false

0001356090

0001356090

2024-08-14

2024-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 14, 2024

Precigen,

Inc.

(Exact name of registrant as specified in its

charter)

| Virginia |

|

001-36042 |

|

26-0084895 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

20374 Seneca Meadows Parkway, Germantown, Maryland

20876

(Address of principal executive offices) (Zip

Code)

(301) 556-9900

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, No Par Value |

|

PGEN |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item | 2.02. Results of Operations and Financial Condition. |

Attached as Exhibit 99.1 is a copy of a press release of Precigen,

Inc., dated August 14, 2024, reporting its financial results for the quarter ended June 30, 2024.

This information, including the Exhibit attached hereto, shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by

reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

|

Exhibit

No. |

Description |

| |

|

| 99.1 |

Press release dated August 14, 2024 |

| |

|

| 104 |

Cover Page Interactive Data File (formatted as inline XBRL with applicable taxonomy extension information contained in Exhibits 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Precigen, Inc. |

| |

|

| By: |

/s/ Donald P. Lehr |

| |

Donald P. Lehr |

| |

Chief Legal Officer |

Dated: August 14, 2024

Exhibit 99.1

Precigen Reports Second Quarter and First Half

2024 Financial Results and Business Updates

– In

June 2024, the Company announced groundbreaking pivotal study data for PRGN-2012 gene therapy at the 2024 ASCO annual meeting in which

more than half of RRP patients achieved Complete Response –

– In

July 2024, the Company appointed Phil Tennant as Chief Commercial Officer to spearhead potential PRGN-2012 commercial launch –

– In

August 2024, the Company announced a strategic reprioritization of its pipeline to focus on advancement of its lead program, PRGN-2012

in RRP –

– PRGN-2012

rolling BLA submission, under an accelerated approval pathway, is anticipated in the second half of 2024; the Company has initiated enrollment

in the confirmatory clinical trial of PRGN-2012 –

–

In August 2024, the Company strengthened its cash position by raising approximately $31.4 million via a public offering of common

stock –

GERMANTOWN, MD, August 14, 2024 –

Precigen, Inc. (Nasdaq: PGEN), a biopharmaceutical company specializing in the development of innovative gene and cell therapies to improve

the lives of patients, today announced second quarter and first half 2024 financial results and business updates.

“We are all in on PRGN-2012 given the immense

unmet need for RRP patients and our groundbreaking pivotal data supporting the potential of what we hope to be the first-ever FDA approved

therapy to treat RRP,” said Helen Sabzevari, PhD, President and CEO of Precigen. “By strategically focusing our portfolio,

streamlining resources and recent public offering, we have optimized the company to rapidly prepare for submission of a rolling biologics

license application under an accelerated approval pathway. We are excited to have initiated enrollment in the confirmatory clinical trial

and will continue to accelerate our commercial readiness campaign for a potential launch in 2025 under the leadership of our newly hired

Chief Commercial Officer. Additionally, we plan to maximize portfolio value by focusing on strategic partnerships to further advance our

highly promising UltraCAR-T programs.”

“Our recent reprioritization and public offering

is expected to fund our operations into early 2025 allowing us to focus on advancement of PRGN-2012 while continuing to explore potential

non-dilutive financing opportunities for future liquidity,” said Harry Thomasian Jr., CFO of Precigen.

