false000183559700018355972023-08-082023-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 08, 2023 |

PepGen Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41374 |

85-3819886 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

321 Harrison Avenue 8th Floor |

|

Boston, Massachusetts |

|

02118 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 781 797-0979 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $0.0001 per share |

|

PEPG |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2023, PepGen Inc. announced its financial results for the quarter ended June 30, 2023 and other business updates. A copy of the press release is furnished as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibit relating to Item 2.02 of this Form 8-K shall be deemed to be furnished and not filed:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

PEPGEN INC. |

|

|

|

|

Date: |

August 8, 2023 |

By: |

/s/ Noel Donnelly |

|

|

|

Noel Donnelly, Chief Financial Officer |

PepGen Reports Second Quarter 2023 Financial Results and Recent Corporate Developments

– Phase 2 open-label CONNECT1-EDO51 study open in Canada –

– Potentially registrational, randomized, double-blind, placebo-controlled Phase 2 CONNECT2-EDO51 multinational study expected to be initiated in the second half of 2023 –

– Continue to pursue global strategy of initiating FREEDOM-EDODM1 clinical study in geographies outside the U.S. –

– Continue to work closely with FDA to lift the clinical hold and initiate the Phase 1 FREEDOM-EDODM1 study in the U.S. as quickly as feasible –

– Ended second quarter 2023 with cash and cash equivalents of $147.0 million; cash runway expected into 2025 –

BOSTON, August 8, 2023 (GLOBE NEWSWIRE) -- PepGen Inc. (Nasdaq: PEPG), a clinical-stage biotechnology company advancing the next generation of oligonucleotide therapies with the goal of transforming the treatment of severe neuromuscular and neurological diseases, today reported financial results for the second quarter ended June 30, 2023 and highlighted recent corporate developments.

“PepGen continues to make strong progress across our pipeline of clinical and pre-clinical stage conjugated oligonucleotide therapies for neuromuscular and neurological diseases," said James McArthur, Ph.D., President and CEO of PepGen. “We continue to expect to report, from the CONNECT1 study, initial dystrophin production, exon skipping and safety data following 4 monthly doses of PGN-EDO51 in mid-2024. Learnings from this study will inform a planned global randomized clinical trial, designated CONNECT2, designed to support a potential accelerated or conditional approval pathway, subject to alignment with regulatory authorities.”

Dr. McArthur added, “In parallel we continue to pursue our global strategy of opening our Phase 1 FREEDOM-EDODM1 study as well, and we continue to work closely with the FDA to address their questions regarding our IND for PGN-EDODM1 and lift the clinical hold in the U.S. as quickly as feasible.”

Recent Corporate Highlights

•The Company is pursuing a global strategy of initiating its Phase 1 FREEDOM-EDODM1 study of PGN-EDODM1 in patients with myotonic dystrophy type 1 (DM1) in multiple geographies, pending alignment with regulatory authorities.

•In May 2023, PepGen announced that it received a clinical hold notice from FDA regarding its Investigational New Drug Application (IND) to initiate a Phase 1 study of PGN-EDODM1 in patients with DM1. PepGen is working closely with the FDA to lift this hold in the U.S. as quickly as possible.

•In May 2023, PepGen participated in three oral presentations at the 5th Annual RNATx Symposium discussing first in human results from PGN-EDO51, at the Meet the Drug Developers Webinar Series, and at the American Society of Cell and Gene Therapy Conference. PepGen also participated in a Defeat Duchenne Canada webinar discussing PGN-EDO51.

Anticipated Upcoming Milestones

PGN-EDO51: PepGen continues to anticipate dosing patients in CONNECT1-EDO51, an open-label, multiple ascending dose (MAD) Phase 2 study in Canada, in the second half of 2023 and also initiating CONNECT2-EDO51, a Phase 2 multinational, randomized, double-blind, placebo-controlled MAD study (RCT), in the second half of 2023.

Financial Results for the Three Months Ended June 30, 2023

•Cash and cash equivalents were $147.0 million as of June 30, 2023, which is anticipated to fund currently planned operations into early 2025.

•Research and Development expenses were $16.9 million for the three months ended June 30, 2023, compared to $14.2 million for the same period in 2022.

•General and Administrative expenses were $4.2 million for the three months ended June 30, 2023, compared to $3.4 million for the same period in 2022.

•Net loss was $19.5 million for the three months ended June 30, 2023, compared to $17.3 million for the same period in 2022. PepGen had approximately 23.8 million shares outstanding on June 30, 2023.

About PepGen

PepGen Inc. is a clinical-stage biotechnology company advancing the next-generation of oligonucleotide therapies with the goal of transforming the treatment of severe neuromuscular and neurological diseases. PepGen’s Enhanced Delivery Oligonucleotide, or EDO, platform is founded on over a decade of research and development and leverages cell-penetrating peptides to improve the uptake and activity of conjugated oligonucleotide therapeutics. Using these EDO peptides, we are generating a pipeline of oligonucleotide therapeutic candidates that are designed to target the root cause of serious diseases.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements may be identified by words such as “aims,” “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “plans,” “possible,” “potential,” “seeks,” “will,” and variations of these words or similar expressions that are intended to identify forward-looking statements. Any such statements in this press release that are not statements of historical fact may be deemed to be forward-looking statements. These forward-looking statements include, without limitation, statements regarding the potential therapeutic benefits and safety profile of our candidates, initiation and timeline of the Phase 2 studies in PGN-EDO51 and the Phase 1 study in PGN-EDODM1, our interpretation of clinical and preclinical study results and the

expected interpretation of such results by regulators, the status of regulatory communications and applications for PGN-EDO51 and PGN-EDODM1, statements about accelerated or conditional approval pathway and statements about our clinical and preclinical programs, product candidates, expected cash runway, achievement of milestones, and corporate and clinical/preclinical strategies.

