizumab for the treatment of wet AMD. LYTENAVA™

(bevacizumab gamma) is the subject of a centralized Marketing

Authorization granted by the European Commission in the European

Union (EU) and Marketing Authorization granted by the Medicines and

Healthcare products Regulatory Agency (MHRA) in the United Kingdom

(UK) for the treatment of wet AMD.

In the United States, ONS-5010 / LYTENAVA™

(bevacizumab-vikg) is investigational.

Bevacizumab-vikg (bevacizumab gamma in the EU

and UK) is a recombinant humanized monoclonal antibody (mAb) that

selectively binds with high affinity to all isoforms of human

vascular endothelial growth factor (VEGF) and neutralizes VEGF’s

biologic activity through a steric blocking of the binding of VEGF

to its receptors Flt-1 (VEGFR-1) and KDR (VEGFR-2) on the surface

of endothelial cells. Following intravitreal injection, the binding

of bevacizumab to VEGF prevents the interaction of VEGF with its

receptors on the surface of endothelial cells, reducing endothelial

cell proliferation, vascular leakage, and new blood vessel

formation in the retina.

About Outlook Therapeutics,

Inc.

Outlook Therapeutics is a biopharmaceutical

company focused on the development and commercialization of

ONS-5010 / LYTENAVA™ (bevacizumab-vikg; bevacizumab gamma), for the

treatment of retina diseases, including wet AMD. LYTENAVA™

(bevacizumab gamma) is the first ophthalmic formulation of

bevacizumab to receive European Commission and MHRA Marketing

Authorization for the treatment of wet AMD. Outlook Therapeutics is

working to initiate its commercial launch of LYTENAVA™ (bevacizumab

gamma) in the EU and the UK as a treatment for wet AMD, expected in

the second quarter of calendar 2025. In the United States, ONS-5010

/ LYTENAVA™ is investigational, is being evaluated in an ongoing

non-inferiority study for the treatment of wet AMD, and if

successful, the data may be sufficient for Outlook to resubmit a

BLA to the FDA in the United States. If approved in the United

States, ONS-5010/LYTENAVA™, would be the first approved ophthalmic

formulation of bevacizumab for use in retinal indications,

including wet AMD.

Non-GAAP Financial Measures

Outlook Therapeutics prepares its consolidated

financial statements in conformity with accounting principles

generally accepted in the United States of America (U.S. GAAP) and

pursuant to accounting requirements of the Securities and Exchange

Commission (SEC). In an effort to provide investors with additional

information regarding the results and to provide a meaningful

period-over-period comparison of Outlook Therapeutics’ financial

performance, Outlook Therapeutics sometimes uses non-U.S. GAAP

financial measures (NGFM) as defined by the SEC. In this press

release, Outlook Therapeutics uses “adjusted net loss attributable

to common stockholders,” which is defined as net loss attributable

to common stockholders excluding warrant related expenses (i.e.,

the excess of the fair value of the warrants upon issuance over the

proceeds of the private placements that closed on March 18, 2024

and April 15, 2024) and changes in fair value of warrants and

convertible promissory notes, as well as “adjusted net loss

attributable to common stockholders per share of common stock –

basic and diluted,” which is defined as net loss attributable to

common stockholders per share of common stock – basic and diluted

excluding warrant related expenses and changes in fair value of

warrants and convertible promissory notes. Management uses these

NGFMs because they adjust for certain non-cash items that impact

financial results but not cash flows and that management believes

are not related to its core business. Management uses these NGFMs

to evaluate Outlook Therapeutics’ financial performance against

internal budgets and targets. Management believes that these NGFMs

are useful for evaluating Outlook Therapeutics’ core operating

results and facilitating comparison across reporting periods.

Outlook Therapeutics believes these NGFMs should be considered in

addition to, and not in lieu of, GAAP financial measures. Outlook

Therapeutics’ NGFMs may be different from the same NGFMs used by

other companies. Reconciliations to the closest U.S. GAAP financial

measures are provided in the tables below.

