Raising Full Year Revenue and Margin

Guidance

Insulet Corporation (NASDAQ: PODD) (Insulet or the Company), the

global leader in tubeless insulin pump technology with its Omnipod®

brand of products, today announced financial results for the three

months ended September 30, 2024.

“We continue to achieve significant milestones and robust

revenue growth," said Jim Hollingshead, President and Chief

Executive Officer. “Omnipod 5 is the first and only automated

insulin delivery system in the U.S. for both type 1 and type 2

diabetes, following recent FDA clearance for the type 2 label

indication. Insulet leads the industry, and Omnipod 5 is

revolutionizing diabetes care worldwide. I am proud of our team’s

daily achievements in improving health outcomes and setting new

standards in diabetes management.”

Third Quarter Financial Highlights:

- Third quarter 2024 revenue of $543.9 million, up 25.7%, or

25.4% in constant currency1, compared to $432.7 million in the

prior year, exceeds the high end of the Company’s guidance range of

21% in constant currency

- Total Omnipod revenue of $533.6 million, an increase of 26.4%,

or 26.1% in constant currency

- U.S. Omnipod revenue of $395.6 million, an increase of

23.4%

- International Omnipod revenue of $138.0 million, an increase of

36.1%, or 34.8% in constant currency

- Drug Delivery revenue of $10.3 million, consistent with prior

year

- Gross margin of 69.3%, up 150 basis points, compared to gross

margin of 67.8% in the prior year

- Operating income of $88.1 million, or 16.2% of revenue, up 350

basis points, compared to operating income of $54.8 million, or

12.7% of revenue, in the prior year

- Net income of $77.5 million, or $1.08 per diluted share,

compared to net income of $51.9 million, or $0.74 per diluted

share, in the prior year.

- Adjusted net income1 of $64.2 million, or $0.90 per diluted

share, excludes a tax benefit of $14.8 million primarily associated

with the release of the Company’s valuation allowance and a $1.5

million loss on an investment. Adjusted net income in the prior

year of $50.0 million, or $0.71 per diluted share, excludes income

of $1.9 million associated with the voluntary medical device

correction notices issued in 2022

- Adjusted EBITDA1 of $126.1 million, or 23.2% of revenue, up 410

basis points, compared to $82.8 million, or 19.1% of revenue, in

the prior year

Recent Strategic Highlights:

- Received FDA clearance for Omnipod 5 for use by the six million

people in the U.S. with type 2 diabetes2, making Omnipod 5 the

first and only automated insulin delivery system indicated for both

type 1 and type 2 diabetes

- Launched U.S. full market release of the Omnipod 5 App for

iPhone

- Omnipod named the number one insulin pump for new pump users in

Europe3

- Published results in Diabetes Care demonstrating improved

glycemic control and psychosocial outcomes in adults with type 1

diabetes compared to pump therapy with CGM.4

2024 Outlook:

Revenue Guidance (in constant

currency):

- For the year ending December 31, 2024, the Company is raising

its expected revenue growth to a range of 20% to 21% (previously

16% to 19%). Revenue growth ranges by product line are:

- Total Omnipod of 21% to 22% (previously 18% to 21%)

- U.S. Omnipod of 19% to 21% (previously 18% to 21%)

- International Omnipod of 25% to 27% (previously 18% to

21%)

- Drug Delivery of (10)% to (5)% (previously (50)% to (40)%)

- For the quarter ending December 31, 2024, the Company expects

revenue growth of 12% to 15%. Revenue growth ranges by product line

are:

- Total Omnipod of 13% to 16%

- U.S. Omnipod of 9% to 12%5

- International Omnipod of 30% to 33%

- Drug Delivery of (20)% to (15)% (approximately $7 million to $8

million)

Gross Margin and Operating Margin

Guidance:

For the year ending December 31, 2024, the Company now expects

gross margin to be approximately 69% (previously 68% to 69%, closer

to the high end).

For the year ending December 31, 2024, the Company is raising

its expected operating margin by 50 basis points to approximately

14.5%.

___________________________

1 See description of non-GAAP financial

measures contained in this release.

2 The expanded indication for the Omnipod

5 Automated Insulin Delivery System is for use for people with type

2 diabetes ages 18 years and older in the U.S.

3 Omnipod was the most frequently chosen

pump in the past year among people new to an insulin pump in a

survey conducted by dQ&A across Germany, Italy, France, United

Kingdom, Spain, Netherlands, Sweden. N=3646; 1H'24: P.47 (August

2024).

