As filed with the U.S. Securities and Exchange

Commission on October 16, 2024

Registration No. 333-[●]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PRIMECH HOLDINGS LTD.

(Exact Name of Registrant as Specified in its Charter)

Not Applicable

(Translation of Registrant’s Name into English)

| Singapore | | 7349 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

23 Ubi Crescent

Singapore 408579

+65 6286 1868

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

COGENCY GLOBAL INC.

122 East 42nd Street, 18th Floor

New York, NY 10168

+1-800-221-0102

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies of all communications, including communications

sent to agent for service, should be sent to:

|

Lawrence S. Venick, Esq.

Loeb & Loeb LLP

2206-19 Jardine House

1 Connaught Road Central

Hong Kong SAR

Telephone: +852-3923-1111

Facsimile: +852-3923-1100 |

|

Richard A. Friedman

Stephen A. Cohen

Sheppard, Mullin, Richter & Hampton LLP

30 Rockefeller Plaza

New York, New York 10112

Telephone: (212) 653-8700

Facsimile: (212) 653-8701 |

Approximate date of commencement

of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933,

check the following box: ☐

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration

number of the earlier effective registration statement for the same offering. ☐

Emerging growth company.

☒

If an emerging growth company

that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to

use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of

the Securities Act. ☐

The registrant hereby amends

this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further

amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the U.S. Securities

and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

This Registration Statement

contains two prospectuses, as set forth below.

| ● | Public Offering Prospectus. A prospectus to be used for the

offering of (i) up to [ ] Ordinary Shares, (ii) Warrants to Purchase up to [_] Ordinary Shares and up to [_] Ordinary Shares issuable

upon exercise of the Warrants, and (iii) Placement Agent Warrants to purchase up to [_] Ordinary Shares and up to [_] Ordinary Shares

issuable upon the exercise of the Placement Agent Warrants of the Registrant (the “Public Offering Prospectus”) through the

placement agent named on the cover page of the Public Offering Prospectus. |

| ● | Resale Prospectus. A prospectus to be used for the resale by

the Selling Shareholder set forth therein of 2,000,000 Ordinary Shares of the Registrant (the “Resale Prospectus”). |

The Resale Prospectus is substantively

identical to the Public Offering Prospectus, except for the following principal points:

| ● | they contain different outside and inside front covers and back

covers; |

| ● | they contain different offering sections in the Prospectus Summary

section beginning on page Alt-1; |

| ● | they contain different Use of Proceeds sections on page Alt-16; |

| ● | a Selling Shareholder section is included in the Resale Prospectus; |

| ● | a Selling Shareholder Plan of Distribution is inserted; and |

| ● | the Legal Matters section in the Resale Prospectus on page Alt-18

deletes the reference to counsel for the underwriter. |

The Registrant has included

in this Registration Statement a set of alternate pages after the back cover page of the Public Offering Prospectus (the “Alternate

Pages”) to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public

Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus

will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will

be used for the resale offering by the Selling Shareholder.

The information in this preliminary prospectus

is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange

Commission is effective. This preliminary prospectus is not an offer to sell these securities nor does it seek an offer to buy these securities

in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS (Subject to Completion) |

|

Dated October

16, 2024 |

Up to [

] Ordinary Shares

Warrants to Purchase up to [_] Ordinary Shares

and up to [_] Ordinary Shares issuable upon exercise of the Warrants

Placement Agent Warrants to purchase up to [_]

Ordinary Shares and up to [_] Ordinary Shares issuable upon the exercise of the Placement Agent Warrants

This is a public offering

of [ ] Ordinary Shares (“Ordinary Shares”), together with warrants to purchase up to [_] Ordinary Shares

(the ‘Warrants”), at an assumed offering price of $[_] per ordinary share, which is equal to the closing trading price of

our ordinary shares as reported on the Nasdaq Capital Market on [_], 2024. Each Ordinary Share will be sold together with [_] warrants.

Each warrant can purchase [_] Ordinary Share, and has an exercise price of $[_] Ordinary Share. The Warrant will expire on the [_] anniversary

of the original issuance date. The Warrant is not tradable on the Nasdaq Capital Market, or Nasdaq. The Ordinary Shares and Warrants are

immediately separable and will be issued separately in this offering, but must be purchased together in this offering. This offering also

relates to the Placement Agent Warrants (as defined below). We are listed on the Nasdaq Capital Market under the symbol “PMEC.”

We refer to the shares of Ordinary Shares, Placement Agent Warrants and Warrants to be issued in this offering collectively as the “Securities.”

The actual combined public

offering price per Ordinary Share and accompanying Warrants will be negotiated between us and the investors, in consultation with the

placement agent based on, among other things, the trading price of our Ordinary Shares prior to the offering, our history and our prospects,

the industry in which we operate, our past and present operating results, the previous experience of our executive officers and the general

condition of the securities markets at the time of this offering, and may be at a discount to the current market price. Therefore, the

assumed combined public offering price used throughout this prospectus may not be indicative of the final offering price. In addition,

there is no established public trading market for the Warrants, and we do not expect a market for the Warrants to develop. We do not intend

to apply for a listing of the Warrants on any national securities exchange. Without an active trading market, the liquidity of the Warrants

will be limited.

This offering will

terminate on [ ], 2024, unless we decide to terminate the offering (which we may do at any time in our discretion)

prior to that date. We will have a single closing for all securities purchased in this offering and the combined public offering price

per Ordinary Share and accompanying Warrants will be fixed for the duration of this offering.

Immediately after the completion

of the Offering, assuming an offering size as set forth above, our Major Shareholder, Sapphire Universe Holdings Limited, will own approximately

[*]% of our outstanding ordinary shares (the “Shares”). As a result, we expect to be a “controlled company” within

the meaning of the corporate governance standards of Nasdaq. See section titled “Prospectus Summary — Implications

of Being a Controlled Company”.

This registration statement

also contains a resale prospectus, pursuant to which the selling shareholder is offering 2,000,000 Ordinary Shares, or the Resale Offering,

to be sold in one or more transactions that may take place in ordinary brokers’ transactions, privately negotiated transactions

or through sales to one or more dealers for resale of such securities as principals after the trading of our Ordinary Shares on the Nasdaq

begins. We will not receive any proceeds from the sale of the Ordinary Shares to be sold by the Selling Shareholder.

Investing in the shares involves

risks. See section titled “Risk Factors” of this prospectus.

We are both an “emerging

growth company” and a “foreign private issuer” under applicable U.S. Securities and Exchange Commission rules and

will be eligible for reduced public company disclosure requirements. See section titled “Prospectus Summary — Implications

of Being an ‘Emerging Growth Company’ and a ‘Foreign Private Issuer’” for additional information.

Neither the Securities and

Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy

of this prospectus. Any representation to the contrary is a criminal offense.

We have engaged FT Global

Capital, Inc. (“FT Global”) as our exclusive placement agent to use its best efforts to solicit offers to purchase

our securities in this offering. The placement agent has no obligation to purchase and is not purchasing or selling the securities offered

by us, and is not required to arrange for the purchase or sale of any specific number or dollar amount of our securities, but will use

its best efforts to solicit offers to purchase the securities offered by this prospectus. Because there is no minimum offering amount

required as a condition to closing in this offering the actual offering amount, the placement agent’s fee, and proceeds to us, if

any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above and throughout

this prospectus. We have agreed to pay the placement agent the placement agent’s fees set forth in the table above, issue warrants

to purchase up to ______ Ordinary Shares and to provide reimbursement of certain expenses and certain other compensation to the placement

agent. See “Plan of Distribution” of this prospectus for more information regarding these arrangements.

