false

0001299130

0001299130

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

November 7, 2024

Pacific Biosciences of California, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-34899 |

|

16-1590339 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1305 O’Brien Drive

Menlo Park, California 94025

(Address of principal executive offices) (Zip

Code)

(650) 521-8000

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which registered |

| Common

Stock, par value $0.001 per share |

|

PACB |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry into a Material Definitive Agreement. |

Letter Agreement

On November 7, 2024, in connection with the

Exchange Transaction (as defined below), Pacific Biosciences of California, Inc. (the “Company”) and SB Northstar LP (“SBN”)

entered into a letter agreement (the “First Letter Agreement”). Pursuant to the First Letter Agreement, the Company and SBN

agreed that, upon any conversion of the New Notes (as defined below), SBN shall not be entitled to be issued a number of shares of the

Company’s common stock, par value $0.001 per share (the “common stock”), which would cause SBN’s beneficial ownership

of common stock to initially exceed either 9.9% of the total number of issued and outstanding shares of common stock following such conversion

or 9.9% of the combined voting power of all of the securities of the Company. The First Letter Agreement further places certain lock-up

restrictions on the Exchange Shares (as defined below), New Notes and any shares of common stock issued upon conversion of the New Notes

(the “Conversion Shares”), for a six-month period beginning on the closing date of the Exchange Transaction (the “Lock-up

Period”); the lock-up restrictions will terminate immediately prior to the consummation of any change in control of the Company.

The foregoing description of the First Letter

Agreement is qualified in its entirety by reference to the First Letter Agreement attached as Exhibit 10.1 to this Current Report on Form

8-K and incorporated herein by reference.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth in Item 8.01 of this

Current Report on Form 8-K regarding the New Notes (as defined below) is incorporated herein by reference.

| Item 3.02 |

Unregistered Sales of Equity Securities. |

The information set forth in Item 8.01 of this

Current Report on Form 8-K is incorporated herein by reference.

On November 7, 2024, the Company entered

into the Exchange Agreement (as defined below), pursuant to which it agreed to issue $200 million aggregate principal amount of the New

Notes, deliver 20,451,570 shares of common stock (the “Exchange Shares”) and make a payment of cash in the amount of $50 million

(the “Cash Payment”) to SBN in exchange for $459 million aggregate principal amount of the Company’s outstanding 1.50%

Convertible Senior Notes due 2028 (the “2028 Notes”), in a private placement exempt from the registration requirements of

the Securities Act of 1933, as amended (the “Securities Act”). The Company will issue the New Notes and Exchange Shares to

SBN in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act. The Company will rely on this

exemption from registration based in part on representations made by SBN in the Exchange Agreement. The Conversion Shares, if any, will

be issued in transactions anticipated to be exempt from registration under the Securities

Act pursuant to Section 3(a)(9) thereof. The Company does not intend to file a registration statement covering the resale of

the New Notes, the Exchange Shares or the Conversion Shares, if any.

Exchange Transaction

On November 7, 2024, the Company entered

into a privately negotiated exchange agreement (the “Exchange Agreement”) with SBN, the holder of the 2028 Notes, pursuant

to which the Company will issue $200 million aggregate principal amount of the Company’s 1.50% Convertible Senior Notes due 2029

(the “New Notes”) and the Exchange Shares and make the Cash Payment in exchange for $459 million aggregate principal amount

of the 2028 Notes (the “Exchange Transaction”), in a transaction exempt from registration under the Securities Act and the

rules and regulations thereunder.

In exchange for issuing the New Notes, delivering

the Exchange Shares and making the Cash Payment pursuant to the Exchange Transaction, the Company will receive and cancel the exchanged

2028 Notes. Following the closing of the Exchange Transaction, no 2028 Notes will remain outstanding.

The Exchange Transaction is expected to close

on or about November 21, 2024, subject to customary closing conditions. The issuance of the New Notes will occur under an indenture

related to the New Notes, to be dated on or around November 21, 2024, between the Company and U.S. Bank Trust Company, National Association,

as trustee.

