0000897723false2024FYhttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrentiso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure00008977232023-10-012024-09-2800008977232024-03-3000008977232024-11-1400008977232024-09-2800008977232023-09-3000008977232022-10-022023-09-3000008977232021-10-032022-10-010000897723sanm:NumberofCommonSharesMember2021-10-020000897723us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2021-10-020000897723us-gaap:TreasuryStockCommonMember2021-10-020000897723us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-10-020000897723us-gaap:RetainedEarningsMember2021-10-020000897723us-gaap:NoncontrollingInterestMember2021-10-0200008977232021-10-020000897723sanm:NumberofCommonSharesMember2021-10-032022-10-010000897723us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2021-10-032022-10-010000897723us-gaap:TreasuryStockCommonMember2021-10-032022-10-010000897723us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-10-032022-10-010000897723us-gaap:RetainedEarningsMember2021-10-032022-10-010000897723us-gaap:NoncontrollingInterestMember2021-10-032022-10-010000897723sanm:NumberofCommonSharesMember2022-10-010000897723us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-10-010000897723us-gaap:TreasuryStockCommonMember2022-10-010000897723us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-010000897723us-gaap:RetainedEarningsMember2022-10-010000897723us-gaap:NoncontrollingInterestMember2022-10-0100008977232022-10-010000897723sanm:NumberofCommonSharesMember2022-10-022023-09-300000897723us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-10-022023-09-300000897723us-gaap:TreasuryStockCommonMember2022-10-022023-09-300000897723us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-022023-09-300000897723us-gaap:NoncontrollingInterestMember2022-10-022023-09-300000897723us-gaap:RetainedEarningsMember2022-10-022023-09-300000897723sanm:NumberofCommonSharesMember2023-09-300000897723us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-09-300000897723us-gaap:TreasuryStockCommonMember2023-09-300000897723us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300000897723us-gaap:RetainedEarningsMember2023-09-300000897723us-gaap:NoncontrollingInterestMember2023-09-300000897723sanm:NumberofCommonSharesMember2023-10-012024-09-280000897723us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-10-012024-09-280000897723us-gaap:TreasuryStockCommonMember2023-10-012024-09-280000897723us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-012024-09-280000897723us-gaap:RetainedEarningsMember2023-10-012024-09-280000897723us-gaap:NoncontrollingInterestMember2023-10-012024-09-280000897723sanm:NumberofCommonSharesMember2024-09-280000897723us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-09-280000897723us-gaap:TreasuryStockCommonMember2024-09-280000897723us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-280000897723us-gaap:RetainedEarningsMember2024-09-280000897723us-gaap:NoncontrollingInterestMember2024-09-280000897723sanm:IMSMember2023-10-012024-09-280000897723srt:MinimumMemberus-gaap:BuildingMember2024-09-280000897723srt:MaximumMemberus-gaap:BuildingMember2024-09-280000897723srt:MinimumMembersanm:MachineryEquipmentFurnitureAndFixturesMember2024-09-280000897723srt:MaximumMembersanm:MachineryEquipmentFurnitureAndFixturesMember2024-09-280000897723srt:MaximumMember2024-09-280000897723srt:MinimumMember2023-10-012024-09-280000897723srt:MaximumMember2023-10-012024-09-280000897723us-gaap:MachineryAndEquipmentMember2024-09-280000897723us-gaap:MachineryAndEquipmentMember2023-09-300000897723us-gaap:LandAndBuildingMember2024-09-280000897723us-gaap:LandAndBuildingMember2023-09-300000897723us-gaap:LeaseholdImprovementsMember2024-09-280000897723us-gaap:LeaseholdImprovementsMember2023-09-300000897723us-gaap:FurnitureAndFixturesMember2024-09-280000897723us-gaap:FurnitureAndFixturesMember2023-09-300000897723us-gaap:ConstructionInProgressMember2024-09-280000897723us-gaap:ConstructionInProgressMember2023-09-300000897723sanm:IMSThirdPartyRevenueMember2023-10-012024-09-280000897723sanm:IMSThirdPartyRevenueMember2022-10-022023-09-300000897723sanm:IMSThirdPartyRevenueMember2021-10-032022-10-010000897723sanm:CPSThirdPartyRevenueMember2023-10-012024-09-280000897723sanm:CPSThirdPartyRevenueMember2022-10-022023-09-300000897723sanm:CPSThirdPartyRevenueMember2021-10-032022-10-010000897723sanm:IndustrialMedicalDefenseAndAerospaceAndAutomotiveMember2023-10-012024-09-280000897723sanm:IndustrialMedicalDefenseAndAerospaceAndAutomotiveMember2022-10-022023-09-300000897723sanm:IndustrialMedicalDefenseAndAerospaceAndAutomotiveMember2021-10-032022-10-010000897723sanm:CommunicationsNetworksAndCloudInfrastructureMember2023-10-012024-09-280000897723sanm:CommunicationsNetworksAndCloudInfrastructureMember2022-10-022023-09-300000897723sanm:CommunicationsNetworksAndCloudInfrastructureMember2021-10-032022-10-010000897723srt:AmericasMember2023-10-012024-09-280000897723srt:AmericasMember2022-10-022023-09-300000897723srt:AmericasMember2021-10-032022-10-010000897723srt:AsiaPacificMember2023-10-012024-09-280000897723srt:AsiaPacificMember2022-10-022023-09-300000897723srt:AsiaPacificMember2021-10-032022-10-010000897723us-gaap:EMEAMember2023-10-012024-09-280000897723us-gaap:EMEAMember2022-10-022023-09-300000897723us-gaap:EMEAMember2021-10-032022-10-010000897723country:MX2024-09-280000897723country:MX2023-09-300000897723country:MX2022-10-010000897723country:US2024-09-280000897723country:US2023-09-300000897723country:US2022-10-010000897723country:MY2023-10-012024-09-280000897723country:MY2022-10-022023-09-300000897723country:MY2021-10-032022-10-010000897723us-gaap:ChangeInAccountingMethodAccountedForAsChangeInEstimateMembersanm:FavorableMember2023-10-012024-09-280000897723us-gaap:ChangeInAccountingMethodAccountedForAsChangeInEstimateMembersanm:FavorableMember2022-10-022023-09-300000897723us-gaap:ChangeInAccountingMethodAccountedForAsChangeInEstimateMembersanm:FavorableMember2021-10-032022-10-010000897723us-gaap:ChangeInAccountingMethodAccountedForAsChangeInEstimateMembersanm:UnfavorableMember2023-10-012024-09-280000897723us-gaap:ChangeInAccountingMethodAccountedForAsChangeInEstimateMembersanm:UnfavorableMember2022-10-022023-09-300000897723us-gaap:ChangeInAccountingMethodAccountedForAsChangeInEstimateMembersanm:UnfavorableMember2021-10-032022-10-010000897723us-gaap:ChangeInAccountingMethodAccountedForAsChangeInEstimateMember2023-10-012024-09-280000897723us-gaap:ChangeInAccountingMethodAccountedForAsChangeInEstimateMember2022-10-022023-09-300000897723us-gaap:ChangeInAccountingMethodAccountedForAsChangeInEstimateMember2021-10-032022-10-010000897723us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-09-280000897723us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-09-300000897723us-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-09-280000897723us-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-09-300000897723us-gaap:AccruedLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-09-280000897723us-gaap:AccruedLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-09-300000897723us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-09-280000897723us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-09-300000897723us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMember2024-09-280000897723us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMember2023-09-300000897723us-gaap:AccruedLiabilitiesMemberus-gaap:NondesignatedMember2024-09-280000897723us-gaap:AccruedLiabilitiesMemberus-gaap:NondesignatedMember2023-09-300000897723us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-09-280000897723us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-09-300000897723us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2024-09-280000897723us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2023-09-300000897723us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-10-012024-09-280000897723us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