We will deliver ordinary

shares being issued to the investors electronically and will mail such investors physical warrant certificates for the warrants sold in

this offering, upon closing and receipt of investor funds for the purchase of the securities offered pursuant to this prospectus.

| | |

PER SHARE

AND

ACCOMPANYING

WARRANTS | | |

TOTAL | |

| Public offering price | |

$ | [ | ] | |

$ | 10,000,000 | |

| Placement Agent commissions(1) | |

$ | [ | ] | |

$ | 750,000 | |

| Proceeds, before expenses, to us | |

$ | [ | ] | |

$ | 9,250,000 | |

| (1) |

We have agreed to pay the Placement Agent a commission equal to 7.5% of the gross proceeds sold in the Offering. In addition, we have agreed to issue to the placement agent warrants to purchase up to 5% of the Ordinary Shares sold in this Offering at an exercise price equal to 125% of the combined public offering price per share of Ordinary Shares and accompanying Common Warrants. We have also agreed to reimburse the Placement Agent for certain of its offering related expenses, including reimbursement for all travel, due diligence, or related expenses. For a description of the compensation to be received by the Placement Agent, see “Plan of Distribution” for more information. |

We expect the delivery of

such securities against payment in U.S. dollars will be made in New York, New York on or about [ ], 2024.

FT GLOBAL CAPITAL, INC.

Prospectus dated [ ], 2024

TABLE OF CONTENTS

For investors outside the United States: neither we, the Selling

Shareholder nor the underwriter have done anything that would permit the IPO and Resale Offering or possession or distribution of this

prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States

who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the IPO and Resale

Offering of the shares and the distribution of this prospectus outside the United States.

Neither we nor the Placement

Agent have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus,

any amendment or supplement to this prospectus, or in any free writing prospectus we have prepared, and neither we nor the Placement Agent

take responsibility for, and can provide no assurance as to the reliability of, any other information others may give you. Neither we

nor the Placement Agent are making an offer to sell, or seeking offers to buy, these securities in any jurisdiction where the offer or

sale is not permitted. The information contained in this prospectus is accurate only as of the date on the cover page of this prospectus,

regardless of the time of delivery of this prospectus or the sale of shares. Our business, financial condition, results of operations

and prospects may have changed since the date on the cover page of this prospectus.

PROSPECTUS SUMMARY

This summary highlights

selected information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider

before investing in our Shares. For a more complete understanding of us and the Offering and Resale Offering, you should read and carefully

consider the entire prospectus, including the more detailed information set forth under “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related

notes. Some of the statements in this prospectus are forward-looking statements. See section titled “Special Note Regarding

Forward-Looking Statements.”

Our Business

We are an established technology-driven

facilities services provider in the public and private sectors operating mainly in Singapore. Our mission is to support businesses by

improving lives and strengthening communities through our business practices and ethics. We compete primarily in Singapore, with a small

portion of our operations in Malaysia.

Our revenues for the fiscal

year ended March 31, 2024 and 2023 were approximately $72,524,000 and $69,026,000, respectively. For the fiscal year ended March 31,

2024 and 2023, we incurred a net loss of approximately $(3,223,000) and $(2,547,000), respectively.

We provide the following services:

| ● | Facilities services. Our facilities services include general cleaning and maintenance of

public and private facilities, such as airports, conservancy areas (i.e., the public areas, refuse disposal areas, parks and

carparks of public housing units), common areas of hotels, educational institutions, public roads, residential spaces, commercial

buildings, office facilities, industrial areas, retail stores and healthcare facilities; housekeeping services; specialized cleaning

services, such as marble polishing services; building façade cleaning services and clean room sanitation services; and waste

management and pest control services. We derive the majority of our revenue from the provision of facilities services, which

accounted for approximately $56.0 million or 77.2% of our revenue in FY 2024 and approximately $55.8 million or 80.8% of

our revenue in FY 2023. |

| ● | Stewarding services. Our stewarding

services include the cleaning of kitchen facilities of healthcare facilities, hotels and restaurants and the supply of ad hoc

customer service officers and food and beverage (“F&B”) service crew to healthcare facilities, hotels and restaurants.

Stewarding services accounted for approximately $10.2 million or 14.0% of our revenue in FY 2024 and approximately $7.6 million

or 11.0% of our revenue in FY 2023. |

| ● | Cleaning services to offices. In

addition to our core facilities services, we provide cleaning services to offices. The provision of office cleaning services accounted

for approximately $5.9 million or 8.1% of our revenue in FY 2024 and approximately $4.9 million or 7.1% of our revenue in FY

2023. |

| ● | Cleaning services to homes. We

provide cleaning services to homes of individual customers who engage our services through our “HomeHelpy” application.

We did not generate significant revenue (i.e., less than 1.0%) from the provision of these services during FY 2024 and FY 2023. |

| ● | Cleaning Supplies. We also manufacture

certain cleaning supplies, both for our own use and for sale to third parties. We did not generate significant revenue (i.e., less than

1.0%) from the sale of cleaning supplies to third parties during FY 2024 and FY 2023. |

Our Industry

| ● | General. Cleaning and landscaping

service providers in Singapore offer a wide spectrum of services. Cleaning services include the provision of various cleaning services

to public areas, offices, factories, and households, among others. Landscaping services include landscape planting, care and maintenance

service activities in and for parks and gardens, public and private housing, buildings, roads and expressways, among others. |

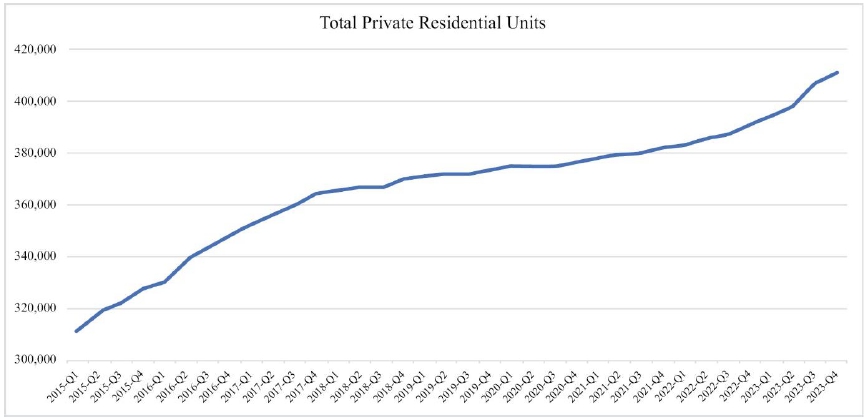

| ● | Growth Drivers and Trends. Demand

derived from office buildings, retail facilities, and residential buildings in Singapore has grown moderately in the past five years.

New automated technologies have enhanced and will continue to enhance productivity. These include environmentally friendly robotic solutions

for public spaces, waste management, and pest and pollution control. Singapore’s demand for cleaning and landscaping services experienced

strong growth from 2014 to 2022, driven by economic sophistication, urbanization, and population growth. The industry market size increased

from $1,377.0 million (S$1,836.0 million) in 2014 to $2,569.9 million (S$3,426.5 million) in 2022, a CAGR of 8.1%.