The New Notes will represent senior unsecured

obligations of the Company and will pay interest semi-annually in arrears on each February 15 and August 15, commencing on February 15,

2025, at a rate of 1.50% per annum. The New Notes will mature on August 15, 2029, unless earlier converted, redeemed or repurchased.

Following the expiration of the Lock-up Period, the New Notes will be convertible at the option of the holder at any time until the second

scheduled trading day prior to the maturity date, including in connection with a redemption by the Company. The New Notes will be convertible

into shares of common stock, based on an initial conversion rate of 204.5157 shares of common stock per $1,000 principal amount of the

New Notes (which is equal to an initial conversion price of approximately $4.89 per share), in each case subject to customary anti-dilution

and other adjustments as a result of certain extraordinary transactions. On or after August 20, 2027 and prior to the 31st scheduled trading

day immediately preceding the maturity date, the Company may redeem for cash all or any portion of the New Notes if the last reported

sale price of the common stock has been at least 150% of the conversion price then in effect for at least 20 trading days (whether or

not consecutive) during any 30 consecutive trading day period (including the last trading day of such period) ending on, and including,

the trading day immediately preceding the date on which the Company provides notice of redemption.

If the Company undergoes a fundamental change

(as defined in the indenture governing the New Notes), holders may require the Company to purchase for cash all or part of their New Notes

at a purchase price equal to 100% of the principal amount of the New Notes to be purchased, plus accrued and unpaid interest, if any,

up to, but excluding, the fundamental change repurchase date, and all unpaid interest from the fundamental change repurchase date to,

but excluding, the maturity date.

The New Notes will be subject to certain debt

and lien covenants as well as springing guarantees, in each case, the terms of which will be set forth in a second letter agreement (the

“Second Letter Agreement”) between the Company and SBN to be dated on or around November 21, 2024.

The Company will not receive any cash proceeds

from the Exchange Transaction. In exchange for issuing the New Notes, delivering the Exchange Shares and making the Cash Payment pursuant

to the Exchange Transaction, the Company will receive and cancel the exchanged 2028 Notes.

Press Release

On November 7, 2024, the Company issued a

press release announcing the Exchange Transaction. A copy of the press release is filed as Exhibit 99.1 and incorporated by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

Pacific Biosciences of California, Inc. |

| |

|

|

| |

By: |

/s/ Susan Kim |

| |

|

Susan Kim |

| |

|

Chief Financial Officer |

| Date: November 7, 2024 |

|

|

Exhibit 10.1

EXECUTION VERSION

PACIFIC BIOSCIENCES OF CALIFORNIA, INC.

November 7, 2024

Ladies and Gentlemen:

Reference is hereby made to (i) the $200,000,000

aggregate principal amount of the 1.50% Convertible Senior Notes due 2029 (the “Notes”) to be issued by Pacific Biosciences

of California, Inc., a Delaware corporation (the “Company”), pursuant to the Indenture, to be dated on or about November 21,

2024 (the “Indenture”), by and between the Company and U.S. Bank Trust Company, National Association, as trustee, (ii) the

20,451,570 shares of Company common stock, $0.001 par value per share (the “Shares”), and (iii) the cash payment

in the amount of $50,000,000 (the “Cash Payment”), which Notes, Shares and Cash Payment are to be issued or made to

SB Northstar LP (the “Investor”), as applicable, on or about November 21, 2024 (the “Closing Date”)

pursuant to that certain Exchange Agreement, dated November 7, 2024 (the “Exchange Agreement”), by and between

the Company and the Investor.

Capitalized terms used but not defined in this

letter agreement shall have the meanings assigned thereto in the Indenture.