Forward-Looking Statements

This press release contains forward-looking

statements. All statements other than statements of historical

facts are “forward-looking statements,” including those relating to

future events. In some cases, you can identify forward-looking

statements by terminology such as “anticipate,” “believe,”

“continue,” “expect,” “may,” “plan,” “potential,” “target,” “will,”

or “would” the negative of terms like these or other comparable

terminology, and other words or terms of similar meaning. These

include, among others, the potential to resubmit the BLA for

ONS-5010 and the timing thereof, expectations concerning Outlook

Therapeutics’ ability to remediate or otherwise resolve

deficiencies identified in the CRL issued by the FDA, including

with respect to an additional clinical trial and CMC issues,

expectations concerning decisions of regulatory bodies and the

timing thereof, plans for commercial launch of LYTENAVA™ in

Germany and the UK and the timing thereof, including the potential

to launch with a partner, expected timing of revenue generation in

Germany and the UK, the potential of ONS-5010 / LYTENAVA™ as a

treatment for wet AMD, the market opportunity for LYTENAVA™ in

Germany and the UK, plans for commercial launch of ONS-5010 /

LYTENAVA™ in additional countries, expectations concerning the

relationship with Cencora and the benefits and potential expansion

thereof, and other statements that are not historical fact.

Although Outlook Therapeutics believes that it has a

reasonable basis for the forward-looking statements contained

herein, they are based on current expectations about future events

affecting Outlook Therapeutics and are subject to risks,

uncertainties and factors relating to its operations and business

environment, all of which are difficult to predict and many of

which are beyond its control. These risk factors include those

risks associated with developing and commercializing pharmaceutical

product candidates, risks of conducting clinical trials and risks

in obtaining necessary regulatory approvals, including the risk

that the data from the NORSE EIGHT trial does not support the

resubmission or subsequent filing by the FDA of the ONS-5010 BLA,

the content and timing of decisions by regulatory bodies, the

sufficiency of Outlook Therapeutics’ resources, as well as those

risks detailed in Outlook Therapeutics’ filings with

the Securities and Exchange Commission (the SEC),

including the Annual Report on Form 10-K for the fiscal year

ended September 30, 2024, filed with

the SEC on December 27, 2024, and future quarterly

reports Outlook Therapeutics files with the SEC,

which include uncertainty of market conditions and future impacts

related to macroeconomic factors, including as a result of the

ongoing overseas conflicts, fluctuations in interest rates and

inflation and potential future bank failures on the global business

environment. These risks may cause actual results to differ

materially from those expressed or implied by forward-looking

statements in this press release. All forward-looking statements

included in this press release are expressly qualified in their

entirety by the foregoing cautionary statements. You are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date hereof. Outlook

Therapeutics does not undertake any obligation to update,

amend or clarify these forward-looking statements whether as a

result of new information, future events or otherwise, except as

may be required under applicable securities law.

