false

0001622345

0001622345

2024-08-14

2024-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2024

POLAR

POWER, INC.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

001-37960 |

|

33-0479020 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

249

E. Gardena Boulevard, Gardena, California 90248

(Address

of Principal Executive Offices) (Zip Code)

(310)

830-9153

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

POLA |

|

The

NASDAQ Stock Market, LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

August 14, 2024, Polar Power, Inc. (the “Company”) issued a press release announcing its financial results for the three

and six months ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 and is incorporated herein by reference.

Item

7.01 Regulation FD Disclosure.

The

information contained in Item 2.02 is incorporated herein by reference.

The

information contained in Items 2.02 and Item 7.01 (including Exhibit 99.1) is furnished pursuant to Items 2.02 and 7.01 and shall not

be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject

to the liabilities of that section.

The

Company does not have, and expressly disclaims, any obligation to release publicly any updates or any changes in the Company’s

expectations or any change in events, conditions, or circumstances on which any forward-looking statement is based, except as required

by law.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

August 14, 2024

| |

POLAR

POWER, INC. |

| |

|

|

| |

By: |

/s/

Arthur D. Sams |

| |

|

Arthur

D. Sams President, Chief Executive Officer and Secretary |

Exhibit

99.1

Polar

Power Reports Second Quarter 2024 Financial Results

Swing

to Quarterly Profit Led by Higher Net Sales

GARDENA,

CA – August 14, 2024 – Polar Power, Inc. (“Polar Power” or the “Company”) (NASDAQ: POLA), a global

provider of prime, backup, and solar hybrid DC power solutions, reports its financial results for the second quarter of 2024.

Q2

2024 Financial Highlights

| ● |

Net

sales were $4.6 million, a sequential improvement of 163% compared to $1.8 million in the first quarter of 2024, and compared to

$5.6 million in the same period in 2023 |

| ● |

The

company’s gross margin improved to 39.3% compared to 26.4%, due in part to higher international sales |

| ● |

Operating

expenses were $1.4 million, slightly lower compared to $1.6 million in the first quarter of 2024, and compared to $1.8 million in

the same period in 2023 |

| ● |

Net

income was $501,000, or $0.03 per basic and diluted share, compared to a net loss of $(436,000), or $(0.03) per basic and diluted

share in the same period in 2023 |

| ● |

Working

capital of $10.1 million as of June 30, 2024, including $15.8 million in inventory |

| ● |

Backlog

at June 30, 2024 was $5.7 million, which includes $2.0 million in new bookings during the second quarter of 2024 |

Corporate

Highlights:

| ● |

Appointed

Mike Field as new Director and Compensation Committee Chairman |

| ● |

Received

approximately $3.0 million in tax refunds and Employee Retention Credits applied for in prior years |

Arthur

Sams, CEO of Polar Power, commented, “Our financial results in the second quarter are a welcome improvement over the first quarter

of the year. We have seen a reversion to more normalized order levels from our top telco customers throughout the year, with more consistent

bookings that started in the back half of 2023, leading to higher sales in the current quarter, and a backlog that remains above $5 million.

A positive swing in the bottom line of approximately $2.6 million compared to the prior quarter resulted in a profit of roughly $500,000,

which importantly marks our first profitable quarter in over two years.

“International

sales represented approximately 20% of our second quarter revenues, highlighting a steady geographic diversification in our sales. Also,

during the quarter, our gross margins improved due to utilization of inventory in products shipped to telecom customers, including both

DC backup power systems and solar hybrid power systems to international customers in Asia and elsewhere. We believe increased revenues

combined with utilization of inventory will provide improved profits as we continue to see market conditions improve in our core telecom

market.”

“We

also appointed a new director to our Board, Michael Field, and we welcome him to the team and look forward to benefitting from his sales,

operational, and leadership experience,” concluded Mr. Sams.

About

Polar Power, Inc.

Polar

Power (NASDAQ: POLA) is pioneering technological changes that radically change the production, consumption, and environmental impact

of power generation and is a leading provider of DC advanced power and cooling systems, pioneering innovations across diverse industrial

applications. Its product portfolio, known for innovation, durability, and efficiency, presently includes standard products for telecom,

military, renewable energy, marine, automotive, residential, commercial, oil field and mining applications. Polar Power’s systems

can be configured to operate on any energy source including photovoltaics, diesel, LPG (propane and butane), and renewable fuels.

Polar

Power’s telecom power solutions offer significant cost savings with installation, permitting, site leases, and operation. Its military

solutions provide compact, lightweight, fuel efficient, reliable power solutions for robotics, drone, communications, hybrid propulsion,

and other applications. Its mobile rapid battery charging technology enables on-demand roadside charging for electric vehicles. Its combined

heat and power (CHP) residential systems offer innovative vehicle charging and integrated home power systems via natural gas or propane

feedstocks, optimizing performance and system costs. Polar Power’s micro / nano grid solutions provide lower cost energy in “bad-grid

or no-grid” environments. Its commitment to technological advancement extends to hybrid propulsion systems for marine and specialty

vehicles, ensuring efficiency, comfort, reliability, and cost savings.