In consideration of the mutual covenants and agreements

of the parties herein, the Investor and the Company agree as follows:

| A. | Beneficial Ownership Limitation. Except

as otherwise provided in Section (I) of this letter agreement, notwithstanding anything to

the contrary contained in this letter agreement, the Indenture, the Notes, the Side Letter

Agreement to be dated on or about November 21, 2024 (the “Side Letter”),

by and between the Company and the Investor, or the Exchange Agreement (collectively, the

“Transaction Documents”), the Investor shall not be entitled to be issued

a number of shares of Common Stock in connection with a conversion of any Notes in excess

of that number of shares of Common Stock which, upon giving effect or immediately prior to

such conversion, would cause (i) the aggregate number of shares of Common Stock beneficially

owned by the Investor and its Affiliates and any other Persons whose beneficial ownership

of Common Stock would be aggregated with the Investor’s for purposes of Section 13(d)

of the Exchange Act to exceed 9.9% of the total number of issued and outstanding shares of

Common Stock of the Company following such conversion, or (ii) the combined voting power

of the securities of the Company beneficially owned by the Investor and its Affiliates and

any other Persons whose beneficial ownership of Common Stock would be aggregated with the

Investor’s for purposes of Section 13(d) of the Exchange Act to exceed 9.9% of the

combined voting power of all of the securities of the Company then outstanding following

such conversion (the foregoing, the “Beneficial Ownership Limitation”).

For purposes of this paragraph, in determining the number of outstanding shares of Common

Stock, the Investor may rely on the number of outstanding shares of Common Stock as reflected

in (x) the Company’s most recent Form 10-Q or Form 10-K, as the case may be, filed

with the U.S. Securities and Exchange Commission prior to the date hereof or (y) a more recent

public announcement by the Company. Upon the written request of the Investor, the Company

shall, within one (1) Trading Day, confirm in writing or by electronic mail to the Investor

the number of shares of Common Stock then outstanding. In any case, for purposes of determining

the aggregate number of shares of Common Stock beneficially owned by the Investor and its

Affiliates and any other Persons whose beneficial ownership of Common Stock would be aggregated

with the Investor’s for purposes of Section 13(d) of the Exchange Act, the number of

outstanding shares of Common Stock shall be determined after giving effect to the conversion

or exercise of securities of the Company, including the Notes, by the Investor since the

date as of which such number of outstanding shares of Common Stock was reported. For purposes

of this paragraph, the aggregate number of shares of Common Stock or voting securities beneficially

owned by the Investor and its Affiliates and any other Persons whose beneficial ownership

of Common Stock would be aggregated with the Investor’s for purposes of Section 13(d)

of the Exchange Act shall include the shares of Common Stock issuable upon the conversion

of the Note with respect to which such determination is being made, but shall exclude the

number of shares of Common Stock which would be issuable upon (x) conversion of the remaining

unconverted and non-cancelled portion of the Note by the Investor and (y) exercise or conversion

of the unexercised, non-converted or non-cancelled portion of any other securities of the

Company that do not have voting power (including without limitation any securities of the

Company which would entitle the holder thereof to acquire at any time Common Stock, including

without limitation any debt, preferred stock, right, option, warrant or other instrument

that is at any time convertible into or exercisable or exchangeable for, or otherwise entitles

the holder thereof to receive, Common Stock), is subject to a limitation on conversion or

exercise analogous to the limitation contained herein and is beneficially owned by the Investor

or any of its Affiliates and other Persons whose beneficial ownership of Common Stock would

be aggregated with the Investor’s for purposes of Section 13(d) of the Exchange Act.