2023-10-012024-09-280000897723us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMembersanm:A300MAggregateNotionalValueOfSwapsMember2023-10-012024-09-280000897723us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-09-280000897723us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-09-300000897723us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMembersanm:A300MAggregateNotionalValueOfSwapsMember2024-09-280000897723sanm:NokiaMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembersanm:IMSMember2022-10-022023-09-300000897723sanm:NokiaMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembersanm:IMSMember2021-10-032022-10-010000897723sanm:NokiaMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembersanm:CPSMember2022-10-022023-09-300000897723sanm:NokiaMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembersanm:CPSMember2021-10-032022-10-010000897723sanm:NokiaMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-10-022023-09-300000897723sanm:NokiaMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-10-032022-10-010000897723sanm:MotorolaMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembersanm:IMSMember2023-10-012024-09-280000897723sanm:MotorolaMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembersanm:IMSMember2021-10-032022-10-010000897723sanm:MotorolaMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembersanm:CPSMember2023-10-012024-09-280000897723sanm:MotorolaMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembersanm:CPSMember2021-10-032022-10-010000897723sanm:MotorolaMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-10-012024-09-280000897723sanm:MotorolaMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-10-032022-10-010000897723sanm:NokiaMemberus-gaap:AccountsReceivableMember2023-10-012024-09-280000897723sanm:TermLoanDue2027Member2024-09-280000897723sanm:TermLoanDue2027Member2023-09-300000897723sanm:FifthAmendedAndRestatedCreditAgreementMember2023-10-012024-09-280000897723sanm:FifthAmendedAndRestatedCreditAgreementMember2022-09-270000897723sanm:FourthAmendedAndRestatedCreditAgreementMember2022-07-032022-10-010000897723sanm:FifthAmendedAndRestatedCreditAgreementMember2024-09-280000897723sanm:FifthAmendedAndRestatedCreditAgreementMember2023-09-300000897723us-gaap:ForeignLineOfCreditMember2024-09-280000897723us-gaap:ForeignLineOfCreditMember2023-10-012024-09-280000897723us-gaap:BankOverdraftsMember2023-09-300000897723us-gaap:BankOverdraftsMember2024-09-280000897723sanm:RPAMember2024-09-280000897723sanm:RPAMember2023-09-300000897723sanm:EnvironmentalMatterMemberus-gaap:SettledLitigationMember2024-06-302024-09-280000897723sanm:DialightMembersanm:CollectibilityOfReceivableAndExcessAndObsoleteInventoryMember2023-10-012024-09-280000897723sanm:DialightMembersanm:CollectibilityOfReceivableAndExcessAndObsoleteInventoryMember2020-10-042021-01-020000897723sanm:DialightMembersanm:PerformanceOfManufacturingServiceAgreementMember2023-10-012024-09-280000897723sanm:DialightMembersanm:CollectibilityOfReceivableAndExcessAndObsoleteInventoryMember2024-06-302024-09-280000897723sanm:DialightMembersanm:PerformanceOfManufacturingServiceAgreementMember2024-06-302024-09-280000897723sanm:EckertQuiTamSuitMembersanm:TrebleDamagesCivilPenaltiesAndInterestPayableMember2023-10-012024-09-280000897723us-gaap:ForeignCountryMember2022-10-022023-09-300000897723us-gaap:ForeignCountryMember2021-10-032022-10-010000897723sanm:JointVentureWithRelianceMember2022-10-022023-09-300000897723us-gaap:StateAndLocalJurisdictionMember2024-09-280000897723us-gaap:ForeignCountryMember2024-09-280000897723us-gaap:InternalRevenueServiceIRSMember2024-09-280000897723us-gaap:DomesticCountryMember2023-10-012024-09-280000897723us-gaap:InternalRevenueServiceIRSMember2023-10-012024-09-2800008977232023-11-172023-11-1700008977232023-11-170000897723sanm:ResolutionOfAuditsAndExpirationOfStatutesMember2024-09-280000897723sanm:InterestAndPenaltiesMember2024-09-280000897723sanm:A2019StockPlanMember2019-03-110000897723sanm:A2019StockPlanMember2023-10-012024-09-280000897723us-gaap:OperatingSegmentsMembersanm:IMSMember2023-10-012024-09-280000897723us-gaap:OperatingSegmentsMembersanm:IMSMember2022-10-022023-09-300000897723us-gaap:OperatingSegmentsMembersanm:IMSMember2021-10-032022-10-010000897723us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2023-10-012024-09-280000897723us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2022-10-022023-09-300000897723us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2021-10-032022-10-010000897723us-gaap:IntersegmentEliminationMember2023-10-012024-09-280000897723us-gaap:IntersegmentEliminationMember2022-10-022023-09-300000897723us-gaap:IntersegmentEliminationMember2021-10-032022-10-010000897723us-gaap:OperatingSegmentsMember2023-10-012024-09-280000897723us-gaap:OperatingSegmentsMember2022-10-022023-09-300000897723us-gaap:OperatingSegmentsMember2021-10-032022-10-010000897723us-gaap:CorporateNonSegmentMember2023-10-012024-09-280000897723us-gaap:CorporateNonSegmentMember2022-10-022023-09-300000897723us-gaap:CorporateNonSegmentMember2021-10-032022-10-010000897723sanm:OtherInternationalMember2024-09-280000897723sanm:OtherInternationalMember2023-09-300000897723us-gaap:CostOfSalesMember2023-10-012024-09-280000897723us-gaap:CostOfSalesMember2022-10-022023-09-300000897723us-gaap:CostOfSalesMember2021-10-032022-10-010000897723us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-10-012024-09-280000897723us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-10-022023-09-300000897723us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-10-032022-10-010000897723us-gaap:ResearchAndDevelopmentExpenseMember2023-10-012024-09-280000897723us-gaap:ResearchAndDevelopmentExpenseMember2022-10-022023-09-300000897723us-gaap:ResearchAndDevelopmentExpenseMember2021-10-032022-10-010000897723sanm:PerformanceSharesWithTSRMembersrt:MinimumMember2023-10-012024-09-280000897723sanm:PerformanceSharesWithTSRMembersrt:MaximumMember2023-10-012024-09-280000897723sanm:PerformanceSharesWithTSRMember2023-10-012024-09-2800008977232020-10-042021-10-020000897723us-gaap:RestrictedStockUnitsRSUMember2024-09-280000897723us-gaap:RestrictedStockUnitsRSUMember2023-10-012024-09-280000897723us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-280000897723us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-3000008977232022-07-032022-10-010000897723us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMember2024-09-280000897723us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMember2023-09-300000897723us-gaap:ForeignPlanMember2024-09-280000897723us-gaap:ForeignPlanMember2023-09-300000897723sanm:JointVentureWithRelianceMembersanm:RSBVLMember2023-09-300000897723sanm:JointVentureWithRelianceMembersanm:SanminaMember2023-09-300000897723sanm:JointVentureWithRelianceMember2024-09-280000897723sanm:SusanJohnsonMember2024-06-302024-09-280000897723sanm:SusanJohnsonMember2024-09-2800008977232024-06-302024-09-280000897723us-gaap:AllowanceForCreditLossMember2021-10-020000897723us-gaap:AllowanceForCreditLossMember2021-10-032022-10-010000897723us-gaap:AllowanceForCreditLossMember2022-10-010000897723us-gaap:AllowanceForCreditLossMember2022-10-022023-09-300000897723us-gaap:AllowanceForCreditLossMember2023-09-300000897723us-gaap:AllowanceForCreditLossMember2023-10-012024-09-280000897723us-gaap:AllowanceForCreditLossMember2024-09-280000897723us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-10-020000897723us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-10-032022-10-010000897723us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-10-010000897723us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-10-022023-09-300000897723us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-09-300000897723us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-10-012024-09-280000897723us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-09-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | | | |

