Registration No. 333-

As filed with the Securities and Exchange Commission on May 21, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Pioneer Bancorp, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Maryland

|

83-4274253

|

|

(State or Other Jurisdiction of

|

(I.R.S. Employer Identification No.)

|

|

Incorporation or Organization)

|

|

652 Albany Shaker Road

Albany, NY 12211

(Address of Principal Executive Offices)

Pioneer Bancorp, Inc. 2020 Equity Incentive Plan

(Full Title of the Plan)

Copies to:

|

Mr. Thomas L. Amell

|

Benjamin M. Azoff, Esq.

|

|

President and Chief Executive Officer

|

Luse Gorman, PC

|

|

Pioneer Bancorp, Inc.

|

5335 Wisconsin Ave., N.W., Suite 780

|

|

652 Albany Shaker Road

|

Washington, DC 20015-2035

|

|

Albany, NY 12211

|

(202) 274-2000

|

|

(518) 730-3025

|

|

|

(Name, Address and Telephone

|

|

|

Number of Agent for Service)

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934, as amended:

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ⌧

|

Smaller reporting company ⌧

|

|

Emerging growth company ⌧

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to

Section 7(a)(2)(B) of the Securities Act. ☐

PART I. INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

Items 1 and 2. Plan Information; and Registrant Information and Employee Plan Annual Information

The documents containing the information specified in Part I of Form S-8 have been or will be sent or given to participants in the Pioneer Bancorp, Inc. 2020 Equity Incentive

Plan (the “Plan”) as specified by Rule 428(b)(1) promulgated by the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”).

Such documents are not being filed with the Commission, but constitute (along with the documents incorporated by reference into this Registration Statement pursuant to Item 3 of

Part II hereof) a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II. INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation

of Documents by Reference

The following documents previously filed by Pioneer Bancorp, Inc. (the “Company”) with the Commission under the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

are incorporated herein by reference (other than any such documents or portions thereof that are furnished under Item 2.02 or Item 7.01 of Form 8-K, unless otherwise indicated therein, including any exhibits included with such Items):

(a)

The Company’s Annual Report on

Form 10-K for the year ended June 30, 2023, filed with the Commission on September 26, 2023 (File No. 001-38991) (including information

specifically incorporated by reference therein from the Company’s definitive proxy statement on Schedule 14A, filed on October 20, 2023);

(b)

The Company’s Quarterly Report on

Form 10-Q for the quarter ended September 30, 2023, filed with the Commission on November 14, 2023, the Company’s Quarterly Report on

Form 10-Q for the quarter ended December 31, 2023, filed with the Commission on February 13, 2024, and the Company’s Quarterly Report on

Form 10-Q for the quarter ended March 31, 2024, filed with the Commission on May 13, 2024 (File No. for all 001-38991);

(c)

The Company’s Current Reports on Form 8-K filed with the

Commission on

July 26, 2023,

November 21, 2023,

November

21, 2023,

December 29, 2023,

January 4, 2024,

February 8,

2024 and

April 1, 2024 (File No. for all 001-38991); and

(d)

The description of the Company’s common stock contained in

the

Registration Statement on Form 8-A filed with the Commission on July 17, 2019

to register the Company's common

stock under the Exchange Act (File No. 001-38991), including any subsequent amendments or reports filed for the purpose of updating such description.

All documents subsequently filed by the Company with the Commission pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act, after the date hereof, and prior to the

filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed incorporated by reference into this Registration Statement and to be a

part thereof from the date of the filing of such documents. Any statement contained in the documents incorporated, or deemed to be incorporated, by reference herein or therein shall be deemed to be modified or superseded for purposes of this

Registration Statement and the prospectus to the extent that a statement contained herein or therein or in any other subsequently filed document which also is, or is deemed to be, incorporated by reference herein or therein modifies or supersedes

such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement and the prospectus.

All information appearing in this Registration Statement and the prospectus is qualified in its entirety by the detailed information, including financial statements, appearing in

the documents incorporated herein or therein by reference.

Item 4. Description of Securities

Not applicable.

Item 5. Interests of Named Experts and Counsel

None.

Item 6. Indemnification of Directors and Officers

Articles 10 and 11 of the Articles of Incorporation of Pioneer Bancorp, Inc. (the “Corporation”) set forth the circumstances under which directors, officers, employees and agents of the Corporation

may be insured or indemnified against liability which they may incur in their capacities as such:

ARTICLE 10. Indemnification, etc. of Directors and Officers.

A. Indemnification. The Corporation shall indemnify (1) its current and former directors and officers, whether serving the Corporation or at its

request any other entity, to the fullest extent required or permitted by the Maryland General Corporation Law (the “MGCL”) now or hereafter in force, including the advancement of expenses under the procedures and to the fullest extent permitted by

law, and (2) other employees and agents to such extent as shall be authorized by the Board of Directors and permitted by law; provided, however, that, except as provided in Section B of this Article 10 with respect to proceedings to enforce rights

to indemnification, the Corporation shall indemnify any such indemnitee in connection with a proceeding (or part thereof) initiated by such indemnitee only if such proceeding (or part thereof) was authorized by the Board of Directors of the

Corporation.