Immediately prior to exercising any right to convert its Note pursuant to Article 14 of the

Indenture, the Investor shall disclose to the Company in writing the number of shares of

Common Stock issuable on conversion of the Notes and the shares of Common Stock and any other

relevant securities then beneficially owned by the Investor and any of its Affiliates for

purposes of Section 13(d) of the Exchange Act or otherwise applicable for the foregoing calculations. |

| B. | Lock-Up Period. Notwithstanding any provision of the Transaction Documents to the contrary, the

Investor shall not, without the Company’s prior written consent, directly or indirectly, during the period commencing on the Closing

Date and ending on the earlier of the date that is six months after the Closing Date or immediately prior to the consummation of any Change

in Control (as defined below) (such period, the “Lock-Up Period”) (a) sell, offer, transfer, assign, mortgage, hypothecate,

gift, pledge or dispose of, enter into or agree to enter into any contract, option or other arrangement or understanding with respect

to the sale, transfer, pledge, mortgage, hypothecation, gift, assignment or similar disposition of (any of the foregoing, a “transfer”),

any of the Shares, Notes or any shares of Common Stock issuable or issued upon conversion or repurchase by the Company of any of the Notes

(other than (i) any transfer to an Affiliate of the Investor following prior written notice to the Company of such proposed transfer,

provided such Affiliate executes and delivers to the Company a joinder, pursuant to which such Affiliate becomes subject to the provisions

of this letter agreement in the same manner as the Investor (a “Joinder”), and, with respect to transfers of the Notes,

a duly completed and executed Internal Revenue Service (“IRS”) Form W-9 or W-8 (or equivalent tax form), (ii) any transfer

to the Company or any of its subsidiaries, (iii) the tender of any shares of Common Stock into any tender or exchange offer made to all

of the holders of Common Stock by any Person (other than the Investor, any member of the Investor or any Affiliate of the Investor) for

a number of outstanding shares of Voting Stock (as defined below) that, if consummated, would result in a Change in Control solely to

the extent that (x) the Company’s board of directors (the “Board of Directors”) has recommended such tender or

exchange offer in a Schedule 14D-9 filed under the Exchange Act or (y) such tender offer or exchange offer is either (I) a tender offer

or exchange offer for less than all of the outstanding shares of Common Stock or (II) part of a two-step transaction and the consideration

to be received in the second step of such transaction is not identical in the amount or form of consideration (or the election of the

type of consideration available to the holders of the Common Stock is not identical in the second step of such transaction) as the first

step of such transaction (a “Third Party Tender/Exchange Offer”) (and any related conversion of Notes to the extent

required to effect such tender or exchange) (for the avoidance of doubt, if such Third Party Tender/Exchange Offer does not close for

any reason, the restrictions on transfer contained in this paragraph shall continue to apply to any Common Stock received pursuant to

the conversion of any Notes that had previously been converted to participate in any such tender or exchange offer), or (iv) any transfer

effected pursuant to and in accordance with the terms of any merger, consolidation or similar transaction consummated by the Company)

or (b) enter into or engage in any hedge, swap, short sale, derivative transaction or other agreement or arrangement that transfers to

any third party, directly or indirectly, in whole or in part, any of the economic consequences of ownership of the Shares, Notes or any

shares of Common Stock issuable or issued upon conversion or repurchase by the Company of any of the Notes; provided, the Investor and

its Affiliates may otherwise enter into or engage in any swap, put or collar agreement in respect of shares of Common Stock other than

the Shares and shares of Common Stock not issuable or issued upon conversion or repurchase by the Company of any of the Notes provided

such activities are conducted in the ordinary course of business and do not result in the Investor and its Affiliates holding a net short

position, as determined excluding the Shares, Notes or any shares of Common Stock issuable or issued upon conversion or repurchase by

the Company of any of the Notes (such actions in clauses (a) and (b), “Prohibited Transfers”). Following the Lock-Up