For

more information, please visit www.polarpower.com. or follow us on www.linkedin.com/company/polar-power-inc/.

Safe

Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This

news release contains certain statements of a forward-looking nature relating to future events or future business performance. Forward-looking

statements can be identified by the words “expects,” “anticipates,” “believes,” “intends,”

“estimates,” “plans,” “will,” “outlook” and similar expressions. Forward-looking statements

are based on management’s current plans, estimates, assumptions and projections, and speak only as of the date they are made. With

the exception of historical information, the matters discussed in this press release including, without limitation, Polar Power’s

belief that orders from its telecom customers will continue to materialize; Polar Power’s expectations that its planned investment

in sales and marketing will accelerate sales growth, and managing operating expenses should enable both top- and bottom-line improvements

throughout 2024 are forward-looking statements and considerations that involve a number of risks and uncertainties. The actual future

results of Polar Power could differ from those statements. Factors that could cause or contribute to such differences include, but are

not limited to, adverse domestic and foreign economic and market conditions, including demand for its Summit Series, 27 kW DC generator

product line; trade tariffs on raw materials; changes in domestic and foreign governmental regulations and policies; the impact of inflation

and changing prices on raw materials; supply chain constraints causing significant delays in sourcing raw materials; labor shortages

as a result of the pandemic, low unemployment rates, or other factors limiting the availability of qualified workers; and other events,

factors and risks. It undertakes no obligation to update any forward-looking statement in light of new information or future events,

except as otherwise required by law. Forward-looking statements involve inherent risks and uncertainties, most of which are difficult

to predict and are generally beyond Polar Power’s control. Actual results or outcomes may differ materially from those implied

by the forward-looking statements as a result of the impact of a number of factors, many of which are discussed in more detail in Polar

Power’s reports filed with the Securities and Exchange Commission.

Media

and Investor Relations:

CoreIR

Peter

Seltzberg, SVP Investor Relations and Corporate Advisory

+1

212-655-0924

ir@polarpowerinc.com

www.CoreIR.com

Company

Contact:

Polar

Power, Inc.

249

E. Gardena Blvd.

Gardena,

CA 90248

Tel:

310-830-9153

ir@polarpowerinc.com

www.polarpower.com

POLAR

POWER, INC.

CONDENSED

BALANCE SHEETS

(in

thousands, except share and per share data)

| | |

June 30, 2024 | |

December 31, 2023 |

| | |

(Unaudited) | |

|

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,119 | | |

$ | 549 | |

| Accounts receivable | |

| 2,310 | | |

| 1,676 | |

| Inventories | |

| 15,776 | | |

| 16,522 | |

| Prepaid expenses | |

| 387 | | |

| 455 | |

| Employee retention credit receivable | |

| — | | |

| 2,000 | |

| Income taxes receivable | |

| — | | |

| 787 | |

| Total current assets | |

| 19,592 | | |

| 21,989 | |

| | |

| | | |

| | |

| Other assets: | |

| | | |

| | |

| Operating lease right-of-use assets, net | |

| 2,239 | | |

| 2,818 | |

| Property and equipment, net | |

| 241 | | |

| 344 | |

| Deposits | |

| 108 | | |

| 108 | |

| | |

| | | |

| | |

| Total assets | |

$ | 22,180 | | |

$ | 25,259 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 597 | | |

$ | 1,762 | |

| Customer deposits | |

| 1,469 | | |

| 1,618 | |

| Accrued liabilities and other current liabilities | |

| 1,156 | | |

| 1,151 | |

| Line of credit | |

| 4,683 | | |

| 4,238 | |

| Notes payable-related party, current portion | |

| 258 | | |

| 257 | |

| Notes payable, current portion | |

| 16 | | |

| 64 | |

| Operating lease liabilities, current portion | |

| 1,260 | | |

| 1,124 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 9,439 | | |

| 10,214 | |

| | |

| | | |

| | |

| Operating lease liabilities, net of current portion | |

| 1,193 | | |

| 1,856 | |

| | |

| | | |

| | |

| Total liabilities | |

| 10,632 | | |

| 12,070 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Preferred stock, $0.0001 par value, 5,000,000 shares authorized, no shares issued and outstanding | |

| — | | |

| — | |

| Common stock, $0.0001 par value, 50,000,000 shares authorized, 17,579,089 shares issued and 17,561,612 shares outstanding on June 30, 2024, and December 31, 2023 | |

| 2 | | |

| 2 | |

| Additional paid-in capital | |

| 38,886 | | |

| 38,886 | |

| Accumulated deficit | |

| (27,300 | ) | |

| (25,659 | ) |

| Treasury Stock, at cost (17,477 shares) | |

| (40 | ) | |

| (40 | ) |

| Total stockholders’ equity | |

| 11,548 | | |

| 13,189 | |

| | |

| | | |

| | |

| Total liabilities and stockholders’ equity | |

$ | 22,180 | | |

$ | 25,259 | |

POLAR

POWER, INC.