4 Renard E et al. Diabetes Care.2024;

47(12):1-10. https://doi.org/10.2337/dc24-1550. Results are from

Insulet’s first international randomized controlled trial of

Omnipod 5 and demonstrated a 17.5% increase in time in range in

those with high baseline A1c.

5 As previously disclosed, U.S. Omnipod

revenue in the fourth quarter of 2023 benefited from two stocking

dynamics totaling an estimated $30 million to $40 million

(impacting fourth quarter of 2024 U.S. Omnipod revenue growth by

~1,100 basis points).

Conference Call:

Insulet will host a conference call at 4:30 p.m. (Eastern Time)

on November 7, 2024 to discuss the financial results and outlook.

The link to the live call will be available on the Investor

Relations section of the Company’s website at

investors.insulet.com, “Events and Presentations,” and will be

archived for future reference. The live call may also be accessed

by dialing (888) 770-7129 for domestic callers or (929) 203-2109

for international callers, passcode 5904836.

About Insulet Corporation:

Insulet Corporation (NASDAQ: PODD), headquartered in

Massachusetts, is an innovative medical device company dedicated to

simplifying life for people with diabetes and other conditions

through its Omnipod product platform. The Omnipod Insulin

Management System provides a unique alternative to traditional

insulin delivery methods. With its simple, wearable design, the

tubeless disposable Pod provides up to three days of non-stop

insulin delivery, without the need to see or handle a needle.

Insulet’s flagship innovation, the Omnipod 5 Automated Insulin

Delivery System, is a tubeless automated insulin delivery system,

integrated with a continuous glucose monitor to manage blood sugar

with no multiple daily injections, zero fingersticks, and can be

fully controlled by a compatible personal smartphone in the U.S. or

by the Omnipod 5 Controller. Insulet also leverages the unique

design of its Pod by tailoring its Omnipod technology platform for

the delivery of non-insulin subcutaneous drugs across other

therapeutic areas. For more information, please visit insulet.com

and omnipod.com.

Non-GAAP Measures:

The Company uses the following non-GAAP financial measures:

- Constant currency revenue growth, which represents the change

in revenue between current and prior year periods using the

exchange rate in effect during the applicable prior year period.

Insulet presents constant currency revenue growth because

management believes it provides meaningful information regarding

the Company’s results on a consistent and comparable basis.

Management uses this non-GAAP financial measure, in addition to

financial measures in accordance with generally accepted accounting

principles in the United States (GAAP), to evaluate the Company’s

operating results. It is also one of the performance metrics that

determines management incentive compensation.

- Adjusted gross margin, adjusted gross margin as a percentage of

revenue, adjusted operating income, adjusted operating income as a

percentage of revenue, adjusted net income, and adjusted diluted

earnings per share exclude the impact of certain significant

transactions or events, such as legal settlements, medical device

corrections, gains (losses) on investments and loss on

extinguishment of debt, that affect the period-to-period

comparability of the Company’s performance, as applicable.

- Adjusted EBITDA, which represents net income plus net interest

expense, income tax expense, depreciation and amortization,

stock-based compensation expense and other significant transactions

or events, such as legal settlements, medical device corrections,

gains (losses) on investments and loss on extinguishment of debt,

that affect the period-to-period comparability of the Company’s

performance, as applicable, and adjusted EBITDA as a percentage of

revenue.

Insulet presents the above non-GAAP financial measures because

management uses them as supplemental measures in assessing the

Company’s performance, and the Company believes they are helpful to

investors and other interested parties as measures of comparative

performance from period to period. They also are commonly used

measures in determining business value, and the Company uses them

internally to report results.

These non-GAAP financial measures should be considered

supplemental to, and not a substitute for, the Company’s reported

financial results prepared in accordance with GAAP. Furthermore,

the Company’s definition of these non-GAAP measures may differ from

similarly titled measures used by others. Because non-GAAP

financial measures exclude the effect of items that will increase

or decrease the Company’s reported results of operations, Insulet

strongly encourages investors to review the Company’s consolidated

financial statements and publicly filed reports in their

entirety.

Forward-Looking Statement:

This press release contains forward-looking statements

regarding, among other things, future operating and financial

performance, product success and efficacy, the outcome of studies

and trials and the approval of products by regulatory bodies. These

forward-looking statements are based on management’s current

beliefs, assumptions and estimates and are not intended to be a

guarantee of future events or performance. If management’s

underlying assumptions turn out to be incorrect, or if certain

risks or uncertainties materialize, actual results could vary

materially from the expectations and projections expressed or

implied by the forward-looking statements.