| (Mark one) |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 28, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 0-21272

Sanmina Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| DE | | 77-0228183 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| | | | |

| 2700 N. First St., | San Jose | CA | | 95134 |

| (Address of principal executive offices) | | (Zip Code) |

|

| Registrant's telephone number, including area code: |

| | 408 | 964-3500 | |

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock | SANM | NASDAQ Global Select Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company | ☐ |

| | | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

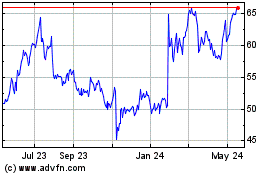

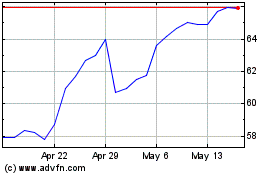

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant was approximately $2.0 billion as of March 30, 2024 based upon the last reported sale price of the common stock on the NASDAQ Global Select Market on March 28, 2024.

As of November 14, 2024, the number of shares outstanding of the registrant's common stock was 53,927,576.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information is incorporated into Part III of this report by reference to the Proxy Statement for the registrant's 2025 annual meeting of stockholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this annual report on Form 10-K.

SANMINA CORPORATION

INDEX

| | | | | | | | |

|

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

|

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

|

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

|

| Item 15. | | |

| |

Item 1. Business

Overview

Sanmina Corporation (“we” or “Sanmina” or the “Company”) is a leading global provider of integrated manufacturing solutions, components, products and repair, logistics and after-market services. We provide these comprehensive offerings primarily to original equipment manufacturers (“OEMs”) in the following industries: industrial, medical, defense and aerospace, automotive, communications networks and cloud infrastructure. Our customer-focused organization with 37,000 employees, including 5,000 temporary employees, supports our customers from 21 countries on four continents. We locate our facilities near our customers and their end markets in major centers for the electronics industry or in lower-cost locations. The combination of our advanced technologies, extensive manufacturing expertise and economies of scale enables us to meet the specialized needs of our customers. All references in this report to years refer to our fiscal years unless otherwise noted.

Our end-to-end solutions, combined with our global supply chain management expertise, allow us to manage our customers' products throughout their life cycles. These solutions include:

•product design and engineering, including concept development, detailed design, prototyping, validation, preproduction services and manufacturing design release and product industrialization;

•manufacturing of components, subassemblies and complete systems;

•high-level assembly and test;

•direct order fulfillment and logistics services;

•after-market product service and support; and

•global supply chain management.

We manage our operations as two businesses:

1) Integrated Manufacturing Solutions (“IMS”). Our IMS business consists of printed circuit board assembly and test, high-level assembly and test and direct-order-fulfillment. This segment generated approximately 80% of our total revenue in 2024.

2) Components, Products and Services (“CPS”). Components include advanced printed circuit boards (“PCBs”), backplanes and backplane assemblies, cable assemblies, fabricated metal parts, precision machined parts, and plastic injected molded parts. Products include optical, radio frequency (“RF”) and microelectronic design and manufacturing services from our Advanced Microsystems Technologies division; multi-chip package memory solutions from our Viking Technology division; high-performance storage platforms for hyperscale and enterprise solutions from our Viking Enterprise Solutions division; defense and aerospace products, design, manufacturing, repair and refurbishment services from our SCI Technology, Inc. (“SCI”) subsidiary; and cloud-based smart manufacturing execution software from our 42Q division. Services include design, engineering, and logistics and repair. CPS generated approximately 20% of our total revenue in 2024.

We target markets that we believe offer significant growth opportunities and in which OEMs sell complex mission critical products that are subject to strict regulatory requirements and/or rapid technological change. We believe these markets offer an opportunity to deliver higher margins as they require higher value-added manufacturing services and provide better opportunities for us to sell customers our advanced vertically integrated components. In addition, diversification across market segments and customers helps mitigate our dependency on any market or customer. We report our end markets as follows:

1) Industrial, Medical, Defense and Aerospace, and Automotive:

a. Industrial. Power generation, distribution, storage and controls for grid, data center, commercial and home applications. Industry 4.0 enabling, warehouse and factory asset management equipment, test and measurement systems and connected factory manufacturing software. Next generation semiconductor emulation and fabrication equipment supporting current and next generation artificial intelligence (“AI”) solutions.

b. Medical. Disposable, wearable and consumable products supporting glucose sensing, insulin and drug delivery, cancer treatment, diagnostic cartridges and general health monitoring. Lab diagnostic, life sciences,

lab processing equipment, high volume automated labs, point of care and personal use devices. Next generation imagining, monitoring and therapeutic delivery systems.

c. Defense and Aerospace. Federal, regional, municipal and commercial surveillance systems, secure network communication systems and personal protection devices. Federal and commercial manned and unmanned aerospace products.

d. Automotive and Transportation. Power conversion and battery management for battery electric vehicles and hybrid electric vehicles. Heavy equipment, agricultural, commercial and passenger vehicles. Autonomous, driver assistance and remote control vehicle applications.

2) Communications Networks and Cloud Infrastructure: Next generation fixed wireless networks. Optical (400G, 800G, 1.6T) shelves, modules and transceivers. Switches, servers, storage, racks and cooling for traditional data centers, edge compute and AI centric data center applications.

Industry Overview

Our industry has historically been comprised of companies that provide a range of design and manufacturing services to companies that utilize electronic components in their products. In recent years, the industry has expanded to respond to customer demand for products and services beyond electronic components, including product design and engineering, manufacturing, high-level assembly and test, direct order fulfillment and logistics services, after-market product services and support, and global supply chain management.

We monitor the current economic environment and its potential impact on both the customers we serve and our end markets, and closely manage our costs and capital resources so that we can respond appropriately as circumstances change. Over the long term, we believe our customers and potential customers rely on our industry’s services to:

•focus on their core competencies;

•access leading design and engineering capabilities;

•optimize their supply chain while reducing risk and maximizing purchasing power;

•reduce their fixed and operating costs and capital investment;

•access global manufacturing services; and

•accelerate their time to market and time to volume.

We believe each of our market sectors is high value and well-aligned with our expertise in more complex and highly-regulated products. This provides us with an opportunity for increased value-add, higher profitability and greater market share as we seek to capitalize on increased outsourcing in our served markets.