Key Program Highlights

| · | PRGN-2012 AdenoVerse® Gene Therapy

in RRP: PRGN-2012 is an investigational off-the-shelf AdenoVerse gene therapy designed to elicit immune responses directed against

cells infected with human papillomavirus (HPV) 6 or HPV 11 for the treatment of recurrent respiratory papillomatosis (RRP). PRGN-2012

received Breakthrough Therapy Designation from the US Food and Drug Administration (FDA). PRGN-2012 also received Orphan Drug Designation

from the FDA and Orphan Drug Designation from the European Commission. |

| o | Results from the pivotal clinical study of PRGN-2012 for the treatment of RRP were presented at the

2024 American Society of Clinical Oncology (ASCO) annual meeting in a late-breaking oral presentation titled, “PRGN-2012, a novel

gorilla adenovirus-based immunotherapy, provides the first treatment that leads to complete and durable responses in recurrent respiratory

papillomatosis patients.” |

| § | Pivotal study met primary safety and efficacy

endpoints. |

| § | 51% (18 out of 35) of patients achieved Complete

Response, requiring no surgeries after treatment with PRGN-2012; Complete Responses have been durable beyond 12 months with median duration

of follow up of 20 months as of the May 20, 2024 data cutoff. |

| § | 86% of patients (30 out of 35) had a decrease

in surgical interventions in the year after PRGN-2012 treatment compared to the year prior to treatment; RRP surgeries reduced from a

median of 4 (range: 3-10) pre-treatment to 0 (range: 0-7) post-treatment. |

| § | PRGN-2012 was well-tolerated with no dose-limiting

toxicities and no treatment-related adverse events greater than Grade 2. |

| § | PRGN-2012 treatment induced HPV 6/11-specific

T cell responses in RRP patients with a significantly greater expansion of peripheral HPV-specific T cells in responders compared with

non-responders. |

| § | PRGN-2012 significantly (p < 0.0001) improved

Derkay and quality of life scores in complete responders. |

| o | A rolling Biologics License Application (BLA) submission under an accelerated approval pathway is anticipated

in the second half of 2024. |

| o | The Company has initiated enrollment in the confirmatory clinical trial, in accordance with the guidance

from the FDA, prior to submission of the BLA. |

| o | The Company and the Recurrent Respiratory Papillomatosis Foundation held the inaugural RRP Awareness Day

on June 11, 2024. The multi-stakeholder event raised awareness by bringing together individuals living with RRP, caregivers, clinicians,

and government officials. |

| · | Strategic Prioritization: In August 2024,

the Company announced a strategic prioritization of its clinical portfolio and associated streamlining of resources, including a reduction

of over 20% of its workforce, to focus on potential commercialization of PRGN-2012. |

| o | PRGN-2009 AdenoVerse® Gene Therapy Clinical Trials |

| § | The Company plans to continue PRGN-2009 Phase

2 clinical trials under a cooperative research and development agreement (CRADA) with the National Cancer Institute (NCI) in recurrent/metastatic

cervical cancer and in newly diagnosed HPV-associated oropharyngeal cancer. |

| § | PRGN-2009 cervical cancer clinical trial enrollment

at non-NCI clinical sites will be paused. |

| o | UltraCAR-T® Clinical Programs |

| § | The Company has completed enrollment of the Phase

1b trial for PRGN-3006 in acute myeloid leukemia (AML), which received Fast Track designation from the FDA, and is preparing for an end

of Phase 1b meeting with the FDA to discuss next steps. |

| § | The Company will pause the PRGN-3005 and PRGN-3007

clinical trials. |

| § | The Company will minimize UltraCAR-T spend and

focus on strategic partnerships to further advance UltraCAR-T programs. |

| § | The Company will pause all preclinical programs. |

| § | The Company has initiated shutdown of its Belgium-based

ActoBio subsidiary operations, including planned elimination of all ActoBio personnel. |

| § | In conjunction with this shutdown, ActoBio's portfolio

of intellectual property will be made available for prospective transactions. |

Financial Highlights

| · | Strategic prioritization resulted in non-cash

impairment charges of $32.9 million, net of tax, in the second quarter and severance

charges of $3.0 million, of which $2.1 million was recorded in the second quarter and $0.9 million is expected to be recorded in the third

quarter. |

| · | The Company closed a public offering of its common stock in August 2024, resulting

in net proceeds of approximately $31.4 million. |

Second

Quarter 2024 Financial Results Compared to Prior Year Period

Research

and development expenses increased $3.8 million, or 32%, compared to the three months ended June 30, 2023. Salaries, benefits, and other

personnel costs increased $2.1 million primarily due to severance charges related to the shutdown of the Company’s ActoBio subsidiary.

