Enrollment of patients ongoing in the pivotal

Phase 2 study of RP-A501 for the treatment of Danon disease and the

Phase 1 study of RP-A601 to treat PKP2 arrhythmogenic

cardiomyopathy

Working toward FDA-approval of KRESLADI for

severe LAD-I; Commercial infrastructure and capabilities in place

for launch

Presented long-term KRESLADI™ follow-up data

from the global Phase 1/2 study for severe LAD-I, results from the

global Phase 1/2 study of RP-L102 for Fanconi Anemia, and data from

the Phase 1 study of RP-L301 for PKD at ASGCT in May

Cash, cash equivalents and investments of

approximately $278.8M; expected operational runway into 2026

Rocket Pharmaceuticals, Inc. (NASDAQ: RCKT), a fully integrated,

late-stage biotechnology company advancing a sustainable pipeline

of genetic therapies for rare disorders with high unmet need, today

reported financial and recent operational results for the quarter

ending June 30, 2024.

“Over the quarter, Rocket has been advancing its clinical

pipeline as we progressed our RP-A501 and RP-A601 cardiac programs,

targeting Danon disease and PKP2-ACM, and continued to actively

enroll patients,” said Gaurav Shah, M.D., Chief Executive Officer,

Rocket Pharmaceuticals. “At ASGCT, we shared follow-up data from

across our hematology portfolio including 4-year follow-up data for

KRESLADI to treat patients with severe LAD-I, demonstrating a 100%

survival rate. In parallel, we have been preparing for the

anticipated FDA approval of KRESLADI.”

Recent Pipeline and Operational Updates

- Continued advancement of Phase 2 pivotal study of RP-A501

for Danon Disease.

- Enrollment in the Phase 2 pivotal study of RP-A501 to treat

Danon Disease is actively progressing. Details of the Phase 2 study

can be found at www.ClinicalTrials.gov under NCT identifier

NCT06092034.

- Granted orphan medicinal product designation from the

European Commission (EC) for RP-A601 for PKP2 arrhythmogenic

cardiomyopathy (ACM).

- In May, Rocket announced orphan medicinal product designation

from the EC for RP-A601 for the treatment of PKP2-ACM. Enrollment

in the Phase 1 study is ongoing. Details of the study can be found

at www.ClinicalTrials.gov under NCT identifier NCT05885412.

- Orphan medicinal product designation by the EC is available to

novel therapeutics that prevent or treat life-threatening or

chronically debilitating conditions that affect fewer than five in

10,000 persons in the European Union (EU). The designation

qualifies for financial and regulatory benefits including protocol

assistance from the European Medicines Agency during clinical

development, access to centralized marketing authorization, and a

10-year period of marketing exclusivity after product

approval.

- U.S. Food and Drug Administration (FDA) review of limited

additional Chemistry Manufacturing and Controls (CMC) information

underway for KRESLADI™ for the treatment of severe

leukocyte adhesion deficiency-I (LAD-I).

- In June, Rocket announced that the FDA requested limited

additional CMC information to complete its review of KRESLADI™

(marnetegragene autotemcel; marne-cel) to treat severe LAD-I. The

Company is working with senior leaders and reviewers from the FDA’s

Center for Biologics Evaluation and Research to support the

approval of KRESLADI™.

- Long-term KRESLADI™ follow-up data from the global Phase 1/2

study were presented at the American Society of Gene and Cell

Therapy (ASGCT) 27th Annual Meeting. Data demonstrated survival of

100% in the absence of allogeneic hematopoietic stem cell

transplantation from 18 to 45 months with a well-tolerated safety

profile in all nine patients with severe LAD-I.

- Progressed Fanconi Anemia (FA) program through regulatory

and clinical milestones.

- Regulatory filings and review for RP-L102 for the treatment of

FA are on track with health authorities in the U.S. and

Europe.

- Results from the global Phase 1/2 study of RP-L102 were

presented at the ASGCT 27th Annual Meeting. Previously disclosed

data demonstrated genetic and phenotypic correction combined with

hematologic stabilization extending to 42 months with polyclonal

integration patterns.

- Furthered Pyruvate Kinase Deficiency (PKD) program through

clinical milestones.

- Updated data from the Phase 1 study of RP-L301 for PKD were

presented at the ASGCT 27th Annual Meeting. Sustained and

clinically meaningful hemoglobin improvement and well-tolerated

safety profile were observed in PKD patients up to 36 months after

RP-L301 treatment.

