REPAY Closes Offering of $287.5 Million of 2.875% Convertible Notes

09 July 2024 - 6:05AM

Business Wire

Repay Holdings Corporation (NASDAQ: RPAY) (“REPAY” or the

“Company”), a leading provider of integrated payment processing

solutions, today announced the successful closing of its offering

of $287.5 million aggregate principal amount of its 2.875%

convertible senior notes due 2029 (the “Convertible Notes”), which

includes the exercise in full of the $27.5 million principal amount

option granted to the initial purchasers of the Convertible

Notes.

John Morris, Co-founder and CEO of REPAY, said, “We are pleased

to successfully close this important financing for the Company, and

we greatly appreciate the tremendous support from both existing and

new investors. The transaction fortifies our balance sheet by

addressing $220.0 million principal amount of our 2026 maturities,

while providing us with financial flexibility to continue focusing

on profitable growth and cash generation.”

“We designed this transaction to minimize the future dilution

for our shareholders," said Tim Murphy, CFO of REPAY. "Our

repurchase of approximately 3.9 million shares concurrently with

the offering and our commitment to repay the principal amount of

the new Convertible Notes in cash are expected to further reduce

potential share dilution even beyond the $20.42 capped call strike

price."

Overview of the Transaction:

- Offering Size: $287.5 million aggregate principal amount,

including the full exercise of the initial purchasers' $27.5

million principal amount option

- Interest Rate: 2.875% per annum, payable semiannually,

beginning on January 15, 2025

- Initial Conversion Rate: 76.8182 shares of the Company’s Class

A common stock (the “common stock”) per $1,000 principal amount of

Convertible Notes

- Initial Conversion Price: Approximately $13.02 per share,

representing a premium of approximately 27.5% over the closing

price of the common stock on July 2, 2024

- Capped Call Cap Price: Initially set at $20.42 which represents

a 100% premium over the closing price of the common stock on July

2, 2024

Uses of Net Proceeds:

- Repurchase of 2026 Convertible Senior Notes: Approximately

$200.0 million of the net proceeds, combined with approximately

$5.1 million of cash on hand, were used to repurchase $220.0

million in aggregate principal amount of the Company’s outstanding

convertible senior notes due 2026

- Capped Call Transactions: Approximately $39.2 million of the

net proceeds were used to fund the cost of the capped call

transactions

- Share Repurchase: Approximately $40.0 million of the net

proceeds were used to repurchase approximately 3.9 million shares

of the common stock

The Convertible Notes were offered and sold only to persons

reasonably believed to be qualified institutional buyers pursuant

to Rule 144A under the Securities Act of 1933, as amended (the

“Securities Act”). The offer and sale of the Convertible Notes and

any shares of common stock issuable upon conversion of the

Convertible Notes have not been, and will not be, registered under

the Securities Act or any other securities laws, and the notes and

any such shares cannot be offered or sold absent registration or

except pursuant to an applicable exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and any other applicable securities laws. This press

release does not constitute an offer to sell, or the solicitation

of an offer to buy, the notes or any shares of common stock

issuable upon conversion of the Convertible Notes, nor will there

be any sale of the Convertible Notes or any such shares, in any

state or other jurisdiction in which such offer, sale or

solicitation would be unlawful.

About Repay

REPAY provides integrated payment processing solutions to

verticals that have specific transaction processing needs. REPAY’s

proprietary, integrated payment technology platform reduces the

complexity of electronic payments for clients, while enhancing the

overall experience for consumers and businesses.

Forward-Looking Statements

This communication contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Such statements include, but are not limited to, statements

about potential share dilution and other effects of the offering

and the use of proceeds and other statements identified by words

such as “will likely result,” “are expected to,” “will continue,”

“is anticipated,” “estimated,” “believe,” “intend,” “plan,”

“projection,” “outlook” or words of similar meaning. Such

forward-looking statements are based upon the current beliefs and

expectations of REPAY’s management and are inherently subject to

significant business, economic and competitive uncertainties and

contingencies, many of which are difficult to predict and generally

beyond REPAY’s control, including, without limitation, the factors

described in REPAY’s reports filed with the SEC. Actual results and

the timing of events may differ materially from the results

anticipated in these forward-looking statements.

All information set forth herein speaks only as of the date

hereof in the case of information about REPAY or the date of such

information in the case of information from persons other than

REPAY, and we disclaim any intention or obligation to update any

forward-looking statements as a result of developments occurring

after the date of this communication.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240708068863/en/

Investor Relations Contact for REPAY: ir@repay.com Media

Relations Contact for REPAY: Kristen Hoyman khoyman@repay.com

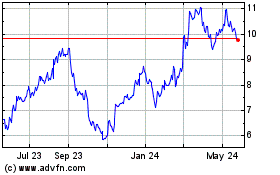

Repay (NASDAQ:RPAY)

Historical Stock Chart

From Jan 2025 to Feb 2025

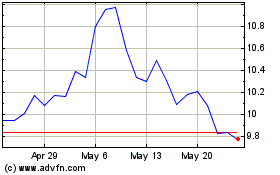

Repay (NASDAQ:RPAY)

Historical Stock Chart

From Feb 2024 to Feb 2025