Additionally, fees paid to contract research organizations related to the start of the PRGN-2012 confirmatory clinical trial and close

out of the PRGN-2012 pivotal clinical trial activities and professional fees incurred related to our manufacturing facility readiness

for anticipated BLA submission increased compared to the same period in 2023.

SG&A

expenses increased by $1.0 million, or 11%, compared to the three months ended June 30, 2023. This increase was primarily driven by severance

costs incurred related to the suspension of ActoBio operations of $0.4 million, increased costs associated with PRGN-2012 commercial readiness

as well as increased professional fees incurred related to general corporate matters compared to the same period in 2023.

In conjunction

with the suspension of ActoBio’s operations, the Company recorded $34.5 million of impairment charges related to goodwill and other

noncurrent assets in the second quarter of 2024, as well as a related tax benefit of $1.7 million.

Total revenues

decreased $1.1 million, or 59%, compared to the three months ended June 30, 2023. This decrease was related to reductions in product and

service revenues at Exemplar.

Net loss

was $58.8 million, or $(0.23) per basic and diluted share, compared to net loss of $20.3 million, or $(0.08) per basic and diluted share,

in period ended June 30, 2023.

First

Half 2024 Financial Results Compared to Prior Year Period

Research

and development expenses increased $5.9 million, or 25%, compared to the six months ended June 30, 2023. Salaries, benefits, and other

personnel costs increased by $3.3 million primarily due to $2.1 million of severance charges related to the shutdown of the Company’s

ActoBio subsidiary and an increase in the hiring of employees related to the advancement of PRGN-2012 in 2023 at Precigen. Additionally,

fees paid to contract research organizations related to the start of the PRGN-2012 confirmatory clinical trial and close out of the PRGN-2012

pivotal clinical trial activities and professional fees incurred related to our manufacturing facility readiness for anticipated BLA submission

increased compared to the prior year period. These increases were offset by lower costs incurred at contract research organizations for

other programs compared to the same period in 2023.

SG&A

expenses decreased by $0.5 million, or 2%, compared to the six months ended June 30, 2023. This decrease was primarily due to lower stock

compensation and insurance expenses in 2024 compared to the same period in 2023. These decreases were offset by severance costs incurred

in the second quarter of 2024 related to the suspension of ActoBio’s operations, and increased costs related to PRGN-2012 commercial

readiness compared to the same period in 2023.

In conjunction

with the suspension of ActoBio’s operations, the Company recorded $34.5 million of impairment charges related to goodwill and other

noncurrent assets in the second quarter of 2024, as well as a related tax benefit of $1.7 million.

Total revenues

decreased $1.9 million, or 51%, compared to the six months ended June 30, 2023. This decrease was related to reductions in product and

service revenues at Exemplar.

Net loss

was $82.5 million, or $(0.33) per basic and diluted share, compared to net loss of $43.1 million, or $(0.18) per basic and diluted share,

in period ended June 30, 2023.

###

Precigen: Advancing Medicine with Precision™

Precigen (Nasdaq: PGEN) is a dedicated discovery

and clinical stage biopharmaceutical company advancing the next generation of gene and cell therapies using precision technology to target

the most urgent and intractable diseases in our core therapeutic areas of immuno-oncology, autoimmune disorders, and infectious diseases.

Our technologies enable us to find innovative solutions for affordable biotherapeutics in a controlled manner. Precigen operates as an

innovation engine progressing a preclinical and clinical pipeline of well-differentiated therapies toward clinical proof-of-concept and

commercialization. For more information about Precigen, visit www.precigen.com or follow us on X @Precigen, LinkedIn or YouTube.