Our Business Strategy

Our vision is to be the trusted leader in providing mission critical products, services and supply chain solutions to accelerate customer success. Key elements of our business strategy to deliver this vision include:

Capitalizing on Our Comprehensive Solutions. Capitalizing on our end-to-end solutions allows us to sell additional solutions to our existing customers and attract new customers. Our end-to-end solutions include product design and engineering, manufacturing, high-level assembly and test, direct order fulfillment and logistics services, after-market product service and support, and global supply chain management. Our vertically integrated manufacturing solutions enable us to manufacture additional system components and subassemblies for our customers. When we provide a customer with multiple services, such as component manufacturing or higher value-added solutions, we can often improve our margins and profitability. Consequently, our goal is to increase the number of manufacturing programs for which we provide multiple solutions. To achieve this goal, our sales and marketing organization seeks to cross-sell our solutions to customers.

Extending Our Technology Capabilities. We rely on advanced processes and technologies to provide our products, components and vertically integrated manufacturing solutions. We continually improve our manufacturing processes and develop more advanced technologies, providing a competitive advantage for our customers. We work with our customers to anticipate their future product and manufacturing requirements and align our technology investment activities with their needs. We use our design expertise to develop product technology platforms that we can customize by incorporating other components

and subassemblies to meet the needs of particular OEMs. These technologies enhance our ability to manufacture complex, high-value added products, maximizing our potential to continue to win business from existing and new customers.

Attracting and Retaining Long-Term Customer Partnerships. A core component of our strategy is to attract, build and retain long-term partnerships with companies in growth industries that will benefit from our global/regional footprint and unique value proposition in advanced electronics manufacturing.

Promoting New Product Introduction (“NPI”) and Joint Design Manufacturing (“JDM”) Solutions. As a result of customer feedback and our customers' desire to manage research and development expenses, we offer product design services to develop systems and components jointly with our customers. Our NPI services include quick-turn prototyping, supply chain readiness, functional test development, and release-to-volume production. In a JDM model, our customers bring market knowledge and product requirements, and we bring complete design engineering and NPI services. Our design engineering offerings include product architecture development, detailed design, simulation, test and validation, system integration, regulatory and qualification services.

Continuing to Penetrate Diverse End Markets. We focus our marketing and sales efforts on end markets that we believe offer significant growth opportunities and for which OEMs sell mission critical products that are subject to strict regulatory requirements and/or rapid technological change because the manufacturing of these products requires higher value-added services. We have invested in technologies and capabilities that further strengthen our value proposition in industries such as industrial, medical, defense and aerospace, and automotive. Our market focused approach increases our customers’ competitiveness by leveraging our vertical capabilities, industry expertise, global scale and regional presence, and global IT systems.

Pursuing Strategic Transactions. We continually seek to identify and undertake strategic transactions that give us the opportunity to grow our business by accessing new customers' products, manufacturing solutions, repair service capabilities, intellectual property, technologies and geographic markets.

Continuing to Seek Cost Savings and Efficiency Improvements. We seek to optimize our facilities to provide cost-effective services for our customers. We continue to invest in factory automation, process improvements, robotics and AI to further enhance our efficiency output. We maintain extensive operations in lower-cost locations and we plan to expand our presence as appropriate to meet the needs of our customers. We believe we are well positioned to take advantage of future opportunities on a global/regional basis.

Our Competitive Strengths

We believe our competitive strengths differentiate us from our competitors and enable us to better serve the needs of OEMs. Our competitive strengths include:

Customer-Focused Organization. We target customers that are leaders in their industries and value our superior capabilities in design, manufacturing and supply chain services. We focus on high growth industries and markets where we have distinctive competence and unique value proposition. We believe customer relationships are critical to our success and we are focused on providing a high level of customer service. Account teams led by global account managers are directly responsible for account management. Global account managers coordinate the additional resources required to facilitate customer-specific solutions. These teams may include subject matter experts in design, specific technology components, services, products, and supply chain. These teams create a hub for interaction between the customer and our locations, providing local support to customers worldwide.

End-to-End Solutions. We provide solutions throughout the world to support our customers' products during their entire life cycle, from product design and engineering, through manufacturing, to direct order fulfillment, logistics and after-market product service and support. We believe our end-to-end solutions are among the most comprehensive in the industry because we focus on adding value before, during and after the actual manufacturing of our customers' products. These solutions also enable us to 1) provide our customers with a single source of supply for their design, supply chain and manufacturing needs, 2) accelerate time to market and time to volume production and 3) lower product costs, while allowing our customers to focus on those activities they expect to add the highest value to their business. We believe our end-to-end solutions allow us to develop closer relationships with our customers and more effectively compete for their future business.

Product Design and Engineering Resources. We provide product design and engineering services for new product designs, cost reductions and Design-for-Manufacturability/Assembly/Test (“DFx”). Our engineers work with our customers

during the complete product life cycle. Our design and NPI centers provide turnkey system design services, including: electrical, mechanical, thermal, software, layout, simulation, test development, design verification, validation, regulatory compliance and testing services. We design high-speed digital, analog, radio frequency, mixed-signal, wired, wireless, optical and electro-mechanical modules and systems.

Our engineering engagement models include JDM, Contract Design Manufacturing (“CDM”) and consulting engineering for DFx and Value Engineering (cost reduction re-design). In these engagement models, our customers bring market knowledge and product requirements and we provide complete design engineering and new product introductions services. For JDM products, the intellectual property is typically jointly owned by us and the customer, and we perform manufacturing and logistics services. For CDM projects, customers pay for all services and own the intellectual property.

Vertically Integrated Manufacturing Solutions. We provide a range of vertically integrated manufacturing solutions, including high-technology components, new product introduction and test development services. These solutions are provided in every major region worldwide, with design and prototyping close to our customer’s product development centers. Our customers benefit significantly from our experience in these areas, including product cost reduction, minimization of assets deployed for manufacturing, accelerated time-to-market and a simplified supply chain. Key system components we manufacture include high-technology printed circuit boards, printed circuit board assemblies, backplanes and backplane assemblies, cable assemblies, fabricated metal parts, precision machined parts, plastic injected molded parts, memory modules, and optical, RF microelectronics modules. These components and sub-assemblies are integrated into a final product or system, configured and tested to our customer’s or the end-customer’s specifications and delivered to the final point of use, with us managing the entire supply chain. By manufacturing system components and subassemblies ourselves, we enhance continuity of supply and reduce costs for our customers.

Advanced Component Technologies. We provide advanced component technologies, which we believe allow us to differentiate ourselves from our competitors. These advanced technologies include the fabrication of complex printed circuit boards, printed circuit board assemblies, backplanes and backplane assemblies, cable assemblies fabricated metal parts, precision machined parts, plastic injected molded parts, memory modules, and optical, RF and microelectronics modules.

We utilize a centralized Technology Council to coordinate the development and introduction of new technologies to meet our customers' needs in various locations and to increase technical collaboration among our facilities and divisions.

Global Manufacturing Capabilities. Most of our customers compete and sell their products on a global basis. As such, they require global solutions that include regional manufacturing for selected end markets, especially when time to market, local manufacturing or content and best cost solutions are critical objectives. Our global network of manufacturing facilities provides our customers a combination of sites to maximize both the benefits of regional and best cost manufacturing solutions and repair services. In addition to our manufacturing, distribution and repair locations, we support our customers’ logistics and repair requirements through a network of certified partners around the world.