Moreover, we believe the productivity of the industry will be enhanced progressively given the technology-driven programs launched by

the government. Technological advancements have contributed to the growth of cleaning and landscaping companies, and we believe the industry

will continue to benefit from future advancements in automation and technology. |

Our Competitive Strengths

We believe our main competitive

strengths are as follows:

| ● | We have a long and established track record and have achieved

a high level of accreditation in the facilities services sector. Primech A&P was amalgamated from A&P

Maintenance and Primech Services & Engrg, which were operating for approximately 30 years or more, respectively. Maint-Kleen

was founded in 2002. Primech A&P and Maint-Kleen thus have been able to secure long-term business relationships with their customers.

Primech Services & Engrg and A&P Maintenance were both awarded the Clean Mark Gold Award in 2020. The Clean Mark Gold Award

is the highest level of accreditation under the Enhanced Clean Mark Accreditation Scheme granted to cleaning businesses. The scheme recognizes

businesses that deliver high cleaning standards through the training of workers, the use of equipment to improve work processes, and

fair employment practices. Primech A&P and Maint-Kleen were also awarded the Clean Mark Gold Award in 2022 and 2023. |

| ● | We are able to provide a bundle of services to a wide spectrum

of customers. We provide a broad spectrum of cleaning services both in the public and private sectors to a

variety of customers including Singapore Changi Airport, conservancy areas, hotels, common areas, educational institutions, integrated

public areas, residential spaces, office facilities, industrial areas, retail stores and healthcare facilities. Our diversified customer

mix ensures that we do not rely on any single customer for our revenue and enables us to better manage our business risks. |

| ● | We believe that our emphasis on having a trained workforce

makes us more competitive in our industry. We believe that the training and development of our employees enables

us to maintain and enhance our quality of solutions and services for the growth of our businesses and operations. In particular, we have

been hiring a variety of employees from different sectors apart from the environment services industry such as the technological, finance,

human resources and business development sectors in order to build up our key management personnel team. |

| ● | We have an experienced and stable management team. We

have an experienced management team led by Mr. Kin Wai Ho, our Chairman. A majority of our senior management team have been employed

by our subsidiaries for more than 19 years. We view their collective industry knowledge and extensive project management experience

as valuable in establishing stable relationships with our customers as well as facilitating the submission of

competitive tenders and believe that this has assisted us in securing numerous tenders over the years. We also believe that our management

team’s experience has assisted us in our cost estimation for contracts during the tendering process, which enables us to reduce

situations of cost overruns. |

Our Business Strategies and Future Plans

Our business strategies and

future plans are as follows:

Automation and Online Expansion. We

will seek to improve efficiency, expand service capacity and reduce our environmental footprint through the use of technology. Our technology

initiatives to date include the use of autonomous floor scrubbing robots equipped with real-time monitoring and self-docking capabilities

to perform cleaning services. We are also in the exploratory stage of a collaboration for the development of cleaning robots to perform

household cleaning. Such initiatives have allowed us to expand our service capacity by leveraging technology instead of increasing our

reliance on manpower in a traditionally labor-intensive industry. In addition, in 2019 we introduced our “HomeHelpy”

website and mobile application to allow individual customers to book our cleaning services, which has enabled us to expand into the B2C

segment (from our primary B2B business).

Geographic Expansion. We

intend to establish ourselves as a regional player in the environmental services industry. While our operations are currently almost exclusively

based in Singapore, we are considering an expansion of our business to other countries in Southeast Asia.

Expansion through organic growth and

acquisitions. We intend to grow our facilities services business organically by expanding our coverage to include

new technology as well as segments of the market where we currently do not have a presence or only have a small presence, such as hospitals,

industrial centers, data centers and cleanrooms.

We intend to continue to pursue suitable

opportunities for acquisitions, joint ventures and strategic alliances to expand our range of facilities services. Such opportunities

could include areas that complement our business, such as waste management, gardening and landscaping, and pest management. We believe

that building up a comprehensive suite of facilities services will enable us to maintain our competitive edge.

IoT. We

are also seeking to build our own IoT system, software, and robots to improve the efficiency and capacity of our services. We have developed

a baseline IoT-enabled cleaning management platform to support data-driven and on-demand cleaning operations since August 2023. This platform

is undergoing continuous enhancement and has been deployed to a few cleaning projects. This system integrated commercial off-the-shelf

IoT devices such as cameras and sensors to be deployed in a facility and/or on robots, which will evaluate and respond to various events

to perform data driven functions or actions to assist our facility services with lower cost and more efficiency. We also intend to develop

an autonomous toilet cleaning robots to alleviate the tedious manual toilet cleaning tasks. We have entered into a memorandum of understanding

with an independent third party, which we intended to incorporate a company in Singapore, primarily focused on research and development,

manufacturing, and sales/lease of cleaning robots.

Electric Vehicles. In

2021, we joined a consortium to submit a tender bid to install electric vehicle (“EV”) charging infrastructure at various

public cark parks in Singapore. We believe that eco-solutions will become increasingly important in the future in the face of climate

change. Integrating eco-solutions into our portfolio will not only expand our service capabilities, but also transition our business towards

a more innovative model, and will ultimately help our business to keep pace with future technological advances.

We plan to replace a portion of our existing

fleet of vehicles with electric vehicles and develop “green” chemicals that are more eco-friendly for use in our cleaning

services. We believe that by integrating environmental sustainability into our business practices, we will be able to attract more customers

and employees, and ultimately reap the benefits of more sustainable growth.

Summary Risk Factors

Our prospectus should be considered

in light of the risks, uncertainties, expenses, and difficulties frequently encountered by similar companies. Below please find a summary

of the principal risks we face, organized under relevant headings. These risks are discussed more carefully in the section titled “Risk

Factors.”

Risks Relating to Our Business

| |

● |

We incurred a net loss in FY 2023 and FY 2024 and we may incur losses in the future; |

| ● | We are subject to risks associated with debt financing; |

| ● | Any adverse material changes to the Singapore market (whether

localized or resulting from global economic or other conditions) such as the occurrence of an economic recession, pandemic or widespread

outbreak of an infectious disease (such as COVID-19), could have a material adverse effect on our business, results of operations and

financial condition; |

| ● | The Clean Mark Gold Award currently awarded to Primech A&P

may be revoked and the class 1 licence currently awarded to Primech A&P may by revoked and/or may not be renewed in May 2026; |

| ● | Our Group does not have a long operating history as an integrated

group; |

| ● | There is no assurance that our future expansion and other

growth plans will be successful; |

| ● | There is no assurance that our existing service contracts

for facilities services will be renewed upon expiry or that we will be successful in securing new service contracts; |

| ● | Our current strategy to expand into the installation of electric

vehicle (EV) charging infrastructure is limited to participation in a pilot program and potential minority investment(s); |

| ● | Our service contracts typically contain liquidated damages

clauses, and our customers may request for liquidated damages if we fail to comply or observe certain contractual requirements; |

| ● | The loss of or reduction of Singapore government grants and/or

subsidies could reduce our profits; |

| ● | We may suffer from cost overruns as our fees are typically

agreed upon submission of tender or quotation; |

| ● | We are exposed to the credit risks of our customers and we

may experience delays or defaults in collecting our receivables, and thus we face liquidity risks; |