Trademarks

Precigen, UltraCAR-T, UltraPorator, AdenoVerse,

UltraVector and Advancing Medicine with Precision are trademarks of Precigen and/or its affiliates. Other names may be trademarks

of their respective owners.

Cautionary Statement Regarding Forward-Looking

Statements

Some of the statements made in this press release

are forward-looking statements. These forward-looking statements are based upon the Company's current expectations and projections about

future events and generally relate to plans, objectives, and expectations for the development of the Company's business, including the

timing and progress of preclinical studies, clinical trials, discovery programs and related milestones, the promise of the Company's portfolio

of therapies, and in particular its CAR-T and AdenoVerse therapies. Although management believes that the plans and objectives reflected

in or suggested by these forward-looking statements are reasonable, all forward-looking statements involve risks and uncertainties and

actual future results may be materially different from the plans, objectives and expectations expressed in this press release. The Company

has no obligation to provide any updates to these forward-looking statements even if its expectations change. All forward-looking statements

are expressly qualified in their entirety by this cautionary statement. For further information on potential risks and uncertainties,

and other important factors, any of which could cause the Company's actual results to differ from those contained in the forward-looking

statements, see the section entitled “Risk Factors“ in the Company's most recent Annual Report on Form 10-K and subsequent

reports filed with the Securities and Exchange Commission.

Investor Contact:

Steven M. Harasym

Vice President, Investor Relations

Tel: +1 (301) 556-9850

investors@precigen.com

Media Contacts:

Donelle M. Gregory

press@precigen.com

Glenn Silver

Lazar-FINN Partners

glenn.silver@finnpartners.com

Precigen, Inc. and Subsidiaries

Consolidated Balance Sheets

(Unaudited)

| (Amounts in thousands) | |

June 30, 2024 | |

December 31, 2023 |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 9,345 | | |

$ | 7,578 | |

| Short-term investments | |

| 10,191 | | |

| 55,277 | |

| Receivables | |

| | | |

| | |

| Trade, net | |

| 511 | | |

| 902 | |

| Other | |

| 505 | | |

| 673 | |

| Prepaid expenses and other | |

| 3,163 | | |

| 4,325 | |

| Total current assets | |

| 23,715 | | |

| 68,755 | |

| Property, plant and equipment, net | |

| 13,451 | | |

| 7,111 | |

| Intangible assets, net | |

| 5,091 | | |

| 40,701 | |

| Goodwill | |

| 24,918 | | |

| 26,612 | |

| Right-of-use assets | |

| 5,550 | | |

| 7,097 | |

| Other assets | |

| 435 | | |

| 767 | |

| Total assets | |

$ | 73,160 | | |

$ | 151,043 | |

| Liabilities and Shareholders' Equity | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 4,846 | | |

$ | 1,726 | |

| Accrued compensation and benefits | |

| 6,675 | | |

| 8,250 | |

| Other accrued liabilities | |

| 6,642 | | |

| 6,223 | |

| Settlement and Indemnification Accrual | |

| 3,213 | | |

| 5,075 | |

| Deferred revenue | |

| 378 | | |

| 509 | |

| Current portion of lease liabilities | |

| 1,269 | | |

| 1,202 | |

| Total current liabilities | |

| 23,023 | | |

| 22,985 | |

| Deferred revenue, net of current portion | |

| 1,818 | | |

| 1,818 | |

| Lease liabilities, net of current portion | |

| 5,072 | | |

| 5,895 | |

| Deferred tax liabilities | |

| 77 | | |

| 1,847 | |

| Total liabilities | |

| 29,990 | | |

| 32,545 | |

| Shareholders' equity | |

| | | |

| | |

| Common stock | |

| — | | |

| — | |

| Additional paid-in capital | |

| 2,093,080 | | |

| 2,084,916 | |

| Accumulated deficit | |

| (2,047,001 | ) | |

| (1,964,471 | ) |

| Accumulated other comprehensive loss | |

| (2,909 | ) | |

| (1,947 | ) |

| Total shareholders' equity | |

| 43,170 | | |

| 118,498 | |

| Total liabilities and shareholders' equity | |

$ | 73,160 | | |

$ | 151,043 | |

Precigen, Inc. and Subsidiaries

Consolidated Statements of Operations

(Unaudited)