Comprehensive IT Systems and Global Supply Chain Management. To manage and coordinate our global operations, we employ an enterprise-wide Enterprise Resource Planning (“ERP”) system at substantially all of our manufacturing locations that operates on a single IT platform and provides us with company-wide inventory planning and purchasing capabilities. This system enables us to standardize planning and purchasing at the facility level and to optimize inventory visibility and management, improve asset utilization worldwide and reduce risk throughout the entire product lifecycle. Our systems also enable our customers to receive key information regarding the status of their programs.

We purchase large quantities of electronic components and other materials from a wide range of suppliers. We are committed to selecting ethical business partners that adhere to the Responsible Business Alliance (“RBA”) Code of Conduct. Our primary supply chain goal is to consolidate our global spend to create the synergy and leverage to drive our supply base for better cost competitiveness, more favorable terms and leading-edge supply chain solutions. As a result, we often receive favorable terms and supply chain solutions from suppliers, which generally enables us to provide our customers with greater total cost reductions than they could obtain themselves. Our strong supplier relationships are beneficial when electronic components and other materials are in short supply and provide us the necessary support to better optimize the use of our inventories.

Supply chain management also involves the planning, purchasing, transportation and warehousing of product components. We use state of the art production management systems to manage our procurement and manufacturing processes in an efficient and cost-effective manner. We collaborate with our customers to enable us to respond to their changing component requirements and to reflect any changes in these requirements in our ERP system. This system enables us to forecast

future supply and demand imbalances and develop strategies to help our customers manage their component requirements, especially during supply shortages that have affected our industry in the recent past. Our enterprise-wide ERP systems provide us with company-wide information regarding component inventories and orders to help optimize inventories, planning and purchasing at the facility level.

Expertise in Serving Diverse End Markets. We have experience in serving customers in the industrial, medical, defense and aerospace, automotive, communications networks and cloud infrastructure end markets. In order to service to the specialized needs of customers in particular market segments, we have dedicated personnel, and in some cases facilities, with industry-specific capabilities and expertise.

Expertise in Industry Standards and Regulatory Requirements. We maintain compliance with industry standards and regulatory requirements applicable to certain markets, including, among others, medical, automotive and defense and aerospace.

Our Products and Solutions

Integrated Manufacturing Solutions includes:

Printed Circuit Board Assembly (“PCBA”) and Test. To meet the ever-changing needs across our diverse customer base, we continue to evolve in support of their current and future requirements. PCBAs are at the core of all electronic systems, and we continue to work to ensure that our PCBA manufacturing capabilities are aligned with the requirements for such systems. Printed circuit board assembly involves attaching electronic components, such as integrated circuits, capacitors, microprocessors, resistors, memory modules, and connectors to printed circuit boards. The most common technologies used to attach components to printed circuit boards employ surface mount technology (“SMT”) and pin-through-hole assembly (“PTH”) and press-fit technology for connectors. We use SMT, PTH, press-fit and other attachment technologies focused on miniaturization and increasing the density of component placement on printed circuit boards. These technologies, which support the needs of our customers to provide greater functionality in smaller products, include chip-scale packaging, ball grid array, direct chip attach and high-density interconnect. We perform in-circuit and functional testing of printed circuit board assemblies. In-circuit testing verifies that all components are properly inserted and attached and that electrical circuits are complete. Functional tests are performed to confirm the board or assembly operates in accordance with its final design and manufacturing specifications. We design and procure test fixtures and develop our own test software or use our customers' test fixtures and test software. In addition, we provide environmental stress tests of the board or assembly that are designed to confirm that the board or assembly will meet the environmental stresses, such as heat, to which it will be subjected.

High-Level Assembly and Test. We provide high-level assembly and test in which assemblies and modules are combined to form complete, finished products. Examples include complex electro-mechanical assemblies, fluid and blood analysis systems, food dispensing equipment, diagnostic medical devices, high-voltage power management systems, rotating x-ray equipment for airport security, particle analyzers for homeland security and motorized magnetic resonance imaging units. Our facilities also support full system level assembly and test and logistic support for a variety of complex electronic systems, including radio base stations and transmission equipment for wireless networks, optical central offices and wireline switching and routing hardware, server and storage systems for data centers, carriers central offices and video streaming service providers, high-volume disposable sensors and drug delivery devices, lab diagnostics, surgical controllers, ultrasound systems, patient monitoring systems, automotive sensor assemblies, and electric vehicle power control systems and modules. These products require highly specialized manufacturing capabilities and processes, as well as integrated IT systems and, in most cases, rigorous regulatory compliance and certifications.

Direct-Order-Fulfillment. We provide direct-order-fulfillment for our OEM customers. Direct-order-fulfillment involves receiving customer orders, configuring products to quickly fill the orders and delivering the products either to the OEM, a distribution channel, or directly to the end customer. We manage our direct-order-fulfillment processes using a core set of common systems and processes that receive order information from the customer and provide comprehensive supply chain management, including procurement and production planning. These systems and processes enable us to process orders for multiple system configurations and varying production quantities including single units. Our direct-order-fulfillment services include build-to-order (“BTO”) and configure-to-order (“CTO”) capabilities: in BTO, we build a system with the particular configuration ordered by the OEM customer; in CTO, we configure systems to an end customer's order, for example by installing software desired by the end customer. The end customer typically places this order by choosing from a variety of possible system configurations and options. Using advanced manufacturing processes and a real-time warehouse management and data control system on the manufacturing floor, we can usually meet a 48-to-72 hour turn-around-time for BTO and CTO requests. We support our direct-order-fulfillment services with logistics that include delivery of parts and assemblies to the final assembly site, distribution and shipment of finished systems and processing of customer returns.

Components, Products and Services includes:

Product Design and Engineering. Our design and engineering groups provide customers with comprehensive services from initial product design and detailed product development to prototyping and validation, production launch and end-of-life support for a wide range of products covering all our market segments. These groups complement our vertically integrated manufacturing capabilities by providing component level design services for printed circuit boards, backplanes and a variety of electro-mechanical systems. Our offerings in design engineering include product architecture, detailed development, simulation, test and validation, integration and regulatory and qualification services, and our NPI services include quick-turn prototypes, functional test development and release-to-volume production. We also offer post-manufacturing and end-of-life support, including repair and sustaining engineering support through our Global Services division. We can also complement our customer's design team with our unique skills and services which can be used to develop custom, high-performance products that are manufacturable and cost optimized to meet product and market requirements. Such engineering services can help in improving a customer’s time-to-market and cost-to-market objectives.

Printed Circuit Boards. We produce a wide range of multilayer printed circuit boards on a global basis with high layer counts and fine line circuitry. Specialized production equipment along with an in-depth understanding of high-performance laminate materials allow us to fabricate some of the largest form factor and highest speed circuit boards in the industry.

Our ability to support NPI and quick-turn fabrication followed by manufacturing in both North America and Asia allows our customers to accelerate their time-to-market as well as their time-to-volume. Standardized processes and procedures make transitioning of products easier for our customers. Our field applications engineering personnel support designers with material selection and design for manufacturability advice.