| ● | Our business involves inherent industrial risks and occupational

hazards and the materialization of such risks may affect our business operations and financial results; |

| ● | We depend on certain equipment to perform our facilities services

and are subject to associated risks of maintenance and obsolescence; |

| ● | We are exposed to legal or other proceedings or to other disputes

or claims; |

| ● | Our insurance coverage may not cover all our damages and losses; |

| ● | We are dependent on our ability to retain existing senior

management personnel and to attract new qualified management personnel; |

| ● | We are dependent on our ability to retain existing senior

management personnel and to attract new qualified management personnel; |

| ● | The appeal of our services is reliant, to some extent, on

maintaining and protecting the brand names and trademarks in our business; |

| ● | We are exposed to risks of infringement of our intellectual

property rights and the unauthorized use of our trademarks by third parties and we may face litigation suits for intellectual property

infringement; |

| ● | We could incur substantial costs as a result of data protection

concerns or IT systems disruption or failure; |

| ● | Unauthorized disclosure, destruction or modification of data,

through cybersecurity breaches, computer viruses or otherwise or disruption of our services could expose us to liability, protracted

and costly litigation and damage our reputation; |

| ● | The value of our intangible assets and costs of investment

may become impaired; |

| ● | Our historical financial and operating results are not a guarantee

of our future performance; |

| ● | We may be exposed to liabilities under applicable anti-corruption

laws and any determination that we violated these laws could have a materially adverse effect on our business; |

| ● | Any inability by us to consummate and effectively incorporate

acquisitions into our business operations may adversely affect our results of operations; |

| ● | We may be subject to claims against us relating to any acquisition

or business combination; |

| ● | We have since the IPO incurred, and we will continue to incur,

significant expenses and devote other significant resources and management time as a result of being a public company, which may negatively

impact our financial performance and could cause our results of operations and financial condition to suffer; |

| ● | If we fail to maintain an effective system of disclosure controls

and internal control over financial reporting, our ability to produce timely and accurate financial statements or comply with applicable

regulations could be impaired; |

| ● | We do not expect to be subject to certain Nasdaq corporate

governance rules applicable to U.S. listed companies; and |

| ● | Negative publicity relating to our Group or our Directors,

Executive Officers or Major Shareholders may materially and adversely affect our reputation and Share price. |

Risks Relating to The Industry In Which

We Operate

| ● | We operate in a highly regulated industry; |

| ● | We may face employee retention and labor shortage issues due

to the labor-intensive nature of the facilities services industry and the limited local labor force in Singapore; |

| ● | Our supply of foreign labor may be affected by the laws, regulations

and policies in the countries from which the foreign labor originates; |

| ● | A shortage of reliable sub-contractors may disrupt our business

operations and increase our costs and we may be liable for the breaches of our sub-contractors; |

| ● | The facilities services industry in Singapore is highly competitive; |

| ● | Industry consolidation may give our competitors advantage

over us, which could result in a loss of customers and/or a reduction of our revenue; |

| ● | We are subject to risks in connection with the use and storage

of cleaning chemicals. In addition, any perceived use of cleaning supplies and/or chemicals that are not environmentally friendly or

safe may adversely affect our brand name and the contracts we can successfully bid for; and |

| ● | New and stricter legislation and regulations may affect our

business, financial condition and results of operations. |

Risks Relating to Investments In Singapore

Companies

| ● | We are incorporated in Singapore, and our shareholders may

have more difficulty in protecting their interests than they would as shareholders of a corporation incorporated in the United States; |

| ● | It may be difficult for you to enforce any judgment obtained

in the United States against us, our Directors, Executive Officers or our affiliates; |

| ● | Subject to the general authority to allot and issue new Shares

provided by our Shareholders, the Companies Act and our Constitution, our directors may allot and issue new Shares on terms and conditions

and for such purposes as may be determined by our Board of Directors in its sole discretion. Any issuance of new Shares would dilute

the percentage ownership of existing Shareholders and could adversely impact the market price of our Shares; |

| ● | We are subject to the laws of Singapore, which differ in certain

material respects from the laws of the United States; and |

| ● | Singapore take-over laws contain provisions that may vary

from those in other jurisdictions. |

Risks Relating to An Investment In Our Shares

| |

● |

This is a “best-efforts” offering, no minimum amount of securities is required to be sold, and we may not raise the amount of capital we believe is required for our business plans, including our near-term business plans, nor will investors in this offering receive a refund in the event that we do not sell an amount of securities sufficient to pursue the business goals outlined in this prospectus; |

| ● | An active trading market for our Ordinary Shares may not continue

and the trading price for our Ordinary Shares may fluctuate significantly; |

| ● | Our share price has been, and could continue to be, volatile.

You may lose all or part of your investment, and litigation may be brought against us; |

| ● | Investors in our Shares and accompanying Warrants will face immediate and substantial dilution in

the net tangible book value per Share and may experience future dilution; |

| ● | We are a “controlled company” within the meaning

of the Nasdaq Listing Rules and, as a result, may rely on exemptions from certain corporate governance requirements that provide protection

to shareholders of other companies; |

| ● | Our Shares may trade below $5.00 per share, and thus would

be known as “penny stock;” trading in penny stocks has certain restrictions and these restrictions could negatively affect

the price and liquidity of our Shares. |

| ● | The trading price of our Shares following the IPO may be subject

to rapid and substantial price volatility that may be unrelated to our actual or expected operating performance and financial condition

or prospects, making it difficult for prospective investors to assess the rapidly changing value of our ordinary shares; |

| ● | There may be circumstances in which the interests of our Major

Shareholder(s) could be in conflict with your interests as a Shareholder; |

| ● | We may require additional funding in the form of equity or

debt for our future growth which will cause dilution in Shareholders’ equity interest; |

| ● | Investors may not be able to participate in future issues

or certain other equity issues of our Shares; |

| ● | We may not be able to pay dividends in the future; |

| ● | If we fail to meet applicable listing requirements, Nasdaq

may delist our Shares from trading, in which case the liquidity and market price of our Shares could decline; |

| ● | We are an emerging growth company within the meaning of the

Securities Act and may take advantage of certain reduced reporting requirements; |

| ● | We qualify as a foreign private issuer and, as a result, we

will not be subject to U.S. proxy rules and will be subject to Exchange Act reporting obligations that permit less detailed

and less frequent reporting than that of a U.S. domestic public company; |

| ● | We may lose our foreign private issuer status in the future,

which could result in significant additional costs and expenses; |

| ● | There can be no assurance that we will not be a passive foreign

investment company, or PFIC, for U.S. federal income tax purposes for any taxable year, which could result in adverse U.S. federal income

tax consequences to U.S. holders of our Shares; |

| ● | We will have broad discretion in the use of proceeds of this

Offering; and |

| ● | Securities analysts may not publish favorable research or

reports about our business or may publish no information at all, which could cause our stock price or trading volume to decline. |

| |

● |

The resale by the Selling Shareholder may cause the market price of our Ordinary Shares to decline. |