Period, the Investor shall not transfer any of the Notes to any Person that did not execute and deliver to the Company a Joinder or did

not deliver to the Company a duly completed and executed IRS Form W-9 or W-8 (or equivalent tax form). Any purported Prohibited Transfer

in violation of this paragraph shall be null and void ab initio. Notwithstanding the foregoing, the Investor (or a controlled Affiliate

of the Investor) shall be permitted to mortgage, hypothecate, and/or pledge the Shares, Notes and/or the shares of Common Stock issuable

or issued upon conversion or repurchase by the Company of the Notes in respect of one or more bona fide purpose (margin) or bona fide

non-purpose loans (each, a “Permitted Loan”). Any Permitted Loan entered into by the Investor or its controlled Affiliates

shall be with one or more financial institutions and nothing contained in this letter agreement shall prohibit or otherwise restrict the

ability of any lender (or its securities’ affiliate) or collateral agent or trustee to foreclose upon and sell, dispose of or otherwise

transfer the Shares, Notes and/or shares of Common Stock (including shares of Common Stock received upon conversion or repurchase by the

Company of the Notes following foreclosure on a Permitted Loan) mortgaged, hypothecated and/or pledged to secure the applicable obligations

of the borrower following an event of default under a Permitted Loan. Notwithstanding the foregoing or anything to the contrary herein,

in the event that any lender or other creditor under a Permitted Loan transaction (including any agent or trustee on their behalf) or

any affiliate of the foregoing exercises any rights or remedies in respect of the Shares, Notes or the shares of Common Stock issuable

or issued upon conversion or repurchase by the Company of the Notes or any other collateral for any Permitted Loan, no lender, creditor,

agent or trustee on their behalf or affiliate of any of the foregoing (other than, for the avoidance of doubt, the Investor or any of

its Affiliates) shall be entitled to any rights or have any obligations or be subject to any transfer restrictions or limitations hereunder.

For purposes hereof, the following terms shall have the following meanings: |

| (i) | “Change in Control” means the occurrence of any of the following events: (i) there

occurs a sale, transfer, conveyance or other disposition of all or substantially all of the consolidated assets of the Company, (ii) any

Person or “group” (as such term is used in Section 13 of the Exchange Act) (in each case excluding the Investor, any member

of the Investor or any of their respective Affiliates or any of their respective portfolio companies), directly or indirectly, obtains

beneficial ownership (as determined for purposes of Section 13(d) of the Exchange Act) of 50% or more of the outstanding Common Stock,

(iii) the Company consummates any merger, consolidation or similar transaction, unless the stockholders of the Company immediately prior

to the consummation of such transaction continue to hold (in substantially the same proportion as their ownership of the Common Stock

immediately prior to the transaction, other than changes in proportionality as a result of any cash/stock election provided under the

terms of the definitive agreement regarding such transaction) more than 50% of all of voting power of the outstanding shares of Voting

Stock of the surviving or resulting entity in such transaction immediately following the consummation of such transaction or (iv) a majority

of the Board of Directors is no longer composed of (x) directors who were directors of the Company on the Closing Date and (y) directors

who were nominated for election or elected or appointed to the Board of Directors with the approval of a majority of the directors described

in subclause (x) together with any incumbent directors previously elected or appointed to the Board of Directors in accordance with this

subclause (y). |

| (ii) | “Voting Stock” means securities of any class or kind having the power to vote generally

for the election of directors, managers or other voting members of the governing body of the Company or any successor thereto. |

| C. | Transfers of Sponsor Notes. The Investor agrees that (i) except in the case of a foreclosure under

a Permitted Loan pursuant to which the lender thereunder is obligated to exchange the foreclosed interest in the Sponsor Notes (as defined

in the Indenture) for a security other than the Sponsor Notes, and except as set forth of clause (C)(ii), the Investor and its Affiliates

will only transfer their interests in the Sponsor Notes to a Person that is not an Affiliate of the Investor that receives such transferred

interest in a Global Note (as defined in the Indenture) other than the Sponsor Notes and (ii) the Investor and its Affiliates may transfer

an interest in the Sponsor Notes to an Affiliate of the Investor and such Affiliate may continue to hold such transferred interest in

the Sponsor Notes solely to the extent that the Sponsor Notes are transferable to such Affiliate under this letter agreement. |

| D. | No Registration. The Investor understands that the offer and sale of the Shares, Notes and any