| | |

Three Months Ended | |

Six Months Ended |

| (Amounts in thousands, except share and per share data) | |

June 30, 2024 | |

June 30, 2023 | |

June 30, 2024 | |

Jun 30, 2023 |

| Revenues | |

| |

| |

| |

|

| Product revenues | |

$ | 31 | | |

$ | 324 | | |

$ | 169 | | |

$ | 648 | |

| Service revenues | |

| 673 | | |

| 1,438 | | |

| 1,592 | | |

| 2,965 | |

| Other revenues | |

| 13 | | |

| 5 | | |

| 21 | | |

| 5 | |

| Total revenues | |

| 717 | | |

| 1,767 | | |

| 1,782 | | |

| 3,618 | |

| Operating Expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of products and services | |

| 1,014 | | |

| 1,697 | | |

| 2,089 | | |

| 3,224 | |

| Research and development | |

| 15,693 | | |

| 11,874 | | |

| 29,942 | | |

| 24,037 | |

| Selling, general and administrative | |

| 10,306 | | |

| 9,316 | | |

| 20,457 | | |

| 20,954 | |

| Impairment of goodwill | |

| 1,630 | | |

| — | | |

| 1,630 | | |

| — | |

| Impairment of other noncurrent assets | |

| 32,915 | | |

| — | | |

| 32,915 | | |

| — | |

| Total operating expenses | |

| 61,558 | | |

| 22,887 | | |

| 87,033 | | |

| 48,215 | |

| Operating loss | |

| (60,841 | ) | |

| (21,120 | ) | |

| (85,251 | ) | |

| (44,597 | ) |

| Other Income (Expense), Net | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (2 | ) | |

| (136 | ) | |

| (4 | ) | |

| (460 | ) |

| Interest income | |

| 319 | | |

| 828 | | |

| 927 | | |

| 1,460 | |

| Other income, net | |

| 43 | | |

| 44 | | |

| 80 | | |

| 424 | |

| Total other income, net | |

| 360 | | |

| 736 | | |

| 1,003 | | |

| 1,424 | |

| Loss before income taxes | |

| (60,481 | ) | |

| (20,384 | ) | |

| (84,248 | ) | |

| (43,173 | ) |

| Income tax benefit | |

| 1,689 | | |

| 65 | | |

| 1,718 | | |

| 120 | |

| Net loss | |

$ | (58,792 | ) | |

$ | (20,319 | ) | |

$ | (82,530 | ) | |

$ | (43,053 | ) |

| Net Loss per share | |

| | | |

| | | |

| | | |

| | |

| Net loss per share, basic and diluted | |

$ | (0.23 | ) | |

$ | (0.08 | ) | |

$ | (0.33 | ) | |

$ | (0.18 | ) |

| Weighted average shares outstanding, basic and diluted | |

| 252,366,533 | | |

| 248,003,322 | | |

| 250,803,790 | | |

| 240,307,403 | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

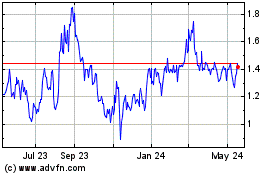

Precigen (NASDAQ:PGEN)

Historical Stock Chart

From Dec 2024 to Jan 2025

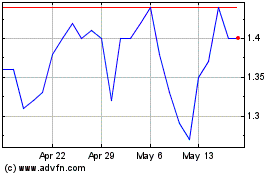

Precigen (NASDAQ:PGEN)

Historical Stock Chart

From Jan 2024 to Jan 2025