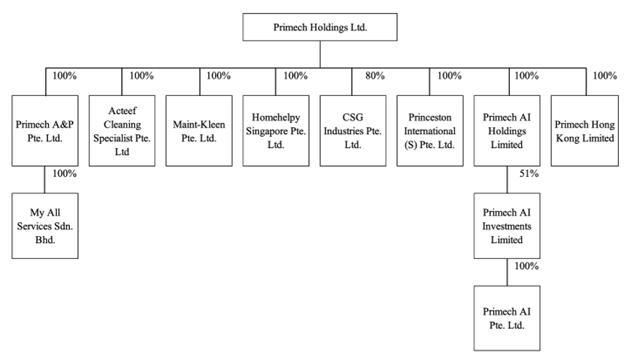

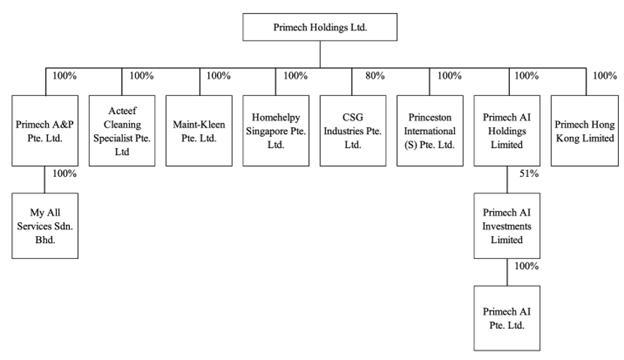

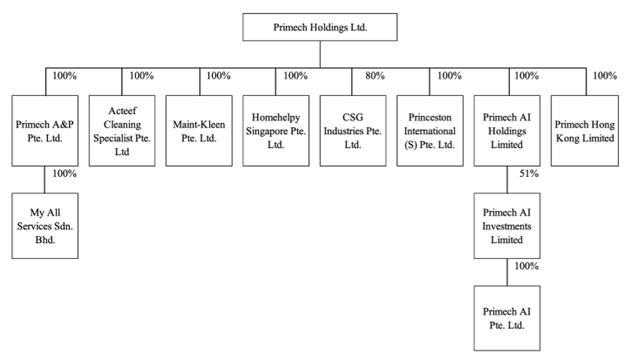

Our Corporate Structure

The structure of our Group

as of the date of this prospectus is as follows:

Corporate Information

Primech Holdings Ltd. is a

Singapore corporation. Our registered office and principal place of business is 23 Ubi Crescent Singapore 408579. The telephone and facsimile

numbers of our registered office are +65 6286 1868 and +65 6288 5260, respectively. Our agent for service of process in the United States

is Cogency Global Inc., located at 122 East 42nd Street, 18th Floor, New York, NY 10168. Our corporate

website is https://primechholdings.com. Information contained on our website does not constitute part of this prospectus.

Implications of Being an “Emerging Growth

Company” and a “Foreign Private Issuer”

Emerging Growth Company

We are an “emerging growth

company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible,

for up to five years, to take advantage of certain exemptions from various reporting requirements that are applicable to other publicly

traded entities that are not emerging growth companies. These exemptions include:

| ● | the ability to include only two years of audited financial

statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations

disclosure; |

| ● | exemptions from the auditor attestation requirements of Section 404

of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), in the assessment of our internal control

over financial reporting; |

| ● | to the extent that we no longer qualify as a foreign private

issuer, (i) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and (ii) exemptions

from the requirement to hold a non-binding advisory vote on executive compensation, including golden parachute compensation. |

We may take advantage of these

provisions until the last day of our fiscal year following the fifth anniversary of the consummation of the IPO or such earlier time

that we are no longer an emerging growth company.

As a result, the information

contained in this prospectus may be different from the information you receive from other public companies in which you hold shares. We

do not know if some investors will find the Shares less attractive because we may rely on these exemptions. The result may be a less active

trading market for the Shares, and the price of the Shares may become more volatile.

We will remain an emerging

growth company until the earliest of: (1) the last day of the first fiscal year in which our annual gross revenue exceeds $1.235 billion;

(2) the last day of the fiscal year following the fifth anniversary of the date of the IPO; (3) the date that we become

a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value

of the Shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed

second fiscal quarter; or (4) the date on which we have issued more than $1.00 billion in non-convertible debt securities during

any three-year period.

Section 107 of the JOBS

Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 13(a) of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for complying with new or revised

accounting standards. Given that we currently report and expect to continue to report under U.S. GAAP, we have irrevocably elected

not to avail ourselves of this extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant

dates on which adoption of such standards is required by the IASB. Under federal securities laws, our decision to opt out of the

extended transition period is irrevocable.

Foreign Private Issuer

Upon consummation of the IPO,

we will report under the Exchange Act as a non-U.S. company with foreign private issuer status. Even after we no longer qualify

as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain

provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| ● | the rules under the Exchange Act requiring domestic

filers to issue financial statements prepared under U.S. GAAP; |

| ● | the sections of the Exchange Act regulating the solicitation

of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| ● | the sections of the Exchange Act requiring insiders

to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short

period of time; and |

| ● | the rules under the Exchange Act requiring the filing

with the Securities and Exchange Commission (the “SEC”) of quarterly reports on Form 10-Q containing unaudited financial

and other specific information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

Notwithstanding these exemptions,

we will file with the SEC, within four months after the end of each fiscal year, or such applicable time as required by the SEC,

an annual report on Form 20-F containing financial statements audited by an independent registered public accounting firm.

We may take advantage of these

exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as

more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies:

(i) the majority of our Executive Officers or members of our Supervisory Board are U.S. citizens or residents, (ii) more

than 50% of our assets are located in the United States, or (iii) our business is administered principally in the United States.

Both foreign private issuers

and emerging growth companies are also exempt from certain more extensive executive compensation disclosure rules. Thus, even if we no

longer qualify as an emerging growth company, but remain a foreign private issuer, we will continue to be exempt from the more extensive

compensation disclosures required of companies that are neither an emerging growth company nor a foreign private issuer and will continue

to be permitted to follow our home country practice on such matters.

Implications of Being a Controlled Company

We became a “controlled company” as defined under the Nasdaq

Listing Rules because at the time of the completion of the IPO, Sapphire Universe held 82.06% of our total issued and outstanding Shares

and was able to exercise 82.06% of the total voting power of our issued and outstanding share capital. Upon the consummation of this Offering,

we will continue to be a “controlled company” because at such time, Sapphire Universe will hold [*]% of our total issued and

outstanding Shares and will be able to exercise [*]% of the total voting power of our issued and outstanding share capital. For so long

as we remain a “controlled company,” we are permitted to elect not to comply with certain corporate governance requirements.

If we rely on these exemptions, you will not have the same protection afforded to shareholders of companies that are subject to these

corporate governance requirements. See section titled “Risk Factors — Risks Relating to an Investment

in our Shares.”

Even if we cease to be a controlled

company, we may still rely on exemptions available to foreign private issuers.

