0001665300false00016653002023-11-012023-11-010001665300us-gaap:CommonStockMember2023-11-012023-11-010001665300us-gaap:WarrantMember2023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 1, 2023

PHUNWARE, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-37862 | | 30-1205798 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

1002 West Avenue, Austin, Texas | | 78701 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (512) 693-4199

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | PHUN | | The NASDAQ Capital Market |

| Warrants to purchase one share of Common Stock | | PHUNW | | The NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K (this "Report") includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These forward-looking statements are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this Report, including statements regarding our future results of operations and financial position, business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions that convey uncertainty of future events or outcomes are intended to identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Report, including estimates or projections of future costs or cash expenditures of shutting down the Company's Lyte personal computer (PC) business, are based on our current expectations and beliefs concerning future developments and their potential effects on us. Future developments affecting us may not be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) and other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors” in our filings with the Securities and Exchange Commission (the "SEC"), including our reports on Forms 10-K, 10-Q, 8-K and other filings that we make with the SEC from time to time. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. These risks and others described under “Risk Factors” may not be exhaustive.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and developments in the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this Report. In addition, even if our results of operations, financial condition and liquidity, and developments in the industry in which we operate are consistent with the forward-looking statements contained in this Report, those results or developments may not be indicative of results or developments in subsequent periods.

Item 2.05 Costs Associated with Exit or Disposal Activities.

On November 1, 2023, Phunware, Inc. (the "Company") committed to a plan to discontinue and wind down, either by sale or closing, operations of its PC manufacturing assembly business, Lyte Technology (“Lyte”). The Company expects to complete this process by the end of 2023. The Company leases Lyte’s warehouse space and such lease has a term through July 31, 2027. The Company has reached an agreement in principle with the landlord to early terminate such lease as of November 30, 2023, and expects to execute same in November 2023. As of result, the Company estimates that it will incur cash costs related to the wind down of between $0.2 million and $0.4 million. The Company currently expects these costs to be paid during November and primarily funded from proceeds from sale of Lyte’s assets. In addition, the Company currently expects to incur pre-tax, non-cash losses that could approximate up to $3.0 million during the fourth quarter of 2023.

The Company may incur additional costs or charges related to the actions described above. Although the Company cannot currently predict the amount or timing of these other charges, at this time, these additional costs or charges could be material. To the extent required by applicable rules of the SEC, in the event the Company determines that it will have additional costs or charges associated with the shutdown, it will file one or more amendments to this Current Report on Form 8-K and/or include such disclosures in future Quarterly Reports on Form 10-Q or Annual Reports on Form 10-K.

Item 2.06 Material Impairments.

The information required under this Item 2.06 is included in Item 2.05 above and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On November 1, 2023, the Company issued a press release announcing the closure of its Lyte computer business, a copy of which is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Exhibit Title |

| 99.1* | | |

| 104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) |

* Furnished herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Dated: November 7, 2023 | Phunware, Inc. |

| | |

| | By: | /s/ Troy Reisner |

| | | Troy Reisner

Chief Financial Officer |

Phunware Announces Wind Down of Lyte Technology’s Operations to Reinforce Core Mission

AUSTIN, TX, November 1, 2023 (ORIGINAL: GLOBE NEWSWIRE) – Phunware, Inc. (NASDAQ: PHUN) (the “Company”), the pioneer of patented Location Based SaaS solutions that offer the only fully integrated enterprise cloud platform for mobile that enables brands to engage, manage and monetize anyone anywhere, announced the wind down of operations of its subsidiary gaming PC Manufacturer, Lyte Technology (“Lyte”), commencing immediately, as part of its recent corporate announcement.

As previously communicated, the decision to wind down the operations of Lyte now follows an extensive and comprehensive assessment of various strategic alternatives available and may be followed by the disposition of remaining Lyte assets via a sale or otherwise.

“The choice to wind down Lyte operations follows an assessment of that business in the context of Phunware’s future direction,” said CEO Mike Snavely. “This transition is both a good financial decision in that it eliminates inventory carrying costs and operational staff expenses, reducing our cash burn by about $2MM annually. It’s also a demonstration that we’re fully invested in our enterprise software business, which has been the cornerstone of the company’s operational success. As I’ve previously indicated, our senior leadership team remains keen on elevating Phunware’s corporate profile by ensuring our resources are primarily utilized toward driving the ubiquitous adoption of Phunware technologies, both via direct and channel sales and via other strategies to monetize our IP.” Snavely concluded, “We thank Caleb Borgstrom and the Lyte Technologies team for their work over the past couple of years.”

About Phunware, Inc.

Everything You Need to Succeed on Mobile — Transforming Digital Human Experience

Phunware, Inc. (NASDAQ: PHUN), the pioneer of Location Based SaaS that offers the only fully integrated enterprise cloud platform for mobile that enables brands to engage, manage and monetize anyone anywhere. Phunware’s Software Development Kits (SDKs) include location-based services, mobile engagement, content management, messaging, advertising, loyalty (PhunCoin & PhunToken) and analytics, as well as a mobile application framework of pre-integrated iOS and Android software modules for building in-house or channel-based mobile application and vertical solutions. Phunware helps the world’s most respected brands create category-defining mobile experiences, with approximately one billion active devices touching its platform each month when operating at scale. For more information about how Phunware is transforming the way consumers and brands interact with mobile in the virtual and physical worlds, visit https://phunware.com and follow @phunware on all social media platforms.

Phunware PR & Media Inquiries:

Email: PRESS@phunware.com

Phone: (512) 693-4199

Phunware Investor Relations:

Matt Glover and John Yi

Gateway Group, Inc.

Email: PHUN@gateway-grp.com

Phone: (949) 574-3860

v3.23.3

Cover

|

Nov. 01, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 01, 2023

|

| Entity Registrant Name |

PHUNWARE, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37862

|

| Entity Tax Identification Number |

30-1205798

|

| Entity Address, Address Line One |

1002 West Avenue

|

| Entity Address, City or Town |

Austin

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78701

|

| City Area Code |

512

|

| Local Phone Number |

693-4199

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001665300

|

| Amendment Flag |

false

|

| Common Stock, par value $0.0001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

PHUN

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase one share of Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase one share of Common Stock

|

| Trading Symbol |

PHUNW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

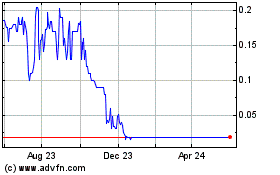

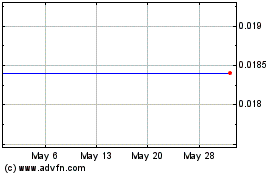

Phunware (NASDAQ:PHUNW)

Historical Stock Chart

From Apr 2024 to May 2024

Phunware (NASDAQ:PHUNW)

Historical Stock Chart

From May 2023 to May 2024