- The global Phase 2 pivotal study of RP-L301 for PKD has been

initiated. Details of the Phase 2 study can be found at

www.ClinicalTrials.gov under NCT identifier NCT06422351.

- Progressing BAG3-associated dilated cardiomyopathy

preclinical program.

- Nonclinical, IND-enabling studies are ongoing.

Second Quarter Financial Results

- Cash position. Cash, cash equivalents and investments as

of June 30, 2024, were $278.8 million.

- R&D expenses. Research and development expenses were

$91.6 million for the six months ended June 30, 2024, compared to

$97.8 million for the six months ended June 30, 2023. The decrease

of $6.2 million in R&D expenses was driven by decreases in

manufacturing and development and direct costs of $14.9 million.

The decreases were partially offset by increases in the costs for

compensation and benefits of $1.2 million due to increased R&D

headcount, professional fees of $3.4 million, laboratory supplies

of $0.6 million, non-cash stock compensation expense of $1.1

million, and clinical trial costs of $1.4 million.

- G&A expenses. General and administrative expenses

were $49.5 million for the six months ended June 30, 2024, compared

to $33.2 million for the six months ended June 30, 2023. The

increase in G&A expenses was primarily driven by increased

commercial preparation expenses which consists of commercial

strategy, medical affairs, market development and pricing analysis

of $9.5 million, legal expenses of $3.3 million, and non-cash stock

compensation expense of $1.4 million.

- Net loss. Net loss was $131.7 million or $1.40 per share

(basic and diluted) for the six months ended June 30, 2024,

compared to $124.0 million or $1.55 (basic and diluted) for the six

months ended June 30, 2023.

- Shares outstanding. 90,956,613 shares of common stock

were outstanding as of June 30, 2024.

Financial Guidance

- Cash position. As of June 30, 2024, Rocket had cash,

cash equivalents and investments of $278.8 million. Rocket expects

such resources will be sufficient to fund its operations into 2026,

including producing AAV cGMP batches at the Company’s Cranbury,

N.J. R&D and manufacturing facility and continued development

of its six clinical and/or preclinical programs.

About Rocket Pharmaceuticals, Inc. Rocket

Pharmaceuticals, Inc. (NASDAQ: RCKT) is a fully integrated,

late-stage biotechnology company advancing a sustainable pipeline

of investigational genetic therapies designed to correct the root

cause of complex and rare disorders. Rocket’s innovative

multi-platform approach allows us to design the optimal gene

therapy for each indication, creating potentially transformative

options that enable people living with devastating rare diseases to

experience long and full lives.

Rocket’s lentiviral (LV) vector-based hematology portfolio

consists of late-stage programs for Fanconi Anemia (FA), a

difficult-to-treat genetic disease that leads to bone marrow

failure (BMF) and potentially cancer, Leukocyte Adhesion

Deficiency-I (LAD-I), a severe pediatric genetic disorder that

causes recurrent and life-threatening infections which are

frequently fatal, and Pyruvate Kinase Deficiency (PKD), a monogenic

red blood cell disorder resulting in increased red cell destruction

and mild to life-threatening anemia.

Rocket’s adeno-associated viral (AAV) vector-based

cardiovascular portfolio includes a late-stage program for Danon

Disease, a devastating heart failure condition resulting in

thickening of the heart, an early-stage program in clinical trials

for PKP2-arrhythmogenic cardiomyopathy (ACM), a life-threatening

heart failure disease causing ventricular arrhythmias and sudden

cardiac death, and a pre-clinical program targeting BAG3-associated

dilated cardiomyopathy (DCM), a heart failure condition that causes

enlarged ventricles.

For more information about Rocket, please visit

www.rocketpharma.com and follow us on LinkedIn, YouTube, and X.