UNAUDITED

CONDENSED STATEMENTS OF OPERATIONS

(in

thousands, except share and per share data)

| | |

Three Months Ended

June 30, | |

Six Months Ended

June 30, |

| | |

2024 | |

2023 | |

2024 | |

2023 |

| Net Sales | |

$ | 4,660 | | |

$ | 5,587 | | |

$ | 6,434 | | |

$ | 9,777 | |

| Cost of Sales | |

| 2,828 | | |

| 4,112 | | |

| 5,005 | | |

| 7,548 | |

| Gross profit | |

| 1,832 | | |

| 1,475 | | |

| 1,429 | | |

| 2,229 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing | |

| 264 | | |

| 310 | | |

| 494 | | |

| 642 | |

| Research and development | |

| 195 | | |

| 338 | | |

| 415 | | |

| 684 | |

| General and administrative | |

| 913 | | |

| 1,137 | | |

| 2,040 | | |

| 2,248 | |

| Total operating expenses | |

| 1,372 | | |

| 1,785 | | |

| 2,949 | | |

| 3,574 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from operations | |

| 460 | | |

| (310 | ) | |

| (1,520 | ) | |

| (1,345 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expenses) | |

| | | |

| | | |

| | | |

| | |

| Interest expense and finance costs | |

| (179 | ) | |

| (126 | ) | |

| (342 | ) | |

| (204 | ) |

| Interest Income | |

| 220 | | |

| — | | |

| 221 | | |

| | |

| Total other income (expenses), net | |

| 41 | | |

| (126 | ) | |

| (121 | ) | |

| (204 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

$ | 501 | | |

$ | (436 | ) | |

$ | (1,641 | ) | |

$ | (1,549 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) per share – basic and diluted | |

$ | 0.03 | | |

$ | (0.03 | ) | |

$ | (0.09 | ) | |

$ | (0.12 | ) |

| Weighted average shares outstanding, basic and diluted | |

| 17,561,612 | | |

| 12,949,550 | | |

| 17,561,612 | | |

| 12,949,550 | |

POLAR

POWER, INC.

UNAUDITED

CONDENSED STATEMENTS OF CASH FLOW

(in

thousands)

| | |

Six Months Ended

June 30, |

| | |

2024 | |

2023 |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (1,641 | ) | |

$ | (1,549 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 121 | | |

| 226 | |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| (634 | ) | |

| (1,488 | ) |

| Employee retention credit | |

| 2,000 | | |

| — | |

| Inventories | |

| 746 | | |

| (2,229 | ) |

| Prepaid expenses | |

| 68 | | |

| 1,579 | |

| Income tax receivable | |

| 787 | | |

| — | |

| Operating lease right-of-use asset | |

| 579 | | |

| 454 | |

| Accounts payable | |

| (1,165 | ) | |

| 1,199 | |

| Customer deposits | |

| (149 | ) | |

| (591 | ) |

| Accrued expenses and other current liabilities | |

| 5 | | |

| 11 | |

| Operating lease liability | |

| (527 | ) | |

| (416 | ) |

| Net cash provided by (used in) operating activities | |

| 190 | | |

| (2,804 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Acquisition of property and equipment | |

| (18 | ) | |

| (194 | ) |

| Net cash used in investing activities | |

| (18 | ) | |

| (194 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from advances from credit facility | |

| 445 | | |

| 3,044 | |

| Proceeds from notes payable, related party | |

| — | | |

| 160 | |

| Repayment of notes payable | |

| (47 | ) | |

| (125 | ) |

| Net cash provided by financing activities | |

| 398 | | |

| 3,079 | |

| | |

| | | |

| | |

| Increase in cash and cash equivalents | |

| 570 | | |

| 81 | |

| Cash and cash equivalents, beginning of period | |

| 549 | | |

| 211 | |

| Cash and cash equivalents, end of period | |

$ | 1,119 | | |

$ | 292 | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

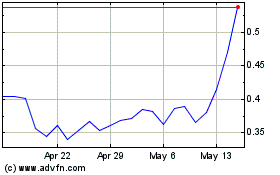

Polar Power (NASDAQ:POLA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Polar Power (NASDAQ:POLA)

Historical Stock Chart

From Jan 2024 to Jan 2025