Conventions Which Apply to this Prospectus

Throughout this prospectus,

we use a number of key terms and provide a number of key performance indicators used by management. Unless the context otherwise requires,

the following definitions apply throughout where the context so admits:

Other Companies, Organizations and Agencies

| “BCA” |

|

: |

Building & Construction Authority of Singapore |

| |

|

|

|

| “HSA” |

|

: |

Health Sciences Authority of Singapore |

| |

|

|

|

| “Independent Registered Public Accounting Firm” |

|

: |

Weinberg & Company P.A. |

| |

|

|

|

| “ISO” |

|

: |

International Organization for Standardization |

| |

|

|

|

| “MOM” |

|

: |

Ministry of Manpower of Singapore |

| |

|

|

|

| “NEA” |

|

: |

National Environment Agency of Singapore |

| |

|

|

|

| “Sapphire Universe” |

|

: |

Sapphire Universe Holdings Limited, which is a Major Shareholder |

General

| “Audit Committee” |

|

: |

The audit committee of our Board of Directors |

| |

|

|

|

| “Board” or “Board of Directors” |

|

: |

The board of directors of our Company |

| |

|

|

|

| “Companies Act” |

|

: |

The Companies Act 1967 of Singapore, as amended, supplemented or modified from time to time |

| |

|

|

|

| “Company” |

|

: |

Primech Holdings Ltd. |

| |

|

|

|

| “Compensation Committee” |

|

: |

The compensation committee of our Board of Directors |

| |

|

|

|

| “Constitution” |

|

: |

The constitution of our Company, as amended, supplemented or modified from time to time |

| |

|

|

|

| “COVID-19” |

|

: |

Coronavirus disease 2019 |

| |

|

|

|

| “CRS” |

|

: |

Contractors Registration System of the BCA |

| |

|

|

|

| “CVPA” |

|

: |

The Control of Vectors and Pesticides Act 1998 of Singapore, as amended, supplemented or modified from time to time |

| |

|

|

|

| “Directors” |

|

: |

The directors of our Company |

| |

|

|

|

| “EFMA” |

|

: |

The Employment of Foreign Manpower Act 1990 of Singapore, as amended, supplemented or modified from time to time |

| |

|

|

|

| “Employment Act” |

|

: |

The Employment Act 1968 of Singapore, as amended, supplemented or modified from time to time |

| |

|

|

|

| “EPHA” |

|

: |

The Environmental Public Health Act 1987 of Singapore, as amended, supplemented or modified from time to time |

| |

|

|

|

| “EPH Regulations” |

|

: |

The Environmental Public Health (General Cleaning Industry) Regulations of Singapore 2014, as amended, supplemented or modified from time to time |

| |

|

|

|

| “Executive Officers” |

|

: |

The executive officers of our Company. See section titled “General Information On Our Group — Our Business Overview — Management.” |

| “FASB” |

|

: |

The Financial Accounting Standards Board |

| |

|

|

|

| “Fiscal Year” or “FY” |

|

: |

Financial year ended or, as the case may be, ending March 31 |

| |

|

|

|

| “GAAP” |

|

: |

Accounting principles generally accepted in the United States of America |

| |

|

|

|

| “Group” |

|

: |

Our Company and our subsidiaries |

| |

|

|

|

| “GST” |

|

: |

Goods and Services Tax |

| |

|

|

|

| “Independent Directors” |

|

: |

The independent non-executive Directors of our Company |

| |

|

|

|

| “IoT” |

|

: |

Internet-of-Things |

| |

|

|

|

| “IPO” |

|

: |

The Company’s initial public offering of 3,050,000 Ordinary Shares which was completed on October 12, 2023 |

| |

|

|

|

| “Lender” |

|

: |

A registered financial institution under the Monetary Authority of Singapore that acts as our Company’s primary bank lender |

| |

|

|

|

| “Listing” |

|

: |

The listing and quotation of our Shares on Nasdaq |

| |

|

|

|

| “Major Shareholder” |

|

: |

A person who has an interest or interests (whether by record or beneficial ownership) in one or more voting shares (excluding treasury shares) in our Company, and the total votes attached to that share, or those shares, is not less than 5.0% of the total votes attached to all the voting shares (excluding treasury shares) in our Company |

| |

|

|

|

| “Nasdaq” |

|

: |

The Nasdaq Stock Market LLC |

| |

|

|

|

| “Nasdaq Listing Rules” |

|

: |

The Nasdaq rules governing listed companies |

| |

|

|

|

| “Nominating and Corporate Governance Committee |

|

: |

The nominating and corporate governance committee of our Board of Directors |

| |

|

|

|

| “Offering” |

|

: |

The offering of Shares by the Underwriter on behalf of our Company for subscription at the Offer Price, subject to and on the terms and conditions set out in this prospectus |

| |

|

|

|

| “Offer Price” |

|

: |

US$[*] for each Share being offered in this Offering |

| |

|

|

|

| “QEHS” |

|

: |

Quality, Environmental, Health and Safety |

| “Placement Agent” |

|

: |

FT Global Capital, Inc. which is acting as exclusive placement agent for this Offering |

| |

|

|

|

| “Placement Agent Agreement” |

|

: |

The Placement Agent Agreement dated ___________, 2024 entered into

between our Company and FT Global Capital, Inc., pursuant to which the Placement Agent has agreed to arrange for the sale of Shares offered

in this prospectus on a “best-efforts” basis, as described in the sections titled “Plan of Distribution”

of this prospectus |

| |

|

|

|

| “Restructuring Exercise” |

|

: |

The corporate restructuring exercise undertaken in anticipation of the Listing in which our Company acquired our current subsidiaries from Sapphire Universe |

| “RM” |

|

: |

Malaysian ringgit or Malaysian dollar |

| |

|

|

|

| “Share(s)” |

|

: |

Ordinary share(s) in the capital of our Company |

| |

|

|

|

| “Shareholders” |

|

: |

Registered holders of Shares |

| |

|

|

|

| “Singapore Take-Over Code” |

|

: |

The Singapore Take-Over Code on Take-Overs and Mergers, as amended, supplemented or modified from time to time |

| |

|

|

|

| “WICA” |

|

: |

Work Injury Compensation Act 2019 of Singapore |

| |

|

|

|

| “WSHA” |

|

: |

Workplace Safety and Health Act 2006 of Singapore |

| |

|

|

|

| “WSHIR” |

|

: |

Workplace Safety and Health (Incident Reporting) Regulations of Singapore |

| |

|

|

|

| “YA” |

|

: |

Year of assessment |

Currencies, Units and Others

| “S$” |

|

: |

Singapore dollars, the lawful currency of the Republic of Singapore |

| |

|

|

|

| “US$” or “$” |

|

: |

U.S. dollars and cents respectively, the lawful currency of the U.S. |

| |

|

|

|

| “%” or “per cent.” |

|

: |

Per centum |

| |

|

|

|

| “sq. m.” |

|

: |

Square meters |

The expressions “associated

company”, “related corporation” and “subsidiary” shall have the respective meanings ascribed to them in

the Companies Act, as the case may be.

Any discrepancies in tables

included herein between the total sum of amounts listed and the totals thereof are due to rounding. Accordingly, figures shown as totals

in certain tables may not be an arithmetic aggregation of the figures that precede them.

In this prospectus, references

to “our Company” or to “the Company” are to Primech Holdings Ltd. and, unless the context otherwise requires,

a reference to “we”, “our”, “us” or “our Group” or their other grammatical variations

is a reference to our Company and our subsidiaries taken as a whole.

Certain of our customers and

suppliers are referred to in this prospectus by their trade names. Our contracts with these customers and suppliers are typically with

an entity or entities in the relevant customer or supplier’s group of companies.

Internet site addresses

in this prospectus are included for reference only and the information contained in any website, including our website, is not incorporated

by reference into, and does not form part of, this prospectus.