shares of Common Stock issuable or issued upon conversion of any of the Notes (collectively, the “Securities”), have

not been, and will not be, registered under the Securities Act of 1933, as amended (the “Securities Act”), by reason

of a specific exemption from the registration provisions of the Securities Act, the availability of which depends upon, among other things,

the bona fide nature of the investment intent and the accuracy of the Investor’s representations as expressed herein or otherwise

made pursuant hereto. |

| E. | Legend Requirement. The Investor understands and agrees that the Company may cause the legend set

forth below, or substantially equivalent legends, to be placed upon any certificate(s) evidencing ownership of the Securities (or book-entry

position representing the Securities), together with any other legends that may be required by the Company or by applicable state or federal

securities laws: |

THE

SECURITIES REPRESENTED HEREBY ARE SUBJECT TO CERTAIN RESTRICTIONS ON TRANSFER, INCLUDING A LOCK-UP PERIOD, AS SET FORTH IN THAT CERTAIN

SIDE LETTER BY AND BETWEEN THE ISSUER AND THE OTHER PARTY(IES) THERETO, A COPY OF WHICH MAY BE OBTAINED AT THE PRINCIPAL OFFICE OF THE

ISSUER. SUCH TRANSFER RESTRICTIONS AND LOCK-UP PERIOD ARE BINDING ON TRANSFEREES OF THESE Securities.

| F. | No Registration Rights. The Investor understands and agrees that, notwithstanding anything in any

Transaction Document, the Company’s 1.50% Convertible Senior Notes due 2028 (the “Existing Notes”), that certain

Indenture between the Company and U.S. Bank National Association, as trustee, dated February 16, 2021, or that certain Investment

Agreement by and between the Company and the Investor dated as of February 9, 2021, to the contrary, the Investor shall not have

any registration rights with respect to these Securities, that the Company has no obligation to register any subsequent proposed resale

of the Securities by the Investor or any other Person, that all prior agreements and understandings, oral or written, between the parties

with respect to the subject matter in this Section F are superseded hereby and that any and all obligations to register for subsequent

resale the Existing Notes or any shares of Common Stock issuable or issued upon conversion or repurchase by the Company of any of the

Existing Notes or maintain any existing registration statement with respect to the Existing Notes or any shares of Common Stock issuable

or issued upon conversion or repurchase by the Company of any of the Existing Notes are hereby terminated. |

| G. | DPA. It is the intent of the Company and the Investor that the Investor shall not obtain any DPA

Triggering Rights (as defined below) in the Company. Notwithstanding any provision of the Transaction Documents or other related agreements

(collectively, the “Transaction Agreements”) to the contrary, the Company shall not provide, nor shall the Investor

seek to obtain, any of the following rights in the Company: (w) access to any “material non-public technical information”

(as defined in the Defense Production Act of 1950, as amended, including all implementing regulations thereof (the “DPA”))

in the possession of the Company; (x) membership or observer rights on the Board of Directors or equivalent governing body of the Company

or the right to nominate an individual to a position on the Board of Directors or equivalent governing body of the Company; (y) any involvement,

other than through the voting of shares, in substantive decision-making of the Company regarding (i) the use, development, acquisition

or release of any Company “critical technology” (as defined in the DPA); (ii) the use, development, acquisition, safekeeping,

or release of “sensitive personal data” (as defined in the DPA) of U.S. citizens maintained or collected by the Company, or

(iii) the management, operation, manufacture, or supply of “covered investment critical infrastructure” (as defined in the

DPA); or (z) “control” (as defined in the DPA) of the Company ((i) – (iv) being the “DPA Triggering Rights”).

