Rover Group, Inc. (“Rover” or the “Company”), the world’s largest

online marketplace for pet care, today announced the completion of

its acquisition by private equity funds affiliated with Blackstone

(“Blackstone”) in an all-cash transaction valued at approximately

$2.3 billion.

The transaction was previously announced on November 29, 2023

and was approved by Rover stockholders at Rover’s special meeting

of stockholders held on February 22, 2024. With the completion of

the acquisition, Rover stockholders are entitled to receive $11.00

in cash for each share of Rover common stock they owned immediately

prior to the closing. Rover’s common stock has ceased trading and

will be delisted from the Nasdaq Stock Market.

“The closing of this transaction is an important milestone in

Rover’s history and marks the start of the next chapter in our

story,” said Aaron Easterly, co-founder and CEO of Rover. “We are

excited to officially partner with Blackstone to leverage their

resources and deep expertise to further our mission of making it

possible for everyone to experience the unconditional love of a

pet.”

Sachin Bavishi, Senior Managing Director at Blackstone, said,

“Aaron and the Rover team have done an incredible job building a

leading digital marketplace for pet services. We’re thrilled to

embark on this partnership, bringing Blackstone’s scale and

resources to further accelerate Rover’s growth and innovation, and

enhance Rover’s strong value proposition relative to

alternatives.”

Advisors

Goldman Sachs & Co. LLC acted as

lead financial advisor to Rover, and Centerview Partners LLC also

acted as a financial advisor to Rover and delivered a fairness

opinion to Rover’s Board of Directors with respect to the proposed

transaction. Wilson Sonsini Goodrich & Rosati, Professional

Corporation acted as legal counsel to Rover.

Evercore acted as lead financial

advisor and Moelis & Company LLC also acted as a financial

advisor to Blackstone, and Kirkland & Ellis LLP acted as legal

counsel to Blackstone.

About Rover Group,

Inc.

Founded in 2011 and

based in Seattle, Rover is the world’s largest online marketplace

for pet care. Rover connects pet parents with pet providers who

offer overnight services, including boarding and in-home pet

sitting, as well as daytime services, including doggy daycare, dog

walking, and drop-in visits. To learn more about Rover, please

visit www.rover.com.

About Blackstone

Blackstone is the world’s largest alternative

asset manager. We seek to deliver compelling returns for

institutional and individual investors by strengthening the

companies in which we invest. Our more than $1 trillion in assets

under management include global investment strategies focused on

real estate, private equity, infrastructure, life sciences, growth

equity, credit, real assets, secondaries and hedge funds. Further

information is available at www.blackstone.com. Follow

@blackstone on LinkedIn, X (Twitter), and Instagram.

Forward-Looking Statements

This communication may contain

forward-looking statements, which include all statements that do

not relate solely to historical or current facts, such as

statements regarding the Company’s impacts of the merger with a

private equity fund managed by Blackstone (the “Merger”), the

Company’s delisting from the Nasdaq Stock Market, and other

statements that concern the Company’s expectations, intentions or

strategies regarding the future. In some cases, you can identify

forward-looking statements by the following words: “may,” “will,”

“could,” “would,” “should,” “expect,” “intend,” “plan,”

“anticipate,” “believe,” “estimate,” “predict,” “project,” “aim,”

“potential,” “continue,” “ongoing,” “goal,” “can,” “seek,” “target”

or the negative of these terms or other similar expressions,

although not all forward-looking statements contain these words.

These forward-looking statements are based on the Company’s

beliefs, as well as assumptions made by, and information currently

available to, the Company. Because such statements are based on

expectations as to future financial and operating results and are

not statements of fact, actual results may differ materially from

those projected and are subject to a number of known and unknown

risks and uncertainties, including, but not limited to: (i) the

effect of the Merger on the Company’s business relationships,

operating results and business generally; (ii) risks that the

Merger disrupts the Company’s current plans and operations; (iii)

the Company’s ability to retain and hire key personnel and maintain

relationships with key business partners and customers, and others

with whom it does business; (iv) risks related to diverting

management’s or employees’ attention from the Company’s ongoing

business operations; (v) the amount of costs, fees, charges or

expenses resulting from the Merger; (vi) potential litigation

relating to the Merger; (vii) risks that the benefits of the Merger

are not realized when or as expected; (viii) continued availability

of capital and financing and rating agency actions; and (ix) other

risks described in the Company’s filings with the U.S. Securities

and Exchange Commission (the “SEC”), such as the risks and

uncertainties described under the headings “Cautionary Note

Regarding Forward-Looking Statements,” “Risk Factors,”

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and other sections of the Company’s Annual

Report on Form 10-K, the Company’s Quarterly Reports on Form 10-Q,

and in the Company’s other filings with the SEC. While the list of

risks and uncertainties presented here is considered

representative, no such list or discussion should be considered a

complete statement of all potential risks and uncertainties.

Unlisted factors may present significant additional obstacles to

the realization of forward-looking statements. Consequences of

material differences in results as compared with those anticipated

in the forward-looking statements could include, among other

things, business disruption, operational problems, financial loss,

legal liability to third parties and/or similar risks, any of which

could have a material adverse effect on the Company’s consolidated

financial condition. The forward-looking statements speak only as

of the date they are made. Except as required by applicable law or

regulation, the Company undertakes no obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise.

The information that can be accessed

through hyperlinks or website addresses included in this

communication is deemed not to be incorporated in or part of this

communication.

Contacts

FOR ROVERInvestorsWalter

Ruddywalter.ruddy@rover.com(206) 715-2369

MediaKristin

Sandbergkristin.sandberg@rover.com(360) 510-6365

FOR BLACKSTONEMediaMatt Anderson(518)

248-7310Matthew.Anderson@blackstone.com

Mariel Seidman-Gati(646)

482-3712Mariel.SeidmanGati@blackstone.com

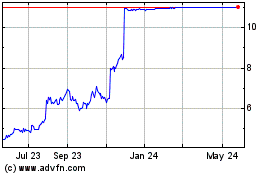

Rover (NASDAQ:ROVR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Rover (NASDAQ:ROVR)

Historical Stock Chart

From Feb 2024 to Feb 2025