Form 425 - Prospectuses and communications, business combinations

15 February 2024 - 8:17AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 10, 2024

PLUM ACQUISITION CORP. I

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-40218 |

|

98-1577353 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

2021 Fillmore St. #2089, San Francisco, CA 94115

(Address of principal executive offices, including

Zip Code)

(415) 683-6773

Registrant’s telephone number, including

area code

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one Class A Ordinary Share and one-fifth of one redeemable warrant |

|

PLMIU |

|

The Nasdaq Stock Market LLC |

| Class A Ordinary Shares included as part of the units |

|

PLMI |

|

The Nasdaq Stock Market LLC |

| Warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 |

|

PLMIW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 4.02 Non-Reliance on Previously Issued Financial Statements

or Related Audit Report or Completed Interim Report.

On February 10, 2024, the audit committee of the

board of directors (the “Audit Committee”) of Plum Acquisition Corp. I (the “Company”) concluded, after discussion

with the Company’s management and accounting professionals, that the Company’s previously-issued unaudited interim financial

statements included in the Company’s Quarterly Report on Form 10-Q for the periods ended March 31, 2023, June 30, 2023, and September

30, 2023, filed with the SEC on May 23, 2023, August 21, 2023, and November 22, 2023, respectively (each an “Affected Period”

and, collectively, the “Affected Periods”), should be restated and no longer be relied upon due to misstatements in (i) debt

discount subscription liability, additional paid-in capital and accumulated deficit in the Company’s condensed balance sheet as

of March 31, 2023, June 30, 2023, and September 30, 2023, and (ii) change in fair value of subscription liability and interest expense

– debt discount on the Company’s condensed statements of operations for the three months ended March 31, 2023, three and six

months ended June 30, 2023, and three and nine months ended September 30, 2023.

The Company shall restate its financial statements

for the Affected Periods in its Annual Report on Form 10-K. The financial information that has been previously filed or otherwise reported

for the Affected Periods will be superseded by the information filed in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023, and the financial statements and related financial information contained in the Quarterly Reports on Form 10-Q for

the Affected Periods should no longer be relied upon. The restatement does not have an impact on the Company’s cash position or

the amount held in the Company’s trust account.

As a result of the foregoing, the Company’s

management has reevaluated the effectiveness of the Company’s disclosure controls and procedures and internal control over financial

reporting for the Affected Periods. The Company’s management concluded that, in light of the misstatements described above, a material

weakness exists in the Company’s internal control over financial reporting and that the Company’s disclosure controls and

procedures for the Affected Periods were not effective. The Company’s management plans to enhance the system of evaluating and implementing

the accounting standards that apply to the Company’s financial statements, including enhanced training of the Company’s personnel

and increased communication among the Company’s personnel and third party professionals with whom the Company consults regarding

the application of complex financial instruments. The Company’s remediation plan with respect

to such material weakness will be described in more detail in the Annual Report on Form 10-K for the year ended December 31, 2023.

The Company’s management has discussed

the matters disclosed in this Current Report on Form 8-K pursuant to this Item 4.02 with Marcum LLP, the Company’s independent

registered public accounting firm.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

PLUM ACQUISITION CORP. I |

| |

|

| Date: February 14, 2024 |

By: |

/s/ Kanishka Roy |

| |

|

Kanishka Roy |

| |

|

Co-Chief Executive Officer and President |

2

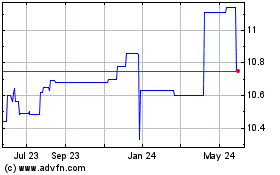

Plum Acquisition Corpora... (NASDAQ:PLMIU)

Historical Stock Chart

From Feb 2025 to Mar 2025

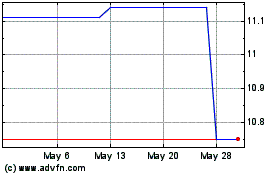

Plum Acquisition Corpora... (NASDAQ:PLMIU)

Historical Stock Chart

From Mar 2024 to Mar 2025