B. Procedure. If a claim under Section A of this Article 10 is not paid in full by the Corporation within

sixty (60) days after a written claim has been received by the Corporation, except in the case of a claim for an advancement of expenses, in which case the applicable period shall be twenty (20) days, the indemnitee may at any time thereafter bring

suit against the Corporation to recover the unpaid amount of the claim. If successful in whole or in part in any such suit, or in a suit brought by the Corporation to recover an advancement of expenses pursuant to the terms of an undertaking, the

indemnitee shall also be entitled to be reimbursed the expense of prosecuting or defending such suit. It shall be a defense to any action for advancement of expenses that the Corporation has not received both (i) an undertaking as required by law

to repay such advances if it shall ultimately be determined that the standard of conduct has not been met and (ii) a written affirmation by the indemnitee of his or her good faith belief that the standard of conduct necessary for indemnification by

the Corporation has been met. In (i) any suit brought by the indemnitee to enforce a right to indemnification hereunder (but not in a suit brought by the indemnitee to enforce a right to an advancement of expenses) it shall be a defense that, and

(ii) any suit by the Corporation to recover an advancement of expenses pursuant to the terms of an undertaking the Corporation shall be entitled to recover such expenses upon a final adjudication that, the indemnitee has not met the applicable

standard for indemnification set forth in the MGCL. Neither the failure of the Corporation (including its Board of Directors, independent legal counsel, or its stockholders) to have made a determination before the commencement of such suit that

indemnification of the indemnitee is proper in the circumstances because the indemnitee has met the applicable standard of conduct set forth in the MGCL, nor an actual determination by the Corporation (including its Board of Directors, independent

legal counsel, or its stockholders) that the indemnitee has not met such applicable standard of conduct, shall create a presumption that the indemnitee has not met the applicable standard of conduct, or, in the case of such a suit brought by the

indemnitee, be a defense to such suit. In any suit brought by the indemnitee to enforce a right to indemnification or to an advancement of expenses hereunder, or by the Corporation to recover an advancement of expenses pursuant to the terms of an

undertaking, the burden of proving that the indemnitee is not entitled to be indemnified, or to such advancement of expenses, under this Article 10 or otherwise, shall be on the Corporation.

C. Non-Exclusivity. The rights to indemnification and to the advancement of expenses conferred in this

Article 10 shall not be exclusive of any other right that any Person may have or hereafter acquire under any statute, these Articles, the Corporation’s Bylaws, any agreement, any vote of stockholders or the Board of Directors, or otherwise.

D. Insurance. The Corporation may maintain insurance, at its expense, to insure itself and any director,

officer, employee or agent of the Corporation or another corporation, partnership, joint venture, trust or other enterprise against any expense, liability or loss, whether or not the Corporation would have the power to indemnify such Person against

such expense, liability or loss under the MGCL.

E. Miscellaneous. The Corporation shall not be liable for any payment under this Article 10 in connection

with a claim made by any indemnitee to the extent such indemnitee has otherwise actually received payment under any insurance policy, agreement, or otherwise, of the amounts otherwise indemnifiable hereunder. The rights to indemnification and to

the advancement of expenses conferred in Sections A and B of this Article 10 shall be contract rights and such rights shall continue as to an indemnitee who has ceased to be a director or officer and shall inure to the benefit of the indemnitee’s

heirs, executors and administrators.

F. Limitations Imposed by Federal Law. Notwithstanding any other provision set forth in this Article 10, in no

event shall any payments made by the Corporation pursuant to this Article 10 exceed the amount permissible under applicable federal law, including, without limitation, Section 18(k) of the Federal Deposit Insurance Act and the regulations promulgated

thereunder.

Any repeal or modification of this Article 10 by the stockholders of the Corporation or the Board of Directors shall not in any way diminish any rights to

indemnification or advancement of expenses of such director or officer or the obligations of the Corporation arising hereunder with respect to events occurring, or claims made, while this Article 10 is in force.

ARTICLE 11. Limitation of Liability. An officer or director of the Corporation, as such, shall not be liable to

the Corporation or its stockholders for money damages, except (A) to the extent that it is proved that the Person actually received an improper benefit or profit in money, property or services, for the amount of the benefit or profit in money,

property or services actually received; or (B) to the extent that a judgment or other final adjudication adverse to the Person is entered in a proceeding based on a finding in the proceeding that the Person’s action, or failure to act, was the

result of active and deliberate dishonesty and was material to the cause of action adjudicated in the proceeding; or (C) to the extent otherwise provided by the MGCL. If the MGCL is amended to further eliminate or limit the personal liability of

officers and directors, then the personal liability of officers and directors of the Corporation shall be eliminated or limited to the fullest extent permitted by the MGCL, as so amended.

Any repeal or modification of the foregoing paragraph by the stockholders of the Corporation shall not adversely affect any right or protection of a director or officer of the Corporation

existing at the time of such repeal or modification.

Item 7. Exemption From Registration Claimed.

Not applicable.

Item 8. List of Exhibits.

|

Regulation S-K

Exhibit Number

|

|

Document

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

The undersigned registrant hereby undertakes:

1. To file, during any period in which offers or sales are

being made, a post-effective amendment to the Registration Statement:

(i) to include any prospectus required by Section 10(a)(3) of

the Securities Act;

(ii) to reflect in the prospectus any facts or events arising

after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement.

Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum

offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) (section 230.424(b)) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering

price set forth in the “Calculation of Registration Fees” table in the effective registration statement;

(iii) to include any material information with respect to the

plan of distribution not previously disclosed in this Registration Statement or any material change to such information in this Registration Statement;

provided, however, that paragraphs 1(i) and 1(ii) above do not apply if the information required to be included in a post-effective amendment by these paragraphs is contained in reports filed with

or furnished to the Commission by the Company pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement.

2. That, for the purpose of determining any liability under the

Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof;

3. To remove from registration by means of a post-effective

amendment any of the securities being registered which remain unsold at the termination of the offering;

4. That, for purposes of determining any liability under the

Securities Act, each filing of the registrant's annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan's annual report pursuant to Section 15(d) of the Exchange Act) that

is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide

offering thereof; and

5. Insofar as indemnification for liabilities arising under the

Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Commission such indemnification is against

public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer

or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be

governed by the final adjudication of such issue.