Rocket Cautionary Statement Regarding Forward-Looking

Statements This press release contains forward-looking

statements concerning Rocket’s future expectations, plans and

prospects that involve risks and uncertainties, as well as

assumptions that, if they do not materialize or prove incorrect,

could cause our results to differ materially from those expressed

or implied by such forward-looking statements. We make such

forward-looking statements pursuant to the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995 and other

federal securities laws. All statements other than statements of

historical facts contained in this release are forward-looking

statements. You should not place reliance on these forward-looking

statements, which often include words such as “could,” “believe,”

“expect,” “anticipate,” “intend,” “plan,” “will give,” “estimate,”

“seek,” “will,” “may,” “suggest” or similar terms, variations of

such terms or the negative of those terms. These forward-looking

statements include, but are not limited to, statements concerning

Rocket’s expectations regarding the safety and effectiveness of

product candidates that Rocket is developing to treat Fanconi

Anemia (FA), Leukocyte Adhesion Deficiency-I (LAD-I), Pyruvate

Kinase Deficiency (PKD), Danon Disease (DD) and other diseases, the

expected timing and data readouts of Rocket’s ongoing and planned

clinical trials, the expected timing and outcome of Rocket’s

regulatory interactions and planned submissions, including the

timing and outcome of the FDA’s review of the additional CMC

information that Rocket will provide in response to the FDA’s

request, the safety, effectiveness and timing of pre-clinical

studies and clinical trials, Rocket’s ability to establish key

collaborations and vendor relationships for its product candidates,

Rocket’s ability to develop sales and marketing capabilities or

enter into agreements with third parties to sell and market its

product candidates, Rocket’s ability to expand its pipeline to

target additional indications that are compatible with its gene

therapy technologies, Rocket’s ability to transition to a

commercial stage pharmaceutical company, and Rocket’s expectation

that its cash, cash equivalents and investments will be sufficient

to funds its operations into 2026. Although Rocket believes that

the expectations reflected in the forward-looking statements are

reasonable, Rocket cannot guarantee such outcomes. Actual results

may differ materially from those indicated by these forward-looking

statements as a result of various important factors, including,

without limitation, Rocket’s dependence on third parties for

development, manufacture, marketing, sales and distribution of

product candidates, the outcome of litigation, unexpected

expenditures, Rocket’s competitors’ activities, including decisions

as to the timing of competing product launches, pricing and

discounting, Rocket’s ability to develop, acquire and advance

product candidates into, enroll a sufficient number of patients

into, and successfully complete, clinical studies, the integration

of new executive team members and the effectiveness of the newly

configured corporate leadership team, Rocket’s ability to acquire

additional businesses, form strategic alliances or create joint

ventures and its ability to realize the benefit of such

acquisitions, alliances or joint ventures, Rocket’s ability to

obtain and enforce patents to protect its product candidates, and

its ability to successfully defend against unforeseen third-party

infringement claims, as well as those risks more fully discussed in

the section entitled “Risk Factors” in Rocket’s Annual Report on

Form 10-K for the year ended December 31, 2023, filed February 27,

2024 with the SEC and subsequent filings with the SEC including our

Quarterly Reports on Form 10-Q. Accordingly, you should not place

undue reliance on these forward-looking statements. All such

statements speak only as of the date made, and Rocket undertakes no

obligation to update or revise publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Operating expenses: Research and development

$

46,345

$

51,383

$

91,572

$

97,754

General and administrative

27,367

17,374

49,515

33,197

Total operating expenses

73,712

68,757

141,087

130,951

Loss from operations

(73,712

)

(68,757

)

(141,087

)

(130,951

)

Interest expense

(471

)

(468

)

(942

)

(936

)

Interest and other income, net

2,294

846

5,323

2,754

Accretion of discount on investments, net

2,243

2,678

5,006

5,097

Net loss

$

(69,646

)

$

(65,701

)

$

(131,700

)

$

(124,036

)

Net loss per share - basic and diluted

$

(0.74

)

$

(0.82

)

$

(1.40

)

$

(1.55

)

Weighted-average common shares outstanding - basic and diluted

93,746,243

80,472,362

93,759,894

79,965,755

June 30, 2024

December 31, 2023

Cash, cash equivalents, and investments

$

278,825

$

407,495

Total assets

446,411

566,341

Total liabilities

61,776

73,767

Total stockholders' equity

384,635

492,574

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240805990502/en/

Media & Investors Meg Dodge

mdodge@rocketpharma.com

Media Kevin Giordano media@rocketpharma.com

Investors Brooks Rahmer investors@rocketpharma.com

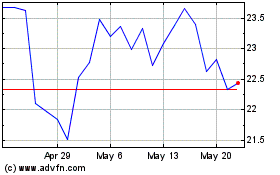

Rocket Pharmaceuticals (NASDAQ:RCKT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Rocket Pharmaceuticals (NASDAQ:RCKT)

Historical Stock Chart

From Mar 2024 to Mar 2025