Risks and uncertainties include, but are not limited to our

dependence on a principal product platform; the impact of

competitive products, technological change and product innovation;

our ability to maintain an effective sales force and expand our

distribution network; our ability to maintain and grow our customer

base; our ability to scale the business to support revenue growth;

our ability to secure and retain adequate coverage or reimbursement

from third-party payors; the impact of healthcare reform laws; our

ability to design, develop, manufacture and commercialize future

products; unfavorable results of clinical studies, including issues

with third parties conducting any studies, or future publication of

articles or announcement of positions by diabetes associations or

other organizations that are unfavorable; our ability to protect

our intellectual property and other proprietary rights; potential

conflicts with the intellectual property of third parties; our

inability to maintain or enter into new license or other agreements

with respect to continuous glucose monitors, data management

systems or other rights necessary to sell our current product

and/or commercialize future products; worldwide macroeconomic and

geopolitical uncertainty as well as risks associated with public

health crises and pandemics, including government actions and

restrictive measures implemented in response, supply chain

disruptions, delays in clinical trials, and other impacts to the

business, our customers, suppliers, and employees; international

business risks, including regulatory, commercial and logistics

risks; the potential violation of anti-bribery/anti-corruption

laws; the concentration of manufacturing operations and storage of

inventory in a limited number of locations; supply problems or

price fluctuations with sole source or third-party suppliers on

which we are dependent; failure to retain key suppliers or other

manufacturing issues; challenges to the future development of our

non-insulin drug delivery product line; failure of our contract

manufacturer or component suppliers to comply with the U.S. Food

and Drug Administration’s quality system regulations; extensive

government regulation applicable to medical devices as well as

complex and evolving privacy and data protection laws; adverse

regulatory or legal actions relating to current or future Omnipod

products; potential adverse impacts resulting from a recall,

discovery of serious safety issues, or product liability lawsuits

relating to off-label use; breaches or failures of our product or

information technology systems, including by cyberattack; loss of

employees or inability to identify and recruit new employees; risks

associated with potential future acquisitions or investments in new

businesses; ability to generate sufficient cash to service our

indebtedness or raise additional funds on acceptable terms or at

all; the volatility of the trading price of our common stock; risks

related to the conversion of outstanding Convertible Senior Notes;

and potential limitations on our ability to use our net operating

loss carryforwards.

For a further list and description of these and other important

risks and uncertainties that may affect our future operations, see

Part I, Item 1A - Risk Factors in our most recent Annual Report on

Form 10-K filed with the Securities and Exchange Commission, which

we may update in Part II, Item 1A - Risk Factors in Quarterly

Reports on Form 10-Q we have filed or will file hereafter. Any

forward-looking statement made in this release speaks only as of

the date of this release. Insulet does not undertake to update any

forward-looking statement, other than as required by law.

©2024 Insulet Corporation. Omnipod is a registered trademark of

Insulet Corporation. All rights reserved. All other trademarks are

the property of their respective owners.

INSULET CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (UNAUDITED)

Three Months Ended

September 30,

Nine Months

Ended September 30,

(dollars in millions, except per share

data)

2024

2023

2024

2023

Revenue

$

543.9

$

432.7

$

1,474.1

$

1,187.3

Cost of revenue

166.8

139.4

459.3

388.6

Gross profit

377.1

293.3

1,014.8

798.7

Research and development expenses

54.9

57.8

159.0

163.0

Selling, general and administrative

expenses

234.1

180.7

656.2

522.1

Operating income

88.1

54.8

199.6

113.6

Interest expense, net

(1.8

)

(1.8

)

(4.8

)

(7.1

)

Other (expense) income, net

(3.4

)

0.7

(5.9

)

0.3

Income before income taxes

82.9

53.7

188.9

106.8

Income tax (expense) benefit

(5.4

)

(1.8

)

128.7

(3.8

)

Net income

$

77.5

$

51.9

$

317.6

$

103.0

Earnings per share:

Basic

$

1.11

$

0.74

$

4.53

$

1.48

Diluted

$

1.08

$

0.74

$

4.40

$

1.47

Weighted-average number of common

shares outstanding (in thousands):

Basic

70,123

69,823

70,047

69,715

Diluted

73,951

73,624

73,830

70,111

RECONCILIATION OF DILUTED NET

INCOME (UNAUDITED)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(in millions, except share and per

share data)