SIGNATURES

The Registrant. Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable

grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement on Form S-8 to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Albany, State of New

York, on May 21, 2024.

| |

|

PIONEER BANCORP, INC.

|

| |

|

|

| |

|

|

| |

By:

|

/s/ Thomas L. Amell

|

| |

|

Thomas L. Amell

|

| |

|

President and Chief Executive Officer

|

| |

|

(Duly Authorized Representative)

|

We, the undersigned directors and officers of Pioneer Bancorp, Inc. (the “Company”) hereby severally constitute and appoint Thomas L. Amell, as our true and lawful attorney and

agent, to do any and all things in our names in the capacities indicated below which said Thomas L. Amell may deem necessary or advisable to enable the Company to comply with the Securities Act and any rules, regulations and requirements of the

Securities and Exchange Commission, in connection with the registration of shares of common stock to be granted and shares of common stock to be issued upon the exercise of stock options to be granted under the Pioneer Bancorp, Inc. 2020 Equity

Incentive Plan, including specifically, but not limited to, power and authority to sign for us in our names in the capacities indicated below the registration statement and any and all amendments (including post-effective amendments) thereto; and we

hereby approve, ratify and confirm all that said Thomas L. Amell shall do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities and on the date indicated.

|

Signatures

|

|

Title

|

|

Date

|

| |

|

|

|

|

| |

|

|

|

|

| /s/ Thomas L. Amell |

|

President, Chief

|

|

May 21, 2024

|

|

Thomas L. Amell

|

|

Executive Officer and Director

|

|

|

| |

|

(Principal Executive Officer)

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| /s/ Patrick J. Hughes |

|

Executive Vice President and

|

|

May 21, 2024

|

|

Patrick J. Hughes

|

|

Chief Financial Officer (Principal Financial and Accounting Officer)

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| /s/ Dr. James K. Reed |

|

Chairman of the Board

|

|

May 21, 2024

|

|

Dr. James K. Reed

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| /s/ Eileen C. Bagnoli |

|

Director

|

|

May 21, 2024

|

|

Eileen C. Bagnoli

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| /s/ Stacey Hengsterman |

|

Director

|

|

May 21, 2024

|

|

Stacey Hengsterman

|

|

|

|

|

|

Signatures

|

|

Title

|

|

Date

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| /s/ Shaun P. Mahoney |

|

Director

|

|

May 21, 2024

|

|

Shaun P. Mahoney

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| /s/ Edward C. Reinfurt |

|

Director

|

|

May 21, 2024

|

|

Edward C. Reinfurt

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| /s/ Madeline D. Taylor |

|

Director

|

|

May 21, 2024

|

|

Madeline D. Taylor

|

|

|

|

|

EXHIBIT 5

LUSE GORMAN, PC

ATTORNEYS AT LAW

5335 WISCONSIN AVENUE, N.W., SUITE 780

WASHINGTON, D.C. 20015

TELEPHONE (202) 274-2000

FACSIMILE (202) 362-2902

www.luselaw.com

May 21, 2024

Board of Directors

Pioneer Bancorp, Inc.

652 Albany Shaker Road

Albany, New York 12211

|

Re: |

Pioneer Bancorp, Inc. - Registration Statement on Form S-8

|

Ladies and Gentlemen:

You have requested the opinion of this firm as to certain matters in connection with the registration of 1,782,068 shares of common stock, $0.01 par value per share (the “Shares”), of Pioneer

Bancorp, Inc. (the “Company”) to be issued pursuant to the Pioneer Bancorp, Inc. 2020 Equity Incentive Plan (the “Equity Plan”).

In rendering the opinion expressed herein, we have reviewed the Articles of Incorporation and Bylaws of the Company, the Equity Plan, the Company’s Registration Statement on Form S-8 (the “Form

S-8”), as well as resolutions of the board of directors of the Company and applicable statutes and regulations governing the Company. We have assumed the authenticity, accuracy and completeness of all documents in connection with the opinion

expressed herein. We have also assumed the legal capacity and genuineness of the signatures of persons signing all documents in connection with which the opinions expressed herein are rendered. This opinion is limited to matters of Maryland

corporate law.

Based on the foregoing, we are of the following opinion:

Following the effectiveness of the Form S-8, the Shares of the Company, when issued in accordance with the terms and conditions of the Equity Plan, will be legally issued, fully paid and

non-assessable.

This opinion has been prepared solely for the use of the Company in connection with the preparation and filing of the Form S-8, and shall not be used for any other purpose or relied upon by any other

person without the prior express written consent of this firm. We hereby consent to the use of this opinion in the Form S-8. By giving such consent, we do not hereby admit that we are in the category of persons whose consent is required under

Section 7 of the Securities Act of 1933, as amended.

| |

Very truly yours,

|

| |

|

| |

|

| |

/s/ Luse Gorman, PC

|

| |

LUSE GORMAN, PC

|

EXHIBIT 10.2

RESTRICTED STOCK AWARD AGREEMENT

Granted by

PIONEER BANCORP, INC.

under the

PIONEER BANCORP, INC.

2020 EQUITY INCENTIVE PLAN

This restricted stock award agreement (“Restricted

Stock Award” or “Agreement”) is and will be subject in every respect to the provisions of the 2020 Equity Incentive Plan (the “Plan”) of Pioneer Bancorp, Inc. (the “Company”)

which are incorporated herein by reference and made a part hereof, subject to the provisions of this Agreement. A copy of the Plan and related prospectus has been provided or made available to each person granted a Restricted Stock Award pursuant to

the Plan. The holder of this Restricted Stock Award (the “Participant”) hereby accepts this Restricted Stock Award, subject to all the terms and

provisions of the Plan and this Agreement, and agrees that all decisions under and interpretations of the Plan and this Agreement by the committee responsible for administering the Plan (the “Committee”) will be final, binding and conclusive upon the Participant and the Participant’s heirs, legal representatives, successors and permitted assigns. Except where the context otherwise

requires, the term “Company” will include the parent and all present and future subsidiaries of the Company as defined in Section 424(e) and 424(f) of the Internal Revenue Code of 1986, as amended from time to time (the “Code”). Capitalized terms used herein but not defined have the same meaning as in the Plan. Any reference to the “Bank” herein shall refer to Pioneer Bank.

|

1.

|

Name of Participant:______________________________________________________

|

|

2.

|

Date of Grant:______________________________________________________

|

|

3.

|

Total number of shares of Company

common stock, $0.01 par value per share, covered by the Restricted Stock Award:_____________

(subject to adjustment pursuant to Section 9 hereof).

|

|

4.

|

Vesting Schedule. Except

as otherwise provided in this Agreement, this Restricted Stock Award first becomes earned in accordance with the vesting schedule specified herein.