To the extent any term in the Transaction Agreements purports to grant any such right to the Investor, that term shall be of no effect. |

| H. | Beneficial Ownership. The provisions of this letter agreement shall be construed, corrected and

implemented in a manner so as to effectuate the intended Beneficial Ownership Limitation herein contained and the shares of Common Stock

underlying the Notes in excess thereof shall not be deemed to be beneficially owned by the Investor for any purpose including for purposes

of Section 13(d) or Rule 16a-1(a)(1) of the Exchange Act. |

| I. | Rights. Notwithstanding Section (A) or Section (D) of this letter agreement or any other provision

of this letter agreement to the contrary, nothing contained in this letter agreement shall restrict or limit in any manner the Company’s

ability to exercise its rights pursuant to the Indenture or the Notes, including, without limitation, the Company’s right to redeem

the Notes pursuant to Section 16.01 of the Indenture. |

| J. | Assignment. The rights provided to the Investor as contained in this letter agreement may not be

assigned without the prior consent of the Company. This letter agreement shall be binding upon and shall be inure to the benefit of the

parties hereto and their respective permitted assigns, and no other person shall have any rights or obligations hereunder. |

| K. | Entire Agreement. This letter agreement constitutes the full and entire understanding of the agreement

between the parties hereto with regard to the subject matter contained herein and supersedes all prior oral or written agreements to understandings

with respect to the subject matter hereof. |

| L. | Governing Law. This letter agreement shall be governed by and construed in accordance with the

laws of the State of New York. |

[Remainder of Page Intentionally Left Blank]

This letter agreement

may be executed in multiple counterpart copies, each of which shall be considered an original and all of which shall constitute one and

the same instrument binding on all parties.

| |

Very truly yours, |

| |

|

|

| |

SB Northstar LP, acting through its

general partner, SB NORTHSTAR GP |

| |

|

|

| |

|

|

| |

By: |

/s/ Stephen Lam |

| |

Name: |

Stephen Lam |

| |

Title: |

Director |

[Signature Page to Investor

Side Letter]

This letter agreement may be

executed in multiple counterpart copies, each of which shall be considered an original and all of which shall constitute one and the same

instrument binding on all parties.

| COMPANY |

|

| |

|

| PACIFIC BIOSCIENCES OF CALIFORNIA, INC. |

|

| |

|

| |

|

| By: |

/s/ Christian Henry |

|

| Name: Christian Henry |

|

| Title: President and Chief Executive Officer |

|

[Signature Page to Investor

Side Letter]

Exhibit 99.1

PacBio

Announces a Private Convertible Exchange Transaction of $459 Million Principal Amount of 1.50% Convertible Senior Notes due 2028

MENLO

PARK, Calif., Nov. 07, 2024 (GLOBE NEWSWIRE) -- PacBio (NASDAQ: PACB), a leading developer of high-quality, highly accurate sequencing

solutions, today announced that it has entered into a privately negotiated exchange agreement with

a holder of PacBio's remaining outstanding 1.50% Convertible Senior Notes due 2028 (the “2028 Notes”), pursuant to which

PacBio will (i) issue $200 million principal amount of its 1.50% Convertible Senior Notes due 2029 (the “New Notes”),

(ii) issue 20,451,570 shares (the “Shares”) of PacBio’s common stock (“common stock”), and (iii) make

a cash payment in the amount of $50 million (the “Cash Consideration”) in exchange

for $459 million principal amount of the 2028 Notes (the “Exchange Transaction”), in a transaction exempt from registration

under the Securities Act of 1933, as amended, and the rules and regulations thereunder. The Exchange Transaction is expected to close

on or about November 21, 2024, subject to customary closing conditions.

“This

transaction meaningfully reduces and extends the duration of our long-term debt while balancing shareholder dilution and impact to our

cash,” said Christian Henry, President and Chief Executive Officer. “This exchange with SB Northstar LP demonstrates the

Company’s commitment to our shareholders and customers to optimize our capital structure and build a long-term sustainable business

around our industry-leading technologies. With our earliest debt maturities now in August of 2029, this strengthens our financial position

and gives us greater flexibility.”

