Correction – Pineapple Energy Highlights Market Factors That Shaped Financial Performance in Recent Months

27 August 2024 - 11:53AM

In a release issued under the same headline earlier today by

Pineapple Energy Inc. (Nasdaq: PEGY), please note that the figures

in Highlights from Pineapple’s New York Subsidiary SUNation and

Pineapple Energy’s financial highlights in Q2 have been amended.

The corrected release follows:

Pineapple Energy Inc. (Nasdaq: PEGY) (Pineapple

Energy) (“Pineapple” or the “Company”), a leading provider of

sustainable solar energy and backup power to households,

businesses, municipalities and for servicing existing systems, is

providing an update on the performance of its ongoing business

activities, with the goal of giving context to the Company’s

recently filed earnings report.

“Our results for the second quarter of 2024 reflected the

lingering impact of certain industry-specific headwinds that have

affected the renewable energy sector across the United States,”

said Scott Maskin, Interim CEO of Pineapple. “These headwinds –

which masked progress across various aspects of our operations -

are beginning to diminish,” Maskin said.

“While we are not satisfied with some of the metrics captured

within our recently filed earnings statement, including seeing some

disappointing news in the performance of our battery attachment

rate within our Hawaii business as the Battery Bonus Program is in

redesign at the utility and state level, and the delayed start to

projects within our commercial pipelines of our New York business,

some of these factors have already, or are likely to, abate as of

writing.”

“We also incurred cash and non-cash charges and expenses related

to our ongoing corporate restructuring efforts, as well as charges

and valuation adjustments related to previously issued debt and

equity instruments. We fully expect that the second half of the

year, notably on the commercial side of the business, will show

marked improvement when compared to the first six months of 2024.

Over time, our recent and continuing restructuring efforts across

Q2 will bear fruit as overhead is reduced, and OpEx is driven

lower,” Maskin added.

Mr. Maskin noted that the performance at SUNation, Pineapple’s

New York subsidiary, produced favorable comparisons in several key

regional metrics during the first six months of 2024 compared to

the same period last year, as well as in comparison to the full

year 2023.

Highlights from Pineapple’s New York Subsidiary SUNation

include:

- SUNation systems sold up 22% year

over year

- Overall kilowatts (KW) sold, up 21%

year over year

- Systems sold via client referrals,

up 19% year over year

- Total invoice value per sale, up 11%

year over year

- Overall client acquisition cost

(CAC), down 4% year over year

- Operating expenses, down $553k

year over year

Mr. Maskin continued, “Our commercial and industrial solar

projects often take longer to materialize when compared to our

residential work, as was reflected in our results for the first

half of the year. A number of material commercial projects that had

been delayed in the first half of 2024 are now fully underway and

the positive financial impact of these projects on our financial

results should start to be reflected beginning in the third

quarter. Our efforts to diversify our revenues via a mix of

business is also evolving in a positive manner, as evidenced by a

46% increase in commercial contract sales during the second quarter

when compared to the same period last year.”

“These figures highlight the opportunity within this growing

segment of our business, as well as the volatility of the

pipelines.”

Overall, Pineapple Energy’s financial highlights in Q2

included:

- Quarterly Revenues of $13,549,420

- Operating expenses decreased 20% from Q2 2023

- Gross Profit decreased 33% from Q2 2023

- Operating losses increased 43% from Q2 2023

Pineapple's complete financial performance for the second

quarter of 2024 can be found in our quarterly report on form 10-Q

here.

“I’m incredibly thankful to our shareholders for their constant

notes of encouragement and arming me with the tools necessary to

address the industry pressures affecting our Company,” Mr. Maskin

continued stated. “The increased share authorization announced in

July provides the Company with the opportunity to potentially

access the capital markets to fund our future growth initiatives,

with a focus on acquiring the best regional solar companies in the

industry,” he noted. “The authorization also had a material

positive impact on the accounting for certain outstanding debt and

capital instruments, with these changes likely to be reflected in

our third quarter results and future periods.”

“As a veteran in the solar space, my team and I have capitalized

through the highest peaks of the “solar coaster” and have sustained

our position through the absolute lowest points. We are laser

focused on cleaning up every single obstruction that is preventing

us from executing on our corporate strategy. We remain committed to

elevating our corporate governance, aligning our operations, and

refining our strategy to most effectively and efficiently address

the significant long-term market opportunities we believe exist in

our industry. The reimagined Pineapple Energy comes with amazing

new board members, corporate leadership changes, OpEx reductions,

and capital stack modifications.”

“What will never change is our dedication to you our

shareholders, our employees, and our customers. We believe that

Pineapple Energy is uniquely positioned to emerge as a national

industry leader. I have never been more excited about the future

and our place in it.”

Forward Looking Statements

This press release includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements regarding future financial

performance, future growth, and future opportunities. These

statements are based on Pineapple Energy’s current expectations or

beliefs and are subject to uncertainty and changes in

circumstances. Actual results may vary materially from those

expressed or implied by the statements here due to changes in

economic, business, competitive or regulatory factors, and other

risks and uncertainties, set forth in the company’s filings with

the Securities and Exchange Commission. The forward-looking

statements in this press release speak only as of the date of this

press release. Pineapple Energy does not undertake any obligation

to update or revise these forward-looking statements for any

reason, except as required by law.

About Pineapple Energy

Pineapple is focused on growing leading local and regional

solar, storage, and energy services companies nationwide. Our

vision is to power the energy transition through grass-roots growth

of solar electricity paired with battery storage. Our portfolio of

brands (SUNation Energy, Hawaii Energy Connection, E-Gear) provide

those within the Residential and Commercial sectors an end-to-end

product offering spanning solar, battery storage, and grid

services.

Contacts:Scott MaskinInterim Chief Executive Officer+1 (631)

823-7131SMaskin@sunation.com

Pineapple Investor RelationsIR@pineappleenergy.com

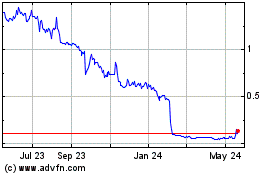

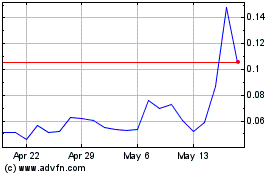

Pineapple Energy (NASDAQ:PEGY)

Historical Stock Chart

From Dec 2024 to Dec 2024

Pineapple Energy (NASDAQ:PEGY)

Historical Stock Chart

From Dec 2023 to Dec 2024