UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 12, 2023

PLUM ACQUISITION CORP. I

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-40218 |

|

98-1577353 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

201 Fillmore St. #2089, San Francisco, CA 94115

(Address of principal executive offices, including

Zip Code)

(415)683-6773

Registrant’s telephone number, including

area code

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one Class A Ordinary Share and one-fifth of one redeemable warrant |

|

PLMIU |

|

The Nasdaq Stock Market LLC |

| Class A Ordinary Shares included as part of the units |

|

PLMI |

|

The Nasdaq Stock Market LLC |

| Warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 |

|

PLMIW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation FD Disclosure

On November 12, 2023,

Plum Acquisition Corp. I (“Plum”) and Veea, Inc. (“Veea”) issued a joint press release announcing a non-binding

letter of intent for a potential business combination. The press release is furnished herewith as Exhibit 99.1.

The information contained

in this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be incorporated

by reference into any filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except

as may be expressly set forth by specific reference in such filing.

Additional Information

and Where to Find It

If a legally binding

definitive agreement with respect to the proposed business combination is executed, Plum intends to file with the U.S. Securities and

Exchange Commission (the “SEC”) a registration statement on Form S-4, which will include a preliminary proxy statement/prospectus

(the “Proxy Statement/Prospectus”). The definitive Proxy Statement/Prospectus would be mailed to Plum’s shareholders

as of a record date to be established for voting on the proposed business combination. Shareholders will also be able to obtain copies

of the Proxy Statement/Prospectus, without charge, at the SEC’s website at www.sec.gov or by directing a request to: Plum

Acquisition Corp. I, 2021 Fillmore St. #2089, San Francisco, California 94115. Plum urges investors, shareholders and other interested

persons to carefully read, when available, the preliminary and definitive Proxy Statement/Prospectus as well as other documents filed

with the SEC in connection with the proposed business combination as they become available because they will contain important information

about the proposed business combination.

No Offer or Solicitation

This Current Report on

Form 8-K shall not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities

in any jurisdiction, or the solicitation of any vote, consent or approval in any jurisdiction in connection with respect to the proposed

business combination, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person

to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. This Current Report on Form 8-K does not

constitute either advice or a recommendation regarding any securities. No offering of securities shall be made except by means of a prospectus

meeting the requirements of the Securities Act or an exemption therefrom.

Forward-Looking Statements

This Current Report on

Form 8-K contains certain statements that are not historical facts but are forward-looking statements for purposes of the safe harbor

provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied

by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “should,” “would,” “plan,” “project,” “forecast,”

“predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and

similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence

of these words does not mean that a statement is not forward looking. These forward-looking statements include, but are not limited to,

the anticipated signing of a definitive business combination agreement between Veea and Plum, the terms and timing of the agreement, and

the market for Veea’s products and technology. These statements are based on various assumptions, whether or not identified in this

report, and on the current expectations of Veea’s and Plum’s management teams and are not predictions of actual performance.

These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied

on by any investor as, a guarantee, an assurance or a definitive statement of fact or probability. Actual events and circumstances are

difficult or impossible to predict, are beyond the control of Veea and Plum, and will differ from assumptions. These forward-looking statements

are subject to a number of risks and uncertainties, as set forth in the section entitled “Risk Factors” in Plum’s Annual

Report for the year ended December 31, 2022, which was filed with the SEC on April 17, 2023, and in the other documents that Plum has

filed, or will file, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially

from the results implied by these forward-looking statements. The risks and uncertainties above are not exhaustive, and there may be additional

risks that neither Veea nor Plum presently know or that Veea and Plum currently believe are immaterial that could also cause actual results

to differ from those contained in the forward-looking statements. Accordingly, undue reliance should not be placed upon the forward-looking

statements. While Veea and Plum may elect to update these forward-looking statements, Veea and Plum specifically disclaim any obligation

to do so, except as required by law.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

PLUM ACQUISITION CORP. I |

| |

|

|

| Date: November 13, 2023 |

By: |

/s/ Kanishka Roy |

| |

|

Kanishka Roy |

| |

|

Co-Chief Executive Officer and President |

2

Exhibit 99.1

Veea, Inc. and Plum Acquisition Corp. I Announce

Letter of Intent for a Business Combination

NEW YORK, NY and SAN FRANCISCO, CA, Nov. 12, 2023 (GLOBE NEWSWIRE) -- Veea, Inc. (“Veea”), a leading digital transformation company, and Plum Acquisition Corp. I (“Plum”)

(NASDAQ: PLMI), a special purpose acquisition company formed by Ursula Burns, Kanishka Roy, and Mike Dinsdale, today announced the signing

of a non-binding letter of intent for a potential business combination.

Founded in 2014, Veea offers edge-to-cloud computing

with its VeeaHub® smart computing hub products, multi-user devices that can replace or complement Wi-Fi Access Points (APs), IoT gateways,

routers, basic firewalls, network attached storage, and other types of hubs and appliances at user premises.

Under the terms of the non-binding letter of intent,

Veea and Plum would become a combined entity, with Veea’s existing shareholders exchanging their shares in Veea for equity in the

combined public company. Veea and Plum expect to finalize a definitive business combination agreement in the coming weeks and plan to

announce additional details at that time.

