Rani Therapeutics Holdings, Inc. Announces Pricing of $10.0 Million Registered Direct Offering

22 July 2024 - 10:30PM

Rani Therapeutics Holdings, Inc. (“Rani Therapeutics” or “Rani”)

(Nasdaq: RANI), a clinical-stage biotherapeutics company focused on

the oral delivery of biologics and drugs, today announced that it

has entered into a securities purchase agreement with a single

institutional investor for the purchase and sale of 2,800,000

shares of Rani Therapeutics’ Class A common stock (the “Common

Stock”) and pre-funded warrants to purchase 446,753 shares of

Common Stock, together with Series A common warrants to purchase up

to an aggregate of 3,246,753 shares of Common Stock and Series B

common warrants to purchase up to an aggregate of 3,246,753 shares

of Common Stock, in a registered direct offering. Each share of

Common Stock and pre-funded warrant is being sold together with one

Series A common warrant to purchase one share of Common Stock and

one Series B common warrant to purchase one share of Common Stock

at a combined purchase price of $3.08. The Series A common

warrants and Series B common warrants will each have an exercise

price of $3.08 per share, will each be exercisable 6

months from the date of issuance, and, in the case of Series A

common warrants, will expire 18 months from the date of issuance,

and in the case of Series B warrants, will expire five and a half

years from the date of issuance.

Maxim Group LLC is acting as the sole placement

agent for the offering.

The offering is expected to close on or about

July 23, 2024, subject to satisfaction of customary closing

conditions. The gross proceeds to the Rani Therapeutics from this

offering are expected to be approximately $10.0 million, before

deducting placement agent fees and other offering expenses,

excluding the proceeds, if any, from the exercise of the pre-funded

warrants and the Series A and Series B common warrants.

The securities in the registered direct offering

are being offered and sold by Rani pursuant to a "shelf"

registration statement on Form S-3 (File No. 333-266444) which was

declared effective by the U.S. Securities and Exchange Commission

(the “SEC”) on August 10, 2022. The offering of the securities is

being made only by means of a prospectus, including a prospectus

supplement, forming a part of the effective registration statement.

A final prospectus supplement and the accompanying prospectus

relating to the registered direct offering will be filed with the

SEC. Electronic copies of the final prospectus supplement and the

accompanying prospectus may be obtained, when available, on the

SEC's website at http://www.sec.gov or by contacting Maxim Group

LLC, 300 Park Avenue, New York, NY 10022, Attention: Syndicate

Department, or via email at syndicate@maximgrp.com or telephone at

(212) 895-3745.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described herein, nor shall there be any sale of these securities

in any state or jurisdiction in which such an offer, solicitation

or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or

jurisdiction.

About Rani

TherapeuticsRani Therapeutics is a clinical-stage

biotherapeutics company focused on advancing technologies to enable

the development of orally administered biologics and drugs. Rani

has developed the RaniPill® capsule, which is a novel, proprietary

and patented platform technology, intended to replace subcutaneous

injection or intravenous infusion of biologics and drugs with oral

dosing. Rani has successfully conducted several preclinical and

clinical studies to evaluate safety, tolerability and

bioavailability using RaniPill® capsule technology.

Investor

Contact:investors@ranitherapeutics.com

Media

Contact:media@ranitherapeutics.com

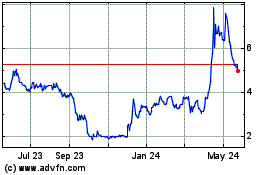

Rani Therapeutics (NASDAQ:RANI)

Historical Stock Chart

From Oct 2024 to Nov 2024

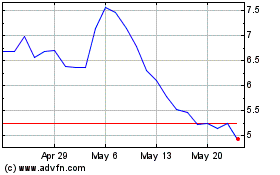

Rani Therapeutics (NASDAQ:RANI)

Historical Stock Chart

From Nov 2023 to Nov 2024