The Restricted Stock granted under this Agreement shall vest in five (5) equal annual installments, with the first installment vesting

on the first anniversary of the date of grant, or __________, 20__, and succeeding installments on each anniversary thereafter, through _________, 20__, subject to accelerated vesting under Section 8 and 10 of this Agreement. To the

extent the Restricted Stock awarded are not equally divisible by “5,” any excess Restricted Stock shall vest on _________, 20__.

Vesting will automatically accelerate pursuant to Sections 2.9 and 4.1 of the Plan (in the event of death, Disability or Involuntary

Termination at or following a Change in Control).

|

| 5. |

Grant of Restricted Stock Award.

The Restricted Stock Award will be in the form of issued and outstanding shares of Stock that will be either registered in the name of

the Participant and held by the Company, together with a stock power executed by the Participant in favor of the Company, pending the vesting or forfeiture of the Restricted Stock, or registered in the name of, and delivered to, the

Participant. Notwithstanding the foregoing, the Company may, in its sole discretion, issue Restricted Stock in any other format (e.g., electronically) in order to facilitate the paperless transfer of such Awards.

If certificated, the certificates evidencing the Restricted Stock Award will bear a legend restricting the transferability of the

Restricted Stock. The Restricted Stock awarded to the Participant will not be sold, encumbered hypothecated or otherwise transferred except in accordance with the terms of the Plan and this Agreement.

|

|

6.1 |

The Participant will have the right to vote the shares of Restricted Stock awarded hereunder on matters which require shareholder vote.

|

|

6.2 |

Any cash dividends or distributions declared with respect to shares of Stock subject to the Restricted Stock Award will be retained and distributed to the Participant

within thirty (30) days after the Restricted Stock vests. If the Restricted Stock does not vest, the dividends will be forfeited by the Participant. Any stock dividends declared on shares of Stock subject to a Restricted Stock Award will be

subject to the same restrictions and will vest at the same time as the shares of Restricted Stock from which said dividends were derived

.

|

| 7. |

Delivery of Shares.

Delivery of shares of Stock under this Restricted Stock Award will comply with all applicable laws (including, the requirements of the Securities Act), and the

applicable requirements of any securities exchange or similar entity.

|

|

8.1 |

In the event of an Involuntary Termination at or following a Change in Control, all Restricted Stock Awards held by the Participant will become fully vested.

|

|

8.2 |

A “Change in Control” will be deemed to have occurred as provided

in Section 4.2 of the Plan.

|

| 9. |

Adjustment Provisions.

This Restricted Stock Award, including the number of shares subject to the Restricted Stock Award, will be adjusted upon the occurrence of the events specified in, and in accordance with the provisions of, Section 3.4 of the Plan.

|

| 10. |

Effect of Termination of Service on Restricted Stock Award.

|

10.1 This Restricted Stock Award will vest as follows:

|

(i)

|

Death. In the event of the Participant’s

Termination of Service by reason of the Participant’s death, all Restricted Stock will vest as to all shares subject to an outstanding Award, whether or not then vested, at the date of Termination of Service.

|

|

(ii)

|

Disability. In the event of the Participant’s Termination of Service by reason of Disability, all Restricted Stock

will vest as to all shares subject to an outstanding Award, whether or not then vested, at the date of Termination of Service.

|

|

(iii)

|

Retirement. In the event of the

Participant’s Termination of Service by reason of the Participant’s Retirement, any Restricted Stock that has not vested as of the date of Termination of Service will expire and be forfeited. The term “Retirement” shall have the meaning

set forth in Section 8.1(aa) of the Plan.

|

|

(iv)

|

Termination for Cause. If the Participant’s Service has been terminated for Cause, all Restricted Stock granted to a Participant that has not vested will be

forfeited.

|

|

(v)

|

Other Termination. If a Participant terminates Service for any reason other than due to death, Disability, Involuntary Termination at or following a Change in Control, all

shares of Restricted Stock awarded to the Participant which have not vested as of the date of Termination of Service will be forfeited.

|

|

11.1 |

No Restricted Stock Award will confer upon the Participant any rights as a stockholder of the Company prior to the date on which the individual fulfills all conditions

for receipt of such rights.

|

|

11.2 |

This Agreement may not be amended or otherwise modified unless evidenced in writing and signed by the Company and the Participant.

|

|

11.3 |

Restricted Stock Awards are not transferable prior to the time such Awards vest in the Participant.

|

|

11.4 |

This Restricted Stock Award will be governed by and construed in accordance with the laws of the State of New York.

|

|

11.5 |

This Restricted Stock Award is subject to all laws, regulations and orders of any governmental authority which may be applicable thereto and, notwithstanding any of the

provisions hereof, the Company will not be obligated to issue any shares of stock hereunder if the issuance of such shares would constitute a violation of any such law, regulation or order or any provision thereof.

|

[Signature page follows]

IN WITNESS WHEREOF, the Company has caused this Agreement to be executed in its name and on its behalf as of the date of grant of

this Restricted Stock Award set forth above.

PIONEER BANCORP, INC.

By:__________________________

Its: __________________________

PARTICIPANT’S ACCEPTANCE

The undersigned hereby accepts the foregoing Restricted Stock Award and agrees to the terms and conditions hereof, including the terms

and provisions of the 2020 Equity Incentive Plan. The undersigned hereby acknowledges receipt of a copy of the Company’s 2020 Equity Incentive Plan.