2024

2023

2024

2023

Net income

$

77.5

$

51.9

$

317.6

$

103.0

Add back interest expense, net of tax

attributable to assumed conversion of convertible senior notes

2.3

2.5

7.1

—

Net income, diluted

$

79.8

$

54.4

$

324.7

$

103.0

INSULET CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

(dollars in millions)

September 30, 2024

December 31, 2023

ASSETS

Cash and cash equivalents

$

902.6

$

704.2

Accounts receivable, net

375.6

359.7

Inventories

444.9

402.6

Prepaid expenses and other current

assets

137.8

116.4

Total current assets

1,860.9

1,582.9

Property, plant and equipment, net

702.9

664.9

Goodwill and other intangible assets,

net

151.3

150.4

Deferred tax assets

144.4

1.8

Other assets

165.9

188.2

Total assets

$

3,025.4

$

2,588.2

LIABILITIES AND STOCKHOLDERS’

EQUITY

Accounts payable

$

40.3

$

19.2

Accrued expenses and other current

liabilities

423.9

382.6

Current portion of long-term debt

42.0

49.4

Total current liabilities

506.2

451.2

Long-term debt, net

1,356.3

1,366.4

Other liabilities

44.9

37.9

Total liabilities

1,907.4

1,855.5

Stockholders’ equity

1,118.0

732.7

Total liabilities and stockholders’

equity

$

3,025.4

$

2,588.2

INSULET CORPORATION

NON-GAAP RECONCILIATIONS

(UNAUDITED)

CONSTANT CURRENCY REVENUE

GROWTH

Three Months Ended September

30,

(dollars in millions)

2024

2023

Percent Change

Currency

Impact

Constant

Currency

Revenue:

U.S. Omnipod

$

395.6

$

320.6

23.4

%

—

%

23.4

%

International Omnipod

138.0

101.4

36.1

%

1.3

%

34.8

%

Total Omnipod

533.6

422.0

26.4

%

0.3

%

26.1

%

Drug Delivery

10.3

10.7

(3.7

)%

—

%

(3.7

)%

Total

$

543.9

$

432.7

25.7

%

0.3

%

25.4

%

Nine Months Ended September

30,

(dollars in millions)

2024

2023

Percent Change

Currency

Impact

Constant

Currency

Revenue:

U.S. Omnipod

$

1,065.6

$

856.4

24.4

%

—

%

24.4

%

International Omnipod

381.4

303.7

25.6

%

0.9

%

24.7

%

Total Omnipod

1,447.0

1,160.1

24.7

%

0.2

%

24.5

%

Drug Delivery

27.1

27.2

(0.4

)%

—

%

(0.4

)%

Total

$

1,474.1

$

1,187.3

24.2

%

0.3

%

23.9

%

INSULET CORPORATION

NON-GAAP RECONCILIATIONS

(UNAUDITED)

ADJUSTED GROSS MARGIN,

OPERATING MARGIN, NET INCOME, DILUTED EPS

Three Months Ended September

30, 2024

(dollars in millions)

Income before

Income Taxes

Net Income(3)

Net Income,

Diluted

Diluted Earnings

per Share

GAAP

$

82.9

$

77.5

$

79.8

$

1.08

Unrealized loss on investments(1)

2.0

1.5

1.5

$

0.02

Tax matters(2)

—

(14.8

)

(14.8

)

$

(0.20

)

Non-GAAP

$

84.9

$

64.2

$

66.5

$

0.90

Nine Months Ended September

30, 2024

(dollars in millions)

Income before

Income Taxes

Net Income(3)

Net Income,

Diluted

Diluted Earnings

per Share

GAAP

$

188.9

$

317.6

$

324.7

$

4.40

Unrealized loss on investments(1)

3.8

2.9

2.9

$

0.04

Tax matters(2)

—

(173.1

)

(173.1

)

$

(2.34

)

Non-GAAP

$

192.7

$

147.4

$

154.5

$

2.09

Three Months Ended September

30, 2023

(dollars in millions)

Income before

Income Taxes

Net Income(3)

Net Income,

Diluted

Diluted Earnings

per Share

GAAP

$

53.7

$

51.9

$

54.4

$

0.74

Voluntary MDCs(4)

(1.9

)

(1.9

)

(1.9

)

$

(0.03

)

Non-GAAP

$

51.8

$

50.0

$

52.5

$

0.71

Nine Months Ended September

30, 2023

(dollars in millions)

Gross Profit

Percent of

Revenue

Operating

Income

Percent of

Revenue

Income

before

Income

Taxes

Net

Income(3)

Diluted

Earnings

per Share

GAAP

$

798.7

67.3

%

$

113.6

9.6

%

$

106.8

$

103.0

$

1.47

Voluntary MDCs(4)

(10.7

)

(10.7

)

(10.7

)

(10.7

)

$

(0.15

)

Non-GAAP

$

788.0

66.4

%

$

102.9

8.7

%

$

96.1

$

92.3

$

1.32

(1)

Represents non-operating loss

resulting from the fair value adjustment of a strategic debt

investment.