Completion of a business combination between Veea

and Plum is subject to, among other things, the completion of due diligence, the negotiation of a definitive agreement providing for the

transaction, the satisfaction of the conditions negotiated therein, and approval of the transaction by the board and shareholders of both

Veea and Plum. There can be no assurance that a definitive agreement will be entered into or that the proposed business combination will

be consummated on the terms or timeframe currently contemplated, or at all.

About Veea Inc.

Veea is redefining and simplifying secure edge computing

in a way that improves application responsiveness, reduces bandwidth costs, and eliminates central cloud dependency. VeeaHub® Smart

Computing Hubs™ integrate a full range of connectivity options, application processing power, and a full security stack to form

an elastic edge computing platform with a dynamic connectivity and application mesh that can easily be deployed and centrally managed

from the cloud. Veea Edge Services run across this application mesh to deliver secure remote access, IoT/IIoT/AIoT, and a wide range of

smart applications. These elements along with a range of groundbreaking vertical-specific applications comprise the Veea Edge Platform,

serving the needs of organizations across Smart Buildings, Smart Energy, Smart Cities, Smart Construction, Smart Farming, Smart Retail,

and other industry verticals. Veea was formed in 2014 and is headquartered in New York City, with its engineering activities located in

Bath, UK, and Iselin, New Jersey, USA, along with sales and support offices located at multiple locations throughout the US, France, South

Korea, and Brazil. Veea was named by Gartner as a 2021 Cool Vendor in Edge Computing and as a Leading Smart Edge Platform in 2023.

About Plum Acquisition Corp. I

Plum Acquisition Corp. I is a special purpose acquisition

company founded by Ursula Burns, Kanishka Roy, and Mike Dinsdale. Plum was formed with the mission of creating a platform, built by operators

for operators, to enable great private companies to become outstanding public companies and listed stocks.

No Offer or Solicitation

This press release shall not constitute an offer

to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation

of any vote, consent or approval in any jurisdiction in connection with respect to the proposed business combination, nor shall there

be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale

may be unlawful under the laws of such jurisdiction. This press release does not constitute either advice or a recommendation regarding

any securities. No offering of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act

of 1933, as amended, or an exemption therefrom.

Additional Information and Where to Find It

If a legally binding definitive agreement with respect

to the proposed business combination is executed, Plum intends to file with the U.S. Securities and Exchange Commission (the “SEC”)

a registration statement on Form S-4, which will include a preliminary proxy statement/prospectus (the “Proxy Statement/Prospectus”).

The definitive Proxy Statement/Prospectus would be mailed to Plum’s shareholders as of a record date to be established for voting

on the proposed business combination. Shareholders will also be able to obtain copies of the Proxy Statement/Prospectus, without charge,

at the SEC’s website at www.sec.gov or by directing a request to: Plum Acquisition Corp. I, 2021 Fillmore St. #2089, San Francisco,

California 94115. Plum urges investors, shareholders and other interested persons to carefully read, when available, the preliminary and

definitive Proxy Statement/Prospectus as well as other documents filed with the SEC in connection with the proposed business combination

as they become available because they will contain important information about the proposed business combination.

Forward-Looking Statements

The disclosure herein includes certain statements

that are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private

Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “intend,”

“expect,” “should,” “would,” “plan,” “project,” “forecast,” “predict,”

“potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions

that predict or indicate future events or trends or that are not statements of historical matters, but the absence of these words does

not mean that a statement is not forward looking. These forward-looking statements include, but are not limited to, the anticipated signing

of a definitive business combination agreement between Veea and Plum, the terms and timing of the agreement, and the market for Veea’s

products and technology. These statements are based on various assumptions, whether or not identified in this press release, and on the

current expectations of Veea’s and Plum’s management teams and are not predictions of actual performance. These forward-looking

statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as,

a guarantee, an assurance or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible

to predict, are beyond the control of Veea and Plum, and will differ from assumptions. These forward-looking statements are subject to

a number of risks and uncertainties, as set forth in the section entitled “Risk Factors” in Plum’s Annual Report for

the year ended December 31, 2022, which was filed with the SEC on April 17, 2023, and in the other documents that Plum has filed, or will

file, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from

the results implied by these forward-looking statements. The risks and uncertainties above are not exhaustive, and there may be additional

risks that neither Veea nor Plum presently know or that Veea and Plum currently believe are immaterial that could also cause actual results

to differ from those contained in the forward-looking statements. Accordingly, undue reliance should not be placed upon the forward-looking

statements. While Veea and Plum may elect to update these forward-looking statements, Veea and Plum specifically disclaim any obligation

to do so, except as required by law.

Contacts:

contact@plumpartners.com

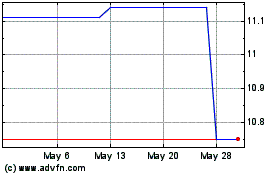

Plum Acquisition Corpora... (NASDAQ:PLMIU)

Historical Stock Chart

From Jan 2025 to Feb 2025

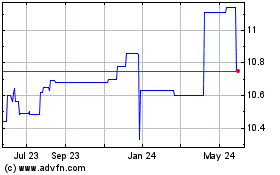

Plum Acquisition Corpora... (NASDAQ:PLMIU)

Historical Stock Chart

From Feb 2024 to Feb 2025