PARTICIPANT

____________________________

5

EXHIBIT 10.3

INCENTIVE STOCK OPTION

Granted by

PIONEER BANCORP, INC.

under the

PIONEER BANCORP, INC.

2020 EQUITY INCENTIVE PLAN

This incentive stock option agreement (“Option”

or “Agreement”) is and will be subject in every respect to the provisions of the 2020 Equity Incentive Plan (the “Plan”) of Pioneer Bancorp, Inc. (the “Company”) which are incorporated

herein by reference and made a part hereof, subject to the provisions of this Agreement. A copy of the Plan and related prospectus has been provided or made available to each person granted a stock option pursuant to the Plan. The holder of this

Option (the “Participant”) hereby accepts this Option, subject to all the terms and provisions of the Plan and this Agreement, and agrees that all

decisions under and interpretations of the Plan and this Agreement by the committee responsible for administering the Plan (the “Committee”) will

be final, binding and conclusive upon the Participant and the Participant’s heirs, legal representatives, successors and permitted assigns. Except where the context otherwise requires, the term “Company” will include the parent and all present and

future subsidiaries of the Company as defined in Section 424(e) and 424(f) of the Internal Revenue Code of 1986, as amended from time to time (the “Code”).

Capitalized terms used herein but not defined have the same meaning as in the Plan. Any reference to the “Bank” herein shall refer to Pioneer Bank.

| 1. |

Name of Participant:_________________________________

|

| 2. |

Date of Grant:_________________________________

|

|

3.

|

Total number of shares of Company

common stock, $0.01 par value per share, that may be acquired pursuant to this Option:

(subject to adjustment pursuant to Section 10 hereof).

|

|

•

|

This is an Incentive Stock Option (“ISO”) to

the maximum extent permitted under Code Section 422(d).

|

| 4. |

Exercise price per share:_________________________________

(subject to adjustment pursuant to Section 10 below)

|

| 5. |

Expiration Date of Option:_________________________________

|

| 6. |

Vesting Schedule. Except as otherwise provided in this

Agreement, this Option first becomes exercisable, subject to the Option’s expiration date, in accordance with the vesting schedule specified herein.

|

The Options granted under this Agreement shall vest in five (5) equal annual installments, with the first installment becoming

exercisable on the first anniversary of the date of grant, or ________, 20__, and succeeding installments on each anniversary thereafter, through ________, 20__. To the extent the Options awarded to me are not equally divisible by “5,” any excess

Options shall vest on ________, 20__.

This Option may not be exercised at any time on or after the Option’s expiration date. Vesting will automatically accelerate pursuant

to Sections 2.9 and 4.1 of the Plan (in the event of death or Disability or Involuntary Termination at or following a Change in Control).

|

7.1 |

Delivery of Notice of Exercise of Option. This Option will be

exercised in whole or in part by the Participant’s delivery to the Company of written notice (the “Notice of Exercise of Option” attached

hereto as Exhibit A or a similar form provided by the Company) setting forth the number of shares with respect to which this Option is to be exercised, together with payment by cash or other means acceptable to the Committee, including:

|

|

•

|

Cash or personal, certified or cashier’s check in full/partial payment of the purchase price.

|

|

•

|

Stock of the Company in full/partial payment of the purchase price.

|

|

•

|

By a net settlement of the Option, using a portion of the shares obtained on exercise in payment of the exercise price of the Option (and, if

applicable, any tax withholding).

|

|

•

|

By selling shares from my Option shares through a broker in full/partial payment of the purchase price.

|

In order to exercise the Option, please deliver the Notice of Exercise and payment (if applicable) to the Company at the following

address:

Pioneer Bancorp, Inc.

652 Albany Shaker Road

Albany, New York 12211

Attention: Susan Hollister

|

7.2 |

“Fair Market Value” shall have the meaning set forth in Section

8.1(p) of the Plan.

|

|

8.1 |

Delivery of Shares. Delivery of shares of Stock upon the

exercise of this Option will comply with all applicable laws (including the requirements of the Securities Act) and the applicable requirements of any securities exchange or similar entity.

|

|

9.1 |

In the event of an Involuntary Termination at or following a Change in Control, all Options held by the Participant, whether or not exercisable at such time, will

become fully exercisable and will remain exercisable for one (1) year following the Involuntary Termination, subject to the expiration provisions otherwise applicable to the Option.

|

|

9.2 |

A “Change in Control” will be deemed to have occurred as provided

in Section 4.2 of the Plan.

|

| 10. |

Adjustment Provisions.

This Option, including the number of shares subject to the Option and the exercise price, will be adjusted upon the occurrence of the events specified in, and in

accordance with the provisions of Section 3.4 of the Plan.

|

| 11. |

Termination of Option and Accelerated Vesting.

This Option will terminate upon the expiration date, except as set forth in the following provisions:

|

|

(i)

|

Death. This Option will become

exercisable as to all shares subject to an outstanding Award, whether or not then exercisable, in the event of the Participant’s Termination of Service by reason of the Participant’s death. This Option may thereafter be exercised by the

Participant’s legal representative or beneficiaries for a period of one (1) year from the date of death, subject to termination on the expiration date of this Option, if earlier. In order for the Options to have ISO treatment, the

Participant’s death must have occurred while employed or within three (3) months of Termination of Service.

|

|

(ii)

|

Disability. This Option will become

exercisable as to all shares subject to an outstanding Award, whether or not then exercisable, in the event of the Participant’s Termination of Service by reason of the Participant’s Disability. This Option may thereafter be exercised for a

period of one (1) year from the date of such Termination of Service by reason of Disability, subject to termination on the Option’s expiration date, if earlier.