(2)

Includes a tax benefit of $12.1

million and $165.6 million for the three and nine months ended

September 30, 2024, respectively, resulting from the release of the

Company’s income tax valuation allowance. Also includes a tax

benefit of $2.7 million and $7.5 million for the three and nine

months ended September 30, 2024, respectively, related to a

research and development tax credit recovery project for prior

years.

(3)

The tax effect on non-GAAP

adjustments is calculated based on the applicable local statutory

tax rates, including the impact of any valuation allowance.

(4)

Represents income resulting from

an adjustment to estimated costs associated with the voluntary

medical device correction (“MDC”) notices issued in the fourth

quarter of 2022, which is included in cost of revenue.

INSULET CORPORATION

NON-GAAP RECONCILIATIONS

(UNAUDITED) (CONTINUED)

ADJUSTED EBITDA

Three Months Ended September

30,

Nine Months Ended September

30,

(dollars in millions)

2024

Percent of

Revenue

2023

Percent of

Revenue

2024

Percent of

Revenue

2023

Percent of

Revenue

Net income

$

77.5

14.2

%

$

51.9

12.0

%

$

317.6

21.5

%

$

103.0

8.7

%

Interest expense, net

1.8

1.8

4.8

7.1

Income tax expense (benefit)

5.4

1.8

(128.7

)

3.8

Depreciation and amortization

21.3

18.7

59.3

54.0

Stock-based compensation expense

18.1

10.5

49.3

35.7

Voluntary MDCs(1)

—

(1.9

)

—

(10.7

)

Unrealized loss on investments(2)

2.0

—

3.8

—

Adjusted EBITDA

$

126.1

23.2

%

$

82.8

19.1

%

$

306.1

20.8

%

$

192.9

16.2

%

(1)

Represents income resulting from

an adjustment to estimated costs associated with the voluntary MDC

notices issued in the fourth quarter of 2022, which is included in

cost of revenue.

(2)

Represents non-operating loss

resulting from the fair value adjustment of a strategic debt

investment.

INSULET CORPORATION

NON-GAAP RECONCILIATIONS

(UNAUDITED) CONTINUED

REVENUE GUIDANCE

Year Ending December 31,

2024

Revenue Growth

GAAP

Currency

Impact

Constant

Currency

U.S. Omnipod

19% - 21%

—%

19% - 21%

International Omnipod

26% - 28%

1%

25% - 27%

Total Omnipod

21% - 22%

—%

21% - 22%

Drug Delivery

(10)% - (5)%

—%

(10)% - (5)%

Total

20% - 21%

—%

20% - 21%

Three Months Ended December

31, 2024

Revenue Growth

GAAP

Currency

Impact

Constant

Currency

U.S. Omnipod

9% - 12%

—%

9% - 12%

International Omnipod

31% - 34%

1%

30% - 33%

Total Omnipod

13% - 16%

—%

13% - 16%

Drug Delivery

(20)% - (15)%

—%

(20)% - (15)%

Total

12% - 15%

—%

12% - 15%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107766953/en/

Investor Relations:

Deborah R. Gordon Vice President, Investor Relations (978)

600-7717 dgordon@insulet.com

Media:

Angela Geryak Wiczek Senior Director, Corporate Communications

(978) 932-0611 awiczek@insulet.com

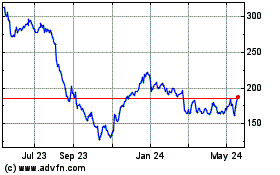

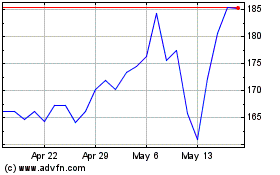

Insulet (NASDAQ:PODD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Insulet (NASDAQ:PODD)

Historical Stock Chart

From Feb 2024 to Feb 2025