Backplanes and Backplane Assemblies. Backplanes are typically very large printed circuit boards that serve as the backbones of sophisticated electronics products, such as internet routers and switches. Backplane fabrication is significantly more complex than printed circuit board fabrication due to the large size and thickness of the backplanes. We assemble backplanes by press-fitting high-density connectors into plated through-holes in the fabricated backplane. In addition, many of the newer, advanced technology backplanes require surface-mounted attachment of components, including active high-pin count packages that come in a variety of sophisticated package types. These advanced assembly processes require specialized equipment and a strong focus on quality and process control. We often perform in-circuit and functional tests on backplane assemblies. We currently have capabilities to manufacture backplanes at greater than 60 layers in sizes up to 26x40 inches and up to a nominal thickness of 0.425 inches and in a wide variety of high-performance laminate materials. These are among the largest and most complex commercially manufactured backplanes and the test equipment we have ensures the quality and performance of these backplane systems is “world class”. We are capable of testing the signal integrity of these backplanes, and often also utilize state of the art x-ray equipment to verify defect-free installation of the new high density/high speed connectors.

Cable Assemblies. Cable assemblies are used to connect modules, assemblies and subassemblies, including backplane assemblies in electronic systems. We provide a broad range of cable assembly products and services, from cable assemblies and harnesses for automobiles to very complex harnesses for industrial products and semiconductor manufacturing equipment. We also provide mechanical assembly and integration services where we often assemble, integrate and test cables with electromechanical systems or sub-systems. We design and manufacture a broad range of high-speed data, radio frequency and fiber optic cabling products. We build cable assemblies that are used in power systems typically classified as low and medium voltage.

Fabricated Metal Parts. Parts that are fabricated from metal are often used in sub-assemblies and full enclosures, racks or cabinets used to house and protect complex, critical and fragile electronic components, modules and sub-systems so that the system's functional performance is not compromised due to mechanical, environmental or any other use conditions. Our mechanical systems manufacturing services are capable of fabricating mechanical components that range from single parts to complex enclosures, racks or cabinets and we often integrate these with various electronic components and sub-systems including backplane assemblies and cables with power and thermal management, and other sensor and control systems.

Precision Machined Parts. We offer a suite of world-class precision machining services in multiple locations. We use advanced numerically controlled machines enabling the machining to very tight tolerances and we often perform further assembly services with these components in clean-room environments. Our capabilities include complex medium and large format mill and lathe machining of aluminum, stainless steel, plastics, ferrous and nonferrous alloys and exotic alloys. We also

have helium and hydrostatic leak-test capabilities. By leveraging our established supply chain, we oversee lapping, anodizing, electrical discharge machining, heat-treating, cleaning, laser inspection, painting and packaging. We have specialized facilities supporting machining and complex integration with access to a range of state-of-the-art, computer-controlled machining equipment that can satisfy rigorous demands for production and quality and meet very tight tolerance specifications. With some of the largest horizontal milling machines in the U.S., we are a supplier of vacuum chamber systems for the semiconductor, flat-panel display, LED equipment, industrial, medical and AS9100-certified aerospace markets.

Plastic Injection Molded Parts. Plastic injection molded parts are used to create a vast array of everyday items, from very small intricate plastic parts to enclosures designed to protect sensitive electronic equipment. Our diverse capability within the plastic injection molding space spans all major markets and industries. We are equipped with nearly 80 plastic injection molding machines with a wide variety of clamping pressures. Our experienced tooling, process, quality and resin engineers work concurrently using a scientific molding approach to develop cost-effective, highly reliable manufacturing solutions for medical, industrial, defense, multimedia, computing and data storage customers.

Advanced Microsystems Technologies. Our Advanced Microsystems Technologies division focuses on optical, RF and microelectronics design and manufacturing services. Our mission is to deliver leading-edge technology solutions that enable our customer products while optimizing the value and performance of our customers’ applications.

We currently supply a wide range of optical products from 100G to 1.6T supporting optical communication, AI, high performance computing, quantum computing and data center marketplaces. For the medical end market, we develop components and subassemblies that support Sanmina’s medical manufacturing operations for products such as blood analyzers, food contamination analyzers, and specialized optical spectrometers and fluorometers utilizing the latest optical technologies. In the automotive and industrial end markets, we are working with customers on next generation photonics based LIDAR product offerings.

Viking Technology. Our Viking Technology division provides advanced high-technology hardware products, such as Solid-State Drives (SSDs), DRAM memory modules, Non-Volatile DIMMs and the latest Compute Express Link (“CXL”) attached memory which increases efficiency by allowing composability, scalability, and flexibility for heterogeneous and distributed computer architectures. Furthermore, Viking Technology specializes in delivering state-of-the-art ruggedized Microelectronics Multi-Chip Package (MCP) memory solutions. The compact and rugged design of these MCPs makes them ideal for Size, Weight, and Power (SWaP) optimized applications. Viking Technology product offerings cater to the networking, industrial, transportation, medical, AI, data centers, and defense and aerospace markets.

Viking Enterprise Solutions. Our Viking Enterprise Solutions division (“VES”) is a market leader in high-performance storage platforms for both enterprise and hyperscaler data centers globally. Our differentiated nonvolatile memory express (“NVMe”) flash and disk-based storage solutions enable VES to meet the growing demands for data processing and storage efficiency.

VES provides solutions ideal for a wide range of applications including rack scale data storage and AI and machine learning workloads. With advances in interconnect speeds and architectural shifts towards disaggregating storage from compute for scalability and efficiency in large data centers, VES is well positioned to take advantage of these trends.

SCI. Our SCI subsidiary has provided engineering services, products, manufacturing, test, and depot and repair solutions to the global defense and aerospace industry for more than 60 years. SCI offers advanced products for aircraft systems and tactical communications, unmanned aerial systems and components, counter-unmanned aerial systems and components, and fiber-optics capabilities for use in a variety of defense-related applications.

SCI's customers include U.S. government agencies, U.S. allies and major defense and aerospace prime contractors. SCI has the infrastructure and facility security clearance to support the stringent certifications, regulations, processes and procedures required by these customers.

Global Services. Sanmina Global Services complements our end-to-end manufacturing strategy by integrating a full range of post-manufacturing and after-market services, engineering, supply chain, manufacturing, logistics, repair and environmentally friendly disposition into a seamless solution for customers, for both Sanmina-manufactured, and non-Sanmina-manufactured products around the world. We provide a wide range of services, including new product introduction, high-level assembly, distribution services and warranty management, life-extension services and end-of-life management as well as programs that focus on reuse, repair, refurbishment, recycle, recover and redesign. Our reverse logistics services include detailed failure analysis and feedback to enhance product design and product quality. Our IT systems provide full traceability of

the product’s lifecycle, from manufacturing and distribution to product returns, the repair process, component swaps and product test results.

42Q. Our 42Q division provides an innovative, world-class cloud-based smart manufacturing execution solution that is scalable, flexible, secure and easy to implement. Our solution provides customers advantages in efficiencies and costs relative to legacy systems and offers traceability and genealogy, multi-plant visibility, compliance management and on-demand work instructions.

Seasonality

Because of the diversity of our customer base, we generally have not experienced significant seasonality in our business in recent years. However, we cannot predict whether this trend will continue.

Backlog

We generally do not obtain firm, long-term commitments from our customers and our customers usually do not make firm orders for product delivery more than thirty to ninety days in advance. Additionally, customers may cancel or postpone scheduled deliveries, in some cases without significant penalty. Therefore, we do not believe the backlog of expected product sales covered by firm orders is a meaningful measure of future sales.