|

|

(iii)

|

Retirement. Vested Options may be

exercised for a period of one (1) year from the date of Termination of Service by reason of Retirement, subject to termination on the Option’s expiration date, if earlier (and, for purposes of clarity, non-vested Options will be forfeited

on the date of Termination of Service by reason of Retirement). The term “Retirement” shall have the meaning set forth in Section 8.1(aa) of the Plan. Options exercised more than three months following Retirement will not have ISO

treatment.

|

|

(iv)

|

Termination for Cause. If the Participant’s Service has terminated for Cause, all Options that have not been exercised will expire and be forfeited.

|

|

(v)

|

Other Termination. If the Participant’s Service terminates for any reason other than due to death, Disability, Retirement, Involuntary Termination following a Change in

Control or Cause, all unvested Options will be forfeited and vested Options may thereafter be exercised, to the extent it was exercisable at the time of such termination, for a period of three (3) months following termination, subject to

termination on the Option’s expiration date, if earlier.

|

|

12.1 |

No Option will confer upon the Participant any rights as a stockholder of the Company prior to the date on which the individual fulfills all conditions for receipt of

such rights.

|

|

12.2 |

This Agreement may not be amended or otherwise modified unless evidenced in writing and signed by the Company and the Participant.

|

|

12.3 |

Except as otherwise provided by the Committee, ISOs under the Plan are not transferable except (1) as designated by the Participant by will or by the laws of descent

and distribution, (2) to a trust established by the Participant, or (3) between spouses incident to a divorce or pursuant to a domestic relations order, provided, however, that in the case of a transfer described under (3), the Option will

not qualify as an ISO as of the day of such transfer.

|

|

12.4 |

This Agreement will be governed by and construed in accordance with the laws of the State of New York.

|

|

12.5 |

This Agreement is subject to all laws, regulations and orders of any governmental authority which may be applicable thereto and, notwithstanding any of the provisions

hereof, the Participant agrees that he will not exercise the Option granted hereby nor will the Company be obligated to issue any shares of stock hereunder if the exercise thereof or the issuance of such shares, as the case may be, would

constitute a violation by the Participant or the Company of any such law, regulation or order or any provision thereof.

|

|

12.6 |

The granting of this Option does not confer upon the Participant any right to be retained in the employ of the Company or any subsidiary.

|

IN WITNESS WHEREOF, the Company has caused this Agreement to be executed in its name and on its behalf as of the

date of grant of this Option set forth above.

PIONEER BANCORP, INC.

By:____________________________

Its: ____________________________

PARTICIPANT’S ACCEPTANCE

The undersigned hereby accepts the foregoing Option and agrees to the terms and conditions hereof, including the

terms and provisions of the 2020 Equity Incentive Plan. The undersigned hereby acknowledges receipt of a copy of the Company’s 2020 Equity Incentive Plan.

PARTICIPANT

_________________________________

EXHIBIT A

NOTICE OF EXERCISE OF OPTION

I hereby exercise the stock option (the “Option”) granted to me by Pioneer Bancorp, Inc. (the “Company”) or its affiliate, subject to

all the terms and provisions set forth in the Stock Option Agreement (the “Agreement”) and the Pioneer Bancorp, Inc. 2020 Equity Incentive Plan (the “Plan”) referred to therein, and notify you of my desire to purchase __________________ shares of

common stock of the Company (“Common Stock”) for a purchase price of $______ per share.

I elect to pay the exercise price by:

|

___ |

Cash or personal, certified or cashier’s check in the sum of $_______, in full/partial payment of the purchase price.

|

|

___ |

Stock of the Company with a fair market value of $______ in full/partial payment of the purchase price.*

|

|

___ |

A net settlement of the Option, using a portion of the shares obtained on exercise in payment of the exercise price of the Option (and, if applicable, any tax

withholding).

|

|

___ |

Selling ______ shares from my Option shares through a broker in full/partial payment of the purchase price.

|

I understand that after this exercise, ____________ shares of Common Stock remain subject to the Option, subject to

all terms and provisions set forth in the Agreement and the Plan.

I hereby represent that it is my intention to acquire these shares for the following purpose:

___ investment

___ resale or distribution

Please note: if your intention is to resell (or distribute within the meaning of Section 2(11) of the Securities

Act of 1933) the shares you acquire through this Option exercise, the Company or transfer agent may require an opinion of counsel that such resale or distribution would not violate the Securities Act of 1933 prior to your exercise of such Option.

Date: ____________, _____. _________________________________________

Participant’s signature

* If I elect to exercise by exchanging shares I already own, I will constructively

return shares that I already own to purchase the new option shares. If my shares are in certificate form, I must attach a separate statement indicating the certificate number of the shares I am treating as having exchanged. If the shares are held

in “street name” by a registered broker, I must provide the Company with a notarized statement attesting to the number of shares owned that will be treated as having been exchanged. I will keep the shares that I already own and treat them as if

they are shares acquired by the option exercise. In addition, I will receive additional shares equal to the difference between the shares I constructively exchange and the total new option shares that I acquire.

EXHIBIT 10.4

NON-QUALIFIED STOCK OPTION

Granted by

PIONEER BANCORP, INC.

under the

PIONEER BANCORP, INC.