The

New Notes will have an initial conversion rate of 204.5157 shares of common stock per $1,000 principal amount of the New Notes (which

is equal to an initial conversion price of approximately $4.89 per share of common stock), subject to customary anti-dilution and other

adjustments. The New Notes will mature on August 15, 2029, unless earlier repurchased, redeemed or converted. The New Notes will

pay interest semi-annually on each February 15 and August 15, commencing on February 15, 2025, at a rate of 1.50% per

annum. Upon conversion, the Company will have the right to elect settlement in cash, shares of common stock or any combination thereof

in its sole discretion. The New Notes will be subject to certain covenants.

In

exchange for issuing the New Notes and Shares and providing the Cash Consideration pursuant to the Exchange Transaction, PacBio will

receive and cancel the exchanged 2028 Notes. Following the closing of the Exchange Transaction, there will be no more 2028 Notes outstanding.

Additional

information regarding this announcement may be found in a Current Report on Form 8-K that the Company intends to file today with the

U.S. Securities and Exchange Commission.

Goldman

Sachs & Co. LLC acted as financial advisor to PacBio in connection with the Exchange Transaction.

About

PacBio

PacBio

(NASDAQ: PACB) is a premier life science technology company that designs, develops, and manufactures advanced sequencing solutions to

help scientists and clinical researchers resolve genetically complex problems. Our products and technologies stem from two highly differentiated

core technologies focused on accuracy, quality and completeness which include our HiFi long-read sequencing and our SBB® short-read

sequencing technologies. Our products address solutions across a broad set of research applications including human germline sequencing,

plant and animal sciences, infectious disease and microbiology, oncology, and other emerging applications. For more information, please

visit www.pacb.com and follow @PacBio.

PacBio

products are provided for Research Use Only. Not for use in diagnostic procedures.

Forward-Looking

Statements:

This

press release contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and the U.S. Private Securities Litigation Reform Act of 1995 regarding the planned offering. All statements other than statements

of historical fact are forward-looking statements, including statements relating to PacBio's ability to scale the company, achieve positive

cash flow, realize anticipated benefits from the Exchange Transaction and bring innovative sequencing solutions to the market. Readers

are cautioned not to place undue reliance on these forward-looking statements and any such forward-looking statements are qualified in

their entirety. These statements involve risks and uncertainties that could cause actual results to differ materially, including, but

not limited to, failure to consummate the Exchange Transaction or realize the anticipated benefits of the Exchange Transaction, including

due to the satisfaction of customary closing conditions and prevailing market conditions or for other reasons, PacBio's failure to reach

positive cash flow when anticipated, if at all, and the impact of general economic, industry or other conditions in the United States

or internationally. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties,

changes in circumstances, and other factors that are, in some cases, beyond PacBio's control and could cause actual results to differ

materially from the information expressed or implied by forward-looking statements made in this press release. Readers are strongly encouraged

to read the full cautionary statements contained in PacBio's filings with the Securities and Exchange Commission, including the risk

factors set forth in PacBio's most recent Quarterly Report on Form 10-Q, filed August 9, 2024. PacBio undertakes no obligation to

revise or update information in this press release to reflect events or circumstances in the future, even if new information becomes

available.

Contacts

For investors:

Todd Friedman

IR@pacificbiosciences.com

For media:

PR@pacificbiosciences.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

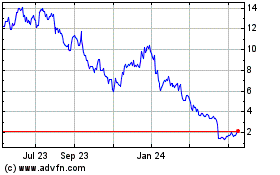

Pacific Biosciences of C... (NASDAQ:PACB)

Historical Stock Chart

From Dec 2024 to Jan 2025

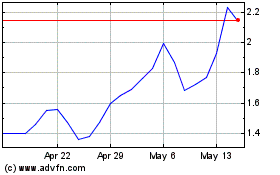

Pacific Biosciences of C... (NASDAQ:PACB)

Historical Stock Chart

From Jan 2024 to Jan 2025