Customers and Marketing

A key component of our strategy is to attract and retain long-term customer partnerships with leading companies in growth industries that will benefit from our global/regional footprint and unique value proposition in advanced electronics manufacturing. We develop relationships with our customers and market our vertically integrated manufacturing solutions through our sales and marketing staff. Our sales team works closely with our customers' engineering and technical personnel to understand their strategy and roadmaps to enable their go-to-market strategy. Our sales and marketing staff supports our business strategy of providing end-to-end solutions by encouraging cross-selling vertically integrated manufacturing solutions and component manufacturing across a broad range of major OEM products. We utilize our existing technical capabilities in design, technology components, and complex assembly, integration, and after-sales services to provide tailored solutions to our customers. With our extensive market knowledge and global/regional footprint, we can align these solutions to our facilities in each region around the world.

Sales to our ten largest customers represented 47% of our net sales in 2024. Motorola represented 10% or more of our net sales in 2024 and 2022. Nokia represented 10% or more of our net sales in 2023 and 2022.

We typically enter into supply agreements with our major OEM customers with terms ranging from three to five years. Our supply agreements generally do not obligate the customer to purchase minimum quantities of products. However, the customer is typically liable for the cost of the materials and components we have ordered to meet their production forecast but which are not used, provided that the material was ordered in accordance with an agreed-upon procurement plan. In some cases, the procurement plan contains provisions regarding the types of materials for which our customers will assume responsibility. Our supply agreements generally contain provisions permitting cancellation and rescheduling of orders upon notice and are subject to cancellation charges and, in some cases, rescheduling charges. In some circumstances, our supply agreements with customers include provisions for cost reduction objectives during the term of the agreement, which can have the effect of reducing revenue and profitability from these arrangements.

Competition

Our business is highly competitive. We compete against numerous domestic and foreign electronic manufacturing service providers, diversified manufacturing service providers and design providers. In addition, our potential customers may also compare the benefits of outsourcing their manufacturing to us with the merits of manufacturing products themselves.

We compete with different companies depending on the type of solution or geographic area. We believe the primary competitive factors in our industry include manufacturing technology, quality, global/regional footprint, delivery, responsiveness, provision of value-added solutions and price. We believe we are extremely competitive with regard to all of these factors.

Intellectual Property

We hold U.S. and foreign patents and patent applications relating to, among other things, printed circuit board manufacturing technology, enclosures, cables, memory modules, optical technology, medical devices and computing and storage. For other proprietary processes, we rely primarily on trade secret protection. A number of our patents have expired or will expire in the near term. The expiration and abandonment of patents reduces our ability to assert claims against competitors or others who use similar technologies and to license such patents to third parties. We have registered a number of trademarks and have pending trademark applications in both the U.S. and internationally. Sanmina, Viking, Viking Enterprise Solutions, Viking Technology and 42Q are registered trademarks of Sanmina Corporation.

Compliance with Government Regulations

Environmental Regulations

We are subject to a variety of local, state, federal and foreign environmental laws and regulations relating to the storage and use of hazardous materials used in our manufacturing processes, as well as the storage, treatment, discharge, emission and disposal of hazardous waste that are by-products of these processes. We are also subject to occupational safety and health laws, product labeling and product content requirements, either directly or as required by our customers. Proper waste disposal is a major consideration for printed circuit board manufacturers due to the metals and chemicals used in the manufacturing process. Water used in the printed circuit board manufacturing process must be treated to remove metal particles and other contaminants before it can be discharged into municipal sanitary sewer systems. We operate on-site wastewater treatment systems at our printed circuit board manufacturing plants in order to treat wastewater generated in the fabrication process.

Additionally, the electronics assembly process can generate lead dust. Upon vacating a facility, we are responsible for remediating lead dust from the interior of the manufacturing facility. Although there are no applicable standards for lead dust remediation in manufacturing facilities, we endeavor to remove the residues. To date, lead dust remediation costs have not been material to our results of operations. We also monitor for airborne concentrations of lead in our buildings and are unaware of any significant lead concentrations that exceed the applicable Occupational Safety & Health Administration (“OSHA”) or other local standards.

We have a range of corporate programs that aim to reduce the use of hazardous materials in manufacturing. We developed corporate-wide standardized environmental management systems, auditing programs and policies to enable better management of environmental compliance activities. For example, almost all of our manufacturing facilities are certified under ISO 14001, a set of standards and procedures relating to environmental compliance management. In addition, the electronics industry must adhere to the European Union's Restrictions of Hazardous Substances (“RoHS”) and Waste Electrical and Electronic Equipment (“WEEE”). Parallel initiatives have been adopted in other jurisdictions throughout the world, including several states in the U.S. and the Peoples' Republic of China. RoHS limits the use of lead, mercury and other specified substances in electronics products. WEEE requires producers to assume responsibility for the collection, recycling and management of waste electronic products and components. We have implemented procedures intended to ensure our manufacturing processes are compliant with RoHS and the European Union's Registration, Evaluation and Authorization of Chemicals (“REACH”) legislation, when required. WEEE compliance is primarily the responsibility of OEMs.

Asbestos containing materials (“ACM”) are present at several of our manufacturing facilities. Although ACM is being managed and controls have been put in place pursuant to ACM operations and maintenance plans, the presence of ACM could give rise to remediation obligations and other liabilities.

Our facilities generally operate under environmental permits issued by governmental authorities. For the most part, these permits must be renewed periodically and are subject to revocation in the event of violations of environmental laws. Any such revocation may require us to cease or limit production at one or more of our facilities, adversely affecting our results of operations.

In connection with certain acquisitions, we have incurred liabilities associated with environmental contamination. These include ongoing investigation and remediation activities at a number of current and former sites, including those located in Owego, New York; Derry, New Hampshire; and Brockville, Ontario. In addition, we have been found liable in a lawsuit alleging operations at our current and former facilities in Orange County, California contributed to groundwater contamination, and also have ongoing investigation activities at and adjacent to a former facility to determine the extent of any soil, soil vapor, and groundwater contamination. Finally, there are some sites, including our acquired facility in Gunzenhausen, Germany,

which are known to have groundwater contamination caused by a third-party, and that third-party has provided indemnification to us for the related liability. However, in certain situations, third-party indemnities may not be effective to reduce our liability for environmental contamination.

We use environmental consultants primarily for risk assessments and remediation, including remedial investigation and feasibility studies, remedial action planning and design and site remediation. Our consultants provide information regarding the nature and extent of site contamination, acceptable remediation alternatives and estimated costs associated with each remediation alternative. We consider their recommendations together with other information when determining the appropriate amount to accrue for environmental liabilities.