2020 EQUITY INCENTIVE PLAN

This non-qualified stock option agreement (“Option” or “Agreement”) is and will be subject in every respect to the provisions of the 2020 Equity Incentive Plan (the “Plan”) of Pioneer Bancorp, Inc. (the “Company”)

which are incorporated herein by reference and made a part hereof, subject to the provisions of this Agreement. A copy of the Plan and related prospectus has been provided or made available to each person granted a stock option pursuant to the

Plan. The holder of this Option (the “Participant”) hereby accepts this Option, subject to all the terms and provisions of the Plan and this

Agreement, and agrees that all decisions under and interpretations of the Plan and this Agreement by the committee responsible for administering the Plan (the “Committee”) will be final, binding and conclusive upon the Participant and the Participant’s heirs, legal representatives, successors and permitted assigns. Except where the context otherwise requires, the term “Company” will include

the parent and all present and future subsidiaries of the Company as defined in Section 424(e) and 424(f) of the Internal Revenue Code of 1986, as amended from time to time (the “Code”). Capitalized terms used herein but not defined have the same meaning as in the Plan. Any reference to the “Bank” herein shall refer to Pioneer Bank.

|

1.

|

Name of Participant:___________________________________

|

|

2.

|

Date of Grant:___________________________________

|

|

3.

|

Total number of

shares of Company common stock, $0.01 par value per share, that may be acquired pursuant to this Option:

(subject to adjustment pursuant to Section 10 hereof).

|

|

•

|

This is a Non-Qualified Option.

|

|

4.

|

Exercise price per share:___________________________________

(subject to adjustment pursuant to Section 10 below)

|

|

5.

|

Expiration Date of Option:___________________________________

|

| 6. |

Vesting Schedule. Except as otherwise provided in this

Agreement, this Option first becomes exercisable, subject to the Option’s expiration date, in accordance with the vesting schedule specified herein.

|

The Options granted under this Agreement shall vest in five (5) equal annual installments, with the first installment becoming

exercisable on the first anniversary of the date of grant, or ________, 20__, and succeeding installments on each anniversary thereafter, through ________, 20__. To the extent the Options awarded are not equally divisible by “5,” any excess Options

shall vest on ________, 20__.

This Option may not be exercised at any time on or after the Option’s expiration date. Vesting will automatically accelerate pursuant

to Section 2.9 and 4.1 of the Plan (in the event of death or Disability or an Involuntary Termination at or following a Change in Control).

|

7.1 |

Delivery of Notice of Exercise of Option. This Option will be

exercised in whole or in part by the Participant’s delivery to the Company of written notice (the “Notice of Exercise of Option” attached

hereto as Exhibit A or a similar form provided by the Company) setting forth the number of shares with respect to which this Option is to be exercised, together with payment by cash or other means acceptable to the Committee, including:

|

|

•

|

Cash or personal, certified or cashier’s check in full/partial payment of the purchase price.

|

|

•

|

Stock of the Company in full/partial payment of the purchase price.

|

|

•

|

By a net settlement of the Option, using a portion of the shares obtained on exercise in payment of the exercise price of the Option (and, if

applicable, any tax withholding).

|

|

•

|

By selling shares from my Option shares through a broker in full/partial payment of the purchase price.

|

In order to exercise the Option, please deliver the Notice of Exercise and payment (if applicable) to the Company at the following

address:

Pioneer Bancorp, Inc.

652 Albany Shaker Road

Albany, New York 12211

Attention: Susan Hollister

|

7.2 |

“Fair Market Value” shall have the meaning set forth in Section

8.1(p) of the Plan.

|

|

8.1 |

Delivery of Shares. Delivery of shares of Stock upon the

exercise of this Option will comply with all applicable laws (including the requirements of the Securities Act) and the applicable requirements of any securities exchange or similar entity.

|

|

9.1 |

In the event of an Involuntary Termination at or following a Change in Control, all Options held by the Participant, whether or not exercisable at such time, will

become fully exercisable and will remain exercisable for one (1) year following the Involuntary Termination, subject to the expiration provisions otherwise applicable to the Option.

|

|

9.2 |

A “Change in Control” will be deemed to have occurred as provided

in Section 4.2 of the Plan.

|

| 10. |

Adjustment Provisions.

|

This Option, including the number of shares subject to the Option and the exercise price, will be adjusted upon

the occurrence of the events specified in, and in accordance with the provisions of Section 3.4 of the Plan.

| 11. |

Termination of Option and Accelerated Vesting.

|

This Option will terminate upon the expiration date, except as set forth in the following provisions:

|

(i)

|

Death. This Option will become

exercisable as to all shares subject to an outstanding Award, whether or not then exercisable, in the event of the Participant’s Termination of Service by reason of the Participant’s death. This Option may thereafter be exercised by the

Participant’s legal representative or beneficiaries for a period of one (1) year from the date of death, subject to termination on the expiration date of this Option, if earlier.

|

|

(ii)

|

Disability. This Option will become

exercisable as to all shares subject to an outstanding Award, whether or not then exercisable, in the event of the Participant’s Termination of Service by reason of the Participant’s Disability. This Option may thereafter be exercised for a

period of one (1) year from the date of such Termination of Service by reason of Disability, subject to termination on the Option’s expiration date, if earlier.

|

|

(iii)

|

Retirement. Vested Options may be

exercised for a period of one (1) year from the date of Termination of Service by reason of Retirement, subject to termination on the Option’s expiration date, if earlier (and, for purposes of clarity, non-vested Options will be forfeited

on the date of Termination of Service by reason of Retirement). The term “Retirement” shall have the meaning set forth in Section 8.1(aa) of the Plan.

|

|

(iv)

|

Termination for Cause. If the Participant’s Service has been terminated for Cause, all Options that have not been exercised will expire and be forfeited.

|

|

(v)

|

Other Termination. If the Participant’s Service terminates for any reason other than due to death, Disability, Retirement, Involuntary Termination following a Change in

Control or Cause, all unvested Options will be forfeited and vested Options may thereafter be exercised, to the extent it was exercisable at the time of such termination, for a period of three (3) months following termination, subject to

termination on the Option’s expiration date, if earlier.

|

12. Miscellaneous.

|

12.1 |

No Option will confer upon the Participant any rights as a stockholder of the Company prior to the date on which the individual fulfills all conditions for receipt of

such rights.

|

|

12.2 |

This Agreement may not be amended or otherwise modified unless evidenced in writing and signed by the Company and the Participant.