Investor Inquiries: Jenene Thomas Chief

Executive Officer JTC Team, LLC T: 908.824.0775 OTLK@jtcir.com

|

|

|

Outlook Therapeutics, Inc. |

|

Consolidated Statements of Operations |

|

(Amounts in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

Research and development |

|

$ |

9,660 |

|

|

$ |

4,529 |

|

|

General and administrative |

|

|

11,947 |

|

|

|

5,794 |

|

|

Loss from operations |

|

|

(21,607 |

) |

|

|

(10,323 |

) |

|

Loss (income) on equity method investment |

|

|

33 |

|

|

|

(3 |

) |

|

Interest income |

|

|

(49 |

) |

|

|

(188 |

) |

|

Loss from change in fair value of promissory notes |

|

|

1,304 |

|

|

|

993 |

|

|

(Gain) loss from change in fair value of warrant liability |

|

|

(40,273 |

) |

|

|

53 |

|

|

Net income (loss) |

|

$ |

17,378 |

|

|

$ |

(11,178 |

) |

|

|

|

|

|

|

|

|

|

Per share information: |

|

|

|

|

|

|

|

Net income (loss) per share of common stock, basic |

|

$ |

0.72 |

|

|

$ |

(0.86 |

) |

|

Net income (loss) per share of common stock, diluted |

|

$ |

0.72 |

|

|

$ |

(0.86 |

) |

|

Weighted average shares outstanding, basic |

|

|

24,234 |

|

|

|

13,013 |

|

|

Weighted average shares outstanding, diluted |

|

|

24,234 |

|

|

|

13,013 |

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Balance Sheet Data |

|

(Amounts in thousands) |

|

|

|

|

|

|

|

|

|

|

|

December 31, 2024 |

September 30, 2024 |

|

Cash and cash equivalents |

|

$ |

5,703 |

|

|

$ |

14,928 |

|

|

Total assets |

|

$ |

17,006 |

|

|

$ |

28,823 |

|

|

Current liabilities |

|

$ |

48,237 |

|

|

$ |

42,554 |

|

|

Total stockholders' deficit |

|

$ |

(50,290 |

) |

|

$ |

(73,077 |

) |

|

|

|

|

|

|

|

|

|

Reconciliation Between Reported Net Income (Loss) (GAAP)

and Adjusted Net (Loss) (Non-GAAP), in each case |

|

Attributable to Common Stockholders |

|

(Amounts in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

Three months ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

Net income (loss) attributable to common stockholders, as

reported (GAAP) |

$ |

17,378 |

|

$ |

(11,178 |

) |

|

Adjustments for reconciled items: |

|

|

|

|

|

Loss from change in fair value of promissory notes |

|

1,304 |

|

|

993 |

|

|

(Gain) loss from change in fair value of warrant liability |

|

(40,273 |

) |

|

53 |

|

|

Adjusted net loss attributable to common stockholders

(non-GAAP) |

$ |

(21,591 |

) |

$ |

(10,132 |

) |

|

|

|

|

|

|

|

Net income (loss) attributable to common stockholders per

share of |

|

|

|

|

|

common stock - basic and diluted as reported

(GAAP) |

$ |

0.72 |

|

$ |

(0.86 |

) |

|

Adjustments for reconciled items: |

|

|

|

|

|

Loss from change in fair value of promissory notes |

|

0.05 |

|

|

0.08 |

|

|

(Gain) loss from change in fair value of warrant liability |

|

(1.66 |

) |

|

- |

|

|

Adjusted net loss attributable to common

stockholders |

|

|

|

|

|

per share of common stock - basic and diluted

(non-GAAP) |

$ |

(0.89 |

) |

$ |

(0.78 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares - basic |

|

24,233,957.00 |

|

|

13,012,833.00 |

|

|

Weighted average shares - diluted |

|

24,233,957.00 |

|

|

13,012,833.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares - basic |

|

24,233,957 |

|

|

13,012,833 |

|

|

Add in the incremental shares for warrants |

|

- |

|

|

- |

|

|

Weighted average shares - diluted for warrants |

|

24,233,957 |

|

|

13,012,833 |

|

|

|

|

|

|

|

|

Weighted average shares - basic |

|

24,233,957 |

|

|

13,012,833 |

|

|

Add in the incremental shares for convertible debt |

|

- |

|

|

- |

|

|

Weighted average shares - diluted for convertible debt |

|

24,233,957 |

|

|

13,012,833 |

|

| |

|

|

|

|

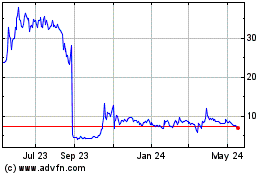

Outlook Therapeutics (NASDAQ:OTLK)

Historical Stock Chart

From Jan 2025 to Feb 2025

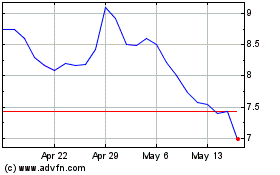

Outlook Therapeutics (NASDAQ:OTLK)

Historical Stock Chart

From Feb 2024 to Feb 2025