Other Regulations

We are also subject to a number of domestic and foreign regulations relating to our operations worldwide. In particular, our sales activities must comply with restrictions relating to the export of controlled technology and sales to denied or sanctioned parties contained in the U.S. International Traffic in Arms Regulations, U.S. Export Administration Regulations and sanctions administered by the Office of Foreign Asset Controls of the U.S. Treasury Department. We must also comply with regulations relating to the award, administration and performance of U.S. government contracts and subcontracts with respect to our defense business, including regulations that govern price negotiations, cost accounting standards, procurement practices, termination at the election of the government and many other aspects of performance under government contracts and subcontracts. These regulations are complex, require extensive compliance efforts and expenditures in the form of additional personnel, systems and processes, and, in some cases, require us to ensure that our suppliers adhere to such regulations. Furthermore, our compliance with these regulations is subject to audit or investigation by governmental authorities and, from time to time, we receive formal and informal inquiries from government agencies and regulators regarding our compliance. Finally, the design, manufacture and repair of products that we conduct for the medical industry often requires compliance with domestic and foreign regulations, including the Food and Drug Administration’s quality system regulations and the European Union’s medical device directive. In addition to complying with these standards, our medical facilities comply with ISO 13485 (formerly EN 46002) and ISO 9001, where required. Should we be found to have violated one or more of such regulations, we could become subject to civil damages (which in some cases can be trebled) or criminal penalties and administrative sanctions, including fines, penalties, appointment of government monitors, termination of our government contracts and, ultimately, debarment from doing further business with the U.S. government. Any of such results would increase our expenses, reduce our revenue and damage our reputation as both a commercial and government supplier.

Human Capital Resources

General Information About Our Human Capital Resources

As of September 28, 2024, we had approximately 37,000 employees, including 5,000 temporary employees in 21 countries.

| | | | | |

| Region | Approximate Breakdown of Employees |

| Americas | 58 | % |

| APAC | 32 | % |

| EMEA | 10 | % |

| Total | 100 | % |

Core Principles

At Sanmina, we believe our employees are the key to our success. We cultivate an agile, innovative workplace culture fueled by collaboration, diversity, equity and inclusion. Having highly engaged employees is essential to our culture and achieving our mission. We embrace diverse perspectives and empower our employees to improve our organization, help us innovate, and continuously strengthen our workplace.

As a founding member of the RBA, its principles are fundamental to our corporate culture and core values and are reflected in our commitments to our customers, stakeholders, employees and communities in which we do business around the world. We have aligned our work programs, processes and procedures to the RBA Code of Conduct to help ensure a safe and

positive work environment for our employees that emphasizes learning and professional development, respect for individuals and ethical conduct, and that is facilitated by a direct management-employee engagement model.

For over a decade, we have tracked human capital metrics that we consider to be key to our business, including health and safety, career growth and development, turnover, hiring and diversity, equity and inclusion. Management regularly reviews these metrics and seeks to improve them.

Health and Safety

The health and safety of our employees is of utmost importance to us. In the U.S., we are subject to the requirements of the United States Department of Labor’s OSHA and we are guided by the Environmental Health and Safety principles as described in the RBA’s Code of Conduct worldwide. We conduct regular self-assessments and audits to ensure compliance with our health and safety guidelines and regulatory requirements. Our ultimate goal is to achieve a level of work-related injuries as close to zero as possible through continuous investment in our safety programs. We provide protective gear (e.g., eye protection, masks and gloves) as required by applicable standards and as appropriate given employee job duties.

Career Growth and Development

We invest resources in professional development and growth as a means of improving employee performance and retaining our employees. We leverage both formal and informal programs, including in-person, virtual, social and self-directed learning, mentoring, coaching, and outside seminars and educational programs, when applicable, to identify, foster, and retain top talent. Employees have access to courses through multiple learning and development platforms.

Our performance review process is intended to promote transparent communication of team member performance, which we believe is a key factor in our success. Performance reviews enable ongoing assessments, reviews, and mentoring to identify career development and learning opportunities for our employees.

Turnover

We continually monitor employee turnover rates, both regionally and as a whole, as our success depends upon retaining our highly trained manufacturing and operating personnel. We believe the combination of competitive compensation, career growth and development opportunities have helped increase employee tenure and reduce voluntary turnover. The average tenure of our employees is approximately eight years and approximately 34% of our employees have been employed by us for more than ten years.

Hiring Practices

We recruit the best people for the job without regard to gender, ethnicity or other protected characteristics and it is our policy to comply fully with all domestic, foreign and local laws relating to discrimination in hiring.

Diversity, Equity and Inclusion

We are focused on creating a culture of belonging where employees can be their authentic selves and cultivate a workplace where everyone has an opportunity to succeed. Recognizing and respecting our global presence, we strive to maintain a diverse, equitable and inclusive workforce everywhere we operate. Approximately 49% of our employees worldwide are female and, in the U.S., non-Caucasian employees account for approximately 60% of the employee base. Our diversity, equity and inclusion principles are reflected in our employee training, in particular with respect to our policies against harassment and bullying and the elimination of bias in the workplace.

Management Engagement Practices

We believe in a direct management-employee engagement model by which managers and employees maintain a regular dialogue about working conditions, compensation, compliance with laws and applicable standards, safety and advancement opportunities. This model is also reflected in our training and compliance programs, which emphasize the need to report concerns about violations of policy or law. None of our U.S. employees are represented by a labor union. In some international locations, our employees are represented by labor unions on either a national or plant level or are subject to collective bargaining agreements.

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The following table sets forth the name, position and age of our current executive officers and their ages as of September 28, 2024.

| | | | | | | | |

| Name | Age | Position |

| Jure Sola | 73 | Chairman and Chief Executive Officer |

| Jonathan Faust | 47 | Executive Vice President, Chief Financial Officer |

| Alan Reid | 61 | Executive Vice President, Global Human Resources |

| Charles C. Mason | 59 | Executive Vice President, Worldwide Sales |

Jure Sola has served as our Chairman and Chief Executive Officer since August 2020. Prior to that time, from October 2017 until August 2020, Mr. Sola served as our Executive Chairman. Mr. Sola also served as our Chief Executive Officer from April 1991 until October 2017, as Chairman of our Board of Directors from April 1991 until December 2001 and from December 2002 until October 2017, and as Co-Chairman of our Board of Directors from December 2001 until December 2002. In 1980, Mr. Sola co-founded Sanmina and initially held the position of Vice President of Sales. In October 1987, he became the Vice President and General Manager of Sanmina, responsible for manufacturing operations, sales and marketing. Mr. Sola served as our President from October 1989 to March 1996.

Jonathan Faust has served as our Executive Vice President and Chief Financial Officer since December 2023. Mr. Faust previously served as Global Controller and Head of Corporate Finance & Services of Hewlett Packard Enterprise (“HP”), which he joined in August 2021. From February 2020 until July 2021, Mr. Faust was Chief Financial Officer of Aruba, a HP company. Mr. Faust spent more than 19 years at HP working in various finance roles, most recently as Senior Vice President and Chief Financial Officer – Hybrid IT from August 2018 until January 2020.

Alan Reid has served as our Executive Vice President of Global Human Resources since October 2012. Mr. Reid has held various roles at Sanmina, including Senior Vice President of Global Human Resources and Human Resources Director of EMEA, from July 2001 to October 2012. Prior to joining us, he was Group Human Resources Manager at Kymata Ltd., an optoelectronic technology startup from June 2000 to July 2001. Prior to Kymata, Mr. Reid held various roles in operations and human resources with The BOC Group PLC. (British Oxygen Company), a global industrial gases and engineering company, from September 1986 to June 2000.

Charles C. Mason has served as our Executive Vice President, Worldwide Sales since March 2023. Mr. Mason has held various senior sales and marketing roles at Sanmina since joining us through an acquisition in 1997, most recently Executive Vice President, Sales for Integrated Manufacturing Services and Senior Vice President, Strategic Accounts.

Available Information