|

|

12.3 |

At the discretion of the Committee, a non-qualified Option granted under the Plan may be transferable by the Participant, provided, however, that such transfers will be

limited to Immediate Family Members of Participants, trusts and partnerships established for the primary benefit of such family members or to charitable organizations, and provided, further, that such transfers are not made for consideration

to the Participant.

|

|

12.4 |

This Agreement will be governed by and construed in accordance with the laws of the State of New York.

|

|

12.5 |

This Agreement is subject to all laws, regulations and orders of any governmental authority which may be applicable thereto and, notwithstanding any of the provisions

hereof, the Participant agrees that he will not exercise the Option granted hereby nor will the Company be obligated to issue any shares of stock hereunder if the exercise thereof or the issuance of such shares, as the case may be, would

constitute a violation by the Participant or the Company of any such law, regulation or order or any provision thereof.

|

|

12.6 |

The granting of this Option does not confer upon the Participant any right to be retained in the service of the Company or any subsidiary.

|

IN WITNESS WHEREOF, the Company has caused this Agreement to be executed in its name and on its behalf as of the

date of grant of this Option set forth above.

PIONEER BANCORP, INC.

By:______________________________

Its: ______________________________

PARTICIPANT’S ACCEPTANCE

The undersigned hereby accepts the foregoing Option and agrees to the terms and conditions hereof, including the

terms and provisions of the 2020 Equity Incentive Plan. The undersigned hereby acknowledges receipt of a copy of the Company’s 2020 Equity Incentive Plan.

PARTICIPANT

_________________________________

EXHIBIT A

NOTICE OF EXERCISE OF OPTION

I hereby exercise the stock option (the “Option”) granted to me by Pioneer Bancorp, Inc. (the “Company”) or its affiliate, subject to

all the terms and provisions set forth in the Stock Option Agreement (the “Agreement”) and the Pioneer Bancorp, Inc. 2020 Equity Incentive Plan (the “Plan”) referred to therein, and notify you of my desire to purchase __________________ shares of

common stock of the Company (“Common Stock”) for a purchase price of $______ per share.

I elect to pay the exercise price by:

|

___ |

Cash or personal, certified or cashier’s check in the sum of $_______, in full/partial payment of the purchase price.

|

|

___ |

Stock of the Company with a fair market value of $______ in full/partial payment of the purchase price.*

|

|

___ |

A net settlement of the Option, using a portion of the shares obtained on exercise in payment of the exercise price of the Option (and, if applicable, any tax

withholding).

|

|

___ |

Selling ______ shares from my Option shares through a broker in full/partial payment of the purchase price.

|

I understand that after this exercise, ____________ shares of Common Stock remain subject to the Option, subject to

all terms and provisions set forth in the Agreement and the Plan.

I hereby represent that it is my intention to acquire these shares for the following purpose:

___ investment

___ resale or distribution

Please note: if your intention is to resell (or distribute within the meaning of Section 2(11) of the Securities

Act of 1933) the shares you acquire through this Option exercise, the Company or transfer agent may require an opinion of counsel that such resale or distribution would not violate the Securities Act of 1933 prior to your exercise of such Option.

Date: ____________, _____. _________________________________________

Participant’s signature

* If I elect to exercise by exchanging shares I already own, I will constructively

return shares that I already own to purchase the new option shares. If my shares are in certificate form, I must attach a separate statement indicating the certificate number of the shares I am treating as having exchanged. If the shares are held

in “street name” by a registered broker, I must provide the Company with a notarized statement attesting to the number of shares owned that will be treated as having been exchanged. I will keep the shares that I already own and treat them as if

they are shares acquired by the option exercise. In addition, I will receive additional shares equal to the difference between the shares I constructively exchange and the total new option shares that I acquire.

EXHIBIT 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated September 26, 2023, relating to the consolidated financial statements for the two years ended June 30,

2023, which appear in the Annual Report on Form 10-K of Pioneer Bancorp, Inc.

/s/ Bonadio & Co., LLP

Pittsford, New York

May 21, 2024

EXHIBIT 107

Calculation of Filing Fee Tables

Form S-8

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount to be Registered(1)

|

Proposed Maximum Aggregate Offering Price Per Share(2)

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

|

Equity

|

Common stock, $0.01 par value per share

|

457(c) and 457(h)

|

1,782,068

|

$9.16

|

$16,323,742.88

|

0.00014760

|

$2,409.38

|

|

Total Offering Amounts

|

|

$16,323,742.88

|

|

$2,409.38

|

|

Total Fee Offsets

|

|

|

|

$0.00

|

|

Net Fee Due

|

|

|

|

$2,409.38

|

___________________________________________

|

(1)

|

Together with an indeterminate number of additional shares that may be necessary to adjust the number of shares reserved for issuance pursuant to

the Pioneer Bancorp, Inc. 2020 Equity Incentive Plan as a result of a stock split, stock dividend or similar adjustment of the outstanding common stock of Pioneer Bancorp, Inc. (the “Company”) pursuant to 17 C.F.R. Section 230.416(a).

|

|

(2)

|

The proposed maximum offering price per share of $9.16 is estimated

solely for the purpose of calculating the registration fee pursuant to Rules 457(c) and 457(h) under the Securities Act and is based upon the average of the high and low prices per share of the Company’s common stock as reported on the Nasdaq Stock Market on May 15, 2024.

|

Table 2: Fee Offset Claims and Sources

N/A

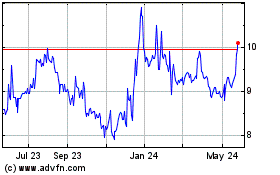

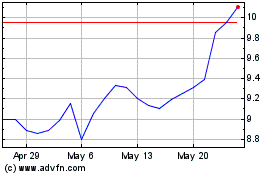

Pioneer Bancorp (NASDAQ:PBFS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Pioneer Bancorp (NASDAQ:PBFS)

Historical Stock Chart

From Mar 2024 to Mar 2025