Market and Industry Data

We obtained certain industry,

market and competitive position data in this prospectus from our own internal estimates, surveys and research and from publicly available

information, including industry and general publications and research, surveys and studies conducted by third parties, such as reports

by governmental agencies, for example, the Singapore Department of Statistics, the Singapore Ministry of Trade and Industry and the Singapore

Urban Redevelopment Authority, among others, and by private entities. None of these governmental agencies and private entities are affiliated

with our Company, and the information contained in this report has not been reviewed or endorsed by any of them.

Industry publications, research,

surveys, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable

but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained

from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus.

These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described

under “Risk Factors”. These and other factors could cause results to differ materially from those expressed in the

forecasts or estimates from independent third parties and us.

Trademarks, Service

Marks and Tradenames

We have proprietary rights

to trademarks used in this prospectus that are important to our business, many of which are registered under applicable intellectual property

laws. Solely for convenience, the trademarks, service marks, logos and trade names referred to in this prospectus are without the ® and

™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable

law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

This prospectus contains additional

trademarks, service marks and trade names of others, which are the property of their respective owners. All trademarks, service marks

and trade names appearing in this prospectus are, to our knowledge, the property of their respective owners. We do not intend our use

or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement

or sponsorship of us by, any other companies.

Presentation of Financial and Other Information

Unless otherwise indicated,

all financial information contained in this prospectus is prepared and presented in accordance with U.S. GAAP.

All references in this prospectus

to “U.S. dollars,” “US$,” “$” and “USD” refer to the currency of the United States

of America and all references to “S$,” “Singapore dollar,” or “SGD” refer to the currency of Singapore.

Unless otherwise indicated, all references to currency amounts in this prospectus are in USD.

We have made rounding adjustments

to some of the figures contained in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be exact arithmetic

aggregations of the figures that preceded them.

THE OFFERING

| Shares offered by us: |

|

Up to [*]

Ordinary Shares. |

| |

|

|

| Offer Price: |

|

$[*] per Share. |

| |

|

|

| Number of Shares outstanding before this Offering: |

|

38,125,951 Shares

are outstanding as of the date of this prospectus. |

| |

|

|

| Shares to be outstanding immediately after this Offering: |

|

[*] Shares. |

| |

|

|

| Warrants offered by us: |

|

Up to [*] warrants to purchase up to [*] Ordinary Shares of the Company.

The Warrants will have an exercise price of $[ ] per share. The Warrants will expire on the [ ]-year anniversary of the initial

issuance date.

The Ordinary Shares and the accompanying Warrants can only be purchased

together in this offering but will be issued separately

To better understand the terms of the Common

Warrants, you should carefully read the “Description of Securities We Are Offering” section of this prospectus. You

should also read the form of Warrants, which has been filed as an exhibit to the registration statement that includes this prospectus.

This prospectus also relates to the offering of the Ordinary Shares issuable upon exercise of the Warrants. |

| |

|

|

| Placement Agent Warrants: |

|

We have agreed issue to the Placement Agent warrants

(the “Placement Agent Warrants”) to purchase that number of Ordinary Shares which equals 5% of the aggregate number of Ordinary

Shares sold in this Offering at an exercise price of $[●] per share (or 125% of the Offering Price per Share).

To better understand the terms of the Placement

Agent Warrants, you should carefully read the descriptions of the Placement Agent Warrants in the “Description of Securities We

Are Offering” and “Plan of Distribution” sections of this prospectus. You should also read the form of Placement

Agent Warrant, which will be filed as an exhibit to the registration statement that includes this prospectus. This prospectus also relates

to the offering of the Ordinary Shares issuable upon exercise of the Placement Agent Warrants. |

| |

|

|

| Use of proceeds: |

|

We estimate that our net proceeds from this Offering will be approximately

US$8.8 million, assuming an Offering price of US$[*] per Share, which was the closing price of our Ordinary Shares on Nasdaq on October

11, 2024, and after deducting the placement agent fees and estimated offering expenses payable by us, assuming no exercise of the Warrants

and Placement Agent Warrants. |

| |

|

|

| |

|

We plan to use the net proceeds of this Offering as follows: |

| |

|

|

| |

|

Approximately $6.6 million for investment, establishment our team of

software developers, programmers, and engineers on research and development, and manufacturing, of cleaning robots. |

| |

|

|

| |

|

Approximately $2.2 million for working capital and other general corporate

purposes. |

| |

|

|

| Lock-up: |

|

We have agreed with the Placement Agent that for a period of ninety (90) days after the date of this prospectus, the Company will not (a) offer, sell or otherwise transfer or dispose of, directly or indirectly, any Shares, or any securities convertible into or exchangeable or exercisable for Shares; or (b) file or cause to be filed any registration statement with the SEC relating to the offering of any Shares or any securities convertible into or exchangeable or exercisable for Shares. In addition, our Directors, Executive Officers and Major Shareholders have agreed with the Placement Agent not to sell, transfer or dispose of, directly or indirectly, any of our Shares or securities convertible into or exercisable or exchangeable for our Shares for a period of sixty (60) days after the date of this prospectus. See sections titled “Shares Eligible for Future Sale” and “Plan of Distribution” for more information. |

| |

|

|

| Controlled company |

|

After this Offering, assuming an offering size as set forth in this section, Sapphire Universe will own approximately [ ]% of our Shares. As a result, we expect to continue to be a “controlled company” within the meaning of the corporate governance standards of the Nasdaq Capital Market, or Nasdaq. See section titled “Prospectus Summary — Implications of Being a Controlled Company”. |

| |

|

|

| Listing |

|

Our Ordinary Shares are listed on the Nasdaq Capital Market under the symbol “PMEC.” |

| |

|

|

| Risk factors |

|

See section titled “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in the Shares. |

Unless otherwise stated, all information in this prospectus assumes

no exercise of the outstanding options and warrants described above into ordinary shares, and no exercise of the Warrants and Placement

Agent Warrants issued in this offering and no sale of pre-funded warrants in this offering.

SUMMARY FINANCIAL INFORMATION

The following summary presents

consolidated balance sheet data as of March 31, 2024 and 2023 and summary consolidated statements of operations data for the years

ended March 31, 2024 and 2023 which have been derived from our audited financial statements included elsewhere in this prospectus.

Our consolidated financial statements are prepared and presented in accordance with U.S. GAAP. You should read this “Selected

Consolidated Financial And Operating Data” section together with our consolidated financial statements and the related notes

and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section included

elsewhere in this prospectus.

| (in thousand dollars) | |

As of

March 31,

2024 | | |

As of

March 31,

2023 | |

| | |

(Audited) | | |

(Audited) | |

| Balance Sheets Data | |

| | |

| |

| Current Assets | |

$ | 31,333 | | |

$ | 27,436 | |

| Non-Current Assets | |

| 14,176 | | |

| 15,387 | |

| Total assets | |

$ | 45,509 | | |

$ | 42,823 | |

| | |

| | | |

| | |

| Current liabilities | |

$ | 22,742 | | |

$ | 24,522 | |

| Non-Current liabilities | |

| 7,708 | | |

| 9,468 | |

| Shareholders’ equity | |

| 15,059 | | |

| 8,833 | |

| Total liabilities and shareholders’ equity | |

$ | 45,509 | | |

$ | 42,823 | |

| | |

For the Years Ended

March 31, | |

| (in thousand dollars) | |

2024 | | |

2023 | |

| Statements of Operations Data | |

| | |

| |

| Revenues | |

$ | 72,524 | | |

$ | 69,026 | |

| | |

| | | |

| | |

| Operating costs and expenses | |

| | | |

| | |

| Cost of revenue | |

| (59,915 | ) | |

| (58,410 | ) |

| General and administrative expenses | |

| (13,160 | ) | |

| (12,304 | ) |

| Sales and marketing expenses | |

| (2,231 | ) | |

| (279 | ) |

| Goodwill impairment | |

| - | | |

| (138 | ) |

| Loss from operations | |

| (2,782 | ) | |

| (2,105 | ) |

| Other income and expense, net | |

| 211 | | |

| 271 | |

| Interest expense | |

| (1,145 | ) | |

| (723 | ) |

| Loss before income taxes | |

| (3,716 | ) | |

| (2,557 | ) |

| Net loss | |

$ | (3,223 | ) | |

$ | (2,547 | ) |

RISK FACTORS

Prospective investors should

carefully consider and evaluate each of the following considerations and all other information set forth in this prospectus before deciding