Any forward-looking statements in this press release are based on current expectations, estimates and projections only as of the date of this release and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to that we may experience delays or fail to successfully initiate or complete our planned clinical trials for PGN-EDO51 and PGN-EDODM1 and preclinical studies of other product candidates or to obtain regulatory approval before commercialization for marketing of such products; our interpretation of clinical and preclinical study results may be incorrect; our product candidates may not be safe and effective; there may be delays in regulatory review, clearance to proceed or approval or changes in regulatory framework that are out of our control; we may not be able to nominate new drug candidates within the estimated timeframes; our estimation of addressable markets of our product candidates may be inaccurate; we may need additional funding before the end of our expected cash runway and may fail to timely raise such additional required funding; more efficient competitors or more effective competing treatments may emerge; we may be involved in disputes surrounding the use of our intellectual property crucial to our success; we may not be able to take advantage of certain accelerated regulatory pathways; we may not be able to attract and retain key employees and qualified personnel; earlier study results may not be predictive of later stage study outcomes; we may encounter liquidity distress due to failure of financial institutions with which we maintain relationship; disruption in financial markets may interfere with our access to cash, including our cash deposited in financial institutions, and we are dependent on third parties for some or all aspects of our product manufacturing, research and preclinical and clinical testing. Additional risks concerning PepGen’s programs and operations are described in our most recent annual report on Form 10-K on file with the SEC and quarterly report on Form 10-Q to be filed with the SEC. PepGen explicitly disclaims any obligation to update any forward-looking statements except to the extent required by law.

Investor Contact

Laurence Watts

Gilmartin Group

Laurence@gilmartinir.com

Media Contact

Sarah Sutton

Argot Partners

pepgen@argotpartners.com

Condensed Consolidated Statements of Operations

(unaudited, in thousands except share and per share amounts)

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

2023 |

|

2022 |

Operating expenses: |

|

|

|

|

Research and development |

|

$ 16,926 |

|

$ 14,240 |

General and administrative |

|

4,218 |

|

3,401 |

Total operating expenses |

|

$ 21,144 |

|

$ 17,641 |

Operating loss |

|

$ (21,144) |

|

$ (17,641) |

Other income (expense) |

|

|

|

|

Interest income |

|

1,684 |

|

250 |

Other income (expense), net |

|

(62) |

|

76 |

Total other income (expense), net |

|

1,622 |

|

326 |

Net loss before income tax |

|

$ (19,522) |

|

$ (17,315) |

Income tax expense |

|

- |

|

- |

Net loss |

|

$ (19,522) |

|

$ (17,315) |

Net loss per share, basic and diluted |

|

$ (0.82) |

|

$ (1.23) |

Weighted-average common shares outstanding, basic and diluted |

|

23,790,430 |

|

14,090,455 |

Condensed Consolidated Balance Sheets

(in thousands)

|

|

|

|

|

|

|

June 30,

2023

(unaudited) |

|

December 31,

2022 |

Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

|

$ 147,027 |

|

$ 181,752 |

Prepaid expenses and other current assets |

|

3,351 |

|

4,331 |

Total current assets |

|

$ 150,378 |

|

$ 186,083 |

Property and equipment, net |

|

$ 5,251 |

|

$ 3,335 |

Operating lease right-of-use asset |

|

24,754 |

|

26,549 |

Other assets |

|

1,702 |

|

1,473 |

Total assets |

|

$ 182,085 |

|

$ 217,440 |

Liabilities and stockholders’ equity |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

|

$ 1,815 |

|

$ 1,362 |

Accrued expenses |

|

11,629 |

|

11,913 |

Operating lease liability |

|

3,492 |

|

5,553 |

Total current liabilities |

|

$ 16,936 |

|

$ 18,828 |

Operating lease liability, net of current portion |

|

17,865 |

|

18,981 |

Total liabilities |

|

$ 34,801 |

|

$ 37,809 |

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

Preferred Stock |

|

$ — |

|

$ — |

Common stock |

|

2 |

|

2 |

Additional paid-in capital |

|

285,966 |

|

282,566 |

Accumulated other comprehensive (loss) |

|

13 |

|

(81) |

Accumulated deficit |

|

(138,697) |

|

(102,856) |

Total stockholders’ equity |

|

$ 147,284 |

|

$ 179,631 |

Total liabilities and stockholders’ equity |

|

$ 182,085 |

|

$ 217,440 |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

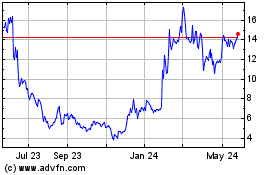

PepGen (NASDAQ:PEPG)

Historical Stock Chart

From Feb 2025 to Mar 2025

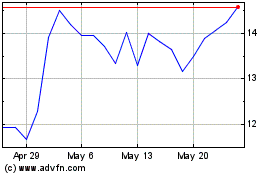

PepGen (NASDAQ:PEPG)

Historical Stock Chart

From Mar 2024 to Mar 2025