to invest in our Shares. The following section describes some of the significant risks known to us now that could directly or indirectly

affect us and the value or trading price of our Shares and should not be construed as a comprehensive listing of all risk factors. The

following section does not state risks unknown to us now but which could occur in the future and risks which we currently believe to be

not material but may subsequently turn out to be so. Should these risks occur and/or turn out to be material, they could materially and

adversely affect our business, financial condition, results of operations and prospects. To the best of our Directors’ knowledge

and belief, the risk factors that are material to investors in making an informed judgment have been set out below. If any of the following

considerations and uncertainties develops into actual events, our business, financial condition, results of operations and prospects could

be materially and adversely affected. In such cases, the trading price of our Shares could decline and investors may lose all or part

of their investment in our Shares. Prospective investors are advised to apprise themselves of all factors involving the risks of investing

in our Shares from their professional advisers before making any decision to invest in our Shares.

This prospectus also contains

forward-looking statements having direct and/or indirect implications on our future performance. Our actual results could differ materially

from those anticipated in these forward-looking statements as a result of certain factors, including the risks and uncertainties faced

by us described below and elsewhere in this prospectus.

RISKS RELATING TO OUR BUSINESS

We incurred a net loss in FY 2023 and FY 2024

and we may incur losses in the future.

For

the years ended March 31, 2024 and 2023, the Company recorded net loss of approximately $3,223,000 and $2,547,000,

respectively. We anticipate that our operating expenses, together with the increased general administrative expenses of a public company,

will increase in the foreseeable future as we seek to maintain and continue to grow our business, attract potential customers and further

enhance our service offering. These efforts may prove more expensive than we currently anticipate, and we may not succeed in increasing

our revenue sufficiently to offset these higher expenses. As a result of the foregoing and other factors, we may incur net losses in the

future and may be unable to achieve or maintain profitability on a quarterly or annual basis for the foreseeable future.

We are subject to risks associated with debt

financing.

Due to our working capital

requirements in support of our day-to-day operations and business expansion, we may finance all or a substantial portion of our costs

through bank loans and credit facilities, in addition to Shareholders’ equity and internally generated funds. Details on our total

indebtedness is set forth in the section titled “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” of this prospectus.

While we believe that we have

sufficient capital from our available cash resources, our cash generated from our business operations and our credit facilities to meet

our current working capital and capital expenditure requirements, we may require additional debt financing to operate our business, implement

our future business strategies and/or acquire complementary businesses or develop new technologies.

Our ability to obtain debt

financing depends on a number of factors including our financial strength, creditworthiness and prospects, as well as other factors beyond

our control, including general economic, liquidity and political conditions. There is no assurance that we will be able to secure adequate

debt financing on terms acceptable to us, or at all. In the event that we are unable to secure adequate debt financing on terms acceptable

to us, we may not be able to implement our business strategies and our business and prospects could be materially and adversely affected

as a result.

Any disruptions, volatility

or uncertainty of the credit markets could limit our ability to borrow funds or cause our borrowings to become more expensive. As such,

we may be forced to pay unattractive interest rates, thereby increasing our interest expense, decreasing our profitability and reducing

our financial flexibility if we take on additional debt financing. Any material increase in interest rates would also increase our cost

of borrowing and debt financing costs, which may weaken our ability to obtain further future debt financing.

Further, debt financing may

restrict our freedom to operate our business as it may require conditions and/or covenants that:

| a. | limit our ability to pay dividends or require us to seek

consent for the payment of dividends; |

| b. | require us to dedicate a portion of our cash flow from operations

to repayments of our debt, thereby reducing the availability of our cash flow for capital expenditures, working capital and other general

corporate purposes; and |

| c. | limit our flexibility in planning for, or reacting to, changes

in our business and our industry. |

Any adverse material changes to the Singapore

market (whether localized or resulting from global economic or other conditions) such as the occurrence of an economic recession, pandemic

or widespread outbreak of an infectious disease (such as COVID-19), could have a material adverse effect on our business, results of operations

and financial condition.

During FY 2024 and FY 2023,

substantially all of our revenue was derived from our operations in Singapore. Any adverse circumstances affecting the Singapore market,

such as an economic recession, epidemic outbreak or natural disaster or other adverse incidents may adversely affect our business, financial

condition, results of operations and prospects. Any downturn in the industry which we operate in resulting in the postponement, delay

or cancellation of contracts and delay in recovery of receivables is likely to have an adverse impact on our business and profitability.

Uncertain global economic conditions

have had and may continue to have an adverse impact on our business in the form of lower net sales due to weakened demand, unfavorable

changes in product price/mix, or lower profit margins. For example, global economic downturns have adversely impacted some of our customers,

such as Singapore Changi Airport, hotels, restaurants, retail establishments, and other entities that are particularly sensitive to business

and consumer spending.

During economic downturns or

recessions, there can be a heightened competition for sales and increased pressure to reduce selling prices as our customers may reduce

their demand for our services. If we lose significant sales volume or reduce selling prices significantly, then there could be a negative

impact on our consolidated financial condition or results of operations, profitability and cash flows.

Reduced availability of credit

may also adversely affect the ability of some of our customers and suppliers to obtain funds for operations and capital expenditures.

This could negatively impact our ability to obtain necessary supplies as well as our sales of materials and equipment to affected customers.

This could additionally result in reduced or delayed collections of outstanding accounts receivable.

An epidemic or outbreak of

communicable diseases may also adversely affect our business, financial condition, results of operations and prospects. For example, outbreak

of COVID-19, resulted in a global health crisis, causing disruptions to social and economic activities, business operations and supply

chains worldwide, including in Singapore. Measures taken by the Singapore government to tackle the spread of COVID-19 have included, among

others, border closures, quarantine measures and lockdown measures. The COVID-19 outbreak and related government measures have adversely

affected our business in a number of ways, including:

| ● | temporary scale-back of certain cleaning services rendered

at Singapore Changi Airport, Terminal 2; |

| ● | termination on short notice of a number of service contracts,

especially contracts pertaining to the hospitality industry, as well as our provision of customer services to hotels and other tourism

venues; and |

| ● | a shortage of labor given that a significant proportion of

our employees are foreign workers who were subject to Singapore government imposed travel restrictions including stay-home notices or

quarantine orders. |

If a substantial number of

our employees are infected with and/or are suspected of having COVID-19, and our employees are required to be hospitalized, this may disrupt

our ability to render services which may have a material adverse effect on our business operations and reputation of our Group.

Singapore removed most remaining